Both Sage Intacct and QuickBooks Online are cloud-based accounting software that cater to a variety of industries. They have robust feature sets with hundreds of integrations to streamline your business processes. The choice between Sage Intacct vs QuickBooks Online depends on the complexity of your financial needs, the size of your business, your budget, and your comfort level with accounting software. It is important to thoroughly evaluate your specific needs to determine which solution aligns better with your business goals:

- Sage Intacct: Better for midsized or large businesses with multiple entities

- QuickBooks Online: Ideal for small businesses looking for an affordable comprehensive bookkeeping solution

Sage Intacct | QuickBooks Online | |

|---|---|---|

Monthly Pricing Plans | Custom quote | $20 for one user to $200 for 25 users |

Billable Clients | Unlimited | Unlimited |

Number of Users | Unlimited | 1 to 25 |

Strengths |

|

|

Weaknesses |

|

|

Overall Ease of Use | Difficult | Easy |

Scalability | Excellent | Good |

For More Information |

When To Use

Which Accounting Software is Right for you?

Sage Intacct Pricing vs QuickBooks Online: Pricing (Tie)

Sage Intacct | QuickBooks Online | |

|---|---|---|

Monthly Pricing | Custom quote |

|

User Seats | Unlimited | 1 to 25 |

Billable Clients | Unlimited | 10,000 to 100,000 |

For More Information |

Although QuickBooks Online has transparent pricing, Sage Intacct offers unlimited user seats and billable clients. It is for this reason that we ruled a tie in this category.

They are so different in their approach to pricing. Unlike many other accounting platforms that are priced on a standard monthly or annual subscription basis, Sage Intacct’s pricing is quote-based. This means there’s no standard Sage Intacct cost, and instead, pricing is customized based on your business.

Meanwhile, QuickBooks Online offers five subscription plans, which range in price from $20 to $200 per month and are based on the number of users and available features. To learn more about its different plans, check out our comparison of QuickBooks Online plans.

Sage Intacct vs QuickBooks: Features (Sage Intacct Wins)

Sage Intacct | QuickBooks Online | |

|---|---|---|

Accessibility | Web browser | Web browser |

Track & Categorize Spending | ✓ | ✓ |

Double-entry Bookkeeping | ✓ | ✓ |

Track Unpaid Bills | ✓ | ✓ |

Track Time & Mileage | With Time Tracker integration | ✓ |

Track Income & Expenses by Class & Location | ✓ | ✓ |

Project Accounting Features | ✓ | ✓ |

Send Estimates | ✕ | ✓ |

Collaboration Tools | ✓ | ✕ |

View Customer History | ✓ | ✕ |

Multiple Entities | ✓ | ✕ |

Connect Bank Accounts | ✓ | ✓ |

Job Costing | ✕ | ✓ |

A/P Automation | ✓ | ✕ |

Customized Workflow for Different Customer and Vendor Types | ✓ | ✕ |

Customization Options | ✕ | ✓ |

Generate W-2s for Employees | ✕ | With QuickBooks Payroll integration |

We selected QuickBooks Online as the best small business accounting software—and for good reasons, such as the ability to send estimates and perform job costing. It excels with its strong customization features, which allow you to brand your forms and customize categories. For businesses with employees, you can generate W-2 forms if you integrate them with QuickBooks Payroll (read our review of QuickBooks Payroll). However, QuickBooks cannot convert currency within reports, defer billing, and handle order management or processing.

It also has strong reporting and inventory tracking capabilities and more than 750 integrations. Additionally, it offers integrated payroll and time tracking (read our review of QuickBooks Time), which is great for businesses not wanting to use a third-party service. Both Sage Intacct and QuickBooks Online let you track income and expenses by class and location and strong project accounting features like project and expense tracking and project invoicing.

Meanwhile, Sage Intacct has six overarching modules, and you can select the ones you need as part of your plan. These include core financials, dashboards, integrations, reporting, billing, budgeting and planning, and advanced functionality for an additional cost.

The platform makes it simple to create real-time dashboards across one or more entities without the need to export them to Excel. Dashboards can combine both financial and operational data and, with their built-in dimensions, you can analyze your data, drilling down to source transactions. It also allows you to set up customized workflows for different customers and vendor types, and A/P automation in the form of a procure-to-pay workflow that starts with the purchase order and ends with the vendor invoice.

For all of Sage Intacct’s benefits, it cannot send estimates to customers, sales orders to vendors, and track time and mileage. However, it does have strong collaboration tools and an ability to view customer history and handle multiple entities, which are features that QuickBooks Online lacks. It is because of these additional features that Sage Intacct wins in this category.

Sage Intacct vs QuickBooks Online: Ease of Use (QuickBooks Online Wins)

Sage Intacct | QuickBooks Online | |

|---|---|---|

Overall Ease of Use | Difficult | Easy |

Online Help Section | ✓ | ✓ |

User-friendly Dashboard | ✓ | ✓ |

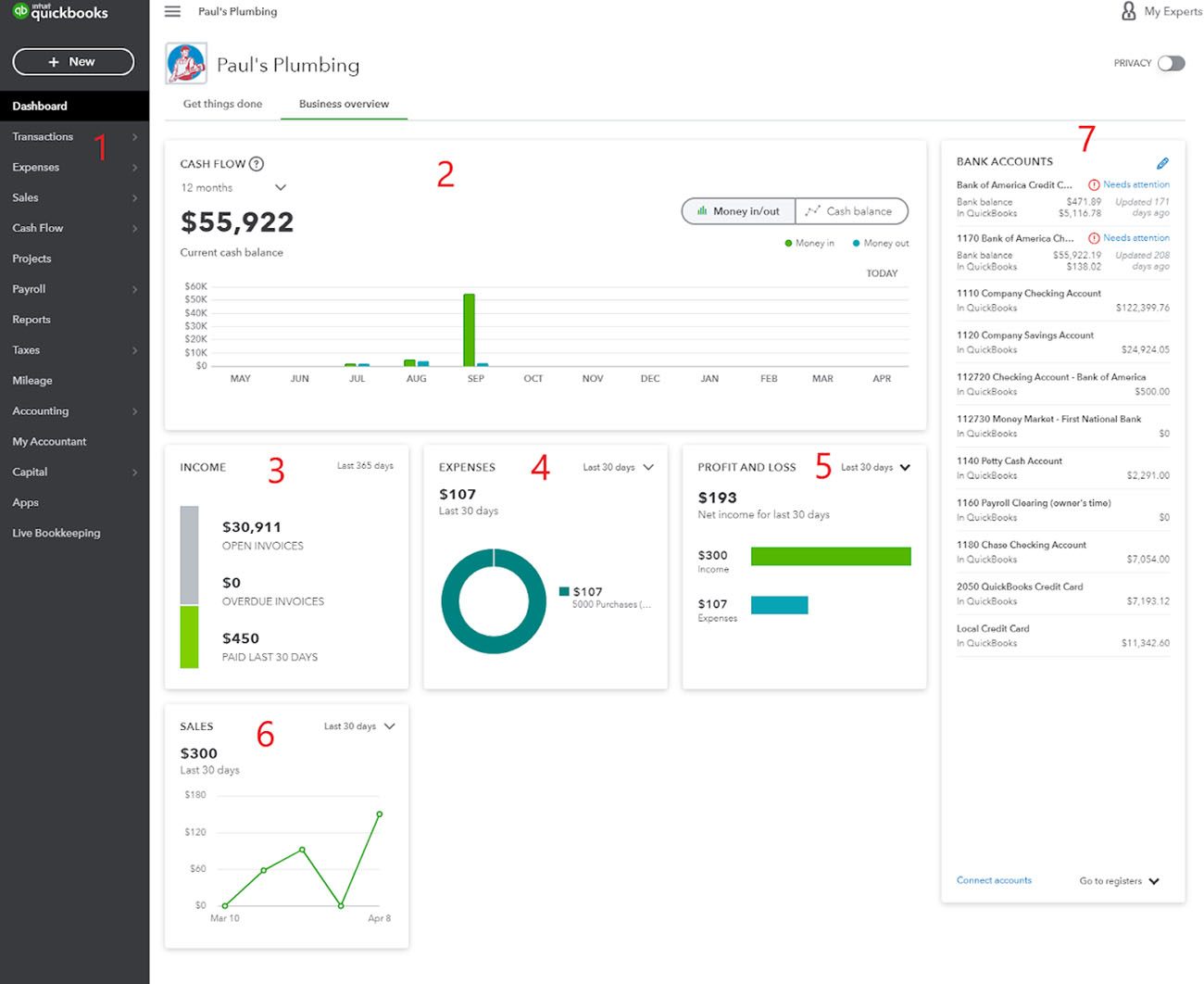

QuickBooks Online is very user-friendly, with a dashboard that allows access to many key features, such as your account balances, income and expense totals, and comprehensive charts. There’s also a navigation bar on the left that will take you to each section:

QuickBooks Online Dashboard

- Left navigation bar: This section has shortcuts to different aspects of your business, including Transactions, Expenses, Sales, Cash Flow, Projects, Payroll, Reports, Taxes, Mileage, Accounting, My Accountant, Capital, Apps, and Live Bookkeeping. Payroll and Live Bookkeeping are add-on services for an additional fee.

- Cash Flow: Customizable by time period, this report shows you your income, cost of goods sold, and expenses.

- Income: All income-related items, such as paid invoices, are shown here. This information allows you to follow up on overdue invoices and view your A/R report.

- Expenses: Your expenses, broken down by category, are shown here.

- Profit and Loss: Your profit and loss (P&L) statement can be generated here.

- Sales: View a customizable graph of sales generated during a specified time period.

- Bank Accounts: Connect your bank and credit card accounts to QuickBooks Online, and you will be able to access both your bank and QuickBooks balances.

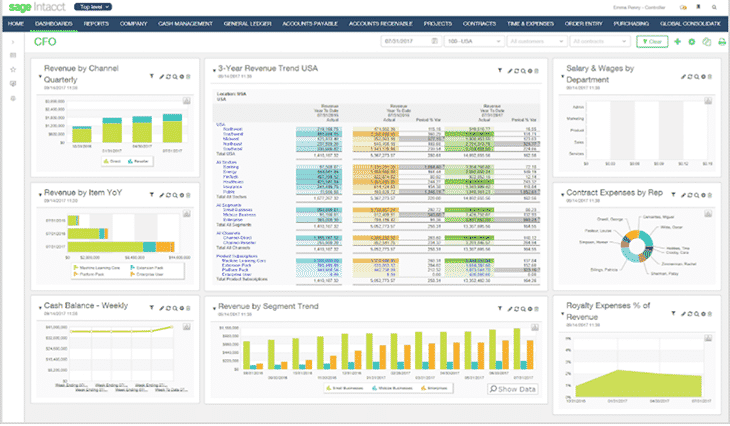

When we compare Sage Intacct and QuickBooks Online for user interface (UI), Sage Intacct’s isn’t that user-friendly and can be overwhelming for beginners, which is why we chose QuickBooks as the winner in the ease of use category. Its advanced user interface is called Action UI, and it offers tools for A/P, bank reconciliations, and creating custom reports:

Sage Intacct’s CFO Dashboard (Source: Sage Intacct)

Shown above is a chief financial officer (CFO) dashboard, which has reports that are unique to the business. This includes quarterly revenue by channel, three-year revenue trend, revenue by segment trend, weekly cash balances, and salary and wages by department. This allows the CFO to obtain a comprehensive glimpse at the different aspects of the business:

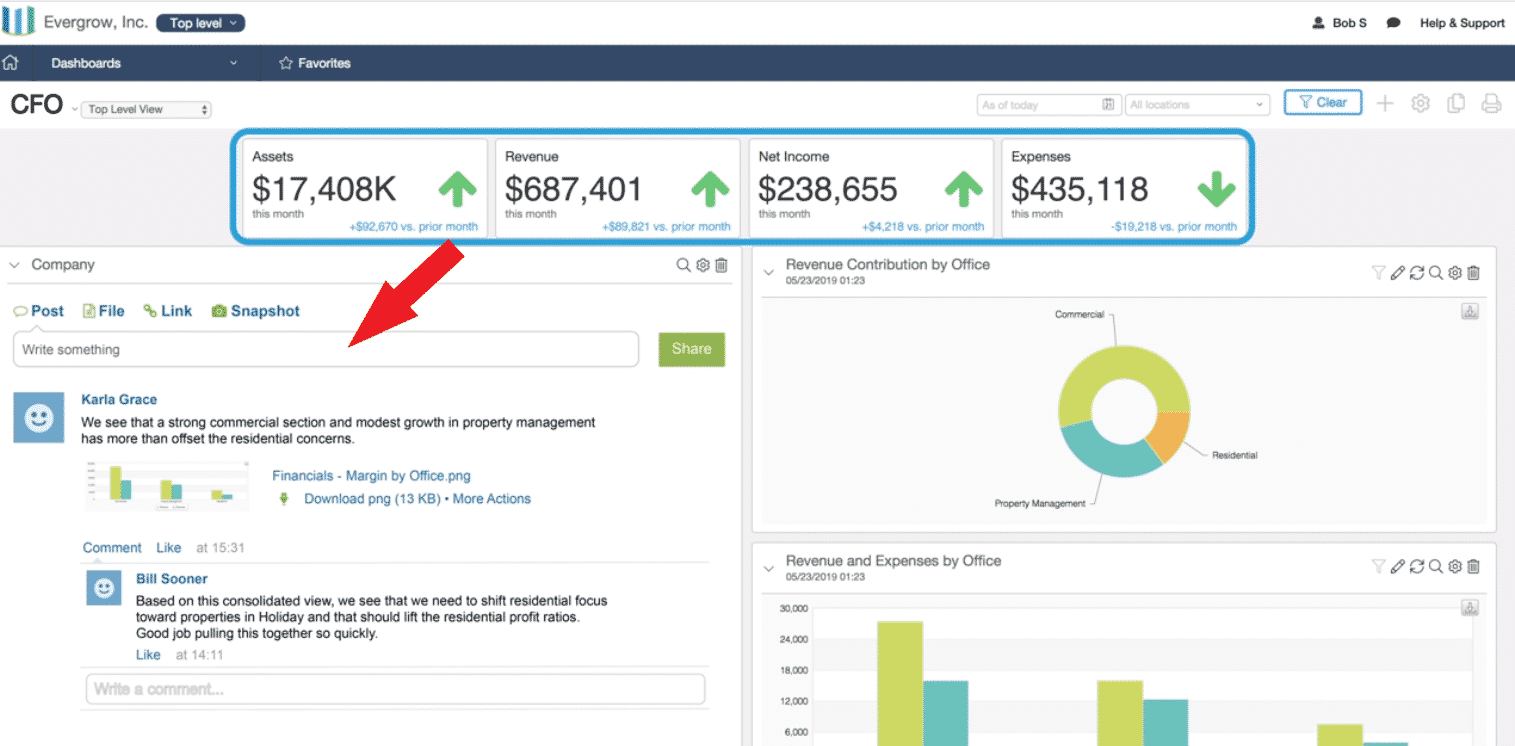

Documented correspondence (Source: Sage Intacct)

There’s also a front-to-back office compliance tool, which allows you to collaborate on decisions and document them in the context of the financial documents they relate to. In the future, you can replace recollections and speculation with a documented decision and audit trail.

Sage Intacct vs QuickBooks Online: Assisted Bookkeeping (QuickBooks Online Wins)

Sage Intacct | QuickBooks Live | |

|---|---|---|

Monthly Cost | N/A | Starts at $200 |

Service Frequency | N/A | Monthly |

Monthly Reports | N/A | Monthly |

Day-to-Day Bookkeeping | N/A | ✕ |

QuickBooks Online offers assisted bookkeeping in the form of QuickBooks Live, which assigns you to a virtual bookkeeper. Its services include monthly reports that allow you to monitor the financial health of your business. Your bookkeeper will first bring your books up-to-date and then work with you to tackle your ongoing work. However, this doesn’t include day-to-day bookkeeping tasks like paying bills, invoicing, A/P, and accounts receivable (A/R)—but it does allow for both cash and accrual accounting.

If your issue is a bit more complex, you might want to consider consulting with someone from Intuit’s expansive network of independent QuickBooks ProAdvisors. Our guide on how to find a QuickBooks ProAdvisor can assist you.

Meanwhile, Sage Intacct doesn’t have a dedicated bookkeeping service available, but we recommend that you take advantage of its partnership with the American Institute of Certified Public Accountants (AICPA) and CPA.com to select from the best outsourced financial pros for your business.

Sage Intacct vs QuickBooks Online: Integrations (Tie)

Sage Intacct offers the ability to connect to all applications you have, whether they’re proprietary custom applications or widely used business systems like Salesforce CRM. You can do this by accessing prebuilt connections that are available through the Sage Intacct Marketplace.

QuickBooks Online, on the other hand, currently integrates with more than 750 popular business apps, including others that can be accessed directly within the platform. Check out our guide to the best QuickBooks Online integrations for small business owners.

Sage Intacct vs QuickBooks Online: Mobile App (QuickBooks Online Wins)

Sage Intacct | QuickBooks Online | |

|---|---|---|

Mobile App | N/A | ✓ |

Operating Systems | N/A | iOS and Android |

GPS Mileage Tracking | N/A | ✓ |

Scan Receipts | N/A | ✓ |

Receive Payments | N/A | ✓ |

Invoice Customers | N/A | ✓ |

Available for both Android and iOS devices, the QuickBooks mobile app gives you an overview of your business activity and allows you to accomplish multiple accounting tasks wherever you are. You can view dashboard data, create and send invoices, accept payments, capture receipts and attach them to expenses, reconcile transactions, view customer information, and message customers from the app. You can also track your mileage using GPS, which you can categorize as business or personal.

Other than accessing Sage Intacct through the web browser, it doesn’t have a mobile app. However, it does have a mobile-friendly browser interface so you can still access it when you’re on the go.

Sage Intacct vs QuickBooks: Customer Support (QuickBooks Online Wins)

Sage Intacct | QuickBooks Online | |

|---|---|---|

Live Chat | ✓ | ✕ |

Phone | ✓ | Additional fee |

Email | ✓ | ✓ |

Community | ✓ | ✓ |

Searchable Knowledgebase | ✓ | ✓ |

Both Sage Intacct and QuickBooks Online offer a variety of ways to receive support. QuickBooks offers:

- Telephone support: While phone support is available, it isn’t possible to call QuickBooks Online directly. You must submit a request for them to call you.

- Email support: Email is an option if your issue is less time sensitive.

- Live chat support: If you’re unable to find what you’re looking for, you can contact the support team by clicking on the “Contact us” button at the bottom of the help window. However, this is unavailable 24/7.

- Searchable knowledge base: This includes help pages, videos, webinars, and paid courses.

- User community: Post a question in the community forum and receive feedback from other users who may be able to help you troubleshoot the issue.

Sage Intacct, meanwhile, has a Help Center, which covers how to use its features and functions. You can also visit Sage Intacct Community, which is available 24/7 and allows you to submit a support case, keep tabs on the status of your open cases, and visit the knowledge base for articles on common issues and troubleshooting solutions.

It also offers premium support plans at four levels: Essentials, Bronze, Silver, and Gold. These give you unlimited access to phone support and enable you to obtain answers related to product features quickly.

Frequently Asked Questions (FAQs)

Sage Intacct is more robust and scalable than QuickBooks Online, making it suitable for larger organizations with complex financial needs. It offers advanced features like multientity support and sophisticated reporting.

Yes, QuickBooks Online provides mobile apps for both iOS and Android devices, allowing you to manage your finances on the go.

Yes, Sage Intacct offers multicurrency support, which is ideal for businesses that operate internationally.

QuickBooks Online offers basic inventory management features, including the ability to track inventory levels, create purchase orders (POs), and manage stock items. It also calculates your cost of goods sold (COGS) automatically.

Bottom Line

Sage Intacct bills itself as the number one choice for organizations outgrowing QuickBooks. It helps CFOs and businesses with multiple entities access integrated management and financial reports across their business entities and delivers automation and controls around billing, accounting, and reporting to reduce errors, stay audit-ready, and scale the business. While QuickBooks Online offers many of the same features, it lacks Sage Intacct’s advanced capabilities such as fund accounting and collaboration tools.