Employers have options when it comes to how to pay employees in a small business. Besides the traditional payment methods, like direct deposit, pay cards, paper checks, and cash, there are some alternative options to choose from, such as stock compensation and mobile payments.

Each payment option has pros and cons and must be managed differently. Be sure that you follow the best practices for the payment types you choose.

Keep in mind that not all payment options are permitted in all states, and some states require employers to offer two or more salary payment methods. Before choosing, make sure to check your specific state’s laws and regulations.

Traditional Payment Methods

Traditional payment methods for payroll include direct deposit, pay cards, paper checks, and cash. These methods have been used for decades and offer certain advantages that make them attractive to small businesses.

Direct Deposit

| PROS | CONS |

|---|---|

| Easy paper trail and reporting | Can take days to process, depending on your provider |

| Safe | Can cost more than cash/check if using payroll software |

| Convenient for employees | Won’t work for employees without bank accounts |

Direct deposit is the most common way to pay employees, with over 93% of US workers electing to be paid this way. It is also one of the easiest ways to pay employees if you’re using payroll software.

Payroll processing with direct deposit is all electronic—the money moves from your bank account to your employees’ account—and you don’t have to do anything but review and approve it. And, as a bonus, it is usually a service that’s included at no additional cost.

Some providers, like Gusto, even offer on-demand pay, meaning you can deposit part of an employee’s paycheck that they’ve earned early if they need funds before payday.

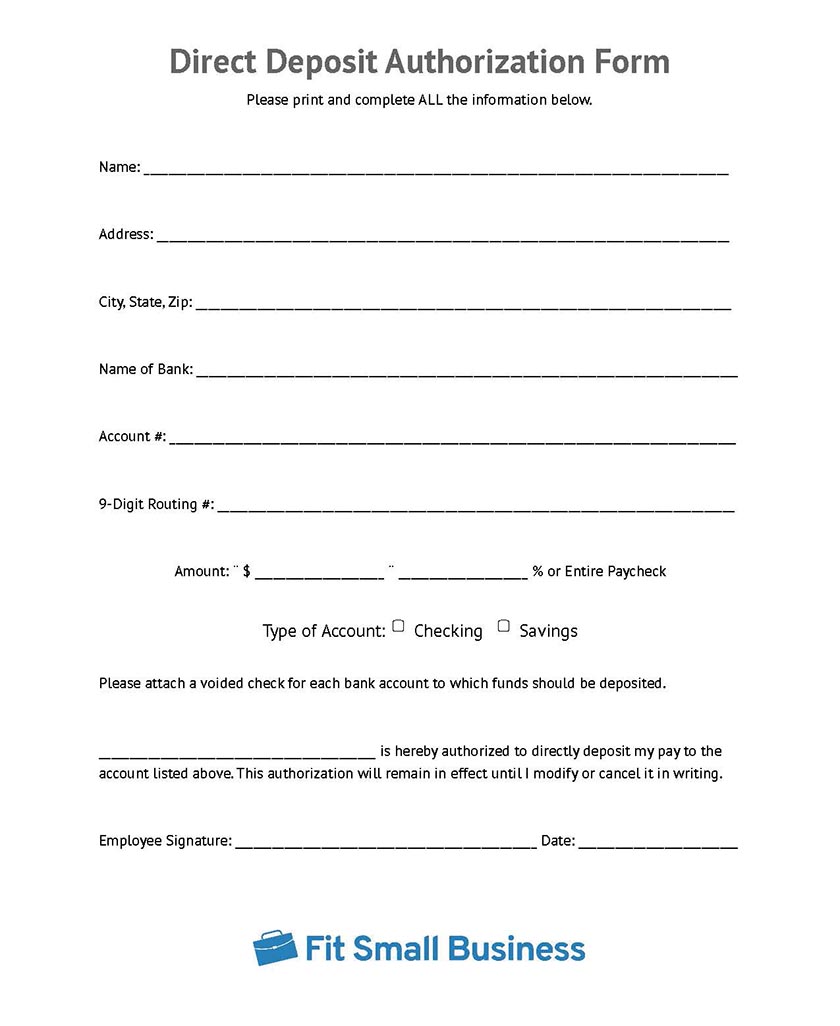

Have your employees fill out a direct deposit form. This ensures accuracy for the deposit of their pay.

If you’re not using payroll software, you can still reap the benefits of direct deposit. You’ll just need to go through your bank to set it up. While some banks provide direct deposit services for free, others may charge fees ranging from $10 to $30 or more per deposit.

If you choose to use your bank to set up direct deposit instead of a payroll provider, you will be responsible for calculating and paying taxes on behalf of your employees. Learn more about how to calculate payroll and taxes.

Read more here about how to set up direct deposit for your employees and download the above template.

Pay Card

| PROS | CONS |

|---|---|

| Completely electronic | Employees can lose access to funds if card is lost/stolen |

| Money is FDIC-insured | Some services (ATM withdrawals) can lead to hefty fees for employees |

| Employees don’t need bank accounts | Heavily regulated in some states |

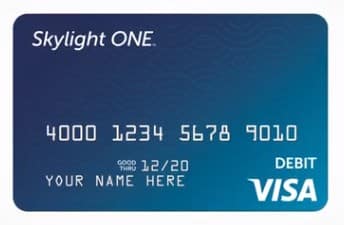

Pay cards are prepaid debit cards you can use to deposit payroll. It’s a great option to use when you have employees without bank accounts. It allows you and your workers to still reap the benefits of direct deposit while eliminating some of the cons. Your employees will receive a debit card similar to the one shown below that they can use at any establishment that accepts VISA or Mastercard (depending on the type of card issued). Additionally, your employees can use this pay card at ATMs, however, a fee may apply.

With payroll cards, your employees can receive their paychecks, withdraw funds, and even make purchases.

Some payroll software offers payroll cards for little to nothing in cost, aside from the expense of the service itself. You can also check with your bank as many of them offer pay cards as well, and the money is FDIC-insured.

Although a legal form of payroll, many states won’t allow pay cards to be the only way for employees to receive paychecks. You must provide alternative options for your employees to choose from. Be sure to check your state rules before you decide how to proceed or you could face penalties and/or litigation.

If you’re interested in learning more about paying your employees with pay cards, check out our article. For help choosing the best service, check out our guide to the best pay card providers for small businesses.

Paper Check

| PROS | CONS |

|---|---|

| Leaves a paper trail | Have to track when or if each check clears the bank |

| Easier for small businesses | May be lost or stolen |

| Simplifies payroll for employees; they can cash them how they like | Can be costly in equipment needed |

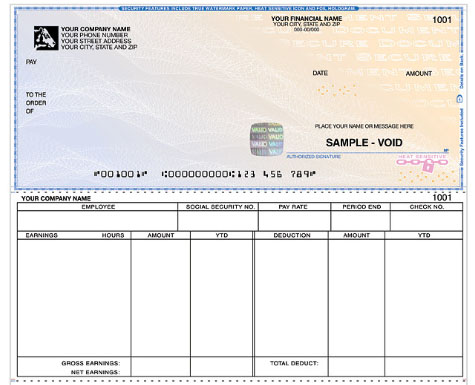

Paper checks may seem outdated, but it is still a reliable way to pay employees for their work. It’s pretty simple, depending on how you’re processing the check. You can print them using your payroll software or handwrite them yourself. Handwriting them is cheaper—unless you print checks online for free—but more time-consuming, especially as your business grows.

Paper checks will show your company name and should have a listing of the earnings for the pay period and year-to-date (YTD).

If printing paper checks using online software, you’ll need a printer and MICR ink to get started, along with having your printer settings adjusted according to the system.

If you choose to print your paychecks, it’s a good idea to ask your bank about its positive pay options. Positive pay is an automated fraud prevention feature some banks offer that matches the information on checks that are cashed (account number, amount, check number) with a list of checks you have uploaded to its system and authorized for payment. If someone attempts to cash a check from your company that you have not authorized, the bank will reject it.

If you’re interested in learning more about paying your employee using checks, read our guide.

Cash

| PROS | CONS |

|---|---|

| Quick | Can raise red flags with the IRS |

| Cheap (no processing fees) | More manual work to ensure compliance with payroll laws |

| Flexible (can make emergency payments at the drop of a hat) | Doesn’t work well for all company sizes |

Most businesses distributing paychecks in cash are small and only have a handful of employees. And usually, those employees are hourly or part-time workers. Paying thousands in cash every pay period isn’t efficient, so it’s best that you check how much in total you’ll need to pay out each payday before choosing this route.

When you pay with cash, be sure to keep detailed payroll records.

We don’t usually recommend employers to pay their employees in cash, as it can increase the risk of being flagged for an audit by the IRS. However, it is a decent option if you’re diligent about creating an audit trail. It’s important that you learn how to do payroll (taxes and all), maintain payroll records of any payroll-related debits from your bank account, and create pay stubs for both your employees and your business.

Tracking your payroll using Excel or even utilizing payroll templates can be a good way to stay organized.

Learn more about how to legally pay your employee using cash.

Alternative Payment Methods

Alternative payment methods refer to the use of nontraditional payment channels, such as stock compensation, PayPal, mobile payments, and electronic wire transfers. These options can be used alongside or instead of traditional paycheck distribution methods.

Stock Compensation

| PROS | CONS |

|---|---|

| Can be used to supplement wages that aren’t competitive | It’s a gamble for the employee if the stock doesn’t do well |

| Lets you compensate employees while saving your most liquid asset | Needs to be managed closely to ensure you don’t give up control of the business |

| Can delay payroll taxes | Not an option for companies that aren’t incorporated |

Paying employees in stock (also known as an Employee Stock Ownership Plan, or ESOP) isn’t as common as the other ways we’ve discussed—but some employers do use it. We don’t recommend using it to pay the full paycheck amount unless you have some sort of special arrangement and the stock has value.

Typically, it’s offered as a benefit to make the company more attractive to job candidates as compared to a replacement for their paycheck. Stock, especially for less established businesses, isn’t usually worth much in the beginning, so future payouts aren’t guaranteed.

Employee Stock Ownership Plans are typically included as a bonus in addition to a regular paycheck.

One important thing to keep in mind is that you will owe payroll taxes on the stock payment just as you do for regular payroll. The only difference is that it won’t be until the stock actually vests, which means the employee has to remain with the company for a certain period of time before the stock transfer is truly theirs. Five years is a common period that many employers wait before allowing employee stock to fully vest, but there’s usually a partial vesting period around the third year.

Read more about how an employee stock ownership plan works.

PayPal

| PROS | CONS |

|---|---|

| Can send money in any currency | Payments are immediate and therefore cannot be scheduled in advance |

| Can pay employees who do not have US bank accounts | It can take several days for the payment to reach the employee |

| Have detailed records of the day and time you made a payment | There is a fee associated with retrieving the money |

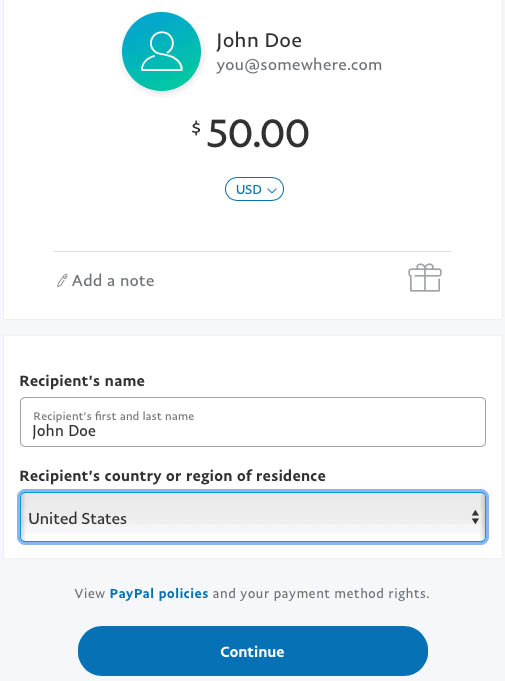

A growing way to pay employees, especially those that are in a foreign country, is through PayPal payments. With PayPal, you can send US dollars to your employees no matter where they are in the world—and it will arrive to them in their currency.

While this method is usually reserved for employees that do not have US bank accounts or do not live in the United States, it is definitely an option to pay your employees or contractors through PayPal. Just be sure if they are not 1099 contractors that you are calculating, deducting, and paying taxes on their behalf. Learn more about how to pay independent contractors.

PayPal lets you choose over 25 currencies in over 200 countries.

When sending PayPal payments, remember that the payments arrive immediately. You are not able to schedule them for a specific date. This will cause you to have to wait to send money on the specific days that coincide with your payroll.

The good news, however, is that, unlike traditional banks, you can send a PayPal payment any day of the week. For instance, if you cash out tips to your restaurant employees using PayPal, you can pay them Saturday or Sunday evenings after their shifts.

Find out if PayPal is right for your small business.

Mobile Payment

| PROS | CONS |

|---|---|

| Enhanced security measures | Still have to keep a paper trail for pay stub and tax purposes |

| Convenient for employees | Still a fairly new way of making payments |

| Similar to a traditional direct deposit, but money is available immediately | Not FDIC-insured |

With the rise of immediate money transfer right from your phone, bank accounts may be losing their appeal—especially for the younger generations. That is where mobile payments (typically through a mobile wallet) come into play. There are several available, including Apple Pay, Venmo, and CashApp.

Money goes directly from your bank account to your employees’ mobile wallet.

Payroll via mobile wallet streamlines the payroll process and eliminates the need for paper checks or direct deposit. A mobile wallet also allows employees to receive their wages directly into their mobile device, which they can then use to make purchases or transfer funds.

Another advantage of using a mobile wallet for payroll is enhanced security measures. Mobile wallets typically require biometric authentication, such as fingerprint recognition or facial recognition technology, before allowing access to funds.

Visit our article to learn more about contactless (mobile wallet) payment options.

ACH Electronic Wire Transfer

| PROS | CONS |

|---|---|

| Money transfers from bank to bank | Costs per transfer |

| FDIC-Insured | Taxes must be paid separately |

| Money can only be sent to a verified account | |

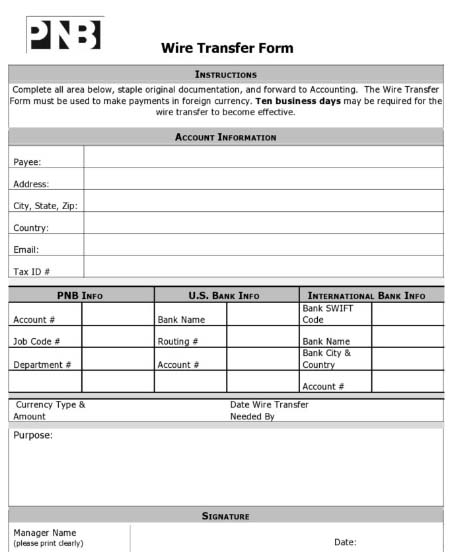

An ACH electronic wire transfer is another way you can pay your employees, whether they are in the United States or abroad. The transfer is sent from one bank account to another in minutes and uses a verification process. It requires a routing number and bank account number just like a direct deposit; however, there is additional information needed when sending overseas (e.g., a bank SWIFT code). Your employees will fill out a bank transfer form in order to receive funds.

An employee fills out their personal and bank information for an ACH transfer.

If you only have a few people to pay with an ACH wire transfer, then this could be a good option for your small business. However, it can be very costly, typically costing around $30 per transaction. We recommend using ACH transfer sparingly and only if no other option is available.

Learn more about what an ACH transfer is.

Bottom Line

When it comes to paying your employees, you should choose payment methods that are best for your business and team. Some ways may seem easier on the surface, like paying your staff with cash, but cause you a headache later.

Remember, you’re responsible for withholding payroll taxes from each paycheck and tracking all earnings so you can pay your portion of employment taxes. It’s also important to make sure that you are mindful of your specific employees’ needs (e.g., if they have bank accounts and what is most important to them—convenience, discounts, or cash). Whatever you decide, be sure to implement a solid system to track it.