Buy now, pay later is a new and popular payment option, particularly for online purchases. However, does the boost in sales BNPL provides offset its steep processing fees?

What Is BNPL? Small Business Guide to Buy Now, Pay Later

This article is part of a larger series on Payments.

Buy now, pay later (BNPL) is a type of short-term financing that lets your customers pay for purchases over time, often with zero or low-interest rates. BNPL payments first gained traction with online shoppers looking to finance apparel and beauty purchases.

While BNPL surged in popularity during the pandemic to finance large purchases, today, people have begun to use these installment plans more frequently for everyday purchases.

This article takes a deep dive into what BNPL is, how it works, the pros and cons of offering this financing option, and the solutions you can use to implement it in your business.

How Does BNPL Work?

While the exact terms of purchase will vary based on the financing solution, in general, the BNPL process begins with a customer choosing their items and selecting the BNPL option at checkout. The customer must then be approved and decide on a payment plan. Once the transaction is complete, your business will receive the full payment amount, while the customer will pay later according to the BNPL terms.

However, transaction fees for BNPL payments are typically about double the cost of standard credit card processing fees—approximately 6% instead of around 3%.

In the News:

As economic conditions cause consumers to tighten their wallets, shoppers are increasingly using BNPL to finance purchases like groceries and car parts, according to the Wall Street Journal.

Buy Now, Pay Later in 5 Steps

Step 1: Customer Shops

Customers shop normally and select the products they want to buy from your store.

BNPL started as an online-only option, but as use has become more common, you are starting to see in-store applications as well.

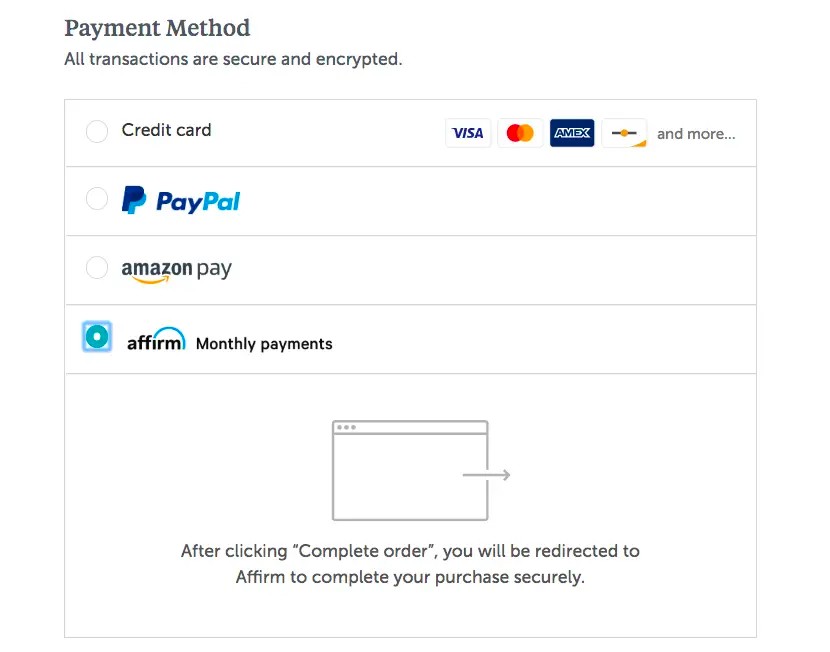

Step 2: Customer Selects BNPL at Checkout

When customers go to checkout, they select the BNPL option as their payment method.

BNPL will appear as a payment method option at checkout, such as with Affirm in this image. (Source: Business Insider)

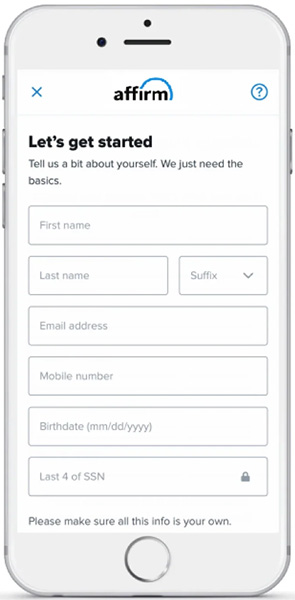

Step 3: Customer Applies for Approval

Before becoming eligible for BNPL financing, customers will sometimes undergo a quick credit check, which typically takes less than a minute. This is not only used for loan approval, but your credit score will also determine your APR rates.

Affirm only requires a simple application to prequalify the customer for a specific amount. (Source: Affirm)

Not every BNPL lender requires a hard credit check; some do a simple identity verification.

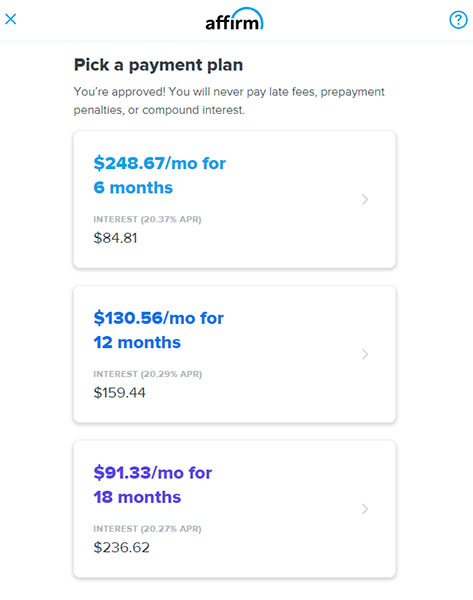

Step 4: Customer Chooses a Payment Plan

Once approved, customers can view their financing options and generally choose between paying monthly or in four biweekly installments. Note, however, that not all BNPL financers offer term options. For some, there is only one timeline, interest rate, and monthly fee to choose from.

Some providers, including Affirm, offer multiple payment term options. Customers can choose one that makes sense for them. (Source: CreditCards)

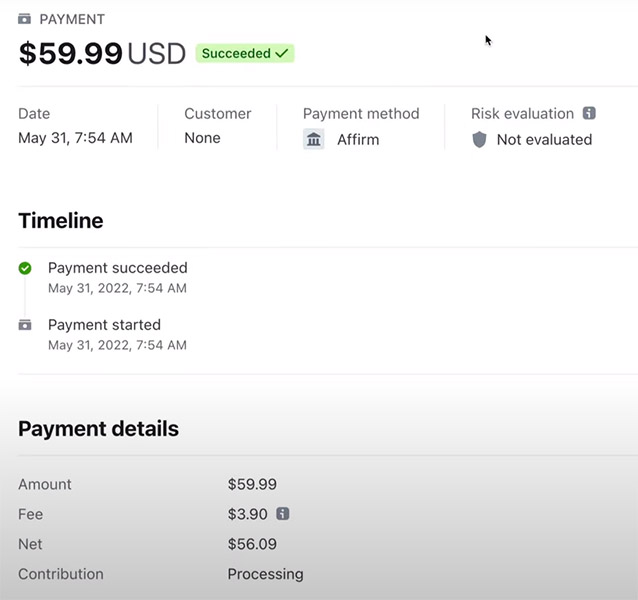

Step 5: You Get Paid, Customer Pays Later

When your customer completes their purchase, you will receive the full amount upfront. All that you owe to the BNPL company is the processing fees. Your customer will then start paying the BNPL company according to their financing terms to avoid any interest or late fees. They can also choose to pay off their entire purchase at any time.

The BNPL company will carry all the loan risk and is responsible for administering late fees and collecting payments. In other words, once you get paid, you are off the hook, and all other purchase concerns move to the BNPL provider.

Merchants may view the Affirm BNPL transaction details. (Source: Stripe)

Sometimes, depending on the plan and BNPL company, the customer will owe a portion of the purchase upfront as a down payment. Depending on their selected terms, this down payment can be 0%–70% but typically runs anywhere from 0%–25%.

Pros & Cons of Offering BNPL

There are lots of great benefits that can come from offering BNPL to your customers. As you’ll see below, most BNPL providers claim to significantly increase conversion rates and average order value. This is the main draw for businesses.

For customers, BNPL can be a convenient way to finance a purchase without using a credit card.

| PROS | CONS |

|---|---|

| Higher conversion rates | BNPL providers charge high merchant fees |

| Higher average order value (AOV) | Late penalties can cause customers to become distrustful of your business |

| Improve customer experience by offering them more ways to pay | Customer credit score is impacted upon taking out loan |

| Expand reach to customers with less upfront capital | Can cause customers to incur debt that they can’t afford |

| Easier to sell high-value products | |

Let your customers know that many BNPL platforms allow them to set up an account where they can link their bank account and put their monthly payments on autopay. This is a great way to avoid late fees and missed payments.

Offering BNPL also helps to capture younger consumers. Nearly 75% of BNPL users are Gen Z or millennials. Overall, 38% of consumers across all demographics use BNPL at least once a month.

It’s important to consider your profit margins, but in many cases, offering BNPL is an easy way for most retailers to increase sales.

BNPL Services & Apps

To offer a BNPL payment option at your business checkout, you will need to sign up and integrate a BNPL solution into your POS and/or ecommerce site. Creating an account and adding it to your site is free—simply pay the processing fee, and the BNPL partner takes care of the rest.

Click through the tabs below to see how the top BNPL providers stack up against each other.

Read our buyer’s guide to the Best BNPL Apps for a more in-depth view of the providers.

How to Set Up BNPL for Your Business

Setting up BNPL as a payment option for your business can be a great way to attract more customers, boost sales, and improve customer satisfaction. To set it up for your business, you will need to look into different Buy Now, Pay Later apps, choose which ones to offer, and integrate and set it up for your business.

Learn more in our detailed guide on how to offer customer financing.

BNPL Frequently Asked Questions (FAQs)

While BNPL services and credit cards operate mostly the same—letting you buy items and pay for them later—BNPL providers typically have higher merchant fees than credit card payments. However, BNPL providers also usually offer lower interest rates, late fees, and penalties. Additionally, there are BNPL options that do not require good credit.

You can sign up for most BNPL providers for free. Simply choose a provider that integrates with your website, sign up, and use the plug-in to add the provider to your checkout and product pages. You then pay the BNPL company in transaction fees for every purchase processed through the financing company.

BNPL is typically free for merchants to sign up for and use. You only pay for BNPL as you use it in the form of processing fees, typically ranging from 1.5% to 6%.

BNPL companies make the majority of their money through processing fees. They also make money from late fees and other consumer penalties.

Typically, you are given a grace period of 5 to 14 days to make your payments. From there, the late penalties vary from a set fee, to a fine equal to 25% of your purchase, to a hit on your credit score—it depends on which company you are working with.

Most BNPL companies have a spending limit ranging from $5,000 to $18,000. Some, however, do not have set caps and base their limits on your credit score.

Bottom Line

As we look to the future of retail, BNPL services will continue to play a major role. So, if you’re asking whether or not it’s worth it to add BNPL as a payment option for your business, the answer is yes. As BNPL gains in popularity, you could be missing out on sales if you don’t have it. So, even though it comes with higher fees, that is the price of staying competitive in today’s retail landscape.

To get started, look to any built-in options your ecommerce platform, website, or point-of-sale system provides, including any of our recommended BNPL solutions.