BILL (formerly Bill.com) is a web-based billing and invoicing software for small businesses and accounting firms. It features accounts payable (A/P) automation to streamline your processing of accounts payable and speed up the settlement of vendor invoices. Payments can be faster if the vendor is also a BILL user, thanks to the BILL vendor network. Besides that, BILL Spend and Expense enable users to issue virtual and physical credit cards to pay for expenses, manage expenses and reimbursements, and create budgets.

Our BILL review revealed that its invoicing—accounts receivable (A/R)—component is at its best when invoices are issued to other BILL users because there’s real-time status tracking for these invoices and payments. Fortunately, BILL has a large customer base, and there’s a good chance a decent-sized portion of your invoices will be sent to BILL users. Monthly plans start at $45 per user, but we recommend the Team plan at $55 per user for two-way sync with QuickBooks and Xero.

The Fit Small Business mission is to deliver the best answers to people’s small business questions. Hence, we spend hours researching and testing so that we develop editorial reviews that can help our audience. For this article, we used a rubric that scored software against a set of criteria that we expect to see in an accounts payable platform.

Pros

- Offers affordable pricing for small businesses

- Integrates with QuickBooks and Xero

- Lets you choose between invoicing (A/R), bill pay (A/P), or both

- Provides easy connection with vendors and customers who are also using BILL

- Has multiple money transmitter licenses in all 50 states for more secure payments

- Free plan for Bill Spend and Expense with unlimited users

Cons

- Is not a full accounting software

- Can be too costly for businesses with many enrolled users

- Offers only manual integration for QuickBooks and Xero in the Essentials plan

Is BILL Right for You?

Is BILL right for you?

BILL Alternatives & Comparison

Our Comparisons of BILL vs Other Software

BILL Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Excellent user interface (UI) | Slow customer support and difficulty in calling support hotlines |

| Convenient for syncing with QuickBooks Online | Clunky integration with accounting software |

| Increased efficiency in processing bills | High pricing if compared with competitors |

Users who left a positive BILL review mentioned that the program is an excellent way to pay vendors and get paid. One reviewer noted that BILL helps them easily send invoices to their consulting clients and get paid through automated clearing house (ACH) bank transfers. Another user likes that adding new customers is simple and that those customers don’t need to set up anything. Meanwhile, those who left negative reviews mentioned slow response in customer support.

Based on our evaluation of BILL’s features, we agree with what the customers say. BILL’s A/P features make it easy for users to track and send payments, especially if made within BILL. Overall, it is a great addition to your accounting processes for A/P.

Here’s how BILL is rated by several review websites:

- Featured Customers[1]: 4.7 out of 5 stars based on around 4,200 reviews

- GetApp[2]: 4.2 out of 5 stars based on about 500 reviews

- G2.com[3]: 4.3 out of 5 stars based on nearly 1,000 reviews

BILL Pricing

BILL offers a billing and invoicing solution for businesses and accounting firms—and customers can choose invoicing solutions (A/R), billing solutions (A/P), or a combination. We gave BILL a perfect score because it is affordable and flexible.

It also offers free basic A/R and A/P functions if you get either the A/P or A/R only plan like creating vendors, attaching copies of receipts, and recording purchase orders. However, if you want advanced features like automatic sync with accounting software, you will need a subscription to the Team plan.

For Small Businesses

For Accounting Firms

The Accountant Partner Program of BILL is accessible to accounting professionals at $49 per month. The program includes:

- Automatic data capture for bills and invoices

- Bill routing to approvers

- Product training with the possibility of earning continuing professional education (CPE) credits

- Resell A/P and A/R services to clients

Transaction Fees

When sending or receiving payments via BILL, transaction fees will apply.

ePayment/ACH Processing Fee | 49 cents per transaction (send and receive) |

Check Mailing by BILL | $1.69 per check or invoice |

Invoice Mailing by BILL | $1.49 per invoice |

Payment by Credit or Debit Card | 2.9% of payment (applies to the payor) |

International Wire Transfer (Local Currency) | $0 fee and competitive exchange rates |

International Wire Transfer in United States dollars | $14.99 flat fee |

Vendor Direct Virtual Card payment | $0 for vendors who accept Vendor Direct |

Faster ACH Payments | $9.99 (same-day or next-day) |

Faster Check Payments | Overnight: $22.99 Two-day: $17.99 Three-day: $11.99 |

Are you looking for affordable billing software? We recommend checking out Melio, a billing software that charges only transaction fees and has zero platform fees. Visit Melio to learn more.

BILL Spend & Expense App

Aside from BILL’s A/P and A/R management platform, they also offer a new service that’ll complement your payments processes. BILL Spend & Expense (formerly Divvy) is a free all-in-one expense management software that provides users with expense tracking, reimbursements, and business credits. With this tool, you can issue virtual cards with credit limits, which could give your business more spending power for working capital needs.

Card issuance also enables you to speed up purchases and streamline all expenses into a single platform for easier review, approval, and accounting. BILL Spend & Expense lets you issue unlimited physical or virtual cards for your employees, making it easier to give allowances, per diems, and spending budgets. BILL Spend & Expense integrates with BILL, making it faster and easier to oversee expenses, receivables, and payables in a single platform.

BILL Features

BILL is both an A/P and A/R solution for small businesses. Let’s go over BILL’s A/P and A/R features.

General A/P Features

BILL scored excellently in general A/P features, but it missed only on some minor features. There is no way to process bills from purchase orders on BILL so we had to give it a less-than-perfect score in that minor criteria. Overall, BILL remains excellent in managing payables and tracking due dates.

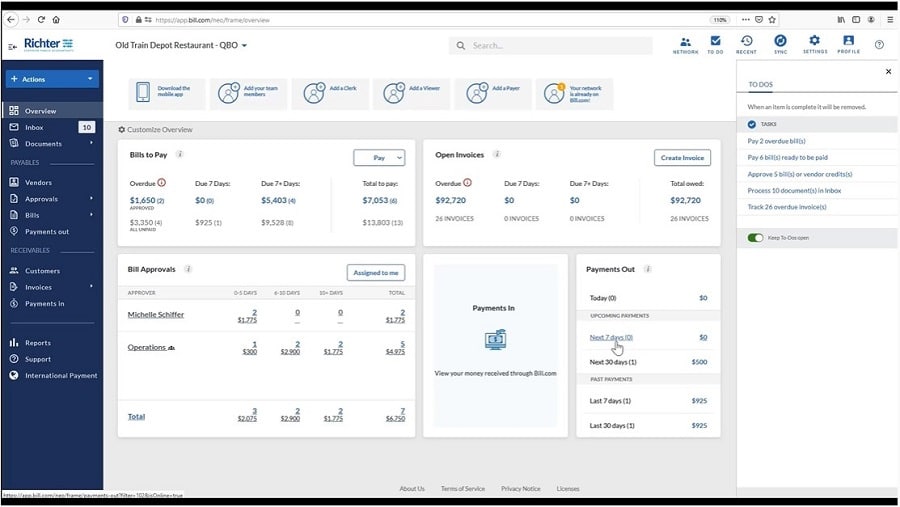

The dashboard of BILL is clean and organized. It’s easy to navigate from the Overview page. This kind of user experience is suitable for small business owners who perform billing and invoicing.

BILL Dashboard

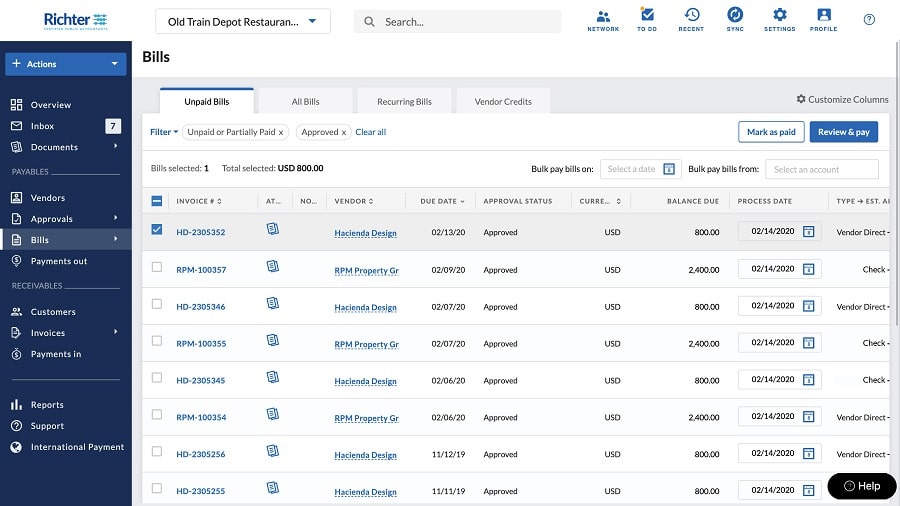

All approved bills will go to the Bills section. There, you’ll see a list of bills approved, including details like due dates, balance due, payment status, and payment amount.

Bills Section

Through BILL, you pay vendors in various ways. You can perform e-payments, Vendor Direct for larger billers, international wire transfers across 130 currencies, and check payments. The Vendor Direct program is for billers who prefer credit card payments, and you can set it up without enrolling or paying additional fees.

In the upper right corner, you set the date to bulk pay bills. After you’ve set the date, the process date of all check bills will adjust automatically, based on the payment date. You can also partially pay bills by modifying the amount under the Payment Amount column. Once you’re set, click Review & Pay to proceed to the Remittance screen.

It also has pay-by-card features that allow you to pay Vendor Direct vendors with a credit card whether they accept card payments or not. BILL processes the payment with your credit card provider and then sends the payment to your vendor via ACH ePayment, check, or Vendor Direct virtual card, depending on your vendor payment setup. You can use any US credit or debit card.

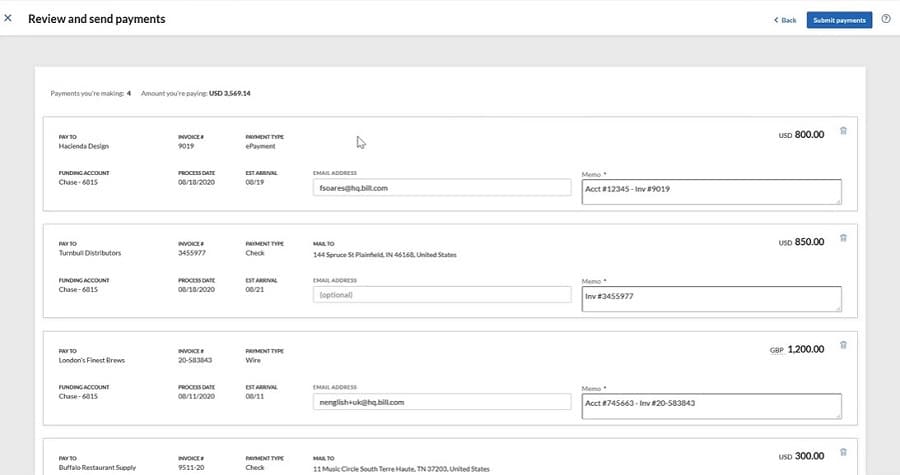

Remittance Screen

In the Remittance screen, you’ll have the chance to review payment details like mailing address and email address. You can also add notes in the memo up to 80 characters. When you enter something in the memo field, the same will appear in the memo line of the check. Once bills have been submitted for payment, all transactions will transfer to the Payments Out screen.

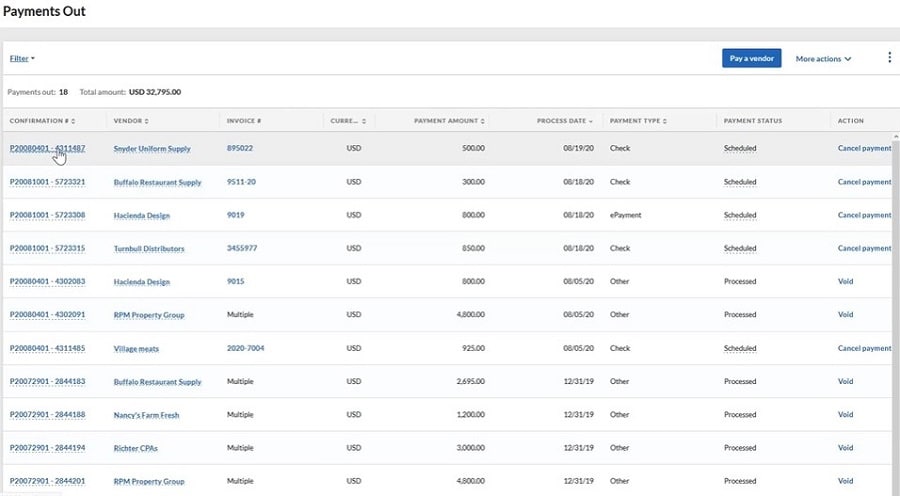

Payments Out Screen

You can still manage payments in the Payments Out screen. If payments have been processed but not yet deposited, you can click Void under the Actions column to cancel the payment. However, if payments are still scheduled or pending approval, you can cancel them by clicking Cancel Payment.

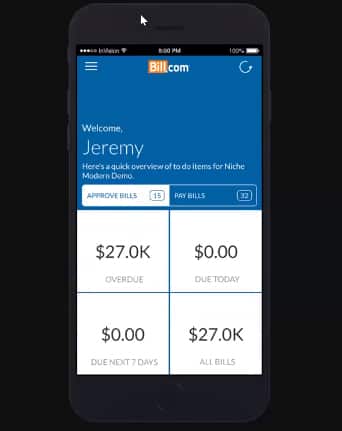

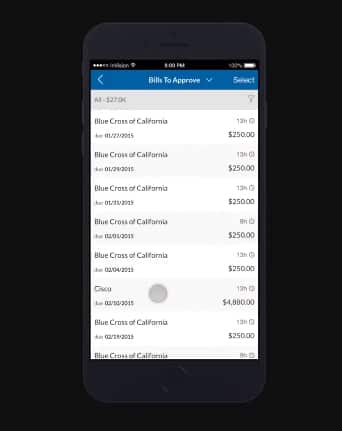

BILL has a mobile app that you can use to capture receipts and approve bills on the go. With it, users can process bills from vendors, and approvers can review submitted bills. Approvers can swipe right to approve bills and swipe left to reject them.

BILL’s invoicing and basic A/R features are free in the A/P subscription. However, the free invoicing in the A/P subscription excludes unlimited data storage for invoices, automatic sync with accounting software, and recurring invoices. If you need these features, you should subscribe to the Team plan.

The platform has decent invoicing features, such as the ability to choose from different templates and upload your logo to reflect your brand. You can also customize the invoice fields based on your unique needs.

You can track the status of the invoice from within the BILL app. However, if the customer doesn’t have a BILL account, there’s no way of tracking the invoice electronically. You can instead reach out to the payor to ask about the status. If the customer processes your invoice through BILL but doesn’t pay using BILL, the invoice status will be marked as Paid Outside of BILL. You need to record payment manually to close the invoice.

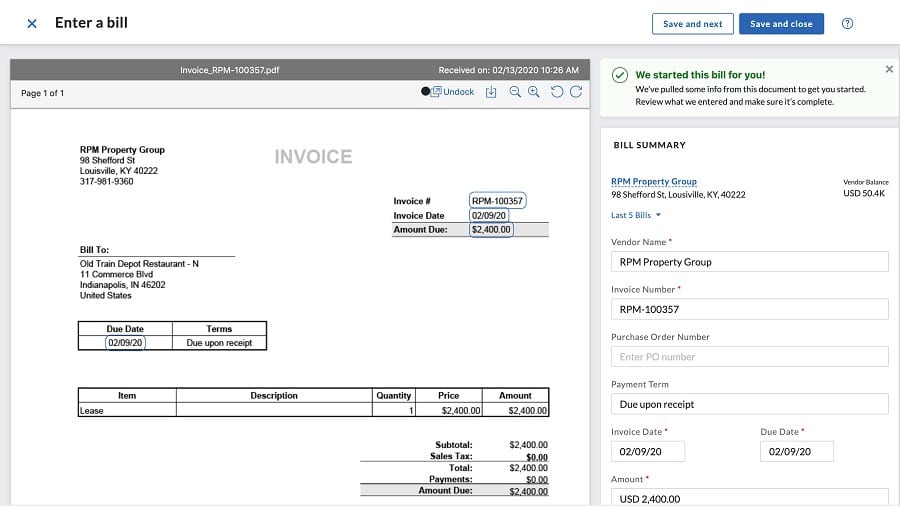

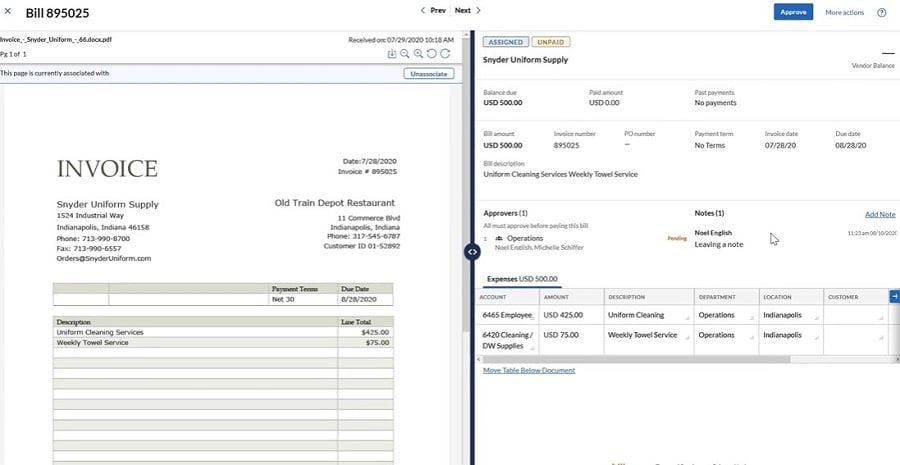

When you receive a bill from a vendor, BILL captures important information like the due date, invoice number, invoice date, and amount due from the PDF or scanned vendor invoice automatically. In the image below, you’ll see some fields completed for you automatically.

Creating a Bill

BILL has an outstanding optical character recognition (OCR) feature powered by its artificial intelligence (AI). It only takes a maximum of 30 seconds for BILL to read a PDF document and capture essential information.

You can also set up a future-dated bill payment instead of having all payments processed on the next business day by default. You can pay vendors from the bill itself, the Bills page, or even without a bill. To pay without a bill, select Payments from the left navigation menu bar, click on Pay a vendor, and provide the information required, such as the payment amount and the processing date.

Special A/P Features

In this section, we look into the special A/P features that focus on A/P automation, an important feature that makes it easy to manage and pay bills. In our evaluation, BILL got perfect marks because it has all the special A/P features we’re looking for like automatic bill capture from email and workflows. With these features, small business owners and managers will have complete oversight of bills and payments.

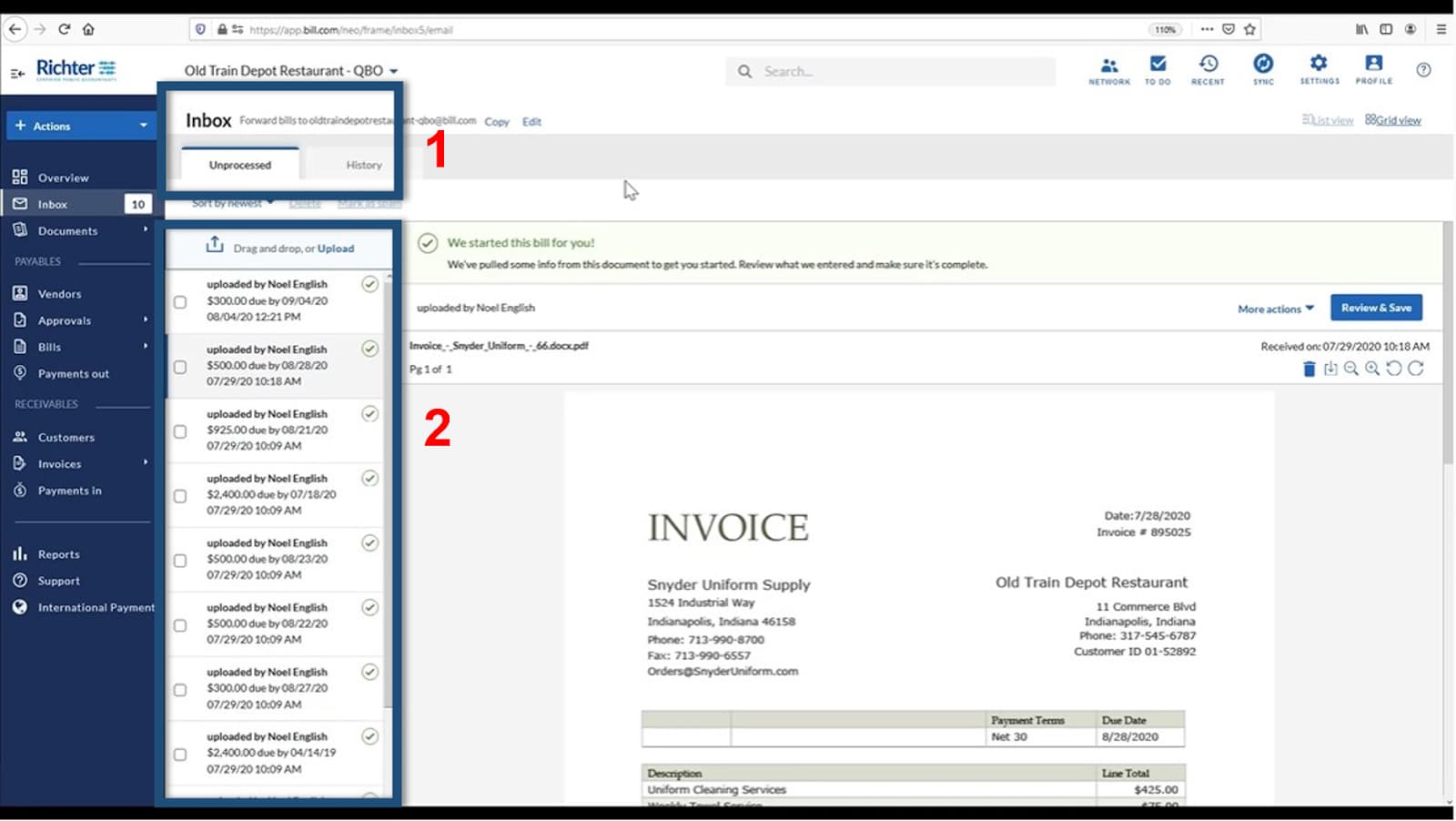

Receiving bills and sending invoices via email can be a problem without proper segregation of documents. On BILL, you’ll be provided with a specific email address where you can send invoices to customers and receive bills from vendors. In the image below, you’ll see the email address where all bills and invoices are forwarded. Once forwarded, you’ll get a notification in the BILL inbox.

BILL Inbox

- Forwarding address: Your vendors can email their invoices to this forwarding address from BILL. Instead of giving them a traditional email address and manually exporting vendor invoices, this address automatically fetches all invoices and brings them to the platform. You can also customize the forwarding address to insert your company name.

- Inbox: Vendor invoices or files sent to the forwarding address will appear in this inbox. BILL extracts useful information like vendor name, due date, and amount due for a quick reference automatically. If you click an item, the full invoice will appear on the right.

Once you receive a bill, BILL’s Intelligent Virtual Assistant (IVA) will capture key billing information like vendor name, vendor’s invoice number, due date, and amount due. However, the A/P clerk can still fill in other fields like purchase order (PO) number or payment terms.

You can also manage other kinds of documents on the platform. IVA can read handwritten invoices and capture important information like vendor name and amount due. BILL can also detect duplicate invoices by checking the invoice numbers and then linking out to the original invoice.

In case of multiple bills in one PDF file, BILL will split them into three files automatically whenever the system detects different vendor names. With the unlimited storage feature, you can also bring in other document types, like W-9s, contracts, and agreements. Moreover, you can assign documents to vendors for easier access.

For example, you can attach a W-9 to a vendor while it’s being stored in a particular folder. In this way, you can access all W-9 forms easily in the W-9 folder or access a specific W-9 by going to the vendor profile.

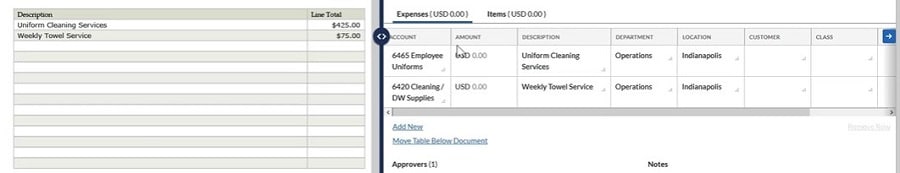

BILL learns from your past transactions. Whenever you receive a bill from a vendor, the system codifies the bill automatically by suggesting accounts affected by the transaction. In our image below, BILL suggested that the bill from Snyder Uniform Supply be chargeable to specific expense accounts.

Account Codification

BILL also automates the assignment of approvers through Bill Approval Policies. If you think that you need to manually assign approvers per invoice, you can let BILL do the majority of the work for you through Bill Approval Policies.

You can set logical arguments and criteria when creating policies; BILL can assign approvers for you automatically if the transaction matches the criteria. You can also create multiple approval policies to help reduce the data entry time in every transaction:

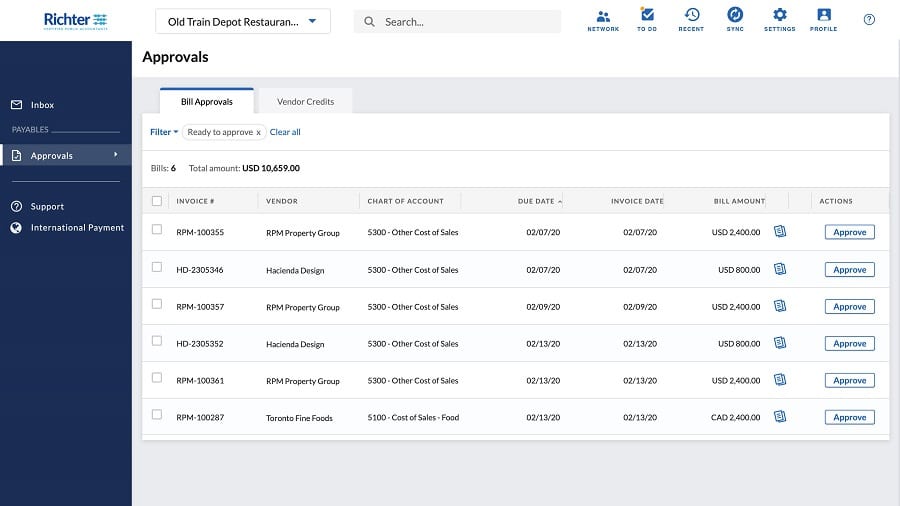

- Approval workflows: After the approver is assigned automatically, they will see the billing on a dedicated page for approvers only. In the approver’s dashboard, they’ll see the invoice number, vendor, account affected, due date, invoice date, and billed amount. On the far right of the screen, they can immediately approve the bill by simply clicking Approve.

Approver’s Dashboard

The approver can also batch-approve or manually approve bills one by one. They can click the item to view all the details about the transaction. In the image below, we can see all the details pertaining to the transaction including the actual vendor invoice. On the approver’s end, invoice details are view-only. They cannot edit it to correct mistakes or change the information.

Viewing Invoice Details on the Approver’s End

If the approver finds a problem, they can return it to the submitter for revision. When denying or rejecting bills and vendor credits, the approver must select a reason for rejection. These reasons include:

- Duplicate bill

- Data entry error

- Incorrect approver

- Other (the approver must specify)

Once the approver is satisfied with the bill or the bill has been rerouted to another person, the approver can approve the bill. After clicking Approve, BILL will generate a timestamp and generate a virtual signature after approval. Once done, the bill cannot be edited or deleted to preserve the integrity of accounting records.

BILL has an auditor access feature that gives your company’s auditor easy access to documents without going through you. Just like the approver’s page, the auditors will have a special login page where they can pull up any invoice or record from your account.

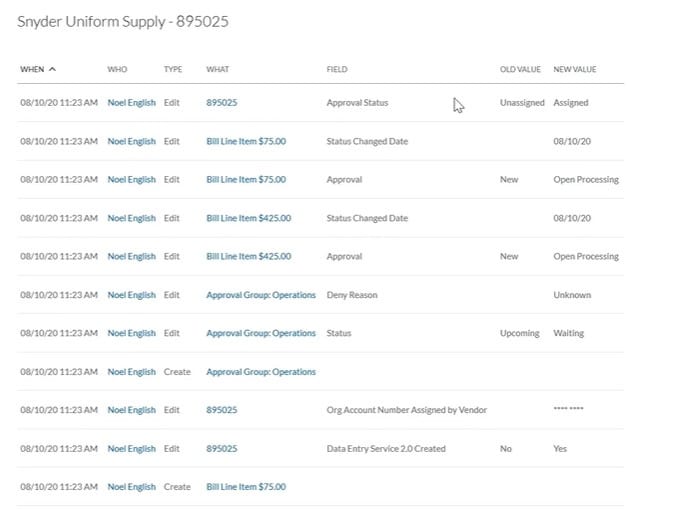

When changes are made to transactions, every change will appear in the audit trail. You can view the audit trail per transaction.

Audit Trail

The audit trail shows who edited the transaction, when it was edited, what field was affected, and what changes occurred. Having an audit trail helps in improving your business’s internal control and prevents employees from performing fraudulent acts.

BILL Ease of Use

Users can access live chat support from 5 a.m. to 6 p.m. Pacific time, Monday to Friday. For immediate support, users may check the Help Center to search for answers. BILL doesn’t have phone numbers where customers can call for support directly. As an alternative to the live chat and Help Center, users can fill up the query form. BILL would have earned higher marks in our evaluation if it had an in-app chatbot for faster self-help support or an email support team.

However, its A/P function is outstanding. It can help you organize your billings and process payments from within the app. The user interface is also neat and easy to use even for small business owners. Moreover, things will get easier if you send invoices to other BILL users. You can track an invoice’s status and payment status in real time, which helps you monitor when payments are expected to arrive.

Integrations

BILL integrates with popular accounting software and ERP solutions:

- QuickBooks

- Xero

- Oracle NetSuite

- Sage Intacct

- Microsoft Dynamics

- SAP

- FreshBooks

- Expensify

- Hubdoc

- Tallie

- Tax1099.com

- Earth Class Mail

- Thomson Reuters

How We Evaluated BILL

BILL is part of our best A/P software buyer’s guide. We evaluated its features and overall performance along these four major areas: pricing, general A/P features, special A/P features, and ease of use.

25% of Overall Score

In assessing the pricing, we considered the transparency, affordability, and flexibility of pricing plans. We also gave more credit to the software providers that can accommodate more users.

25% of Overall Score

When considering basic A/P functionality, we looked at features, such as creating vendors, tracking vendor transactions, viewing outstanding bills, recording vendor credits, and other minor A/P features.

25% of Overall Score

In evaluating special A/P features, we focused more on A/P automation. We heavily considered the ability of the software to reduce data entry time, workflow approvals, and batch processing. We also included the following:

25% of Overall Score

Frequently Asked Questions (FAQs)

Businesses use BILL to streamline their A/P and A/R processes. It offers different ways to pay bills and accept payments from your customers.

No, BILL charges a monthly fee per user plus small transaction fees. For electronic payments, BILL charges 49 cents per transaction.

BILL charges a monthly fee per user plus small transaction fees.

You should get the Team or Corporate plan for accounting software integration. BILL won’t charge an additional fee for integration, but make sure that you have existing subscriptions with your chosen accounting software.

Bottom Line

BILL offers a convenient two-in-one solution for billing and invoicing. Its A/P automation and A/P workflow make billing simpler with less data entry and easier with approvers on standby, and its invoicing side has limitations if your customers aren’t using BILL. However, you can’t fully utilize the invoice tracking features for customers processing invoices outside BILL. Overall, its A/P functions are outstanding, but we can’t recommend it for A/R.

[1]Featured Customers

[2]GetApp

[3]G2.com