Plumbing insurance coverage is an important part of a successful plumbing company and consists of general liability and equipment coverage. Depending on the size of the business, plumbing insurance will include workers’ compensation and commercial auto, too. Plumbing insurance costs between $45 and $100 a month for general liability. Plumbers will pay a lot less for their tools, around $20 to $30 a month for equipment and tool coverage.

Plumbing Insurance: What You Need to Know

Plumbing insurance coverage is a policy, or collection of policies, that, when necessary, can be used to help a business facing a loss. There can be two types of loss: first-party and third-party losses. A first-party loss is when your business sustains damages or some kind of loss, like theft, to its property. In these situations, plumbing insurance will help replace or repair damaged items.

The other type of loss is third-party losses, commonly called liability claims. For instance, they can be in the form of a claim that someone files against the business because while working on a pipe in their home, an employee broke a ‘Ming Dynasty’ vase. This coverage will help provide protection from a lawsuit, or it can resolve damage or injury claims.

Of course, depending on the size of the operation, some plumbing businesses may need a few types of coverage.

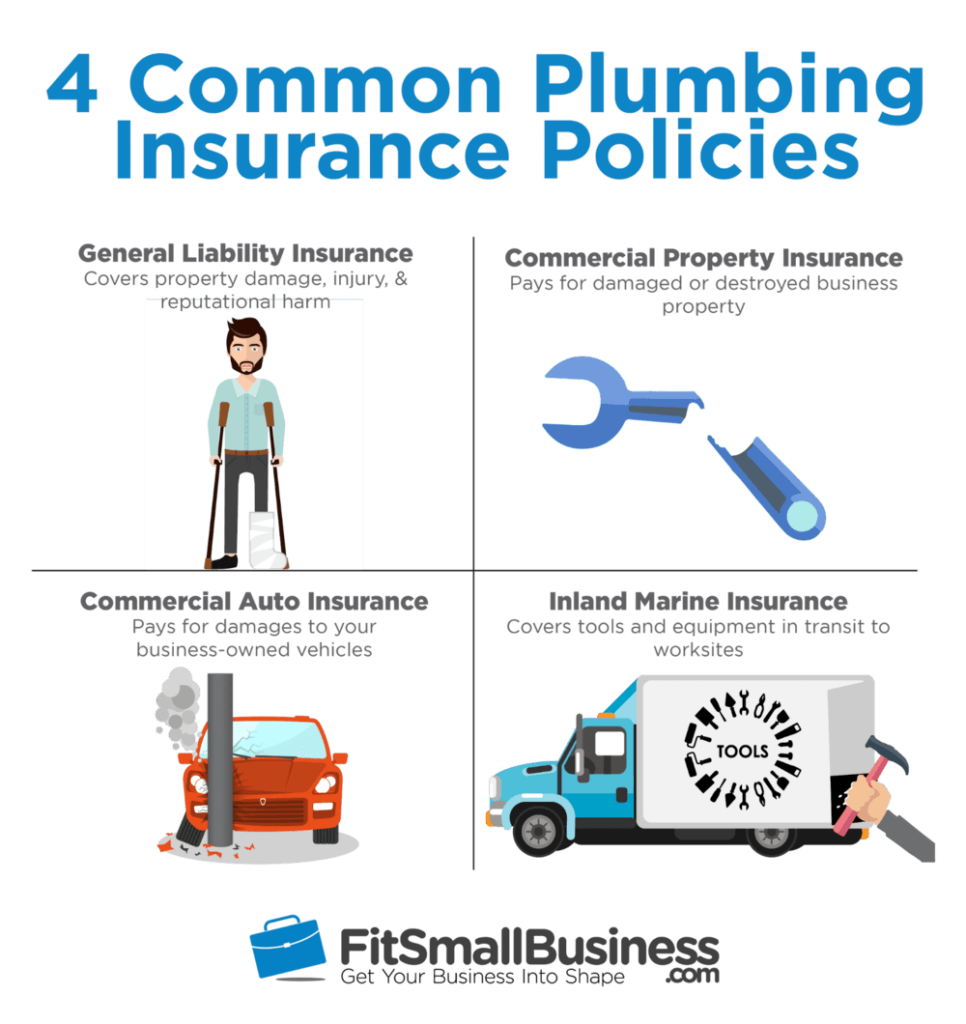

Types of Plumbing Insurance Coverage

Type of Insurance | What It Covers |

|---|---|

General Liability | Third-party claims for injuries, property damage, and reputational harm |

Commercial Property | Repairs or replaces damaged, stolen, or vandalized business property |

Commercial Auto | Third-party injuries and property damage caused by business-owned vehicles |

Workers’ Compensation Insurance | Employees’ work-related illnesses and injuries |

Surety Bonds | Clients’ financial losses if you fail to deliver on contracted services |

General liability insurance is the most important policy for plumbers because it covers the risk of third parties suing over property damage, bodily injury, and reputational harm. One type of general liability claim can be a bodily injury loss. For a plumber, two common ways for a bodily injury claim can be as follows:

- A delivery person breaks their leg, tripping over the hosepipe you forgot to put away.

- A homeowner slips and falls on water from a worksite that is not properly cleaned up or lacks any type of caution signs to let people know there is standing water.

For losses like these, general liability helps with court costs, attorney’s fees, and settlements or judgments against you.

Commercial property is a first-party insurance, meaning it exists to help a business with its property. It does so by paying to repair or replace any business property that is damaged, lost, or stolen and falls under a covered loss. Commercial property losses are covered under a named peril basis and typically include the following:

- Theft

- Vandalism

- Fire

- Windstorm

- Hail

Commercial property can be purchased for a building and its contents. In those situations, the coverage is limited to the location listed on the policy.

If you need your tools and equipment covered when they aren’t at the office, you’ll want inland marine insurance. Sometimes, insurers will sell inland marine as “tools and equipment” coverage as an endorsement for general liability.

Not every plumber will need a commercial auto policy. If you drive your regular vehicle to job sites, this is just like commuting to work. However, if you have a work truck or van used primarily or solely for the business, you will need a separate commercial auto policy. Commercial auto insurance is a special policy with multiple types of coverage that you can add.

- Liability: Pays for injuries to a third party or damage to their property

- Collision: Pays for repairs to your business-owned vehicle if it is damaged in a car accident

- Comprehensive: Pays for repairs to your business-owned vehicle if it is damaged in an event other than a collision, such as vandalism or theft

- Medical payments: Pays medical bills for you, your insured driver, and your passengers regardless of fault

The other type of required coverage is workers’ compensation insurance. This important policy is required in every state except Texas and South Dakota. However, every state has a different threshold of requirements based on how many employees your business has.

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Alabama | Coverage is required for businesses with five or more employees (part-time or full-time). |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Alaska | Any business with one or more employees must offer workers’ compensation. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Arizona | Any business with at least one employee, including part-time or family members, must provide workers’ compensation. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Arkansas | Coverage is required for any employer with two or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

California | Coverage is required for any business with at least one employee. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Colorado | Required for any business with one or more employees, including part-time workers. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Connecticut | Any business with one employee, including full-time and contract workers, must offer workers’ comp. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Delaware | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Washington, D.C. | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Florida | Any business with four or more employees must offer workers’ compensation. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Georgia | Any business with three or more employees must offer workers’ compensation. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Hawaii | Required for any business with one or more employees (including temporary employees). |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Idaho | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Illinois | Required for any business with one or more employees, including part-time. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Indiana | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Iowa | Required for any business with one or more employees. Casual employees who make less than $1,500 during 12 consecutive months prior to an injury are exempt. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Kansas | Required for all businesses with employees with a gross payroll over $20,000. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Kentucky | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Louisiana | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Maine | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Maryland | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Massachusetts | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Michigan | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Minnesota | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Mississippi | Required for any business with five or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Missouri | Required for any business with five or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Montana | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Nebraska | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Nevada | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

New Hampshire | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

New Jersey | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

New Mexico | Required for any business with three or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

New York | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

North Carolina | Required for any business with three or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

North Dakota | Required for any business with one or more employees.. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Ohio | Required for any business with one or more employees |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Oklahoma | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Oregon | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Pennsylvania | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Rhode Island | Required for any business with four or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

South Carolina | Required for any business with four or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

South Dakota | There is no law in South Dakota requiring an employer to carry workers’ compensation. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Tennessee | Required for any business with five or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Texas | Workers’ comp is optional for businesses in Texas. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Utah | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Vermont | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Virginia | Required for any business with two or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Washington | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

West Virginia | Required for any business with one or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Wisconsin | Required for any business with three or more employees. |

State | Workers’ Compensation Requirements | State Website |

|---|---|---|

Wyoming | Required for any business with one or more employees. |

Without workers’ compensation, plumbers would be responsible for covering their injured employees’ medical bills and lost wages or paying death benefits to the survivors of an employee who is killed on the job.

While not insurance, a surety bond functions very similarly to insurance. Here is how a surety bond works: it is a financial guarantee that your work will follow regulations and be completed on time. If your work is incomplete or not up to code, your customer can file a claim with the bond issuer, who then reimburses your client. A significant difference from insurance is that with a surety bond, bond issuers expect you to pay back the claims they pay.

Importantly, surety bonds are often required by state governments, local governments, or local license boards. Even if you don’t need a surety bond for a plumber’s license in your state, you may find clients who only want to work with plumbers who are bonded.

Plumbing Insurance Costs

Plumbing insurance costs are the combined premiums of all the policies purchased plus the deductible.

Insurance Type | Estimated Annual Premium | Typical Deductible | Coverage Amount |

|---|---|---|---|

General Liability | $500-$1,300 | No deductible | $1 million per occurrence and $2 million aggregate |

Commercial Auto Insurance | $900-$2,200 | No deductible for liability | $500,000 in combined liability |

Surety Bonds | 0.75%-15% of coverage amount* | $0 | $3,000-$25,000* |

Inland Marine Insurance | $225-$700 | $500-$1000 | $30,000 |

*The amount required for a surety bond will vary depending on the job or license requirements.

Plumbers insurance costs will necessarily have some variance due to several key factors. For instance, a plumber who owns a storefront typically pays more for their commercial property policy. Some other factors that impact plumbing insurance costs are as follows:

- Deductibles: Selecting higher deductibles lowers your premium but means more out-of-pocket costs for claims.

- Coverage limits: Insurers increase your premium when you opt for higher coverage limits because it means they pay more when you file a claim.

- Your revenue: Plumbers with higher revenue typically pay more for insurance because carriers assume they have more to lose and raise costs accordingly.

- Your employees: Plumbers with employees have to get workers’ compensation insurance, plus hiring more staff usually means greater liability risk. This higher risk means you’ll see an increase in your premiums.

- Your claims history: Unfortunately, filing a claim can make a plumber look too risky for an insurer. If you’ve filed a claim in the last three to five years, you can expect to pay higher rates.

- Geographic location: The location of your business can have a significant impact on the premium. Some zip codes within a state are more prone to loss than others, and some states have laws that are friendly to a plaintiff. In both situations, these factors can mean you’ll pay a higher premium.

While the above list is standard for nearly every insurer, there are other proprietary factors that a company will use when determining plumbing insurance costs. So it’s a good idea to compare quotes from multiple carriers before purchasing a policy.

Frequently Asked Questions (FAQs) About Plumbers Insurance

Short answer: nothing good. If you are faced with a loss while being uninsured, it could cost you your business and, depending on how it is structured, your personal assets, too. If it is a workers’ comp loss and you are uninsured, you may be hit with compliance fees from the government on top of being responsible for the loss. The cost of insurance is far less than the cost of being uninsured when something goes wrong.

Plumbing insurance can help you if your business suffers a loss by paying to repair or replace your property or stepping in and handling a lawsuit on your behalf. But plumbing insurance coverage can also benefit your business if you are trying to bid on a job and need proof of insurance.

Workers’ compensation and commercial auto are the only two types of insurance for plumbers that are required. Workers’ comp requirements will come down to the specific laws of your state. Beyond that, there are no broad requirements for plumber’s insurance. However, many local governments and licensing boards can require general liability and a surety bond to be licensed.

Bottom Line

Plumbers play an important role in our society by making it possible for people to have access to clean drinking water while also giving us ways to be clean and hygienic. When something happens, like a clogged pipe or a broken water line, the plumber is one of the first people called to fix the problem.

Plumbing insurance coverage is there to help plumbers when they run into a problem and need someone to help them fix it. From replacing your tool chest to helping negotiate the settlement to a property damage claim, plumbing insurance coverage is an important part of any plumbing business.

Simply Business is an online digital broker specializing in offering small businesses insurance. Plumbing insurance costs an average of $41 a month for general liability for Simply Business customers. In just minutes, you can compare multiple quotes and buy a policy online without needing to speak with anyone.