An invoice number is a unique and sequential number assigned to each invoice document. Invoice numbers can be purely numeric, such as 10021, or alphanumeric, such as INV-10021. It allows businesses and customers to refer to a particular invoice easily when multiple invoices exist, making it much easier to match invoices with payments.

For small businesses, invoice numbers enable you to track and organize invoices further. Since invoice numbers are sequential, you can spot if there is a missing invoice quickly, allowing you to investigate further and detect errors along the way.

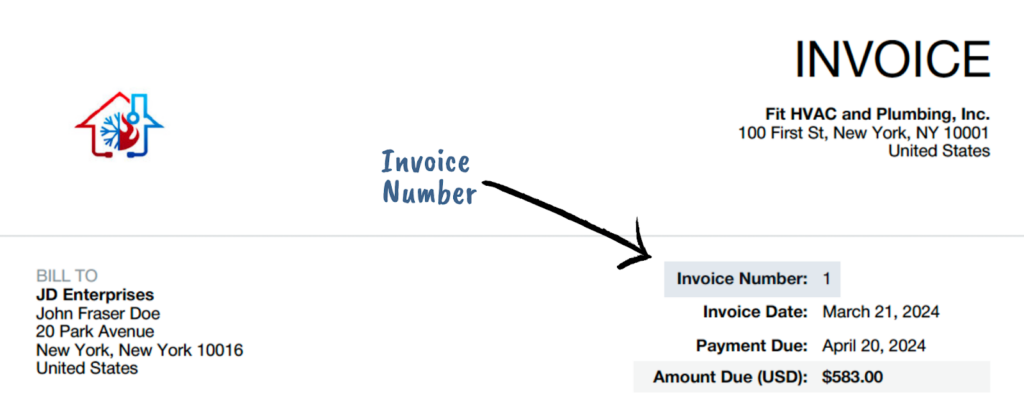

The image below shows where you can usually find the invoice number. Invoice designs differ, but invoice numbers are usually placed in the upper portion of the document.

Sample Invoice

In this guide, we’ll go over the uses and importance of invoice numbers. We’ll also show you how you can design a unique invoice number for your small business.

Importance of Invoice Numbers

Every invoice must have a unique invoice number. Without it, the invoice can’t be easily tracked or retrieved. Regardless of the invoice design, the invoice number must be present and prominent in the document.

1. Matching Customer Payments

When customers pay their dues, the business must match the payment with the corresponding invoice to verify if the customer has paid the correct amount. Some businesses require customers to indicate the invoice number in the payment to make it easy for the bookkeeper to mark invoices as paid.

2. Avoiding Duplicate Invoices

Without a proper invoice numbering system, there’s a high chance that you’ll have duplicate invoices. Proper numbering helps you organize all invoices and provide a single reference number for each invoice issued.

If you’re using invoicing software, the tool often auto-generates the invoice number. So, when there are two invoices with duplicate information but different invoice numbers, it’s easy to declare that one is a duplicate invoice.

3. Auditing Sales Transactions

An invoice is a source document in accounting that serves as evidence for revenue transactions. Invoice numbers can help you organize sales transactions per period, especially for sales cutoff testing. When performing cutoff procedures, you can check if current period recorded sales match current period invoices—as the next period’s invoices may be recorded as the current period sales or vice versa.

Hence, keeping a detailed inventory of invoice numbers can help you identify if all invoices have been recorded or if there are missing invoices. For example, if you have determined that invoices 1050 to 1100 are invoices issued in 2023, invoice numbers 1101 onward are assumed to be invoices issued in 2024.

4. Sending Payment Reminders or Collection Letters

Some customers can have multiple outstanding invoices in your business records. Invoice numbers will be the first point of reference when sending payment reminders or collection letters. For instance, the reminder may be worded like, “Hello, Customer. We’re sending you this gentle reminder for your outstanding balance of $230 in Invoice No. 12589 dated March 25, 2024. The due date is on April 15, 2024. Please settle this invoice on or before the due date.”

Mentioning the invoice number makes it easy for the customer to pull up the invoice from their records and verify if the reminder is correct. Without an invoice number mentioned in the reminder, it would be hard for the customer to locate the invoice document.

Related resources:

Designing an Invoice Numbering System

For your invoice numbering system, it’s easiest to start with 1 as the invoice number. However, that is rather plain and confusing, considering that there are other reference numbers used in the business—such as purchase order number or payment reference number. To make it unique, use unique numbers or letters that can serve as identifiers.

Here are some ideas that can help you design an invoice numbering system:

These are some examples of invoice numbering syntaxes. We recommend that you design a unique invoice numbering system that best suits your processes.

Frequently Asked Questions (FAQs)

It is the seller who provides and generates the invoice number. It is often generated automatically in the invoicing or accounting software used and should be predominantly displayed at the top of the invoice.

New businesses start with invoice number one. But as you begin a new accounting period, the invoice number starts with the number after the last invoice number. For instance, if calendar year 2024 ended with invoice number 1120, the invoice number for 2025 should start at 1121.

Bottom Line

We hope this article helped you understand what an invoice number is and why it’s important in the accounting system. Without invoice numbers, you will have difficulty organizing and sending invoices. For customers, they will also have a hard time distinguishing which invoice arrived first. However, accounting and invoicing software generate invoice numbers for you automatically whenever you create an invoice.