Expensify is a cloud-based expense management application that tracks expenses and allows employees to submit them for reimbursement. In our Expensify review, we tackle its features in expense tracking and reporting, expense policies, and approvals. It also has Expensify Cards, which enables you to issue prepaid cards to employees.

It offers a free plan for individuals, while pricing for businesses becomes free if more than 50% of total business expenses are on Expensify Cards. Otherwise, you’ll have to pay $20 or $36 per user, per month. Those who left positive Expensify reviews placed emphasis on its capability to streamline the expense workflow.

At Fit Small Business (FSB), we are committed to delivering thorough and dependable software reviews. In adherence to the FSB editorial policy, we seize every opportunity to try the accounting practice software we review firsthand, allowing us to test how the features work in real-world scenarios. This approach allows us to customize our reviews and provide more relevant insights and recommendations tailored to the unique needs of your accounting firm.

Pros

- Basic analytical tools for analyzing expenses, such as charts and filters

- Approval flows and expense policies

- Easy-to-understand interface

- Submit mileage expenses

- Submit expenses based on billable hours

Cons

- Not a bookkeeping software substitute

- Has no multiple approval workflows in the Free and Collect plans

- Has limited SmartScans in the free plan

Expensify Alternatives & Comparisons

Expensify Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Clean interface | Problems in generating reports |

| Time saver for processing expenses | Sometimes is incorrect in optical character recognition (OCR) scans |

| Easy to scan receipts | Issues in uploading receipts |

Those who left feedback praised the platform for having a clean user interface (UI) and mentioned how Expensify helped streamline their processes, and one Expensify review highlights that SmartScans reduced data entry time when recording expenses. We agree that the UI design and overall user experience of the system are outstanding. However, some reviewers said that they found inefficiencies, such as the inability to upload credit card statements. There are also instances where some encountered duplicate entries for receipts.

Overall, Expensify offers a competent expense tracking solution. Its average ratings on user review sites are as follows:

- G2.com[1]: 4.5 out of 5 based on around 5,000 reviews

- GetApp[2]: 4.4 out of 5 based on around 1,000 reviews

Expensify offers three plans for businesses. It took a slight dip in the pricing score because the rates per user are expensive. Competitors like Zoho Expense can offer the same set of features at a lower price point.

Free | Collect | Control | |

|---|---|---|---|

Monthly Price (Billed Annually) | $0 | ||

Monthly Price (Billed Monthly) | $0 | ||

Number of SmartScans | 25 per month | Unlimited | Unlimited |

Number of Receipt Uploads | Unlimited | Unlimited | Unlimited |

Expensify Cards | Unlimited | Unlimited | Unlimited |

Third-party Corporate Cards | ✕ | ✓ | ✓ |

Accounting Sync | ✕ | ✓ | ✓ |

Smart Limits | ✕ | ✓ | ✓ |

Expense Rules & Policies | ✕ | ✕ | ✓ |

Multiple Approvers | ✕ | ✕ | ✓ |

Expensify Features

Below, we look at Expensify’s features, specifically in expense tracking and card features. These are the two major criteria in our rubric.

Expensify’s core feature is expense management—nothing more, nothing less. Its score in expense tracking is commendable but most of the great features are in the Control plan. We believe that not all small businesses can afford this plan.

Expensify focuses on expense recording, tracking, reporting, and reimbursement. If you maintain books and accounts for your business, you can integrate Expensify with your accounting software.

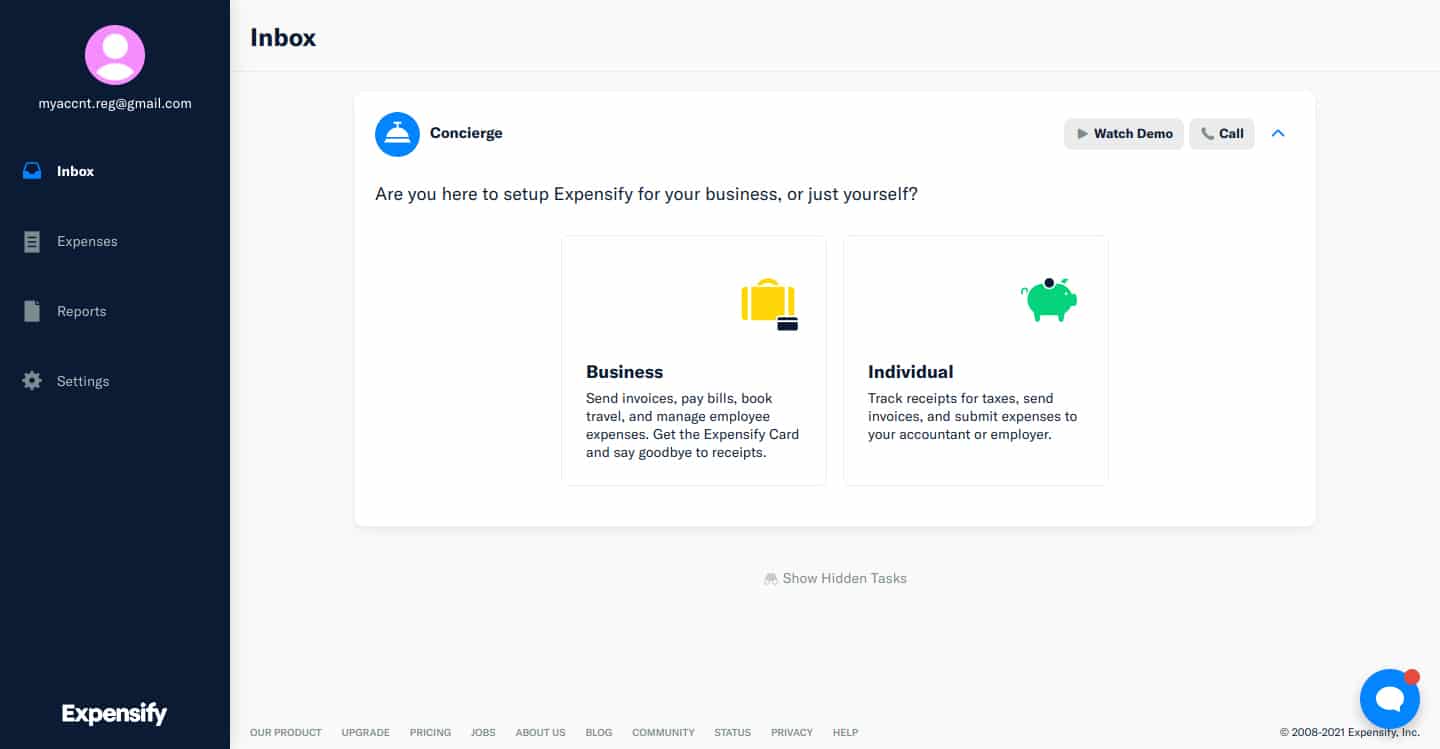

Setting up Expensify

After logging in, the software will prompt you to set up your account. Expensify’s concierge will guide you during your first use of the app. It’ll provide tips and procedures to get you acquainted with its features. Regardless, you can always contact customer support by clicking the blue message bubble at the bottom-right corner of the screen.

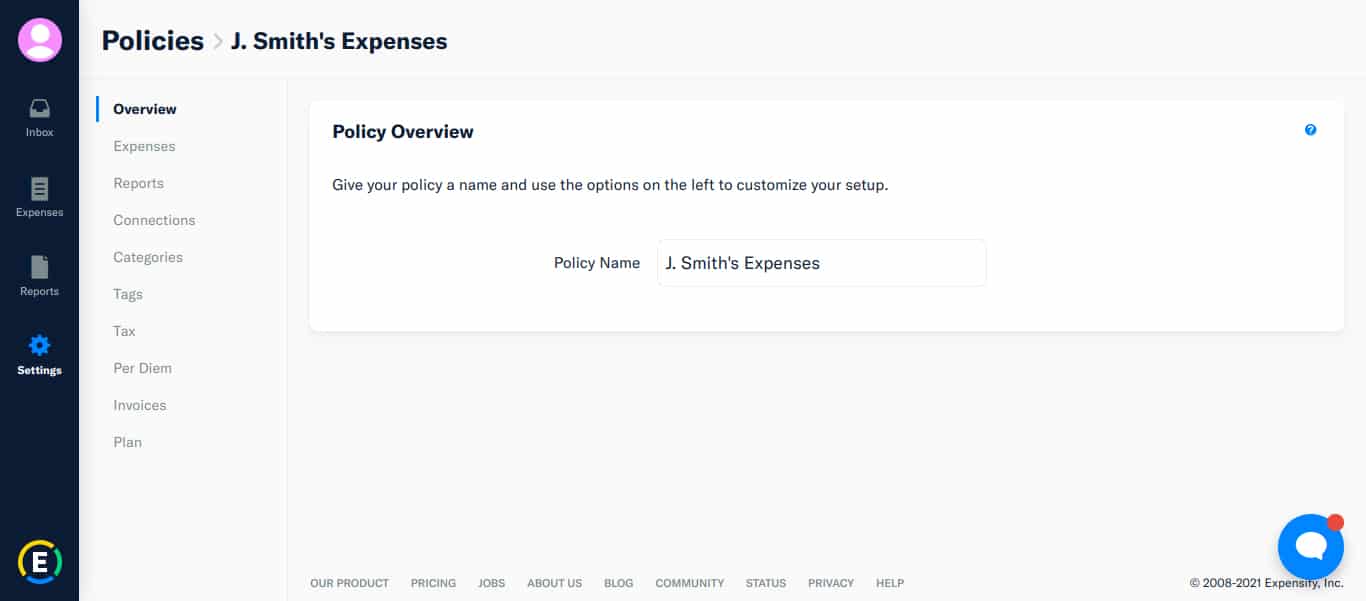

Before you begin utilizing the app, it’s best to set up your expense policies. Expensify lets you set standard rates and quantities.

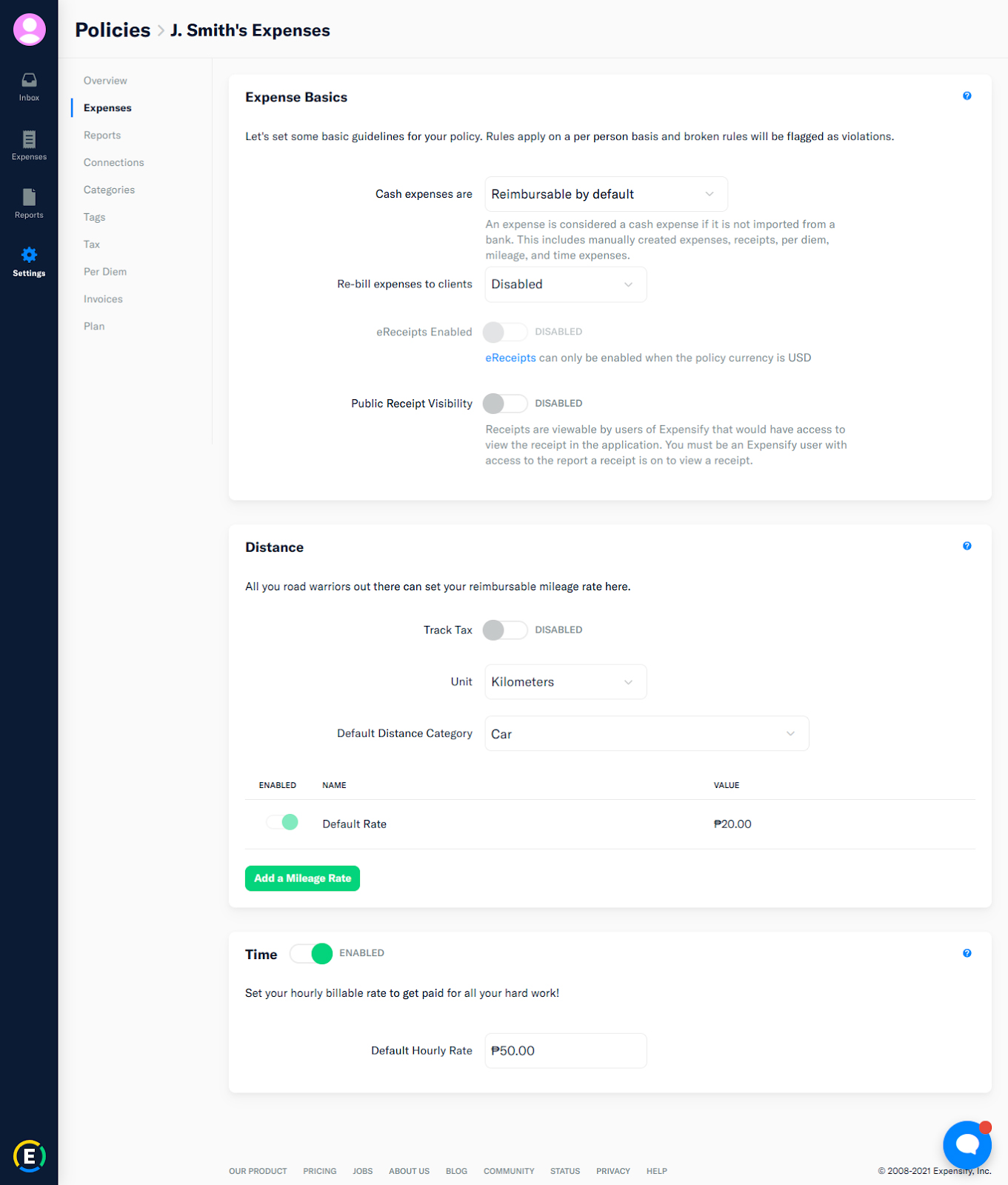

Policy Screen

The Expense Policies screen will instruct Expensify on how to treat your transactions. You can set cash expenses as reimbursable or nonreimbursable by default. You can enable tax tracking for mileage, specify the unit of measure, and set mileage rates. Expensify has its default rate but you can add more rates as you see fit. Aside from mileage, you can also set your billable hourly rate.

Setting up Expense Policies

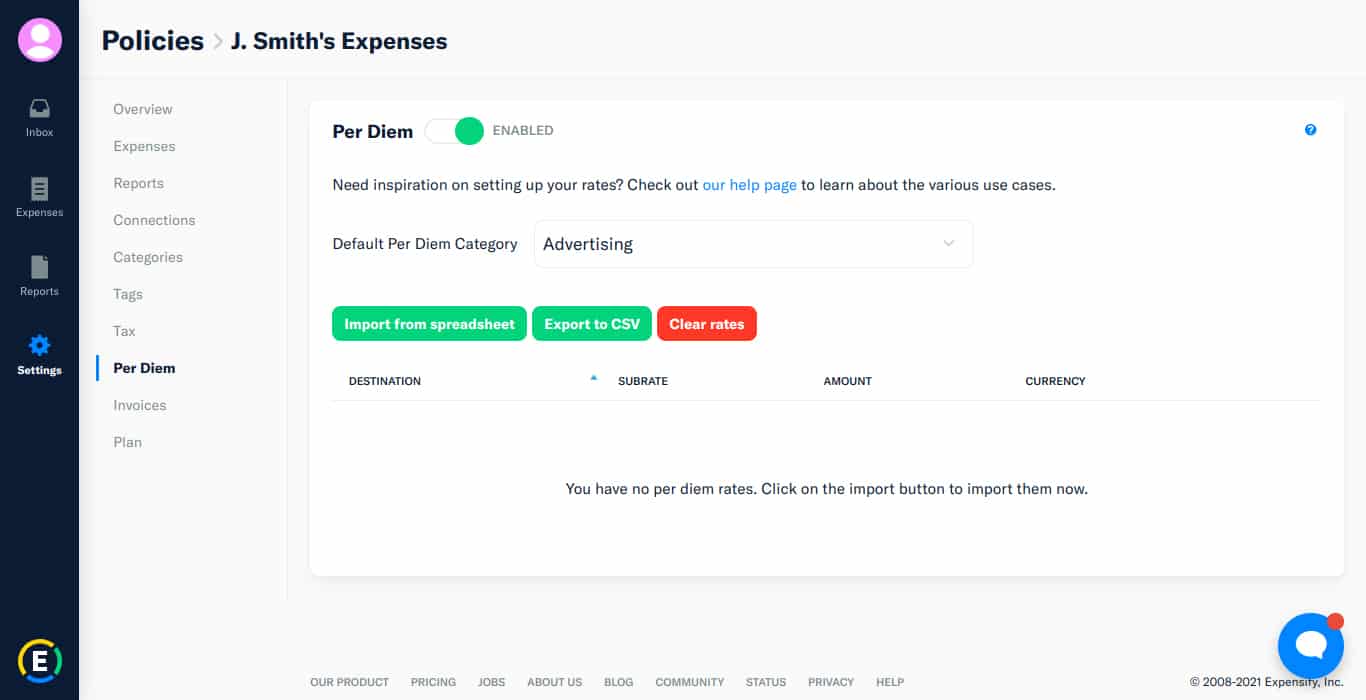

If your company allows per diem for employees, Expensify can automate it based on your per diem rates. You can import your rates from a spreadsheet, and Expensify will apply them to your future transactions. It also lets you set the per diem on a default category for easier pooling of per diem expenses.

Setting up Per Diem Policies

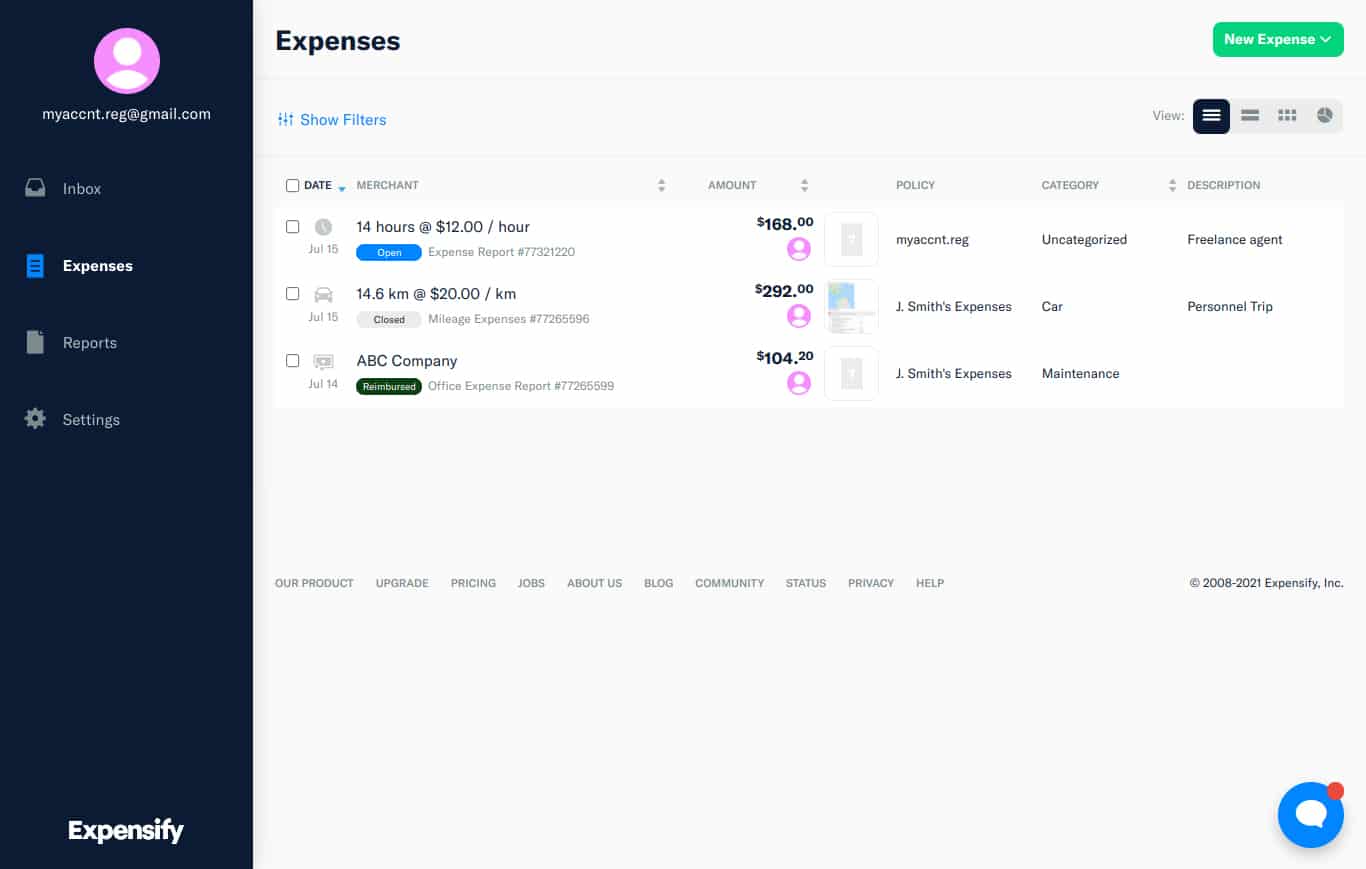

If you click Expenses in the left menu bar, it’ll bring you to the Expense tab. This will show you all expenses encoded in the system. Each expense is marked depending on its status:

- Unreported (white): Expense hasn’t yet been added to any report

- Open (light blue): Expense has been recorded and added to a report

- Processing (dark blue): Report has been submitted but not yet approved

- Approved (light green): Report has been approved but not yet reimbursed

- Closed (gray): Report has been approved but not reimbursed

- Reimbursed (dark green): Expenses in an approved report have been reimbursed

Expense Overview

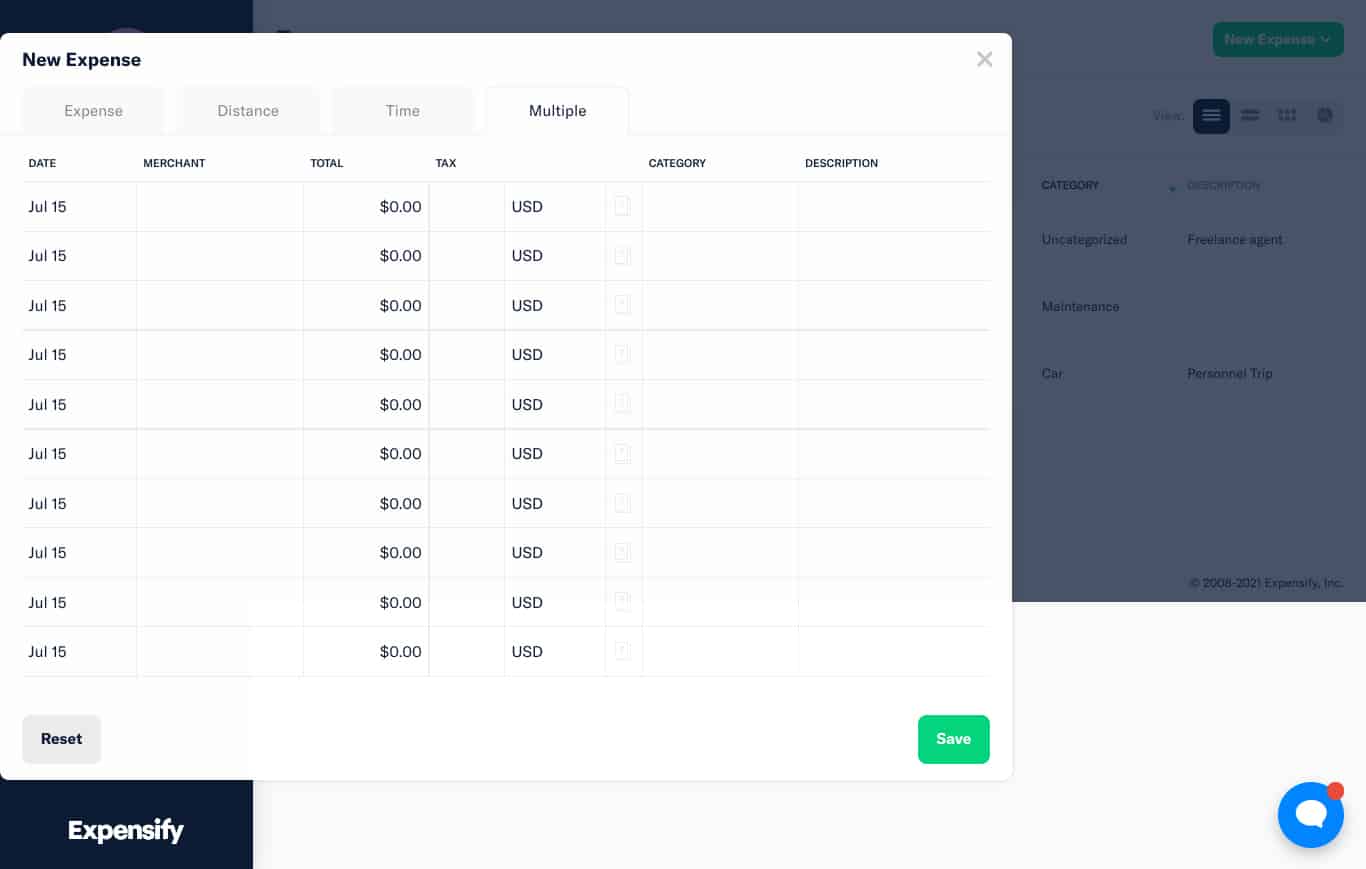

There are two ways to encode an expense: manually or via SmartScan. If you have to enter several expenses, you can add multiple entries in a single window as shown in the image below.

Encoding Multiple Expenses

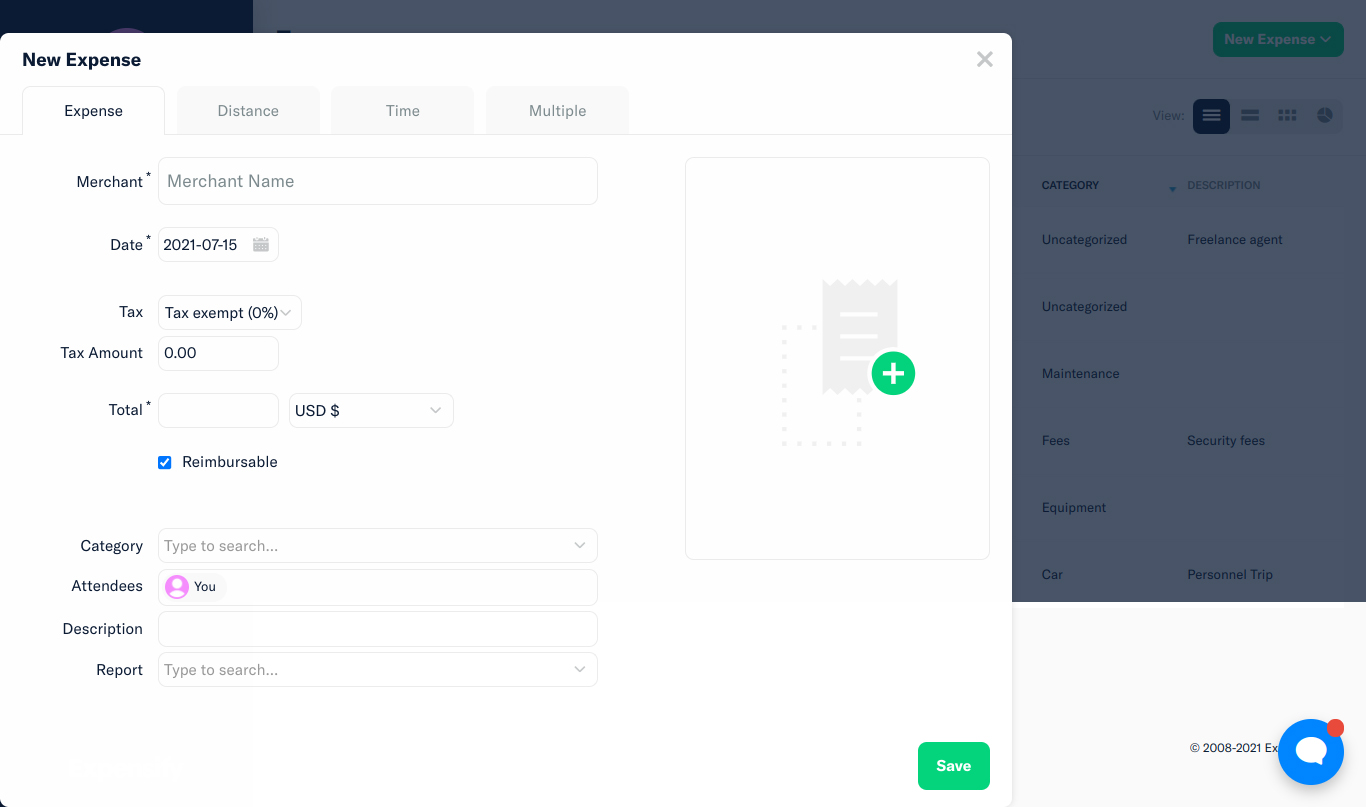

When encoding expenses manually, you can enter the merchant, applicable tax, amount paid, expense category, attendees, and a brief description of the expense. You can also add a PDF copy of the receipt or its image.

Entering Expenses Manually

Once everything is laid out, you can add expenses to a new or existing employee’s expense report. Click the drop-down menu beside the Report tab, and it’ll show all your reports. In case there are no existing reports, Expensify can auto-generate a report for you. Once you click Save, the expense’s status will be Open.

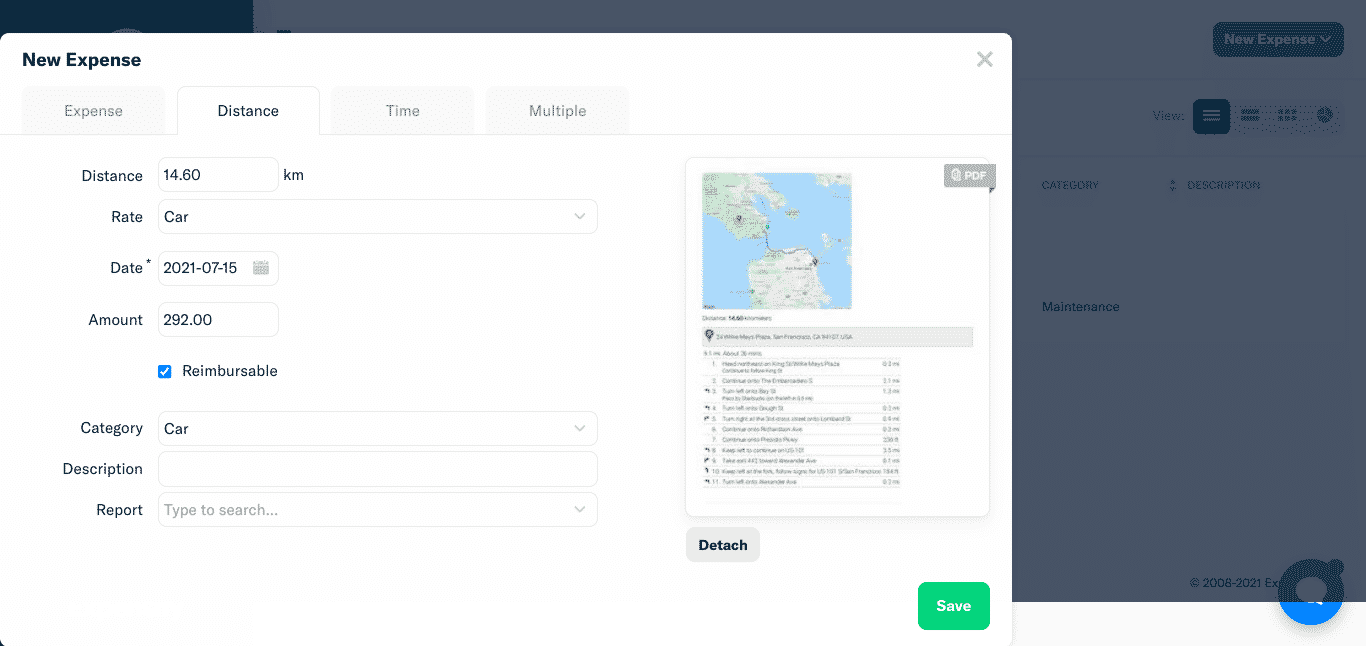

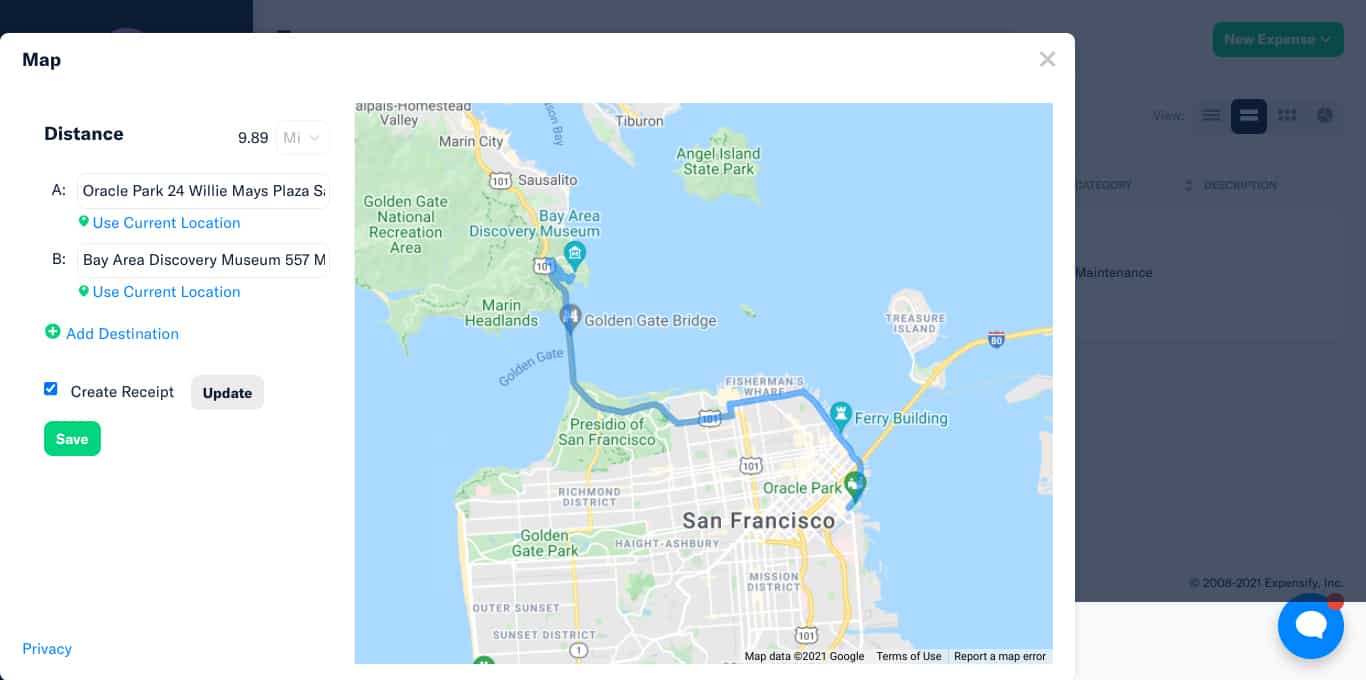

Expensify can record mileage expenses in two ways: entering miles manually or via map. You can use your odometer to track your miles and input them into Expensify. The app will compute your mileage cost automatically based on the mileage policy and applicable taxes. Alternatively, creating mileage expenses via map allows you to enter your starting point and destination, and Expensify will compute the number of miles automatically.

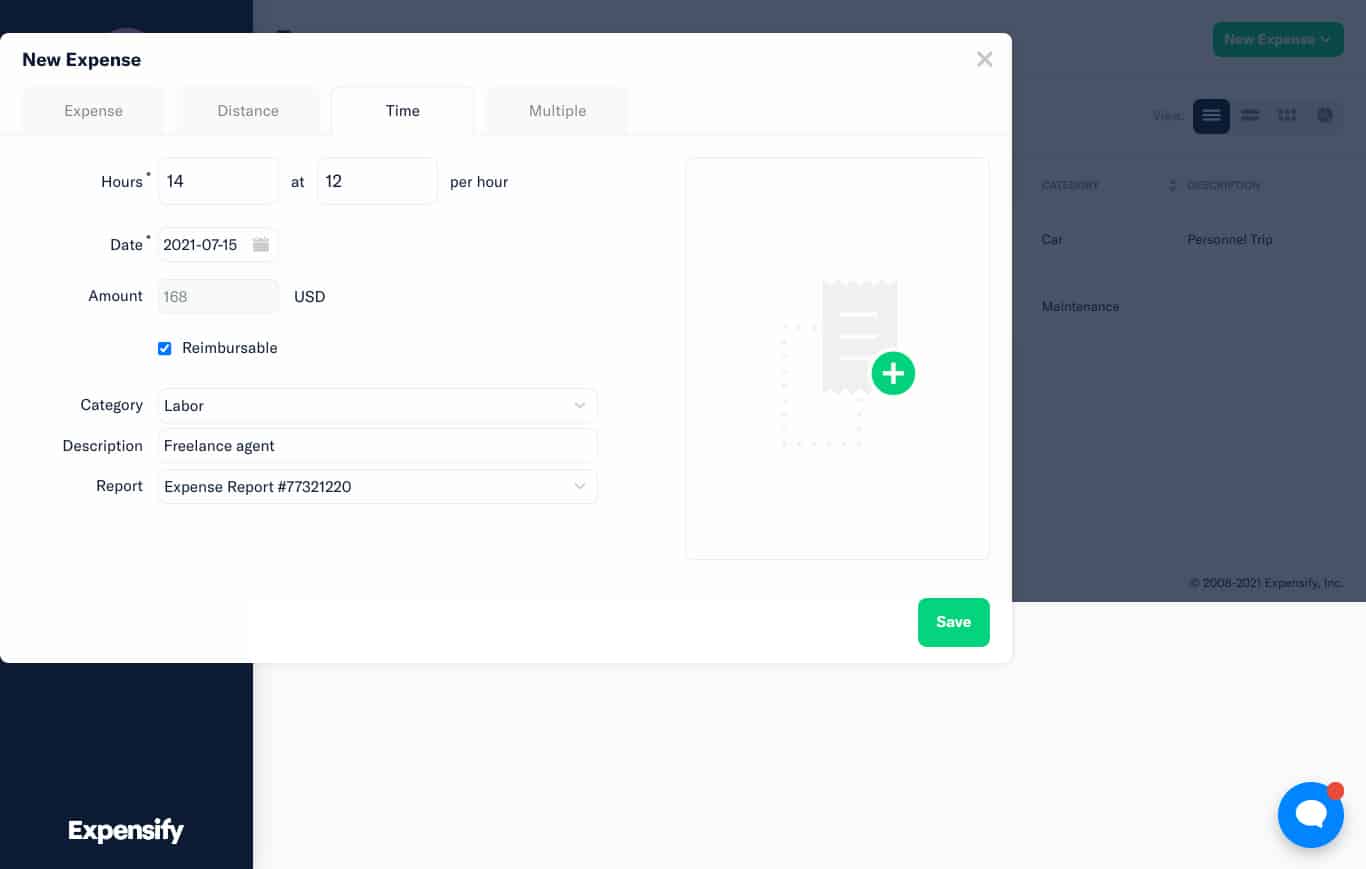

Expenses incurred based on billable hours are also accepted by the system. You can add the number of hours billed, and Expensify will do the rest.

Entering Expenses Based on Billable Hours

If you want to see a brief snapshot of your expenses, the Expense screen provides essential analytic tools like charts and graphs to visualize your transactions. You can also filter specific expenses based on status to assess your efficiency in approving expenses.

Visualization of Expense Categories

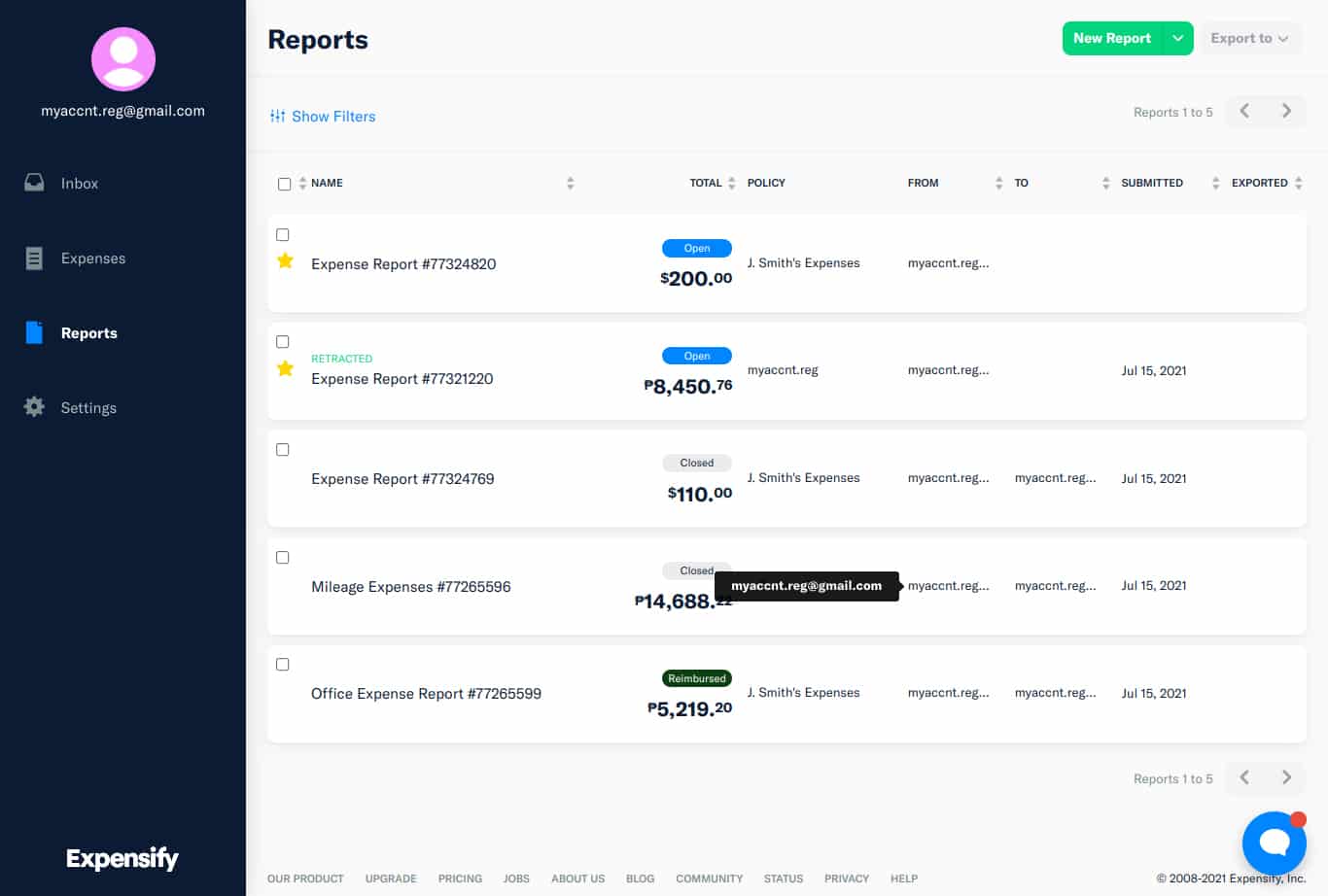

All expenses are pooled into a report that is then submitted to the approver. If you click Reports, it’ll show you all reports. The approver will review the report and approve or reject some of the items enumerated. Only approved items will move forward in the process.

Reports Overview

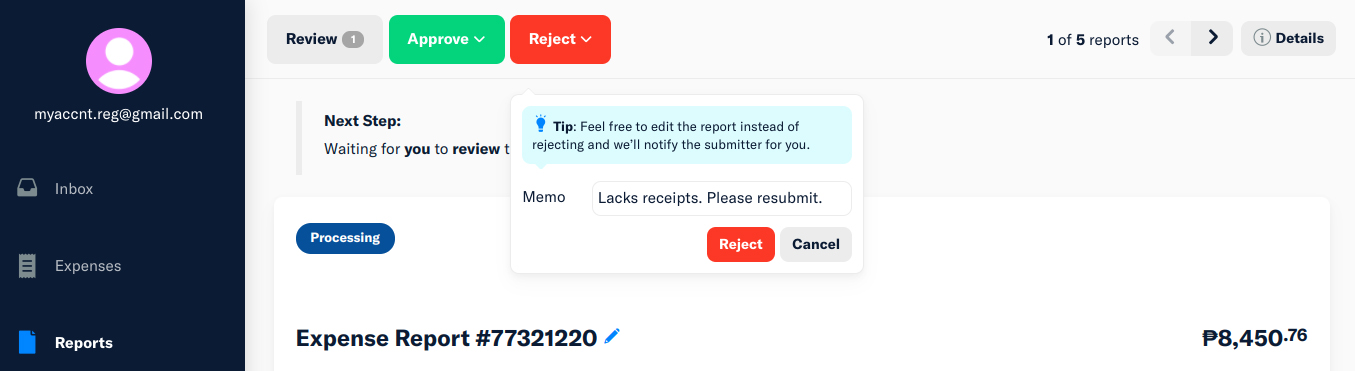

If the approver rejects a report, it goes back to the submitter and is marked as “Retracted.” All expenses in a rejected report will become Open again. However, after making the necessary changes, the submitter can resubmit it for approval.

Rejecting a Report

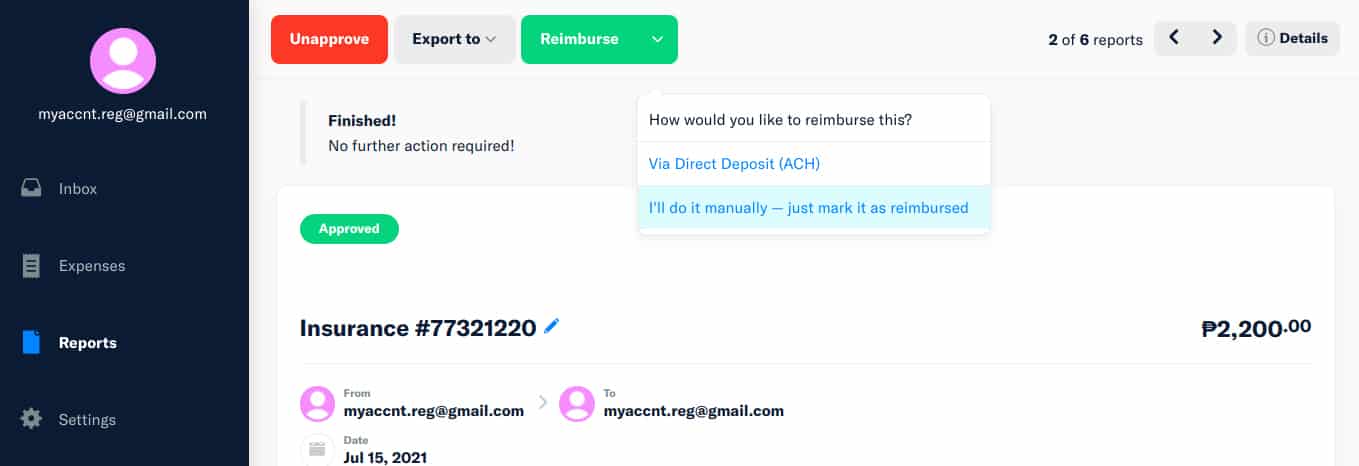

After approval, expenses are now ready for reimbursement. The system lets you reimburse via direct deposit or manual reimbursement.

Modes of Reimbursement

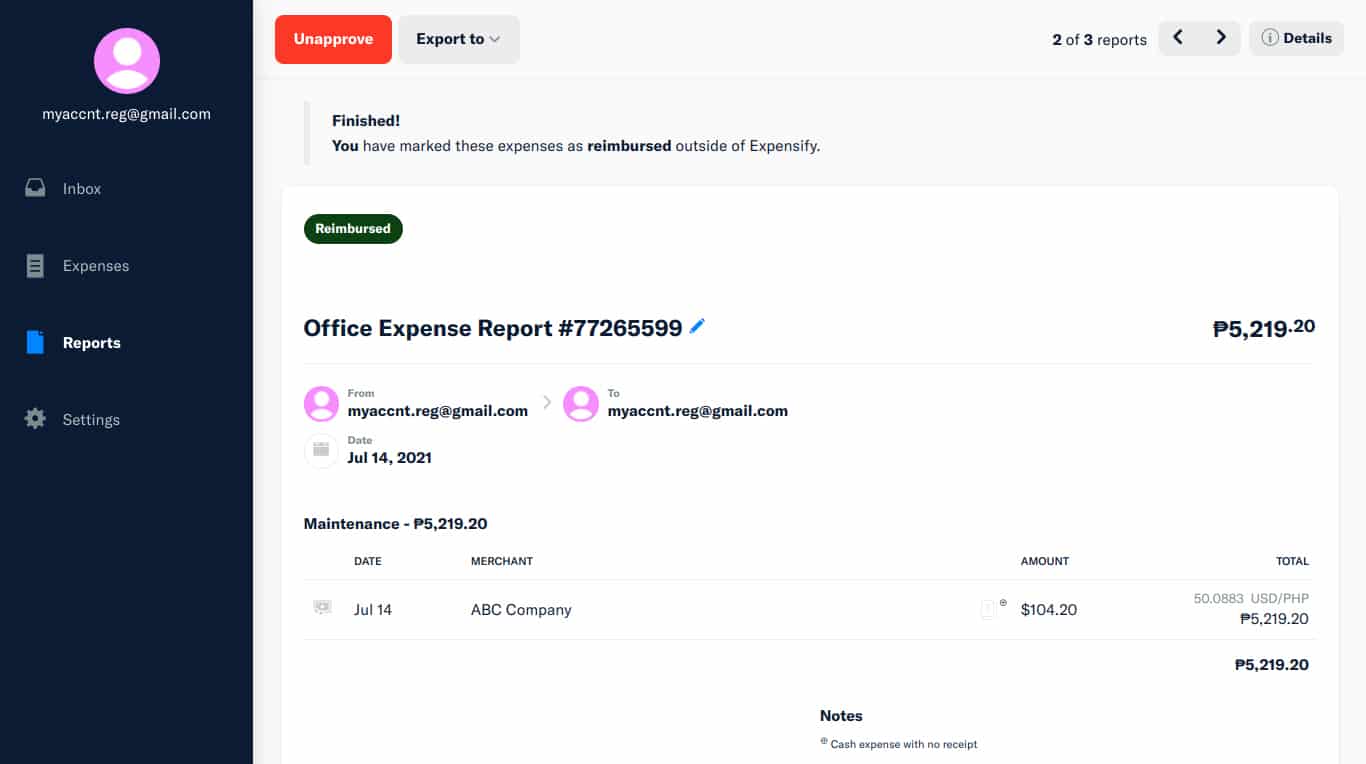

For direct deposit, you have to set up your bank account within Expensify, and it’ll be reimbursed via an automated clearing house (ACH). Manual reimbursements let you transfer cash physically while Expensify only marks the report as Reimbursed.

Approved and Reimbursed Report

One good thing about Expensify is it can issue Expensify Cards and allows them to integrate third-party corporate cards. However, the catch is that you can get Expensify plans for free if 50% of company expenses are on Expensify Cards. If you don’t meet these requirements, you’ll have to pay for the regular price of your plan. Expensify’s score in our evaluation dropped because Expensify Cards are exclusively Visa cards, whereas its competitors offer both Visa and Mastercard.

Overall, Expensify’s corporate card system is flexible. You get to integrate and retain your third-party corporate card while also having the ability to issue Expensify cards. However, keep in mind you can get Expensify for free if you mostly use Expensify cards vs third-party cards.

How We Evaluated Expensify

As part of our roundup of the best business expense tracker apps, we evaluated Expensify’s features and capabilities based on the following criteria:

15% of Overall Score

Pricing is an important part of your decision. In evaluating this criterion, we considered factors, such as a free trial, monthly and annual billing options, scalability, plan customizability, and price comparison with competitors.

40% of Overall Score

Since we’re evaluating expense trackers, we placed significant weight on expense tracking features. We evaluated this criterion based on the major expense workflow steps: recording, review, approval, and reimbursement.

25% of Overall Score

We include card programs in our rubric since we believe that expense tracking should be tied to the business’ card program. Here, we considered whether the provider can issue cards or enroll in third-party corporate programs.

20% of Overall Score

The ease of use score revolves around customer support channels, integrations, user reviews, and our expert rating. The software must make it easy for users to access support in case of problems. Moreover, it must have adequate integrations with other software so that it would be easier to insert it into existing business processes. We looked at user reviews from third-party websites for the user review scores. We weighed the comments and made sure that we remained objective in our evaluation.

Frequently Asked Questions (FAQs)

Expensify is free for individuals. Business plans start at $10 per user, per month, if billed annually.

While Expensify can be expensive compared to competitors, users get free Expensify cards for the whole team. Expensify is worth it if your business wants to give all employees a company card.

Bottom line

Overall, Expensify is the ideal app for businesses needing to process and reimburse expense reports. Its features can help accountants and accounting clerks speed up bookkeeping procedures and correctly book expenses based on Expensify reports. In other words, expenses processed under Expensify will provide more accurate information for bookkeeping than those tracked manually in a spreadsheet. We highly recommend it as a supplementary app to your accounting software. However, it’s not a standalone bookkeeping program.