Cash on delivery is a method of accepting customer payment when a product or service is delivered (as opposed to in advance). COD reduces card fees and lets customers try before they buy.

Cash on Delivery: What It Is & How It Works

This article is part of a larger series on Payments.

With cash on delivery (COD)—also called collect on delivery—a customer can use cash or another payment type, like a cashier’s check or credit card, to pay the courier once their merchandise is delivered. COD is popular in regions where consumer trust in online payments is low and among businesses that want to let customers “try before they buy.”

Cash on Delivery in Different Industries

Cash on delivery/collect on delivery services operate with slight variations in multiple industries. Expand the sections below to see how different business types use the COD format.

Payment by COD is popular for ecommerce personal styling services like Trunk Club. These services request customer payment information in advance (typically along with a “styling fee” of around $25). The service then sends customers a selection of clothing and accessories to try on. After customers try the items, they choose which items to keep and which to return. The retailer then charges the customer for the items they kept.

Collect on delivery is a popular payment method for ecommerce personal styling services like Stitch Fix. (Source: Stitch Fix)

Amazon Prime also offers its own version of COD that they call “Pay on Delivery.” This service allows customers that subscribe to Amazon’s Prime service to order items with deferred cash on delivery payments. Cash is a payment option with Amazon’s Pay on Delivery, though Amazon also includes options for easy QR code payments and SMS text payment links.

Food delivery is the most common form of cash on delivery seen in the US—especially in business types where phone orders are still common, like local pizza delivery.

Local pizza delivery drivers process a lot of cash on delivery transactions. (Source: Photo by RDNE Stock project)

Many food delivery drivers will accept cash from customers and carry some small bills on their person to make change if necessary. When the driver returns to the restaurant, they give the cash for the order to the restaurant, holding back any cash tips. If the restaurant uses a point-of-sale (POS) system, the software will track all of their daily deliveries and let the restaurant manager know exactly how much cash to expect from the driver.

Vendors that supply other businesses typically invoice for supply deliveries. In most cases, the client retailers and restaurants can pay their balance in seven to 30 days (depending on the supplier’s credit terms). But suppliers typically require payment on delivery for new clients, or for clients that have fallen behind on invoice payments.

Most dry cleaners accept payment on site in their businesses. But the dry cleaning business model is another version of cash on delivery since dry cleaners receive payment after they have already rendered the cleaning service. When the cleaner delivers the cleaned garments to the customer, the customer pays for the cleaning service.

Dry cleaners only get paid for their services when they deliver the clean garments. (Source: Press Cleaners)

Benefits of Cash on Delivery

COD might sound complicated and antiquated, but it has demonstrated staying power for a few reasons. Cash on delivery sales have some distinct benefits for small businesses.

- No processing fees: COD sales do not require credit card processing. Small retailers can ship products without signing up for a merchant account. And customers can make purchases without a credit card. If your business does not have a merchant services account to process credit card payments, COD payment makes sense.

- Increased customer trust: A commonly cited survey found that 37% of consumers prefer a “try before you buy” model. COD lets you offer that option.

- Faster payment (in some cases): If your business typically operates via client invoices, shifting some orders to COD can get you paid more quickly than waiting for a check or an ACH transfer seven or 30 days after delivery.

- Risk reduction (in some cases): For vendors that supply other businesses, COD reduces risk by ensuring immediate payment for goods from new clients or those who have outstanding unpaid invoices.

Risks & Challenges of Cash on Delivery

There are, of course, some risks with accepting cash on delivery. In most cases, cash on delivery shifts the risks of lost, stolen, damaged, undelivered or unsatisfactory goods to the seller rather than the buyer. There are a few other risks small business owners should keep in mind:

- Shipping delays delaying payment: Delays from shippers or couriers mean your payments are delayed, too.

- Return costs: Customers can refuse goods on delivery, in which case, you are out the costs of shipping and returning without getting the profit from finalizing the sale.

- Tedious bookkeeping: Unlike payment at the time of purchase (where the payment is immediately applied), or net payment terms (where you will receive payment on a set schedule), you don’t know exactly when you will receive a cash on delivery payment. This makes bookkeeping tricky.

How to Implement COD in Your Business

How you implement COD in your business will vary based on your business type. There are several ways to configure your cash on delivery or collect on delivery plan. You can:

- Ship products using a shipper’s COD service: USPS, UPS, and FedEx all have COD shipping services. So, you can choose a preferred shipper and rely on their couriers to handle the payments for you. Learn more in our comparison of USPS vs UPS vs FedEx.

- Use a POS: Restaurants and retailers that offer local delivery can manage cash on delivery receipts via their POS system, which tracks sales by staff member. So, you can tell immediately how much cash to expect from a day’s deliveries. Many POS systems also offer remote card readers to process mobile payments or allow you to send SMS text payment links to process digital payments.

- Use a card on file: Another option for processing collect on delivery payments is keep customer payment information on file. Then you can process the payment once the customer has accepted the goods. The only drawback to this system is that card-on-file transactions are a form of card-not-present transaction and tend to have higher processing fees.

Brief History of Cash on Delivery

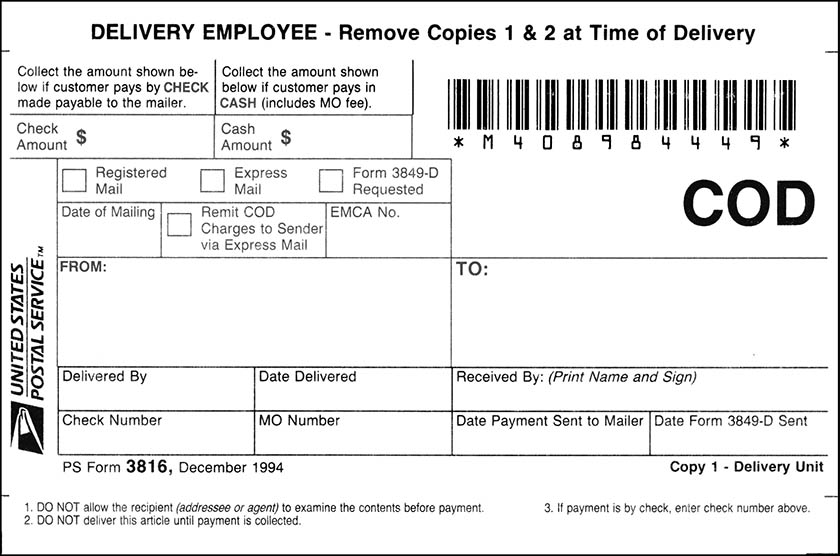

In the days before internet shopping led to a massive diversification of business models, cash on delivery referred specifically to the cash on delivery service offered by the United States Postal Service (USPS). A sender—typically a retailer or craftsperson—pays for postage to send an item to the customer before processing a payment. The customer pays the courier directly after receiving and inspecting the goods.

The sender guarantees the USPS that they will pay the return fees if the item is returned. The postal carrier collects customer payment at the time of delivery. Currently, the USPS sets the maximum payment limit at $1,000.

The USPS has a streamlined process for handing cash on delivery sales. (Source: USPS)

With this service, the sender cannot request that the USPS only accept a specific payment type. Customers can pay for the item with cash, a personal check, a cashier’s check, or a PIN-based debit card. If the customer pays in cash, the USPS converts that cash into a cashier’s check (minus a nominal processing fee). The USPS then sends the payment to the sender via First Class Mail. If the sender has a USPS Corporate Account, the COD funds can be deposited directly.

The United Parcel Service (UPS) and FedEx also offer collect on delivery services. These services operate similarly to the USPS system, though they may require you to have a full-scale shipper account. With USPS, you can send one-off COD deliveries without creating a business account.

Cash on Delivery Frequently Asked Questions (FAQs)

Cash on delivery works by giving delivery couriers the responsibility of accepting payment for deliveries. The process will vary slightly depending on the business type and the product type, but typically, the delivery driver will accept cash or another form of payment when the item is delivered. Some ecommerce businesses will instead retain customer payment information on file and only charge the card on file once the delivery has been accepted by the customer.

COD stands for “cash on delivery” or “collect on delivery.” These phrases are basically instructions to the delivery courier, advising them to expect payment before leaving the delivery with the customer.

COD is popular in many regions where digital payment infrastructure is still growing or where small businesses prefer to operate without credit card processing fees. But even large ecommerce retailers like Amazon offer some payment on delivery options to customers that subscribe to their Prime service.

Bottom Line

Cash on delivery—or collect on delivery—is a flexible way to accept payments. It allows small businesses to reach a wider range of customers and meets customer preferences to try on products before finalizing their purchases. Cash on delivery is also a common way for suppliers to reduce the risk of supplying other small businesses by requiring immediate (rather than invoiced) payment. There are some additional risks to retailers; you’ll have more complicated bookkeeping and shipping delays result in payment delays.

However, depending on your industry, business size, and location, the benefits could outweigh the complexities.