An early payment discount―also called a prompt payment or cash discount―is a reduction in an invoice balance when it’s paid before the due date. It provides an incentive for customers to pay their bills before they’re due.

When used strategically, early payment discounts can speed up the bookkeeping process, increase customer loyalty, and improve cash flow. Our guide covers how to calculate it, its benefits, guidance on if you should offer it and how much to give, and more.

How To Calculate Early Payment Discounts

To calculate early payment discounts, multiply the total invoice amount by the discount percentage. Next, subtract the discount amount from the total invoice amount to get the payment due on the invoice.

Discount = Invoice Amount x Discount Rate

Net Invoice Amount = Invoice Amount – Discount

So, assume you invoice a customer for $850 with a discount term of 2/10 Net 30:

- Step 1: Calculate the early payment discount as 2% of $850, or $17

- Step 2: Deduct the discount of $17 to get the balance due of $833

This means that the customer can pay $833 instead of $850 if they settle the bill within 10 days of the invoice date.

Common Payment Terms

It’s important to understand common payment terms when calculating early payment discounts and applying them to your invoices.

- 1/10 Net 30: The customer receives a 1% prompt payment discount if the payment is received within 10 days of the invoice date. If the customer doesn’t pay within 10 days, then the invoice is due in 30 days with no discount. This prompt payment discount might be good to incentivize those customers who never seem to pay their invoices on time.

- 1/15 Net 30: This means the customer receives a 1% discount if payment is received within 15 days. If the customer doesn’t pay within 15 days, then the invoice is due in 30 days with no discount. This early payment discount can be used to reward those customers who have consistently paid on time under the 1/10 Net 30 by providing an additional five days.

- 2/10 Net 30: The customer receives a 2% early payment discount if payment is received within 10 days. If the invoice isn’t paid within 10 days, it’s due in 30 days with no discount. This type of prompt payment discount can be used to accelerate cash flow with a larger discount for jobs that require a large outlay of cash that you need to recoup quickly.

- 2/15 Net 30: This is when the customer receives a 2% discount if the invoice is paid within 15 days. If the invoice isn’t paid within 15 days, then it’s due in 30 days with no discount. Similar to the 2/10 Net 30 early payment discounts, this type of early payment discount is ideal for jobs that require you to spend a large amount of cash upfront.

Payment terms can help you manage accounts receivable (A/R) and convert them to cash immediately. Read our article about A/R best practices to learn more.

Benefits of Prompt Payment Discounts

Early payment discounts have benefits for both vendors and customers beyond the obvious one of saving the customer money.

Should You Offer Early Payment Discounts?

When deciding whether implementing early payment discounts is a good strategy for your business, you should consider the following questions:

- Are your competitors doing it? Find out if offering early discount payments is an industry standard. If no one else is doing it, then evaluate if it gives you an edge over your competitors.

- Is getting paid sooner crucial to your business? Prompt payment discounts can have a significant impact on your profitability. It’s important to weigh the benefits of getting paid early and increasing your cash flow against the reduction in profit you’ll experience from offering the discount.

Offering early payment discounts can help speed up invoice collection. Managing invoices is an important bookkeeping responsibility. Our small business bookkeeping guide teaches you all essential bookkeeping responsibilities you should know.

How Much Early Payment Discount To Offer, If Any

The discount a vendor offers will vary based on several factors.

- The industry standard: Find out what kind of payment terms other businesses in your industry are offering. You want to make sure that the payment terms you offer aren’t too far off from the industry standard.

- The prompt payment discount the competition offers: Check out what kind of payment terms your closest competitors are offering. To stay competitive, you should offer similar payment terms.

- Your client’s payment history: If a customer consistently pays on time, there’s no need to offer early payment discount terms. However, be careful when rewarding late-paying clients by offering them discounts. Your customers that always pay on time might not be happy about the policy.

There’s no rule that you must offer every customer the same payment terms. If you offer different terms, however, be sure to follow a written policy to justify the terms offered to defend against potential accusations of favoritism or discrimination.

Tip: Implementing early discount payments can be tedious if you’re relying on manual bookkeeping. Accounting software like QuickBooks Online allows you to set up specific terms for each customer. Simply set up the discount terms when creating an invoice or sales receipt, and the program will calculate and apply early payment discounts to your invoice automatically.

How To Avoid Potential Problems With Early Payment Discounts

The terms of an early payment discount should be clearly stated on all invoices. Generally, payments must be received by the vendor within the stated number of days from the invoice date for the discount to be applied.

However, some clients will try to take the discount as long as their check is written within the discount period. You should establish a firm rule regarding this issue and display it at the bottom of all invoices that include an early payment discount.

Alternatives To Early Payment Discounts

If giving early payment discounts won’t work for some customers, you can try alternatives that can help maximize your finances without compromising your healthy relationships with them.

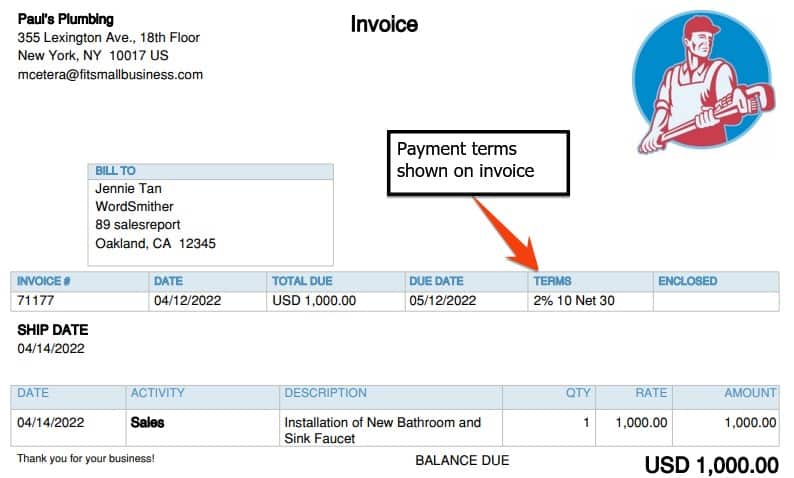

Suppose Paul’s Plumbing invoices a customer for the installation of a new bathroom and sink faucet for $1,000. The term for the early payment discount is 2%/10 Net 30, so if you receive payment in 10 days or less, the invoice will be reduced to $980. If the customer pays after 10 days, they must pay the full $1,000. The screenshot below shows how this payment term is displayed on an invoice from QuickBooks Online.

Sample invoice created in QuickBooks with early payment discount terms

How To Set an Early Payment Discount in QuickBooks Online

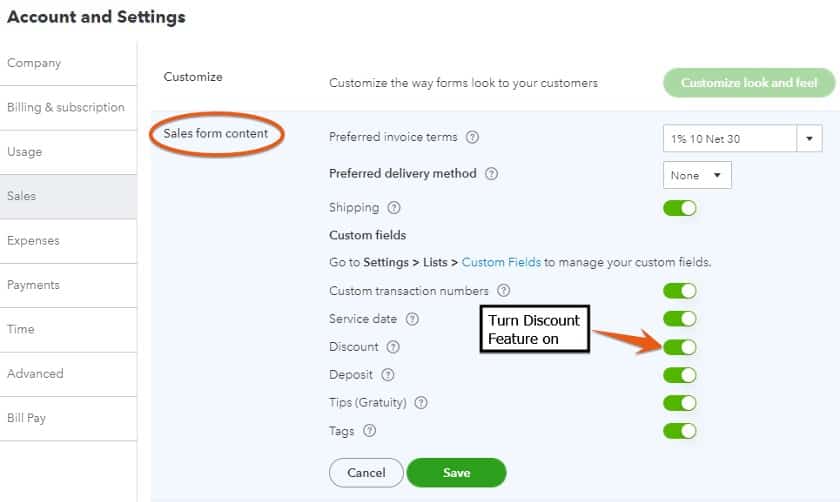

If you’re a QuickBooks Online user, you can add a discount to an invoice or sales receipt for customers who pay early by turning the Discount feature on. To do this, click on the gear icon on the top right part of your dashboard, select Account and Settings, and then choose Sales. From the Sales form content tab, toggle Discount to on.

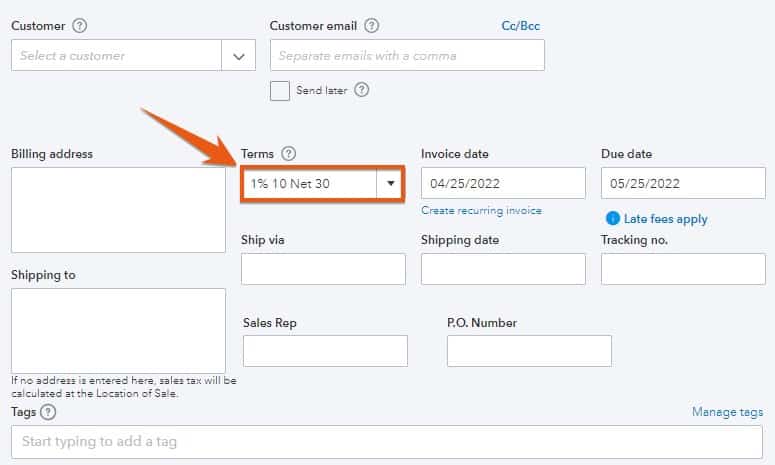

When creating an invoice, a discount field appears on your sales form. Indicate your customers’ discounted payment terms for early payments.

Frequently Asked Questions (FAQs)

Yes, as early payment discounts can help establish long-term relationships with customers. It can also encourage them to pay early, which would help you recover cash to be used for operations.

Discounts are deducted from gross sales using the account title “sales discounts.”

Bottom Line

Depending on your needs and goals, offering early payment discounts can help speed up the collection process—but it can also pose some challenges, especially when not implemented properly. It’s best to consult your accountant or bookkeeper to analyze the impact of early payment discounts on your business.

If you decide that early payment discounts are a win-win for you and your customers, you should leverage your accounting software to apply discounts to your invoices automatically.