Meta Pay is an in-app mobile payment service owned by social media company Meta. It allows users on Facebook, Instagram, and WhatsApp to send and accept money within the app. Businesses may also add a Meta Pay button on their websites so customers can conduct seamless transactions without leaving the website.

Using Meta Pay will make it easy and convenient for a business to accept payments for their products and services directly on the platform. It is available to businesses through Facebook Shops and Marketplace by integrating with their payment processors.

Meta Pay, the brainchild of the social media giant Meta, started as a P2P payment service through Messenger in 2015. This service evolved into Facebook Pay in 2019 and became available through Facebook, Messenger, Instagram, and WhatsApp. It was rebranded as Meta Pay in 2022 and currently available in 144 countries and supports 55 currencies.

How Does Meta Pay Work for Business?

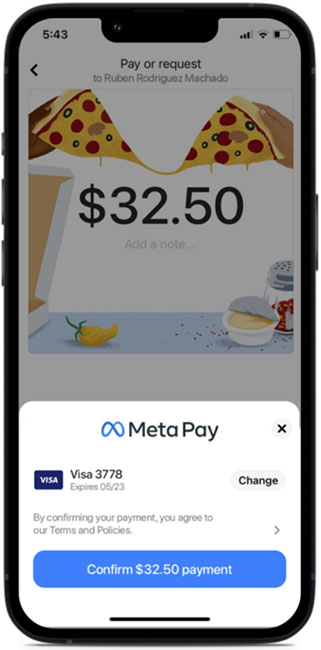

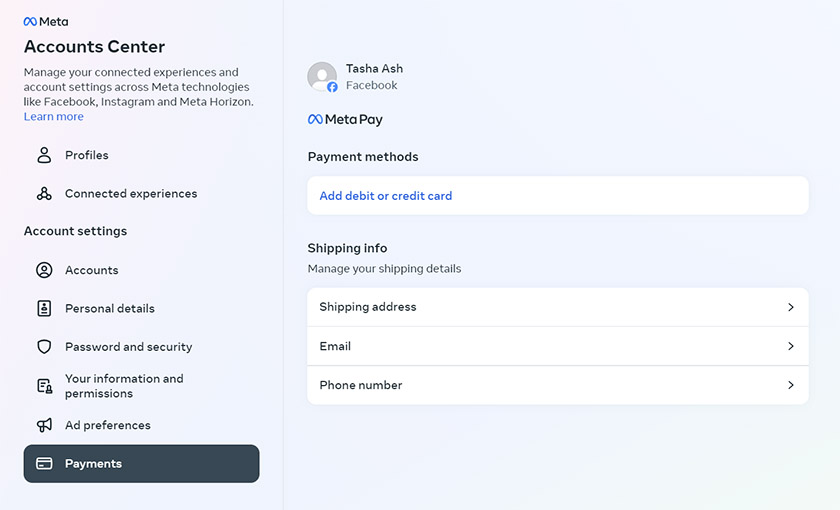

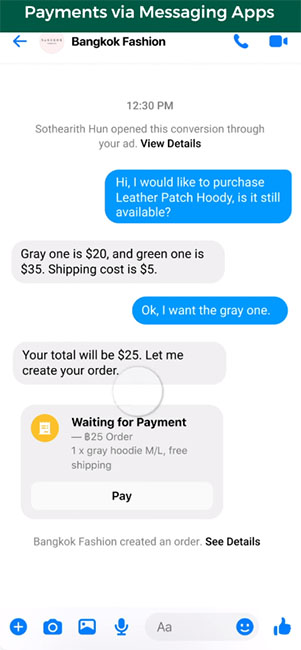

Meta Pay allows users to seamlessly send and receive money directly through social media and messaging apps. Beyond its social media integration, businesses have the option to enhance their online transactions by incorporating a Meta Pay button on their websites, providing customers with a convenient and efficient payment experience.

Meta Pay allows businesses to accept payments directly on Meta platforms such as Messenger with a Pay button. (Source: Meta Pay)

There are several ways you can use Meta Pay to accept payments for your business: on social media platforms, through website integration, and on messaging apps.

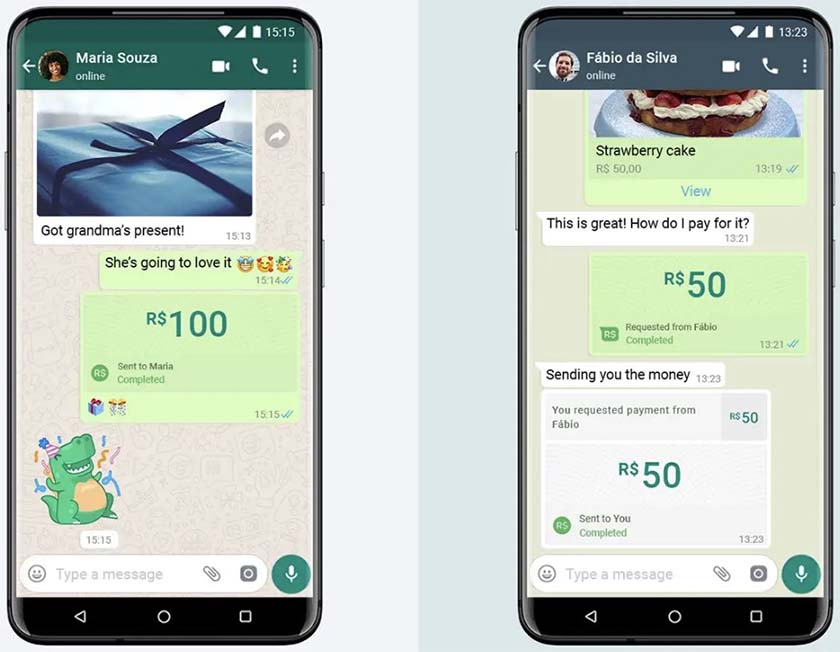

Limited availability

Although Meta Pay is available in many countries, Checkout on Facebook and Instagram is only available to businesses in the US that show “Secure Checkout on Facebook.” On WhatsApp, Meta Pay is currently only available for sending and receiving money in India, Brazil, and Singapore.

Meta Pay Costs

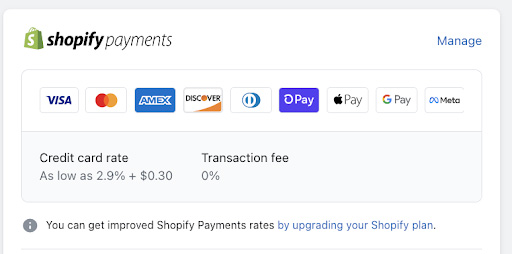

There is no fee to use Meta Pay. However, if you use Meta Pay to accept payments, you will need to integrate it with your payment processor. Your payment processor may charge you its usual transaction fees.

If you do not have a payment processor yet, look for options that offer easy Meta Pay integrations. Shopify is one of the ecommerce platforms that accept Meta Pay as a payment method. Meta Pay also has an application programming interface (API) integration and a JavaScript software development kit (SDK) for integrating Meta Pay into your website. This is available for approved merchants and partners.

How to Set Up Meta Pay for Your Business

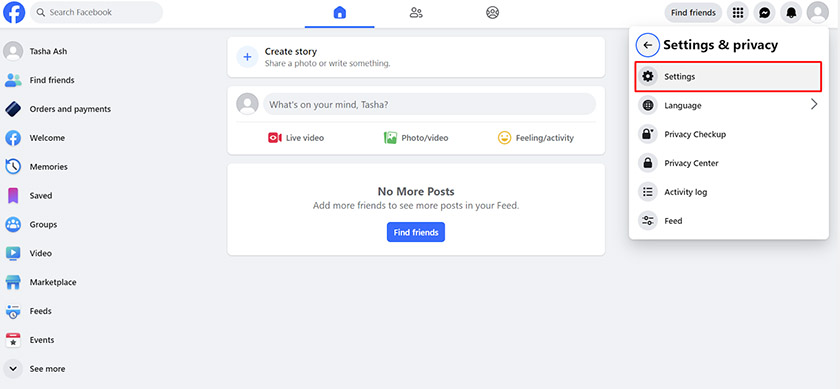

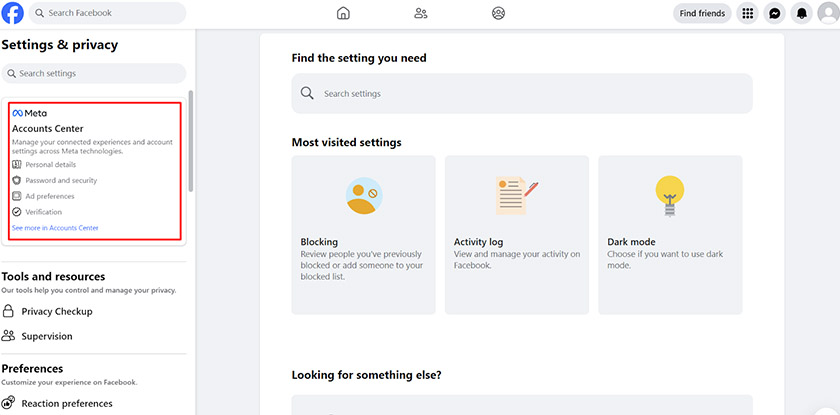

Setting up Meta Pay is easy. You only need to be logged in to Facebook, Instagram, or Messenger. Here is a quick guide on how to do it on Facebook:

When you already have a Meta Pay account, you can enable Meta Pay as a payment method on your Facebook Shop, Instagram Shop, or ecommerce site.

Meta Pay Pros & Cons

| PROS | CONS |

|---|---|

| Seamless integration with social media platforms | Limited to Meta-owned platforms |

| No additional fee for businesses | Limited locations only |

| Easy set up | Privacy concerns |

| Secure | |

| Faster checkout for customers | |

Meta Pay is basically a mobile wallet that is integrated with Facebook, Instagram, and WhatsApp. With 3 billion Facebook users, 2 billion Instagram users, and 2 billion WhatsApp users, social selling can help businesses reach a wider market, and having Meta Pay will make it easy to accept payments from customers with just a click.

A Meta Pay button may also be easily added to their websites for quick and hassle-free transactions. Currently, there are around 1.7 thousand stores that accept Meta Pay, including Ticketmaster, Kylie Cosmetics, and Hello Molly. Whether used to accept payments on Meta platforms or a website, Meta Pay provides a fast one-click checkout experience that makes a better overall customer experience.

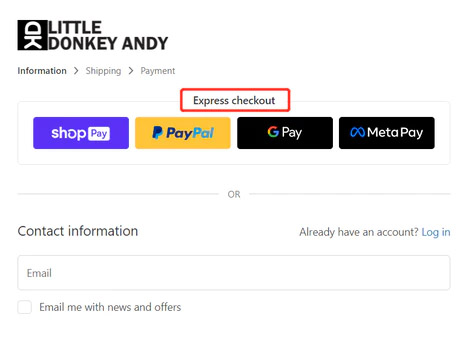

Little Donkey Andy’s website offers Meta Pay as one of its express checkout buttons. (Source: Little Donkey Andy)

One of the biggest reasons to use Meta Pay if your business already has a presence in any Meta-owned platform is that there are currently no fees for using it. To accept payments, businesses need to integrate their payment processor and they only need to pay for transaction fees charged by their payment processor. Additionally, as a payment service, the security of users’ financial information is protected with robust encryption and authentication measures during transactions.

Although there are benefits to using Meta Pay to accept payments, its integration is limited to Meta-owned platforms, excluding businesses or customers who favor alternative social media or communication channels.

Another concern, like with most digital payment services, is privacy considerations. Users and businesses should be aware of the data-sharing policies within Meta Pay and ensure compliance with privacy regulations.

Should My Business Use Meta Pay?

Whether your business should adopt Meta Pay depends on various factors, including your target audience, existing digital presence, and the nature of your products or services. If your customer base is actively engaged on Facebook, Instagram, or Whatsapp, integrating Meta Pay could provide a competitive edge by offering a convenient and familiar payment option.

However, businesses that do not have any customers that use Meta Pay will not lose out on not using it at the moment. It is still a good alternative payment option and since it does not cost anything to sign up and accept payments, enabling it for your business will only provide you with another payment channel.

Individual sellers who would like to sell items on Facebook or Instagram will benefit from using Meta Pay as it allows them to easily send and receive money within the platform.

Want to use Meta Pay for your business? Learn how to sell on Facebook Shops and Marketplace, and read about selling on Instagram.

Frequently Asked Questions (FAQs)

Click through the sections below to read common questions about Meta Pay:

When customers use Meta Pay as their payment method to pay for products or services, the transaction appears on their bank statement. All Meta Pay charges may also be viewed through the Facebook account, under Orders and Payments>Activity.

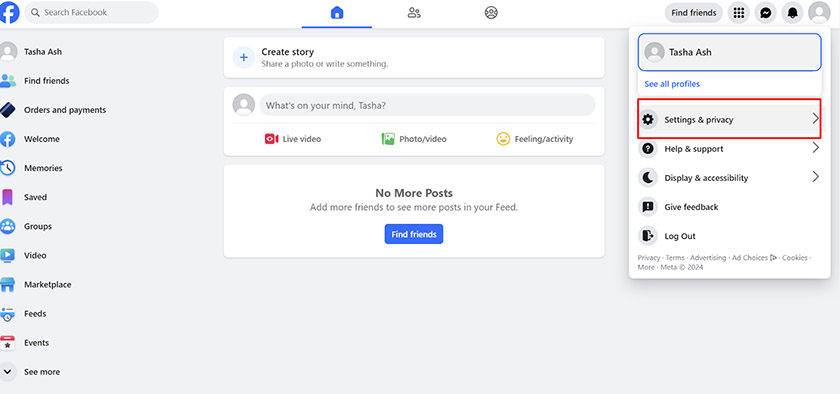

There is no option to cancel a Meta Pay account. However, Meta Pay users can make sure that they do not get any more Meta Pay charges by removing all their payment methods. This can be done by going to Settings & Privacy>Settings, choosing Meta Pay from the left menu, selecting Payment Methods, and then removing all payment methods previously added.

No, Meta Pay and PayPal are two different payment services. While both facilitate online transactions, Meta Pay is integrated into social media platforms like Facebook, Instagram, Messenger, and Whatsapp, whereas PayPal is a standalone digital payment platform widely used for online purchases and money transfers across various websites and applications.

Yes, Meta Pay is a legitimate mobile payment service owned by Meta, formerly known as Facebook. It is designed to facilitate secure and convenient transactions within social media platforms and websites.

Bottom Line

Meta Pay is a mobile payment solution that is seamlessly integrated into Meta-owned social media platforms and messaging apps. It can be used by small businesses to accept in-app payments easily and securely on Facebook, Instagram, Messenger, and WhatsApp. Merchants with their own website may also add a Meta Pay button for quick payments of customers that have Meta Pay accounts. It’s a straightforward option with no upfront costs for businesses.

While it’s a great choice for those already active on Meta-owned platforms, it currently has limited reach beyond those channels. If your customers are on Facebook, Instagram, Messenger, or WhatsApp, Meta Pay could be a convenient and secure addition to your payment options.