Hiring foreign contractors can be a great way to expand your talent pool and save money. However, it is also a daunting task. You need to find qualified candidates, negotiate payment terms, and comply with labor laws in different countries. Our guide walks you through the process of how to hire international contractors, from planning your project and evaluating candidates to requesting quotes and completing forms. We also provide a free independent contractor agreement template you can customize to fit your needs.

Looking for an all-in-one HR & Payroll platform for your global team? Easily hire and pay employees and contractors in 140+ countries using Rippling. |

|

Step 1: Understand the Benefits & Risks

The first step of hiring an international contractor should actually be to weigh the potential benefits and risks. You want to strongly consider if foreign contractors are right for your business before moving forward.

Let’s say you want to conduct market research for a new product you plan to launch in a country. If there isn’t a local market research company that can handle the special project, you can recruit an international independent contractor (instead of getting a full-time employee) to do this for you.

Don’t forget to compare costs. The lower labor expense in hiring a foreign contractor may be a more cost-effective solution for your business, which is helpful for projects with budget constraints. You also have to take into consideration cultural differences that may impact the project (such as language issues) and evaluate whether your company has the necessary infrastructure, communication tools, and project management systems to effectively collaborate with international contractors remotely.

For a list of some of the pros and cons of hiring international contractors, check out the table below:

| PROS | CONS |

|---|---|

| Access to a diverse talent pool | Legal and compliance issues |

| Cost-effectiveness | Communication challenges |

| Specialized sills | Cultural differences |

| Global market insights | Data security and privacy |

| Flexibility | Quality and performance risks |

Step 2: Identify Your Hiring Needs

Before beginning the recruitment process, define your specific hiring needs and objectives. Clearly outline the skills, experience, and qualifications required for the project or position. You should also determine whether you need a contractor for a short-term project or a long-term collaboration.

- Do I Have Specific Projects or Tasks Requiring Specialized Skills?

Determine if there are specific projects or tasks that demand expertise not readily available in your local talent pool. Assess whether hiring overseas contractors with the necessary qualifications is a viable solution.

- Have I Exhausted Local Talent Options?

Evaluate whether you have thoroughly explored local talent options and whether there is a shortage of suitable candidates with the required skills and experience.

- Is Cost-effectiveness a Priority?

Consider whether hiring international contractors from regions with lower labor costs can provide a cost-effective solution for your business, especially for projects with budget constraints.

- Is Time Sensitivity a Factor?

Assess the urgency of the projects and whether the contractors with immediate availability can accelerate project delivery compared to local alternatives.

- Are Effective Communication and Cultural Understanding Essential?

Determine if effective communication and understanding of cultural nuances are critical for project success, especially if you’re dealing with clients or stakeholders from specific regions.

- Do I Have the Resources for Remote Work Management?

Evaluate whether your company has the necessary infrastructure, communication tools, and project management systems to effectively collaborate with international contractors remotely.

- Is Intellectual Property Protection Essential?

Consider the nature of the project and whether intellectual property (IP) rights need to be protected. Assess if international contractors understand and agree to comply with IP protection measures.

- Do I Have Prior Experience With International Contractors?

Reflect on any past experiences of working with international contractors. Evaluate the successes and challenges faced during previous engagements.

- What Are the Long-term vs Short-term Hiring Needs?

Determine whether your hiring needs are short-term or long-term. Consider if hiring contractors overseas is more suitable for specific projects.

- How Will Hiring International Contractors Impact Company Culture?

Consider the potential impact of engaging international contractors on your company culture and team dynamics. Evaluate whether your existing team is open to collaborating with remote workers and embracing diversity.

Step 3: Create a Job Ad & Evaluate Candidates

Just like when you hire regular employees, you need to post a job ad to let applicants know you’re looking. It should state with absolute clarity that you’re hiring independent contractors, not full-time employees. To avoid worker misclassification issues, it’s important to keep your job ad focused on project work, not daily tasks. Read more about classifying workers in the section below.

For example, if you need someone to respond to customer emails using a comprehensive guide, work in your client management system, and escalate issues to you, that’s an employee. But if you need someone to build you a client management system, that could be a project for a skilled contractor.

Make sure your job ad includes:

- Details about the project

- Any education, skills, and certification requirements

- Estimated length of time the project will take to complete

- A few sentences about your company

Some companies also include their budget for the foreign contractor in their job ads. This can help ensure that your job posting only attracts candidates who are willing to work within your budget but could also hurt your negotiations. If you don’t mention the rate, you can instead get quotes from the foreign contractors (which we discuss in the next step) to help in your decision-making.

You can use typical job boards to advertise your job posting, or a platform like Upwork, which boasts millions of users, including many foreign contractors. You can search profiles and let them apply to your job post. Upwork makes it easy to pay them as well, using its platform as the payment processor. To learn more about its features, read our Upwork review.

You can also hire a recruiter or partner with providers who offer Employer of Record (EOR) services to streamline the hiring process. These agencies have the expertise to handle legal and administrative matters, including compliance with local labor laws, payroll processing, and tax obligations. Check out our list of the best EOR services to find suitable options.

Step 4: Request Quotes

Once you’ve received applications from interested foreign contractors and compiled your list of the most qualified, ask them for quotes. Doing this before an interview will help you reduce the number of interviews you need to conduct, as some quotes may be outside your budget. Negotiation can come later.

At this point, you’re trying to make sure the foreign contractor’s rates are reasonable. Do your research beforehand to determine the reasonable pay for that type of project in the countries your applicants are in.

Review the quotes when you get them, and be cautious of quotes that are outside the norm, both low and high—this could be a red flag that someone doesn’t know what they’re doing. Remove any foreign contractors who don’t fit into your budget.

Step 5: Review Applicants & Conduct Interviews

As you screen applicants and their credentials, don’t be afraid to reach out and ask questions before scheduling an interview or official discussion regarding the project. You may want links to some of the work they’ve produced (if applicable) or just clarification that they’re really interested.

We recommend narrowing your final list of contracting candidates down to approximately half a dozen. If you choose too many to interview, you will be unable to effectively decide which contractor is right for your project.

Some foreign contractors will look great in their application but fail to live up to your expectations during an official discussion. That’s why it’s crucial that you ask certain questions, including:

- Have you recently completed a similar project? Can you tell me more about it?

- How long do you estimate this project will take?

- Do you have all of the equipment you need to do this job?

- What are your education and certifications?

- How many clients do you have right now?

- What are your payment terms?

- Do you have the required insurance?

- Do you have any references I could call?

- After you have spoken with every candidate, make a selection about who you want to work with on your project.

Hiring independent contractors abroad means dealing with people who come from different backgrounds. So, instead of conducting your regular interview, doing a cross-cultural interview will help you assess if the person is indeed a good fit for the company. The process will also prevent any hiring biases, misconceptions, and misunderstandings before they happen. Here are a few things to remember when doing this:

- Develop Cultural Awareness: Before conducting cross-cultural interviews, educate yourself and your interviewers about the cultural backgrounds of the candidates you will be interviewing. Learn about cultural norms, communication styles, and common interview practices in their countries.

- Avoid Assumptions and Stereotypes: Approach the interview with an open mind and avoid making assumptions or relying on stereotypes based on the candidate’s cultural background. Treat each candidate as an individual with unique skills and experiences.

- Use Clear and Simple Language: Speak clearly and use simple language to ensure that your questions are easily understood by candidates whose first language may not be English or may be different from your own.

- Ask Open-ended Questions: Ask open-ended questions that encourage candidates to share their experiences, skills, and perspectives in more detail. This allows candidates to provide comprehensive responses and highlights their unique qualifications.

- Be Mindful of Nonverbal Communication: Be aware of the impact of nonverbal cues during the interview. Respect cultural differences in body language, eye contact, and hand gestures, as these may vary across cultures.

- Provide Context for Behavioral Questions: When asking behavioral questions, provide context and examples to ensure candidates understand what you are seeking. This helps candidates relate their experiences to the specific situation being discussed.

- Avoid Loaded Questions: Steer clear of questions that might be considered sensitive or offensive in certain cultures. Focus on professional qualifications and work-related experiences.

- Incorporate Cultural Sensitivity in Feedback: When providing feedback to candidates after the interview, be culturally sensitive in your communication. Offer constructive feedback in a respectful and supportive manner.

Step 6: Make an Offer Using an Independent Contractor Agreement

When you’ve decided which foreign independent contractor you want to partner with, discuss the offer with them. This is a less formal process than an employee offer and is usually a simple discussion on terms. Once you agree, you’ll formalize everything in an independent contractor agreement, which states the work scope and project details clearly. Both parties should sign it.

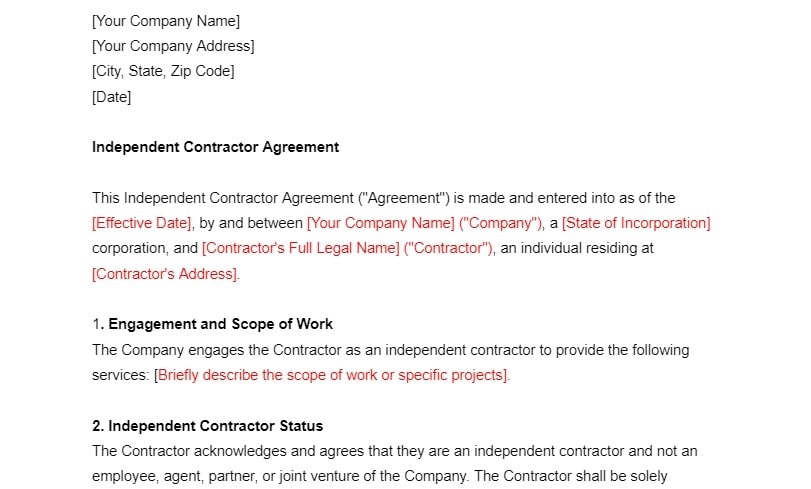

Here’s an independent contractor template you can use:

Compliance Tip: If an independent contractor agreement is challenged, a court or governing body will glance at the agreement but will thoroughly evaluate the actual day-to-day relationship of the parties. While having a contract is critical, it’s equally important that you treat the contractor as a non-employee. Do not control when they work, provide them with equipment, and assign them a supervisor. All of this could be evidence of an employment relationship, leading to costly fines. Read more about properly classifying your workers below.

One of the important steps on how to hire international contractors is using a compliant work agreement. There should be a specific clause in the contract stating that the parties are not entering into an employer-employee relationship, but instead entering into a contractor relationship.

Mere words, however, are not enough. That’s why it’s important for the scope of work to clearly show the foreign contractor has complete control over how and when they work, helping solidify the independent contractor status of the worker. If you require daily check-ins, for example, that could be seen as the beginning of an employment relationship.

Of course, you’ll need to have regular status updates and contact with the foreign worker—but you cannot become their supervisor. You’re partnering with them to complete a project or provide some expertise. Make that abundantly clear.

A termination clause should exist in the international independent contractor agreement as well. This will set the process for ending the contract, should the contractor not live up to your expectations; they can be terminated at any time without compensation.

If the contractor has successfully completed the project and you have no additional work for them, you still need to terminate the contract. Usually, this is done by providing written notice to the contractor that their services are no longer required. Whether parting on good terms or bad, make sure that the process for termination is clear in the contract.

Step 7: Complete & Retain the Right Forms

When you hire international employees, there are certain forms you must collect. The same is true for foreign independent contractors—you need them to complete either Form W-8BEN or Form W-8BEN-E.

These forms are used to establish the status of a foreign independent contractor. Form W-8BEN is used for individuals who work as a sole proprietor, whereas Form W-8BEN-E is used for foreign workers who have set up their own formal entities. Check out our guide to learn more about the differences between the W-8BEN and W-8BEN-E forms.

When the international contractor completes the appropriate form, you do not need to send it to the IRS. The form is for you to determine tax reporting and withholding obligations in the US.

The international worker will be required to adhere to tax obligations in their home country. However, as mentioned above, there are a few countries that require US companies to pay benefits or taxes. These laws are in place to protect independent contractors in those countries from exploitation. Every country has slightly different requirements, so it’s a good idea to discuss this with an international employment lawyer.

Classify the Worker Correctly (& Don’t Cross the Line)

Deal with foreign independent contractors as a business partnership, not as an employer-employee relationship. In the US, the Internal Revenue Service (IRS) defines an independent contractor as someone who has the right to control their own work and is not directed by a company on what to do and how to do it.

Other countries, including many European countries, go even further and, in certain circumstances, require companies to provide limited benefits to independent contractors, including time off and holiday pay. This is why understanding local employment laws, in addition to those in the US, is crucial to making sure your company stays compliant.

There are several types of employees you can hire, each classified differently. Even if you have a solid international independent contractor agreement in place, if your company tells the worker when or how to work, you may inadvertently transition them from an independent contractor to an employee, subjecting your company to fines, back taxes, overtime pay, and other penalties.

To avoid misclassification, abide by the following best practices:

- Do not require the international contractor to work specific hours

- Ensure the contractor’s work is not the central focus of your business

- Do not have the contractor sign a noncompete or non-solicitation agreement

- Do not be the only source of income for the contractor

- Do not assign a direct supervisor or conduct performance reviews

- Make sure the foreign contractor has all of the supplies required and your company does not provide them with any tools or equipment

- Unless required by the foreign contractor’s home country, do not provide benefits

Why is this so important? Because it can be extremely costly. The US routinely fines companies for misclassification, and other countries even put people in prison for violating their employment laws. Learn more in our guide on 1099 vs W-2 workers.

Bottom Line

There are inherent risks to any business relationship, and working with international contractors is no different. Taking the time to follow a structured process can reduce the risk of legal troubles and help you find the right foreign contractor for your needs. Make sure you always have a contractor agreement in place and do not take action that will transition the foreign contractor into an employee.

If you’re unsure how to hire international contractors or don’t want to handle the complexities of global recruiting, consider partnering with an EOR service like Remote. The provider offers locally compliant contracts and a free worker misclassification risk tool. Remote also helps companies stay up-to-date with the latest labor laws in the 180+ countries where they hire and pay contractors.