Global payroll providers help businesses compliantly process salary payments for a global workforce but also offer tools to automate basic HR processes.

6 Best International Payroll Services in 2024

This article is part of a larger series on Payroll Services.

The best international payroll services allow you to pay workers located in other countries and comply with local tax and labor laws. Some have separate plans for paying global contractors, while others offer employer of record (EOR) services—allowing them to handle your international employment needs.

In this guide, we evaluated 14 of the most popular global payroll providers and narrowed our list down to the six best.

- Papaya Global: Best overall global payroll software

- Remote: Best international payroll with free HRIS tools

- Deel: Best for multiple contractor payment options

- Rippling: Best affordable payroll for international employees and contractors

- Oyster HR: Best for hiring, onboarding, and payroll support

- Multiplier: Best multicountry hiring and payroll in Asia

Looking for an all-in-one HR & Payroll platform for your global team? Easily hire and pay employees and contractors in 140+ countries using Rippling. |

|

Best International Payroll Services Compared

Our Score (Out of 5) | Country Coverage | ||||

|---|---|---|---|---|---|

4.68 | $25 per employee | 160-plus | |||

4.58 | $50 per employee | $29 per worker | $699 per employee | 180-plus | |

4.58 | $29 per employee | $49 per contract worker | $599 per employee | 150-plus | |

4.46 | 140-plus | ||||

4.41 | $50 per employee | $29 per worker | $699 per employee | 180-plus | |

4.34 | Custom-priced | $40 per worker | $400 per employee | 150-plus | |

Note that all the global payroll providers we reviewed offer EOR services, international tax support, online onboarding, local benefits plans, time off tracking, and locally-compliant employment contracts. They also have in-country experts who can guide you through the complexities of managing local laws and regulations.

Looking for something else? If you only need an EOR solution for your global hiring and payroll needs, read our best employer of record guide. For US-only payroll, check out our best payroll services article, which contains our top recommendations for small businesses.

Papaya Global: Best Overall Global Payroll Service

Pros

- It provides transparent pricing.

- It guarantees cross-border payroll payments in as fast as 72 hours.

- Agent of Record (AOR) services include contractor misclassification tools.

- It provides access to a dedicated customer success manager (CSM) who handles your account and answers your queries.

Cons

- It charges a setup fee.

- It lacks local entities and only has partners in countries that it services.

- Payroll plans require at least 100 employees.

- Discounts are reserved for large companies with volume payroll requirements; it has no discounts for startups.

Overview

Who should use it:

Papaya Global is great for mid-sized to large businesses that need overseas payroll services with full liability and local compliance. As a licensed payments provider, it can handle payments to employees, contractors, and local tax authorities. It also offers a global workforce software that lets you manage worker data, onboarding, global employee benefits, reports, and staff attendance on one platform.

Why we like it:

Papaya Global topped our list of best international payroll services because of its bank-level security payments and wide range of features. Aside from global payroll, it has EOR and AOR services for hiring and paying international employees and contractors, respectively. It offers end-to-end fraud protection and uses artificial intelligence (AI) tools to validate payments and automate compliance. Unlike the other picks on our list, Papaya provides access to unlimited digital workforce wallets you can fund in 14 currencies, allowing you to securely pay workers in their local currencies in over 160 countries.

While Papaya offers secure global payments, it doesn’t have local entities in the countries it services. This is a feature that most on our list offer, making it easy to legally manage, pay, and recruit global employees. Papaya makes up for this by providing legal support and full access to in-house global payroll professionals and its team of designated country experts, which consists of 40 different top-tier certified public accountant (CPA) firms across the globe.

- PayrollPlus

- Grow Global: Starts at $25 per employee monthly for businesses with up to four entities and 101-500 employees

- Scale Global: Starts at $20 per employee monthly for businesses with up to 10 entities and 501-1,000 employees

- Enterprise Global: Starts at $15 per employee monthly for businesses with over 10 entities and more than 1,000 employees

- EOR: Starts at $599 per employee monthly

- Contractor Payments and Management: Starts at $30 per worker monthly

- Payroll, compliance and contractor management

- AOR: Starts at $200 per worker monthly

- Contractor management, payroll, compliance, and worker classification

- Payments: Starts at $2.5 per transaction

- Facilitate ad hoc workforce payments (e.g., split payroll payments and statutory payouts to local authorities)

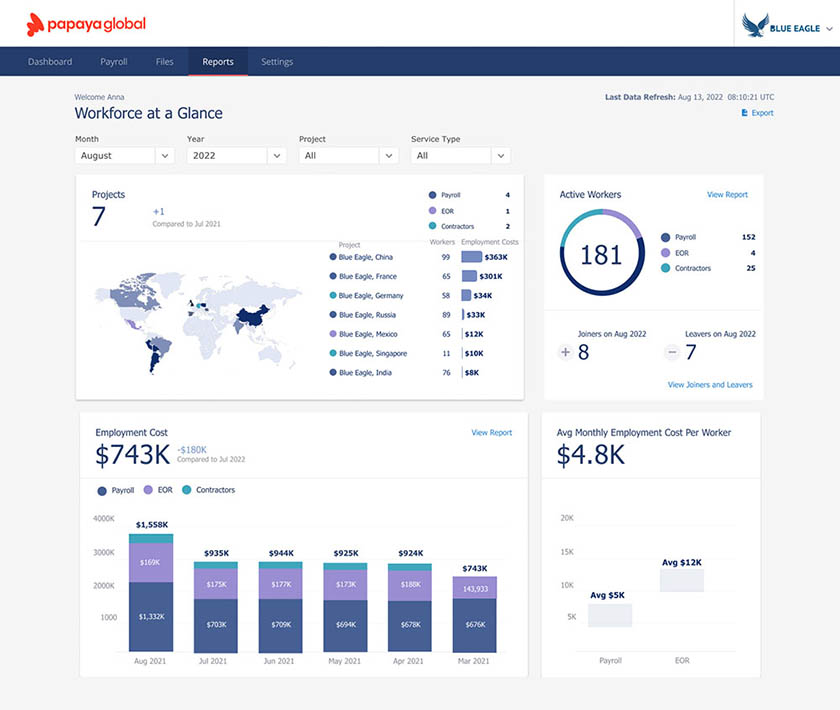

Papaya Global has an intuitive dashboard that shows a comprehensive view of your international workforce, payroll expenses, and more.

(Source: Papaya Global)

- It offers a 60-day money-back guarantee for new clients who may be unsatisfied with Papaya Global’s services.

- It offers cross-border payments with guaranteed payouts of up to 72 hours.

- It offers instant employee payments via the Papaya Payroll debit card—perfect for workers who don’t have bank accounts.

- It has unlimited workforce wallets to make global direct deposits for employees and contractors, including payments to local authorities.

- You can view and access workforce payment funds in dedicated wallets that sit safely in segregated Client Money Accounts with global banking institution, J.P. Morgan.

- It offers fraud protection with adherence to global know your customer (KYC) practices and anti-money laundering (AML) standards.

- It has AI-based validation tools to check payments and spot errors, which helps ensure payroll compliance.

Remote: Best Global Payroll Service With Free HRIS Tools

Pros

- It offers a free HR information system (HRIS).

- It is available in 180-plus countries and has local entities in countries that it services.

- It provides free refugee hiring services and discounts for startups and nonprofits.

- It has a freelancer hub for solopreneurs to manage global client payments.

Cons

- Payroll cutoff deadline is the 11th of each month (except for Bulgaria, Germany, and countries with semimonthly payroll).

- It charges an implementation fee for its global payroll tool if you’re processing employee payments for your business entities.

- It collects a refundable deposit (equivalent to one month of the total employment cost).

Overview

Who should use it:

Companies of all sizes can use Remote to pay international contractors and employees. Similar to the top global payroll providers we reviewed, Remote offers EOR and contractor management services with built-in compliance tools and secure payments in over 180 countries.

Why we like it:

Unlike Papaya Global, Remote owns legal entities in countries that it services. Remote also has iron-clad intellectual property (IP) and invention protection tools to help you track IP transfers while ensuring you retain ownership over your invention rights. Its discounts for startups and Series A businesses Eligible startups get a 15% discount on Remote service fees for an unlimited number of hires for 12 months. , social purpose organizations Eligible organizations get co-marketing opportunities, including 15% off EOR (for annual plans only) and 15% off contractor services during their first year with Remote. , and companies that hire refugees Free EOR services for up to 10 employees when hiring refugees who have the legal right to work in any country where Remote has an entity. make Remote stand out from the rest on our list.

What also sets it apart is its HRIS platform for managing staff information and documents, onboarding and offboarding workers, submitting expense claims, and tracking employee hours. This tool is free to use and comes with zero employee limits. However, Remote’s online support features are not as good as those of Deel and Papaya Global, as it doesn’t provide dedicated support to its clients.

- HR Management: Free tools for managing employee information, documents, time off, staff attendance, onboarding and offboarding, and expense claims

- Remote Payroll: $50 per employee monthly

- Employer of Record: Starts at $699 per employee monthly ($599 per employee monthly if billed annually)

- Contractor Management: $29 per contractor monthly

- Includes payroll and contractor invoices

- Contractor Management Plus: $99 per contractor monthly

- Contractor Management plus indemnity coverage

- Remote Talent: Starts at $119 monthly

- Includes tools for posting jobs to attract qualified candidates

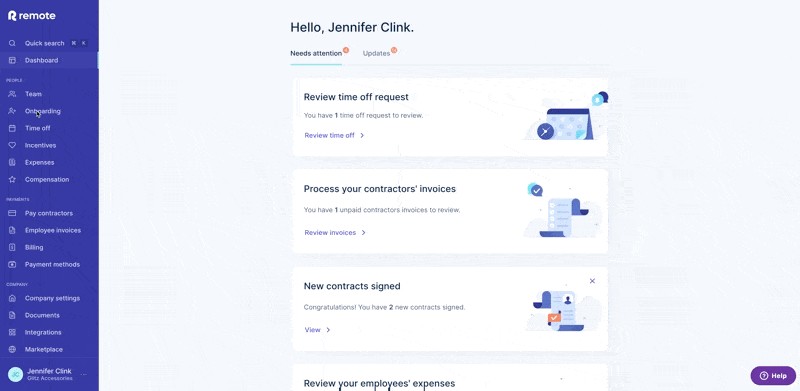

Remote’s main dashboard shows updates and tasks that require your attention.

(Source: Remote)

- It offers a 90-day money-back guarantee for new clients (this is longer than Papaya’s money-back guarantee).

- It has smart employee profiles that allow you to instantly edit important employment details (such as job titles, manager reporting lines, and annual salaries).

- It supports over 100 currencies in at least 180 nations and does not charge interchange fees.

- Workers employed through Remote can choose to get a portion of their salary in cryptocurrency.

- Contractor payments cover more than 200 countries, the largest coverage among our list of best international payroll providers.

- Solopreneurs can use the Remote Freelancer Hub to manage global clients, organize contracts, track and send client invoices, and receive payments (the others on our list don’t have this feature).

Deel: Best for Multiple Contractor Payment Options

Pros

- It offers multiple payment options (bank transfer, crypto, bitcoin, digital payment processors, and contractor card).

- It assigns a dedicated CSM to its clients.

- Free HRIS to manage staff information and onboarding/offboarding.

Cons

- Background checks, localized benefits, and company device management tools are paid add-ons.

- Dedicated CSM is not provided to small businesses (only available to enterprises).

- It doesn’t offer a special plan or discount for hiring refugees.

Overview

Who should use it:

Deel helps businesses with plans to expand globally by providing global payroll for employees and contractors, including EOR services and immigration support that handles the entire visa process. It also offers worker misclassification tools similar to Papaya Global’s AOR feature. Classifying workers correctly helps avoid potential legal issues and costly fines for violating employment laws.

Why we like it:

Deel’s international payroll processing for contractors sets it apart from the others on our list. It has 15 contractor payment options, which include payouts via digital payment processors, bank transfers, cryptocurrency, and a Deel contractor card. It also has a user-friendly interface with simple-to-use contract generation tools. However, it lacks built-in time tracking tools and dedicated support for all clients (this is only available for large businesses).

Besides global payroll and HR tools, Deel also handles payroll for US workers across all states. Similar to Rippling, it has professional employer organization (PEO) services for US companies that need expert help in managing day-to-day HR administration and workforce management tasks.

- Deel HR: Free

- Includes tools for managing staff information, documents, onboarding, time-off, and expense claims

- Payroll: Starts at $29 per employee monthly

- Includes payroll solutions for global teams

- Contractor Management: Starts at $49 per worker monthly

- Includes flexible payment options, locally compliant contracts, time-off tracking, invoicing and expense management, and access to HR support

- EOR: Starts at $599 per employee monthly

- US Payroll: Starts at $19 per employee monthly

- Includes payroll services in all 50 states, payroll tax filings in all levels (federal, state, and local), year-end tax forms, and new hire state reporting

- US PEO: Starts at $79 per employee monthly

- Immigration: Call for quote

- Immigration and visa assistance in 25 countries plus support from local immigration experts

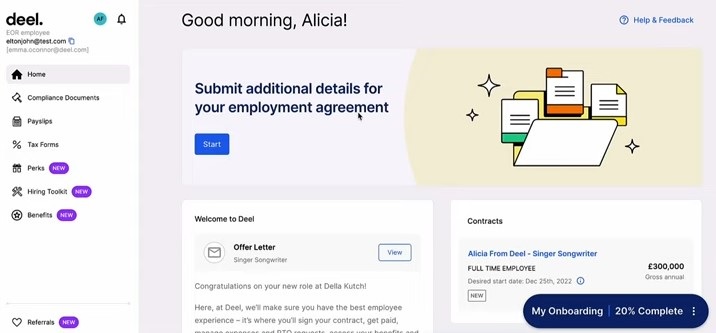

Deel will guide your new employees through the onboarding process—from signing the online offer letter to submitting new hire paperwork (such as bank information).

(Source: Deel)

- Deel HR automates the entire employee lifecycle and includes compliance tools to keep you compliant with local labor laws in over 100 countries.

- It offers multiple payment options via bank transfers, digital payment processors (like Wise and Payoneer), and cryptocurrency (through Binance and Coinbase).

- Deel’s contractor card allows your contract workers to receive payments and pay for personal purchases. It has virtual and physical versions, although the physical card doesn’t support ATM withdrawals.

- It has a wide range of HR services to manage work visa and immigration processes and the issuance of company-assigned devices (like laptops) to your global workforce.

- Deel plugins for Slack help simplify onboarding, employee referrals, surveys, and team communications.

Rippling: Best Affordable Payroll for International Workers

Pros

- It integrates with over 500 business apps.

- It offers modular HR, payroll, IT, and expense management tools and can create a custom plan to fit your requirements.

- It has strong workflow and automation tools.

Cons

- Pricing isn’t all transparent.

- Benefits administration, IT tools, and HR advisory services are paid extras.

- You can’t buy its payroll solution (and other modules) without purchasing its core workforce management platform first.

Overview

Who should use it:

For businesses looking for low-cost global payroll tools, Rippling’s international payroll processing module comes with an affordable price tag. It costs only $20 per worker monthly to pay global employees and contractors—the cheapest among the providers we reviewed.

Why we like it:

Rippling offers HR payroll tools, EOR and PEO services, and HR and IT support for businesses of all sizes. Its strength lies in its ease of use, robust automation tools, and capability to work with other applications. Companies with international workers can use Rippling’s feature-rich platform to manage essential HR, payroll, and IT processes—from tracking employee attendance to monitoring the inventory of laptops assigned to employees across at least 140 countries.

While it has a wide range of features and a modular system that lets you choose the tools you need, Rippling can get pricey depending on the functionalities selected. It also lacks Papaya Global’s unlimited workforce wallets with bank-level security, Remote and Deel’s free HRIS, and Oyster’s easy-to-use application programming interface (API) tools.

For multicountry payroll and hiring, Rippling offers the following services:

- Global payroll*: $20 per employee monthly

- Global contractor payroll*: $20 per worker monthly

- EOR services*: $599 per employee monthly

*Pricing is based on a quote we received

Rippling automatically syncs HR and employee data with its payroll tool, enabling it to easily process employee payments.

(Source: Rippling)

- Rippling’s modules connect easily with each other, enabling the seamless transfer of employee and payroll-related data across its various tools.

- It pays employees and contractors in over 50 currencies.

- It has Excel-like formulas you can add to custom reports, allowing you to generate data showing calculations for tenure and fixed bonus amounts.

- Rippling claims it can process global payroll in as fast as 90 seconds.

- App management tools remotely manage and disable business software, such as Google Workspace, Slack, and Microsoft 365.

- Workflow tools can automate HR, payroll, and IT tasks with its if-then logic and custom triggers.

- Device management module helps you assign, track, and lock computer devices issued to employees.

- It can integrate with over 500 apps, so it’s extremely versatile (no other software on our list has this breadth of flexibility).

Oyster: Best for Hiring, Onboarding & Payroll Support

Pros

- It offers reasonably priced plans.

- It provides dedicated support for account and system setup; clients who plan to ramp up global recruitment get a hiring success manager to help them hire employees.

- It offers a lump sum payment (or single invoice) to cover all worker payments.

Cons

- Pricing for EOR services varies, depending on the country.

- It has limited third-party software integration options.

- Its standalone payroll option is in beta mode (as of this writing).

- It charges a refundable deposit.

Overview

Who should use it:

Global companies that need hiring support can take advantage of Oyster’s recruiting services. It offers the services of hiring success managers who can help you hire and onboard employees. Oyster also provides EOR and contractor management services for hiring and paying employees and contract workers, respectively.

Why we like it:

With Oyster, you can hire, onboard, pay, and provide benefits to employees in more than 180 countries. It supports more than 120 currencies, offers invoicing and expense management tools, and provides access to locally compliant contracts. Onboarding employees is a breeze with Oyster’s easy-to-use platform, although new clients also get system setup and initial onboarding assistance from a dedicated CSM.

Similar to Papaya Global, it has built-in time tracking features but Oyster’s is limited to specific countries. While it has a standalone global payroll, this is still in beta mode (as of this writing).

- Global Payroll: $50 per employee monthly

- Contractor: Starts at $29 per contractor monthly

New clients who sign up for the contractor plan get the first 30 days free. Note that this promo may change at any time. Visit Oyster's website to see the latest promotions on offer.

- Includes hiring, payroll, onboarding, invoicing, and expense management tools

- Employer of Record: Starts at $699 per employee monthly ($599 per employee monthly if billed annually); pricing also varies depending on country

- Scale: Call for quote

- This plan lets you prepurchase and reuse annual seats for hiring five or more employees

- Includes custom global compliance assistance and access to a dedicated hiring success team

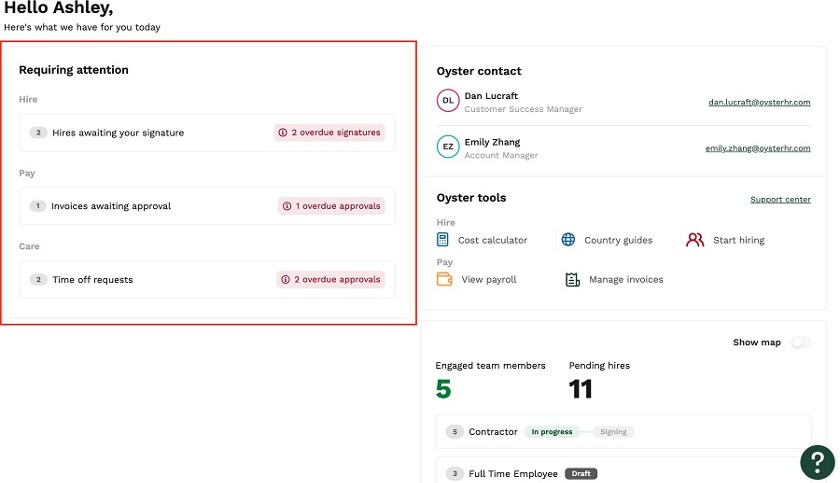

Oyster’s dashboard not only shows the number of employees you have and the online tools you can use, but also flags overdue tasks that require immediate attention.

(Source: Oyster)

- It supports clients with volume hiring requirements by assigning dedicated hiring success managers who can help find candidates that best fit your needs.

- Its standalone payroll tools can process contractor payments in over 180 countries and employees in Spain, Canada, and the U.K. (as of this writing).

- It provides access to Oyster’s global payroll consultants to run fast and compliant pay runs.

- It has an online calculator that shows your total employment cost and a “benefits advisor” tool with a list of statutory and best-in-class benefits plans that local benefits advisors recommend.

- Oyster’s easy-to-use APIs allow you to integrate its platform with third-party software—no coding knowledge required.

- Similar to Remote, it offers discounts for qualified nonprofit organizations and B Corp businesses. Hiring refugees in countries where Oyster has direct entities is also free (up to 10 refugee hires per company only).

- You can settle payments to Oyster with a lump sum option to cover all salaries, and Oyster will divide the amount correctly so each worker is paid accurately and on time.

Multiplier: Best for Multicountry Hiring & Payroll in Asia

Pros

- Its hiring solution covers 150-plus countries.

- It supports payments in 120 currencies, including cryptocurrency payouts for contractors.

- It offers 24/5 assistance from local HR and legal experts.

- It owns legal entities across the Asia Pacific (APAC) region.

Cons

- It lacks time tracking features (only monitors leave accruals).

- It only integrates with BambooHR, as of this writing.

- It has a fixed payroll cut-off date (every 10th of the month).

Overview

Who should use it:

Multiplier owns legal entities across Asia, making it a great choice for recruiting and paying employees in APAC. It also offers multilingual and locally-compliant employment contracts that you can generate instantly.

Why we like it:

Out of all the providers on our list of best international payroll software, Multiplier has the least expensive EOR package. For a monthly fee of $400 per employee, you can compliantly hire and pay international employees. The other providers in this guide have EOR services that cost anywhere from $599 to $699 per employee monthly.

It also has a global team of multilingual payroll experts who are experts in local labor and tax rules. Basic HR tools are also available to help you manage employee data, track time off, and process expense reimbursement claims.

- Global Payroll: Call for a quote

- Employer of Record: Starts at $400 per employee monthly

- Independent Contractors: Starts at $40 per worker monthly

- Instant contracts with multicurrency and crypto payments

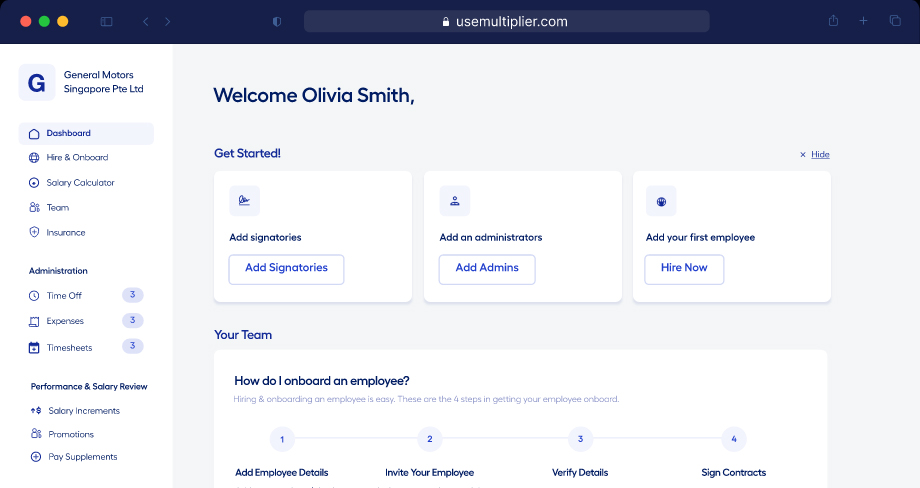

Multiplier’s main dashboard provides easy access to hiring, onboarding, and user management tools. (Source: Multiplier)

- It pays workers in over 120 currencies in more than 150 countries.

- It offers cryptocurrency contractor payments for workers who choose this currency.

- Multiplier claims that it can quickly generate online employment contracts that are multilingual and regionally compliant, provided you give the required new hire information (such as full name, email address, job title, and compensation details).

- Multiplier touts an employee onboarding process that can be completed in less than a week.

- Similar to Rippling and Deel’s device management tools, Multiplier’s onboarding tool lets you issue laptops directly from its platform.

How to Choose the Best International Payroll Providers

In choosing the right payroll solution to handle your international pay processing needs, consider the following factors:

- Size of your workforce: Aside from your current headcount, consider your company’s growth plans. Do you plan to add more workers in the near future? Will those be employees or contractors? Knowing the answer to these questions will help you gauge whether a payroll provider can handle your growing global pay processing needs.

- Location and number of countries where your business operates: Check whether the countries where your business is located are covered by the provider’s international payroll services. Don’t forget your growth plans. Look for providers who can handle payroll in countries where you plan to expand business operations.

- Your budget: Once you’ve identified your headcount and location, calculate whether the provider’s monthly fees meet your budget. If you have a large team, consider international payroll companies that offer volume discounts.

- HR and payroll features: Take stock of the functionalities that your business needs. Ask yourself questions—such as which part of the international payroll process do you find most challenging, and can the provider help you with that? Do you require integration options so you can connect the provider’s platform with the software that you use (like accounting systems)?

- Support services: Check whether the global payroll service includes access to compliance experts, in-country payroll professionals, 24/7 assistance, and dedicated support. Also, ask the provider if they offer system setup and data migration assistance. This will help save you time from doing all the initial setup yourself.

Methodology: How We Evaluated the Best International Payroll Services

We started our research by comparing 14 reputable payroll providers for criteria such as transparency in pricing, HR functionalities, customer support, and payment options. After thoroughly exploring each provider’s offerings, we scored and ranked the services to narrow our list to the six best global payroll providers.

Click through the tabs below for our full evaluation criteria:

25% of Overall Score

20% of Overall Score

We highly favored providers that showed straightforward pricing with multiple plan options. In addition to each software’s per-employee pricing, we checked if there were any required setup fees. We also gave more points to providers that offer a separate plan for contractor payments.

15% of Overall Score

The best global payroll service includes essential HR features, such as onboarding, self-service portals, and benefits. We favored companies that offered tools to help with legal compliance issues. We also considered PEO services and benefit and deduction assistance.

15% of Overall Score

We considered providers that offer setup assistance and a dedicated account manager to their clients. We gave more points to those with online platforms that are intuitive and easy to use. We also looked for live phone support, how-to guides, and data export options.

10% of Overall Score

In addition to the number of payroll reports, we considered whether they were customizable or if you could create special reports for your specific needs.

10% of Overall Score

Sometimes, a service can check all the boxes but not be the best fit for a small business. The expert review is our opinion on how well a service meets SMB needs for payroll and HR, including its general value for the dollar.

5% of Overall Score

We took the average review ratings from third-party sites like G2 and Capterra, which are also based on a 5-star scale. Any option with an average of 4-plus stars is ideal. We also favored software with at least 1,000 reviews on any third-party site.

Global Payroll Services Frequently Asked Questions (FAQs)

A global payroll service helps you manage pay processing functions for all of your business locations across the world. It ensures you pay international workers (either employees or contractors) accurately and on time while keeping you compliant with country tax and labor laws. Its services also involve calculating the applicable wages and deductions, remitting payroll tax payments, generating and filing tax forms, and providing pay slips to employees.

You need to consider the local employment laws of countries where you’re planning on hiring, as some might have specific regulations for hiring employees and contractors. When it comes to paying distributed teams, it’s important to understand the method of payment, labor laws and tax regulations, and operational considerations you must comply with. This will prevent you from facing penalties and fines because of worker misclassification (e.g., you hired independent contractors, but if you direct their work, they are considered employees).

If you choose to hire international employees to manage day-to-day operations, you can control their work schedules, oversee how the work is completed, and even implement performance management measures.

On the other hand, when working with foreign independent contractors to complete specific projects, you are not legally allowed to direct how and when contract workers can do the job—they can set deadlines and define the output of the project. Note, however, that the definition of a contractor can vary in different countries. We recommend you consult with hiring and compliance experts to avoid potential worker misclassification issues.

Bottom Line

The best international payroll services can help businesses that are expanding their workforce by keeping companies out of legal trouble and ensuring that local tax and employment laws are followed. If needed, they will also provide PEO, EOR, and outsourced HR services locally.

If you are looking to expand your business beyond the US, consider partnering with Papaya Global. It is affordable, offers an EOR solution, and has solid payroll services. In addition to providing local tax filing assistance and compliance support, it can help you manage and administer benefits plans for your global workforce.