Hiring from the Philippines may prove beneficial to your company and give you a competitive advantage. Many Filipino workers are experts in their fields, speak English, and can help your organization grow at a fraction of the cost you’ll pay US staff.

Before anything, decide whether to hire an independent contractor or a local employee. If you only need a few workers, then working with independent contractors is the way to go. However, if you plan to hire many workers, then setting up a business and hiring employees might be your best bet—or work with an Employer of Record (EOR) for an even easier time. We discuss these options more in-depth below.

Looking for an all-in-one HR & Payroll platform for your global team? Easily hire and pay employees and contractors in 140+ countries using Rippling. |

|

Currency Note: Throughout this article, we will refer to the Philippine Peso (PHP) and compare it to the US Dollar (USD). The conversion rate at the time of writing this article is 1 USD to 55.46 PHP. Make sure you check current conversion rates for a more accurate figure.

Hiring Contractors in the Philippines

If you’re only hiring one or two employees, then getting independent contractors is your best bet; in fact, a lot of Filipinos are used to this setup, especially when working with US-based employers. However, you will have less control over the work done, and you may face stiff fines and penalties for misclassification if the worker should really be an employee.

Hiring contractors from the Philippines will generally follow the same process as hiring any international contractor, which includes, creating a job ad to post on job boards like OnlineJobs.ph, evaluating candidates, and making an offer. Here, we discuss the steps and considerations that are unique to the Philippines’ labor market.

Step 1: Review Philippine Labor Laws

Although the terms “contractor” and “freelancer” are used interchangeably in the Philippines, there are subtle differences in how they are understood and utilized. The Philippines House of Congress has passed House Bill 6718 or the Freelance Workers Protection Act, which defines these terms, including the scope of services he or she can offer. It also contains provisions that help independent contractors as well as the benefits a freelancer is entitled to, such as hazard pay and night differentials.

Here’s a table to give you an overview of the differences between a freelancer and a contractor:

Freelancer | Contractor | |

|---|---|---|

Type of Work | Offers services independently on a per-project basis | Hired for specific projects or specialized services |

Autonomy of Management | High degree of autonomy over work; Usually work independently | Typically work on-site and location-specific; May employ teams or subcontractors for a project |

Client Acquisition & Contract Handling | Responsible for finding own clients; Negotiates contracts and sets rates | Usually hired by clients or businesses for projects; May negotiate terms but typically work under a contract |

Range of Services | Offers a wide range of services for a wide array of industries (writing, design, etc.) | Specialized services in trade-related industries, such as construction, home renovations, and maintenance |

Work Location | Often work remotely | Work is usually on-site |

Online Platforms (in PH) | Many work on online platforms like Upwork, etc. | Not typically associated with online marketplaces |

Here’s an example of what it should look like using the case of hiring a Filipino virtual assistant (VA) as an example:

A US-based digital marketing company, XYZ Digital, wants to hire a Filipino VA to help manage their social media accounts and handle administrative tasks. The VA only provides virtual assistant services to other companies and uses their own computer, internet, and equipment. They are responsible for choosing their work hours and deciding how to manage their time and workload effectively.

XYZ Digital and the contractor have entered into an independent contractor agreement, which lays out the terms and conditions of their relationship. The document specifically notes that the Filipino VA is an independent contractor and not an employee of XYZ Digital.

Step 2: Consider Withholding Taxes & Collect W-8BEN Forms

Here’s where things can initially seem complex but are actually fairly straightforward: taxes. If the independent contractor you work with lives and does all their work for you inside the Philippines, then you don’t have to withhold taxes.

Here’s the catch: if the independent contractor ever comes to the US and does work for you while in the country, then the compensation for work done domestically will be taxed by the US. That’s why you must have them complete Form W-8BEN or W-8BEN-E. These forms must be completed by the foreign independent contractor and retained by your business—you don’t file them with any government agency. The purpose of these forms is to ensure you don’t have to withhold taxes—or, if you do, you withhold at the appropriate rate.

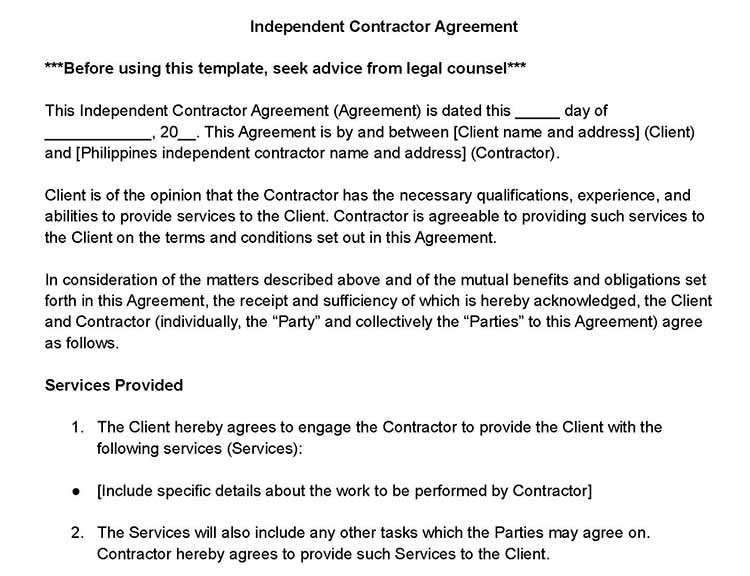

Step 3: Use an Independent Contractor Agreement

When you hire international independent contractors, the way you make a job offer is to provide an independent contractor agreement. This agreement will lay out the terms and conditions of your relationship, stating clearly what you need the independent contractor to do and that there is no employer-employee relationship.

Your agreement should include:

- Specific description of the project, including a term or duration if known

- Payment rate, terms, and an administrative fee of not less than 10% of the total contract amount

Step 4: Determine How to Pay the Filipino Independent Contractor

You’ll need to set up a regular payment system to pay the independent contractor. You can pay by wire transfer, but that may come with cost-prohibitive charges, especially if you’re paying more than once per month.

Related: How to Pay International Contractors—An Ultimate Guide

The most popular option is to use a digital payment platform. Once both you and the Filipino independent contractor have accounts on the same platform, it’s simple and quick to transfer money to them. You can enter a US dollar amount, and the contractor will get their money in their local currency (Philippine Pesos).

You could also consider using a payroll provider like Papaya Global. Even if you don’t plan to hire employees in the Philippines, Papaya Global can easily set up and pay your Filipino independent contractor on the regular schedule you decide.

Hiring Employees in the Philippines

To hire a regular employee in the Philippines, you need to set up a legal entity in the country to legally pay the employee and taxes. There are registration requirements, fees, and corporate taxes you may need to pay, including US tax withholdings.

As with contractors, hiring an employee in the Philippines will follow the general international hiring process that includes determining the type of worker you need, creating your job description, and drafting an offer letter. See our guide to hiring an international employee for more specifics.

Here, we discuss the unique steps and considerations to keep in mind when establishing your own Filipino workforce.

Step 1: Determine Salary & Understand Compliance Issues

The cost of living in the Philippines is much less than in the US—75% less, in fact. As such, salaries are also much less, averaging about $800 per month. However, depending on the work you need done, the skills required, and the experience you seek, you may need to pay much higher than the average.

Along with salary, you’ll need to ensure you have a way to pay your Philippine employees. There is no requirement of how frequently you make payments, but most Filipino workers are used to being paid twice a month.

The general workweek in the Philippines is 40 hours, and each worker is required to receive at least one one-hour break each day. Overtime is allowed at 1.25 times the regular hourly rate and must be paid to employees working over 40 hours in a workweek or eight hours in a single workday. Explore our guide to doing payroll in the Philippines for more detailed information on payroll compliance.

Hiring international employees requires compliance with laws in two countries. That can be overwhelming for small businesses, which is why we recommend using a provider like Papaya Global—in fact, it is our top recommended international payroll service. Its services can help you pay your Filipino workers correctly and ensure compliance with both Philippine and US laws.

Step 2: Post the Job Ad

Your job ad needs to be posted on job boards Filipino workers will see. Some of the most used job sites include:

Your job ad needs to describe not only the duties and responsibilities of the position clearly but also the work hours. Whether you decide to let the Filipino worker work their local hours or work your hours, leave no ambiguity here and make it clear what you expect. This will help you weed out applicants not looking to work during the hours you require, reducing the amount of time you need to spend reviewing resumes and interviewing candidates.

Compliance note on resumes:

It’s common for Filipino workers to put headshots and even physical attributes on resumes. We recommend asking applicants to remove these items from their resumes before applying, as US anti-discrimination laws could be breached. It’s a gray area, but it’s better to avoid even the appearance of discrimination.

Step 3: Review Applications & Conduct Interviews

To help you sort through applicants quickly and effectively, we recommend making a must-haves list for the position. No applicant will match up perfectly, but the best candidates should be able to meet your handful of must-haves. To find out more, check out our guide to resume screening.

Conducting interviews internationally will present some time zone challenges, but this is good practice for you to see how the individual candidates communicate given these obstacles. Set up a video interview with five to eight of the most qualified candidates. The best way to ensure that they have a stable internet connection is by conducting a video interview.

We also recommend having a list of structured interview questions for each applicant. As a result, you will be able to rate each based on their answers to the same questions, allowing you to narrow the candidates down to just one.

Step 4: Check References

After the interviews are complete, and you have targeted the candidate you want to hire, ask for references. You want to make sure you speak with at least two supervisory references—this will give you a good idea of the candidate’s work ethic, the skills they possess, and what it’s like to manage this individual. Ask the reference both direct and follow-up questions to gauge whether the worker is capable of the job.

Checking international references can be difficult. While we usually recommend all reference checks be completed over the phone only, it might be too cumbersome to do so. Given that, it may be acceptable to communicate with a reference via email.

Step 5: Make a Job Offer

Completing all of the above steps will lead you to a successful conclusion of your hiring process: making a job offer. We recommend connecting with the chosen candidate first to discuss the offer with them and discuss any remaining details.

Once you’ve agreed on all the terms, present the candidate with a formal written offer letter that includes:

- Salary and pay frequency

- Job title

- Start date

- Specific working hours

- Benefits

Also include the job description for the candidate to sign off on. This will allow you the ability to hold them accountable should they not meet your expectations. Give the candidate at least a week to review the offer letter and return it to you.

Step 6: Use an EoR

Hiring international employees or contractors can be quite tricky, especially if you are not aware of the legal requirements in a specific country. You can eliminate that hassle by using an EoR. It can help you navigate the complexities of employment laws in different countries. It can also conduct compliance checks to ensure your employment practices align with local laws.

Here are our top picks of the best employer of record services for more options.

Best Employer of Record Companies Compared

Monthly pricing (Per Employee Per Month) | Setup fee | Plan for Contract Workers ($/Month) | Number of Countries | |

|---|---|---|---|---|

$699 | None | $29 per worker | 170+ | |

Custom pricing | None | Starts at $8/worker | 150+ | |

Starts at $650 | ✓ | Starts at $25 per employee | 160+ | |

| Starts at $599 | None | Starts at $49 per worker | 90+ |

Starts at $300 | None | $40 per worker | 150+ | |

| Custom-priced (call for quote) | Added to price | $49 per worker | 187+ |

| Custom-priced (call for quote) | Included in quote | Custom-priced (call for quote) | 185+ |

| Starts at $599* | None | Starts at $29 per worker | 180+ |

Cost of Hiring in the Philippines

Upon hiring Filipino workers as regular employees, employers must adhere to a number of local payroll compliance regulations, including the deduction of main statutory contributions from employees’ salaries—income tax, Social Security, health insurance, and the Home Development Mutual Fund (HDMF)—and the 13th-month pay.

The Philippines income tax is composed of six brackets, with rates ranging from 0% to 32%. Employers don’t need to pay the income tax, but they must deduct it from their employees’ monthly salary. The brackets are as follows:

- 0%: For taxable income of ₱250,000 or less.

- 15%: For taxable income in excess of ₱250,000 but not exceeding ₱400,000.

- 20%: For taxable income in excess of ₱400,000 but not exceeding ₱800,000.

- 25%: For taxable income in excess of ₱800,000 but not exceeding ₱2,000,000.

- 30%: For taxable income in excess of ₱2,000,000 but not exceeding ₱8,000,000.

- 32%: For taxable income in excess of ₱8,000,000.

The first ₱250,000 of taxable income is exempt from income tax. This means that a person with a taxable income of ₱250,000 will not pay any income tax. The income tax rates are applied on a progressive basis, which means that the higher your taxable income, the higher the percentage of tax you will pay.

Social Security

The Social Security System (SSS) is a social insurance program in the Philippines that provides benefits for retirement, disability, sickness, and death. Employers and employees are required to contribute to the SSS.

The monthly contribution rate is 9.5% for employers and 4.5% for employees, with a cap of ₱1,900 ($34.28) for employers and ₱900 ($16.24) for employees. For example, if an employee earns ₱15,000 ($270) per month, the employer will contribute ₱1,425 ($25.70) and the employee will contribute ₱675 ($12.18).

Philippine Health Insurance (Philhealth)

The Philippine Health Insurance Corporation (PhilHealth) is a government-run health insurance program that provides health insurance coverage for all Filipinos. Employers and employees are required to contribute to PhilHealth.

The monthly contribution rate is 4% for both employers and employees, with an income ceiling of ₱80,000 ($1,443.50). So, if an employee earns ₱15,000 ($270) per month, the employer and employee will each contribute ₱600 ($10.83).

Home Development Mutual Fund (HDMF)

The Home Development Mutual Fund (Pag-IBIG Fund) is a government-owned savings and loan institution that helps Filipinos save for a home. Employers and employees are required to contribute to the Pag-IBIG Fund.

The monthly contribution rate is 2% for both employers and employees, regardless of the employee’s salary. So if an employee earns ₱15,000 ($270) per month, the employer and employee will each contribute ₱300 ($5.41).

13th-Month Pay

The 13th-month pay is mandatory for all private sector rank-and-file employees, regardless of their designation, position, employment status, or method by which their salaries are paid. However, it is not mandatory for government employees.

It is calculated based on the employee’s basic salary, which is the fixed amount of money that the employee receives on a monthly basis. It does not include overtime pay, bonuses, or other allowances. Simply get the employee’s annual income and divide it by 12.

If an employee earns $18,000 a year, the monthly pay is $1,500 (₱84,981.74). This would represent the 13th-month pay amount—if the employee worked the full year. If not, you’ll need to calculate a prorated amount.

Calculating Prorated 13th-Month Pay

Employees who worked less than a year will receive a prorated 13th-month pay. To calculate the prorated amount, simply multiply the employee’s monthly salary by the number of months they have worked and divide it by 12.

Here’s the sample computation of an employee with a $1,500 per month salary and has been in the company for only four months:

$1,500 X 4 months = $6,000

6,000 / 12 months = $500 (₱27,679)

Based on the computation above, the employee’s prorated 13th-month pay is $500 (₱27,710).

Here’s a table that summarizes the cost of hiring a Filipino worker based on a $1,500 per month salary.

Gross Monthly Salary $1,500 | |

|---|---|

Employer cost and contribution | Employee salary and contribution |

Employee salary: $1,500 | Gross salary: $1,500 |

+SSS: $34.28 | -SSS: $16.24 |

+PhilHealth: $60 | -PhilHealth: $60 |

+HDMF: $30 | HDMF: $30 |

+13th-month pay: $125 | -Income tax: $375 |

Total monthly cost: $1,749.28 | Net pay: $1,018.76 |

What to Consider Before Hiring in the Philippines

The biggest reason US small businesses hire Filipino workers is the reduced overhead. The ability to save money is a good reason to hire them—but make sure you consider other factors as well.

Common Types of Work Outsourced to the Philippines

Remote workers in the Philippines hold various roles in many industries, just like those in the US. Here are some of the most common jobs outsourced to Filipino workers and their average monthly salary:

Job | Average Salary* |

|---|---|

Office and admin assistants | $485 |

Virtual assistants | $485 |

Customer service and support reps | $370 |

Web master and web developers | $600 |

Content writers | $460 |

IT support reps | $400 |

Research assistants | $355 |

Graphics and multimedia designers | $450 |

Marketing, sales, and advertising reps | $400 |

English teachers | $300 |

*Salary quotes are based on the information we gathered from Indeed.com

The Philippines’ education system has modeled itself after the US. As such, expect Filipinos to have similar educational backgrounds and resumes as US workers.

Cultural Differences

When hiring employees, certain skills are necessary to complete the job effectively. Some of these skills are soft skills that come about through cultural differences. While the Philippines and the US education systems are similar, Filipinos are generally more communal in their decision-making and respectful of hierarchy—traits not always found in US workers.

As a result, you may find that some Filipino workers will check in with you or defer important decisions to you or another supervisor, making them less autonomous than US workers. Understand that this does not make them ineffective workers; it is instead simply a cultural difference that may require some adjustment on your end.

Time Difference

The East Coast of the US is 12 hours behind the Philippines. When it’s 8 a.m. in New York, it’s 8 p.m. in the Philippines, making it difficult for workers to overlap and collaborate. If your company doesn’t need workers to do so, then the time difference won’t be an issue.

However, if your company needs teams to work together, you may need to shift hours. Your US-based employees may have to work earlier some days, while your Filipino members may have to work later. Some companies require Filipino workers to work US hours all the time. While that means they’re working overnight, it can benefit your company by having every employee on the same schedule.

Hiring From the Philippines Frequently Asked Questions (FAQs)

Can I hire Filipino workers directly?

In order to hire workers in the Philippines, whether a contractor or employee, you must first find an entity to manage the employee’s wages and taxes. You can find a list of licensed private employment agencies at the Philippine Overseas Labor Office (POLO).

How do I pay an employee in the Philippines?

In order to pay employees in the Philippines, you can work with a local payroll processing company that will ensure legal compliance and pay and process taxes for you. Or, you can choose to pay in-house, but be sure you follow all the legal requirements for paying employees in the Philippines. For a list of steps on how to pay employees in the Philippines, as well as forms required, visit our article on How to Do Payroll in the Philippines.

How do I terminate an independent contractor or employee in the Philippines?

To terminate an independent contractor in the Philippines, you need to follow the termination clause outlined in the contract. Usually, this means providing at least one month’s notice of termination. If you’re terminating an employee, you may also need to have just cause and provide a legal reason for the termination.

Bottom Line

Hiring any international worker comes with unique challenges. Making the hiring process streamlined and stress-free for both you and your new contractor or employee can be achieved by following the guidelines covered above. We also recommend that you seek advice from an international employment lawyer to ensure your company remains compliant.