A vacancy rate represents the percentage of unoccupied units in a multi-unit rental property. It is a helpful indicator for determining if a rental property is performing well and whether it is or will be a profitable investment. To understand more about what a vacancy rate is, we’ll utilize a vacancy rate calculator and examine why it matters to investors, methods to reduce vacancies, and the level of vacancies in the United States.

Vacancy Rate Calculator

To calculate your property’s rate of vacancy, these are the two numbers you’ll need to gather: the total number of units in the building and the number of currently vacant units in the same building. If you already own the property, review your ledger to find these numbers. If you’re evaluating a new property purchase, have your real estate agent gather this information from the current owner or do your own research online.

Learn how to calculate the vacancy rate using the formula below or by inputting your figures into the calculator:

Vacancy Rate Formula | = | Number of Vacant Units | ✕ | 100 |

Total Number of Units |

Example calculation:

In an apartment building with 80 total units, 12 are currently unoccupied. Using the vacancy rate calculator formula, we first multiply the number of vacant units by 100, then divide by the total number of units (80) to get the vacancy percentage.

(12 vacant units x 100) / 80 total units = 15% vacancy rate

In the example above, the vacancy level of the rental property is 15%. If the average rate of vacancy for the area is 5%, it’s clear that the building is not performing properly. The next step is to determine why the vacancy level is so high. It may be because the apartments are overpriced, outdated, need repairs, or the building is unattractive and lacks amenities.

Pro tip: When you are figuring out the number of vacant units, many investors exclude units where tenants just moved out, units in need of repairs, or a unit that has just been updated and placed on the market recently because these factors skew the data. Make sure to carefully consider which units are included when you determine or receive the vacancy ratio of a rental property.

What Defines a Good or Bad Vacancy Rate?

So, what is a good vacancy rate? It is highly relative to each property’s location, rental market, economy, season, and price. Most investors consider between 2% and 4% a good vacancy level in metropolitan areas. As of the second quarter of 2023, the rental vacancy ratio is 6.3%. In general, high or “bad” vacancy rates mean that a property is not performing well and may indicate poor property condition, poor management, or local problems like job loss and economic downturn.

In contrast, low or “good” vacancy percentage are generally considered an indicator that people want to live in the building or unit and that there is a strong demand for rentals. However, a low number of vacancies can also be overlooked as an indicator of a potential problem. If the vacancy level is constantly at zero, then it’s likely that the rent price is too low and must be raised to increase cash flow. Investors must know how to set the rent price for a property to maximize cash flow and minimize vacancies.

Why Vacancy Rates Are Important to Investors

Vacancy rates are an essential metric to evaluate the rental market across a neighborhood, city, state, or country. When you perform a rental market analysis (RMA), you’ll gather and compare information about multiple rental properties throughout an area to comprehensively evaluate the overall rental market.

Real estate vacancy rates indicate how a rental property performs, especially compared to the average vacancy ratio in comparable properties. It can also aid investors in determining whether or not the property is profitable, but this shouldn’t be the sole determining factor. Some of the most common factors that impact vacancy level include:

- Location

- Rental listing marketing

- Condition of the property

- Property management style

- Rental pricing

- Rental market demand

Factors Affecting Rental Vacancy Rate

Determining the factors contributing to the rental vacancy rates will help you learn more valuable information than just the general vacancy calculation. Several factors affect how often and how long a property is vacant. Some are entirely controllable by the property owner or landlords, while others are mainly due to forces in the marketplace:

- Economic factors: This includes a declining population or an increase in the local unemployment rate.

- Competition: Other properties that affect your rental rates, like newly constructed apartment complexes or a subdivision of single-family rental residences.

- High rent prices or rent increases: This may result in high turnover as renters can’t afford your rental price, which would force them to find a better deal elsewhere.

- Lack of demand for the property type: Each renter has unique demands and desires. Renters will not rent your property if it has too few or too many bedrooms for the market served, or if it lacks amenities that tenants require.

- Unresolved tenant maintenance issues: Current tenants will move if landlords aren’t fulfilling their duties or may share unresolved issues with potential tenants. For example, a water leak that would later lead to mold or a broken door lock that compromises the tenant’s safety and security.

- Hiring an understaffed or inexperienced property management business: This results in tenant unhappiness and a decline in property value due to unsatisfactory upkeep and rent collection.

How the Vacancy Rate Formula Affects Other Real Estate Metrics

Vacancy rates play a crucial role in all the necessary rental property calculations. Knowing how many vacancies there are enables investors to accurately calculate the property’s rental income and long-term return on investment (ROI).

Vacancy ratio can affect the calculation of rental property indicators, including the following formulas:

Real Estate Metrics | Formula | How Vacancy Rate Affects It |

|---|---|---|

NOI = Rental income + Other income - Vacancy losses - Total operating expenses | This is the total potential income of a rental property after all income, expenses, and losses from vacancies are considered. | |

Cap rate = Net operating income / Purchase price x 100 | This shows the rate of return for the property over time, including losses from vacancies. | |

Cash flow (without a loan) = [(Monthly rental income + Other monthly income) - Vacancy rate] x 12 months - (Monthly operating expenses x 12 months) | Vacancy is included in estimating expenses since it provides a more accurate picture of your cash flow. Your projected annual income is also adjusted based on the number of vacancies. | |

ROI = Annual return / Total investment x 100 | The property's vacancy ratio reveals if it generates as much income as possible, which may positively or negatively affect the ROI. | |

Occupancy Rate | Occupancy rate = Number of occupied rooms / Total number of available rooms | This is the opposite of the vacancy rate, and shows how many units within a rental property are occupied and generating income. |

GRM = Property price / Gross rental income | This calculation determines how many years or months it will take to earn back your investment in the property, which depends on minimizing vacancy rates. | |

N/A | This provides an overall assessment of an area’s rental potential. The number of vacancies will show you an area to avoid or an area that is a great candidate for an investment property. |

How to Avoid High Vacancy Rates

Vacancies are inevitable for everyone who invests in real estate, but it becomes a big problem if units remain unoccupied for weeks or months at a time. Fortunately, it’s relatively easy to learn how to efficiently turn over rental units and prevent units from long-term vacancies.

The best ways to decrease rental vacancies are:

- Thoroughly screen new tenants: Choosing quality tenants who care for the property will help you foster long-term relationships, minimize vacancies, and cause less intensive repair and maintenance costs.

- Improve curb appeal: Whether you have an apartment complex or single-family rentals, making the properties look clean and appealing will significantly impact your ability to attract and keep tenants.

- Offer amenities: When possible, offer on-site conveniences like parking, laundry, a fitness center, or security. These will help attract more tenants and potentially allow you to increase rental prices.

- Establish an efficient communication system: Ensure tenants can easily communicate with the landlord, property manager, and maintenance member when necessary. This improves the tenants’ experience and builds trust, which helps keep them motivated to take care of the property. It also enables you to stay on top of maintenance requests.

- Consistently maintain properties: By maintaining properties on an ongoing basis, you won’t have to designate time to make repairs and updates when tenants move out. This should include preventative care like changing air filters, pest control, and checking smoke detectors. Use a property maintenance checklist to track these tasks.

- Promote and advertise your rental: Renters can’t apply for your property if they don’t know it’s available. Learn how to market your rental listings effectively so that you can start gathering applications as soon as your previous tenants move out.

Pro tip: For commercial properties or rentals in highly seasonal markets (e.g., towns with college students or vacation areas), another way to offset high vacancies is with short-term rental agreements. Month-to-month rental agreements are useful for short- and mid-term tenants and are often ideal for investors to continue generating rental income while selling the property. On the other hand, using the space as a vacation rental can generate income even on a weekly basis.

Average Vacancy Rate Statistics 2023

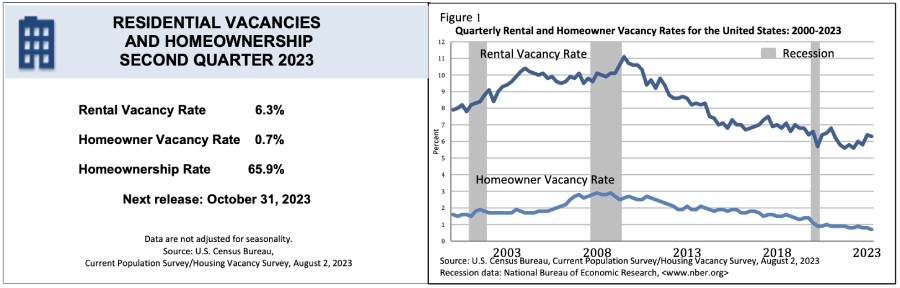

In the second quarter of 2023, the nationwide vacancy ratio for rental housing was 6.3% and 0.7% for homeowner housing. The rate of rental vacancies was higher than in the second quarter of 2022 (5.6%) but statistically not different from the rate in the first quarter of 2023 (6.4%). This signifies that vacancies across the country are higher than most investors would prefer, but the homeownership rate and demand for rental properties are increasing significantly.

Quarterly rental and homeowner vacancy rates in 2023 (Source: Census.gov)

While knowing the average in the U.S. is helpful, landlords also need to see the vacancy level in their specific location and the factors that affect the vacancies in their area. This will give landlords a better understanding of how their property or potential property stacks up against the competition. Look at the state map below to see the vacancy percentage in your state. Also, there are a few current examples of how vacancy range can be drastically different across the U.S.:

Rental vacancy rate per state (Source: iPropertyManagement)

- The median asking rent for vacant units was $1,445 (as of the second quarter of 2023).

- In the second quarter of 2023, the median asking sales price for vacant for sale units was $309,800.

- Outside metropolitan statistical areas, the percentage of rental vacancies for the second quarter of 2023 decreased to 6.1% from 6.7% in the same quarter last year.

- The level of rental vacancy was highest in the South (7.8%), followed by the Midwest (6.9%), the West (5%), and the Northeast (4.5%).

- As of February 2023, the apartment vacancy level is at 6.36%, a 1.76% increase from the same month last year.

Bottom Line

A vacancy rate reflects how many unoccupied units are in a rental property, which is critical to helping investors calculate potential profits and identify property weaknesses. Average vacancy level varies wildly depending on various factors, so this vital metric should be just one piece of your rental property evaluation. An investor with a thorough understanding of the rental market can take a property with a high vacancy percentage and learn how to find good quality tenants, keep the units occupied, and maximize cash flow.