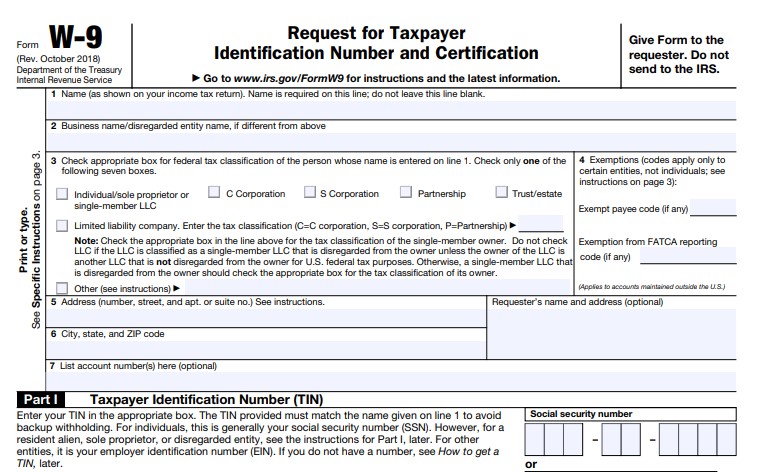

W-9 for contractors is a form that gathers basic information about independent contractors, like name and Social Security number. The W-9 form is used to verify a contractor’s tax ID number in order to report earnings (>$600) for the year.

The form is easy to complete and doesn’t need to be submitted to the IRS. However, if your contractor doesn’t fill out a W-9 form, you may face challenges reporting their earnings to the IRS—and in some cases, you may be forced to withhold taxes.

Below you can learn more about how to fill out a W-9 form and download the form directly from the IRS website or via the link below.

How W-9 Forms Work

Contractors fill out the W-9 form, which they can either print or complete online, and then submit it to you before you pay them. The form requests their tax identification number (TIN)—either the contractor’s Social Security number or employer identification number (EIN) if they are paying taxes under a business entity. You will need this number when filling out an IRS Form 1099 at the end of the year to report the contractor’s gross earnings.

Did you know? You do not need to calculate and pay taxes for contractors, but you do need to report their earnings if they exceed $600 per year. Learn more about how the IRS Form 1099 works and where to report it.

When to Fill Out a W-9 Form

Any contractor you hire (regardless of how much you expect them to earn) should fill out a W-9 form before doing work for your company. Contractors are defined as people who work independently, with control over how and when they complete tasks (within reason)—and they don’t receive employee benefits.

Contractors include independent workers, LLCs, C or S Corporations, Partnerships, and Trusts or Estates. If you need to file a 1099 at the end of the year to report a person’s or entity’s earnings, then you need to have them fill out a Form W-9.

The form itself is easy to fill out, especially for independent contractors or sole proprietor LLCs. Corporations, trusts, and partnerships need to check for exemptions and note them on the form.

Any worker classified as an employee should not fill out a W-9 form. Learn the difference between an employee (who requires a W2 form) and an independent contractor (who needs a 1099 form) so that you are sure to file the correct forms with the IRS.

How to Send the W-9 to Contractors

As part of the hiring process, along with an independent contractor employment agreement and payroll forms (e.g., direct deposit form), you need to collect a W-9 form from every contractor. Provide the contractor with a link to the official IRS Form W-9, where they can complete it online and return it to you in PDF form. Alternatively, you can provide the contractor with a printed version of the form for them to fill out.

Retaining the W-9 Form

Once you collect the Form W-9 from the contractor, you should keep it on file for four years in case the IRS or workers come to you with questions. You do not need to submit the form to the IRS. Because the form contains sensitive information, it is suggested that you keep all W-9 forms either in a secure filing cabinet or in a password-protected online folder.

Note, however, that you must receive the W-9 before the 1099-MISC filing deadline (Jan. 31 of the year following). For example, if a contractor fulfilled their contract and received pay on May 31, 2020, you must receive the W-9 well in advance of Jan. 31, 2021, because that’s the deadline you have to meet for submitting 1099 forms.

If a contractor fails to submit the W-9 or submits it with the wrong information, they could be subject to a penalty.

How to Fill Out a W-9 Form: Instructions to Complete

Form W-9 is to be filled out by your contractors and not by you, the employer. You can provide them with the below video and written instructions to assist them in filling it out.

- Line 1: Print the full name that will show on their tax return. Review it for typos to prevent having to request a revised Form 1099 at tax time.

- Line 2: If there’s a business name, include the legal name as well.

- Line 3: Check the box that most accurately describes their type of business. If in doubt, the most likely response is “individual or sole proprietor.”

- Line 4: If exemptions are applicable, include here. Generally, independent contractors or sole LLCs do not have exemptions. If the entity is a corporation, trust, or partnership, refer to page 3 of the full form to get the correct exemption numbers.

- Line 5, 6: Enter mailing address.

- Line 7: Enter exemptions, if applicable.

- Part I: If there’s an EIN, enter it; otherwise, provide a Social Security number.

- Part II: To avoid confusion, sign with a legal name as it appears in Line 1.

- Part II, Line 2: You may want to point out that if your contractor is subject to backup withholdings, they must cross out Line 2 before signing. In this case, you need to withhold income tax from their pay at a rate of 24% and send it to the IRS.

Need help paying your contractors? Learn how to do payroll for your business and check out our guide to payroll tax rates.

W-9 Form Frequently Asked Questions (FAQs)

Form W-9 for contractors aims to collect the tax identification number (Social Security or employer ID) from your independent contract workers. This information is then used to report wages earned (over $600) in a year.

Not necessarily. Your contractors will complete a W-9 form at the start of their contract with your business. Once you have this document on file, it is not required to continuously update it. However, some businesses have contractors review and update their W-9 form annually, or whenever a change occurs (e.g., address change, name change, etc.).

It is the contractor’s responsibility to send you the W-9. It’s helpful to send them a copy or a link to the IRS website. They can download it, fill it out, and send it to you in print or PDF form. To protect the information on the form, it’s best if you supply an encrypted file-sharing service rather than having them email it to you. You do not need to submit the form to the IRS, but you must retain copies in your files for four years.

Bottom Line

It’s a good idea to get a W-9 form from all contract workers to cover your bases, but you must have them on file for any that earn over $600 in a calendar year; you’ll need the information for filling out the year-end 1099 Form tax forms. Download the W-9 form directly from the IRS website, collect it from all contractors, and retain it for your records.