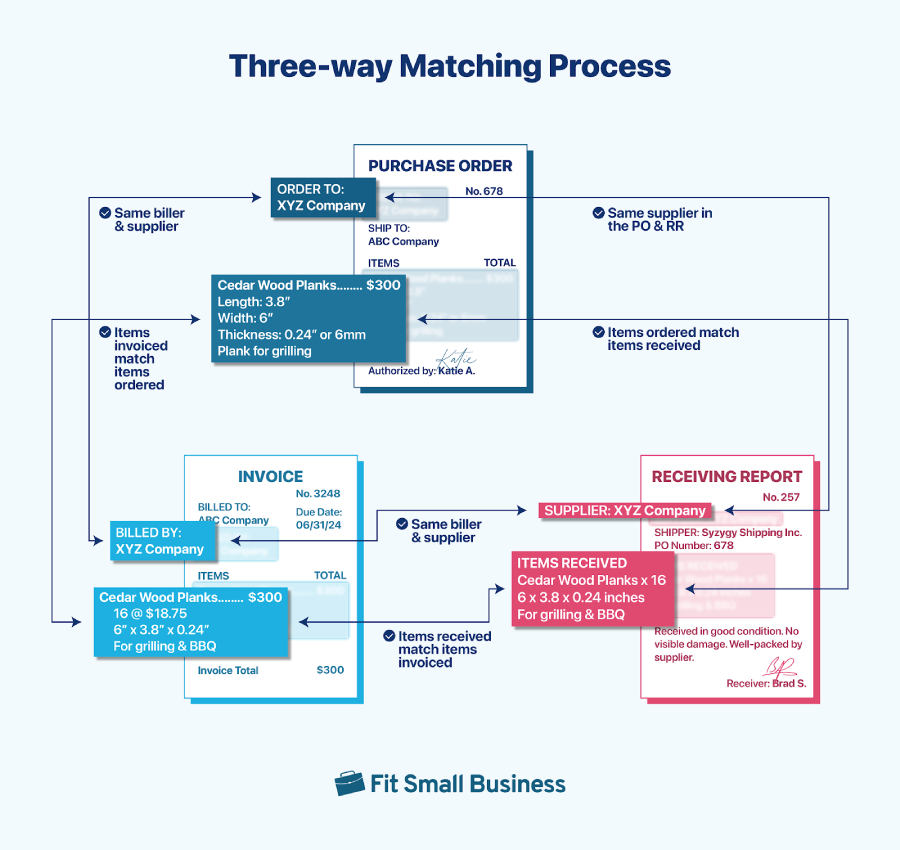

A 3-way matching in accounts payable (A/P) management is the process of matching three documents—purchase order (PO), receiving report (RR), and supplier invoice—to ensure that a purchase is correct and legitimate before making a payment. Businesses use it to detect and prevent fraud, trigger the vendor payment process, save time and money, maintain positive relationships with vendors, and keep records accurate and audit-ready.

Simply put, the PO, RR, and supplier invoice should show the same biller, supplier, and items.

Three-way Matching Components

The 3-way matching process involves cross-verifying three documents to confirm that all relevant details related to a purchase align. Here are the three documents involved in the process:

- Purchase Order: This document is sent from the buyer to the seller specifying what the buyer is purchasing. It includes details, like the product description, the item being ordered, the quantity, and the price. Learn more about what a purchase order is.

- Receiving Report: This is completed by the person who receives the goods for the buyer. It validates whether the items received meet the specified quantity and quality requirements.

- Supplier Invoice: This is a payment request from the seller to the buyer. It breaks down the products or services that were purchased, the agreed-upon price, payment terms, and a unique invoice number for tracking purposes. For more information, read our article on what an invoice is.

How Does Three-way Matching Work

3-way matching in A/P works like so:

- Verifying PO information: This involves ensuring that all the details listed on the PO—including the biller and supplier, product names, amount of purchase, and general ledger codes if needed—match those on the invoice and RR. The descriptions should be sufficiently detailed to verify that they refer to the same goods or services.

- Checking delivery information on the RR: The receiving or inventory department verifies with the RR whether the supplier and biller and the products delivered, including quantities and conditions, match those in the PO.

- Reviewing supplier invoice data: This includes verifying whether the biller and supplier and invoice details—such as quantities, unit prices, and the total amount—match those in the PO.

Three-way Matching Example

To show how three-way matching works, let’s use a scenario where a company needs to purchase 50 chairs for its employees from a vendor called All Office Solutions. Each chair costs $100, which means the total cost is $5,000.

To better understand the process, we’ll show the series of phases, from procurement to payment.

Phase 1: Purchase of Goods

Based on our sample, the company’s A/P department creates a PO to detail the specific items needed. The PO includes:

- Quantity: 50 chairs

- Price: $100 per chair

- Total Cost: $5,000

- Vendor: All Office Solutions

- Additional information: Expected delivery date, delivery address, general ledger codes if required, etc.

The PO is then sent to the vendor, All Office Solutions, to confirm the order details.

Phase 2: Delivery

All Office Solutions accepts the PO and delivers the 50 office chairs to the company, and the receiving department inspects the chairs and generates an RR that includes:

- Quantity Received: 50 chairs

- Condition: Good

Phase 3: Supplier Invoice

All Office Solutions sends an invoice to the company for the 50 chairs. The invoice includes:

- Quantity: 50 chairs

- Unit Price: $100 per chair

- Total Amount Due: $5,000

- Invoice Number: 12345

- Payment Terms: Net 30 days

Phase 4: Three-way Matching

The A/P department performs three-way matching by comparing the PO, the RR, and the supplier’s invoice. Based on our example, they verified that:

- PO vs RR: They verify that the 50 chairs ordered match the 50 chairs received—all of which are in good quality and condition.

- PO vs Invoice: They confirm that the invoice amount ($5,000) matches the cost specified in the PO and that the price per unit aligns.

- RR vs Invoice: They check that the quantity billed (50 chairs) matches the quantity received and documented in the RR.

Phase 5: Payment

Once all three documents are verified and matched without any discrepancies, the A/P department will then proceed to make the payment. If there were any discrepancies (e.g., incorrect quantities or damaged items) found, then payment will be withheld until the issue is resolved.

Why You Should Use Three-way Matching

- Detects and prevents fraud: US companies are reportedly experiencing an average annual loss of $300,000 per business to fraudulent invoices. To avoid the risk of fraudulent activity, three-way matching helps you identify discrepancies and take proactive actions to avoid them. For instance, if a supplier issues an invoice for products that you never actually received, it will be easily determined during the matching process.

- Triggers the payment process: By successfully matching the PO, RR, and supplier invoice, the A/P team verifies that the order is fulfilled correctly and that it is now ready for payment. If errors or discrepancies are flagged during the matching process, then the invoice is put on hold and the payment is withheld.

- Saves time and money: Three-way matching reduces the need for manual corrections, saving you time on resolving payment issues. Additionally, businesses can save money by ensuring they only pay for goods and services properly received.

- Improves vendor relationship: When you consistently verify orders, deliveries, and invoices to address issues quickly, it helps ensure timely payments and improves transparency and trust with your vendors.

- Helps you prepare for an audit. Three-way matching helps you keep a well-documented record of your transactions, which is essential for audits.

Benefits of Automating the Three-way Matching Process

Manual three-way matching can be time-consuming and prone to errors, so we recommend automating your three-way matching processes. Here are some of the benefits of three-way matching automation:

- Prevents risk of lost or missing documents: Manual matching means you have to manually collect, store, and maintain all documents needed for future reference. These documents could get lost or stolen over time, which can affect A/P tracking.

- Saves you time: Instead of spending hours manually comparing details on three separate documents, you can save time by using specialized software to automate the process.

- Detects errors automatically: Automated three-way matching can efficiently identify errors, such as mismatched quantities, incorrect prices, and missed deliveries.

- Speeds up the payment approval process: Since documents are automatically cross-verified, the personnel involved are notified immediately when an invoice is correct and ready for payment.

When to Use Three-way Matching

Three-way matching is particularly beneficial in various scenarios, such as:

- Purchasing expensive items or large orders: Businesses dealing with high-value items and large orders may easily experience discrepancies, and even worse, financial loss. Three-way matching can help mitigate these risks by cross-referring the three essential documents.

- Dealing with recurring purchases: If you have regular orders (e.g., monthly office supplies), it’s crucial to verify that each delivery matches the agreed terms. By doing three-way matching, you’ll ensure a purchase isn’t invoiced twice by matching each invoice to a unique receiving report.

- Working with new suppliers: When dealing with new or less-established suppliers, three-way matching can help you determine whether they are ready or reliable enough to work with for future transactions.

2-way vs 3-way vs 4-way Matching

The table below summarizes the key differences among 2-way, 3-way, and 4-way matching.

2-way | 3-way | 4-way | |

|---|---|---|---|

Who It’s Best For | Those with minimal procurement activity | Those dealing with recurring purchases, new suppliers, and expensive items or large orders | Those with complex transactions, such as high-value purchases and large orders with multiple items |

Documents Involved | PO and Supplier Invoice | RR, PO, and Supplier Invoice | Inspection & Verification Report, RR, PO, and Supplier Invoice |

Ease of Implementation | Easy; simple verification process | Moderate; needs more documentation | Difficult; time-consuming and requires comprehensive documentation |

To help you stay on top of your A/P processes, check out our accounts payable workflow guide, which summarizes the AP process in three major steps.

Frequently Asked Questions (FAQs)

It works by comparing the details on the PO, RR, and supplier invoice. Payment is approved only when all of these three documents match.

It helps ensure that a business only pays for goods or services that were actually ordered and received, which helps prevent overpayments, fraud, and errors.

It involves the PO, RR, and the supplier invoice.

Yes, and you can do it by using specialized A/P software like Bill.com

Bottom Line

The 3-way matching in accounts payable is essential for many businesses, especially those that manage substantial procurement activities or high-volume transactions. It helps ensure that the details on the PO, RR, and supplier invoice are consistent—which means that the A/P team can proceed with paying the invoice with confidence.