Cash discounting is offering a discount on a product or service to customers who pay with cash. Businesses use cash discounting to avoid credit card processing fees. It is seen more commonly with small or mom-and-pop businesses, especially those with a lot of customers already paying in cash or those with particularly tight margins.

How Does Cash Discounting Work?

In a cash discount program, pricing for all products and services is pre-adjusted to include the credit card processing fee.

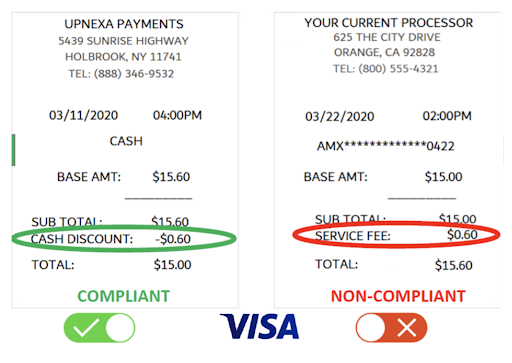

When a customer checks out and pays with cash, the receipt shows a line item for cash discount that deducts a small amount (basically the amount of the credit card processing fee). In the end, the customer is happy to receive a discount while the merchant accepts the full value of the product or service—free of credit card fees.

Examples of a compliant and noncompliant customer receipts in a cash discounting program. Compliance guidelines require receipts to clearly identify the pre-adjusted base amount of the product sold, followed by the cash discounts for the transaction. The noncompliant sample receipt is, by default, a credit surcharge, which we discuss in the next section. (Source: UpNexa)

Note that transparency at checkout is a crucial part of the process. Before accepting any payment, cashiers have to ensure customers are aware that (1) they will receive a discount if they pay in cash, and (2) they still have the option to pay with a credit/debit card, simply without a discount.

Cash Discounting vs Credit Surcharging

While cash discounting and credit surcharging are both strategies for passing on credit card processing fees to customers, there are a number of key points where they vary.

Credit surcharging allows merchants to impose a “surcharge fee” to purchases that were made with a credit card. Learn more about credit surcharging.

Cash Discounting | Credit Surcharging |

|---|---|

Removes a portion of the list price at checkout | Adds a fee to the product list price at checkout |

Perceived as an incentive | Perceived as a penalty |

Legal in all US states as long as the program is compliant to federal regulations | Limited and not allowed in some US states |

Less regulated by card networks | Comes with more card network regulations |

Requires extra work to raise product list price and issue discounts at checkout | Easier for merchants to manage and stay compliant |

Debit cards are treated the same as credit cards | Debit cards cannot be subjected to surcharging |

Displayed as a “cash discount” in sales receipts | Displayed as “surcharge” or “service fee” in sales receipt. No discounts for cash transactions. |

Simply put, customers pay less than the list price with cash discounting. But when a customer pays more than the product list price, it’s surcharging. This basic difference is at the core of how state laws and card networks impose regulations for both zero-cost payment processing strategies.

What about convenience fees?

A convenience fee is different from cash discounting and credit surcharging. Convenience fees are fixed amounts added when customers pay online or by phone. While also legal in all 50 US states (subject to proper disclosure), card networks limit the applicability of convenience fees for certain payment types.

Cash Discounting Regulations in the US

The Durbin Amendment of the Dodd-Frank Wall Street Reform and Consumer Protection Act protects the rights of business owners to offer cash discounts in all US states. In general, state and federal regulations for cash discounting echo the standards set by the Durbin Amendment:

1. Disclosure: Clear and conspicuous signage is required by law to be displayed at the business entry point and at the point of sale to explain the discount program payment options easily and accurately—if a customer “chooses to pay with cash or check the service charge is discounted.”

2. Transparency: The customer service fee or discounted amount must be present on any generated receipts from the transaction. Therefore, receipts should indicate:

- Base amount

- Cash discount

- Total Sale

3. Non-discriminatory: Other federal regulatory bodies like the Electronic Funds Transfer Act (EFTA) imposed guidelines to ensure that cash discounts are offered to all customers who pay in cash and do not discriminate against customers who choose to pay with credit.

Additionally, some states like California (through the Department of Business Oversight) and Texas (through the Office of Consumer Credit Commissioner) require businesses to apply for a special license to offer a cash discount program.

Card networks also adapted their guidelines based on federal regulations. And while there are no specific cash discounting regulations similar to credit surcharging, merchants are also expected to observe proper disclosure, transparency, and non-discrimination when using cash discounting.

Pro Tip: Always check with your local regulatory body for updated state guidelines before signing up for a cash discount program.

Cash Discounting Pros & Cons

| PROS | CONS |

|---|---|

| Minimizes credit card transaction fees | Lost sales from customers preferring to pay with credit cards |

| Less chances of chargebacks | Cash susceptible to theft |

| Improves business cash flow | Extra work and compliance |

| Customer convenience | |

With a cash discount program in place, businesses have faster access to cash needed for operations. Merchants not only avoid the cost of accepting credit card payments but also pass on the credit card processing fees to customers who opt to pay with their credit cards. Fewer credit card transactions also mean merchants are less likely to face chargebacks that can lead to sanctions. All this while customers enjoy the convenience of being able to choose their payment method. Learn more about credit card processing fees.

On the other hand, setting up cash discounting takes a lot of work—even with an automated program that adjusts product/service list prices to add and remove the cash discount rate when needed. Businesses not only need to train employees on how to properly ring up the sales but also know how to explain the policy to the customers.

There’s also a chance that not all customers will welcome the cash discount program. Instead of an incentive, some may see it as a penalty and decide to shop elsewhere—particularly those who prefer to use their credit cards. Merchants will also need to set up a strong cash management policy to avoid human error and theft.

What Businesses Should Use a Cash Discount Program

In general, high-volume businesses selling low-ticket products or services significantly boost their earnings with a cash discount program. However, there are other factors involved, such as your business model, customer preference, and even your competitors.

Consider using a cash discount program if:

Your business has enough sales volume to offset cash discount program fees. At the end of the day, your business should be paying less for the monthly cash discount service compared to your average monthly credit card processing fees.

You sell low-ticket products or services. Regardless of ticket size, merchants still pay for the same amount of processing fees, as many processors charge a flat-rate fee per transaction.

Your customers often pay in cash. A cash discount program is more effective if your business already caters to a high percentage of cash-paying customers

You sell a necessary product or service. Customers will be less hesitant to pay with cash for businesses that sell a necessary product or service.

Your competitors in the area also offer cash discounting. Customers will be less likely to leave your store if similar businesses in your location also have a cash discount program in place.

You have a strong cash tracking policy. Handling/managing a huge amount of cash can be prone to errors and even theft.

What Is a Cash Discount Frequently Asked Questions (FAQs)

In payments, cash discounting is a zero-cost payment processing strategy where a merchant adds the credit card processing fees to the cost of their product or service and offers customers a discount of equal amount if they chose to pay in cash.

Yes, cash discounting is legal in all US states, provided that businesses follow compliance regulations.

Reach out to your current merchant services or payment services provider and ask about their cash discount program. Sign up and have your provider configure your point-of-sale (POS) and payment software and hardware. You should also improve and implement a cash management policy and then train your staff to handle both processes. Lastly, put up the required signages around the store before implementing the cash discount program.

Yes, instead of physical signages, your website can have banners and notices displayed on the landing page and at the checkout page. Ask your payments provider to help you set up the pricing from the back end.

Fortunately, your merchant services or payment services provider can set up the cash discount program to automate the pricing computations and adjustments.

While some states may have additional rules, merchants implementing a cash discount program should (1) post their cash discount information/policy at the entrance and checkout counter, (2) print test receipts to ensure that it clearly displays cash discounts, and (3) train cashiers to verbally offer cash discounts before accepting payments.

Bottom Line

Any business that accepts credit card payments can consider cash discounting, but whether it’s the best idea or not is an entirely different matter. While a cash discount program can help you save on payment processing cost, remember that there will still be monthly and recurring fees that need to be paid. So it’s important to know that you have the right type of business and merchant account services provider that can successfully earn you that extra margin with this strategy.