BILL, formerly Bill.com, is an A/P and A/R software that focuses on processing vendor billings and sending customer invoices. Meanwhile, QuickBooks Bill Pay is deeply integrated into QuickBooks Online, a complete accounting software that can also process bills and vendor payments. Overall, I found that QuickBooks Bill Pay is the better fit for most small businesses because of its deep integration and the accounting software’s strong feature set.

While BILL covers two essential accounting functions, it isn’t a substitute for accounting software like QuickBooks Online. Whereas BILL’s monthly fee starts at $29, QuickBooks Bill Pay is $90 per month for unlimited payments—in addition to your monthly subscription to QuickBooks Online, which ranges from $35 to $235. QuickBooks Bill Pay also offers a free plan with basic features like importing bills and making five automated clearing house (ACH) payments monthly.

- BILL: Ideal for Xero users and other businesses that don’t want to use QuickBooks Online

- QuickBooks Bill Pay: Best for QuickBooks Online users looking for a complete accounting system with the built-in ability to manage and pay bills electronically

BILL vs QuickBooks Bill Pay: At-a-Glance Comparison

|  | |

|---|---|---|

4.8 ★ | 4.4 ★ | |

Monthly Pricing | Starts at $29 per user | $0 to $90; QuickBooks Online subscription required |

Billable Clients | Unlimited | Unlimited |

Maximum Users | Unlimited (additional fee for each user) | 1 to 25, determined by the base QuickBooks Online plan selected |

Free Trial | ✕ | 30 days |

Automatic Bill Capture | ✓ | ✓ |

Approval Workflow | ✓ | Elite plan only |

Batch Bill Processing | ✓ | ✓ |

Bill Pay by Check | $1.69 per transaction | $1.50 per transaction |

Bill Pay by ACH | ✓ | ✓ |

Accountant Partner Program | $49 per month | N/A |

Mobile App | iOS and Android | iOS and Android |

Ease of Use | Easy | Easy |

User Review Rating on Third-party Sites | ||

Use Cases and Pros & Cons

User Reviews: Tie

|  | |

|---|---|---|

Average Rating on Third-party Sites | ||

Users Like |

|

|

Users Dislike |

|

|

BILL and QuickBooks Online received good user reviews, so I called this category a tie. I agree with users who experienced increased efficiency in managing bills, regardless of the software. However, although QuickBooks Bill Pay offers a couple more useful features, such as payment approval workflows and user permissions, they are only available with the most expensive plan—and the additional cost of QuickBooks Online must be factored in.

With BILL, users appreciated the intuitive user interface and its proficiency in processing a large number of bills. However, some users encountered issues when integrating with accounting software and felt that it is more expensive than its competitors.

Users reported issues of “clunky integration” with QuickBooks, which supports my recommendation that if you use QuickBooks Online as your accounting platform, then QuickBooks Bill Pay is a much better choice because of its more seamless integration.

BILL earned the following average scores on popular review sites:

QuickBooks Bill Pay is deeply integrated into QuickBooks Online, so we’ve used user reviews of QuickBooks Online to evaluate QuickBooks Bill Pay.

Users like QuickBooks Online’s more useful features, such as its ability to turn invoices into bills automatically by importing them to QuickBooks. They also appreciated that QuickBooks Bill Pay offers a free plan for up to five ACH transfers per month. However, users disliked that it’s not possible to manage multiple companies with one account.

QuickBooks Online has earned the following average scores on popular review sites:

Pricing: QuickBooks Bill Pay Wins

|  | |

|---|---|---|

Monthly Pricing |

|

|

Number of Users Included | Per-user pricing for unlimited users | 1 to 25, depending on your QuickBooks Online subscription |

Accountant Partner Program | $49 per month | N/A |

Free Trial | ✕ | 30 days |

Unlike QuickBooks Online, which allows a certain number of users per subscription level, BILL’s monthly charges are per user. Also, only QuickBooks Online offers a free trial. QuickBooks Bill Pay is our winner for pricing because it is much more affordable for businesses that also want an accounting system—which should be almost all businesses other than part-time freelancers.

However, there can be some situations where BILL is less expensive. Consider these factors when evaluating the overall price:

- Do you need a general ledger accounting system?

- Do you need approval workflows?

- Do you need invoicing (A/R) features in addition to bill pay features?

- How many users do you need?

Look at two sample scenarios to help you determine the total cost of each option.

For the Essentials and Team plans, you can select between Payables, which streamlines your A/P procedures; and Receivables, which automates invoicing functions. The Corporate and Enterprise plans include both Payables and Receivables products.

BILL also has the Accountant Partner Program for accounting firms and professionals. This plan is priced at a flat fee of $49 per month and includes the A/P and A/R functions, plus perks for certified public accountants (CPAs) like training where they can earn continuing professional education (CPE) credits.

There are also a few additional services:

- Mail checks and invoices service: BILL will mail your checks or invoices for you. This service costs $1.69 per check or invoice.

- ACH/ePayment: BILL will process your electronic payments for 49 cents per transaction.

Bill Pay is available with QuickBooks Online Simple Start, Essentials, Plus, and Advanced, but is unavailable for Self-Employed. To use Bill Pay, users must activate it from their QuickBooks Online account. Here’s a summary of the available plans:

- Basic: $0, includes five free ACH payments per month, automated bill creation, and automatic transaction matching

- Premium: $15 per month, includes everything in Basic plus 40 free ACH payments per month and unlimited 1099 filing

- Elite: $90 per month, includes everything in Premium plus roles and permissions and bill approval workflows

Extra ACH payments for Basic and Premium are 50 cents per transaction.

There are also a couple of additional services:

- Check payments: For all plans is $1.50 per transaction

- Faster ACH: $10 (doesn’t count toward your monthly allotted ACH payments)

The number of QuickBooks Bill Pay users is determined by the number of users included in your QuickBooks Online plan:

- Simple Start: $35 per month for one user

- Essentials: $65 per month for three users

- Plus: $99 per month for five users

- Advanced: $235 per month for 25 users

Accounts Payable: BILL Wins

BILL | QuickBooks Bill Pay | |

|---|---|---|

Intelligent Virtual Assistant | ✓ | ✕ |

Automatic Invoice Capture from Email | ✓ | ✕ |

Bill Approvals | ✓ | Elite plan only |

OCR | ✓ | ✓ |

The major advantage you can get with BILL is its automatic invoice capture. Moreover, it has a dedicated email address where vendors can send their invoices, and its Intelligent Virtual Assistant (IVA) will automatically capture invoice data and supply it into necessary fields. In QuickBooks Online, you must manually upload vendor invoices or scan them first using the QuickBooks receipt scanner.

BILL, overall, offers a convenient solution for businesses processing many billing transactions. Its automation features release staff from hours of data entry and ensures that all bills are accurate and legitimate through a series of approvals. . You can also pay within BILL via international wire transfer, credit card, debit card, check, or ACH payments.

QuickBooks Online comes at an advantage if you and your accounting team can handle billings without the need for automation. Although QuickBooks Online still needs some data entry and manual uploading of receipts, its OCR function can reduce the data entry burden so that you can focus on specific fields like inputting the credit term or applying vendor credits. However, BILL’s OCR features are still superior because it can read handwritten receipts.

Meanwhile, QuickBooks Bill Pay’s features automate the process of paying bills with useful functions like the ability to schedule payments in advance, import bills, and sync transactions to QuickBooks. Also, with its Elite plan, you can assign roles and permissions to give users the ability to create, approve, and pay bills. Unlimited 1099 filing is available to Premium and Elite users.

Accounts Receivable: QuickBooks Bill Pay Wins

BILL | QuickBooks Bill Pay | |

|---|---|---|

Invoice Customization | ✕ | ✓ |

Sales Tax Tracking | ✕ | ✓ |

Create and Send Invoices | ✓ | ✓ |

QuickBooks Bill Pay is integrated with QuickBooks Online, which you can use to modify your invoice design and add your company logo. There are also templates you can choose from. The most useful features of QuickBooks Online’s A/R management are its ability to view sales tax liability in detail, track sales tax collected, and pay sales taxes.

Meanwhile, BILL offers invoicing capabilities with automation features if you get the invoicing plan. However, its A/R functions aren’t as striking and impressive as other invoicing software. In terms of invoice processing, I like that invoice tracking is possible through invoice statuses. However, that would only work if the customer is also using BILL.

Another limitation is its invoice design—there’s no way to incorporate company branding like logo and colors. Lastly, adding sales taxes in BILL depends on what accounting software or enterprise resource planning (ERP) system you use. Otherwise, you’ll have to create sales taxes manually.

Ease of Use: Tie

BILL | QuickBooks Online | |

|---|---|---|

Overall Ease of Use | Easy | Easy |

Accessibility | Cloud | Cloud |

Online Help Section | ✓ | ✓ |

User-friendly Dashboard | ✓ | ✓ |

Both BILL and QuickBooks have intuitive UIs, but the latter is more complex with its features. If all you want is a bill pay service, then BILL will be the easiest because you won’t have to deal with all the other features that come with QuickBooks Online. However, if you want an accounting system integrated with your bill service, then QuickBooks Bill Pay is the easiest to use and comes deeply integrated with QuickBooks Online.

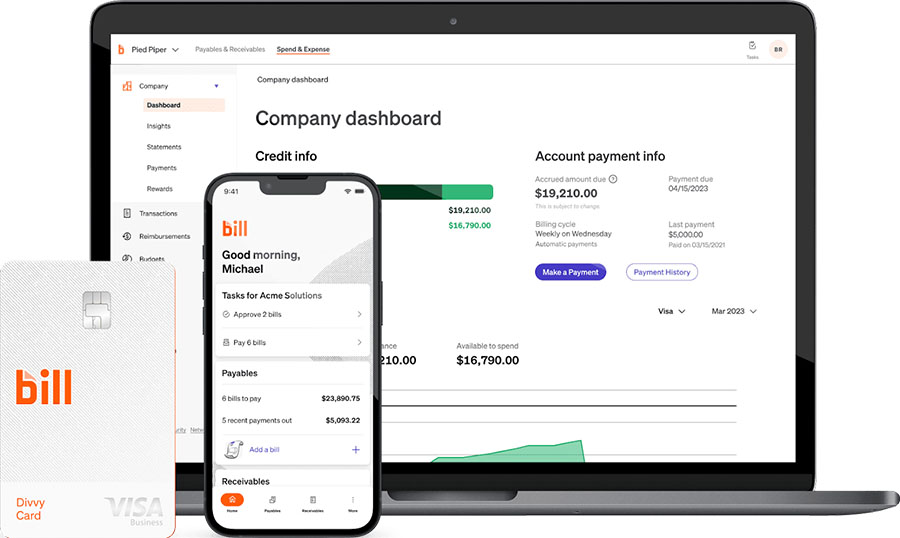

Below is a view of the BILL Dashboard for Corporate and Enterprise plans, which you will see when you log into the program. It shows the bills to pay, open invoices, bill approvals, payments in, and payments out. The smaller plans will show graphs pertaining to A/R or A/P.

View of BILL Dashboard

The interface of BILL is neat and organized. It’s suitable even for business owners without experience in invoicing and billing. The dashboard shows an overview of all your invoices and payables. You can also see the number of invoices awaiting approval and the person in charge of approving them.

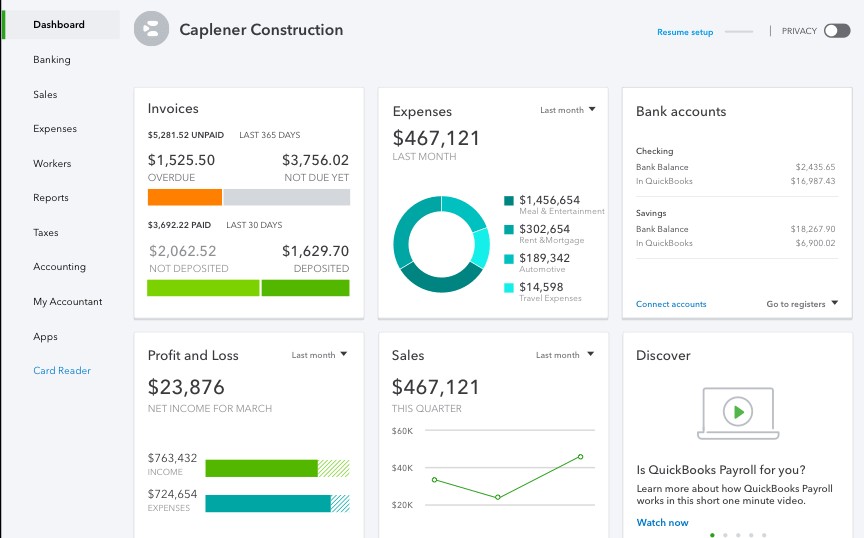

The QuickBooks Online Dashboard is easy to navigate and gives you access to your account balances, income and expense totals, and graphs that illustrate your cash flow during a specific time period. The interface is intuitive, especially with the left menu bar with tabs that navigate to each section.

View of QuickBooks Online dashboard

QuickBooks Online’s dashboard shares a similar idea with BILL by using “Kanban-style” card graphs. QuickBooks Online’s dashboard is more comprehensive because it’s a complete accounting software. It shows your credit card charges and other movements in your bank accounts. You’ll also have a glance at P&L data and time tracking details as well.

Integrations: QuickBooks Online Wins

BILL | QuickBooks Online | |

|---|---|---|

Built-in Integrations | 0 | 3 |

Third-party Integrations | 10 | 750-plus |

Because of its limited integrations, BILL is better served as an integration itself as it can be connected to several accounting software packages. QuickBooks integrates with more than 750 apps and has three built-in integrations to streamline your payments, payroll, and time tracking.

BILL offers 10 integrations, and most of these will connect your BILL profile to your accounting software, including QuickBooks Online, Xero, Sage Intacct, and NetSuite. These integrations feature two-way synchronization, meaning you can enter A/P or A/R data in either program and it will automatically transfer to the other. However, not every integration is available with each plan. An application programming interface (API) is available for developers (Enterprise plan) only.

BILL also integrates with a wide variety of apps and other tools from expense management to tax services. Its integrations include HubDoc, Tax1099, Tallie, and Earth Class Mail.

QuickBooks Online integrates with more than 750 popular business apps, which can assist with other aspects of your business like CRM or ecommerce. Three built-in integrations can be accessed directly within the QuickBooks Online app, which are QuickBooks Payments, QuickBooks Payroll, and QuickBooks Time.

The Team and Corporate plans of BILL also integrate with QuickBooks Online. Here are some of the other integrations for QuickBooks Online:

- A/R: Freedom Merchants, ARCollect, Invoiced, and Melio

- CRM: HubSpot, Method:CRM, and Insightly CRM

- Ecommerce: PayTraQer, Stripe by Connex, and Freedom Merchants

- Expenses: Expensify, Dext Prepare, Veryfi, and Greenback

- Inventory management: SOS Inventory, Katana, Magento, and Order Time

- Payroll: Gusto, RUN Powered by ADP, Wagepoint, and Justworks

- Time tracking: Time Tracker by eBillity, Timesheets.com, and Hour Timesheet

Mobile App: Tie

BILL | QuickBooks Online | |

|---|---|---|

Accessibility | iOS and Android | iOS and Android |

Invoice Customers | ✓ | ✓ |

Pay Bills | ✓ | ✓ |

Bill/Receipt Scanning | ✓ | ✓ |

Automated Workflows | ✓ | ✕ |

Send Estimates & Sales Receipts | ✕ | ✓ |

Financial Reports | ✕ | ✓ |

Both platforms have robust mobile apps that assist with payables and receivables. They have the same basic features, such as the ability to create invoices and receive payments.

BILL has the added benefit of workflow functionality with A/P, like the ability to view an audit trail of bill approval and review notes from vendors and customers. You can also scan documents with your phone’s camera and process them into bills or send them to your inbox. Meanwhile, QuickBooks has a greater depth of features when it comes to A/R, such as the ability to not only send invoices but also estimates and sales receipts.

Customer Support: QuickBooks Online Wins

BILL | QuickBooks Online | |

|---|---|---|

Unlimited Support | ✕ | ✓ |

Community Support | ✕ | ✓ |

Phone Support | ✕ | ✓ |

Email Support | ✓ | ✓ |

Live Chat Support | ✓ | ✓ |

Searchable Knowledge Base | ✓ | ✓ |

Online Help Resources | ✓ | ✓ |

Although QuickBooks encourages you to try other support avenues before requesting phone support, BILL doesn’t offer phone support at all and instead requires that you submit a support inquiry, which will be answered via email, which is why QuickBooks takes the lead in this category. However, both have other resources, such as a help center and knowledge base, which can be consulted for less urgent needs.

It can sometimes be a challenge to find the answers that you’re looking for with BILL. Live support is available from 5 a.m. to 6 p.m. Pacific time, Monday through Friday. There are also a few other resources:

- Support form: You can submit a support inquiry in the Message Center.

- Help center: There is a comprehensive help center available, with extensive how-to articles, getting started resources, frequently asked questions (FAQs), and announcements.

- BILL resources: This page is a collection of webinars, case studies, white papers, and other BILL resources.

- YouTube videos: The YouTube channel features many customer testimonials and a few how-to videos.

- BILL blog: Updated frequently, the blog has everything you need to know about payments, going paperless, new integrations, and more.

QuickBooks has an extensive knowledge base that can be accessed from both within the program and on the website. Below is a summary of the available ways to access support:

- Telephone support: This is only available by completing a request on the website for QuickBooks to contact you.

- Email support: You can contact the support team by clicking on the “Contact us” button at the bottom of the help window.

- Messaging support: Live chat support is also available, although not 24/7.

- In-product help: Every time you open up a new feature, a step-by-step guide or video shows up, with the option to view more information.

- Searchable knowledge base: This includes how-to articles, webinars, tutorials, and FAQs

- User community: You can also post a question in the community forum, in which other users may be able to provide assistance.

How I Evaluated BILL vs QuickBooks Online

The Fit Small Business accounting team developed a rubric to determine the best A/P software, assigning certain percentages for each criterion and different weights for subcriteria. Given, I was able to evaluate and compare the pricing, general features, specific features, and ease of use of BILL and QuickBooks Online.

25% of Overall Score

In assessing the pricing, we considered the transparency, affordability, and flexibility of pricing plans. We also gave more credit to the software providers that can accommodate more users.

25% of Overall Score

When considering basic A/P functionality, we looked at features, such as creating vendors, tracking vendor transactions, viewing outstanding bills, recording vendor credits, and other minor A/P features.

25% of Overall Score

In evaluating special A/P features, we focused more on A/P automation. We heavily considered the ability of the software to reduce data entry time, workflow approvals, and batch processing. We also included the following:

25% of Overall Score

Frequently Asked Questions (FAQs)

Yes, all QuickBooks Online plans automatically include basic bill management features. If you want to send more than five ACH payments to vendors and contractors using QuickBooks Online, you’ll need to select the Bill Play plan.

No, BILL doesn’t currently offer a free trial.

Yes, QuickBooks Online offers a free mobile app with each subscription, which gives you access to paying bills, uploading receipts, and GPS mileage tracking.

Yes, BILL lets you capture your invoices all in one digital platform and automate your approval workflows and requests, and it’ll sync automatically with your accounting software.

A/P involves managing the company’s outgoing cash flow as it deals with payments to suppliers and vendors, while A/R involves managing the company’s incoming cash flow as it pertains to payments from customers. Delaying payments may help improve short-term cash flow, but it may affect relationships with suppliers. Likewise, timely collection of receivables is crucial for maintaining healthy cash flow. Managing A/P and A/R are two crucial aspects of financial management for businesses.

Bottom Line

When you compare BILL and QuickBooks Bill Pay, BILL offers many useful A/P features like the ability to process large volumes of transactions and an automated bill import system. However, QuickBooks Online Bill Pay is deeply integrated with QuickBooks Online, and you have the benefit of features like approval workflows and user permissions. QuickBooks Bill Pay is the overall winner because of its strong A/P features within a powerful accounting software.

[1] GetApp | BILL

[2] G2 | BILL

[3] Featured Customers | BILL

[4] G2 | QuickBooks Online

[5] Software Advice | QuickBooks Online

[6] TrustRadius | QuickBooks Online