Sage Intacct is a cloud-based financial management and accounting suite that automates complex financial processes, including payroll, tax filings, and inventory management. It caters to a wide range of industries, including construction, real estate, financial services, professional services, and nonprofits. Sage Intacct prices are available upon request.

Pros

- Tailor-made features for nonprofits

- Can handle multientity transactions

- Multidimensional chart of accounts

- Drill-down capability in financial reports

- Complies with generally accepted accounting principles (GAAP) standards

Cons

- No upfront pricing

- Has a steep learning curve for users without accounting background

- Not ideal for small businesses

- Expensive technical support

- Companies outgrowing QuickBooks Online: Sage Intacct offers a more powerful accounting solution than QuickBooks Online in terms of accounting for special transactions, such as business combinations and foreign currency transactions and translation.

- Midsize nonprofits with a team of finance professionals: Sage Intacct is a full-featured and sophisticated accounting program, so it’s a great choice if you have accounting and finance professionals doing your books and financials.

- Venture capitalists: Venture capitalists can do well with Intacct as its global consolidation module can consolidate hundreds of entities in minutes, making it a solid choice for companies with multiple locations, currencies, divisions, and subsidiaries.

- Publicly traded companies: Sage Intacct’s features can handle complex accounting transactions while following accounting standards.

- Business owners who want to keep their own books: Sage Intacct is too expensive and complicated for business owners to use, particularly if they don’t have accounting experience. If you need an easier-to-use and more affordable alternative, consider QuickBooks Online, our overall best small business accounting software.

- Nonprofits who want member management: If you need nonprofit bookkeeping software that also gives you the ability to manage and track your members, choose Aplos. It is our leading nonprofit accounting software because it caters to different kinds of nonprofits with its comprehensive accounting and church management features.

- Small businesses looking for a more affordable Sage product: Sage Intacct is expensive and more sophisticated than needed by most small companies. Sage 50cloud is an excellent Sage product geared toward small businesses and is our best QuickBooks alternative for managing multiple companies.

If you think general-purpose bookkeeping solutions might meet your company’s needs, check out our evaluation of the best small business accounting software.

Sage Intacct Deciding Factors

Supported Business Types | Businesses outgrowing QuickBooks |

Pricing | Custom quote |

Free Trial | N/A |

Payroll | Through Rippling |

Standout Features |

|

Customer Support | Paid support, phone, and self-help library |

Sage Intacct Alternatives

Pricing | Number of Users | Multicompany Consolidation | Class and Location Tracking | Salesforce Integration | Fixed Asset Management | |

|---|---|---|---|---|---|---|

Custom Pricing | Depends on company size | ✓ | ✓ | ✓ | ✓ | |

Check Alternatives Below | ||||||

$200 per month | Up to 25 users | ✕ | ✓ | ✕ | ✕ | |

$57.17 to $389.67 per month | 1 to 10 users | ✕ | ✕ | ✕ | ✕ | |

$1,830 to $4,400 per year | 1 to 30 users | ✓ | ✓ | ✕ | ✓ | |

Check out our Sage Intacct vs QuickBooks Online comparison article for a closer look between these two popular accounting software.

Sage Intacct Pricing

Sage Intacct doesn’t provide prices on its website. However, business technology firm BT Partners reports that its pricing runs from $15,000 per year for a single-user system to $60,000 or more, depending on the complexity of your organization.

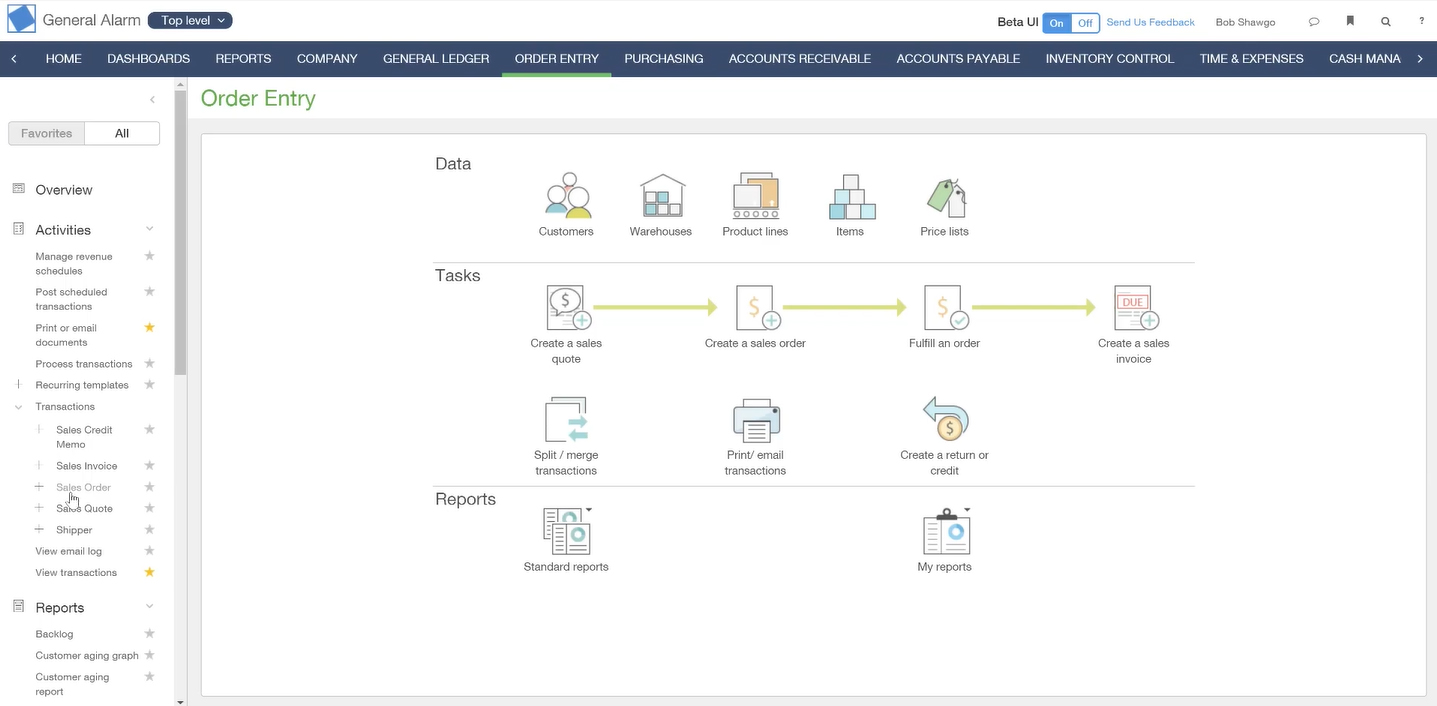

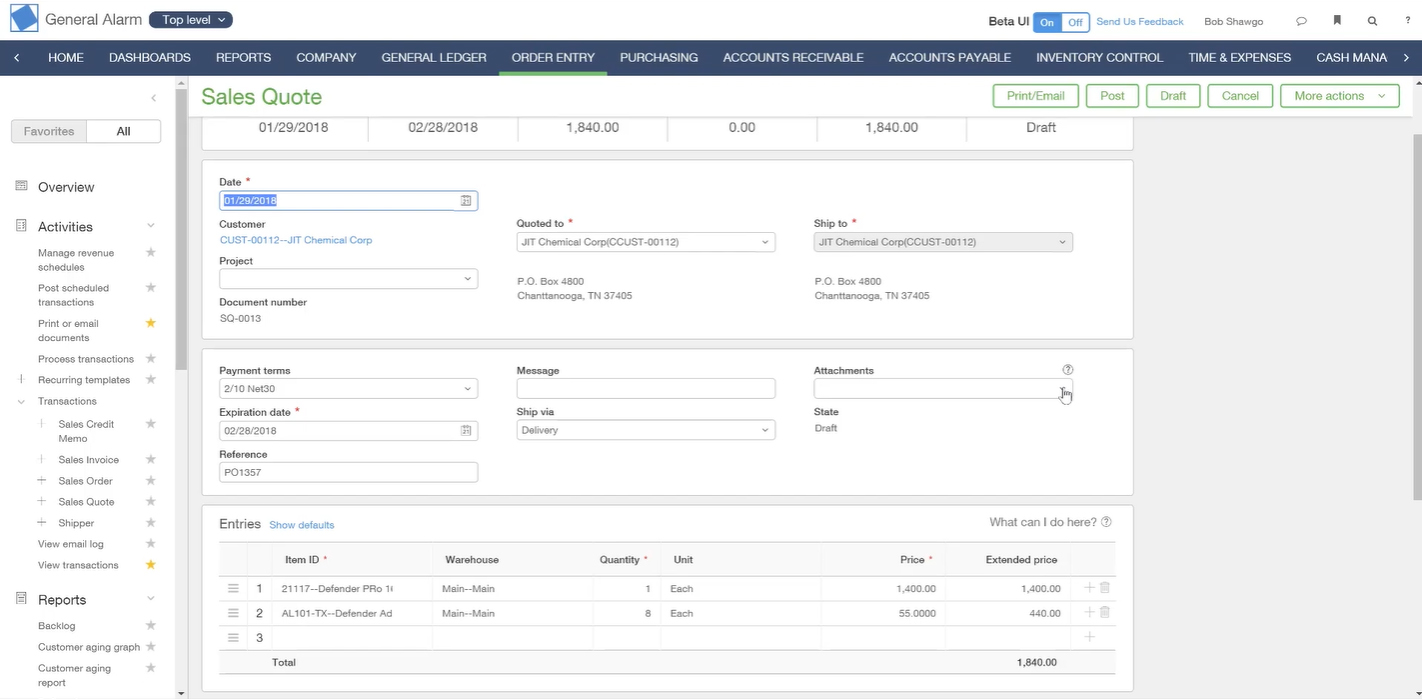

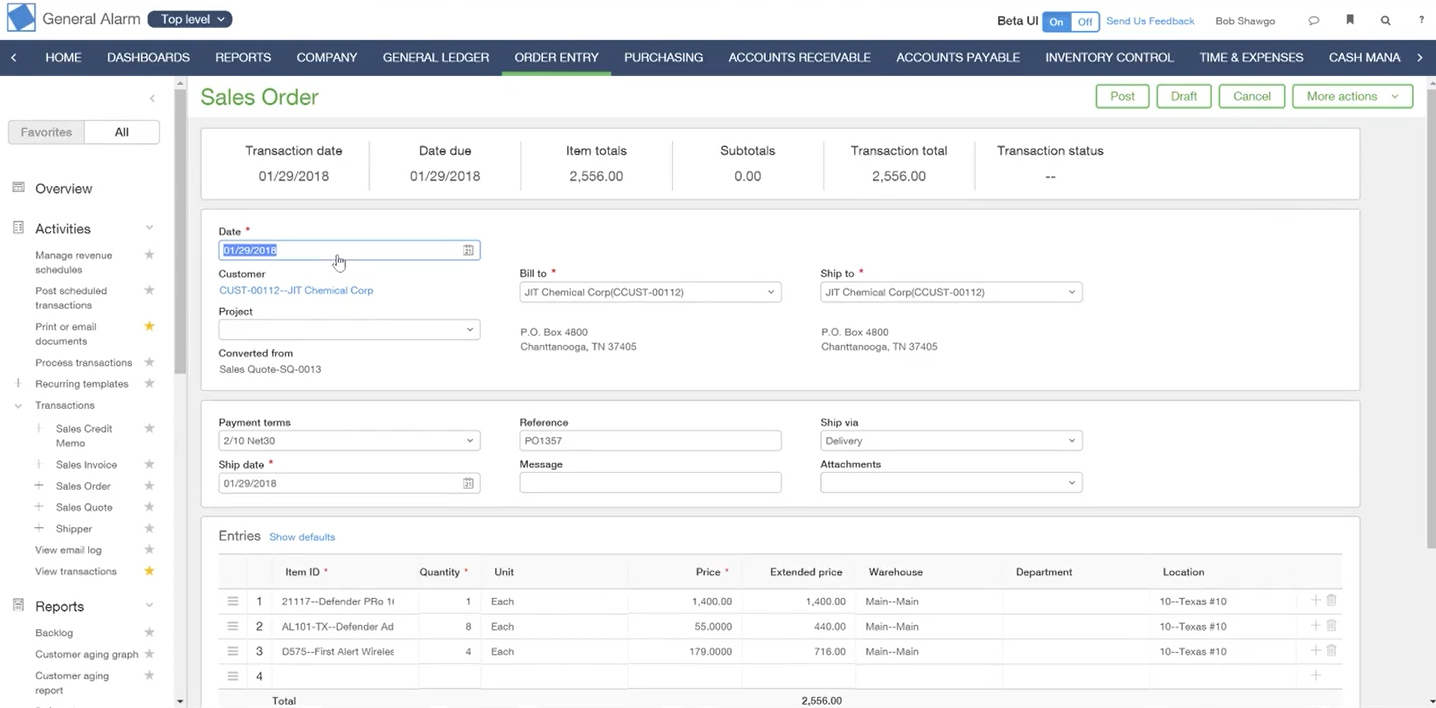

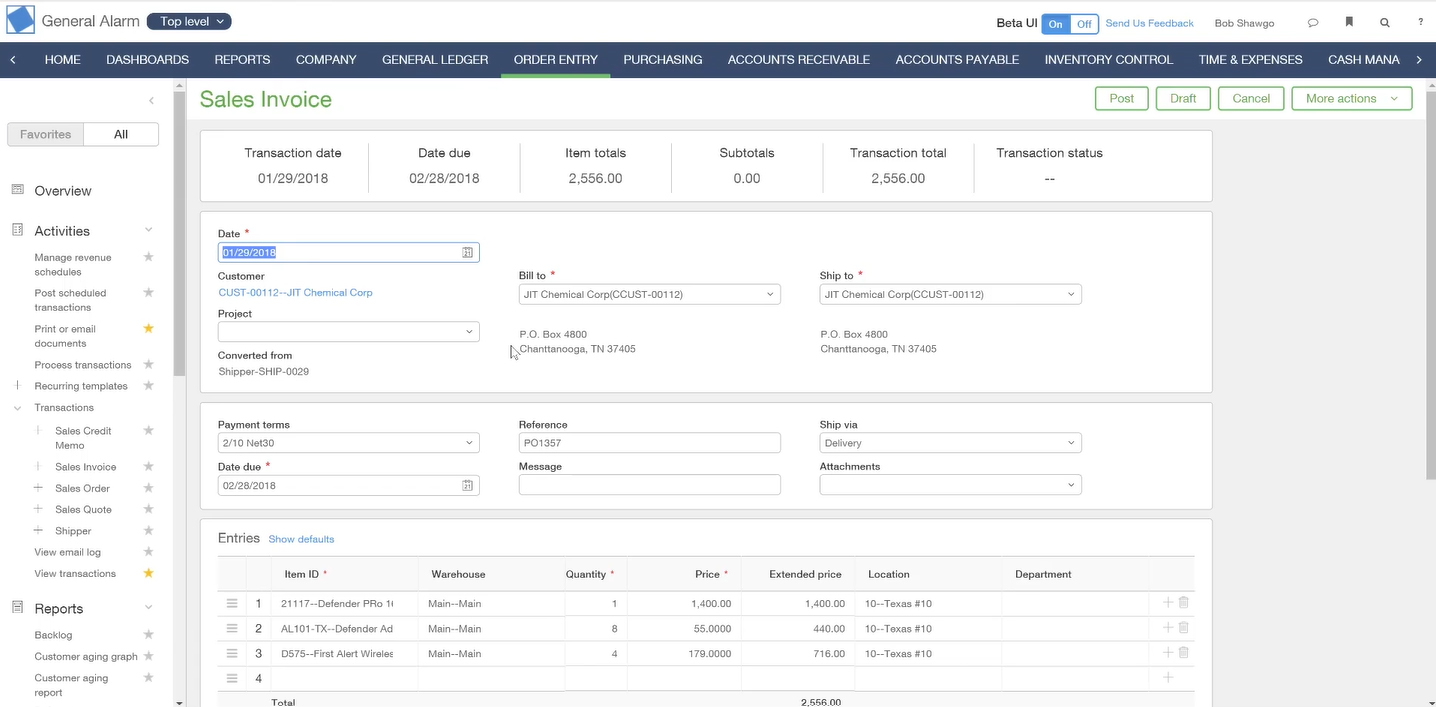

Sage Intacct Features

Sage Intacct has a robust set of features to simplify tedious and repetitive financial tasks, such as grant tracking, budget planning, fund accounting, expense management, and financial reporting. Here’s a list of its top features to help you decide whether Sage Intacct is right for your organization:

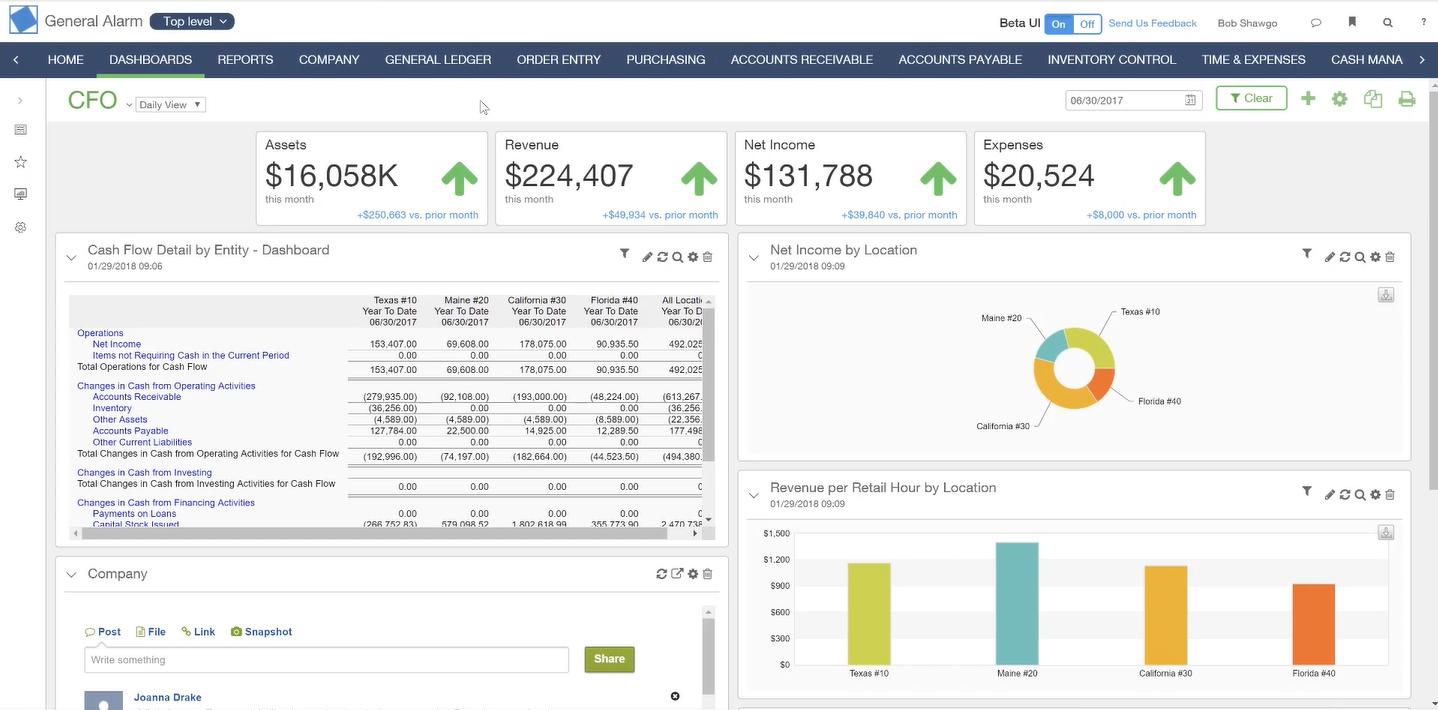

There are several dashboards included in Sage Intacct. The main dashboard that you’ll see is the CFO Dashboard, which is useful for chief financial officers (CFOs) because it shows financial performance like profit and loss (P&L) by location or a comparison between actual and projected profit. You’ll also see key financial ratios, revenue charts, expense graphs, and a balance sheet.

CFO Dashboard

In addition to the CFO Dashboard, there are role-based dashboards for project managers, controllers, A/P accountants, and accounts receivable (A/R) accountants. Overall, the CFO Dashboard is the most comprehensive dashboard, and we believe it’s the best one for monitoring the financial aspects of your business.

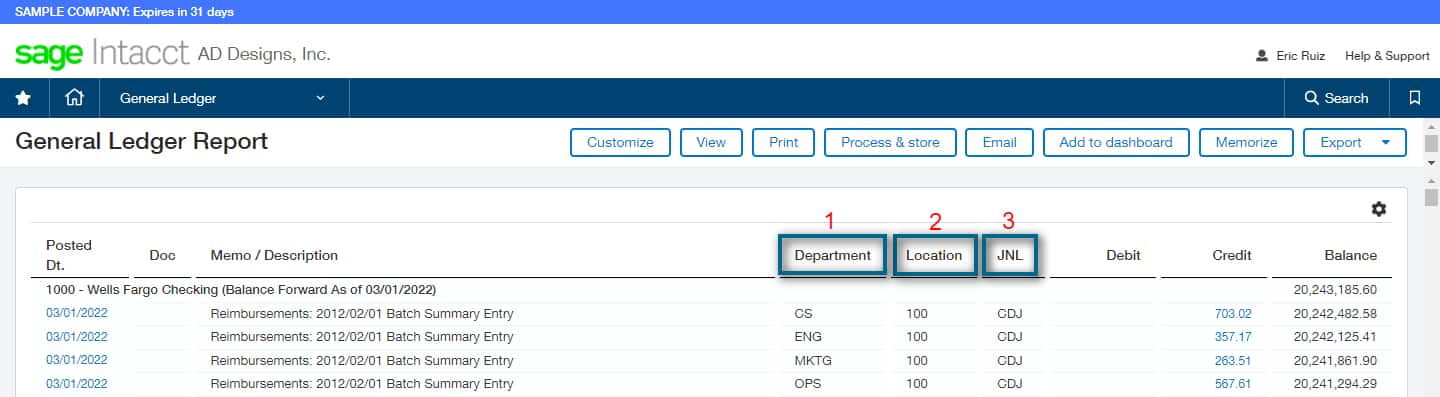

Sage Intacct has a sophisticated general ledger (GL) with a multidimensional chart of accounts. The GL manages sophisticated financial tasks across multiple entities, whether locally or globally. You can merge data, manage currency conversions, and generate consolidated reports without having to wait for the end of the month.

Transactions are posted in real time, with the ability to configure how transactions are posted in each account. You can also create and organize account groups, such as checking or cash, to help generate reports.

Sample General Ledger Report

Sage Intacct’s GL report is detailed, showing additional information that might be useful in tracking transactions. We’ve highlighted the additional columns that we like:

- Department Code: Sage Intacct shows the department codes whenever an entry gets posted to the GL. These codes can be useful in tracking transactions, especially when determining the source of the credit or debit to the specific account.

- Location ID: Aside from department codes, the platform adds location IDs so that you can pinpoint where the credit or debit came from. In the sample data above, location ID 100 pertains to New York, while location ID 200 is San Francisco (not shown in screenshot). So, a batch entry summary credit of $703.20 to the Wells Fargo Checking account is from a department in New York.

- Journal (JNL): Another striking feature is that Sage Intacct includes the journal where the posting came from. This feature is uncommon in accounting software products like QuickBooks Online. Showing the journal code is a good feature if you want to establish a clean audit trail.

Sage Intacct’s default chart of accounts is impressive, especially for corporations. It contains essential accounts for financial reporting, including specialized accounts like the following:

- Goodwill (those arising from business combinations)

- Intercompany accounts (those arising from intercompany transactions)

- Special revenue accounts (as required by revenue standards)

- Cumulative translation adjustments (those arising from translating financial statements from functional currency to presentation currency)

Overall, we appreciate that the chart of accounts is comprehensive. However, we don’t see it as a good fit for small businesses without complex transactions. But if you’re a midsize company doing business overseas or engaging in complex transactions, Sage Intacct is the ideal software for you.

Sage Intacct offers a traditional A/R system similar to those found in enterprise resource planning (ERP) software. As such, its invoicing function is technical and not straightforward. In simpler accounting software, making an invoice involves simple steps like entering the product name, quantity, and rate. In Sage Intacct, invoicing focuses more on how it affects the accounts, so the bookkeeper must be familiar with all the accounts.

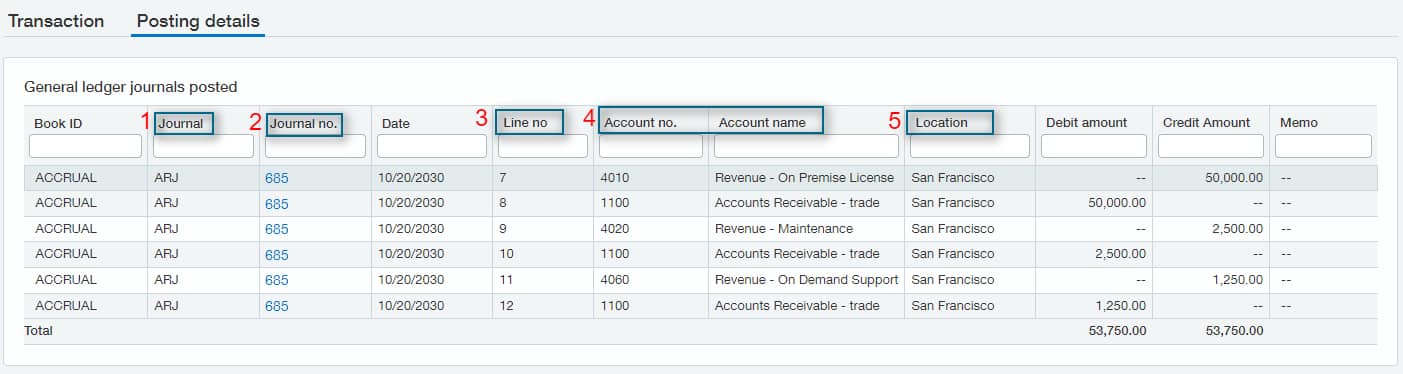

Another interesting feature of Sage Intacct’s invoicing module is the Posting Details section. Here, you’ll see all the accounts affected by the invoice. In the accounting process, an invoice affects two kinds of accounts: revenues and A/R. In the Posting Details section, you’ll see which accounts were affected and if they were debited or credited.

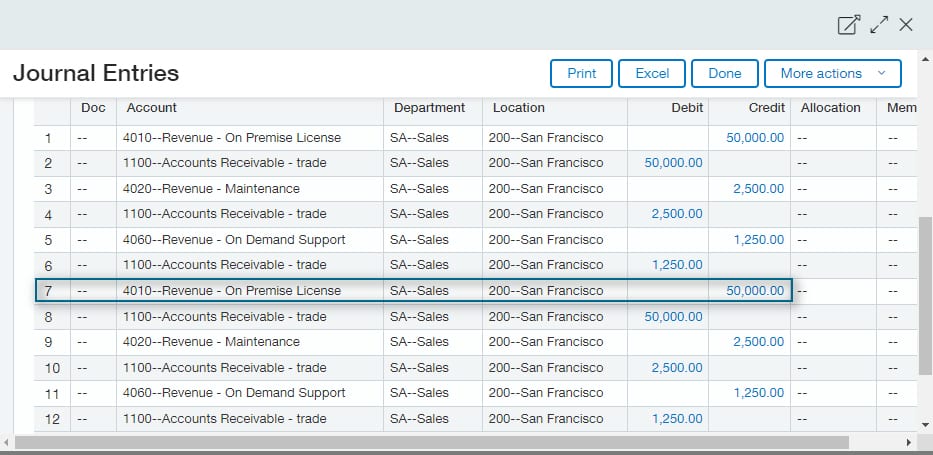

Below is an example of the Posting Details section:

Posting Details

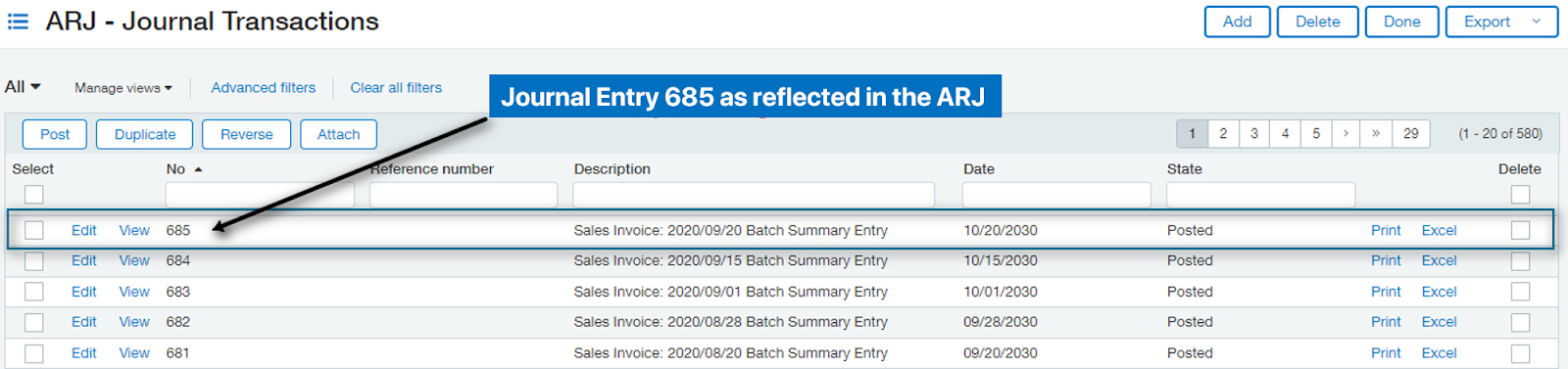

- Journal: This column shows the journal codes where the invoice was recorded. In the example above, it was recorded in the Accounts Receivable Journal (ARJ). By default, Sage Intacct has different journal codes for Purchases Journal (PJ), Cash Receipts Journal (CRJ), and many more.

- Journal Number: This column shows the journal entry number when the invoice was recorded. In the image above, we can say that entry number 685 is in the ARJ. If you go to the ARJ, you’ll see JE 685 described as a “Batch Entry Summary.”

Tracing the Journal Entry in the ARJ

- Line Number: This column shows the line where the entry was made. In our example, the credit to “Revenue – On Premise License” was recorded on line seven of the journal entry.

Tracing the invoice transaction to the journal entry

- Account Number and Name: These columns show the affected accounts. Under standard numbering of accounts, you’ll often see revenue accounts starting with “4” and asset accounts starting with “1.”

- Location: If you have businesses in multiple locations, the locations column is extremely useful. It keeps you from having to create special accounts like “Accounts Receivable – New York” just to track all receivables from that location.

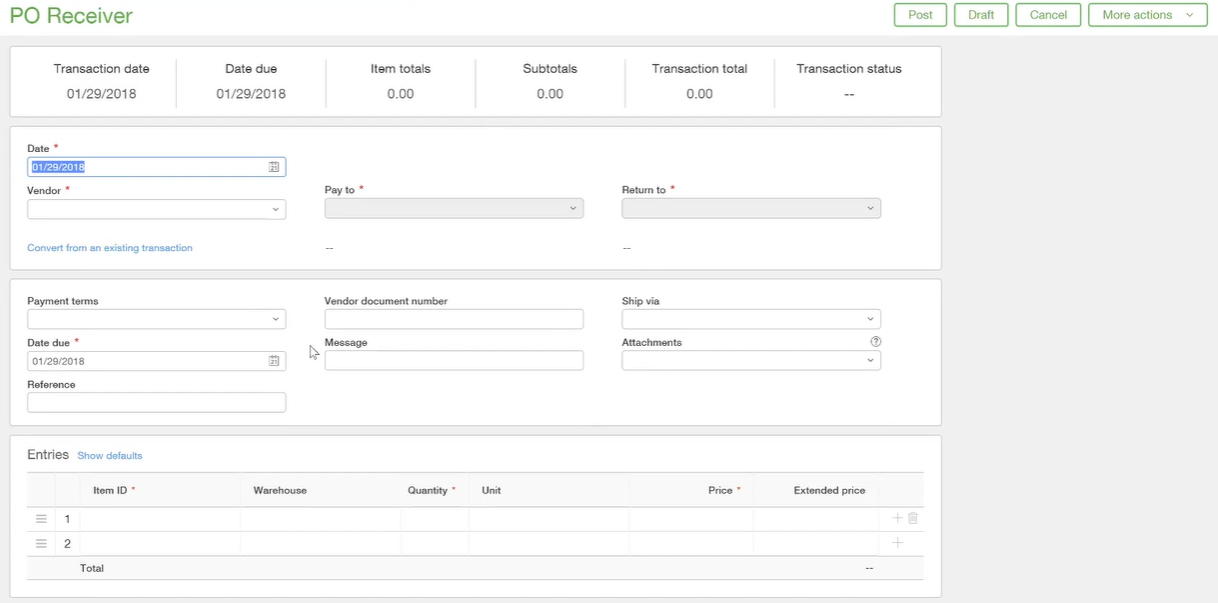

The A/P module works like the A/R module. There’s no significant difference between the two, except for the nature of transactions in the A/P module. In terms of process flow, it’s the same. When you enter a bill, you’ll need to fill in vendor information and view the posting details. All bills are posted in the Accounts Payable Journal (APJ).

You can connect your bank accounts and cards to Sage Intacct in the Cash Management tab. An interesting feature of the cash management module is the level of detail it gives about your cash transactions.

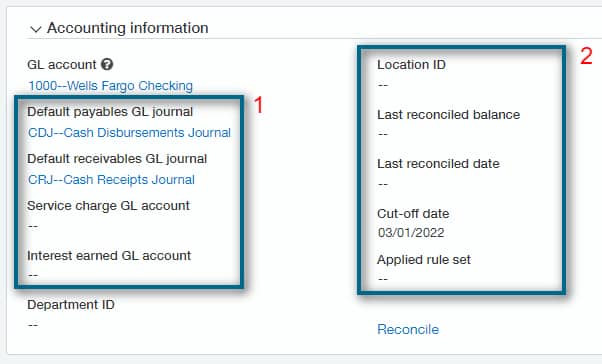

Cash account information

- Journals affected: You can modify how your checking or card transactions are recorded in the books. In the image above, you’ll see that the Wells Fargo Checking account affects the Cash Disbursement Journal (CDJ) for cash payments and CRJ for cash receipts. You can also specify where account charges and credits are recorded in the GL.

- Location and reconciliation information: If you maintain separate checking accounts for different locations, you can specify the bank account to associate with each location. There’s also information about the last reconciliation date and previous reconciled balance.

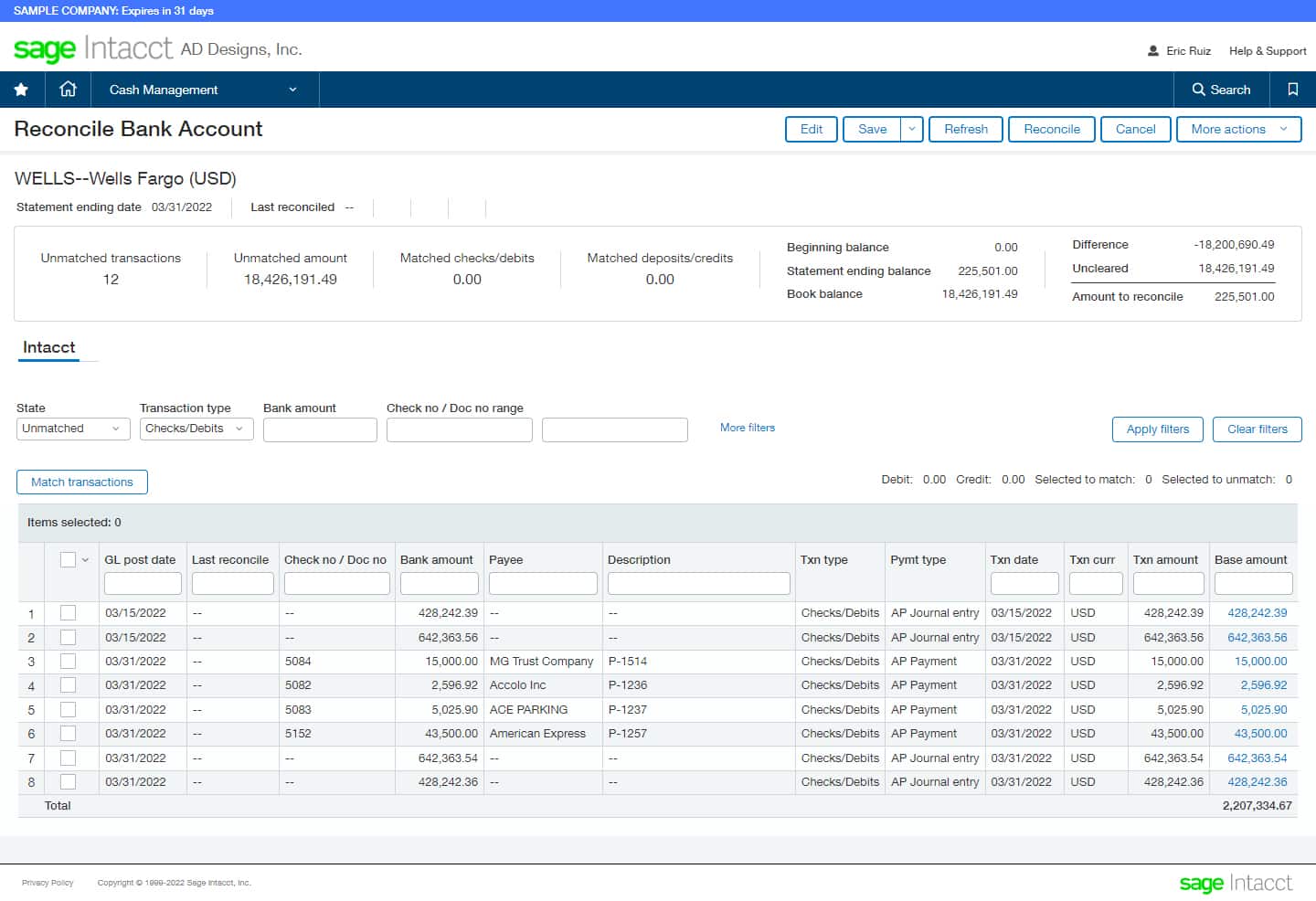

Bank reconciliation module

Sage Intacct’s bank reconciliation feature is also standard, but it’s hard for users to understand without experience in accounting information systems. A good feature in reconciling bank accounts is that Sage Intacct asks for the bank statement balance. In case you don’t want to connect your bank accounts in Sage Intacct, you can still reconcile your accounts manually.

Overall, experienced accountants will like the reconciliation module. However, we can’t recommend this to business owners wanting to perform do-it-yourself (DIY) bookkeeping.

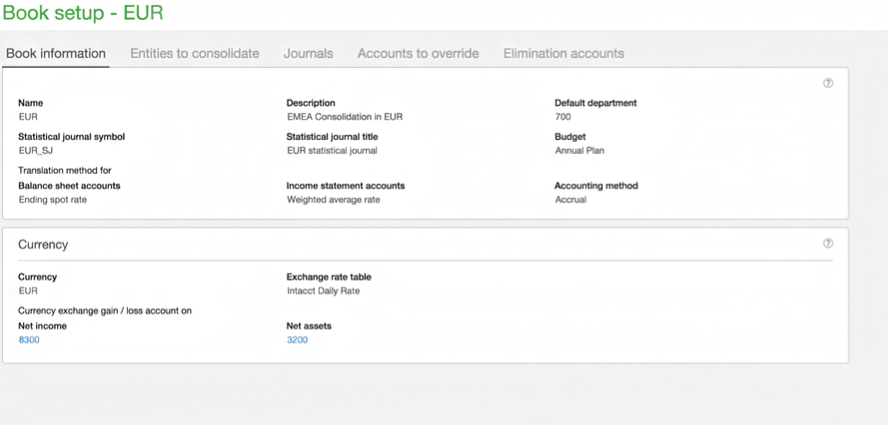

Consolidation settings

Sage Intacct’s strength is multicompany accounting and multicurrency management. These features become extremely useful if you conduct transactions outside the United States and pay in foreign currency. The image above shows the settings for consolidation, such as selecting the exchange rate, managing elimination accounts, determining exchange rates for income statement accounts, and electing a presentation currency.

If you have a foreign affiliate, Sage Intacct can also consolidate financial statements. There’s no need to create a tedious working paper when eliminating intercompany transactions or translating your foreign affiliate’s financial statements to US dollars. You can do that in Sage Intacct easily and conveniently.

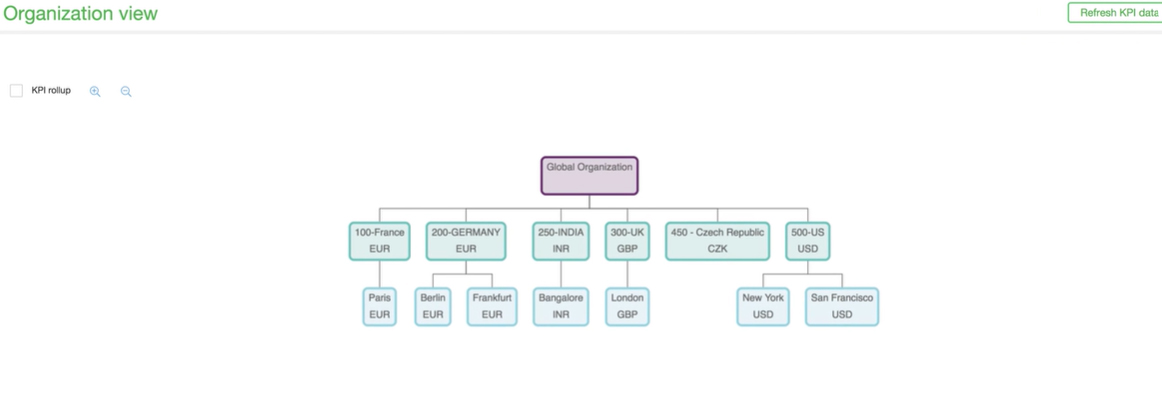

KPI rollups under Organization view

Part of the consolidation process is the KPI [key performance indicator] rollups, which helps consolidate all goals across the organization as a whole.

Intacct generates around 150 built-in reports, with visualization features like graphs, charts, and performance cards. It provides a multidimensional view of your balance sheet, income statements, cash flow statements, and other critical reports. You can also create custom reports using the interactive custom report writer. Reports and dashboards can be viewed on your mobile devices, and reports can be exported in comma-separated values (CSV), Excel, PDF, and HTML formats.

Sage Intacct Customer Service & Ease of Use

Sage Intacct’s user interface isn’t very user-friendly compared to other accounting software like QuickBooks Online. It’s similar to enterprise resource planning (ERP) systems, and those without experience in complex accounting systems can find it difficult to use. Moreover, customization options for reporting can be overwhelming for beginners; however, it can be a great benefit for experienced bookkeepers and seasoned Sage Intacct users.

Sage Intacct subscriptions include the Essential support plan, and support is available 24/5. You can upgrade to Bronze, Silver, and Gold for additional services like consulting, learning membership, and faster response. Only the Gold tier has a response time of one to four hours; the rest of the plans have a response time of one to eight hours.

Sage Intacct User Reviews

Most Sage Intacct reviews are positive. Users praise the software because it helps them automate certain tasks and is flexible for different industries. However, some reviewers said that they find the custom report writer hard to use.

Here are the scores of Sage Intacct across review websites:

- Featured Customers: 4.7 out of 5 stars based on around 3,800 reviews

- G2.com: 4.3 out of 5 stars based on around 1,800 reviews

- GetApp.com: 4.2 out of 5 stars based on around 360 reviews

Frequently Asked Questions (FAQs)

Users without accounting and accounting software experience will find Sage Intacct hard to learn. It isn’t software that can be used easily right out of the box as it’s meant for certified public accountants (CPAs) and bookkeepers with extensive knowledge of accounting information systems.

Sage Intacct is software for mid and large-scale businesses needing more advanced accounting features, such as revenue recognition, allocation, and expense matching.

Sage Intacct offers more complex accounting features than Sage Accounting. Even though both are browser-based software, Sage Intacct is suitable for businesses with complex accounting issues like private equity accounting, fair value accounting, and derivative accounting. Sage Accounting is good for very small businesses and freelancers looking for a DIY bookkeeping solution.

Bottom Line

Sage Intacct is sophisticated and expensive accounting software for midsize and large businesses. If you have an accounting department that can take advantage of Sage Intacct’s advanced features, it may be well worth the investment. We recommend it for medium-sized organizations with complex financial tasks. Businesses with no complex transactions will find it too much for their needs. For easy-to-use accounting software, our choice would be QuickBooks Online Plus.