Convenience fees are charges imposed by merchants on credit card transactions that pass on the cost of accepting credit card payments to customers. However, only merchants whose primary method is anything other than credit cards can impose convenience charges. Some examples are accepting payment for bills, taxes, and event tickets purchased online instead of at a ticketing office.

Customers are generally open to paying a convenience fee as it represents the cost of avoiding physical travel and long lines. This is why most convenience charges are imposed on online transactions.

Key Takeaways:

- Convenience fees can be a fixed amount or a percentage of a transaction (typically 2.5%–4%).

- Only businesses that accept card payments as an alternative payment method can impose convenience fees.

- While convenience fees are generally accepted in all 50 states, some jurisdictions are highly regulated.

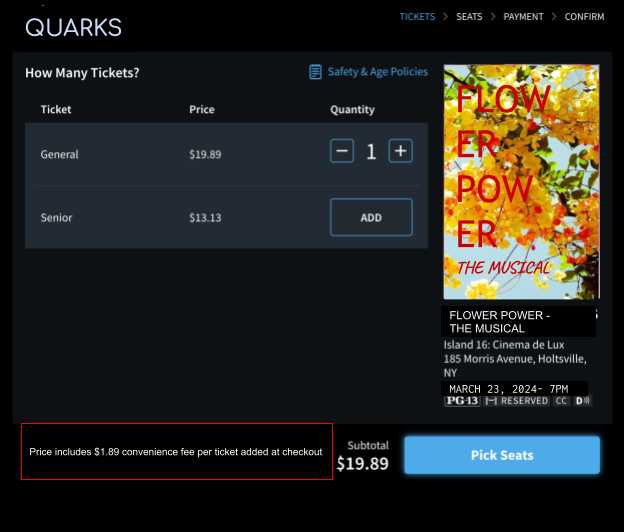

Here’s an example of what a convenience fee might look like for an online ticket sale:

Customers who purchase event tickets online will find convenience fees added to their total cost.

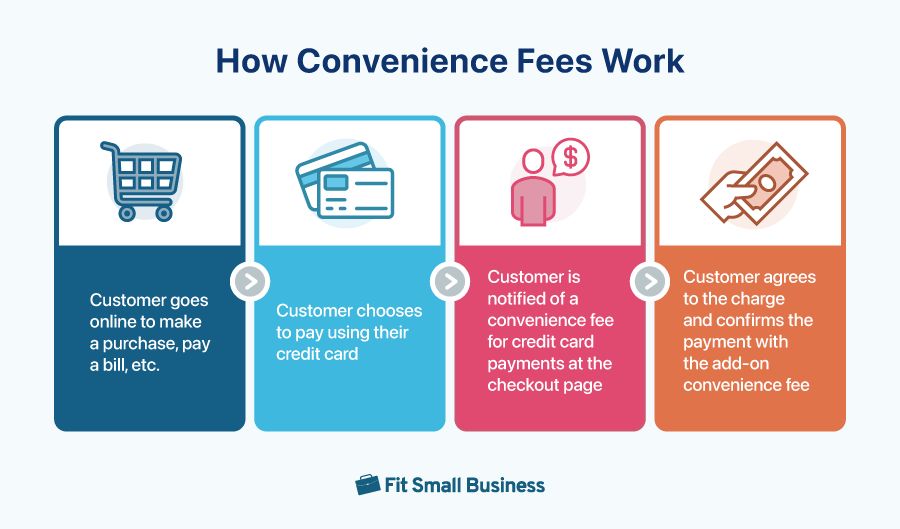

How Convenience Fees Work

As the name suggests, convenience fees are fees merchants charge customers in exchange for the convenience of paying with a credit card. The cost can be a fixed amount or a percentage between 2.5%–4% and is meant to be reflective of the actual costs incurred by the merchant to process the credit card transaction.

Convenience charges are often associated with online payments for goods and services such as the tickets shown above. However, businesses and service providers for utilities, and government and municipality offices for tax payments can all impose convenience fees.

Convenience Fees vs Surcharging Fees

Surcharging fees are similar to convenience fees because they account for a merchant’s transaction fee and pass this on to the customer. Both are strictly used to cover operating costs and not to earn profit.

However, unlike surcharge fees, convenience fees can be a fixed amount set by the merchant to cover not only the payment processing cost but also the cost to run an online portal or to accept payments over the phone.

Additionally, surcharge fees are different in the sense that these are applicable to businesses that normally accept credit card payments such as supermarkets, retailers, and restaurants.

Convenience Fees vs Service Fees

Convenience fees and service fees are interchangeable terms and apply to similar transactions where credit cards are treated as an alternative payment method. You would often find online ticketing, schools, and government payment portals refer to convenience charges as service fees.

However, technically, service fees are a type of convenience fee in card network terms, where each card brand (Visa, Mastercard, American Express, Discover) has a slightly different set of rules for merchants to qualify. Card brands also assign different merchant category codes (MCC) for businesses that qualify for service fees, which means a different interchange rate.

Service fees can also be used to refer to the cost of general or admin services such as airlines, banks, and restaurants.

Rules on Convenience Fees

Not every business can implement convenience fees and there are a number of regulations to be observed for those that do. One general rule by both card networks and state laws is that it is illegal to earn a profit from convenience fees. The following guidelines are also implemented by state and card networks.

State Regulations

Generally, convenience fees are seen as legal in all 50 states. However, some jurisdictions come with very restrictive terminology that can even be prohibitive.

For instance, in Maine and Massachusetts, there are no explicit rules against imposing convenience charges; however, the rules for prohibiting credit card surcharging in both states are worded in such a way that they also see convenience fees as illegal. Connecticut regulations, meanwhile, have strict rules for implementing convenience fees.

Therefore, we highly recommend that any merchant planning to add a convenience fee program should consult with their local government for proper guidance.

Card Network Regulations

Below is a summary of card network regulations for convenience fees:

Card Network | Business Type | Payment Type | Fee Type | Convenience Fee Disclosure |

|---|---|---|---|---|

Visa | With physical and online store | Mail, Phone, Online transactions | Flat fee | Prior to transaction, No need to include on receipt |

Mastercard | With physical and online store | In person, Mail, Phone, Online, Recurring transactions | Flat fee, percentage, or tiered based on transaction | Prior to transaction, No need to include on receipt |

American Express | With physical and online store | In person, Mail, Phone, Online, Recurring transactions | Flat fee, percentage, or fixed based on transaction | Prior to transaction, No need to include on receipt |

Discover | Allows convenience fee as long as it is in equal treatment with other credit card brands | |||

Pros & Cons of Charging Convenience Fees

If your business falls under a jurisdiction that allows convenience charges, your next consideration should be whether or not your business will thrive with a convenience fee program. Adding convenience fees has both advantages and disadvantages.

| Pros | Cons |

|---|---|

| Amount can be set by merchant | Not for traditional retail and restaurant merchants |

| Can cover costs other than transaction fees | Varying card network rules |

| Can lower operational cost | Vague laws around convenience fees in some states |

| Easier for customers to accept than surcharge fees | Still some chance of losing sales from customers who don’t want to pay additional |

Aside from recovering payment processing costs by passing on credit card fees to customers, businesses that are qualified to apply convenience fees can also potentially lower their operational costs. If customers opt to pay using non-card payment methods, then merchants also save on some (but not all) incidental charges such as authorization fees.

As mentioned earlier, convenience fees are more flexible compared to surcharging, so they can cover part of the cost of maintaining online portals or virtual terminals for over-the-phone payments. Convenience fees are also easier for customers to accept if they are looking for a more convenient way to pay for their tickets, bills, and other services.

On the other hand, there are limited businesses that can qualify for the use of convenience fees. And those who do will have to contend with varying card network rules and state regulations that can be difficult to implement safely without professional help. Lastly, the risk of losing sales is still there if customers find you have competitors who do not charge a convenience fee.

Tips & Best Practices for Convenience Fees

For merchants who decide to apply convenience fees, consider the following best practices to help you safely navigate the policies surrounding the program:

Check Your Competitors

While it’s easy for qualified establishments to start a convenience fee program, it’s important for you, as a merchant, to first do due diligence and research your competitors. You will likely lose customers if some similar businesses in your industry or your area do not collect a convenience fee.

Be Prudent When Assigning Convenience Fee Value

A unique feature of convenience fees is that you can manually assign a fixed amount. However, please note that there are certain rules for applying a convenience fee based on credit card network and state rules so be sure to reach out and confirm how much exactly you can change.

For example, the convenience fee in the state of Oklahoma is set to a maximum of 4% of the actual payment processing cost or a specific amount (whichever is lower).

Inform Your Customers

There are also certain regulations surrounding how customers should be informed about convenience charges. Card networks, for instance, require that customers be informed prior to making the payment; however, the convenience fee amount does not need to have a separate line on the receipt.

States also have varying regulations around informing customers such as where to display and at what point of the transaction should the information be disclosed, whether or not a verbal disclosure and offering an alternative payment is required for in-person payments, and more.

Train Your Employees

Sometimes, a well-trained sales employee can be the difference between completing a sale or losing a customer over add-on costs. So regardless of where or how your business accepts convenience fees, your customer-facing staff must know how to explain the purpose of the charge. This is especially so if your jurisdiction requires a verbal disclosure and making sure they remember to inform your customers of alternative payment methods.

Choose the Right Payment Processor

Navigating all the policies and regulations around implementing convenience fees would be easier if you work with the right payment processor Service providers that provide the system for merchants to accept credit card payments . These merchant service providers can help you set up and comply with the requirements for implementing convenience fees.

Frequently Asked Questions (FAQs)

Click through the sections below to learn about the most common questions we get around convenience fees.

If your business model primarily accepts cash and other non-card forms of payment and you would like to provide credit card payment as an alternative, then you can apply a convenience fee. This is assuming that your business is within a state that allows for convenience fees.

In most states, yes, charging a convenience fee is legal. However, please note that there are limited business types that are qualified to add a convenience fee for card payments.

The average credit card convenience fee is anywhere between 2.5% to 4% of the actual transaction cost, or a fixed amount set by the merchant, whichever is lower.

Bottom Line

Convenience fees, sometimes called “pay-to-pay,” encourage customers to use alternative payment methods that minimize the merchant’s cost of doing business. Not all businesses can apply convenience fees and even then, there are considerable regulations a merchant must follow to ensure compliance. It is, therefore, important, that merchants work with a payment processor that specializes in free credit card processing programs and provide you with the best solution to match your business.