Interchange fees are costs merchants pay to accept and process credit and debit card payments. They consist of a small fixed fee plus a percentage of total sales, set by card networks (Visa, Mastercard, Discover, American Express) to cover the costs and risks associated with processing card transactions. Typical interchange fees range from 1.29%-3.5%.

Key Takeaways:

- Interchange fees are assessed by card networks and are non-negotiable.

- Interchange fees make up a portion of the total credit card processing fees.

- Many factors such as your business type, transaction type, and payment method determine interchange fees.

How Card Networks Assess Interchange Fees

In general, the interchange fee you pay depends on the card brand your customer pays with and the transaction you are processing. While the card networks use different rates, they consider similar factors to identify which fee is applicable for any type of merchant:

- Card association: Credit card associations (Visa, Mastercard, etc.) set their own interchange rates, so there’s variability, which we’ll cover further down.

- Card owner: Consumer, business, government, and nonprofit credit cards also come with their own interchange fees.

- Merchant Category Code (MCC): Your MCC is based on the type of business you run. (For instance, retail, supermarket, fuel, and travel businesses each have different interchange rates)

- Type of card: There are different types of credit cards. Cards that offer many awards and benefits for the cardholder typically come with higher interchange fees for the merchant.

- Mode of credit card payment: Fees are higher when credit cards are used for remote transactions as opposed to in-person where the actual credit card is present and is either swiped or tapped on a credit card terminal. This still reflects the level of risk associated with the way a credit card is used.

Computing for Interchange Fees

The credit card interchange rates are based on a percentage of a merchant’s monthly transactions and expressed as a percentage and a fixed fee (for example: 1.8% + 10 cents). There is no singular way of computing interchange fees, mainly because card networks assess these fees based on constantly fluctuating economic and financial factors such as:

- Time value of money: Accounts for the estimated change in current and future value of a currency (inflation).

- Risk of doing business: A financial institution’s assessment of a business’s likelihood of being exposed to fraud.

- Cost of moving money: Determines the overall cost of transferring funds to different locations and methods.

Note that each card network evaluates these factors differently, so they all have different interchange rates. (We include an average range of these rates later in the section below.)

There are hundreds of different possible rates within each card network for different consumer and business credit and debit cards, transaction types (card-present, keyed, and online), business types (retail, government, travel, etc.), and business sizes (businesses processing over $750 million can typically qualify for lower rates).

Credit Card Interchange Rates by Network

To know how much your business is paying in interchange fees, you will need to refer to the card network’s table of fees.

Below is an average range of the latest interchange fees by network. Note that these interchange fee examples are based on the common rates—business, reward, and international credit cards will all have higher fees. High-volume businesses, like B2B companies or businesses processing billions of dollars in transactions, can also qualify for different processing tiers, which offer lower rates.

Card Network | From | To |

|---|---|---|

1.15% + 10 cents | 2.50% + 10 cents | |

1.15% + 10 cents | 2.60% + 10 cents | |

1.56% + 10 cents | 2.30% + 10 cents | |

American Express (Opt Blue) | 0.99% + 15 cents | 1.99% + 10 cents |

How Interchange Fees Work for Businesses

Did you know? Interchange fees make up only a portion of your credit card processing fees.

Merchants generally don’t need to worry about calculating interchange fees as they are built into the rates paid to their payment processor. You will often see interchange fees incorporated into one static processing fee: 2.6% + 10 cents, for example. Or, the processor will pass along the direct interchange fee with its markup, so there is more variability with each transaction.

Every time a merchant processes a credit card transaction—swipe, chip, keyed-in, or online—that merchant collects the money paid for their products or services. However, they also pay third parties some of that money (markup, interchange, and assessment fees).

Credit card processing fees = Interchange fees + assessment fees + merchant services markup, monthly, and incidental fees

Debit Card Interchange Fees

Merchants are also charged interchange fees when customers pay with a debit card. These fees are imposed by the bank that issued the debit card and can vary depending on the size of the bank, your business type, and the mode of payment used (PIN or signature). As with credit card payments, the debit interchange fee is only a portion of the total processing fees for debit card payments.

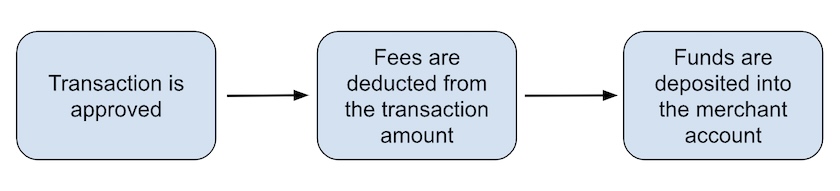

How Merchants Pay for Interchange & Card Processing Fees

Typically, the payment processing systems are connected to the merchant’s bank (the merchant account), so the fees are automatically withdrawn. Your payment processor will send you a statement at the end of every billing period, which will show you the total amount deducted from your sales as card processing fees. You don’t have to pay interchange fees like you would a utility bill or standard invoice.

How Interchange Fees Are Regulated

Credit card interchange fees are regulated through legislation. In the US, debit card transactions are capped at 0.05% + 22 cents for issuing banks with more than $10 billion in assets. Meanwhile, as of this writing, there is no government-mandated cap for credit card interchange fees.

Just this March, Visa and Mastercard agreed to lower and cap interchange fees for at least five years as part of a 2005 class-action settlement. Visa and Mastercard are expected to reduce interchange fees by 0.07% (0.04% on all types of charged transactions plus 0.03% on selected fee programs). This is equal to an estimated $30 billion in merchant savings for the next five years.

Antitrust

Antitrust is the lack of transparency in how member banks of card networks determine interchange rates that can be used to create anticompetitive opportunities (collusion).

One of the largest antitrust case settlements happened in September 2018, where Visa, Mastercard, and several large banks in the US agreed to pay an estimated $5.6 million to hundreds of merchants for excessive fees.

Frequently Asked Questions (FAQs)

These are some of the most common questions we get about what interchange fees are and how they are computed.

Strictly speaking, interchange fees are non-negotiable. However, if you process business credit cards (one business selling to another), the amount of data required for the transaction is significant in determining the interchange rate. These are known as Level 2 or Level 3 transactions.

The more data provided, the more secure the transaction is assumed to be—and the lower the rate becomes. It’s important to remember that while a business transaction may qualify for a Level 2 or 3 rate, it will be charged as Level 1 (generally associated with consumer purchases) if you do not provide the required information.

See if you qualify for Level 2, Level 3, or B2B payment processing—one of the only ways for small businesses to lower interchange fees.

For most storefronts, the customer likely has the card and enters it into a payment terminal. This is a card-present (CP) transaction. But sometimes, the card isn’t physically available—you might enter the card manually or take payment over the phone, for instance. These, and all online transactions, are card-not-present (CNP) transactions. CNP transactions are inherently riskier, so they incur higher fees.

Rates may also fluctuate depending on how much information has been entered. To lower your rates, you want to provide as much information as possible to show that the transaction is legitimate and mitigate fraud risk. Use Address Verification Service (AVS) and include the authorization ID and order number when you settle the transaction. We also recommend settling transactions within three days of the sale.

You may have heard of free credit card processing, but these methods do not truly eliminate your card processing fees, especially interchange fees. Free credit card processing, or zero-cost processing, essentially allows businesses to pass along their card processing cost to consumers. However, not all states consider these methods legal, and some consumers may avoid businesses that implement them.

Bottom Line

Interchange rates might be pesky, but they’re necessary. While mostly out of your control, understanding what interchange fees are will help you find the most affordable overall rates and keep more for your profit. To know which processor will provide the lowest rates for your business, check out our guide on the cheapest credit card processing companies. Or you can learn how to accept credit card payments if you’re just starting.