Durango Merchant Services is a payment services provider that specializes in high-risk merchant account solutions although it also supports low-risk businesses. The system provides merchants with the ability to accept multi-currency, ACH, and e-check payments. It also offers tools for payment gateway, mobile payments, chargeback, and fraud protection.

As with most high-risk merchant providers, Durango does not advertise its pricing. However, custom quotes show that the monthly fee starts at $10 and access to the payment gateway can cost an additional $10–$15 per month. Third-party user reviews gave Durango Merchant Services a score of 4.5 out of 5 stars.

The Fit Small Business editorial process follows strict standards to ensure that our “best” answers are founded on the basis of accuracy, clarity, authority, objectivity, and accessibility.

To evaluate Durango, I compared it to other merchant services across 23 data points for contract and pricing, payment types, merchant account features, integrations, setup, and ease of use. I also conducted product testing (when available), collected feedback from user reviews, and had multiple conversations with representatives from Durango to get clarification on pricing, policies, and procedures.

Based on our methodology, Durango Merchant Services received an overall score of 3.75 out of 5. Incidental fees such as monthly minimums and lack of same-day funding options are some of the reasons that prevented Durango from making our list of top-recommended merchant services.

Durango Merchant Services Overview

Pros

- Fast onboarding with high approval rate

- Built-in fraud protection tools

- Dedicated 24/7 account manager support

Cons

- Monthly fee for merchant accounts

- Additional monthly fee for payment gateway

- Requires a monthly minimum

Deciding Factors

Supported Business Types | Flexible Low & high-risk businesses, retail, professional services, mid- to large-size businesses |

Standout Features |

|

Monthly Software Fees | Starts at $10 |

Setup and Installation Fees | From $0 |

Contract Length | Month-to-month |

Point-of-Sale Options | Integrations |

Payment Processing Fees | Interchange plus

|

Customer Support |

|

Visit Durango Merchant Services

Is Durango Merchant Services Right For You?

Consider using Durango:

- If you need high-risk merchant account solutions

- If you have a terminated merchant account

- If you need a high level of fraud and chargeback protection

- Online businesses that want to accept different currencies

Use an alternative:

- If you need a free merchant account

- If your business needs flexible pricing, try PaymentCloud

Traditional small businesses and startups can see our recommended merchant service providers.

Durango Merchant Services Alternatives & Comparison

Monthly fee | Transaction fee | Cancellation fee | Chargeback fee | |

|---|---|---|---|---|

| Starts at $10 | Interchange + 0.5% + 20 cents–2% | $0 | $25–$30 |

| Starts at $10 | 2%–4.3% | $0 | $25 |

| $14.99 | Custom | Not disclosed | Not disclosed |

| Custom | Varies | $0–$595 (depends on processing bank) | $35 max |

Durango Merchant Services User Reviews

| Users Like | Users Dislike |

|---|---|

| Professional, excellent customer service | Cannot support every high-risk business |

| Fast approval | Undisclosed contract terms |

| Reasonably priced | |

There are still not a whole lot of online reviews for Durango Merchant Services although most feedback from new and longtime Durango merchant account holders are favorable. Users rave about this provider’s excellent customer service and ability to secure merchant accounts. What little negative feedback there is seems to be a reaction to not being approved for a merchant account.

- Trustpilot[1]: 4.5 out of 5 stars from 30+ user reviews

- Better Business Bureau (BBB)[2]: 5 out of 5 stars based on 1 review

Durango Merchant Services does not have any publicly disclosed pricing but it’s easy to reach out to one of their representatives for a sample quote. My evaluation for this criteria is based on the pricing details that we were provided. I like that Durango offers interchange-plus pricing but points were also docked for the monthly fees as well as monthly minimums.

Payment Processing

Durango Merchant Services offers month-to-month billing; however, financials and the level of risk involved will always be the determining factor, so expect the possibility of long-term contracts of up to three years for businesses with higher risk. Like other high-risk merchant service providers, its pricing is highly customized, so specific details are not disclosed.

I reached out to Durango’s sales team, who have been kind enough to share core pricing information with me:

Medium–High-risk | Low-risk | |

|---|---|---|

Monthly account fee | Custom | $10–$15 |

Setup fee | Custom | $0 |

Transaction fee (interchange-plus) | 0.25%–2% | 0.5% + 20 cents |

Gateway fee | $10–$15 per month and 10 cents per transaction (free setup) | |

Chargeback fee | $25 | |

Echeck/ACH processing | 1%–5% depending on the account | |

Other incidental fees include:

- Chargeback protection: 5 to 15 cents per transaction, depending on the service level

- Cryptocurrency: 1% with no per-transaction, monthly, or setup fees

- Average monthly minimum: $500/month

- Fee for not meeting the average monthly minimum: $25

- Cancellation fee: $0

- Early termination fee: $0 (for all types of accounts)

Durango Merchant Services offer several e-check and ACH options for high-risk businesses. While the transaction fee ranges from 1% to 5% depending on Durango’s risk assessment of your merchant account, there are other fees tied to signing up for this service.

Below is an example of a custom quote for accepting digital check payments with Durango:

- 1.90%–3.9% discount rate per check

- 75 cents minimum per transaction

- 48-hour approval

- 24-hour funding

- $150 refundable deposit upon approval

- $20 monthly fee minimum

- $99 setup fee

Note that Durango Merchant Services works with multiple acquiring banks, and the rates will depend on the proposed bank. The discount rate (payment processing fee) will then reflect the final underwriting, which can be negotiated after three to six months. The minimum charge takes precedence over a lower per-transaction fee. For example, if the e-check you process is only $10 and your rate is 2.9%, Durango will bill you the minimum charge of 75 cents instead of 29 cents.

Hardware

Durango Merchant Services also carries its own card reader solutions. Its sales team emphasized that it does not want to burden potential clients with upfront fees, so it’s safe to assume that it offers payment terms for purchasing hardware.

- Mobile card reader: Accepts EMV payments and connects with your mobile device via Bluetooth. Costs $115 (approximate), BBPOS chip and card reader (from $49).

- Card terminals and PIN pads: EMV chip card-ready terminals that can also accept contactless payments (Apple Pay, Samsung Pay, and Google Wallet). Comes with 3G and/or Wi-Fi support. Touch-screen terminals are also available. Costs range from $150 to $250 (approximate).

Durango offers flexibility when it comes to payment types, supporting all options we considered for this evaluation. However, some of them may come with additional costs, causing it to lose a few points in my evaluation.

Durango Merchant Services allows merchants to accept debit and credit cards, ACH and e-checks, and cryptocurrency payments, along with recurring billing and electronic invoicing tools. It also has a mobile card reader and payment app for mobile payment processing and features tools for setting up point-of-sale payments for brick-and-mortar shops.

Durango’s credit card processing tools include advanced mid-routing that gives you the support of multiple merchant accounts with different bank processors so that your business keeps running even if you encounter problems. Batch processing allows you to process multiple transactions at the same time.

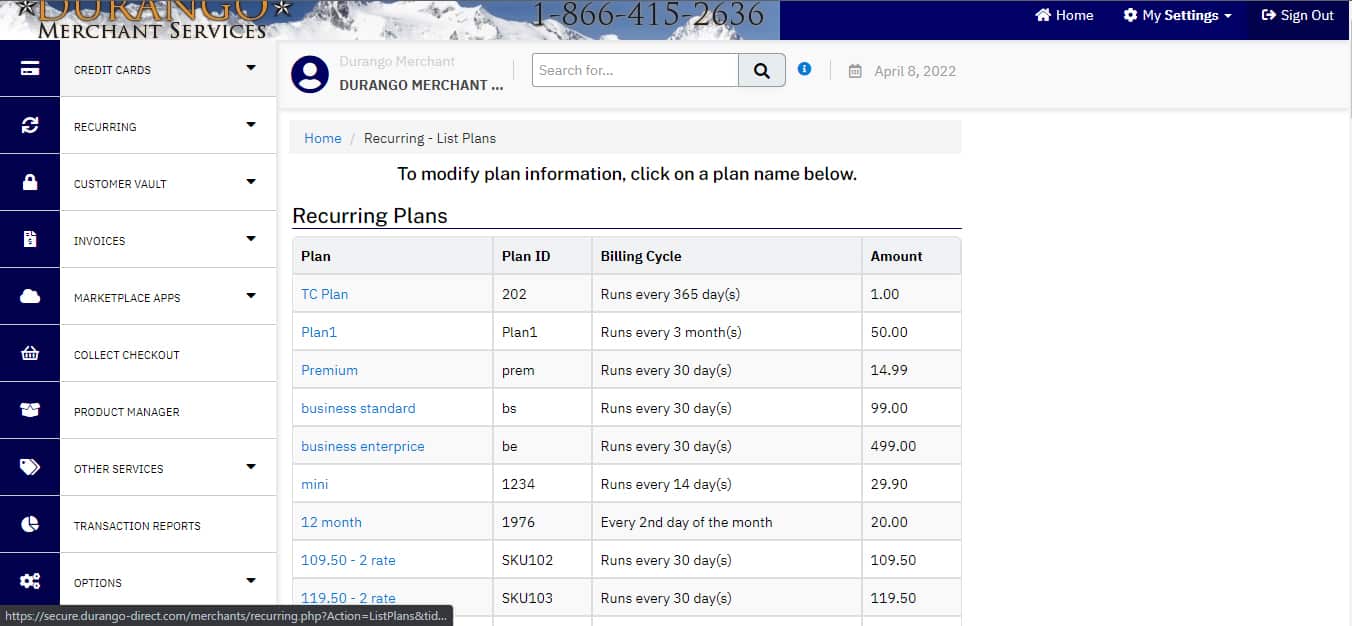

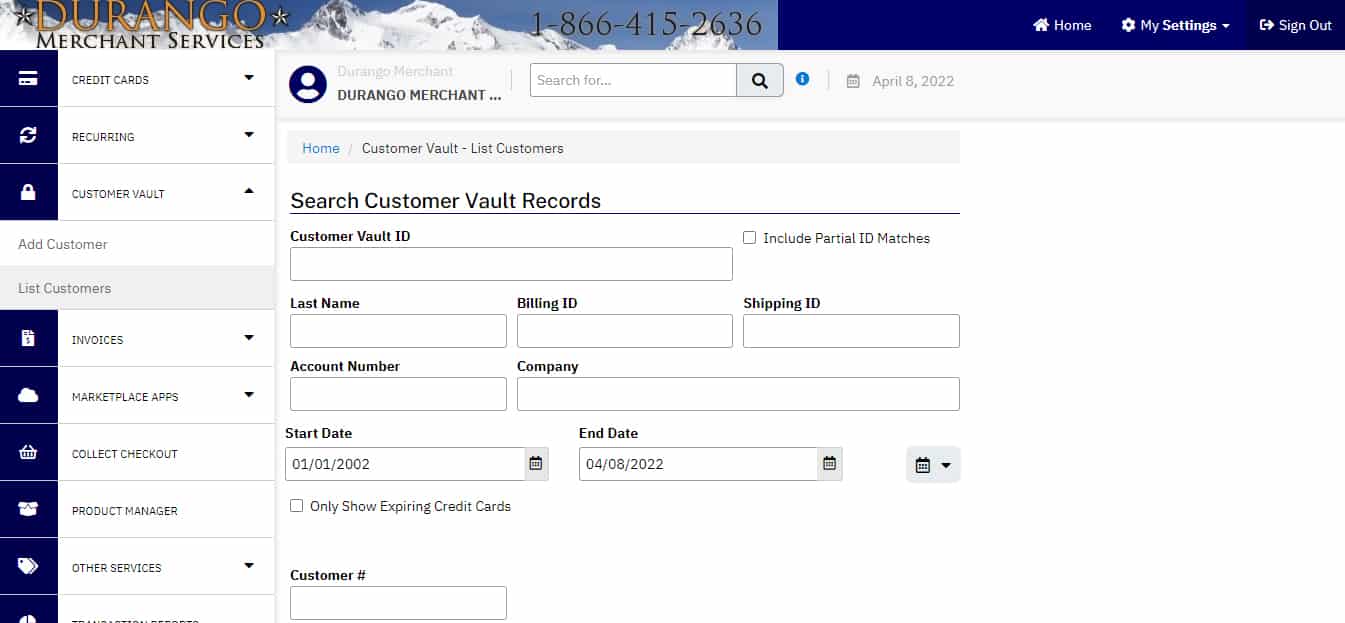

With a customer vault, you can securely accept, track, and process recurring payments. (Source: Durango Merchant Services)

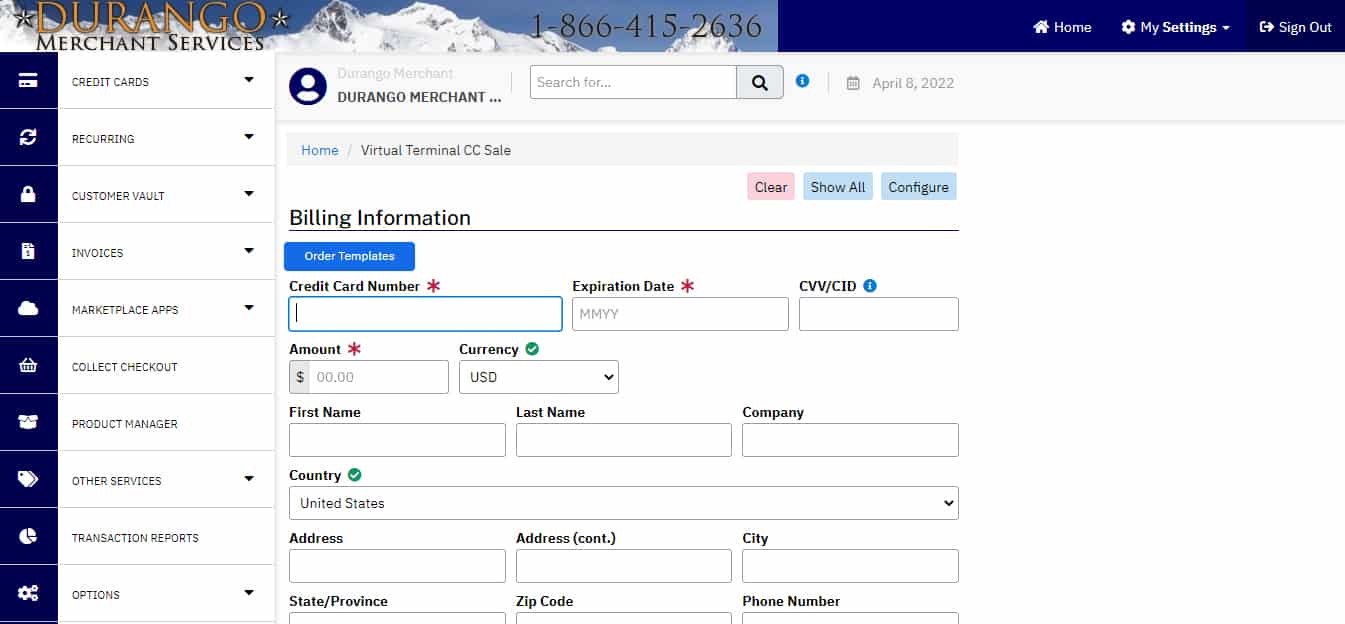

Durango Merchant Services comes with an ecommerce payment gateway that includes a virtual terminal, which allows your customers to send payments from any device with an internet connection and lets you access your payment processing tools from the platform. It also comes with a free shopping cart, “Buy Now” button generators, and a recurring billing tool so you can send out and manage recurring transactions from the same platform.

Also included are integrations with third-party shopping carts, API-based options for developers, its very own DurangoCart™ for ecommerce merchants with no coding skills, and a gateway emulator that makes switching from your current gateway to Durango PayTM an easy task.

Process payments anywhere with a browser through Durango’s virtual terminal. (Source: Durango Merchant Services)

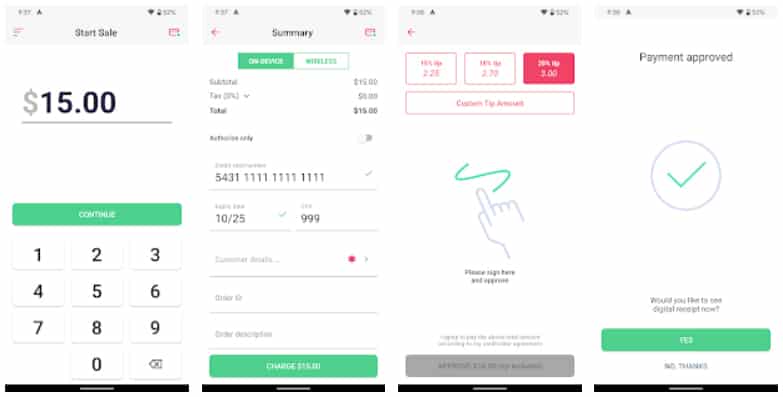

Durango now offers a mobile processing app compatible with both iOS and Android mobile devices. This mobile payments solution allows you to accept credit card payments via manual key-in of credit card payment details or by using a compatible mobile card reader. Other features include access to the customer vault, custom tipping and taxing, transaction reporting, and digital signature capture.

The app has around 200+ reviews with a rating of 3.3 on Google Play[3] and around 25 reviews with a rating of 2.7 on the App Store[4]. The user feedback ranged from the app being unusable to a few comments about it being able to do everything they need.

Durango’s mobile payment app is available to merchants through their gateway credentials. (Source: Durango Merchant Services)

Electronic payments allow you to use Durango to send echeck payments to vendors and employees and accept payments by phone. It can also perform bill payments, check deposits on your behalf, capture IP addresses, and send electronic receipts to customers who pay online using echecks. Ecommerce integrations for e-check processing include built-in plugins for third-party shopping carts, like WooCommerce and Shopify. You can accept payment by phone by entering the check details into the Durango virtual terminal. You can even customize settings with options for same-day or next-day funding.

Durango Merchant Services main product features are credit card processing, e-check processing, and chargeback and fraud protection tools. As with most traditional and high-risk merchant accounts, sign-up and approval take longer, which may not be ideal for most small businesses.

Contract & Terms of Service

A copy of Durango’s contract & terms of service is not publicly available, but a closer look at its website and communication with the provider’s account experts provide us with concrete ideas of what to expect when signing up for a Durango Merchant Services merchant account.

- Initial required documentation: Copy of your driver’s license or passport, voided business check or bank reference letter, DBA registration, business license, and articles of incorporation or articles of organization (for partnerships or corporations).

- Verification: Expect the processor to hire a third party to investigate and review your personal credit and your business model.

- Risk assessment: Like other processors, Durango will also verify if you or any of your partners are listed on the MATCH list.

Member Alert to Control High-risk Merchants (MATCH) List: A record of merchants maintained by the Card Network who have had a merchant account terminated for violating a merchant agreement.

- Contract length: All account types are considered for a month-to-month contract but will be assessed based on the following:

- Poor credit

- High volume or high ticket size

- Any industry with historically high chargebacks

- Account that has high chargebacks showing on their current history

- Businesses dealing with any future deliverable product

- Hardware purchase: Durango may offer hardware by installment, but this may mean being tied to a long-term contract.

- Additional fees: Add-on services such as digital check processing and use of third-party gateways may include additional costs.

Setup & Application

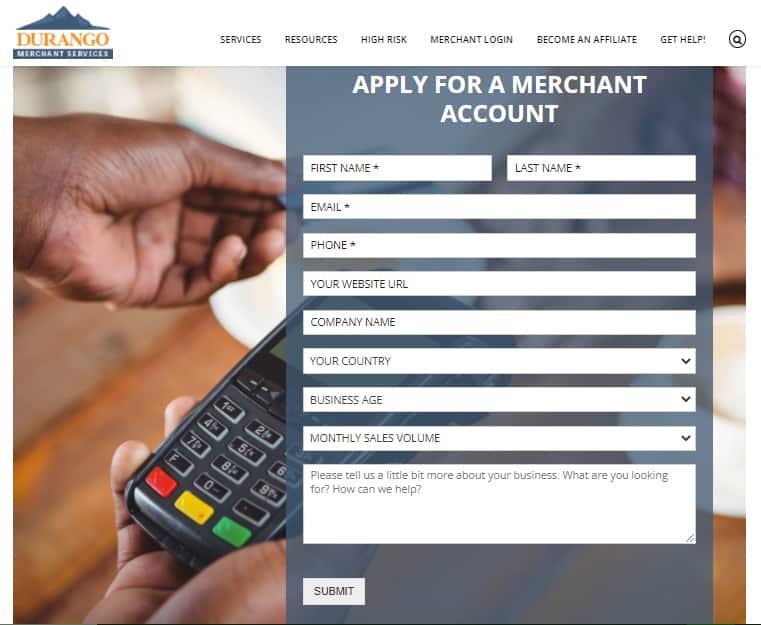

Durango Merchant Services supports both low-risk and medium- to high-risk merchant accounts. Approval takes anywhere from three to five business days, and there are no signup fees, while setup fees depend entirely on the type of merchant account and service you require. Your application starts by filling out an inquiry form from the website. Durango Merchant Services will then assign you an expert consultant to help double-check your application and complete your requirements.

A representative from Durango Merchant Services will contact you within 24 hours after signing up for a no-obligation quote. (Source: Durango Merchant Services)

Customer Vault

The Customer Vault is Durango’s Level 1 Payment Card Industry (PCI)-certified data facility that provides merchants with the ability to process their customers’ payments through an encrypted (SSL) connection. This tokenization feature is ideal for merchants that accept automatic payments or process recurring transactions. Durango Merchant Services also features a “Three-Step Redirect Method” that allows merchants to process payments without transmitting their customer’s payment information through the web application using Customer Vault.

Add and manage your customers’ payment details safely with tokenization features offered through Durango’s customer vault. (Source: Durango Merchant Services)

Plug-and-Play Add-ons & Integrations

This provider offers plug-and-play shopping carts and “Pay Now” buttons so that users with no coding skills can easily set up more payment options for their customers. It also offers a variety of integrations, such as:

- iSpyFraud Detailed Overview

- QuickBooks™ SyncPay Plug-In Instructions

- Three-Step Redirect Overview

- Authorize.net Emulator Integration Instructions

Fraud & Chargeback Protection

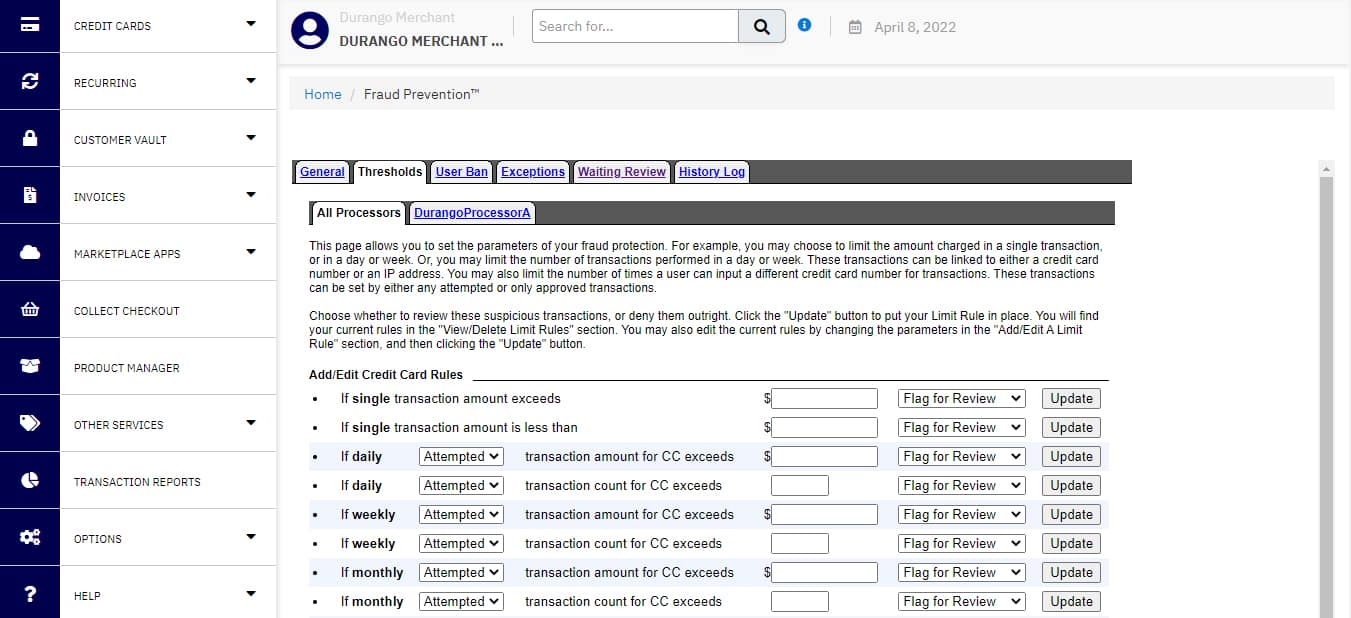

Durango Merchant Services offers a variety of fraud and chargeback protection tools for each of its payment processing solutions. It comes with fraud protection tools, AVS and CVV rule matching, iSpy Fraud, payer authentication, and more. It also includes being able to decline or approve transactions before or even after authorization.

All accounts come with anti-fraud services, including Verified by Visa, Mastercard SecureCode, Fraud Scrubbing, and EMV 3d Secure 2.0.

Durango lets you set custom rules for accepting or rejecting transactions. (Source: Durango Merchant Services)

Customer Support

Durango provides a dedicated account manager available to its customers 24/7, helping it earn perfect scores for the customer support criteria. Although specific merchant terms vary, they can offer 24-hour funding as well. It only lost a few points for other features that may come with additional fees.

Its website includes an FAQ, a Glossary, and a Get Help page, which lists the company’s email and phone details. Phone support is available during business hours, Monday through Friday, from 8:30 a.m. to 5 p.m., Mountain time.

Durango Merchant Services is a trusted and reliable merchant service provider. Although it can cater to traditional, low-risk businesses, it is more popular for businesses in the high-risk category including those requiring offshore merchant accounts. Specific pricing and terms vary, depending on the business, which is typical for providers that cater to high-risk merchants.

It scored well for ease of use, popularity, and integrations, but lost a few points for affordability. Small, low-risk businesses will still find other more suitable providers without any upfront costs and offer the same payment flexibility, such as Square or Helcim.

The limited online user reviews make it difficult to gauge how Durango actually works with longtime users. While some may interpret this negatively, I find the lack of complaints generally means satisfied clients. That said, Durango Merchant Services can certainly benefit from encouraging merchant clients to share their experience with the service.

Methodology – How We Evaluated Durango Merchant Services

We test each merchant account service provider ourselves to ensure an extensive review of the products. We compare pricing methods, identifying providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. We then further evaluate according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

30% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts and extra points if those discounts are transparent or automated.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

20% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

Bottom Line

Durango Merchant Services draws on its almost three decades of experience to come up with one of the most reliable services for businesses needing high-risk merchant accounts. This is obvious from the online reviews available and the number of years these reviewers have been with Durango as clients.

Overall, I recommend Durango Merchant Services for high-risk online companies, such as online auctions, telemarketing, and mail or telephone order businesses. Contact Durango for a free, no-obligation quote.

Visit Durango Merchant Services