Customer financing is when customers pay for a product or service in installments or with store credit instead of paying the full amount upfront. Businesses offer short-term payment plans in exchange for customers agreeing to a small interest amount on top of the purchase price. Offering customer financing options can boost sales, increase conversions, improve customer loyalty, and drive repeat business.

Because customer financing, also known as Buy Now, Pay Later (BNPL), happens at the point of purchase or point of sale (POS), it can also be referred to as POS loans.

Step 1: Decide What Kind of Customer Financing to Offer

The first step to offering customer financing is to determine what kind of financing to provide. Customer financing can be either in-house, meaning financed by the business itself, or provided by a third-party platform, like Afterpay or Klarna. In-house financing requires running credit checks, offering financing, and managing payment collection yourself, and also comes with more risk and legal responsibilities pertaining to consumer credit information.

Learn more about the customer financing landscape with our article Buy Now, Pay Later Statistics Small Businesses Should Know.

The ideal type of financing for your business depends on a number of factors, including implementation, scalability, cost, risk, and flexibility. Consider these factors when determining the type of customer financing program that’s right for you.

- Implementation: The best customer financing tools are easy to implement and don’t involve a lot of training for employees. Financing should also be intuitive for your customers and should not substantially interfere with the checkout process. Keep in mind that in-house financing will likely require growing your account receivables team.

Many POS systems are starting to integrate financing options into the checkout interface, so employees can easily offer financing terms on every day, in-store purchases right from the checkout screen. BNPL apps pre-qualify customers and automate collections, significantly reducing repetitive customer financing management tasks. Square, our top POS system for retailers, has integrated Afterpay into its in-person POS.

- Scalability: Ideally, customer financing should help you increase sales as you grow across all platforms. This includes your brick-and-mortar store, ecommerce store, mobile events, and popup locations. If growth can’t be accomplished in-house, ensure the financing platform offers the tools your business needs to grow.

Offering a BNPL option to your customers can increase conversion rates by 2.1% year on year.

- Cost: Third-party financing companies charge merchants a percentage of each financed transaction, meaning the service can cut into a business’s bottom line. Additionally, stores offering in-house customer financing also see an initial drop in cash flow because they aren’t getting paid for financed purchases upfront.

- Risk: While there is always some risk in letting customers buy now and pay later, it is elevated for businesses offering in-house financing. Generally, third-party financing providers protect businesses from much of this risk because they pay the merchants in full. But, depending on the provider, there can be a risk of non-payment.

- Flexibility: Some customer financing platforms impose limitations on what can be financed. In general, however, they give shoppers the flexibility to finance even small purchases that individual stores might not be willing to finance in-house. Consider your prices and average order value (AOVs) when deciding how to offer customer financing.

Step 2: Choose a Financing Provider

If you decide to offer in-house financing, you can skip this step. Begin focusing on how you will perform credit checks for your customers and the internal payment system you will facilitate for them to pay off their purchases. Note that it is rare for SMBs to offer financing in-house, as BNPL partners take on much of the risk and create seamless systems for offering and completing loans. The rest of this guide will focus on the processes involved in working with a financial partner.

If you decide to outsource financing, the next thing you will want to do is select a partner. Click through the provider names below to learn about some of your options.

BNPL users will surpass 900 million globally by 2027—a 157% increase over 2022’s 360 million users. This surge will be driven by the increased demand for low-cost credit solutions that will come with the anticipated upcoming economic downturn.

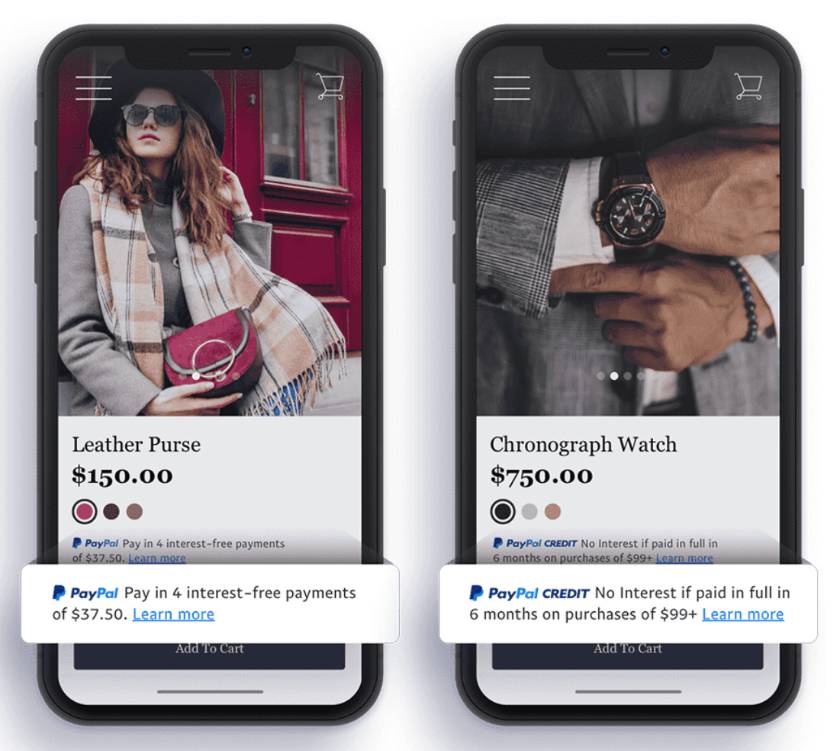

PayPal allows you to display its financing options on product pages. (Source: PayPal)

PayPal‘s Pay in Four allows merchants to offer installment payment plans to customers who opt for PayPal payments at checkout.

Pay in Four is an interest-free financing option where the customer pays off their purchase in four biweekly installments, with one installment due upon checkout. It works with BigCommerce, WooCommerce, Magento, and other popular ecommerce platforms. Retailers are paid in full when the transaction is completed. Merchants are then charged the standard PayPal transaction fee, which is typically somewhere from 1.9%–3.49% of each transaction, plus a fixed fee ranging from 5 cents–50 cents.

Did you know? PayPal has over 377 million active users globally, so it’s easy for shoppers to check out using it.

Zip offers 4-installment payment plans. (Source: Zip)

Zip is another popular customer financing platform that you can use both in-store and online. With Zip, you can offer your customers a four-installment, biweekly payment plan with a flat $1 interest fee on each payment.

It has great results for its merchants, including a reported 20% increase in conversion and topline sales and a 60% increase in AOV. Fees are not readily disclosed, but third-party sources put Zip’s rates between 2%–4% + 15 cents per transaction. Your exact rate is determined based on the size of your business, the value of your products, and other factors that you specify in the application process.

The solution integrates with many of the major ecommerce platforms, including Magento 2, WooCommerce, Shopify, BigCommerce, Commerce Cloud, and CartHook. For in-store purchases, customers use the Zip app to apply for financing. Then, you can process their payment at your card terminal via the app-generated QR code—no POS integration required.

Did you know? Zip is the only BNPL platform that can process Amex and Discover card payments.

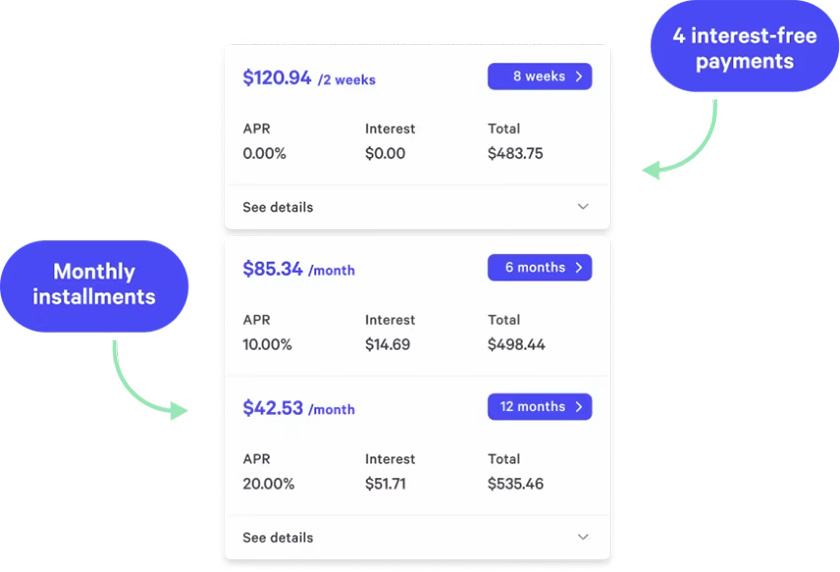

Affirm allows you to provide your customers with flexible installment options of up to 48 months. (Source: Affirm)

Affirm is another popular online and in-person BNPL platform. Ideal for businesses that process midsize to large-ticket sales, Affirm allows customers to choose from a variety of flexible payment plans for purchases between $50 to $17,500 per transaction. It claims merchants that use their service enjoy a 60% increase in average order value and 20% annual repeat purchases.

Fees are not available on their website, although third-party sources put Affirm’s transaction fee as 5.99% plus 30 cents. Affirm integrates with Stripe, Shopify, WooCommerce, BigCommerce, Wix, and Salesforce Commerce Cloud.

Did you know? Stripe integrates with a number of BNPL platforms such as Affirm, AfterPay, Klarna, and Zip. Read our full Stripe review.

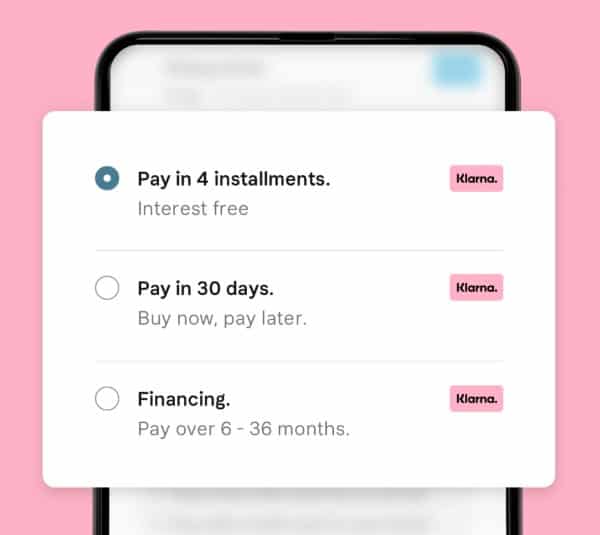

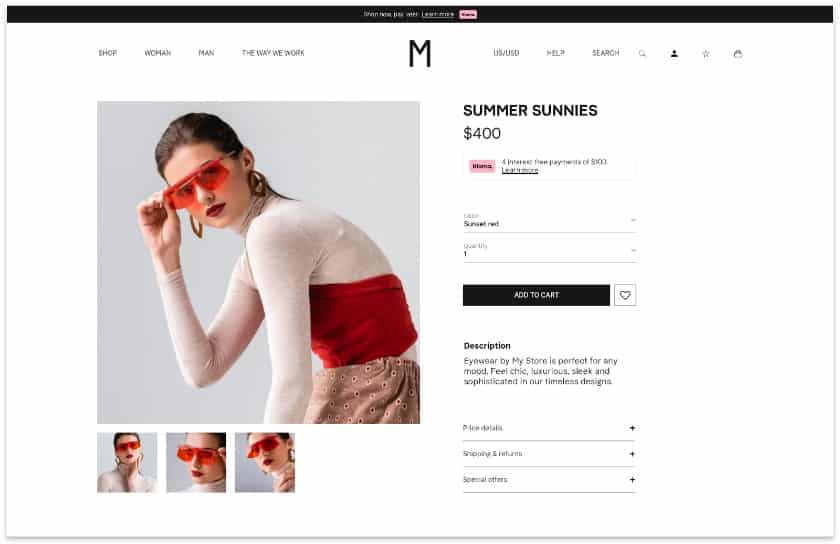

Klarna lets customers pick financing terms that are right for them. (Source: Klarna)

Klarna is one of the largest financing companies on the market, with over 20 million US users and more than 250,000 retail partners. It offers customers flexible financing options, including four interest-free payments, pay-in-30-days, and 6–36-month payment plans (0%–24.99% APR). You can also market Klarna throughout your site, so shoppers are informed and know their buying options from the start.

Transaction fees vary based on the type of financing and whether purchases are made in-store or online. However, each transaction comes with a 30-cent fee + a variable fee of up to 5.99% online and 3.29% in-store.

Did you know? As millennials and Gen Z embrace ecommerce and become more skeptical of banks, the BNPL market is expected to grow exponentially. In 2019, the $60B BNPL market represented 2.6% of global ecommerce (ex-China); Worldpay estimates that it could grow at a CAGR of 28% to reach $166 billion by 2023.

Like other customer financing platforms, Klarna eliminates credit and fraud risk while letting businesses get paid upfront. Plus, the user dashboard makes it easy to manage orders, refunds, and disputes. It is also easy to integrate with ecommerce partners like Shopify, WooCommerce, Magento, and BigCommerce.

Learn more in our Klarna review for businesses.

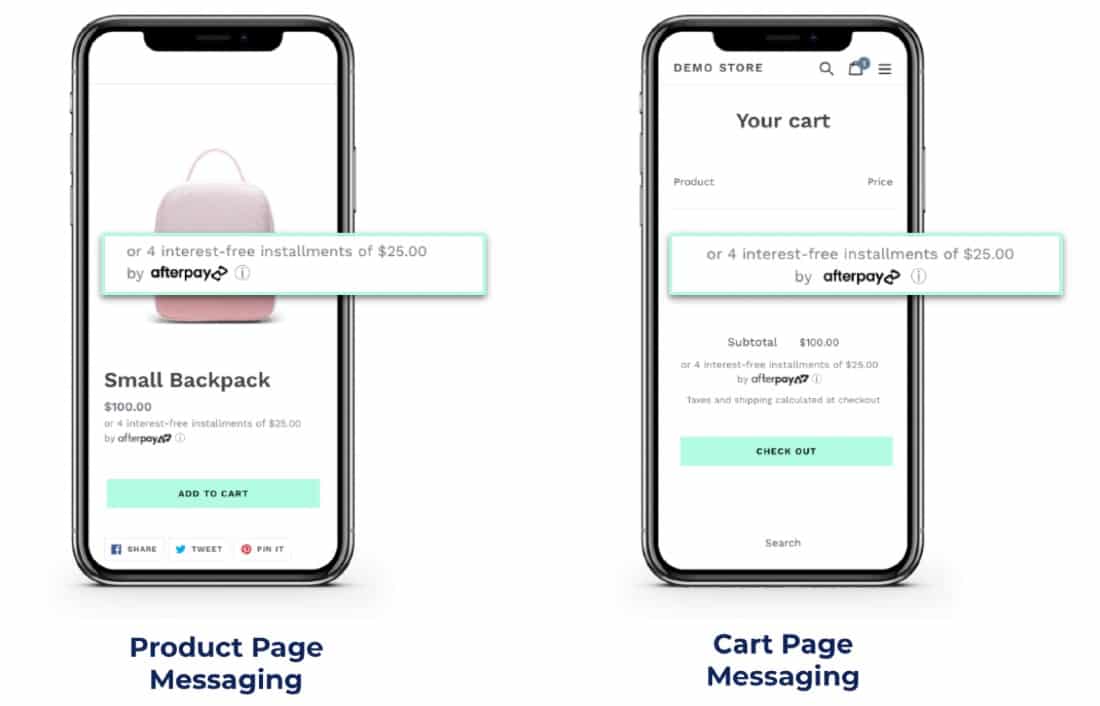

You can display an Afterpay financing option on product pages so customers know how they can pay as they shop. (Source: Afterpay)

Afterpay is another popular option that businesses can use to offer interest-free customer financing with a pay-in-four model. On average, 90% of shoppers are approved for financing, so you don’t have to worry about accessibility for your customers. When purchasing an item, customers make their first of four payments at checkout, and the remaining three are made over the course of six weeks. Afterpay does not offer alternate payment plan options at this time.

For online purchases, Afterpay charges a flat fee of 30 cents and a 4%–6% merchant fee that varies with the value and volume of transactions. Basically, the more you sell in both volume and value, the lower the percentage fee will be.

Step 3: Integrate Financing Across Sales Channels

Regardless of whether you opt for in-house or outsourced financing, you’ll need to add the payment option to all of your sales channels. This means using a POS system that either lets you program your own financing options or integrates with a third-party financing platform. Additionally, online retailers should incorporate financing options into product listings and the checkout process.

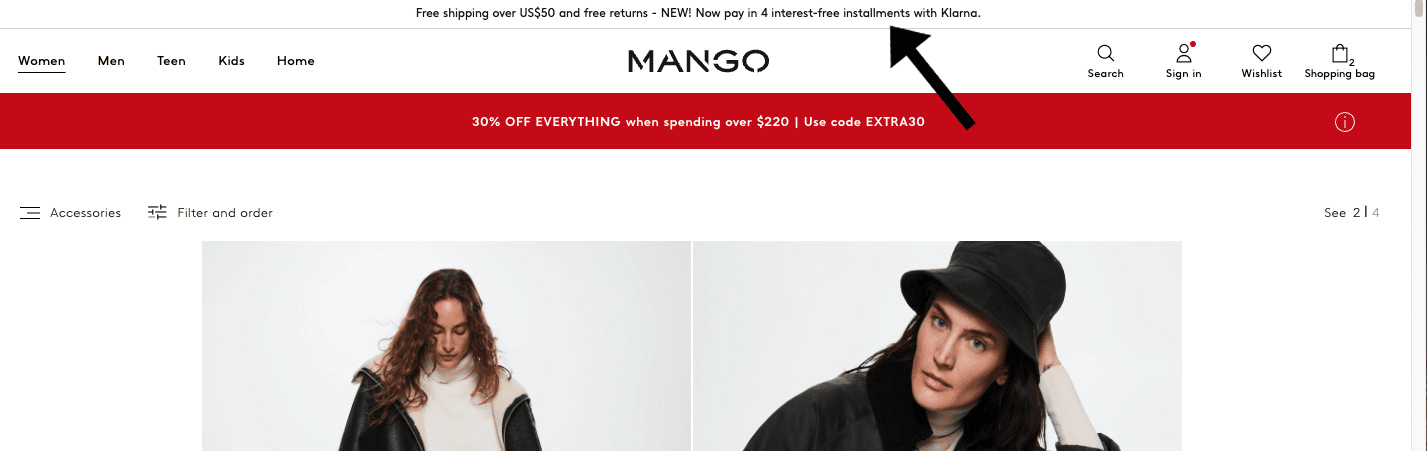

Many providers let customers see their financing options on individual product pages. (Source: Mango)

The best POS financing partners make it easy to integrate with the top POS and ecommerce platforms, so you can streamline checkout and keep all of your sales data in one place. You should work to integrate your financing options with your:

- In-store POS: Allow customers to opt for a financing option for in-store purchases by integrating your financing option with your POS system.

- Website checkout page: Add your third-party or in-house financing option as a payment option to your checkout page, just like you would with Apple Pay, Debit, and Credit.

- Online product pages: It is best to display both the list price and the financing monthly rate so that shoppers can see that they can afford an item as they view it.

Klarna, PayPal, and Afterpay—options we explored in this article—allow you to integrate their financing options with your product pages. As we will discuss below, this integration can boost your conversion rates massively.

Step 4: Advertise Your Financing Options to Customers

After all of the leg work is done, it’s time to share your new financing options with your customers. Prominently advertise financing in your store, on your website, and across social media so that customers know about the options upfront.

This strategy can turn passive browsers into buyers, especially when it comes to big-ticket purchases and online shopping. Incorporating financing into your marketing strategy can also encourage shoppers to choose your brand over competitors.

Mango has a banner advertising its financing option that appears on every page of its website. (Source: Mango)

You will also want to ensure that you train your employees to execute a financed purchase on your POS system and mention financing options at checkout and when working with customers.

Pros & Cons of Offering Consumer Financing

Customer financing through third-party platforms can offer merchants a number of benefits, from the ability to compete with larger retailers to increased customer satisfaction and retention. However, there are also some risks associated with customer financing, and they may lead to more complex accounting requirements for your business.

| PROS | CONS |

|---|---|

| Upfront payment: Using a third-party customer financing platform lets retailers get paid upfront and avoid the risk of nonpayment by a customer/borrower. | Debt risk: Financing customer purchases in-house requires accepting the risk that not all borrowers will satisfy their debts. This can be especially damaging for businesses with already narrow profit margins. And, even if you contract with a third-party financing platform, it may reserve the right to terminate a financing agreement at any time—leaving you exposed to financial risks. |

| Competitiveness with big-box retailers: Most big-box retailers offer a financing option or store card with beneficial promotional offers. If you don’t provide customer financing, you could lose countless revenue to big-box competitors. | More complex accounting: If you choose to do in-house financing instead of working with a third-party financing company, you’ll have to spend time tracking and following up with borrowers to collect outstanding payments. This translates into needing more resources for your accounts receivable department. |

| Increased sales: Offering customer financing means more shoppers can afford to make purchases at your store. This translates to a higher customer conversion rate, which can ultimately lead to more extensive brand loyalty. | Reduced cash flow: Again, businesses handling customer financing in-house will see an initial dip in cash flow. This is because the business only receives a down payment when a customer purchases and finances an item. While financing options can lead to increased sales, waiting for full payment may not be an option for many businesses. |

| Higher AOVs: Consumer financing encourages customers to make add-on purchases because they add minimal cost to their monthly expenses. This means that financing can increase your AOV. Similarly, customers may upgrade to more expensive versions of products rather than settling for the more affordable product they can pay off immediately. | Increased risk of chargebacks: Online fraud is a valid cause of concern when implementing BNPL. Customers who are not mindful of their recurring payment obligations tend to file for chargebacks when their funds are automatically debited for the installments. |

How to Evaluate Customer Financing Options

Not all customer financing options are built the same and while some businesses may benefit from one style of customer financing, others may not. It’s important to match your business model and identify cost-effective tools you need to successfully thrive with customer financing.

Here are some questions you need to ask when evaluating your customer financing options:

- Does my business sell large-ticket items? Businesses that sell high-value items such as automotives and real estate are better off with an in-house customer financing program. This requires a stricter vetting process and higher purchasing limit that you won’t find with BNPL providers.

- What are the transaction fees? BNPL transaction rates range anywhere from 3%–7% (which does not include fixed charges and sales tax) so businesses should consider this against their average ticket sales. If you regularly process sales of below $50, consider how much of your proceeds will be after the fees and if your projected sales volume will make up for the cost.

- What is the average conversion rate? This is most important particularly if you are operating your business on a budget. Consider each BNPL processor’s average conversion rate to make sure that your business does not fall victim to overspending customers.

- How trustworthy and reliable is this BNPL processor? Look for merchant user reviews and find any recurring issues on overbilling, account suspensions, and funding. Also, note that there are still very limited regulations around the BNPL payment method so even the most popular BNPL service providers get called out for nondisclosure issues on terms and fees by regulatory agencies such as the Consumer Financial Protection Bureau.

Before even choosing a customer financing option, the first thing you need to decide is whether your business is right for your business. Some business types like those that primarily earn from accepting cross-border payments will not benefit from a BNPL program.

Offering Customer Financing Frequently Asked Questions (FAQs)

Click through the questions below to get answers to some of your most common questions.

Small business customers typically like as many plan options as you can offer them, including interest-free, pay-in-four, and longer six to 36 month programs. Klarna and PayPal offer the widest variety of financing options.

Offering customer financing options can increase conversion rates, expand your customer base, increase profits, boost your average order value (AOV), and help you sell your more expensive merchandise.

A customer financing company is a company you can partner with to offer customer financing. It provides the credit check, manages customer payments, takes on the risk, and lets you get paid upfront. It will also have integrations that allow you to offer financing to customers, both in-store and online.

Yes! Simply choose a provider, integrate your financing options across your online and in-store payment platforms, and let your customers start shopping.

Bottom Line

In today’s economic climate, many customers don’t have the funds necessary to make large purchases. Customer financing gives shoppers the ability to pay off large purchases over time while increasing your store’s sales and transaction values. Make the most out of customer financing by choosing a POS financing partner that meets the needs of your business and its customers.