For the 2023 holiday season, total consumer spending surpassed expert predictions and, for the 14th year in a row, became the biggest holiday season on record. According to data from Adobe Analytics, between Nov. 1 and Dec. 31 of 2023, consumers spent a remarkable $221.1 billion on holiday purchases, up 3.1% from 2022.

While this was a welcomed surprise for retailers, it begs the question—why are people spending so much? The world is staring down the nose of a global recession, product prices are still at unprecedented levels, unemployment and labor are still a major concern, there is a housing crisis, geopolitical conditions are volatile, and we are about to enter an election year, introducing even more uncertainty. So, what is going on? Why are consumers still spending with such resilience? And, should we wait for the other shoe to drop?

What Is Doom Spending?

The answer to one of these questions—what is going on?—is simple: People are doom spending.

Doom spending: An uptick in consumption inspired by fear of future economic and global conditions in which such spending will not be possible.

In other words, people are filled with a sense of doom about the future and are spending now before things get worse and such frivolity won’t be possible. Many fear a worsening global recession, a housing market crash, new wars, and student debt payments, and doubt that they will ever own anything meaningful, like a home or business.

Instead of taking these fears and resorting to saving, we are seeing an increase in frivolous spending—for consumers, what doom spending looks like is higher debt and increased spending on nonessentials, especially among millennials and Gen Z.

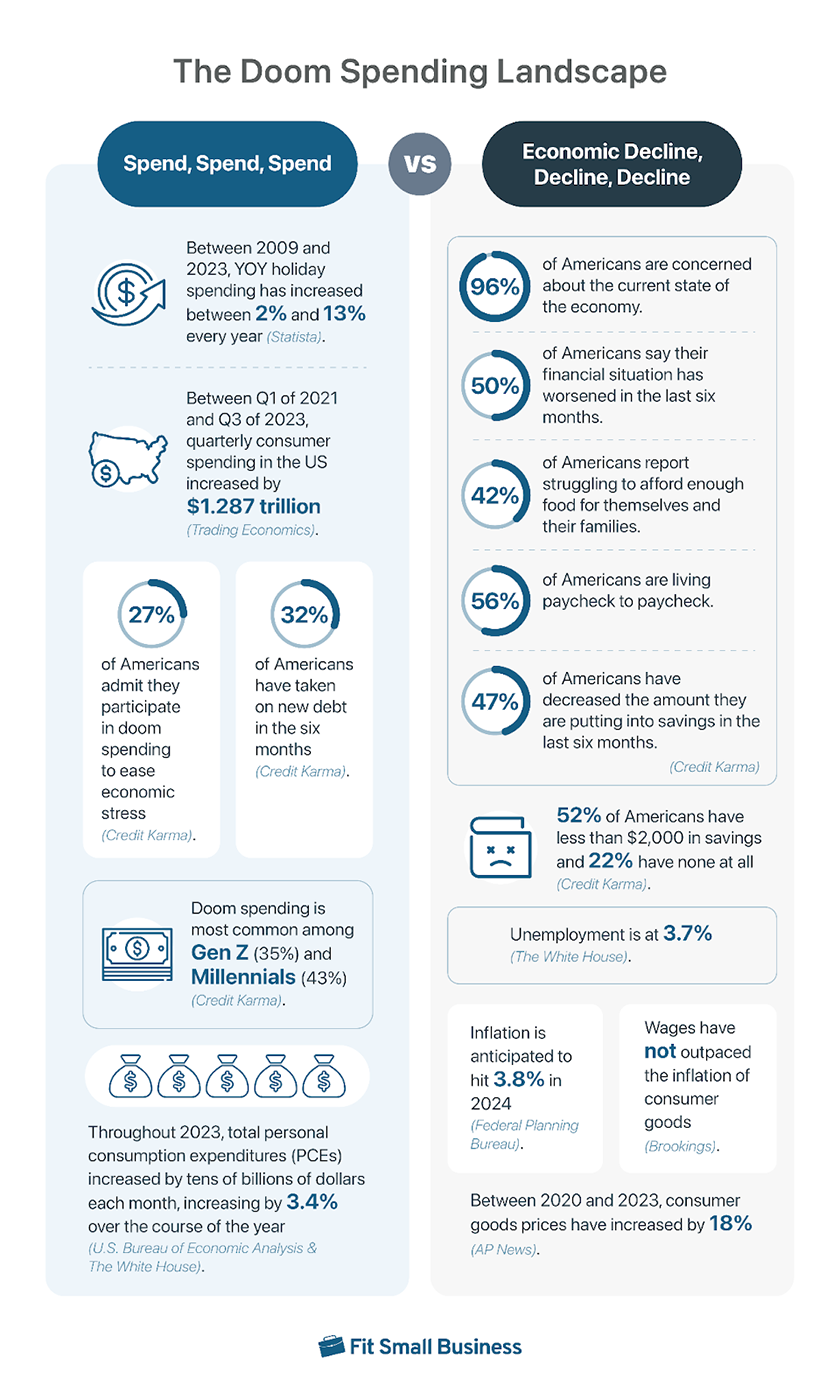

Take a look at the graphic below to see just what the doom spending landscape looks like.

What Is This Supposed Doom, Anyway?

Student debt, the housing market, an election year, inflation, the labor market, geopolitical tensions—these are all present issues, but people are only anticipating that they will worsen as time goes on. This anticipation of things getting worse in these areas is what doom spenders are trying to get ahead of by spending their money now.

The BNPL Explosion

One interesting element of the doom spending landscape is the massive uptick in customer financing or buy now, pay later (BNPL) services. During the 2023 holiday season alone, consumers spent $16.6 billion via BNPL. Not only that, a 2023 PYMNTS survey found that people were spending more via BNPL than their credit cards—nearly $700 more in a 90-day period.

Yet, only about 50% of BNPL users are very confident that they will be able to pay off their purchases according to their financing schedule.

BNPL adds a new variable in the context of doom spending. People are clearly buying things they can’t afford outright, and while that would have meant halting a purchase or putting it on a credit card just a few years ago, suddenly people are moving forward with those unattainable purchases as BNPL has become part of everyday consumption—especially with the promises of zero debt or APR that many BNPL providers make.

So, if not economic conditions, will BNPL debt be what finally puts an end to doom spending? Or, is it simply a compounding variable that has made people’s doom spending more extreme?

Eventually, these BNPL payments will cut into everyday budgets and overall spending and saving power. Thus, there is reason to believe that BNPL could temper doom spending as the reality of irresponsible purchases takes hold and people’s disposable incomes see the results over time. BNPL and its monthly installment structure might be the softer way for people to see they have spent beyond their means and need to pull back, before things spiral out of control.

Learn more about the customer financing landscape with our article on buy now, pay later statistics for 2024.

Credit Card Balances Hit an All-time High

Another interesting piece of the doom spending landscape is credit cards. Like customer financing debts, we have seen a large uptick in credit card debts, with outstanding credit card balances in the US surpassing $1 trillion for the first time in 2023. Additionally, in 2023 Q3, balances were 18.2% higher than at the start of the recession in 2020 Q1 and 34.8% higher than the post-recession low in 2021 Q1.

This phenomenon, again, shows that people are spending beyond their means right now, using their credit cards to hold debt so they can continue to spend.

Is It Inflation or Is It Doom Spending?

As we look at the current spending landscape, it is reasonable to ask whether the uptick in consumer spending and debts we are seeing is not a result of additional spending but rather inflation and the rising prices of goods. At the least, inflation contributes to the current consumer spending landscape as people are paying more for items they need.

However, inflation reached its peak at 9.1% in June of 2022 and consumer spending and debt has outpaced the inflation rates quarter over quarter since 2020. This means that while people were spending on their normal purchases, they were also making additional purchases rather than putting that money into savings. While this additional buying is partially due to the stimulus packages people received during the COVID-19 pandemic, people are still spending beyond their means even as those checks run dry, as we can see from the increased credit card and BNPL debts.

In conclusion, inflation certainly plays a role in people’s increased spending, however, people’s spending is continually outpacing inflation, causing experts to look to different variables to explain the increased spend, like doom spending.

The Other Shoe Has to Drop

The idea that this constant spending has to end is part of the definition of doom spending. The anticipated doom—in this case, a recession and the fall of the housing market—has to hit at some point. What happens then? What are the repercussions of the end of doom spending?

There are a few areas where we can surmise logical consequences to the end of doom spending.

- Decreased savings: Doom spending has already cut into people’s savings and does not inspire new saving habits. When the doom hits and people are finally done spending, their savings will be diminished and people won’t have the capital to make large purchases.

- Saving mentality: When the doom spending subsides, people will likely swing to a savings mentality, and consumer spending will slow.

- Asset drought: Because people are filled with a sense of doom about the housing market and do not want to end up upside down in their mortgages, they are not trying to buy homes or other major assets right now, and are instead buying what they can without saving for a home in mind. When the economy takes the turn doom spenders expect, they won’t have any assets to fall back on and the ability to buy a home will be even less possible.

- Debt drowning: With the BNPL loans, lack of saving activity, and outsized purchasing we are seeing now, people are taking out unprecedented amounts of debt that will cut into their everyday purchasing power when they are forced to acknowledge the hole they have put themselves in.

- Rent for life: The savings that doom spending prevents will further the housing crisis as the economy weakens, trapping people in renting situations. While it is currently better to rent than to buy for most of the country, doom spending inhibits saving and will make buying impossible when the housing market rights itself.

- Waste not, want not: With all the goods people are scooping up right now, there will be less need to buy more over time, and spending on non-essentials will slow.

In short, doom spending will end and when it does, people will have less savings, more debt, and less purchasing power. This will make them pull back on everyday spending and will diminish their ability to make large purchases, like for a home or car, worsening the housing crisis that is already raging.

Additionally, as these doom spending consequences hit, consumers will likely swing back in the opposite direction and enter a savings mentality, lowering buying even more.

What Small Businesses Can Do

We now know that the current spending environment can’t last and consumers will start acting more logically as the economy declines. So, how can you prepare and avoid the pitfalls of doom spending’s illusion of prosperity?

- Adjust your sales forecast: If you are to use the past few years of sales data as indicators for what is to be expected for future sales, you will likely overestimate your performance. Adjust your sales forecast to account for the doom spending phenomenon and its impending end.

- Don’t hold excess safety stock: To avoid running into excess (and God forbid, liquidation) be conservative with your safety stock both in terms of quantity and product.

- Use a smart pricing strategy: More and more, people will be looking for a sense of value when they shop. Give them that with a pricing strategy that delivers the deal without sacrificing your bottom line.

- Start saving yesterday: Capitalize on the current increased consumer spending by saving so you are safe when the buck finally stops. Interest rates are projected to drop this year, so take advantage of higher saving rates while they are available.

- Integrate BNPL options: We know that BNPL services are a big part of the doom spending landscape, but they will also be a big part of driving conversion rates when doom spending finally stops. Make sure you have customer financing options available for both in-store and online purchases to maximize your potential.

- Trim your operations: The money coming through your doors will not be this high forever. Prepare for this by cutting back on unnecessary parts of your business operations, from software, to inventory, to staffing.

- Adopt a savings mindset: Understand that the cash flows that you are seeing now probably won’t last. Put money away each month to ensure you can ride out lower spend periods.

While these strategies won’t guarantee fortification against the end of doom spending and its aftermath, they can make the shift less jarring. Understanding that the rapid, outsized spending we are seeing now won’t last is the first step. Preparing for the doom that spenders anticipate is the next. Then, you should be able to ride out any storm that we see in the wake of doom spending (or maybe no storm at all. Keep reading).

Did Doom Spending Save the Economy? Did We Avoid the Doom?

As we enter 2024, many political leaders and economists are hopeful that the economy is turning itself around. In fact, in a recent statement from the White House, US leaders stated:

“A year ago, financial news outlets were reporting that the market expected an imminent recession. One declared that the probability of a US recession within 12 months was 100%. Almost a year to the day later, the Wall Street Journal reported that according to its own survey research, ‘Economists are turning optimistic on the US economy. They now think it will skirt a recession…’ In fact, over the last four quarters, real GDP has grown at a healthy 2.9%, far surpassing the consensus 0.2% growth projected last year…”

This is certainly a better future than the one where doom spenders’ economic forecast comes to fruition. Was doom spending what saved our economy? Or will it inhibit the economy’s growth in the future?

On the one hand, even as the economy faced tumult between 2020 and 2023, people kept spending. Regardless of whether this spending was a result of some doom they anticipated, this spending kept the economy afloat—keeping businesses going, keeping the GDP high, and keeping the economy fueled and poised to bounce back, as we are seeing now.

On the other hand, the economy is turning around, but will people be ready to meet it in the wake of their doom spending? Doom spending has given people more debt and less savings. So, as the market improves, people won’t be able to capitalize on lower interest rates and better opportunities. This will either cause doom spenders to pull back and start to save and invest as their prospects improve. Or, it will leave them even more hopeless than before when they can’t afford the house or pay off their debts even in economically prosperous times, launching them into another doom spending cycle.

Only time will tell how economic improvements will impact doom spenders and how doom spenders will impact the economy, but one thing is sure: when people don’t have hope for their long-term goals, they will abandon them for short-term gratification. The long-term effects of this are only starting to play out, but we will see them most dramatically in people’s debt-to-income ratio and the fall of the housing market.

Bottom Line

As we can see, consumers feel themselves to be economically doomed and are spending in the meantime to assuage their anxieties. But, as the doom spending phenomenon suggests, the buck has to stop sometime and, when that happens, there will be repercussions. There is only so much you can do—capitalize on the prosperity of now with strategies to prepare for the downfall.