Hiring from the Philippines may benefit your company and give you a competitive advantage. Many Filipino workers are experts in their fields, speak English, and can help your organization grow at a fraction of the cost you’ll pay US staff.

Before anything, decide whether to hire an independent contractor or a local employee. If you only need a few workers, then working with independent contractors is the way to go. However, if you plan to hire many workers, then setting up a business and hiring employees might be your best bet—or work with an Employer of Record (EOR) for an even easier time. We discuss these options more in-depth below.

Key Takeaways:

- Hiring employees from the Philippines is a different process from hiring contractors.

- You can either set up an entity or use an employer of record (EOR) if you decide to hire employees from the Philippines.

- There are several payroll laws you need to comply with when hiring employees from the Philippines.

Hiring Contractors in the Philippines

If you’re only hiring one or two employees, then getting independent contractors is your best bet; in fact, a lot of Filipinos are used to this setup, especially when working with US-based employers. However, you will have less control over the work done, and you may face stiff fines and penalties for misclassification if the worker should really be an employee.

Hiring contractors from the Philippines will generally follow the same process as hiring any international contractor, which includes, creating a job ad to post on job boards like OnlineJobs.ph, evaluating candidates, and making an offer. Here, we discuss considerations that are unique to the Philippines’ labor market.

Understanding the Difference Between Contractors and Freelancers

Although the terms “contractor” and “freelancer” are used interchangeably in the Philippines, there are subtle differences in how they are understood and utilized. The Philippines House of Congress has passed House Bill 6718, or the Freelance Workers Protection Act, which defines these terms, including the scope of services they can offer. It also contains provisions that help independent contractors and outlines the benefits a freelancer is entitled to, such as hazard pay and night differentials.

Here’s a table to give you an overview of the differences between a freelancer and a contractor in the Philippine context:

Freelancer | Contractor | |

|---|---|---|

Type of Work | Offers services independently on a per-project basis | Hired for specific projects or specialized services |

Autonomy of Management | High degree of autonomy over work; Usually work independently | Typically work on-site and location-specific; May employ teams or subcontractors for a project |

Client Acquisition & Contract Handling | Responsible for finding own clients; Negotiates contracts and sets rates | Usually hired by clients or businesses for projects; May negotiate terms but typically work under a contract |

Range of Services | Offers a wide range of services for a wide array of industries (writing, design, etc.) | Specialized services in trade-related industries, such as construction, home renovations, and maintenance |

Work Location | Often work remotely | Work is usually on-site |

Online Platforms (in PH) | Many work on online platforms like Upwork, etc. | Not typically associated with online marketplaces |

Withholding Taxes and W-8BEN Forms

This can initially seem complex but is actually fairly straightforward. If the independent contractor lives and does all their work for you inside the Philippines, then you don’t have to withhold taxes.

Here’s the catch: if the independent contractor ever comes to the US and does work for you while in the country, then the compensation for work done domestically will be taxed by the US. That’s why you must have them complete Form W-8BEN or W-8BEN-E. These forms must be completed by the foreign independent contractor and retained by your business—you don’t file them with any government agency. The purpose of these forms is to ensure you don’t have to withhold taxes—or, if you do, you withhold at the appropriate rate.

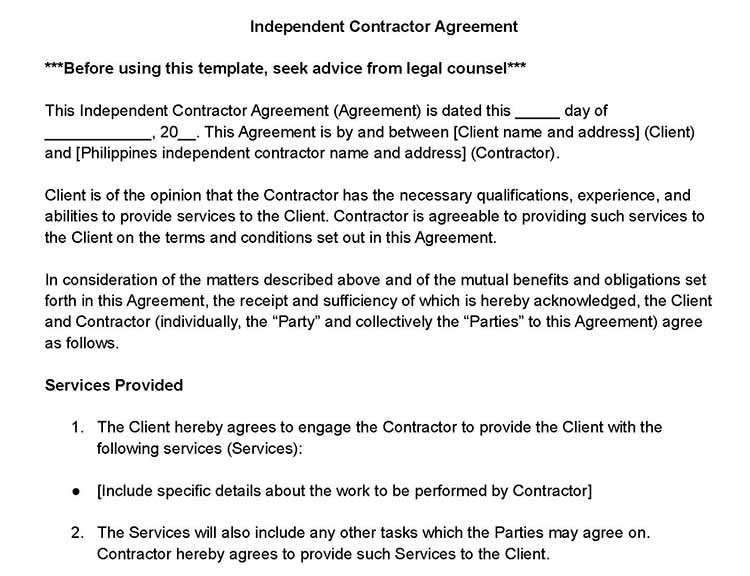

Using an Independent Contractor Agreement

When you hire international independent contractors, the way you make a job offer is to provide an independent contractor agreement. This agreement will lay out the terms and conditions of your relationship, clearly stating what you need the independent contractor to do and that there is no employer-employee relationship.

Your agreement should include:

- A specific description of the project, including a term or duration if known

- Payment rate, terms, and an administrative fee of not less than 10% of the total contract amount

Here’s an example of what it should look like, using the case of hiring a Filipino virtual assistant (VA) as an example:

A US-based digital marketing company, XYZ Digital, wants to know how to hire from the Philippines to help manage their social media accounts and handle administrative tasks. The VA only provides virtual assistant services to other companies and uses their own computer, internet, and equipment. They are responsible for choosing their work hours and deciding how to manage their time and workload effectively.

XYZ Digital and the contractor have entered into an independent contractor agreement, which lays out the terms and conditions of their relationship. The document specifically notes that the Filipino VA is an independent contractor and not an employee of XYZ Digital.

Paying Contractors in the Philippines

You’ll need to set up a regular payment system to pay the independent contractor. You can pay by wire transfer, but that may come with cost-prohibitive charges, especially if you’re paying more than once per month.

The most popular option is to use a digital payment platform, like Wise, Payoneer, and Veem. Once both you and the Filipino independent contractor have accounts on the same platform, it’s simple and quick to transfer money to them. You can enter a US dollar amount, and the contractor will get their money in their local currency (Philippine Pesos).

Before paying freelancers, remember to always verify their payment details carefully and use secure, reputable payment platforms that offer buyer protection against fraud. Be wary of requests to use less common payment methods.

Hiring Employees in the Philippines

If you are unsure how to hire employees in the Philippines, there are two ways to go about it: set up an entity or use an employer of record (EOR).

Setting Up an Entity

Establishing a legal entity in the Philippines requires careful planning and execution. Here’s what the process involves:

- Choose the business structure (most common is a domestic corporation with foreign ownership)

- Register with the Securities and Exchange Commission (SEC):

- Reserve your company name

- Submit articles of incorporation and other required documents

- Pay the required fees

- Get a Taxpayer’s Identification Number (TIN) from the Bureau of Internal Revenue (BIR)

- Register with local government units.

- Get a business permit from the city/municipality

- Secure barangay clearance

- Register with mandatory government agencies

- Social Security Systems (SSS)

- Philippine Health Insurance (PhilHealth)

- Home Development Mutual Fund (PAG-IBIG)

- Open a bank account

While the procedure can be complex, engaging local legal counsel or consultants can significantly streamline the process.

The primary advantages of setting up a local entity include full operational control, direct employment capabilities, and a demonstration of commitment to the Philippine market. This can be particularly beneficial when cultivating relationships with local partners and clients. It’s crucial to note, however, that the Philippines maintains restrictions on foreign ownership in certain industries.

Using an Employee of Record

An employee of record acts as the legal employer for your workforce in another country (in which case, the Philippines), managing critical functions such as payroll administration, benefits provision, and regulatory compliance. The arrangement allows your company to maintain control over day-to-day operations and employee management while outsourcing the complexities of local employment regulations.

Hiring international employees or contractors can be quite tricky, especially if you are not aware of the legal requirements in a specific country. You can eliminate that hassle by using an EoR. It can help you navigate the complexities of employment laws in different countries. It can also conduct compliance checks to ensure your employment practices align with local laws.

Here are our top picks of the best employer of record services for more options.

Best Employee of Record (EOR) Overview

Monthly Starting Pricing (per Employee) | Monthly Pricing for Contracting Employees (per Worker) | Setup Fee | Number of Countries | |

|---|---|---|---|---|

$599 | $29/worker | None | 170+ | |

Custom pricing (call for quote) | $20/worker* (call for quote) | None | 150+ | |

$599 | $30/worker | ✓ | 160+ | |

| $599 | $49/worker | None | 90+ |

| $400 | $40/worker | None | 150+ |

| Custom pricing (call for quote) | Custom pricing | Added to price | 187+ |

| Custom-priced (call for quote) | Included in quote | Custom pricing (call for quote) | 185+ |

| $599 | $29/worker | None | 130+ |

Cost of Hiring Employees in the Philippines

Upon hiring Filipino workers as regular employees, employers must adhere to several local payroll compliance regulations, including the deduction of main statutory contributions from employees’ salaries—income tax, Social Security, health insurance, and the Home Development Mutual Fund (HDMF)—and the 13th-month pay.

Income Tax

The Philippines income tax is composed of six brackets, with rates ranging from 0% to 32%. Employers don’t need to pay the income tax, but they must deduct it from their employees’ monthly salary. The brackets are as follows. Note that the figures represent the total annual salary of an employee:

- 0%: For taxable income of ₱250,000 or less

- 15%: For taxable income in excess of ₱250,000 but not exceeding ₱400,000

- 20%: For taxable income in excess of ₱400,000 but not exceeding ₱800,000

- 25%: For taxable income in excess of ₱800,000 but not exceeding ₱2,000,000

- 30%: For taxable income in excess of ₱2,000,000 but not exceeding ₱8,000,000

- 32%: For taxable income in excess of ₱8,000,000

The first ₱250,000 of taxable income is exempt from income tax. This means that a person with a taxable income of ₱250,000 will not pay any income tax. The income tax rates are applied on a progressive basis, which means that the higher your taxable income, the higher the percentage of tax you will pay.

Social Security

The Social Security System (SSS) is a social insurance program in the Philippines that provides benefits for retirement, disability, sickness, and death. Employers and employees are required to contribute to the SSS.

The monthly contribution rate is 9.5% for employers and 4.5% for employees, with a cap of ₱1,900 ($34.28) for employers and ₱900 ($16.24) for employees. For example, if an employee earns ₱15,000 ($270) per month, the employer will contribute ₱1,425 ($25.70) and the employee will contribute ₱675 ($12.18).

Philippine Health Insurance (PhilHealth)

The Philippine Health Insurance Corporation (PhilHealth) is a government-run health insurance program that provides health insurance coverage for all Filipinos. Employers and employees are required to contribute to PhilHealth.

The monthly contribution rate is 4% for both employers and employees, with an income ceiling of ₱80,000 ($1,443.50). So, if an employee earns ₱15,000 ($270) per month, the employer and employee will each contribute ₱600 ($10.83).

Home Development Fund

The Home Development Mutual Fund (Pag-IBIG Fund) is a government-owned savings and loan institution that helps Filipinos save for a home. Employers and employees are required to contribute to the Pag-IBIG Fund.

The monthly contribution rate is 2% for both employers and employees, regardless of the employee’s salary. So if an employee earns ₱15,000 ($270) per month, the employer and employee will each contribute ₱300 ($5.41).

13th-Month Pay

The 13th-month pay is mandatory for all private sector rank-and-file employees, regardless of their designation, position, employment status, or method by which their salaries are paid. However, it is not mandatory for government employees.

It is calculated based on the employee’s basic salary, which is the fixed amount of money that the employee receives monthly. It does not include overtime pay, bonuses, or other allowances. Simply get the employee’s annual income and divide it by 12.

For example, if an employee earns $18,000 a year, the monthly pay is $1,500 (₱84,981.74). This would represent the 13th-month pay amount—if the employee worked the full year. If not, you’ll need to calculate a prorated amount.

Calculating Prorated 13th-month Pay

Employees who worked less than a year will receive a prorated 13th-month pay. To calculate the prorated amount, simply multiply the employee’s monthly salary by the number of months they have worked and divide it by 12.

Here’s the sample computation of an employee with a $1,500 per month salary and who has been in the company for only four months:

$1,500 X 4 months = $6,000

6,000 / 12 months = $500 (₱27,679)

Based on the computation above, the employee’s prorated 13th-month pay is $500 (₱27,710).

Here’s a table that summarizes the cost of hiring a Filipino worker based on a $1,500 per month salary.

Gross Monthly Salary $1,500 | |

Employer cost and contribution | Employee salary and contribution |

Employee salary: $1,500 | Gross salary: $1,500 |

+ SSS: $33.45 | - SSS: $15.85 |

+ PhilHealth: $60 | - PhilHealth: $60 |

+ HDMF: $30 | - HDMF: $30 |

+ 13th-month pay: $125 | - Income tax: $375 |

Total monthly cost: $1,748.45 | Net pay: $1,019.15 |

How to Pay Employees in the Philippines

Foreign employers can utilize specialized payroll software to pay their employees in the Philippines. Employers who choose this method should make sure that their calculations and deductions are accurate. They also have to ensure that these deductions and calculations comply with local payroll regulations. After that, salary disbursement is done through bank transfers to a local account.

Many global organizations often choose to outsource their payroll operations in the Philippines for several reasons. Global payroll outsourcing providers offer specialized knowledge of local requirements while also providing the advantage of standardized processes across multiple countries.

Labor Laws in the Philippines

The Philippines has a comprehensive set of labor laws designed to protect workers’ rights and promote fair employment practices. Key aspects of these laws include:

Salary, Working Hours, and Overtime

The cost of living in the Philippines is much less than in the US—75% less, in fact. As such, salaries are also much less, averaging about $800 per month. However, depending on the work you need done, the skills required, and the experience you seek, you may need to pay much higher than the average.

Along with salary, you’ll need to ensure you have a way to pay your Philippine employees. There is no requirement of how frequently you make payments, but most Filipino workers are used to being paid twice a month.

The general workweek in the Philippines is 40 hours, and each worker is required to receive at least one one-hour break each day. Overtime is allowed at 1.25 times the regular hourly rate and must be paid to employees working over 40 hours in a workweek or eight hours in a single workday.

Explore our guide to doing payroll in the Philippines for more detailed information on payroll compliance.

Statutory Benefits

Aside from the mandatory benefits listed above, Philippine labor laws require employers to provide statutory benefits, including:

- Night shift differential: If employees work between 10 p.m. and 6 a.m., they should receive an additional 10% of their regular wage

- Maternity leave: 105 days paid leave after the mother gives birth

- Paternity leave: 7 days paid leave for married male employees

- Special leave for women: 60 days paid leave for women who underwent surgery due to gynecological disorders

- Solo parent leave: 7 days paid leave for qualified single parents

Holidays

The Philippines has 10 regular holidays and 8 special non-working days. Employees are not required to work during regular holidays but receive their full daily wage. If they work during regular holidays, they are entitled to receive 200% of their daily rate.

For example, if the employee’s daily wage is ₱800 and they work on a regular holiday, the employer will pay them double, which is ₱1,600.

Special non-working holidays, on the other hand, work on a “no work, no pay” principle. If an employee is requested to work during these holidays, they are entitled to 130% of their daily rate. So let’s say the same employee works during a special non-working holiday; the computation will be:

Daily wage X 30%, thus;

800 X 0.3 = 1,040

Additionally, if employees render overtime work during regular or special non-working holidays, they receive another 30% of their hourly rate on top of their salary during that day (regular: 230%, special non-working: 160%).

What to Consider Before Hiring in the Philippines

The biggest reason US small businesses hire Filipino workers is the reduced overhead. The ability to save money is a good reason to hire from the Philippines—but make sure you consider other factors as well.

Cultural Differences

When hiring employees, certain skills are necessary to complete the job effectively. Some of these skills are soft skills that come about through cultural differences. While the Philippines and the US education systems are similar, Filipinos are generally more communal in their decision-making and respectful of hierarchy—traits not always found in US workers.

As a result, you may find that some Filipino workers will check in with you or defer important decisions to you or another supervisor, making them less autonomous than US workers. Understand that this does not make them ineffective workers; it is instead simply a cultural difference that may require some adjustment on your end.

Time Difference

The US East Coast is 12 hours behind the Philippines. When it’s 8 a.m. in New York, it’s 8 p.m. in the Philippines, making it difficult for workers to overlap and collaborate. If your company doesn’t need workers to do so, then the time difference won’t be an issue.

However, if your company needs teams to work together, you may need to shift hours. Your US-based employees may have to work earlier some days, while your Filipino members may have to work later. Some companies require Filipino workers to work US hours all the time. While that means they’re working overnight, it can benefit your company by having every employee on the same schedule.

Hiring from the Philippines Frequently Asked Questions (FAQs)

You can hire workers from the Philippines directly as an independent contractor. However, if you hire workers as employees, you must first find an entity to manage the employee’s wages and taxes. You can find a list of licensed private employment agencies at the Philippine Overseas Labor Office (POLO).

To pay employees in the Philippines, you can work with a local payroll processing company that will ensure legal compliance and pay and process taxes for you. You can also choose to pay in-house, but be sure you follow all the legal requirements for paying employees in the Philippines.

To terminate an independent contractor in the Philippines, you need to follow the termination clause outlined in the contract. Usually, this means providing at least one month’s notice of termination. If you’re terminating an employee, you may also need to have just cause and provide a legal reason for the termination.