Nonemployee compensation is the payment you give to an independent contractor who performs contingent work or temporary jobs for your business. It also includes other fees, commissions, prizes, and awards that independent contractors get for services rendered. Unlike with employee wages and salaries, you’re generally not required to withhold taxes on nonemployee compensation. Independent contractors are responsible for filing applicable taxes with the Internal Revenue Service (IRS).

However, you may need to file Form 1099-NEC if you meet the conditions set by the IRS, which we will cover in more detail below. We will also answer questions about what is nonemployee compensation and share a few examples of non-employee compensation.

Key takeaways

- If you pay an independent contractor $600 or more in one calendar year, you have to prepare and file Form 1099-NEC.

- The deadline for submitting Form 1099-NEC to the IRS, state tax department (if required), and each independent contractor whose earnings meet the threshold is on or before Jan. 31.

Who Can Receive Nonemployee Compensation

While independent contractors may be top of mind when you think of individuals who receive nonemployee compensation, workers like freelancers, consultants, and self-employed individuals also fall under this payment category. Basically, it’s anyone who isn’t an employee but contributes their expertise to your business for temporary or contingent jobs.

As independent contractors, you’re not required to withhold taxes from their earnings. This is why it’s important you know how to determine whether a worker is an employee or independent contractor. Aside from preventing payroll tax errors, this helps you avoid potential legal issues from worker misclassification problems.

When Is Nonemployee Compensation Taxable

The only time you withhold taxes from nonemployee compensation is if the worker is subject to backup withholding. This happens when an independent contractor you hired for your business fails to provide you with a tax identification number (TIN). You are required to withhold a certain percentage of tax every pay period and remit it to the IRS. For 2024, the backup withholding tax rate is 24%.

Nonemployee Compensation: Tax Reporting Requirements

When you do payroll for employees, you withhold payroll taxes from worker salaries. With nonemployee compensation, payment calculations and pay processing are handled differently. You don’t withhold taxes when doing independent contractor payroll. These workers are paid their full earnings for the pay period, and it’s up to them to report and remit self-employment taxes to the IRS.

As an employer, you don’t have to prepare contractor-related tax forms—unless you meet all of the IRS’ tax reporting requirements for nonemployee compensation. There are four criteria:

- A payment was made to a non-employee

- A payment was made to an individual, partnership, estate, or corporation

- The payment was for services rendered in the course of your trade or business

- The total payment reached at least $600 for the year

You are required to prepare and submit 1099-NEC forms for each independent contractor whose earnings for the taxable year reach or exceed the threshold. These forms should be filed to the IRS and state tax department (if needed) by Jan. 31. You should also provide applicable independent contractors with copies of their 1099-NEC forms on or before the deadline date.

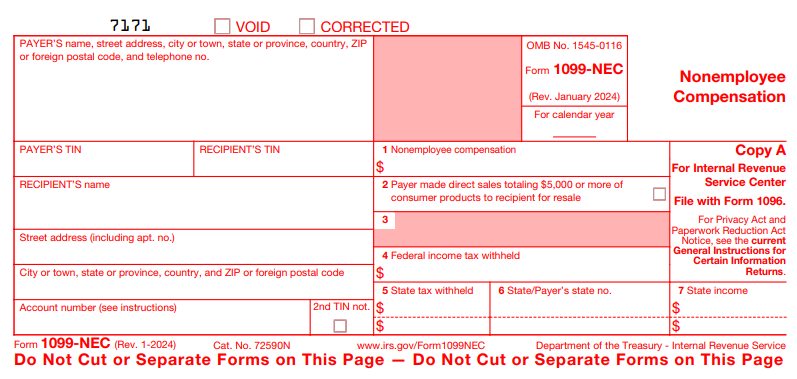

The form is available for download via the IRS website. For easy access, you can also get Form 1099-NEC through the link below.

Examples of Nonemployee Compensation

There are scenarios when it may be difficult to determine whether payments made to independent contractors are considered nonemployee compensation. Here are a few examples to help you understand when worker payments would fall under this category and if you need to file Form 1099-NEC.

Scenario 1

You have a fleet of three trucks for your food truck business. A truck breaks down, so you contact a mechanic, who’s an independent contractor, to fix it. You paid the mechanic $700 to repair the food truck.

The amount you paid is considered nonemployee compensation because the service rendered is for your business. In this scenario, you have to prepare and send Form 1099-NEC to the mechanic.

Scenario 2

Let’s say, aside from your three food trucks, you have a car you use only for personal errands. Your car breaks down, so you contact the same mechanic. You paid the mechanic $600 for the repair service.

While the payment made meets the threshold for filing Form 1099-NEC, this transaction isn’t considered nonemployee compensation. Given that the car that the mechanic repaired isn’t used for business operations, the mechanic isn’t an independent contractor doing work for your business.

Scenario 3

You’re still the owner of the food truck business and another truck breaks down, but this time, you contact a different mechanic, who is also an independent contractor. You paid the mechanic $500 to repair the vehicle. Let’s say, for the taxable year 2024, this was the only time that this particular mechanic repaired your food truck.

The payment is considered nonemployee compensation since the truck is used for your business. However, you don’t need to prepare and send Form 1099-NEC because this mechanic’s annual earnings from your business didn’t meet the $600 threshold.

Bottom Line

For independent contractor payments to be considered nonemployee compensation, these workers have to do temporary or contingent jobs for your business. While you generally don’t withhold taxes from nonemployee compensation and file tax forms, you may have to do backup withholding or prepare Form 1099-NEC if payments for a contractor will reach $600 or more in a year.

If you’re unsure whether payments should fall under nonemployee compensation, consult a tax expert. You can also partner with payroll software providers like Gusto, who can handle contractor payments and send 1099 forms to your independent contractors. You’re even granted access to HR advisors if you have questions about worker classification and compliance. Sign up for a contractor plan today.