Economic conditions are causing consumers to tighten their wallets and carefully monitor spending. Cash stuffing is making a comeback as a budgeting method of choice.

Cash Stuffing: What Businesses Need to Know

This article is part of a larger series on Retail Management.

Cash stuffing is a budgeting method that has recently started gaining traction. While many consumers have increasingly gone digital in their spending, rising inflation and cost of living have pushed some—particularly younger consumers—to pursue “old school” approaches to money management.

With “cash stuffing” making the rounds across millions of posts on TikTok, it is one budgeting trend that independent retailers should keep an eye on and offers an interesting window into consumer behavior and spending patterns.

What Is Cash Stuffing?

Cash stuffing is quite literally stuffing cash away for safekeeping. It’s also referred to as the cash envelope method. This method is used when people put money (aka, “stuff cash”) into envelopes in an effort to help them with personal budgeting. It’s a simple, straightforward way for consumers to budget their finances.

How Does Cash Stuffing Work?

The cash stuffing method is typically broken down into monthly budgets. When someone receives their paycheck or income via other means, they divide the physical cash meant for spending into different envelopes.

Each envelope represents a different spending category for that month. Categories could include:

- Rent

- Utilities

- Groceries

- Gas and transportation

- Dining out

- Entertainment

- Insurance

- Medical costs

- Miscellaneous

- Charitable giving

It’s up to the individual to determine which categories get an envelope.

Many people use the 50/30/20 rule to help inform how they divide their cash into each envelope. It essentially means 50% of someone’s cash goes toward essential living expenses, like groceries and rent; 30% of the cash goes toward “wants” and discretionary spending, like going out to eat, travel, and other entertainment; and 20% goes toward savings—both long- and short-term.

Here’s an example of the 50/30/20 method in action:

@sunshinecottagenyc It was hard at first, but we got the hang of it! #payday #couplegoals #budget #budgeting #paydayroutine #savings #100envelopechallenge #cashstuffing #financialliteracy #envelopechallenge ♬ original sound – FamilySaves NYC

Consumers can choose to use just three envelopes or categorize them more granularly.

Once the money is gone from an envelope, the individual is meant to wait until the next month or pay period to be able to spend in that category again. If money is left over at the end of the period, it can either be saved, invested, or rolled over to the next month, depending on how they want to handle it. Cash stuffing essentially helps people avoid spending more than their budget or what they have.

Why Is Cash Stuffing Popular?

The current state of the economy is putting consumers in a predicament. The cost of living is skyrocketing, job opportunities are getting harder to come by, and wages aren’t keeping up with inflation. As a result, many consumers—especially Gen Z consumers—are actually going old school and opting for cash. A 2023 survey from Credit Karma found that a majority of Gen Z adults (72%) are aware of cash stuffing and 30% use it.

According to the same survey, 69% of Gen Z used cash more than they did in 2022. Another 23% used cash for most of their purchases. Of these consumers, 59% say it helps them budget their money, and 64% say they spend less when using cash for payment. In fact, many use cash to pay for the following specific items:

- Groceries: 50%

- Clothing: 46%

- Non-essentials: 40%

- Takeout: 40%

Financial challenges aren’t the only reason cash stuffing is trending. Social media—TikTok in particular—is contributing to the rise in popularity of cash stuffing. “Cash Stuffing” has garnered around 78 million posts as of this writing.

@matcha.money Part 1 of cash stuffing June paycheck no. 1~ #cashstuffing #cashenvelopesystem #cashstuffingasmr ♬ original sound – matchamoney

Read more: Understanding consumer behaviors and habits across generations

Cash Stuffing & Consumer Behavior

Consumer behavior is always shifting, and cash stuffing is making a notable impact on the spending habits of shoppers.

Why Are Consumers Cash Stuffing?

The main motivation for using the cash envelope system? To save (according to 55% of Gen Z shoppers). They want to spend less and spend more responsibly. About 18% say cash stuffing actually makes them feel more in control of how they spend their money. In fact, about 70% have been able to spend less as a result of their cash stuffing practices.

Similar Trends Centered Around Spending Less

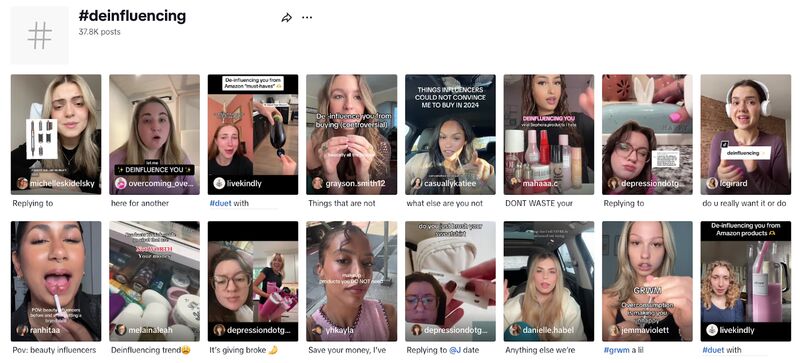

There are many parallels between cash stuffing and the trend of deinfluencing. Deinfluencing is essentially a rejection of the saturation of messages from social media that attempt to convince consumers to buy more things.

Gen Z and millennial TikTokers share deinfluencing videos featuring products they think aren’t worth buying.

Social media and influencer marketing have spiked over recent years, and many consumers are becoming fatigued from all the messaging—and disappointing purchases. Deinfluencing is a direct rejection of these practices, encouraging people to spend less on non-essentials.

In addition to deinfluencing, which picked up steam in 2023, this year there is another social media trend centered around spending less, called “underconsumption core.” This trend romanticizes and encourages reusing items, thrifting, and generally spending less on consumer products for financial and sustainability reasons.

Further reading:

What Small Businesses Need to Do to Appeal to Cash Stuffers

Essentially, these consumers are looking to save more, spend less, and be more conscious of where their money is going. This means retail businesses need to find ways to appeal to these shoppers and prove their products are worth the expense.

Here are some ideas on how to cater to this consumer group:

Make It Easy for Customers to Pay Cash

Though credit cards are the most preferred payment method across all age groups, cash is still the most commonly used method for in-store purchases. This is a good sign for brick-and-mortar retailers, as offering cash payments is more feasible for in-person transactions.

You can also get creative for online shoppers, too. Offer the option of curbside pickup, click and collect, or buy online pick up in-store (BOPIS). Then you can drive sales online but manage the cash in your retail establishment.

Related:

Offer Cash Discounts

Cash discounts are a form of incentivizing cash payments. Many businesses do this to eliminate payment processing and transaction fees associated with credit and debit cards and other digital payment options.

In some places, it’s not allowed to pass payment processing fees onto the customer. But the workaround is to offer a cash discount. So, before implementing a cash discount program for your business, check with your local regulations.

Related:

Provide BNPL Options

Buy now, pay later (BNPL) is another way to get these budget-conscious consumers to spend money with your business. It essentially allows shoppers to pay a portion of the total price and then pay for the rest in installments. While it’s not completely cash payment, some BNPL providers allow for an initial cash payment and then succeeding digital payments.

You can use BNPL apps to implement this option on your ecommerce store, as well as integrate it with your point-of-sale (POS) to offer the option to in-store customers.

Related:

Allow for Layaway

You can also allow for complete cash payments in a layaway purchase, making it even more appealing to cash buyers. Layaway in retail is similar to BNPL. Except rather than working with a BNPL platform, you can manage this yourself. Plus, the customer doesn’t receive the product until it’s paid for in full—whereas BNPL allows the customer to walk out the door with the product immediately and then pay for it after the fact.

Cash Stuffing for Businesses

Cash stuffing isn’t just for consumers looking to manage their spending; small businesses can also utilize the envelope method.

Many business banking providers offer sub-accounts linked directly to your primary business account. Sub-accounts allow you to designate a dollar amount or percentage of each deposit to be sectioned out into those dedicated accounts. These sub-accounts are effectively the same as the “envelopes” used by cash stuffers—they allow you to designate funds for specific uses (e.g., taxes, insurance, lease payments).

Related:

Frequently Asked Questions (FAQs)

These are some of the most common questions we see about cash stuffing.

The cash envelope system can be smart for the right people. If someone has a hard time saving and investing their money or sticking to a budget, cash stuffing can be a smart way to hold them accountable and enforce spending limits. It also offers more tangible visibility into their available capital.

The downsides of cash stuffing include:

- It is potentially less secure

- It can create missed opportunities to invest and earn interest

- It doesn’t account for the future

- You lose value to inflation

The 50/30/20 rule essentially states that 50% of your income should go to your needs, 30% of your income should go to discretionary spending, and 20% of your income should go toward saving and investing in your future.

Bottom Line

Cash stuffing is an interesting trend, especially considering Gen Z is more likely to go cash-only than older generations. Though Gen Z tends to be early adopters of technology and innovation, cash stuffing is a return to “tradition.” Retailers that both acknowledge and cater to these evolving consumer preferences can make a good impression early on and win loyal customers for years to come.