The prime cost is the total direct material and labor costs of producing a product or delivering a service. It helps you analyze how much these costs reduce your gross profit, making it easier to determine whether your expenses are within a healthy range. The formula for computing prime costs is as follows: Prime cost…

What is

What Is Call Center Monitoring? Importance & Benefits

Monitoring call quality and agent performance is crucial for customer satisfaction in a call center. Call center monitoring allows you to record or listen to calls to aid in evaluation, assessment, and feedback. In recent years, we have also seen improvements in call center quality monitoring due to artificial intelligence (AI) features that automate the…

What Is Square? How It Works & Why Small Businesses Love It

Square is a mobile payment company that offers a suite of business software, point-of-sale (POS) systems, payment hardware products, and small business services like marketing tools and loyalty programs. The Square payment and POS app has been downloaded over 33 million times and has more than 4 million merchant clients. Should you use Square? We’ll…

What Is a Business Loan Broker, and Should You Use One?

A business loan broker acts as an intermediary between a borrower and a lender to help secure business financing. Essentially, a broker utilizes your financing application to research and pair you with financing options applicable to your needs. With this, you can save time and money when shopping around for a lender. It’s worth noting…

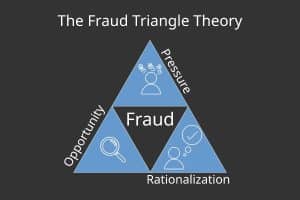

What Is the Fraud Triangle in Accounting?

The fraud triangle is a framework that outlines three coexisting conditions that typically lead to higher instances of occupational fraud: pressure, opportunity, and rationalization.

Designed by well-known criminologist Donald R. Cressey, the fraud triangle explains the reasons behind fraud and is a guide for small business owners and managers to assess the areas where fraud might exist. In the accounting process, we look at fraud as a causative factor for material misstatements in accounting records and financial statements. We…

What Is a Certificate of Beneficial Ownership Form?

A Certificate of Beneficial Ownership (CBO) form is a document required by financial institutions in which a legal entity discloses information and the identities of individuals considered to be beneficial owners? of the business. It is commonly used when obtaining financing and opening business bank accounts. It’s deemed necessary by the Financial Crimes Enforcement Network…

What is Workforce Development?

Learn about workforce development and how it can help your small business remain agile in the face of competition and a changing economy.

Workforce development definition Workforce development is all about helping employees improve their skills, education, and overall capabilities to meet the evolving demands of the job market. For small businesses like yours, this means providing current employees and jobseekers access to practical training, upskilling programs, certifications, and mentorship opportunities that can help your team grow and…

What Is an LLC Loan and How to Get One

An LLC loan is any type of small business loan issued to a business structured as a Limited Liability Corporation (LLC). An LLC is one of several legal tax structures a business can operate as, with examples of other options including sole proprietorships, partnerships, and S corporations. LLC loans can be used for many different…