A rollover for business startups, or a ROBS for short, is a way for a business owner to access their personal retirement funds tax- and penalty-free. Completing a ROBS can be a complex process as it requires you to navigate multiple areas of tax rules and regulations. Fortunately, ROBS providers like Guidant Financial exist not only to walk you through the process but also to provide audit protections in the unlikely event of a compliance issue.

Looking for a non-debt financing option? Consider a ROBS from Guidant |

|

Key Takeaways

- To be eligible for a ROBS, your business must be structured as a C-corp.

- Although you can get tax- and penalty-free access to your retirement funds, be aware that you could lose the funds entirely should your business fail.

- A ROBS has ongoing maintenance and compliance requirements that must be met to avoid fines or penalties from regulatory agencies like the Internal Revenue Service (IRS).

What Is a ROBS?

In a simplified form, a ROBS requires that funds be transferred from your personal retirement accounts into your corporation’s retirement plan. The corporation’s retirement plan, acting as a separate entity, then purchases stock in the company. This provides the corporation with additional funds, which is similar to how companies have access to more funds when individuals purchase stock in publicly owned businesses.

A ROBS is not a loan, so there are no interest charges or funds that must be repaid. To help navigate the various tax rules and regulations needed to complete a ROBS, ROBS providers often charge fees ranging from $1,000 to $5,000. Depending on the amount of fees charged, they may also require you to have a minimum balance to ensure the expenses are not excessive in relation to the amount being rolled over. A minimum balance of $50,000 is considered standard.

Pros & Cons of a ROBS Rollover

| PROS | CONS |

|---|---|

| Provides tax- and penalty-free access to retirement funds | Requires your business to be a C-corp to qualify |

| Has no requirements for credit score, time in business, or revenue | Comes with the risk of losing retirement funds if business fails |

| Does not require any collateral | Can take several weeks to complete |

| Provides funds that can be used for a variety of business-related expenses | Must adhere to ongoing compliance requirements to avoid penalties |

| Has no interest charges and loan payment requirement | May come with one-time and recurring maintenance fees, depending on the ROBS provider |

Who a ROBS Is Right For

A ROBS can be beneficial for business owners because of its accessibility and financing flexibility. For early-stage businesses with limited credit history or access to capital, a ROBS can help bridge the gap between a variety of potential business situations. It may be for you in the following cases:

- You are an early-stage business: Using personal resources can benefit your business if you lack other resources to get your business up and running. Using a ROBS in place of traditional debt financing allows you to fund your business with limited restrictions for however much you may need, depending on your available balance.

- You want to avoid debt payments: A ROBS is not a loan, so there is no debt for you to repay. Without the burden of needing to make debt payments, this can allow you to manage your business with higher levels of monthly cash flow.

- You are unable to qualify for a business loan: A ROBS rollover has fewer qualification requirements compared with a traditional loan. The two most difficult requirements to meet include having a balance of $50,000 in retirement funds and starting a C corporation (C-corp). Common loan requirements—such as credit score, time in business, and revenue—are not considered when using a ROBS.

- You don’t want to hurt your credit: Getting a ROBS will not impact your credit. Most loans, on the other hand, can temporarily lower your credit score in the short term. This is because applying for credit can result in a hard credit inquiry, which typically lowers your credit score by several points. Having a new loan can also negatively impact your credit score as it lowers your average age of credit accounts.

If you find yourself in one of these categories and would like to discuss your eligibility with a provider, I recommend Guidant Financial. It allows business owners to schedule a free, no-obligation consultation phone call to determine if it is right for the business.

Prohibited Uses of ROBS Funds

Funds provided by a ROBS must be used strictly for business expenses. Within the scope of business purposes, however, there are several uses of funds that are not allowed.

- Paying yourself an unreasonable salary: To avoid penalties or fees, the salary you pay yourself must be considered reasonable, and you’ll need to be able to support this if audited by the DOL or IRS. You can consider average salaries for individuals performing your job functions, as well as the salary you’re earning in relation to the revenue generated by your business.

- Funding a business that is not an active operating company: An active operating company is one that is actively engaged in selling a product or service. You also need to play an active role in your company’s day-to-day tasks. Some examples can include managing payroll, assigning employee shifts, and maintaining the cleanliness of the business premises.

- Funding a business engaged in activities that are not federally legal: If your business deals with products or services that are not legal at the federal level, you cannot do a ROBS rollover. Cannabis, while it may be legal in certain states, is not allowed at the federal level and would be one example of an industry that would be ineligible for a ROBS.

- Paying certain third-party professional fees: ROBS business funding cannot be used for certain third-party services, such as setting up and maintaining the ROBS program. Rather, these services must be paid for using a separate source of funds.

- Using business property for personal use: Using ROBS funds for anything other than business purposes is prohibited by the IRS. Doing so can result in fines and penalties.

ROBS Requirements

The requirements necessary to qualify for a loan are generally not applicable to getting a ROBS, making a ROBS easier to get. That being said, there are ongoing compliance requirements that must be met to avoid fees or penalties from the IRS. Here are some of the requirements you should be aware of:

Although most personal retirement accounts are eligible, some cannot be used in a ROBS program. Below is a list of eligible retirement accounts:

- 401(k)

- 403(b)

- Thrift savings plan (TSP)

- Traditional IRA

- Keogh

- Simplified employer pension (SEP)

A minimum balance of $50,000 in an eligible retirement account is typically required to do a ROBS rollover. However, this may vary depending on the provider. As a general rule of thumb, if a provider’s fees are excessive in relation to the amount you are looking to roll over, you may not be able to do a ROBS.

If you do have a sufficient amount in your retirement accounts, ensure you roll over enough to satisfy your business funding needs. Although additional rollovers can be done, they often come with additional fees.

To do a ROBS, your business must be structured as a C-corp. No other business structures are eligible. For guidance, see our article on how to start a C-corp.

One requirement of the ROBS program is that you must draw a reasonable salary, which is something that may be reviewed if audited by the DOL or IRS. A reasonable salary may be determined by factors such as the wages paid in relation to your company’s income, the average salary in your industry for someone performing your job duties, the level of your knowledge and experience, and more.

To meet the definition of an active employee, you must be actively engaged in your business. Some examples can include processing payroll, assigning employee shifts, and acting as a floor manager.

To remain compliant with IRS regulations, you must allow employees to contribute to your company’s retirement plan. Some flexibility can be granted, such as requiring new employees to reach a minimum number of days of employment before being eligible to participate.

ROBS Costs

- One-time fees: These can range from $1,000 to $5,000. This will depend on the ROBS provider you choose. In many cases, you get what you pay for. ROBS providers that charge higher upfront fees tend to offer additional legal support, audit protection, and other services. Those items can save you time and money if audited by either the DOL or IRS.

- Recurring fees: Monthly recurring fees typically run from $100 to $200. These typically cover the cost of maintaining your C-corp’s retirement plan. It also covers services provided to you for things like ongoing administrative and guidance for paperwork filing requirements.

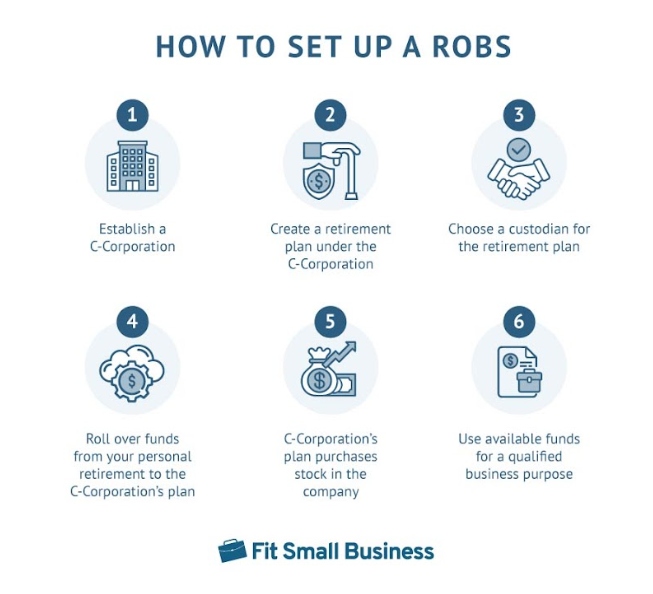

How to Get a ROBS

Getting a ROBS involves several steps. If you decide to work with a ROBS provider, it will guide you through each stage of the process to ensure compliance with tax rules and regulations.

The process of setting up a ROBS

To be eligible to do a ROBS, your business must be structured as a C-corp. This is largely because this business structure is the only one that can issue the type of stock that will allow you to get access to your personal retirement funds. S corporations, partnerships, and sole proprietorships would be unable to pursue a ROBS for business funding.

If you are already structured as a C-corp or have created a new C-corp, the next step will be to create a retirement plan under this business structure. Some retirement plan options include a 401(k), a defined benefit plan, and a defined contribution plan.

To oversee and manage the retirement plan, you’ll need to choose a custodian. The custodian can provide a platform for plan participants to manage their accounts and is responsible for the administration and management of paperwork and logistics for all plan participants, such as issuing year-end tax forms, monthly statements, trading, and more.

Once the C-corp retirement plan is set up, you can now transfer funds from your personal retirement accounts to it. Most ROBS providers require a minimum of $50,000 in funds to be transferred during this step.

Once your C-corp’s retirement plan is funded, it will purchase shares of stock in the company. In other words, the retirement plan gives funds to the corporation in exchange for shares of stock. This makes funding available to the corporation, which can then be used for business-related expenses.

As long as you use ROBS funds for a business-related purpose, you should not run into any issues if audited by the IRS or DOL. Business uses can include things like payroll, equipment, machinery, vehicles, furniture, and operational expenses.

Additional ROBS Rollovers

There’s no limit to how many ROBS transactions you can do. If you decide that you need more business funding, you can do additional ROBS rollovers. However, depending on your ROBS provider, you could be charged additional fees for each individual transaction.

Additional ROBS rollovers may also carry additional requirements. For example, it is common to have to show a positive business valuation, something that can be done by having a business appraisal completed.

ROBS Rollover Compliance Requirements

There are various compliance requirements to keep in mind when getting a ROBS. You’ll need to conduct annual reviews to ensure ongoing compliance requirements are being met and to avoid any fines or penalties.

The list of items that must be reviewed can be lengthy. I recommend working with your accountant and a ROBS provider to keep track of these requirements. You can consider a provider like Guidant Financial, as its team of experts can ensure your plan remains compliant. The company also offers a robust audit protection and satisfaction guarantee to its customers, which promises to cover all legal costs associated with representing your firm should you be selected for an audit.

- File business tax returns: You must file your C-corp’s tax returns promptly each year to remain compliant. Tax return extensions are also permissible as long as they are filed on time. ROBS providers will not be able to handle this step for you, but they can keep you informed of the filing deadline.

- File Form 5500 for your retirement plan: Form 5500 must be filed with the IRS each year, which reports the value, operations, and management of your corporation’s retirement plan. Learn more about what this is and how to fill out the form in our guide to IRS Form 5500.

- Maintain an ERISA fidelity bond: This offers insurance protection to plan participants against loss or theft of funds as the result of illegal activity. You must maintain adequate coverage, which is currently the lesser of $500,000 or 10% of the plan’s value.

- Review state-specific requirements: Additional filing requirements may apply depending on the state you are located in. Your ROBS provider may be able to provide guidance for this step.

- Keep your C-corp in good standing: C-corps have ongoing requirements that must be met if you want the business to stay in good standing with the IRS, the Secretary of State, and other state and federal regulations. Some of these requirements can include properly recording meeting minutes, holding a sufficient number of shareholder meetings, filing annual reports, and maintaining accurate financial records.

- Maintain status as an active operating company: To be considered an active operating company, you must be primarily engaged in the business of selling a product or service.

Unwinding a ROBS

Unwinding a ROBS requires certain steps to be taken to avoid fees and penalties. Unwinding, or terminating a ROBS, can occur if the business fails, you want to sell or close the business, or you otherwise want to discontinue the C-corp.

Determining what your company is worth can be accomplished by performing an appraisal of the business assets and current stock price. Insolvent businesses must be able to provide financial documents that support a stock valuation of $0.

Part of terminating the retirement plan requires proper notice to be given to all plan participants. Additional paperwork may also need to be filed depending on where you are located and the specific details of your business. You can learn more in our guide on how to terminate a ROBS 401(k) plan.

IRS Form 5500 must be filed as it formally notifies the IRS that your corporation’s retirement plan has been terminated. Skipping this step can result in the IRS assessing fines and penalties.

How to Choose a ROBS Provider

Choosing the right ROBS provider is a crucial step. Not only can it impact your overall experience, but it can also affect your company’s finances and the length of time needed to get funding. Different providers also offer various features and value-added perks, so you should consider which are best suited for your needs.

To save you time, our team has evaluated different companies and created a list of the best ROBS providers. I also recommend considering the following characteristics before deciding on any one company:

- Fees: In addition to upfront costs associated with getting the ROBS, also think about any ongoing recurring expenses that may be charged for maintaining your company’s plan. For example, some companies may charge for preparing tax forms that must be filed annually with the IRS.

- Audit protection: Because of the complexity of a ROBS, it’s important to think carefully about how audits will be conducted if you’re selected by the IRS for a review. If you’re uncomfortable handling this on your own, you may want to select a company that not only provides services to assist with an audit but also one that covers all of the associated expenses.

- Money-back guarantee: Some companies offer this to give you an added layer of confidence that you’ll receive a high level of service.

- Legal support & other resources: Since a ROBS deals with tax regulations, it’s common for companies to provide legal support for guidance. Some companies, like Guidant Financial, may also pay for you to get unbiased guidance from outside counsel at no additional cost.

- Ongoing support: A ROBS has ongoing compliance requirements, so you should consider whether you’ll receive assistance for maintaining your 401k plan and whether you’ll have guidance in meeting recurring compliance items.

Common Mistakes to Avoid With a ROBS

A ROBS is not a common form of funding, so it can be easy to make mistakes when it comes to completing a rollover. Below are some oversights I’ve seen other business owners make when it comes to getting funds via a ROBS transaction:

- Feeling uncertainty about the return on investment (ROI): Completing a ROBS without a good degree of confidence in the expected ROI is a risky move. Should your business fail, you’ll lose the balance of the retirement accounts used in the rollover.

- Rolling over the wrong amount of funds: Rolling over too little money can mean you won’t have a sufficient amount to invest or fund your company’s goals. Similarly, rolling over too much could cause you to lose more than is needed in your personal retirement accounts should your business fail.

- Overlooking compliance requirements: Even after you’ve set up your ROBS, you’ll still have to stay on top of recurring compliance paperwork and other requirements. Failing to file paperwork or missing deadlines can result in hefty fines and penalties from the IRS. This includes filing Form 5500, documenting and conducting nondiscrimination tests for your retirement plan, and ensuring minimum contributions were made.

- Overlooking associated costs: If you go through with a ROBS, you’ll need to maintain your company’s new retirement plan. Most ROBS providers can do this for you in exchange for a monthly fee of $100 to $150. However, also consider costs associated with record-keeping, compliance, and any potential expenses that might be incurred should you be selected for an audit.

Risks Associated With a ROBS

As a ROBS is part of your personal retirement account, your personal finances could be at risk if your business were to fail. To illustrate the likelihood of something like this happening, the IRS conducted a ROBS compliance project study on it in 2009.

It found that most businesses that used a ROBS for funding eventually failed or were on the brink of bankruptcy. Other findings showed that it was not uncommon for businesses to overlook ongoing compliance requirements, something that can lead to fines and penalties.

Alternatives to a ROBS

Using a ROBS can be a great way to fund your business without taking on debt. However, it’s not the only option you have. If you have a 401(k), for instance, you can also cash it out or get a loan, something we talk about in greater detail in our guide on how to use a 401(k) to fund a business.

That said, a ROBS may not be for everyone. If you don’t think you qualify or do not want to risk losing your retirement funds, here are some more alternatives you can consider that may be easier to obtain:

- Small Business Administration (SBA) loans: SBA loans are government-backed financing options that can offer low rates and favorable terms for businesses that have strong credit and finances. View our recommendations for the best SBA lenders.

- Startup business loan: Some lenders specialize in lending to startup companies. Funding options can include different types of loans, such as microloans, equipment financing, personal loans, and more. Head over to our guide on startup business loans to learn more about each option.

- Loans from friends and family: Borrowing money from friends and family can provide funding for your business, usually with lower interest rates and more flexible repayment terms than traditional financing. To see if this might be right for you, you can check out our article on raising money from friends and family to fund your business.

- Venture capital: In exchange for equity stakes in your business, venture capitalists can invest in your business and provide funding without debt obligations. There are no monthly payments required, although you will have to give up a portion of ownership. Learn more about whether this might be right for you in our article on what venture capital is.

- Angel investors: Angel investors can give you funding in exchange for equity, or part-ownership, in your company. This is similar to venture capital but is a less formal process. To learn more, read our guides on the pros and cons of angel investors funding your business and how to raise angel funding.

If you decide that pursuing a business loan may be a better option for your financing needs, you can read our guide on how to get a small business loan to learn more about the process, how to choose a lender, and how to qualify.

Frequently Asked Questions (FAQs)

A ROBS is a complex transaction with many rules and regulations. To save you time and give you a brief overview of what a ROBS consists of, here are some common questions regarding the ROBS program.

Setting up a ROBS rollover is a complex process, but it can be summarized in three major steps. First, you’ll need to have a retirement plan set up under a C-corp. You can then roll over your personal retirement funds to that of the C-corp. Those funds are then used to buy stock in the company, at which point you’ll have the funds available for use.

Funds obtained through a ROBS program must be used for business purposes. Examples include purchasing business equipment, covering operational expenses, and funding payroll needs. Funds can be used for an existing business, acquiring a new business, or investing in a franchise.

To do a ROBS rollover, most providers require that you have a balance of $50,000 in an eligible retirement account. Your business must also be structured as a C-corp. Unlike loans, a ROBS has no requirements for credit score, time in business, or revenue.

You can be assessed fees and penalties if you complete a ROBS rollover but do not use it for qualified business expenses. If you’re thinking about starting a business or purchasing another company, this is a risk that should be taken into consideration if you’re unsure if you’ll see it through to completion.

If your business fails, you could lose all of the personal retirement funds that were used in the ROBS rollover. Businesses that fail must also file additional paperwork to properly terminate and unwind the ROBS program.

Yes, you can unwind a ROBS if you want to close your business as a result of a business failure or sale of the company. However, you’ll need to remember to file the appropriate paperwork to avoid fees or other penalties.

Bottom Line

Using a ROBS can allow you to fund your business without taking out a loan and is a good option if you’re looking for financing opportunities without repayment obligations. Keep in mind that it doesn’t come without risk; in the event that your business fails, your personal retirement account could be at a loss.

You’ll also need to consider the various compliance and documentation requirements necessary and determine if you meet the necessary qualifications. Before selecting a ROBS rollover as a funding source, you should evaluate all your options to determine if it’s the best option for you and your business needs.