Pilot Bookkeeping, launched in 2017, is a financial services firm that focuses on providing bookkeeping, chief financial officer (CFO), and tax services for startups and small businesses. It’s geared toward rapidly growing businesses, acting as a one-stop financial shop for small companies looking for chief financial officer (CFO) consultants, even assisting with research and development (R&D) loan applications for an additional fee.

It also specializes in working with high-growth technology startups, ecommerce and professional service providers, and nonprofits. Pricing starts at $499 per month for businesses with less than $15,000 in monthly expenses. Pilot is only compatible with QuickBooks Online and doesn’t offer payroll services or cash-basis accounting. It is very expensive when compared to its competitors, but geared towards larger companies or companies that anticipate rapid growth.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

Pros

- Dedicated bookkeeper

- Unlimited connected bank and credit card accounts

- Catch-up and clean-up bookkeeping

- Advanced services offered, such as tax filing and CFO consulting

Cons

- No cash-basis accounting

- More expensive than its competitors

- Lacks payroll services

- Businesses must use QuickBooks Online

Pilot Bookkeeping Alternatives & Comparison

Which Online Bookkeeping Service is Right For You?

| Users Like | Users Dislike |

|---|---|

| Resourceful and responsive customer support with quick turnaround times | Pricing can be expensive, especially for CFO services |

| Clear onboarding structure and implementation with other tools | Not able to file personal income tax returns |

| Scope of services that range from bookkeeping to tax and R&D filing, and CFO/Board reporting | QuickBooks Online is the only compatible bookkeeping software |

Those who left a Pilot Bookkeeping review on third-party sites said that they appreciated the communicative and knowledgeable customer support team that makes it easy to pose questions each month about transactions with a speedy response time. They also like the wide range of services available.

One of Pilot’s biggest drawbacks is that it is very expensive, and pricing is based on your monthly expenses. Other users said that they wished that it was compatible with other bookkeeping software besides QuickBooks Online.

The solution earned the following average scores on these popular review sites:

- Software Advice[1]: 4.9 out of 5 based on around 20 reviews

- Product Hunt[2]: 4.9 out of 5 based on nearly 40 reviews

- G2.com[3]: 4.7 out of 5 based on about 80 reviews

Pilot Bookkeeping Featured Industry Uses on Fit Small Business

- Best Online Bookkeeping Services: Best for startups

- Best Online Tax Preparation Services for Small Businesses: Best for startups seeking a scalable tax solution

Pilot Bookkeeping is very expensive compared to other online bookkeeping services. However, it is probably still less expensive than hiring a local certified public accountant (CPA) for bookkeeping, tax handling, and consultancy services.

Its bookkeeping services are based on an annual subscription model, with pricing that scales with your monthly expenses and your business needs. It also charges an onboarding fee that’s equal to one month of bookkeeping. The services are billed on an annual basis.

| Starter | Core | Plus | |

|---|---|---|---|

Who It’s Best For | Small businesses | Growing businesses that need more support | Larger businesses or those with complex needs |

Cost (Less Than $15,000 in Monthly Expenses) | $499 per month | $699 per month | Custom pricing |

Cost ($15,000 to $30,000 in Monthly Expenses) | $559 per month | $759 per month | Custom pricing |

Cost ($30,000 to $60,000 in Monthly Expenses) | $639 per month | $839 per month | Custom pricing |

Cost ($60,000 to $100,000 in Monthly Expenses) | $739 per month | $939 per month | Custom pricing |

Cost ($100,000 to $199,999 in Monthly Expenses) | $839 per month | $1,039 per month | Custom pricing |

Cost ($200,000-plus in Monthly Expenses) | Only available with Plus plan | Only available with Plus plan | Custom pricing |

Dedicated Bookkeeper | ✓ | ✓ | ✓ |

Accrual Basis Bookkeeping | ✓ | ✓ | ✓ |

Profit and Loss (P&L), Balance Sheet & Cash Flow Statements | ✓ | ✓ | ✓ |

Customer Support & Advice | ✓ | ✓ | ✓ |

Industry Standard Financial Ratios | ✕ | ✓ | ✓ |

Expedited Books Delivery | ✕ | ✓ | ✓ |

Monthly Phone Reviews | ✕ | ✓ | ✓ |

Priority Support | ✕ | ✓ | ✓ |

Support for Multiple Entities, Classes & Location | ✕ | ✕ | ✓ |

Accounts Receivable (A/R), Accounts Payable (A/P) & Inventory Tracking | ✕ | ✕ | ✓ |

Billable Expenses | ✕ | ✕ | ✓ |

Fully Customizable Chart of Accounts | ✕ | ✕ | ✓ |

Pilot offers other financial services for an additional fee:

- Pilot CFO: From $2,250 to $6,750 per month, billed annually for monthly engagement plus a budget and forecast model charge of $8,100

- Pilot Tax: Starting at $2,450 per year for unprofitable C corporations (C-corps) with no foreign subsidiaries and $4,950 for profitable C-corps, limited liability companies (LLCs), S corporations (S-corps), or businesses with foreign subsidiaries, includes federal and state corporate income tax and Delaware franchise tax filing

- A/P and A/R: Contact sales representative for a quote

- Stock administration: Starting at $399 per hour for C-corps that are issuing equity through Carta, prepaid annually and additional hours beyond the basic subscription billed at $450 per hour

- Research and development (R&D) tax credit: Price is computed at 20% of total credit received

When you sign up for Pilot, you’ll be assigned a dedicated bookkeeping expert who’ll serve as your point of contact. They’ll walk you through how to integrate your existing processes and software with QuickBooks. If you have any questions, you can speak with your account manager through the QuickBooks portal or by email at no additional cost.

Before the formal bookkeeping process begins, Pilot will onboard clients to introduce the bookkeeping software and show how the process works. The onboarding process will also help Pilot experts know what to expect and what needs to be done. Clients will also be introduced to their dedicated bookkeeping expert upon onboarding.

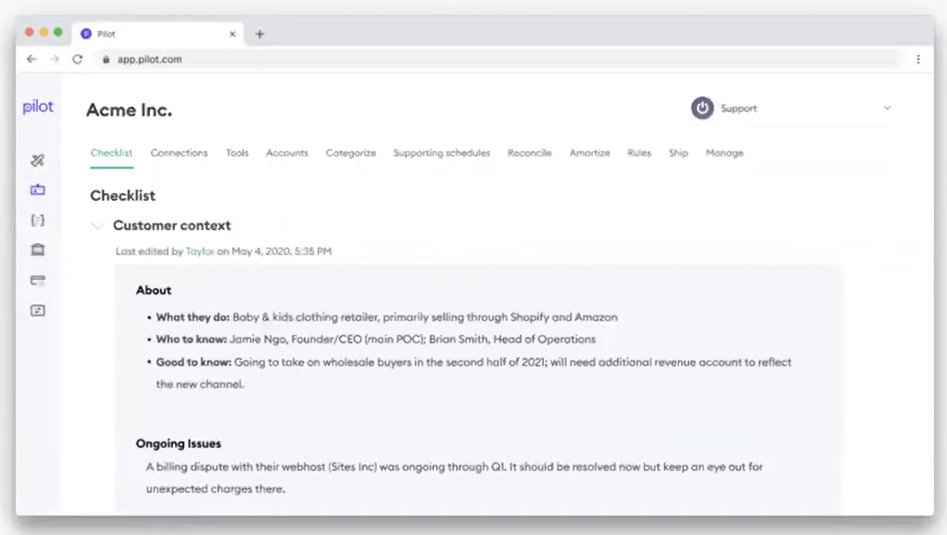

Onboarding notes prepared by Pilot’s dedicated bookkeeping expert (Source: Pilot)

Upon onboarding, the dedicated bookkeeping expert will log important notes about the client to help Pilot fully understand the client’s business and operations. This log can be found in the Customer Context tab. These notes are regularly maintained to make it easy for anyone in Pilot to help the client in case their dedicated bookkeeper is out.

In our evaluation of the best online bookkeeping services, we rated Pilot Bookkeeping as the best for startups. Its many valuable services include a detailed monthly reporting package and add-on CFO and tax services. However, while it has useful features, such as Reviewbot, an artificial intelligence (AI) tool that flags missing or inaccurate transactions, it doesn’t provide payroll services and cash-basis accounting.

Pilot provides a unique account checklist that helps Pilot bookkeepers stay organized when doing your bookkeeping. The items in this checklist include:

- Customer context

- Getting set up

- Reconciling bank and credit card accounts

- Categorizing transactions

- Expense reports

- Bills and invoices

- Credit card processing

- Journal entries

- Review

Customer context is performed during onboarding, but the dedicated bookkeeper will update this information so that other Pilot bookkeepers can access it easily. The rest of the steps in the checklist will be routine bookkeeping procedures.

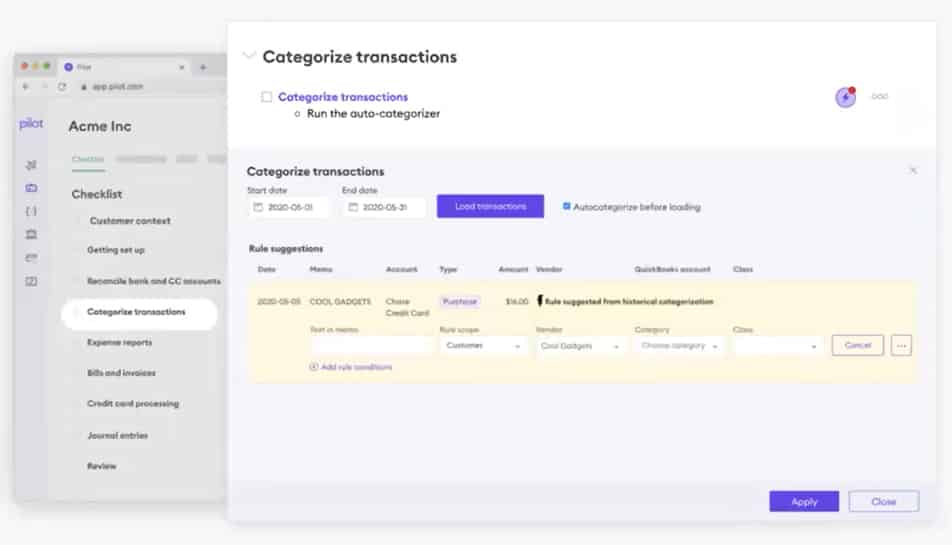

Categorize transactions substep in the checklist (Source: Pilot)

All the processes in the checklist can be done manually. However, Pilot’s system has a way of learning transactions so that it can fully automate the process and give the dedicated bookkeeper more time to attend to other transactions. In the image above, there’s a credit card purchase from Cool Gadgets. At the very top, you’ll see a “bolt” icon—this icon means that Pilot has encountered this transaction from past records and it can auto-categorize it.

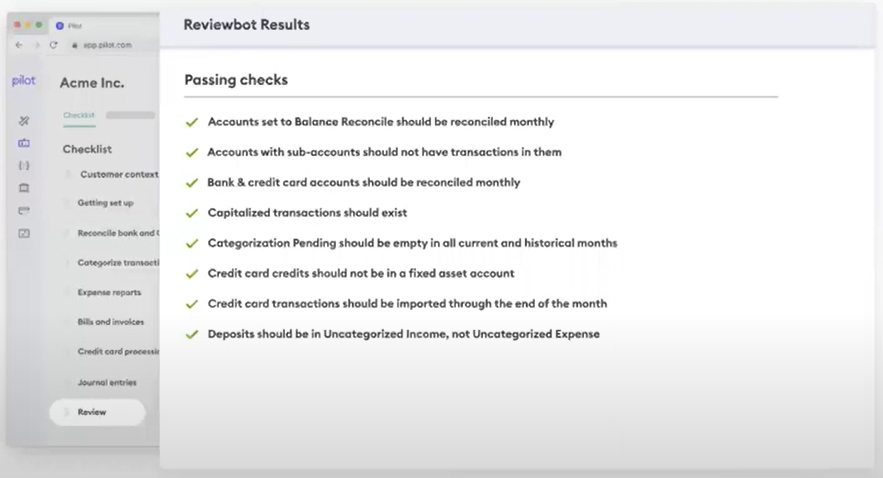

Pilot has a tool called Reviewbot that will initially review transactions and check for missing or erroneously categorized transactions. Reviewbot can filter out transactions that the dedicated bookkeeper need not review manually and only flag transactions that need manual adjustment or correction.

Reviewbot initial review results (Source: Pilot)

When Reviewbot flags certain transactions, it’ll alert your dedicated bookkeeper to check them. It can only spot anomalies in the records and lets the dedicated bookkeeper resolve these issues manually. In the image below, you’ll see an example of flagged transactions spotted after the initial review.

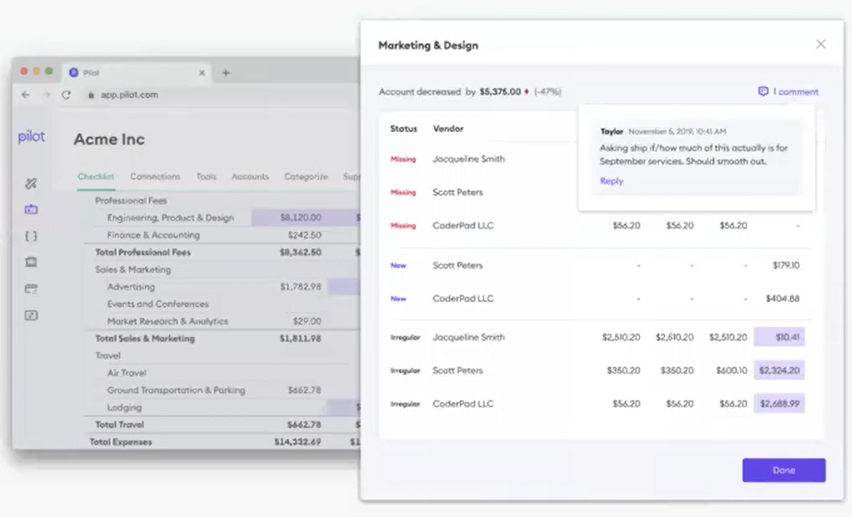

Flagged transactions passed to the dedicated bookkeeper (Source: Pilot)

The dedicated bookkeeper will review, analyze, and resolve these transactions manually. But to ensure that your dedicated bookkeeper made the right corrections, your books will undergo a third and final review. A peer reviewer from Pilot will look at the flagged transactions to ensure that all corrections are appropriate or detect if your dedicated bookkeeper missed something.

Once your dedicated bookkeeper finishes the checklist and review process, they’ll email you to tell you that the bookkeeping process has been completed. You can immediately see all the changes they made in your QuickBooks Online account.

Each month, you’ll receive a detailed report package that contains your P&L, balance sheet, and cash flow statements for the prior month. Your monthly reports also include metrics specific to your industry. For startup businesses, Pilot will calculate your burn rate, while for ecommerce stores, it’ll provide inventory updates.

In addition, Pilot’s Plus plan offers these custom schedules and reports on an as-needed basis:

- Reports by class, location, and department

- Supporting schedules, like prepaid expenses, amortization, and depreciation

- Detailed A/P and A/R reporting

- Multiple currency reports

- Reports by entity

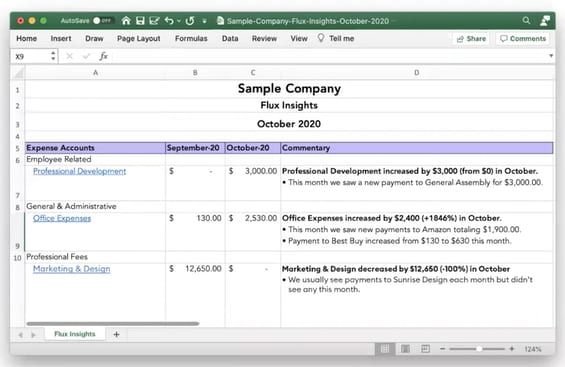

Flux Insights report (Source: Pilot)

Aside from basic financial reports, Pilot will also include a Flux Insights report that will show significant changes in your accounts and a short commentary that briefly explains what caused the change. This report helps keep you on top of expenses and makes you aware of when your business is incurring significant expenses.

Pilot Tax, a full-service tax preparation service, will take care of your state and federal income tax filing, as well as any 1099s that you need to issue to contractors. You’ll be assigned your own dedicated tax preparer who will answer all of your questions and provide you with access to live status updates of all of your filings.

Businesses that are just getting started would benefit from the Essential plan, which provides support for unprofitable C-corps and is priced at $2,450 per year. Pilot’s Standard plan is ideal for growing businesses with net income or foreign subsidiaries, and custom pricing is available starting at $4,950 per year. Both plans include federal and state corporate income tax filing, Delaware franchise tax filing, 1099-NEC filing, and email support.

How We Evaluated Pilot Bookkeeping

We evaluated Pilot Bookkeeping based on bookkeeping services, personal bookkeeper, user reviews, tax and consulting services, and pricing.

35% of Overall Score

Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service.

20% of Overall Score

You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

15% of Overall Score

The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

10% of Overall Score

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

20% of Overall Score

We consider the opinions of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found.

Frequently Asked Questions (FAQs)

Pilot exclusively uses QuickBooks Online for its bookkeeping.

To get started, Pilot has three requirements to deliver the most accurate books for your business: electronic transaction access, expense reporting software, and no commingling of personal expenses.

Yes, support is included in your plan. Your dedicated bookkeeper can answer any of your questions either through the QuickBooks portal or email.

Yes, Pilot can transition your books to QuickBooks Online. As part of your onboarding process, Pilot will migrate summarized monthly information from Xero to QuickBooks, going back to the beginning of the year.

Bottom Line

Pilot Bookkeeping is a financial service provider tailored to startups and small and medium-sized businesses (SMBs). Aside from its bookkeeping solutions, it also offers advice to growing businesses from CFO consultants and tax advisors. It also connects your business with a dedicated account manager who’ll learn the ins and outs of your business quickly. Using a blend of custom software and expert bookkeepers, it can deliver accurate bookkeeping at a price that can be customized based on the needs of your business.

User review references:

1Software Advice

2Product Hunt

3G2.com