Real estate investing (REI) education is crucial for success in the market. With the rise of online courses, aspiring investors now have convenient access to valuable resources and information to help meet their investing goals. The best real estate investing courses online are cost-effective and offer flexibility, fitting into various schedules. Additionally, these courses provide valuable networking opportunities with like-minded investors, fostering collaboration and idea-sharing for a well-rounded REI education.

Factors to Consider When Choosing the Best REI Courses

As you’re reading through, you must weigh several factors before selecting your ideal course. The first is evaluating the course content and curriculum to ensure it aligns with their interests and goals. Here are additional important factors to consider when choosing the best real estate investment courses to increase your knowledge:

- Instructor’s expertise and credibility: This is vital as learners benefit significantly from seasoned professionals with practical experience.

- Customer reviews: Offer valuable insights into the course’s effectiveness and the satisfaction of past participants.

- Course length and level of commitment: Allows learners to plan and manage their time effectively, ensuring a fruitful learning experience.

1. Beginner’s REI Fundamentals

Real estate investment fundamental courses cover the foundational principles of real estate investing, including the pros and cons of investing, property evaluation, risk assessment, due diligence, and market analysis. They’re excellent for aspiring real estate investors and seasoned investors who want a refresher or to hone their skills.

Fundamentals of Analyzing Real Estate Investments | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnConfidently evaluate and distinguish between "good" and "bad" deals. Plus, you’ll learn investment models to assess rental income properties, how to start fix-and-flip businesses, commercial properties, and vacation rental opportunities. Moreover, you will gain the expertise to implement intelligent investment deal structures and apply professional real estate investment strategies and techniques for success. Here are some topics covered:

| |

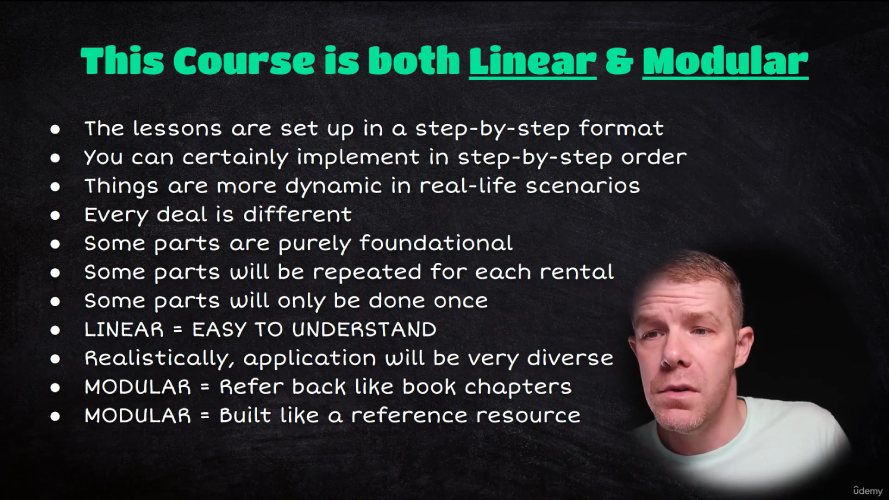

Free preview of the investment property analysis. (Source: Udemy)

There are many real estate investing courses for beginners to learn the fundamentals of investing at various price points. Students can learn from top universities with livestream or self-study formats.

| |

2. Buy-and-hold Real Estate Investing

Real estate investing using the buy-and-hold strategy is for investors who want to buy their first property or more and hang on to them as a rental instead of flipping them for a fast return. It’s an excellent way to build long-term wealth, earning positive cash flow while building equity over time.

BUY & HOLD: How To Buy, Fix, Tenant, & Manage Rentals | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnIn this course, you’ll discover comprehensive real estate investment guidance, such as assessing buy-and-hold properties and local vs remote investing. You’ll learn how to master negotiations, contracts, and property processes. In conclusion, you will be able to grasp cash flow, return on investment (ROI), and metrics through practical exercises to avoid costly Fair House Act penalties. Other topics include:

| |

Course Preview. (Source: Udemy)

Some of these alternatives to the best real estate investing courses online teach more than long-term investment strategies, including fundamentals. They provide multiple opportunities to take a deep dive into real estate investing.

| |

3. Fix-and-flip Investing

Fixing and flipping property is a real estate investing strategy where an investor purchases a property needing repairs or complete rehabilitation, fixes it up, and resells it when renovations are complete. Many investors reinvest the proceeds into another project, offering greater returns and using the strategy to build wealth.

The Complete Real Estate Investing: Learn to Fix & Flip, Step-by-Step Bundle | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnThis thorough course package delves into diverse real estate investment aspects. Discover the fix-and-flip process, covering sourcing, funding, renovation, and sales. Gain insights via walkthroughs and lessons on property rehab. A 10-lesson module covers agent roles, valuation, negotiation, and real estate tech. This intensive course also offers:

| |

Flipping course preview (Source: StackSkills)

Other schools offer several of the best real estate investing courses online for fix-and-flip, including the classes listed below. Also, real estate coaching programs are available online for fix-and-flip investors.

| |

4. Commercial Real Estate Investing

Courses that concentrate on investing in commercial properties, including office, retail, and industrial, teach the fundamentals of how to get started with these property sectors. Some courses focus on specific property types that fall within the commercial real estate realm. Commercial real estate (CRE) is much more nuanced than residential, so learning CRE statistics and background before buying is essential.

Commercial Real Estate Investment Certificate | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnEarn a Commercial Real Estate (CRE) certificate through the esteemed Cornell SC Johnson College of Business. This comprehensive program equips you with in-depth knowledge and skills in the commercial real estate domain, enhancing your professional growth and expertise in the field. Some topics covered include:

| |

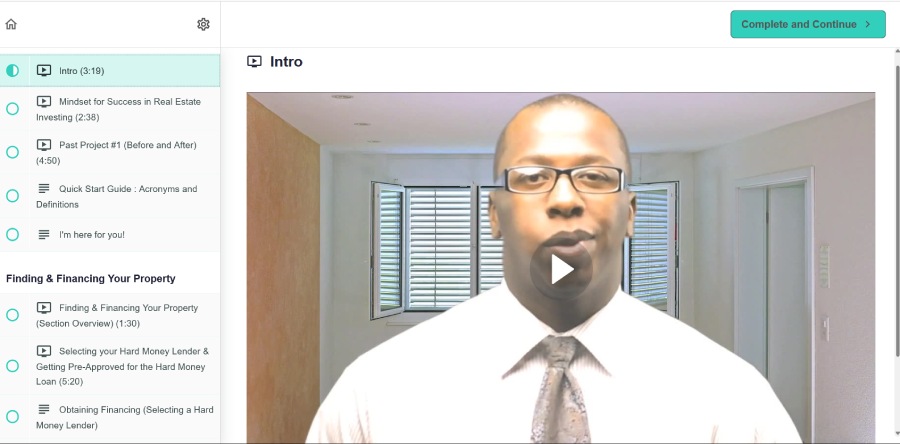

Intro to the CRE certificate course (Source: eCornell)

These alternative CRE courses from Udemy and MIT can be completed in one day to two months. The CCIM courses vary in length and complexity.

Did you know?

| |

5. Real Estate Business Development & Entrepreneurship

Real estate business development and entrepreneurship guides aspiring investors on starting and scaling their businesses and includes basic startup skills. It also involves identifying opportunities, creating real estate investment business plans and models, and implementing strategies to establish and enhance real estate ventures. This includes acquisition, development, marketing, financing, and management activities.

U.S. Small Business Administration (SBA) Learning Center | |

Course Details:

| Pricing & Structure:

|

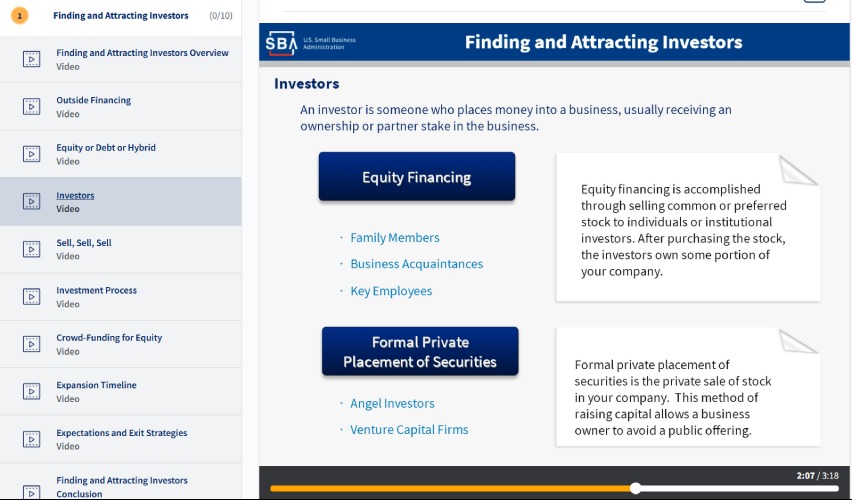

What You’ll LearnThe U.S. Small Business Administration online Learning Center content is not directly for real estate investing. However, many would-be successful investors spend a lot of time analyzing deals but don’t develop the necessary skills to start, manage, and grow a business. These courses have hundreds of on-demand videos covering writing a business plan, balance sheets, financing, pricing, and technology. These courses have so many gems, and they’re all free. Here are more topics the center courses cover:

| |

A sample from one of the SBA courses (Source: SBA.gov)

The SBA courses can provide basic business education, but as you grow as an investor, you may also want real estate investing development and entrepreneurship courses that cover the strategic expansion, innovation, and growth of real estate enterprises. Here are some excellent options that are more nuanced.

| |

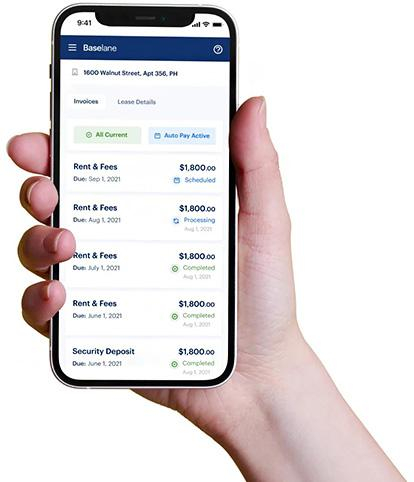

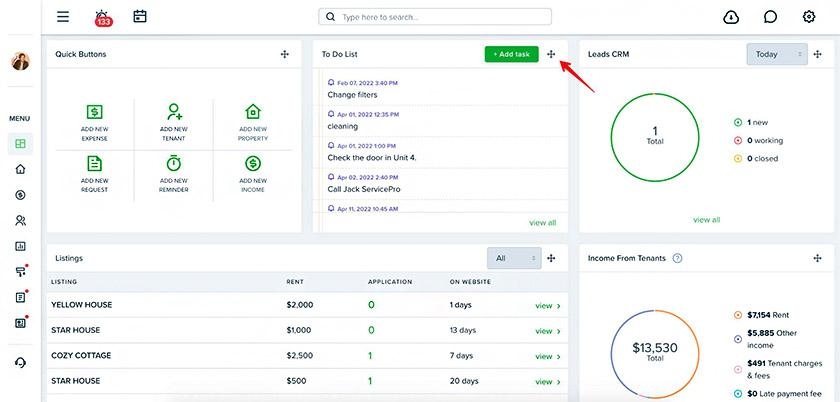

Tenant mobile payments on the app (Source: Baselane)

When you start generating revenue from your investments, you must plan to manage profits. Whether you own one unit or building or want to scale your business to the next level, Baselane can help. Baselane is a new banking platform built specifically for independent landlords. It offers free banking, free rent collection, and free bookkeeping and reporting tools from one simple-to-use platform. It offers FREE high-yield accounts (4.25%) for individuals, LLCs, corporations, and partnerships.

6. Rental Property Management

Rental property management oversees leased real estate and operations, from tenant selection and rent collection to maintenance and legal compliance. It aims to optimize property value, rental income, and tenant satisfaction while adhering to regulations and industry standards. These online top real estate investing courses teach the ins and outs of investing, such as property management duties, tenant screening, and optimizing rental income.

Property Management Certificate | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnIn this course, you will develop and sustain positive tenant relationships by mastering communication and empathizing with tenant needs. You’ll also learn effective management techniques for diverse rental categories, including commercial, multi-family, and single-family units. Understanding advertising vacancies, tenant screening, credit assessment, and optimizing turnover schedules, can help you reduce vacancy periods. You’ll also gain knowledge of property risk assessment and liability transfer to external entities. The program deepens comprehension and adherence to Fair Housing statutes and regulations, ensuring a lawful and ethical landlord-tenant approach. Some topic areas cover:

| |

An overview of the Penn Foster experience (Source: Penn Foster)

There are two types of property management online courses. One type provides for-credit training and education for receiving or maintaining a state license. The other is for investors, landlords, and property managers to learn how to manage the properties in their portfolios. There is overlap, so check with the schools to ensure you’re eligible.

| |

Customization dashboard (Source: Tenant Cloud)

For a well-organized real estate investment journey, TenantCloud is invaluable. This cloud-based property management software simplifies tasks like tenant screening, lease management, and communication. It offers fair pricing, comprehensive features, and the ability to list and manage numerous properties, making it ideal for independent landlords and property managers seeking efficiency and ease in handling rental processes.

7. Real Estate Finance & Investment Analysis

These courses delve into the financial aspects of real estate investing, such as property financing, cash flow analysis, and return on investment calculations. The best real estate investing courses online teach creative financing techniques and deal structuring strategies for real estate investment.

Real Estate Financial Modeling | |

Course Details:

| Pricing & Structure:

|

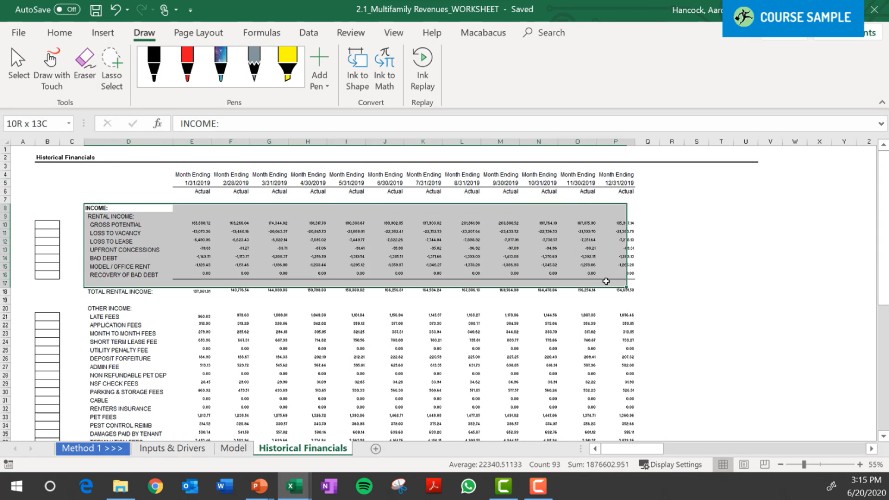

What You’ll LearnThis course commences by laying the groundwork in real estate finance and Excel techniques, gradually advancing in complexity. Participants will adeptly construct comprehensive, industry-standard models for multi-family, office, retail, and industrial properties by the program's conclusion. This encompasses a detailed exploration of revenue, operational costs, capital enhancements, debt structuring, and collaborative venture distributions. Some additional critical topics covered entail:

| |

Multi-family Revenue Build: Historical Financials Preview (Source: Wall Street Prep)

The real estate investment finance world is complex. It requires a strong understanding of evaluating deals for profitability and creating financial models. These alternative courses in real estate investment financial modeling can assist you in creating mathematical representations of real estate investment scenarios to forecast potential outcomes and assess the financial viability of a property or project.

| |

8. Real Estate Deal Negotiating Skills

This course focuses on honing negotiation skills for successful real estate transactions. It is effectively navigating and securing favorable terms in real estate transactions. These skills are essential for buyers, sellers, investors, agents, and other professionals involved in real estate deals. Negotiation involves discussions and compromises related to property prices, terms, conditions, financing, repairs, and other aspects of a transaction.

Online Negotiation Training Courses Led By Experts | |

Course Details:

| Pricing & Structure:

|

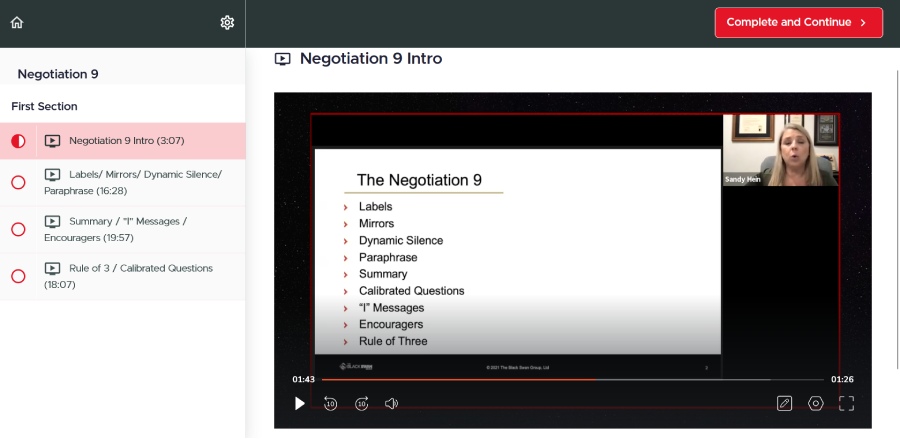

What You’ll LearnChris Voss, a former FBI international hostage negotiator and founder of the Black Swan Group, provides various online negotiation training courses. In his negotiation training courses, you’ll learn his “tactical empathy” strategy, teaching you how using empathy in your communications will take you further than bullish negotiation tactics. There’s also a course on using your tone of voice to build rapport and get what you want. There are negotiation courses for real estate agents, company leaders, and anyone who wants to develop the art of negotiation. There is also a subscription where you can receive a one-year on-demand video subscription to the teachings in the chapters of Never Split the Difference and an advanced livestream Zoom course in advanced tactical empathy. Some of the course choices are:

| |

The “Negotiation 9” course intro (Source: Black Swan Group)

Knowing how to negotiate is an invaluable skill that carries into all areas of life. These alternatives to the best online real estate investing courses provide additional tools and techniques to master the art of negotiation.

| |

9. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are investment vehicles that allow individuals to invest in real estate assets without directly owning properties. REITs pool funds from multiple investors to purchase, manage, and often generate income from portfolios or ventures, such as commercial properties, apartment buildings, and hotels. They provide a convenient way to access real estate markets, offering potential dividends and capital appreciation while also providing liquidity due to their listing on stock exchanges.

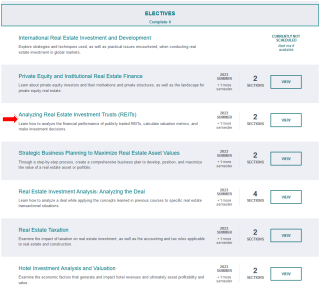

Analyzing Real Estate Investment Trusts (REITs) | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnIn this course, you will gain expertise in evaluating the financial performance of publicly traded REITs and making informed investment decisions. The curriculum encompasses qualitative and quantitative analysis, teaching you to define strategies and interpret portfolio statistics. It also teaches you to comprehend income statements and the REIT-specific metric funds from operation (FFO). Additional learning includes:

| |

Real Estate Investing certificate electives with the REIT course (Source: NYU)

Depending on how deep you wish to delve into your study of REITs before investing, there are complete master classes and short courses to better prepare you for passive investing. Check out these alternatives for additional information on passive investment strategies.

| |

10. Real Estate Portfolio & Asset Management

Asset and portfolio management real estate investing courses guide investors on managing a diversified portfolio of real estate effectively, whether it’s their holdings or they manage portfolios for others. Asset management strategies help maximize returns and optimize investments.

Real Estate Asset Management 101 | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnIn this course, you will learn how to analyze and maximize deals in your portfolio and how to achieve goals in asset management. Additionally, the course teaches you how to create quarterly and annual reports, key projections, and a budget. Lastly, you’ll learn how to negotiate leases. Some key outcomes include:

| |

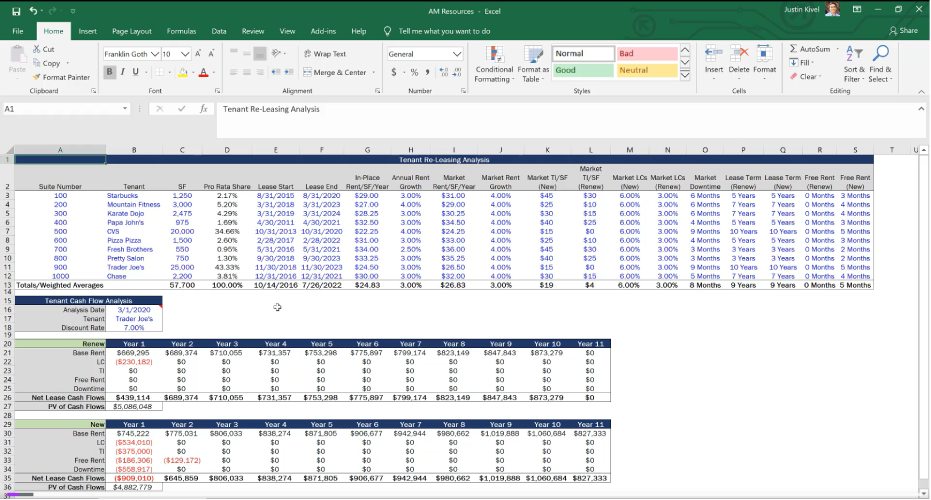

A sample from the re-leasing analysis in Excel (Source: Udemy)

Portfolio and asset management courses are ideal for investors, property managers, and those who manage portfolios for other investors. Understanding how to manage assets and portfolios is essential for investors buying more than one property.

| |

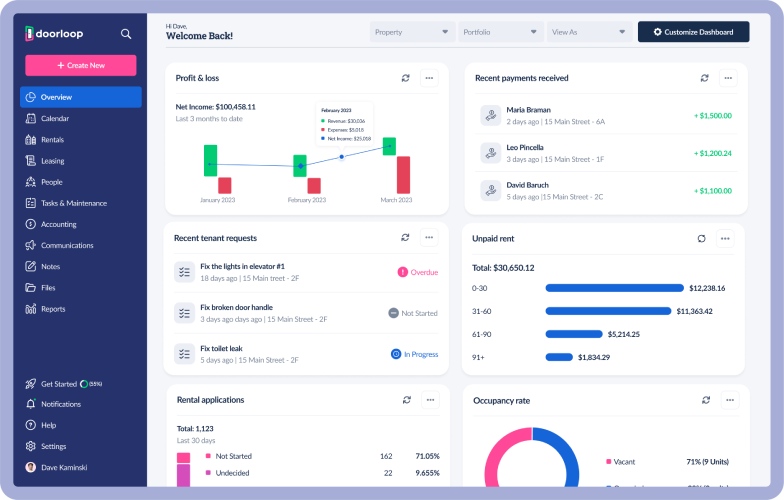

The portfolio management dashboard (Source: DoorLoop)

If you’re looking for a robust program to easily manage and grow your portfolio from anywhere, check out DooLoop. The online platform will handle portfolios of any size and property type. It provides accounting for non-accounts, rent collection, and marketing vacancies, and you can fully automate your property management processes.

11. Social Impact & Sustainable Real Estate Investing

Socially responsible and sustainable real estate investing focuses on ethical, environmental, and community-oriented practices. It seeks to minimize negative impacts on society and the environment while promoting long-term economic viability. This approach considers energy efficiency, social equity, and responsible land use (for investors who want to buy land) to create positive outcomes for investors and the broader community.

Sustainable Real Estate: Creating a Better Built Environment | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnThe course explores real estate's ecological, social, and governance dimensions, including trends, risks, and opportunities. It emphasizes sustainable practices to enhance community resilience and contribute to a sustainable future. Over eight weeks, you'll devise a customized action plan to address sustainability challenges, identifying opportunities for positive impact. By implementing these strategies, individuals and organizations can foster a more sustainable real estate industry and create positive change in supply chains and communities. Some course takeaways:

| |

12: Real Estate Crowdfunding & Syndication

Crowdfunding and syndication real estate investor courses explore how to invest in real estate projects through online platforms. Crowdfunding and syndication investments are deals where investors pool their money for commercial real estate. These opportunities are almost always exclusive to accredited investors. However, some real estate crowdfunding sites have opportunities for non-accredited investors to participate in buying shares of the company’s holdings.

Syndication & Crowdfunding Workshop | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnThis advanced training teaches you how to use crowdfunding and real estate syndication to gather money from investors to fund your commercial real estate ventures. You will learn how to raise capital from private sources while adhering to securities regulations. You'll also learn how to structure your agreements, which legal entities to use, and other effective methods for raising large sums of money. Some course highlights include:

| |

13. International Real Estate Investing

Courses on how to do international real estate investing provide strategies and insights into investing outside of one’s own country. These courses are unique because they provide an intense look into international real estate law.

Learn International Real Estate Investing In The U.S | |

Course Details:

| Pricing & Structure:

|

What You’ll LearnForeign nationals interested in real estate investment will be guided through a comprehensive step-by-step process on effectively investing in the United States. They will acquire the knowledge and skills required to establish and manage their real estate ventures within the country. Learn how to build strong relationships with hard money lenders, understand the necessary steps and criteria, and successfully identify suitable properties. They will also learn to comprehend market dynamics while operating abroad. Furthermore, participants will gain proficiency in utilizing essential tools crucial for achieving success in REI. Some course section cover:

| |

Free preview on incorporating your business in the United States (Source: Udemy)

Alternative international real estate investment courses provide vital insights into global markets, including varied investment strategies, and cross-border regulations, equipping learners to navigate complexities. It also helps them identify opportunities, and manage risks. These courses empower individuals for successful international real estate ventures. Enhanced skills and broader perspectives enable seizing unique investment chances and cultivating a global real estate approach.

| |

Pros & Cons of Online Investing Courses

Online real estate investing courses present a convenient pathway to gain expertise in property investment. They offer accessible access to industry insights and trends, enabling flexible learning. However, like any educational endeavor, these courses come with their own set of advantages and disadvantages. Explore the following pros and cons to make an informed decision about your investment in online real estate education.

| PROS | CONS |

|---|---|

| Convenience and flexibility: Online courses allow you to learn at your own pace and schedule. | Technical challenges: Reliable internet and basic computer skills are necessary; technical issues can disrupt progress. |

| Cost-effective: Can be more affordable than in-person classes, saving on tuition and commuting expenses. | Variable quality: The quality of online courses can vary, with some lacking up-to-date information or credible instructors. |

| Diverse learning materials: Courses typically include videos, readings, quizzes, and interactive elements, catering to various learning styles. | Self-motivation: Staying motivated and disciplined can be challenging, leading to incomplete courses. |

| Global reach: You can enroll in courses from anywhere, accessing content and networking opportunities that might not be available locally. | Potential lack of interaction: Online courses might offer less interaction with instructors and peers, impacting discussion and networking opportunities. |

| Access to experts: These courses often feature experienced instructors and industry professionals, providing valuable insights and practical knowledge. | Limited hands-on opportunities: Online courses may lack the practical, hands-on experience that in-person classes or workshops can provide. |

Bottom Line

Choosing quality real estate investment courses is essential for success. Pick a course that aligns with your goals and preferences, and embrace continuous learning to thrive in the real estate market. By equipping yourself with valuable knowledge and skills, you’ll be better prepared to navigate the complexities of real estate investing. Remember, continuous learning is the key to staying ahead and achieving long-term financial prosperity.

Sustainable real estate course trailer (Source: University of Cambridge)