Amazon Pay is a secure and user-friendly online payment processing platform that streamlines checkout for businesses and customers. It lets customers with Amazon accounts use their stored payment information to pay for products and services quickly and securely. Amazon Pay has features specifically designed for online, mobile, and voice (Alexa devices) payments. Other tools include analytics reporting, recurring payments, preorders, and fraud prevention.

In our evaluation, it earned an overall score of 3.65 out of 5. Although it is an easy and effective ecommerce payment option, it didn’t make our list of the best online payment processors because of its limited payment and customer type.

Amazon Pay Overview

Pros

- Secure and trusted platform

- Streamlined online checkout that is optimized for mobile and can help reduce cart abandonment rates

- Voice payment capability through Alexa devices

- Express payout option

Cons

- Limited to customers with Amazon accounts

- Long merchant account approval time

- Mandatory tiered reserves

- Slow deposit speed

Deciding Factors

Supported Business Types | Limited Ecommerce, nonprofit |

Standout Features |

|

Monthly Fees | $0 |

Setup and Installation Fees | $0 |

Contract Length | None; cancel anytime |

Ecommerce Integrations | Shopify, BigCommerce, Woo, PrestaShop, Adobe Commerce (formerly Magento) |

Payment Processing Fees |

|

Customer Support |

|

Is Amazon Pay Right for You?

In our Amazon Pay review, we found it to be an excellent addition for businesses focused on online sales due to its seamless integration with ecommerce providers like Shopify and BigCommerce and its effectiveness in managing international payments. The platform also supports Alexa-enabled purchases and offers discounted rates for qualified nonprofit organizations, though this program is invitation-only.

While easy to use, Amazon Pay is best as a supplemental payment option, requiring Amazon Seller verification and catering only to customers with Amazon accounts. It lacks tools for in-person transactions and support for high-risk businesses, making it unsuitable as a primary merchant account provider.

When to Use Amazon Pay:

- If a large percentage of your customers are Amazon users

- To reduce cart abandonment

- For accepting online international payments

- If you are a nonprofit organization

- For enabling voice payments

- As a supplemental payment option and not as your sole merchant account

When Not to Use Amazon Pay:

- For accepting in-store payments

- If you need all-in-one merchant services

- If you are considered a high-risk business

- If you accept a lot of mail order/telephone order (MOTO) payments

Amazon Pay Alternatives

Best for | Monthly Fee From | |

|---|---|---|

| Small and casual retailers | $0 |

| New and small businesses that need omnichannel payment processing | $0 |

| High-risk businesses | $10 |

Amazon Pay User Reviews

| Users Like | Users Don’t Like |

|---|---|

| Trusted, secure platform | Unpredictable freezing of account and/or funds |

| Easy to use | High fees |

| Cashback options | |

Reviews of Amazon Pay are a mix of merchants and shoppers. Overall, Amazon Pay users are satisfied with the platform. Reviewers enjoy the simplicity of the program and the convenience for both merchants and customers. However, some reviews noted that fund transfers can be delayed for new clients and accounts can be suspended with little to no warning.

- Capterra[1]: Amazon Pay got 4.6 out of 5 stars from around 90+ reviews on Capterra. While most users particularly liked its ease of use and customer service, some wish they could use it for more than receiving online payments.

- G2[2]: On G2, around 530+ reviews gave Amazon Pay 4.5 out of 5 stars. Users mostly comment on the security of the transactions and really like the cashback options. However, there are some complaints about fees.

- FinancesOnline[3]: While there are only 17 reviews on FinancesOnline, Amazon Pay received a 98% user satisfaction rating. Reviewers comment on the secure and convenient checkout, but one user notes the limit should be higher than $10,000.

- Trustpilot[4]: Reviewers were mostly negative on Trustpilot, and Amazon Pay earned 1.3 out of 5 stars based on 170+ reviews. Merchants are disappointed with account suspensions that come with no explanation and the withholding of funds. However, one shopper reviewing Amazon Pay praised the cashback perks.

Amazon Pay Pricing & Contract

Amazon Pay charges a flat-rate processing fee plus a standard authorization fee of 30 cents per transaction. The processing fee depends on whether you are accepting cross-border or local payments. It has discounted rates for qualified nonprofits.

Additionally, the provider offers a pay-as-you-go subscription and does not charge any monthly or cancellation fees. However, it does not offer volume discounts or custom rates, so these transaction fees are pricey for high-volume businesses. Another drawback is its mandatory tiered reserves, where a portion of your processing funds will be set aside and held by Amazon.

While Amazon Pay has the ability to accept recurring payments, it is very limited as it only allows up to $500/month.

Web and mobile | Nonprofits | |

|---|---|---|

Transaction fee | 2.9% + 30 cents | 2.2% + 30 cents |

Cross-border processing fee | 3.9% + 30 cents | 3.2% + 30 cents |

Amazon Pay does not impose a chargeback fee if you want to contest a chargeback over goods that are covered in Amazon’s Payment Protection Policy. Otherwise, requesting to challenge a claim will cost you $20, which is about the industry average ($15–$25).

It is important to know that all Amazon Pay merchant accounts are subject to reserve requirements. This is done to minimize the risk brought about by transaction disputes and claims. Generally, reserves can be frustrating for businesses because they eat into your cash flow, especially if you are not expecting them.

The required reserve amount is tiered based on a percentage of payments processed over a period or the value of all unresolved transaction disputes for the same period.

Tier Level | Reserve Amount | Eligibility |

|---|---|---|

1 | 100% of payments processed over the past seven days, AND Value of all unresolved disputed transactions | New Amazon Pay merchants (less than a year) |

2 | Higher than: 3% of average daily payments processed over the past 28 days, OR Value of all unresolved disputed transactions | Amazon Pay merchants of more than one year, minimum of 100 completed orders, OR Amazon Pay merchants for at least six months, minimum of 100 completed orders, have maintained an ODR* below 1% |

2 Plus | Value of all unresolved disputed transactions | Amazon Pay merchants in Reserve Tier 2, maintained an average ODR* less than 1% over the past 60 days |

*Order Defect Rate: percentage of orders that have received negative feedback | ||

While low-risk merchants typically won’t have reserves when working with a traditional merchant account, reserves are common for high-risk businesses and businesses working with aggregate or online processors such as Amazon and PayPal.

New Amazon Pay merchants will need to wait 14 days before receiving the funds from initial transactions. After this initial hold, deposits will typically take three to five business days for funds to reach your bank account, except for US sellers who are eligible for Express Payout. With Express Payout, Amazon Pay businesses can receive deposits in their bank accounts within 24 hours for free.

Amazon Pay doesn’t have any hardware. Because it’s purely for online commerce, there’s no need for hardware to administer in-person transactions—like card readers and cash drawers.

Technical Requirements

Operating System | Browser | |

|---|---|---|

Desktop/Laptop | Windows 10 | Google Chrome (78 and later) Mozilla Firefox (70 and later) Internet Explorer (11 and later) Microsoft Edge (18.18362 and later) |

Mac OS X | Apple Safari (13.0.1 and later) | |

Mobile/Tablet | Android 9 and later | Google Chrome 78 and later |

iOS 12.3.1 and later | Safari Mobile 12 and later |

Amazon Pay Payment Types

Amazon Pay supports most common payment methods, like credit and debit cards and mobile wallets. You can also accept international payments and set up preorders and recurring payments. There are also Amazon store cards that may be used by selected merchants.

However, Amazon Pay is surprisingly incompatible with Amazon gift cards and does not offer any tools for in-person transactions. It also does not have a virtual terminal and does not accept ACH or e-check payments.

Although Amazon Pay gets relatively low scores for its lack of diversity in accepted payment types, we gave extra points for its ability to accept voice payments via Alexa devices—there is no other payment processor that offers this feature.

Ecommerce

As an online payment processor, Amazon Pay supports a wide range of ecommerce integrations. These include website builders, shopping carts, and marketplaces. Note that some of these third-party integrations may require additional fees.

- 3dcart

- BigCommerce

- FoxyCart

- Magento

- Miva

- OpenCart

- Recurly

- Shopify

- ShopSite

- Volusion

- WooCommerce

- X-Cart

Recurring Payment/Checkout

Amazon provides an API that allows you to develop a checkout page for accepting recurring payments. You can set rules for managing subscriptions, including actions for requesting payment pre-authorization, triggering automatic card charging, and managing cancellations. You can also charge a flat or fluctuating amount (for usage-based billing) and communicate with your customer this information ahead of time via email.

Note, however, that Amazon Pay limits the total number of recurring payment transactions you can accept from each of your customers per month. The limit is usually based on your business type, but in most cases, it’s capped at $500/month. So, if you run a big-ticket subscription business, you’ll need to contact your account manager to request approval for a higher limit.

Voice Commerce

A unique feature when compared with other payment options is that Amazon Pay works with voice search and voice commerce via Alexa devices. Shoppers can add items to their Amazon wish lists, reorder products, and check orders with voice commands.

To get started, attend Amazon Pay’s webinar for Voice Commerce, and contact one of Amazon’s skill builder experts. They will guide you in navigating Amazon Pay’s flexible APIs and SDKs, which you need to create a customized, secure voice checkout experience.

Amazon Pay integrates with third-party AI tools for developing Alexa skills and functionalities.

(Source: Amazon Pay)

Amazon Pay Account Features

Amazon Pay’s strengths are its easy ecommerce integration and extensive developer resources. Most ecommerce platforms allow users to add Amazon Pay to their websites by simply adding their Amazon Pay account information and turning the feature on. It is simple to set up and use, making it a no-fuss platform for merchants with limited technical resources.

It is also backed by the same security and fraud protection technology as Amazon.com, making it a safe and secure online payment service.

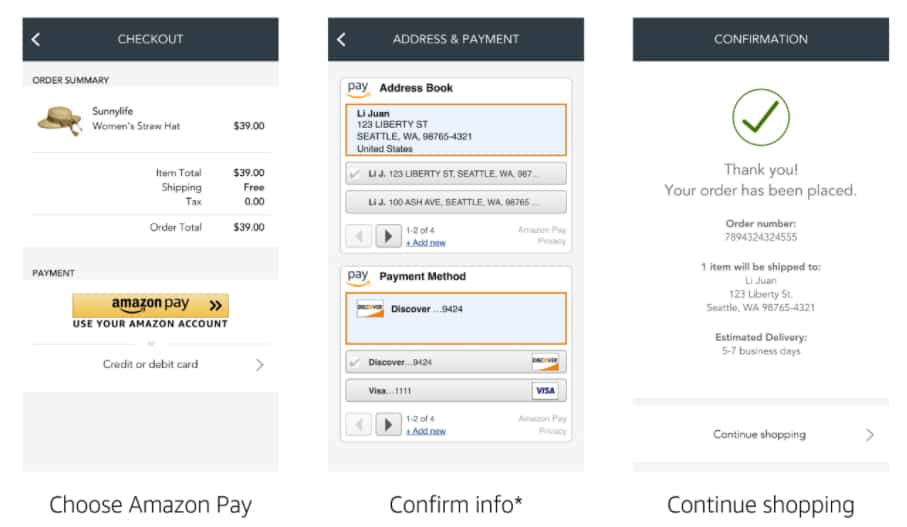

One of the standout features is Amazon Pay’s streamlined online checkout, which helps reduce cart abandonment rates. Shoppers don’t need their credit card information to pay when logged in. It also offers a simple platform for mobile payments, so customers can pay right from their phones. Amazon’s most recent update is Checkout V2, which features tools replacing its traditional payment and address widgets for a more seamless checkout experience.

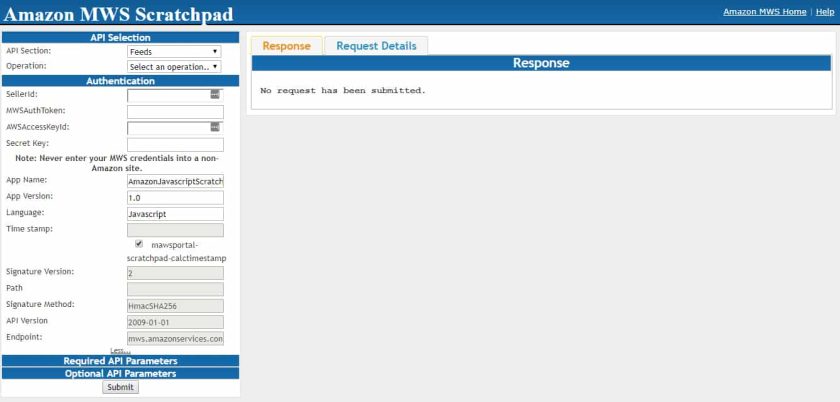

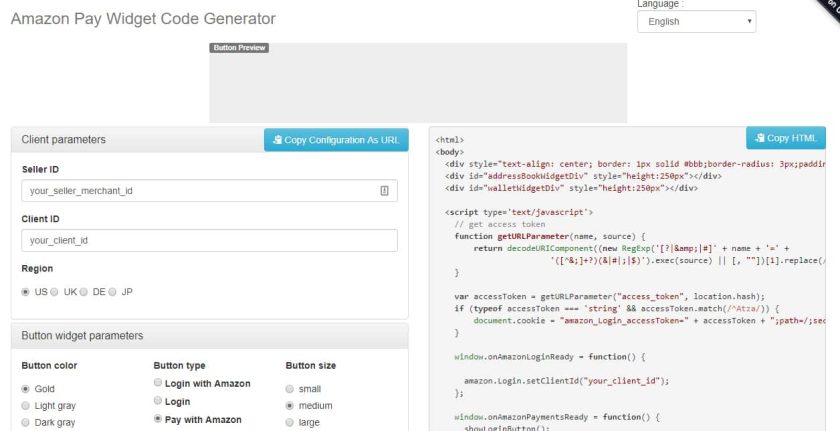

Developer integrations can be intimidating, but Amazon Pay provides the necessary tools for developing a highly customized checkout experience for your customers. These tools allow you to visualize the look and feel of your checkout function, try a variety of options, and minimize the need for coding with its built-in code generators.

- Amazon Pay Demo site

- Amazon Pay SDKs

- MWS Scratchpad

- Widget Code generator

Amazon Pay’s seller platform is backed by secure fraud detection technology. It verifies customer information before processing payments and gives you the option to process them asynchronously, increasing the chance of detecting fraudulent transactions.

It also provides chargeback controls and risk management tools at no extra cost. Amazon’s Payment Protection Policy waives chargeback fees for qualified transactions if you send in the requested supporting information within 11 calendar days after getting notified of the dispute.

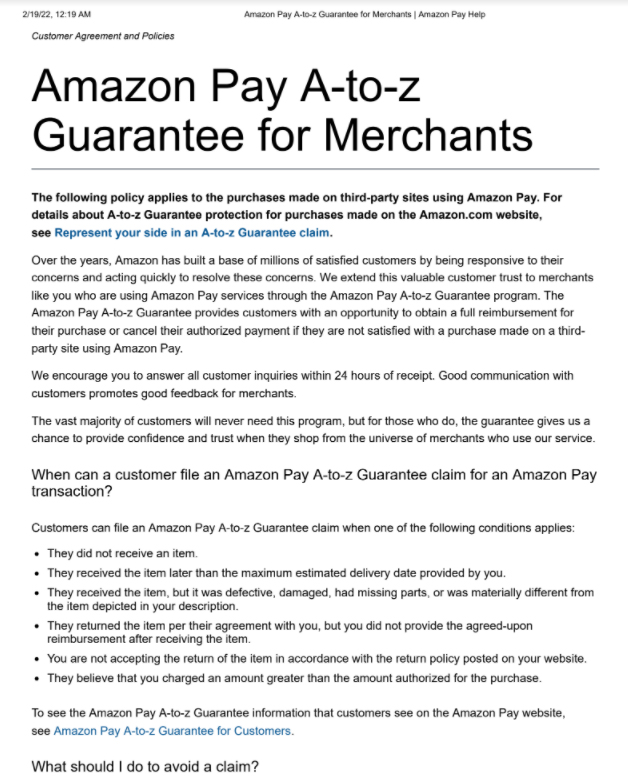

There are different Amazon Pay merchant protection pay policies depending on where the purchases are made. For purchases made on the Amazon.com website, head on to your Seller Central account to learn how to represent your side in a buyer claim. If your customer purchased your product with their Amazon account on a third-party website, refer to the Amazon Pay A-to-z Guarantee for Merchants below.

Amazon Pay A-to-z Guarantee for Merchants

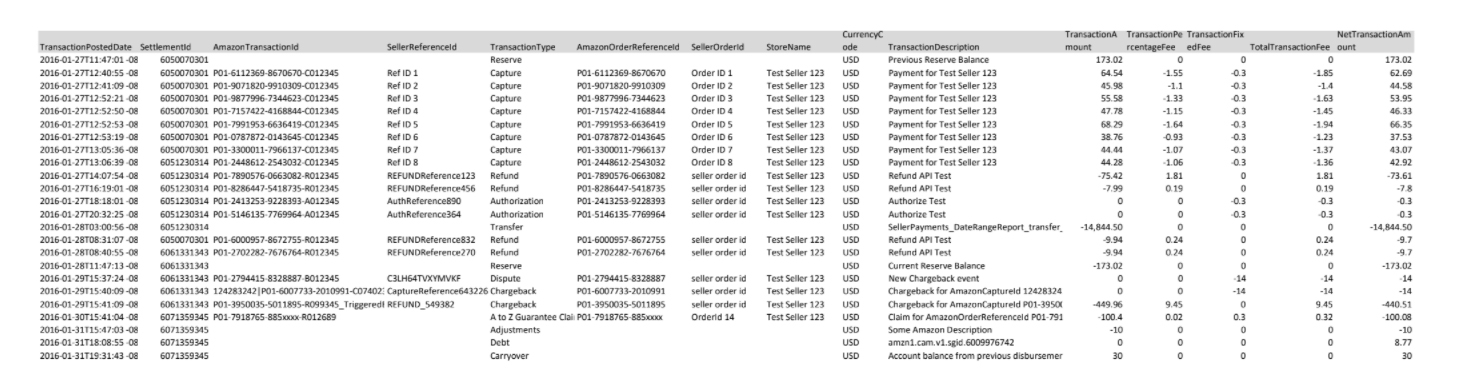

Amazon provides settlement reports in lieu of a billing statement, which you can find in Seller Central under Reports > Payments > Statement View. You then have the option to generate all statements or specify the date range, and then either view or download the report as a CSV file.

Aside from settlements, Amazon’s Seller Central has performance reports, including transaction and settlement reports for reconciliation. Here, you can also manage claims and disputes and check customer feedback.

Amazon Pay Settlement Report

Amazon Pay Ease of Use & Expert Score

We gave Amazon Pay perfect scores for its ease of use, user reviews, and integrations. It lost points for pricing because of its lack of discounts for high-volume merchants. At zero monthly fees, Amazon Pay is an easy addition for small businesses that accept online payments. It is easy to integrate with most ecommerce platforms; you simply need to turn the feature on and enter your Amazon Pay merchant account details.

For more customized websites, there are extensive developer resources and built-in code generators that make it easy to use with minimal coding.

Aside from its ease of use and developer support, another notable feature of Amazon Pay is its integration with Alexa, which lets users pay with voice commands. It will be a huge step forward if Amazon Pay also offers tools for in-person transactions in the future.

Customer Support

For troubleshooting, Amazon Pay has an extensive online support center. Merchants needing additional support can log in for more personalized assistance by accessing live chat or submitting an online form. Users have noted the team is usually responsive, though the user-friendly format minimizes the need for support.

Setup & Application

Signing up for a merchant account with Amazon Pay starts with completing an online form on the website. To set up an account, local businesses will need a US-based phone number, a credit card issued by a US-based bank, a checking account with a US-based bank, and a business taxpayer ID, EIN, or personal Social Security number.

Register your business information with Amazon Pay for a merchant account and start taking payments in minutes.

(Source: Amazon Pay)

A couple of things you need to note, however, is that it can take 20 to 30 days for merchant application approval, and all accounts are subjected to the tiered reserve. Be sure to read the policy in Amazon Pay’s Merchant FAQs.

Once you have your business account, the dashboard is relatively easy to get used to, and you can use it to set up notifications, check high-level analytics, and manage integrations. You can also store and update customer payment information.

Contract & Merchant Agreement Terms

Customer agreement and policies are available on Amazon’s help center. You’ll find both general merchant terms of service and specific policies on the use of the different Amazon products. The customer agreement, in particular, is the general terms and conditions for any Amazon user (both buyer and seller), so make sure to read the document thoroughly before signing up for an account.

The sections relevant to your merchant account are as follows:

- General terms: It covers stipulations on establishing your account, which may include undergoing a credit investigation, establishing a reserve, receiving payments and chargebacks, Amazon fees and taxes, contract terms and termination, and confidentiality.

- Seller accounts: It details the terms and conditions for creating and maintaining a merchant account, accepting payments, depositing funds, and chargeback protection.

- Marketplace Web service (MWS): This is now referred to as Selling Partner API (SP-API); for sellers who want MWS, terms and conditions cover the use and access to APIs and tools specific to this service.

- Credit Card Association agreement: It highlights the terms associated with accepting payments through card networks (Visa, MasterCard, AMEX, etc.) on Amazon Pay.

Methodology: How We Reviewed Amazon Pay

We test each online payment processor ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best online payment processors. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every online payment processor has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall online payment processor evaluation criteria:

20% of Overall Score

The main factor that pulled down Amazon Pay’s score in this category is the lack of volume discounts. Since its transaction fees are on par with those of other popular payment processors, the lack of discounts for volume transactions makes it pricier for busy merchants.

30% of Overall Score

The best online payment processors can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Amazon Pay received lower than average scores for this criteria because of the lack of diversity in the payment types it accepts.

25% of Overall Score

Amazon Pay’s excellent developer resources, ecommerce integration, BNPL options, and Express Payout helped it earn good scores in this category. The lack of a mobile app prevented it from scoring higher.

25% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

We gave Amazon Pay perfect scores in the different sub-criteria in this category except for pricing, mainly due to its lack of volume discounts.

Frequently Asked Questions (FAQs)

Amazon Pay is extremely easy to use, convenient, and offers extensive ecommerce integration. It is also highly secure and offers fraud protection.

Amazon is one of the largest online retailers and cloud service providers that offers a wide range of services. Amazon Pay is one of the services available to Amazon users. This free online payment service allows users to purchase items using the payment methods they have stored in their Amazon accounts.

You will need to register as a business with Amazon. Once you have your Amazon business account details, you can simply turn on Amazon Pay as a payment method from your ecommerce platform. If you require more custom integration, check the developer resources for more information.

Yes. Amazon Pay is backed by the same secure and fraud protection technology used by Amazon.

Bottom Line

Amazon Pay is a quick and easy solution if you need an easy, foolproof, and trusted way to set up online payments. However, if you’re looking for something long-term that can provide many business tools, you may want to opt for something more flexible.

[1] Capterra

[2] G2

[3] FinancesOnline

[4] Trustpilot