For small businesses with employees, payroll is a significant part of operations—both financially and administratively. Payroll tasks overlap with complex employment laws and confusing tax rules and can affect various business areas.

Understanding overall payroll statistics can help you estimate when certain workforce changes might affect your business. This can help you prepare and find innovative solutions that might help lower payroll expenses, boost employee morale, and reduce the hassle that this process typically brings.

Key Takeaways

- Small businesses play a significant role in the private sector payroll.

- A majority of American workers are living from paycheck to paycheck.

- More than half of businesses have been penalized for payroll noncompliance.

- More and more businesses are outsourcing their payroll processes

General Payroll Statistics

1. Biweekly payroll is the most common payroll run

According to the most recent data, payroll runs done every other week or biweekly are the most common in the US, with nearly half of all companies using this payroll frequency. The second most common is weekly payroll, followed by twice monthly. Monthly payroll only encompasses 10.3% of US company payroll.

(Bureau of Labor Statistics: Length of Pay Periods)

2. One in four US workers lives in a pay transparency state

Many states and cities now require employers to provide some level of pay transparency to employees and applicants. Whether companies have to disclose the pay range to applicants or post it in public job ads, these laws are taking hold—and your company must ensure compliance.

Even if your company has no business operations in a state, if you’re posting a job ad that will be viewed by candidates in Colorado, for example, you must post the pay range in that job ad to comply with Colorado law.

(CNBC: Salary Transparency)

3. 39.4% of private sector payroll is paid by small businesses

This figure emphasized the significant role small businesses play in employment and the economy. Additionally, a majority of small business owners are planning to expand or grow their businesses despite the challenges they face.

(Small Business Administration)

4. There’s an 8.39% decrease in the use of printed payslips

Printed payslips continue to decline, which reflects a broader shift towards digital alternatives, driven by the need for cost savings, environmental concerns, and the increasing adoption of electronic payroll systems.

(Payslip Survey Report 2024)

Employee Payroll Statistics

5. 65% of workers live from paycheck to paycheck

The number of workers who say they are living from paycheck to paycheck has increased from 58% in 2023 to 65% in 2024. Such situations make employees more likely to leave a company, but they also put them in actual financial distress. When employees cannot meet their financial obligations, they may have trouble focusing and producing high-quality work. More companies are offering employees the right to access their pay as they earn it via on-demand pay options that many payroll services provide.

(CNBC: Americans Living from Paycheck to Paycheck)

6. 95.15% of employees are paid through direct deposit

Although there are still options for some businesses, paying employees in cash and paper checks isn’t as common. Direct deposit allows employees to be paid electronically, reducing the risk of fraud, theft, or loss of paycheck. It’s also usually free for many small businesses through their payroll software or service provider.

If your company isn’t offering direct deposit payments to your employees, you risk losing access to potential new employees who don’t want to deal with paper paychecks.

(American Payroll Association)

7. There are 60 million gig economy workers

Hiring gig workers, which make up about 39% of the US workforce, requires you to ensure that you are classifying the workers correctly and paying them in accordance with your state paycheck laws. Partnering with gig workers can help your business, but you need to pay attention to the legal issues involved.

(Upwork)

8. Over twice as many workers prefer higher wages over better health benefits

When surveyed, 27% of workers wanted better health benefits from their employer, while 73% preferred higher wages. This shows that while benefits are important to workers, they must be balanced with competitive wages that allow the worker to have a higher quality of life.

(American Payroll Association)

9. Over 90% of workers say they always receive their paycheck on time

Despite the IRS levying enormous fines for payroll mistakes, over 90% of US workers surveyed say their paycheck is always on time. That’s good news for the vast majority of businesses and their employees, who can be seriously impacted by late paychecks.

(American Payroll Association)

10. 62% of businesses say they have or will provide off-cycle increases in 2024

These off-cycle adjustments, outside the standard annual review periods, are typically aimed at retaining top talent, addressing inflationary pressures, responding to market conditions, or rewarding exceptional performance, ensuring competitive and equitable compensation throughout.

(World at Work)

Payroll Error Statistics

11. The IRS netted around $2.8 billion in tax penalties

Payroll mistakes cause problems for employees and massive financial troubles for companies. The most common payroll mistake is “failure to pay,” which could mean not paying employees at all or paying them incorrectly. For this reason alone, the IRS netted about $2.8 billion in penalties.

(IRS)

12. 53% of companies have been penalized for payroll noncompliance in the last five years

According to Alight’s 2024 Global Payroll Complexity Report, the primary reason for payroll noncompliance (and payroll error) is due to manual intervention. Despite this, only 8% of these businesses are planning to implement AI in their payroll processing in the next four years.

(Alight)

13. 32% of global employees say it takes two or more pay cycles to resolve underpayments

ADP’s 2024 Global Payroll Survey revealed that a lot of the respondents from across the globe revealed that it still takes them quite a while to resolve underpayment issues. Additionally, 22% say that these errors, including tax recalculations and supplementary payroll runs, usually happen mid-cycle.

(ADP)

Payroll Software and Automation Statistics

14. 77% HR leaders integrate AI with their payroll and processing

According to the Future of Work: Intelligent by Design survey conducted by Eightfold.ai, most HR leaders have incorporated AI into their payroll and benefits administration as well as other HR processes, such as employee records management, hiring, performance management, and more.

(Eightfold.ai)

15. 85% of businesses encounter challenges with their payroll technology

While a lot of organizations have already adopted HR software to automate their payroll and other HR processes, 85% are experiencing limitations in the technology they use. These challenges include not having all the features they need (39%), not using the software’s full capabilities (37%), and requiring too much manual effort (34%).

(TrustRadius)

16. 37% of global businesses still lack integrations across all HR systems

Integration complexities are one of the biggest barriers for organizations to implementing a global payroll model. According to ADP’s Global Payroll Survey, the most common integration is with finance and accounting systems (41%), followed by the following:

- Benefits management (39%)

- HR systems of record (39%)

- Time and attendance tracking (38%)

- PTO management (37%)

- Enterprise resource planning (ERP) systems (35%)

(Eightfold.ai)

Payroll Outsourcing Statistics

17. Payroll outsourcing is projected to grow by nearly 6% by 2027

Payroll outsourcing is projected to increase quite dramatically through 2027, creating a $7 billion market. This illustrates just how many companies are looking to outsource their payroll needs.

(Technavio)

18. 69% of employers are thinking of outsourcing most or all of their payroll processes

ADP’s Global Payroll Survey revealed that there are two primary reasons why more businesses are considering outsourcing. First, 8 out of 10 businesses are planning to expand their payroll teams—and outsourcing is a good option to quickly fill that need. Second, there is a skills shortage of payroll staff that affects most HR teams. By outsourcing, they can fill the skills gap while upskilling their in-house staff.

(ADP)

19. 23% of small businesses choose to outsource their payroll

While 49% of business owners use payroll software to calculate and process their payroll, others trust third-party payroll providers to do the job for them. Aside from payroll processing, employers are also willing to pay extra for other services, such as financial planning and state tax registration.

(OnPay)

Payroll Statistics by Industry

20. Nonfarm payroll employment increased by 175,000

According to the latest BLS figures, healthcare added 56,000 jobs in April 2024. Other sectors that experienced employment growth are:

- Social assistance: 31,000

- Transportation and warehousing: 22,000

- Retail: 20,000

(BLS: The Economics Daily)

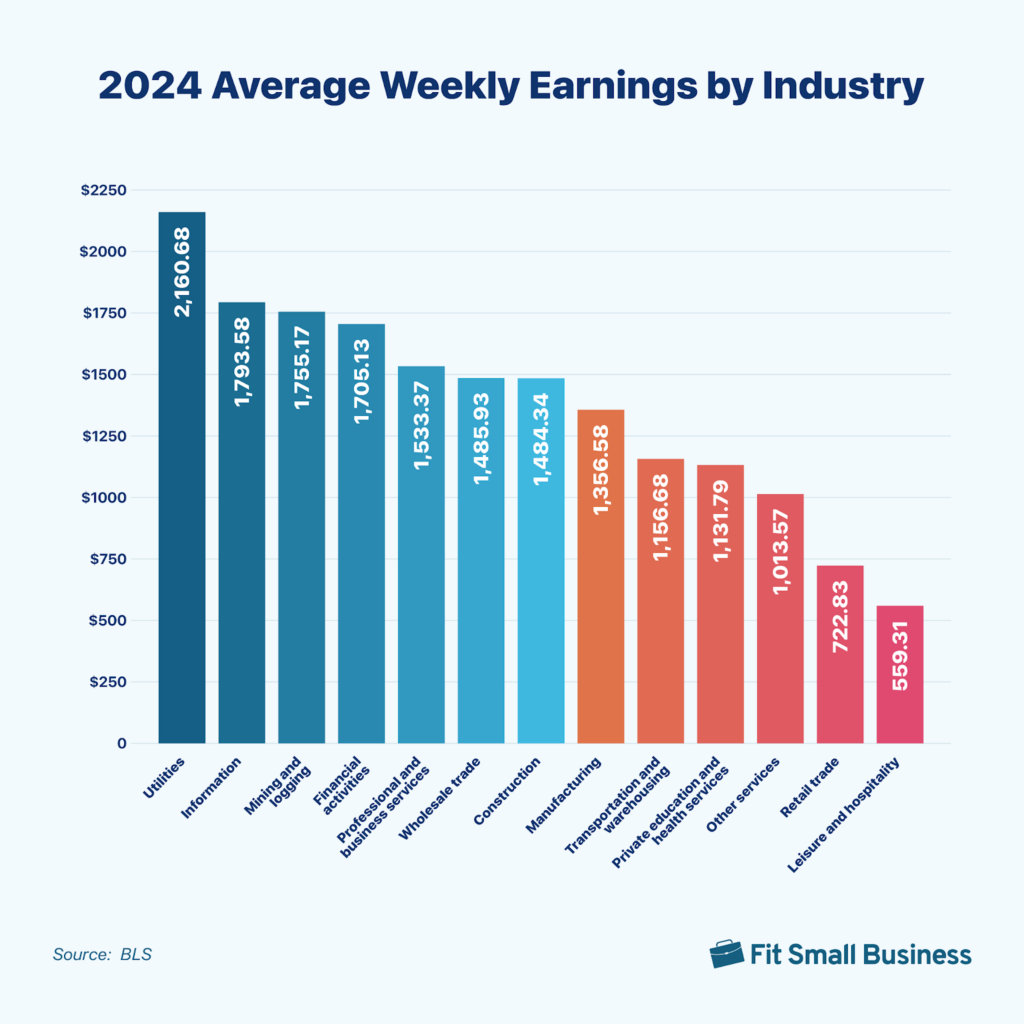

21. The utilities sector has the highest salary at around $2,000 a week

Those who belong in the utilities sector include plant operators, field service technicians, and more. According to Indeed, the salary ranges between $97,000 and $47,000 a year.

(Indeed)

22. 71% of senior finance leaders plan to increase compensation by 2024

Gartner’s 2023 CFO survey revealed that the vast majority of CFOs are planning to raise compensation by 4%. This move is set to outpace inflation, which is running below 3%.

(Gartner)

Frequently Asked Questions (FAQs)

A nonpayroll employee is a worker who provides services to a company but is not on the company’s official payroll. This means they are not entitled to the same benefits, tax withholdings, or regular salaries as traditional employees. Instead, they are often independent contractors, freelancers, or consultants, and they usually receive payment through invoices or stipends for their work.

The most common pay frequency in the US is every other week, which accounts for nearly half of all payroll runs in the US. This is sometimes referred to as biweekly payroll, which is ambiguous and why we use the phrase every other week.

It depends on your payroll frequency. Here’s a breakdown:

- Weekly: 52 pay periods

- Every other week: 26 pay periods

- Twice monthly: 24 pay periods

- Monthly: 12 pay periods

Bottom Line

Today’s workforce is changing. But paying employees, gig workers, and independent contractors remains a vital piece of the puzzle. Not knowing payroll stats can leave your company behind and exposed to legal liability. Formalizing your processes internally or partnering with an outsourced payroll service can be easier and more cost-effective for your small business.

References: Bureau of Labor Statistics (Length of Pay Periods, The Economics Daily), CNBC (Salary Transparency, Americans Living from Paycheck to Paycheck) Small Business Administration, Payslip Survey Report 2024, American Payroll Association, Upwork, World at Work, IRS, Alight, ADP, Eightfold.ai, TrustRadius, Technavio, OnPay, Indeed, Gartner