Quadient Accounts Payable Automation by Beanworks (formerly Beanworks AP) is a cloud-based automated A/P solution that helps accounting teams move swiftly from invoice to payment. It uses automatic data entry to import data to its secure online dashboard and manages the approval process.

While upfront pricing is unavailable, you can request a demo of the software before purchasing. My Quadient Accounts Payable by Beanworks review goes over the platform’s pros and cons, salient features, ease of use, and more to help you determine if it fits the bill.

Pros

- Bill coding feature, including multi currency bills

- Bill approvals and routing

- Audit trail

- Accounting software integration with QuickBooks

- Unlimited users

Cons

- Pricing isn’t transparent

- Image files containing invoice data can’t be exported from Quadient AP to QuickBooks

- Limited mobile app features

Pricing | Prices are not published on Quadient AP’s website. You may request pricing by completing Quadient AP’s contact form. |

Discount | ✕ |

Free Trial | ✕ |

Payroll | ✕ |

Standout Features |

|

Ease of Use | Easy to use; integrates with other software and multiple customer support options |

Customer Support | Mix of positive and negative reviews. Users like it because it’s easy to use, while some find that it lacks robust features in PO management |

- Large merchandising and retail companies: If your operations are procurement-heavy, Quadient AP’s automated PO and invoice matching can help you streamline the procurement process, reduce errors, and speed up transaction processing.

- Businesses seeking software integration for QuickBooks Online and Desktop: We selected Quadient AP as one of the best A/P software because it integrates with popular accounting solutions.

- Controllers and chief financial officers (CFOs) seeking more control over the A/P process: Your accounting team will make well-informed decisions with access to accurate reports and the ability to manage multiple legal entities in one central place.

- Businesses operating remotely: Quadient AP’s mobile app lets you approve or reject invoices, capture receipts, and submit reports for approval. This can come in handy while on the road.

Quadient AP Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Easy to use and intuitive | Sync errors with some accounting software |

| Excellent bill approval workflow | Duplicate entries on rare occasions |

| Efficient and accurate A/P tracking | Can’t download disbursed checks as PDF |

Positive Quadient Accounts Payable by Beanworks reviews highlight the tool’s intuitive and user-friendly interface, which simplifies the A/P process even for users with limited accounting experience. Many appreciate its seamless integration with popular accounting systems like Sage and QuickBooks. Reviewers also commend the platform’s ability to manage high volumes of invoices efficiently, along with the helpful and responsive customer support.

On the downside, some report sync errors with accounting integrations, particularly Sage, which can disrupt workflows. There are also complaints about duplicate entries and minor inaccuracies in data extraction from invoices, necessitating manual corrections. The search functionality is occasionally described as cumbersome, requiring more steps than ideal to locate specific records. Despite these issues, most still find that the benefits outweigh the drawbacks.

Here are Quadient AP’s scores in top user review websites:

- Featured Customers[1]: 4.7 out of 5 stars from around 2,300 reviews

- G2[2]: 4.5 out of 5 stars from about 180 reviews

- GetApp[3]: 4.5 out of 5 stars from around 50 reviews

I couldn’t award the platform a higher mark in this criterion because of its lack of transparent pricing. Quadient AP offers customized feature-based plans instead of tiers, with very few details about the different options.

- Purchase orders: For businesses looking to manage POs and requisitions

- Invoices: For businesses wanting invoicing solutions for unlimited users and storage

- Payments: For businesses needing payment solutions like check payments, automated clearing house (ACH), electronic funds transfer (EFT), forex, and remittances

- Expenses: For businesses looking to track expenses

Quadient AP Features

In evaluating the features of Quadient Accounts Payable, I compiled general and special features related to A/P. General features are essential functions like creating bills, recording bills, creating POs, and paying bills. Special ones, on the other hand, pertain to A/P automation features that help users have a smoother A/P management experience.

The main purpose of Quadient Accounts Payable is to assist businesses with tackling four core areas: POs, invoices, payments, and expenses. It can create and match POs automatically to invoices, set and manage spending limits, search for digital invoices, configure customized approval channels, and set up batch payments. It is mobile-friendly, with the ability to access and approve invoices on both iOS and Android devices.

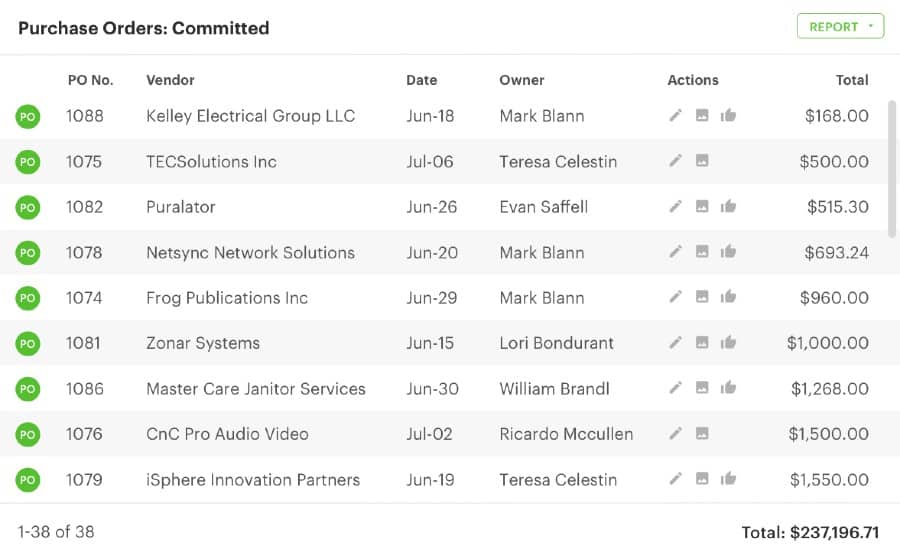

In the Purchase Orders module, users can create or view imported POs and approve them. This adds visibility into your committed costs and enables users to track spending within their department easily. Each PO is coded, submitted for approval and, once fully approved, it’ll wait to be matched automatically to invoices when they arrive in Quadient Accounts Payable.

Automated POs (Source: Quadient Accounts Payable)

You have the option of setting and managing spending limits by department, vendor, or project. You can also set manager budgets to control spending for each department.

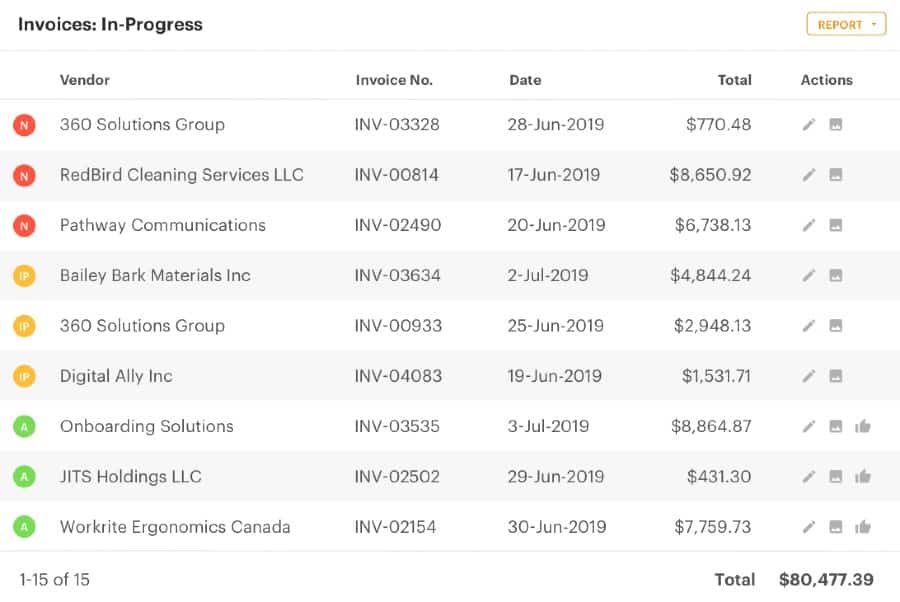

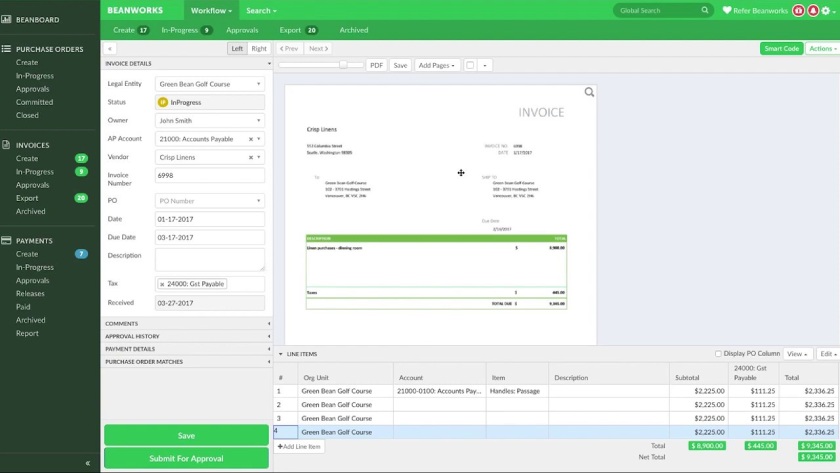

The heart of Quadient AP is the Invoices module, which is where invoices first arrive from vendors or from being scanned. Using the GL smart coding feature, these invoices are coded with all required information needed, and then they’re submitted for approval.

Invoices in progress (Source: Quadient Accounts Payable)

Once approved, invoices can be exported to your enterprise resource planning (ERP) or accounting software. The invoice coding capability automates data entry for invoices by importing information from your accounting and ERP platforms. You can also reduce the risk of duplicate payments and errors by setting up customized approval channels for your team.

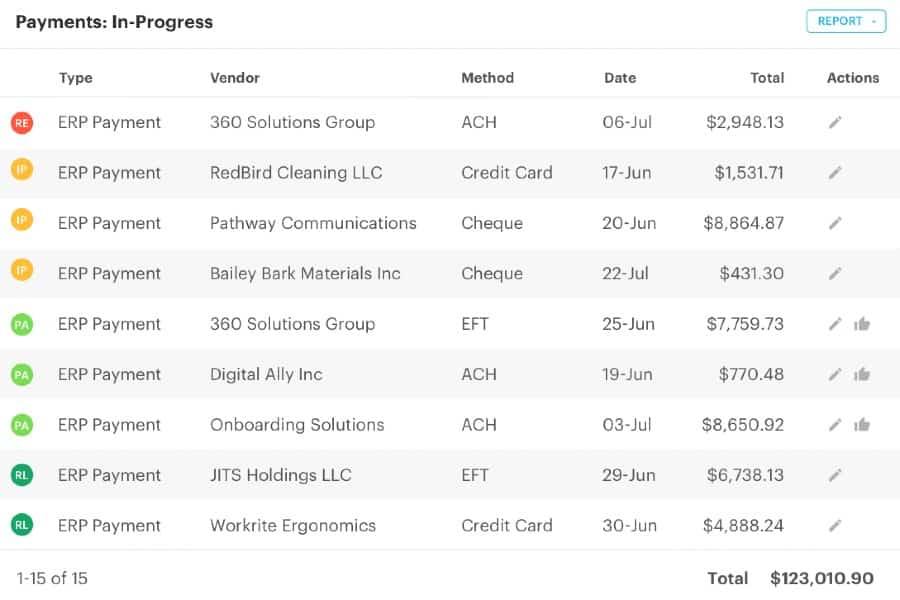

In the Payments module, you can create virtual credit card, check, EFT, ACH, and wire payments for your unpaid invoices and request authorization easily. Once the payments have been approved, they’re released to complete the invoice lifecycle.

Payments in progress (Source: Quadient Accounts Payable)

This module is also used to create payment backup for payments made out of your ERP or accounting software and matched to invoices in Quadient AP. This is so that the payment authorizers have the invoice backup for review while signing off on payments not made through Quadient AP. It also has a two-way sync with your accounting software, so you can verify which invoices have been paid.

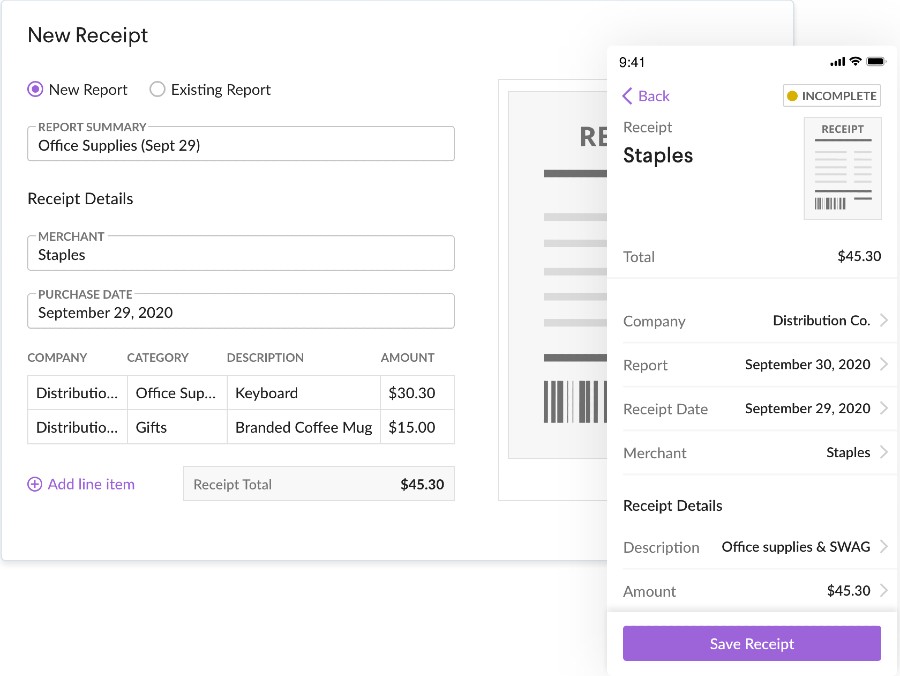

With the Expenses module, you can allow employees to upload receipts and create expense reports from anywhere via the web browser or mobile app. You have the option to create approval procedures that will ensure compliance with expense policies.

Tracking expenses (Source: Quadient Accounts Payable)

Managers can be given access to approvals, reducing any potential delays. By setting up customized receipt categories that map to your GL codes, coding will be completed automatically.

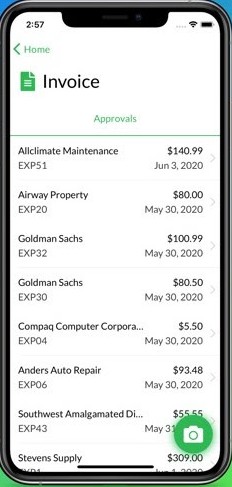

The Quadient AP mobile app is available for iOS and Android users and is an extension of the web application. Both the invoices and expense modules are supported on the mobile app.

Mobile App (Source: Quadient Accounts Payable)

With the Invoices module, you have the option of capturing invoice images with your mobile device, submitting them to the web app, and approving or rejecting the invoice. With the Expenses module, you can capture the receipt, add it to the expense report, and submit the report for approval.

Quadient AP integrates with many of the leading ERP and accounting programs to automate the A/P process. These include QuickBooks, Xero, Sage 50/100/300/500, Sage Intacct, Oracle NetSuite, Rent Manager, Jonas Club Software, Microsoft Dynamics GP, Clubessential, and Northstar.

Quadient AP’s reporting functionality and quick, real-time access to your expense data provide you with financial insights and allow you to conduct internal audits from anywhere. For example, you can view the previous month’s invoices and verify the prices within the software. You can also stay on top of late payments by creating an on-demand aging report.

The platform allows you to digitize your office filing cabinet, giving you and your team access to invoices at any time, from any location. Completed invoices and transactions are securely stored in the cloud for seven years, which eliminates paperwork filing. You can also search invoices by vendor, GL code, amount, legal entity, or any other information on the invoice easily.

Quadient AP includes key features that streamline workflows and enhance data accuracy. Its optical character recognition (OCR) automates data entry with 99% accuracy, making it especially valuable for small businesses that handle many physical documents.

The platform also offers integrated workflows that sync seamlessly with your accounting software, automatically forwarding data as steps are completed. For added convenience, Quadient AP can fetch invoices and bills sent to your email, capturing and recording them directly within the platform for easy management.

Quadient AP provides a comprehensive support structure. The website features a help center with detailed information on core functions, while the resources section offers blogs, white papers, infographics, and case studies focused on A/P automation. Customer support is provided within 16 hours, and by upgrading the plan, support can be provided within two to eight hours.

The platform integrates seamlessly with accounting software, simplifying batch payment data export, and claims to implement a fully automated A/P system in under six hours—minimizing downtime for businesses.

Additionally, the Beanboard dashboard displays performance metrics, including processed and approved invoices, allowing users to monitor A/P activity efficiently. This combination of resources and features makes Quadient AP an attractive choice for businesses seeking both automation and support in accounts payable processes.

View of Dashboard (or Beanboard) (Source: Quadient Accounts Payable)

Information for invoices processed includes the number of invoices and average and median processing times. Meanwhile, information for invoices approved includes the total number of invoices, average and median approval times, and number of invoices approved or rejected. This information can be filtered by legal entity name and date range and can be exported to a CSV file.

How I Evaluated Quadient AP

I evaluated the A/P software based on four criteria: pricing, general A/P features, special A/P features, and ease of use.

25% of Overall Score

In assessing the pricing, we considered the transparency, affordability, and flexibility of pricing plans. We also gave more credit to the software providers that can accommodate more users.

25% of Overall Score

When considering basic A/P functionality, we looked at features, such as creating vendors, tracking vendor transactions, viewing outstanding bills, recording vendor credits, and other minor A/P features.

25% of Overall Score

In evaluating special A/P features, we focused more on A/P automation. We heavily considered the ability of the software to reduce data entry time, workflow approvals, and batch processing. We also included the following:

25% of Overall Score

Frequently Asked Questions (FAQs)

Quadient AP Automation by Beanworks (formerly Beanworks AP) is cloud-based A/P automation software that integrates with popular accounting software like QuickBooks Online and Xero.

Yes, QuickBooks has A/P automation features, but they aren’t as robust as Quadient AP Automation by Beanworks. Since QuickBooks focuses mainly on accounting, you can expect basic A/P automation features like workflows (in QuickBooks Online Advanced) and bill management.

Bottom Line

Quadient Accounts Payable Automation by Beanworks empowers accounting teams to succeed by automating the A/P process. You can set the A/P workflow, automate the approval channels, and manage multiple entities easily in one consolidated system. With the addition of smart coding, the data entry is all but eliminated.

The platform excels when used across multiple teams, departments, and companies, allowing you to manage simple yet powerful workflows. With no user fees, you can involve the real spenders and collaborate across the entire organization in real time.

[1]Featured Customers

[2]G2

[3]GetApp