Food Liability Insurance Program (FLIP) is a simple, easy, and affordable option for small businesses that operate in the food vendor space. Some of the industries FLIP covers include food trucks, food vendors, bartenders, food manufacturers, and caterers. Coverage is streamlined and presented straightforwardly, so choosing coverage and purchasing insurance online from FLIP is very easy.

Pros

- Easy online interface

- Available in all 50 states

- Appetite for alcohol-related industries

Cons

- Claims reporting only through the dashboard

- Limited number of coverages available

- Not open on the weekend

Standout Features

- General liability insurance policy with broad coverage and healthy limits for an affordable price

- Easy-to-use system to get insurance or add coverage

- Very affordable, with starting insurance costing $299 annually

- Designed with the food industry in mind, so coverages match the expected risks and needs

Financial stability: FLIP policies are serviced by the Great American Insurance Group (GAIG). AM Best rated GAIG an A+ (Superior).

FLIP Alternatives

Best for businesses looking to save money by comparing quotes | Best for 24/7 availability and in-house adjusters | Best for small business owners with a claims history |

A- to A+ (Excellent to Superior) Financial Rating | A+ (Superior) Financial Rating | A- to A+ (Excellent to Superior) Financial Rating |

FLIP Program Options

FLIP is an offshoot of parent company Veracity Insurance, and its offerings are limited but growing. Veracity Insurance began by specializing in product liability insurance. Accordingly, FLIP’s main offerings include general liability with product liability.

General liability insurance is the main policy offered by FLIP. Its general liability insurance, similar to other general liability insurance policies, provides coverage for property damage, bodily injury, and personal and advertising injury coverage.

The policy also includes medical payment coverage. However, it includes coverage for property (through inland marine), product liability, and premises liability, too. Thankfully, through its website, FLIP makes it very easy to see coverage and limits that are part of its base policy.

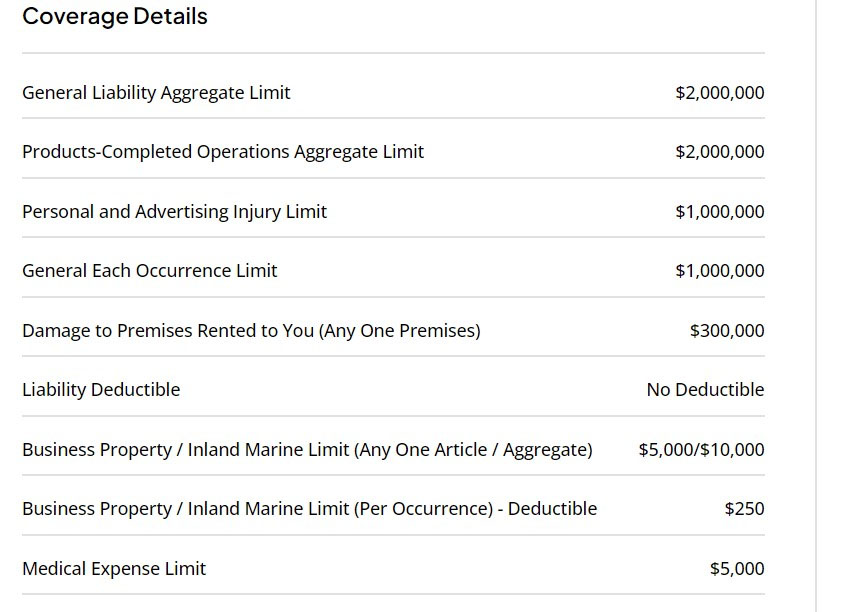

FLIP’s coverage details

FLIP’s general liability offering contains all the components of a general liability policy that you need:

- Standard general liability (property damage and bodily injury)

- Product liability

- Premise liability

- Personal and advertising injury

- Medical payments

It is uncommon to find all of these layers of protection in a standard general liability policy, especially with high limits like $1 to $2 million (depending on the coverage). As you can see, FLIP’s general liability policy is the Cadillac of liability policies.

FLIP offers liquor liability insurance coverage in two forms: as a standalone policy or with general liability insurance:

- The liquor liability policy with general liability is the Platinum option and carries the same coverage listed above, with liquor liability carrying limits of up to $1 million per occurrence and $2 million aggregate.

- The standalone liquor liability policy is the Gold policy, which carries the same limits of $1 million per occurrence and $2 million aggregate.

Both policies come with the option to purchase assault and battery coverage.

Another coverage FLIP offers that reflects its commitment to the food industry is a special event insurance policy. It is somewhat related to FLIP’s liquor liability option described above.

Special event coverage from FLIP has two options, Silver and Bronze:

- The Silver package is comparable to the Platinum option for liquor liability listed above but provides coverage for just three days.

- Likewise, the Bronze package corresponds to the Gold policy for liquor liability described above but lasts for only three days of coverage.

Finally, the last main line of coverage available through FLIP is workers’ compensation. This coverage was just added to FLIP’s offerings in January 2024. The industries it supports appear to be narrower: food truck operators, home bakers, and caterers.

FLIP’s workers’ comp coverage comes with two components:

- Standard workers’ compensation: Covers employee injury or illnesses suffered as a result of their job

- Employer’s liability: Covers expenses related to liabilities outside of the usual workers’ comp, or if the affected employee sues your business

A neat feature of FLIP’s workers’ comp is that you can purchase it online. Workers’ comp also can be bundled with general liability.

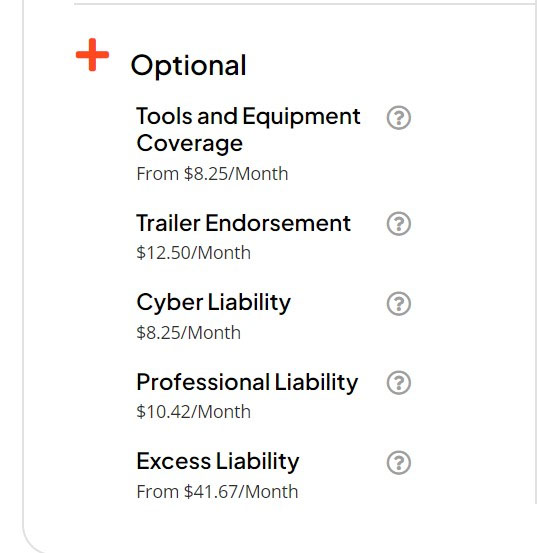

Above and beyond its main insurance offerings, FLIP has several optional add-ons to its primary general liability insurance coverage, including tools and equipment coverage, cyber liability, professional liability, and more.

Again, the simplicity of FLIP’s user interface and the company’s cost transparency are on display. The optional add-ons are available from the main policy purchase page.

FLIP’s list of add-ons

FLIP Industries Covered

As the name implies, FLIP targets industries in the food sector. When surveying its published list of target industries, I found that the businesses it serves are pretty encompassing. Rather than list all the industries it covers, I’ll direct your attention to a few that stand out:

- Bartenders

- Dram shops

- Personal chefs

- Food festivals

- Commercial kitchens

Interestingly, FLIP does not cover restaurants. It includes restaurants in its list of excluded activities and provides a link to the broker CoverWallet to get a quote for restaurant insurance.

Specifically, FLIP states that coverage is excluded for the “Owner or operator of a food court/storefront Restaurant, Cafe, Bakery, Tavern or Similar Establishment, with Operations Where You Own or Lease the Space Where Customers Enter to Purchase Food or Beverages.”[1]

FLIP Insurance Quotes & Costs

One of FLIP’s standout features is its easy policy shopping and purchasing experience. In just minutes, you can purchase an active policy at an affordable price.

How To Get FLIP Program Insurance Quotes Online

Getting a quote from FLIP is a unique experience from what you’ll encounter with most carriers and brokers, but it is straightforward. It is a bit like eating at a buffet.

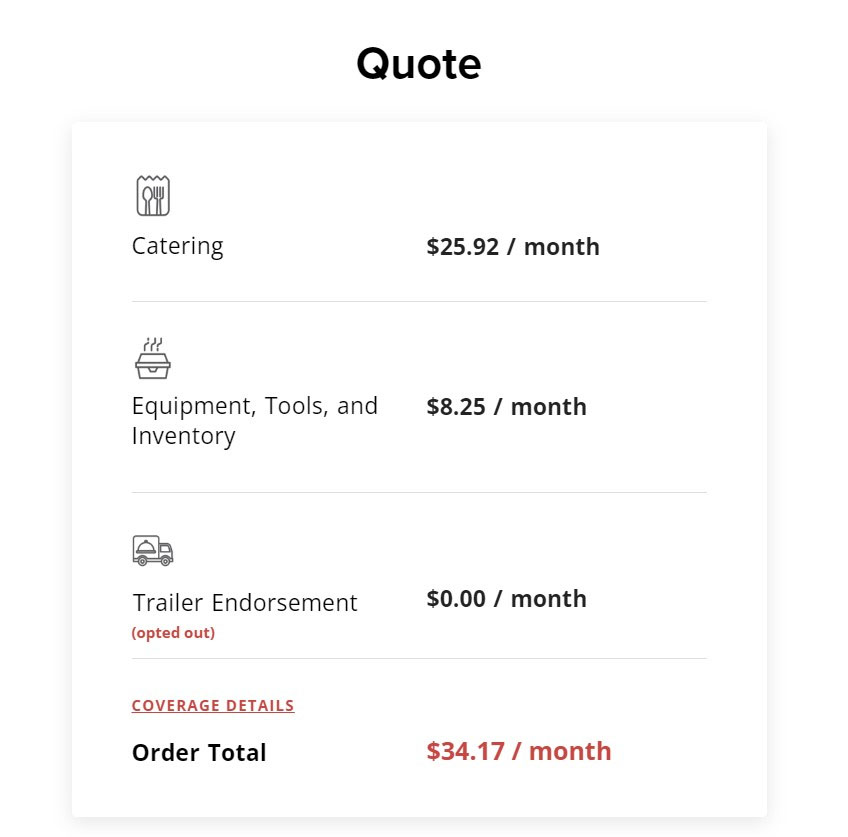

FLIP has streamlined its underwriting and quoting algorithms and can offer straightforward insurance. It offers you its base policy of general liability. From there, you can select whether to add some additional coverages, like inland marine. With each additional coverage, the price is displayed clearly. When you’re done, you’ll “check out” or buy the policy.

So, to get started from nearly any page on its site, select “Buy Now.” For example, I received the following quote for a catering company in less than a minute.

My sample quote from FLIP

FLIP Insurance Pricing

FLIP’s pricing is also straightforward. The base policy begins at $25.92 a month. From there, the cost will depend on what types of coverages you need or would like to add.

For example, in the above quote, I chose the lower coverage for tools and equipment, which was $8.25 monthly. I could have chosen the second tier, which costs $28.25 a month, or I could have decided not to protect tools and equipment.

Likewise, in the above quote, I could have also chosen the endorsement to extend liability to a parked trailer for $12.50 a month.

Other costs from FLIP might include:

- Cyber insurance at $8.25 monthly

- Professional liability at $10.42 monthly

- Excess liability at $41.67 monthly

For policies that include liquor liability, the costs are higher—but that is to be expected given the extra risk incurred when alcohol is involved.

Coverage | Starting Costs |

|---|---|

General Liability With Liquor Liability | $429 annually |

Liquor Liability | $200 annually |

General Liability With Liquor Liability for Special Events | $134 for the event |

Liquor Liability for Special Events | $105 for the event |

FLIP Claims Process & Other Services

Because FLIP is a managing general agent (MGA), it operates in a space between a traditional agent and a carrier. This means FLIP can assist you with most policy services for which you would traditionally contact an insurance provider.

Other Customer Services

Once you become a FLIP policyholder, your account dashboard is the primary resource for managing your policy. From this dashboard, you have 24/7 access to your policy documents.

Additionally, the account dashboard is where you add additional insureds and download a certificate of insurance (COI). A nice feature of FLIP is that it doesn’t charge fees for additional insureds.

If you need to speak with someone, keep in mind that FLIP only operates during weekdays. You can email them, use a chat function, or call. Its hours are Monday through Friday, from 7:30 a.m. to 4:30 p.m., Mountain time.

Claims Services

Claims services is one area where FLIP falls short, but this is true for any MGA operating in this space. Claims are initiated from the dashboard, and an adjuster from GAIG will contact you after a claim is received.

FLIP Insurance Reviews

Given that FLIP has issued over 32,000 policies, I expected to find more reviews online—but there are surprisingly few. That said, I looked at several sources to understand how policyholders feel about their experience with FLIP.

As odd as it may be, insurance is not federally regulated but is instead monitored at the state level by local insurance departments. Most state insurance commissioners participate in the National Association of Insurance Commissioners (NAIC), which provides data on complaints filed at the state level against carriers. This review data from the NAIC is one effective way to get a picture of how a company is doing.

While FLIP doesn’t have an NAIC code due to its status as an MGA, GAIG does. Looking at the trend report for 2022 (the most recent data available), GAIG has received zero complaints!

Narrowing our focus to FLIP’s customer experience, I found that policyholders have posted quite a few reviews on Google, which are also published on FLIP’s webpage as testimonials.

When surveying the ~360 reviews, FLIP has a rating of 4.8 out of 5 stars on Google[2]. When I surveyed the first page of reviews, I noticed several themes: people speak of the easy signup process for insurance and the affordability of its policies.

Frequently Asked Questions (FAQs)

Yes, FLIP is a legitimate provider of insurance for small businesses in the food and beverage space. It offers most of the policies a business would need either to participate in an event or to be protected from third-party claims of negligence.

FLIP’s primary offerings are liability insurance, including general, professional, and excess liability. It also has several endorsements to expand coverage, such as cyber liability and inland marine. It recently started selling workers’ compensation.

FLIP insurance pricing is standardized and affordably priced, with the base policy starting at $25.92 per month. If you need liquor liability, a standalone policy starts at $200 annually, or a combination of liquor liability and general liability starts at $429 annually.

There are three ways to reach FLIP: send an email, connect with a licensed, noncommissioned agent via online chat, or call (844) 520-6992.

FLIP is located in Utah, so its hours of operation correspond to Mountain time. You can reach a representative from Monday through Friday, 7:30 a.m. to 4:30 p.m.

FLIP is a risk-purchasing group owned by Veracity Insurance. Veracity is a brokerage and MGA that works with several carriers. For FLIP policies, Veracity partners with GAIG.

Bottom Line

FLIP specializes in liability and a few other coverages (most recently workers’ comp) for small businesses in the food and beverage space. Honestly, it is hard to find another way for food and beverage businesses to purchase insurance as quickly or as simply as they can with FLIP. In just minutes, you can build out the coverage you need for your business and then complete the purchase online. You can also call and speak with a noncommissioned agent.

Sources:

[1]FLIP | Who We Insure

[2]Google Reviews | FLIP