A statement summarizes a customer’s activity for a given period, whereas an invoice is sent to a customer requesting payment shortly after a product or service has been delivered. Statements are usually sent monthly and list invoices issued and payments received during the month. Meanwhile, invoices are issued before payment is made and generally contain more detail about the goods or services provided than a statement does. Learn more in this statement vs invoice comparison.

Aspect | Statement | Invoice |

|---|---|---|

Purpose | Inform customers of account status | Request payment |

Content | Summary of multiple transactions | Details of a single transaction |

Timing | Often monthly, but can also be bimonthly or quarterly | Shortly after a transaction |

Payment Request | Only if an outstanding balance | ✓ |

Payment Terms | Not necessarily | ✓ |

Is Used for Accounting | Only for tracking and reconciling accounts | ✓ |

Invoice vs Statement: Purpose

An invoice is issued to formally request payment for something that a customer has purchased from you. When you issue an invoice—which contains details of a single transaction—the customer is obligated to pay the indicated amount based on the terms specified on the invoice.

On the other hand, a statement is sent to customers regularly to help them track all the activity in their accounts with your business. Statements are used primarily for informational purposes and are essentially records of past transactions.

Invoice vs Statement: Content

An invoice provides more details about a specific transaction, while a statement lists multiple transactions and therefore provides less detail about each transaction.

What to Include in an Invoice

- Business information: This includes your company’s name, address, and contact information.

- Customer information: This is the customer’s name, business (if applicable), address, and contact information.

- Invoice number: This serves as a unique identifier of the invoice, which can be used for tracking and referencing purposes.

- Invoice date: Indicate the date the invoice was issued.

- Due date: This lets the customer know the date by which they are expected to pay.

- Product/service description: Add clear descriptions of each product or service provided, including the quantities, unit prices, and any other applicable details.

- Invoice subtotal: This shows the subtotal of all the items before taxes or discounts are applied.

- Total amount due: This is the total amount owed by the customer, including taxes and discounts.

- Applicable sales taxes: If applicable, include the amount of sales tax charged.

- Payment terms: This shows the number of days in which the payment is due. Some of the most common payment terms as discussed in our article on common invoice payment terms are:

- Due upon receipt: The customer is expected to pay as soon as they receive the invoice.

- Net 30/60/90: This shows how many days the payment is due after the invoice date. For example, Net 30 means the customer is expected to pay within 30 days after the invoice date.

- Cash on delivery (COD): The payment must be made when the product or service is delivered.

- End of month (EOM): This shows the number of days a customer has to issue payment following the end of the month. For instance, Net EOM 10 means that the payment is due within 10 days after the end of the month the invoice was issued.

What to Include in a Statement

Rather than in-depth details of particular transactions provided by invoices, statements usually provide only the date and number of each invoice issued during the month. However, some statements will also include a summary description of each invoice. At a minimum, statements should include:

- Statement date: Specify the date the statement was issued.

- Statement number: Provide a unique identifying number for the customer.

- Statement dates covered: Indicate the period covered by the statement.

- Fees and interest charges: Include late fees, finance charges, or any fees or interest charged to the account.

- Recent invoices: Include the list of invoices that were issued during the statement period, including their corresponding dates, invoice number, total amount, payments made, and the invoice balance.

Some statements will include a customer-specific account number instead of a statement number. The account number combined with the statement date provides an easy way to identify the statement.

Invoice vs Statement: Timing

Invoices are generally sent after the completion or delivery of the products or services purchased. For instance, when a customer contacts you to place an order for an office computer, you might not collect the payment right away. You would prepare an invoice and send it to the customer when the computer is delivered. Additionally, you’ll send an invoice to a customer when they purchase something without paying right away.

Unlike invoices, statements are issued at regular intervals, such as monthly, bimonthly, quarterly, or as requested by the customer. For instance, many companies send billing statements at the end of the month to inform customers of their outstanding invoices and to confirm payments received.

Invoice vs Statement: Accounting Usage

Invoices are essential for accounting purposes, as they document accounts receivable. When an invoice is issued, it represents revenue that the seller expects to receive from the buyer.

Meanwhile, statements are used mainly for tracking and reconciling accounts by the customer. Since income is recorded when an invoice is issued, the subsequent issue of a statement does not affect either income or accounts receivable.

Statement vs Invoice: Examples

While you can create invoices and statements manually using tools like Word and Excel, you can automate the process by using accounting software like QuickBooks Online. Instead of manually entering the data needed to create the document, you just need to complete the entry form in QuickBooks, and it will automatically generate your invoice or estimate.

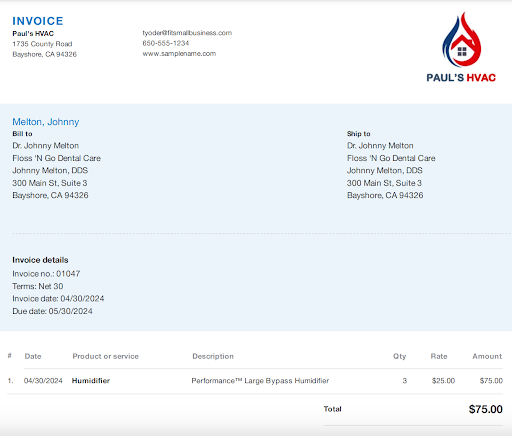

Below is a sample invoice created in QuickBooks Online. It’s issued by company Paul’s HVAC to customer Johnny Melton to request payment for three humidifiers they purchased.

Sample invoice created in QuickBooks Online

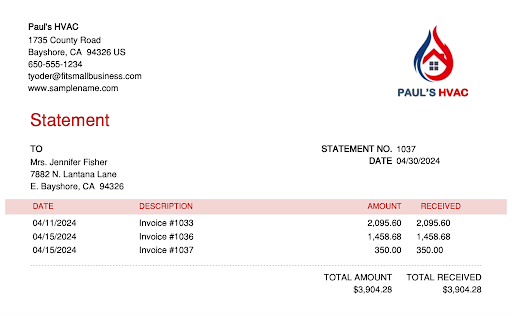

Meanwhile, here is a sample QuickBooks statement issued to customer Jennifer Fisher. The statement shows three invoices and the corresponding payments received against those invoices.

Sample statement in QuickBooks Online

Frequently Asked Questions (FAQs)

A statement is a summary of all activity and transactions between you and the customer within a specific period (usually monthly), whereas an invoice is a document you use to request payment from the customer for a product or service completed.

You should include key information, such as the invoice number, invoice date, payment terms, description of goods or services purchased, total amount due, and other relevant details.

The basic components of a statement include the statement date, statement number, statement dates covered, outstanding balance, invoice lists, and total payments received.

You should send invoices within two to three days after a transaction. Statements are usually sent monthly but can also be issued bimonthly, quarterly, or as requested by the customer.

Bottom Line

Invoices and statements are both used for tracking transactions, but they serve different purposes. You would send an invoice to request payment from the customer, and you’d send a statement to inform the customer of their account activity and balance.