A high-risk merchant account is used when financial institutions consider a business highly susceptible to chargebacks and fraud. Operating a high-risk business makes it harder to open a merchant account, just like certain factors can impact your business’s ability to get insurance coverage or financing. Businesses declined by a traditional merchant services provider can opt for a high-risk merchant account instead.

High-risk merchant account providers are supported by banks ready to bear the risk of transactions likely to suffer from fraud. By partnering with these banks, high-risk merchant service providers can work with businesses or individuals with less-than-stellar credit.

Based on our evaluation, the best high-risk merchant account providers are:

- PaymentCloud: Best overall (and most versatile)

- Durango Merchant Services: Best for online and international sellers

- First Card Payments: Best one-stop shop

- SMB Global: Best for chargeback monitoring

- eMerchantBroker: Best for online CBD sales

- Soar Payments: Fastest application process

Flexible payment processing for any business |

|

Top High-risk Merchant Accounts Compared

Please note that actual high-risk merchant fees are always custom-quoted based on specific business factors. Figures shown in this guide are averages and estimates we obtained from each processor.

PaymentCloud: Best Overall for High-risk Merchant Accounts

Pros

- Works with most ecommerce platforms and all payment gateways

- Fast application and setup

- Seamless merchant account migration

Cons

- Monthly fees for payment gateway and virtual terminal

- Limited customer support hours

Overview

PaymentCloud takes a very hands-on approach, helping businesses through the application process and using multiple backend processors to find the lowest rates. Once onboarded, it continues to offer dedicated support for key functions, such as cardholder subscription migration management and advanced fraud/filtering setup for your payment gateway.

The provider also makes migrating easy by providing you with a pricing structure you’re familiar with (fixed-rate, interchange-plus, tiered). It integrates with all payment gateways, so you can continue using your provider without interruption, or it can assist you in finding a more compatible payment gateway solution.

- Monthly fee: $10-$45

- Payment gateway fee: $15/month (average)

- Virtual terminal: $15-$45/month

- Transaction fees:

- Low-risk: 2%-3.1%

- Medium-risk: 2.3%-3.4%

- High-risk: 2.7%-4.3%

- Chargeback fee: $25

- Cancelation fee: Waived

- Payment types: All major credit cards, debit cards, automated clearing house (ACH), and cryptocurrency payments

- Online payment methods: Payment gateways, virtual terminal, and online shopping cart integrations

- In-person payments: Credit card terminals, POS systems, and mobile payments (including text-2-pay)

- Payment gateway agnostic: PaymentCloud integrates with all payment gateway platforms so merchants can continue using their providers without interruption

- Chargeback prevention: Partnership with Chargeback Gurus to get instant dispute alerts, dispute tracking, a dispute cause analyzer, and prevention analysis

- Fraud prevention: Industry-standard AVS technology, tokenization, 3D Secure, and temporary payment halts to verify cardholders and pause suspicious transactions. Additionally, PaymentCloud customizes velocity filters in your payment gateway to limit authorizations per hour or minute, reducing fraud

- Level 2 and 3 processing: PaymentCloud supports B2Bs with level 2 and 3 data processing for securing large-scale transactions

PaymentCloud works with MATCH list businesses. It also has one of the most extensive lists of approved industries out of all the high-risk merchant services providers on our list, boasts a 98% approval rating with its banks, and offers free quote comparisons.

PaymentCloud works with the following industries classified as high-risk. (Source: PaymentCloud)

Durango Merchant Services: Best for Online Sellers

Pros

- Fast onboarding with high approval rates

- Free fraud reduction tools and consultation

- Multicurrency merchant account

Cons

- Limited Mountain time support hours

- Does not work with companies offering remote computer support

Overview

Durango Merchant Services is one of the oldest merchant service providers specializing in high-risk accounts. It is one of the more lenient high-risk merchant account providers, especially when helping small businesses with bad credit secure payment processing services.

Its proprietary Durango Cart shopping cart technology and Durango Pay payment gateway’s built-in load balancing feature make it a great option for online businesses. Durango Merchant Services also works with offshore and international businesses and companies on the MATCH list.

- Monthly fee: $30 (including payment gateway)

- Transaction fees:

- Ecommerce/MOTO: Interchange plus 0.25%

- Payment gateway: 10 cents per transaction

- Authorization fees: 15-25 cents

- Rolling reserve requirements: 0%-10%

- Chargeback fee: $25

- Early termination fee: $0

- Payment types: All major credit and debit cards, ACH, e-check payments, and cryptocurrency

- Payment methods: Point-of-sale payments, mobile payments through the iProcess app, online payments via Durango Cart, or integration with ecommerce or web builder platforms with the Durango Pay payment gateway

- Fraud protection: All accounts come with anti-fraud services, including Verified by Visa, Mastercard SecureCode, Fraud Scrubbing, and EMV 3d Secure 2.0

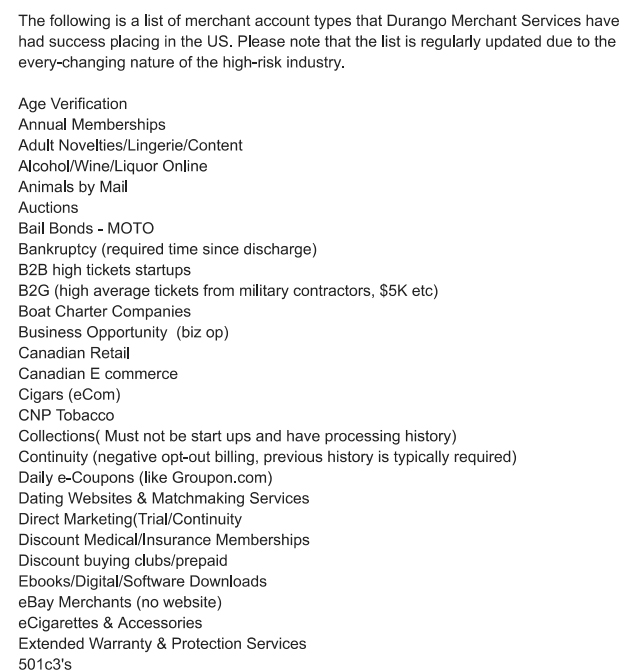

All the merchant account providers on our list accept a wide range of companies—and Durango is no exception. The company works with membership businesses, horoscope and fortune-telling services, mail or telephone order (MOTO) businesses, multilevel marketers, online auctions, telemarketing or telecommunications firms, timeshare advertisers, high-ticket businesses, pawnshops, and more.

Unlike most of the other merchant account providers in our guide, Durango does not explicitly list all of the businesses it works with, but a Durango representative shared a copy of high-risk businesses that it has successfully approved for a merchant account.

Click to view Durango Merchant Services’ merchant list:

First Card Payments: Best One-stop Solution for High-risk Merchants

Pros

- Offers 25% savings on current rates

- Works with offshore merchants and specializes in B2Bs

- Business operations integrations

Cons

- Very limited client reviews

- Limited customer support hours and FAQs on its website

Overview

First Card Payments has been around for 20 years in the industry with 30+ financial institution partnerships, boosting its ability to get approvals for its high-risk merchant services clients. It offers ACH, in-person, and online payments processing, and works with almost all types of high-risk merchants, including offshore, and even specializing in working with B2Bs.

The system also provides business operational support through partnerships with other companies such as web development and search engine optimization (SEO) services through Zulushack Digital. It also has customer management services through Nextiva, and call center services through a Panama call room company.

While its rates are not publicly available, we liked how easy it is to get a response from First Card Payments for pricing information. It also offers a unique promise of reducing 25% of current merchant fees for businesses that would switch over to First Card Payments.

- Monthly fee: Custom

- Transaction fees:

- Interchange plus 0.25%-2.5% plus 10 cents to 20 cents

- Can also work with flat-rate pricing

- Offers 25% cheaper fees compared to existing rates with current processor

- Chargeback fee: $15-$35

- Early termination fee: $0

- Application and setup fee: $0

- Contract length: Month-to-month for 90% of merchants

- Payment types: Card-present, card-not-present, and ACH payments

- Payment methods: Card terminals, POS integrations, payment gateways, and online shopping cart integrations

- Offshore and B2B merchants: First Card Payments specializes in working with B2B merchants with level 2 and 3 data processing as well as companies that operate offshore

- Chargeback prevention: Offers a chargeback mitigation program that alerts merchants as early as 78 hours before a chargeback occurs and provides expert support to work on winning any chargeback

- Business operations partner: First Card Payments also offers in-house and integrated partners for operational support such as web development, SEO, call center, and phone services

- Business financing: First Card Payments offers a merchant cash advance program to start-ups and small businesses looking to sign up for a merchant account

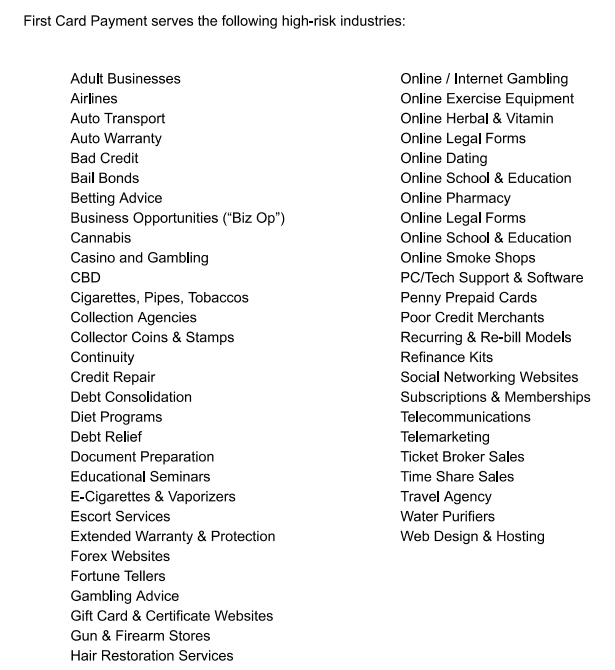

First Card Payments works with a wide range of high-risk businesses, including poor credit and high-volume merchants, B2Bs, and offshore companies. It also works with businesses in the MATCH list.

Click for the complete list of high-risk businesses supported by First Card Payments:

SMB Global: Best for Chargeback Management

Pros

- Excellent chargeback support

- Supports offshore accounts

- 175+ online shopping cart integrations

Cons

- Lacks a native payment gateway

- Stricter guidelines for approving CBD businesses

- Very limited user reviews

Overview

SMB Global is a merchant service provider partner of Payline Data, a popular and reputable low-risk processor. SMB Global exclusively deals with high-risk and international businesses. It offers robust chargeback prevention features (including an auto-response feature to fight chargebacks quickly). SMB Global also has two popular payment gateway options—and each integrates with more than 175 online shopping carts.

User reviews are limited, but those who rave about SMB Global claim qualifying for a month-to-month contract with zero rolling reserve requirements and unlimited processing volume. Interestingly, SMB Global and Payline Data also partner with top-ranked PaymentCloud.

No publicly disclosed pricing. The standard policy for high-risk merchant accounts is from month-to-month to up to three-year long-term contracts, plus as much as $500 in early termination fees.

Additionally, there may be extra fees for processing different payment methods, such as credit cards, ACH transfers, and digital wallets. It’s important to review the contract thoroughly to understand all potential costs.

- Payment types: All major credit and debit cards, ACH, and e-check processing

- Payment methods: POS terminals, including Verifone; online and mobile payments available through Authorize.net and NMI payment gateways

- Short application process: Sends your application to many processing partners to find the best rates and contract terms (like most other high-risk merchant accounts)

- Offshore merchant accounts: SMB Global assists high-risk businesses in applying for offshore merchant accounts, providing broader underwriting guidelines and higher processing volume caps

- Chargeback prevention platform: The analytics platform shows real-time chargeback counts and ratios, forecasts month-end results, and auto-responds to chargebacks for quick, accurate disputes

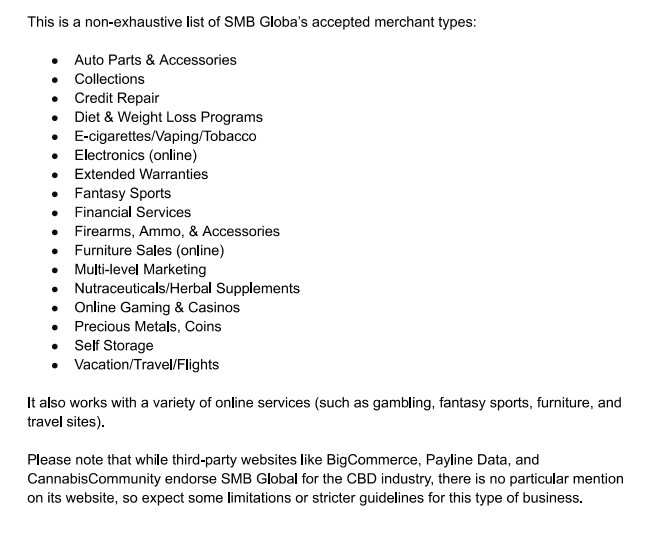

Like PaymentCloud, SMB Global has a long list of products, industries, and services it works with. It is worth noting that SMB works with many types of unconventional product sales, including auto parts, weight loss programs, electronics, firearms, supplements, and collectibles.

Click to view SMB Global’s highlighted list of approved merchants:

eMerchantBroker: Best for Online CBD

Pros

- Specializes in CBD (including edibles and vape)

- Chargeback prevention system

- Zero monthly fee ecommerce integration

Cons

- Limited in-person processing tools

- Long-term contracts

- Early termination fees

Overview

eMerchantBroker (EMB) is one of the few credit card processing companies that actively advertises working with CBD and hemp vendors and medical marijuana dispensaries. It boasts a 99% payment processing approval rating for its merchant clients. Users also rave about eMerchant Broker’s onboarding experts and 24/7 customer support staff.

If you sell CBD oil, vapes, extract, or edibles and have trouble getting approved for a merchant account, eMerchantBroker is a good option. PaymentCloud also supports CBD businesses, but EMB has worked with them in detail as well. So make sure to ask industry-specific questions and compare fees before signing up with either.

- Monthly account fee: Varies

- Transaction fees: Varies

- Ecommerce plan: $0 monthly fee, 10 cents per transaction, 0.6% fee on all EMB volume, requires a $50 monthly minimum transaction volume

- Payment gateway fee: $0 with proprietary payment gateway, up to $25 with partners

- Chargeback fee: $35

- Rolling reserve: 0%-10%

- Early termination fee: $0-$595

- Contract length: 1-3 years

- Payment types: All major credit and debit cards, checks, cryptocurrency payments

- Online payment methods: Accept online payments through a proprietary EMB payment gateway, Authorize.net, or integrations with Square, Wix, BigCommerce, and Shopify

- Chargeback prevention: Partnership with Verifi and Ethoca to minimize and notify merchants of chargebacks

- CBD merchant accounts: Works with businesses selling CBD supplements and vitamins, beauty products, CBD oil, pet products, hemp oil, vaping oil and pens, CBD edibles, creams and topical treatments, pain-relief sprays, extracts, and more

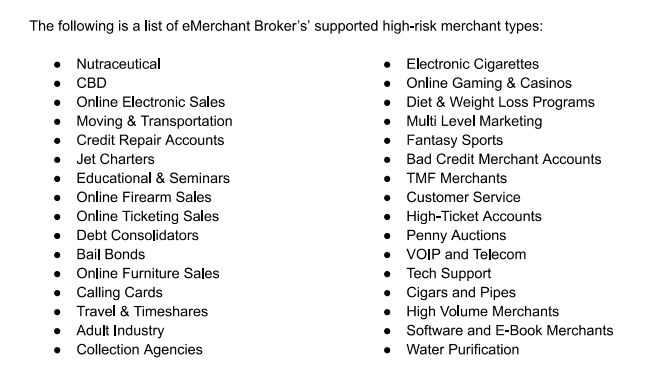

EMB works with a wide range of high-risk businesses, including electronic cigarettes, adult, tech support, credit repair, nutraceutical, collection, weight loss, and electronic businesses. According to its website, it has a 95% account approval rating, which is very high, especially for high-risk merchant services.

Click to view EMBs approved high-risk industries:

Soar Payments: Best for Instant Quotes & Automated Application

Pros

- Instant quotes and fast approval

- No application fees

- Integration with QuickBooks and other software

Cons

- Long initial contract term

- Steep early termination fees

Overview

Soar Payments is a high-risk merchant services provider that works with various industries and business types. It offers the most direct integrations with accounting, customer relationship management (CRM), and ecommerce platforms out of all the solutions on our list.

One of Soar Payments’ standout features is that it offers instant online quotes and a 24-hour approval process, which you cannot find in highly-rated alternatives. Note, however, that there is still an underwriting process that takes up to five business days.

- Average monthly fee: $19-$45

- Application and setup fees: $0

- Transaction fee:

- From 2.49% transaction fees for mid-risk merchants

- Tiered and interchange-plus pricing

- Early termination fee: $0 for some merchant accounts, otherwise $200-$395 depending on merchant standing

- Chargeback fee: $25-$30

- Rolling reserve typically: 5%-10%

- Contract Length: 2-3 years

- Payment types: All major credit and debit cards, ACH, and e-check

- Payment methods: POS payments, plus mobile and online payments through Authorize.Net, NMI gateway, and USAePay

- Chargeback protection: Partnership with Chargeback.com to include alert emails, representation to fight chargebacks, fraud detection, and more

- Approval process: Fully online application process, 24-hour turnaround time for approvals, plus an additional 3-5 business days for underwriting

- Deposit speed: Soar Payments takes 48-72 hours to process sending funds to your bank account

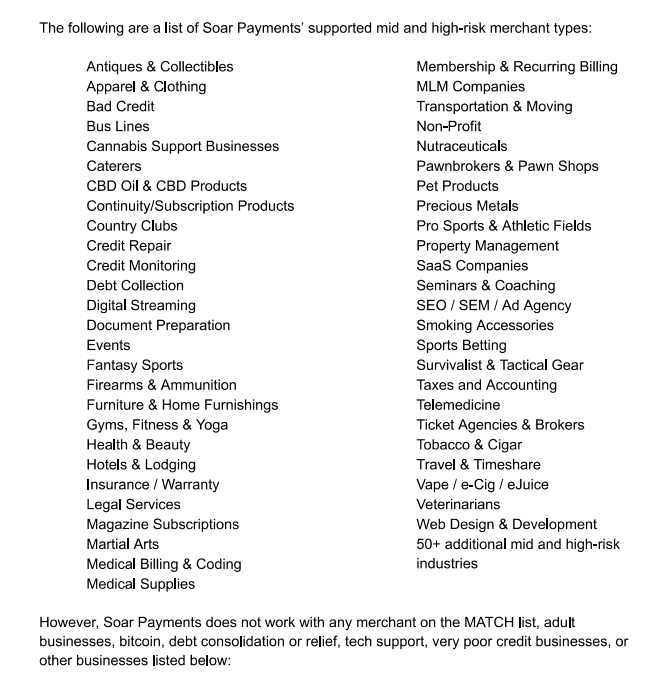

oar Payments works with over 50 high-risk business types, including those with bad credit and those involved in cannabis support, CBD products, credit repair and monitoring, fantasy sports, firearms, multilevel marketing, pawnbrokers, nutraceuticals, survivalist businesses, and travel.

Click on this list of Soar Payments’ accepted high-risk merchant types

High-risk Merchant Account 101

If you’re a new small business owner, you might be wondering whether your business falls under the high-risk category. It will also be helpful to know how to choose a high-risk merchant account provider and what the difference is between low-risk and high-risk merchants.

Do I Need a High-risk Merchant Account?

High-risk merchants are typically not approved for a traditional merchant account and instead require payment service providers that handle high-risk transactions. Most of our preferred small business payment processors, such as Square and PayPal, only work with low-risk businesses.

You need to apply for a high-risk merchant account if:

- Your product or service belongs in an industry known for being highly susceptible to fraud and chargebacks

- Your product or service belongs to a highly regulated industry

- You have poor credit record or low credit scores

- Your business is highly dependent on international sales

- Your business is included in the MATCH/TMF list

Low-risk vs High-risk Merchant Account

Here is a quick overview of high-risk vs low-risk merchant accounts:

Payment Feature | Low-risk Merchant Account | High-risk Merchant Account |

|---|---|---|

Monthly fees | From $0 | From $10 |

Transaction rates | Generally lower than high-risk | Higher due to transaction risk |

Chargeback fees | Can be waived | From $15 |

Rolling reserves | Can be $0 | Often required due to risk |

Contract length | From month-to-month | Often long-term |

Merchant application | At times not required | Required |

How to Choose Your High-risk Merchant Account

Although finding a provider that will accept your high-risk business can be challenging, you should not sign up with the first one you find. Choosing a high-risk merchant account provider requires careful consideration to ensure your business needs are met effectively.

Here are some considerations to keep in mind:

- Fee structure: Most providers offer custom quotes for high-risk merchants depending on the size and nature of their business. Look closely at the fees before signing up to prevent any unexpected costs.

- Contract terms: Carefully review the contract terms, including contract length, termination clauses, and any hidden fees or restrictive policies.

- Customer support: High-quality customer support is crucial. Verify the availability and responsiveness of the provider’s customer support team. Ideally, they should offer 24/7 support and have knowledgeable representatives who can assist you promptly.

- Available payment methods: Check if the payment methods you need match what the provider offers. Consider whether they support credit card processing, alternative payment options, international transactions, or any specific payment solutions relevant to your business.

- Expertise and industry knowledge: Look for a provider specializing or having experience working with merchants in your industry. They should have a deep understanding of the unique challenges and compliance requirements associated with your business type.

- Feedback and reputation: Look for reviews, testimonials, and feedback to gauge the provider’s reliability, customer satisfaction, and ability to deliver on their promises.

- Fraud protection and risk management: High-risk merchant accounts face a higher likelihood of chargebacks or fraud. Check for tools and support that the provider offers to help mitigate and manage the risks.

Need help applying for a merchant account? Download our free step-by-step guide:

How We Evaluated High-risk Merchant Accounts

High-risk merchant account providers partner with many different underwriting banks and will help you fill out an application to shop around for the best rates—so rates will vary. Hence, comparing providers based on fees or transparency will not provide the best recommendation.

Instead, we looked at the overall pricing structures and specific features—like load balancing, chargeback prevention, and protection tools—offered by each provider. We also prioritized processors that work to get merchants placed regardless of history or business type. Finally, we considered standard payment features, deposit times, customer support hours, and user reviews.

Based on our evaluation, PaymentCloud emerged as the best high-risk merchant account provider. It offers a lot of the much-needed high-risk merchant payment processing tools, along with plenty of hardware and solutions for online, storefront, and mobile sellers.

Click through the tabs below for our specific evaluation criteria:

30% of Overall Score

We awarded points to processors that have average contract lengths below the three-year industry standard, have minimal or negotiable rolling reserve policies, and do not charge cancellation or early termination fees and any application or setup fees.

20% of Overall Score

Processors earned points for offering point-of-sale payment options, ecommerce or shopping cart integrations, mobile payment solutions, and cryptocurrency payment processing. Though nearly every processor provides payment gateway solutions, we awarded bonus points to those that charge minimal or no fees.

30% of Overall Score

We prioritized 24/7 customer support and processors that offer dedicated account managers, include free chargeback monitoring and protection tools, and provide fast deposits. We also considered what industries and business types each processor works with, awarding points to those that are the most flexible.

20% of Overall Score

Processors earned points for positive user reviews and overall transparent pricing practices. Our experts also considered the company’s overall reputation, reliability, and their personal experience interacting with company representatives.

Frequently Asked Questions (FAQs)

These are some of the most common questions we get about the best high-risk merchant accounts.

A high-risk merchant is a business deemed risky by financial institutions, often due to high non-retail, card-not-present transactions, or a chargeback ratio over 1%. Businesses in vulnerable or questionable industries, like CBD vendors or offshore operations, are also classified as high risk. Financial institutions are cautious about offering merchant accounts to such businesses.

High-risk merchant accounts differ from low-risk ones by having higher fees and stricter volume restrictions. It’s advisable to apply for traditional merchant services first. PaymentCloud, our top choice, also serves low- and medium-risk businesses.

Bottom Line

If your business does not fall under the credit policies of a tier-one traditional bank, your application for a traditional merchant account may be rejected. In this case, you will need to find a merchant account provider that specializes in working with high-risk customers. However, choosing a credit card processor as a high-risk business can be tricky without knowing what to look for.

Overall, you want a provider that’s easy to work with and that you can trust to charge fair rates. PaymentCloud, our choice for the best high-risk merchant account services provider, is a reliable credit card processor that specializes in high-risk merchant accounts and works with many back-end processors to service a wide variety of online, ecommerce, and retail businesses. It also offers fast approvals, competitive pricing, and next-day funding. Get a free quote today.