Buying vacant land can be a lucrative investment with high returns if you carefully plan, understand the factors, and weigh the pros and cons. To get started, you must know where and how to find land and consider the type of land to purchase. Then, develop your profit plan, get financing pre-approval, make an offer, and close on your new land purchase. While a land purchase can be an inexpensive and hands-off investment, producing a monetary return is often more complex than a residential property.

This article provides seven steps to help you learn how to buy land—from weighing the pros and cons to arranging financing and closing.

1. Weigh the Pros & Cons of Buying Land

Land is often overlooked as a potential real estate investment. There are many benefits to buying and owning raw land; it’s low-maintenance and typically less expensive than buying a developed property. However, there are also downsides to be aware of, like carrying costs and illiquidity.

| PROS | CONS |

|---|---|

| Limited resource: Land isn’t reproducible—there is a fixed supply. Being a limited resource causes it to appreciate over time. | Doesn’t produce immediate income: Unless you lease or flip your land, it isn’t going to generate revenue quickly. |

| Inexpensive entry: Vacant land can be inexpensive to buy and you can build equity if you wait for it to appreciate. | Carrying costs: Land has costs without revenue, like property taxes and debt service if financed. |

| Hands-off investment: If you buy and hold the land without developing it, there’s not much to do but visit it occasionally. | Illiquid asset: Land isn’t always easy to resell since fewer buyers exist. Your cash can be inaccessible in a financial emergency for months or years. |

Weighing the pros and cons can help you decide if this real estate investment is right for you. If you need asset liquidity, land may not be your best option. Or, if you are hoping to flip your land purchase, you’ll need some money for capital improvements or to buy it at a wholesale price. Still, reselling land can take time. On the other hand, if you want a hands-off investment with the potential for a less expensive entry into the market, land may be the right choice for you.

2. Consider the Essential Factors Before Purchasing Land

Buying land for investment can be an excellent strategy if properly executed. However, first-time land investors can be lured by affordable prices or deals without knowing all the facts. Some land deals may look sweet on paper, but don’t be quick to jump in without proper due diligence.

When learning how to buy land, you must research before signing a purchase contract. You can lose a lot of money if you purchase the wrong type of land, like unbuildable lots or improper zoning for your investment strategy.

As part of your due diligence, here are some factors to explore when purchasing land:

The location depends on your investment goals and how you plan to profit from it. For example, if you want to sell individual residential lots or create a subdivision, look for land in a residential area with proper zoning (we’ll discuss zoning in a moment).

If you want to buy and hold land because it’s in an area poised for commercial growth, review traffic patterns, zoning, and population density, and make sure the land can be developed. To buy land in a residential area with primarily young families, check out distances from schools and other amenities.

A deed is a legal document that records land ownership transfer between parties. Researching ownership can be challenging because vacant land may not have been examined, adequately measured, and recorded, creating boundary disputes. In contrast, a property with an existing building likely went through at least one title search, and ownership claims were resolved.

Multiple parties sometimes have legitimate claims to a parcel of land through inheritance, easements, or gifting. Unrecorded claims sometimes come out of the woodwork but, in the end, must be substantiated.

Pro tip: When considering how to purchase land, pay for a title examination and get title insurance through a title or escrow company or real estate lawyer. The search uncovers if anyone has claims to the property or liens against it. Title insurance protects your interest in the property in a dispute.

Unlike most real estate investments, owning land comes with few expenses. The only ongoing expense after buying land for an investment, other than a mortgage payment, is annual property taxes. Therefore, make sure you know what the taxes are before closing. You can search tax records online on the city’s tax collector website or call their office.

Did you know?

In some areas of the country, property taxes are minimal. However, taxes are significant in densely populated urban or suburban areas like New York, Boston, or Los Angeles, and can cost as much as a mortgage payment. Ensure you have enough income to cover the taxes, and if you plan to hold the property, plan for tax increases.

Every piece of land has a zoning designation, which specifies how to use the property. There are many zoning categories, depending on your area. The primary categories are:

- Residential: Allows for single-family homes

- Multifamily: Allows for single-family and multifamily homes, like duplexes, triplexes, fourplexes, and apartment buildings

- Commercial: Permits office buildings, retail, and sometimes hotels

- Industrial: Generally reserved for warehouses, factories, and light manufacturing

- Agricultural: For farms, orchards, ranches, and similar. Single-family homes and small multi-units like duplexes are sometimes allowed with this zoning.

These zoning designations can change (getting “rezoned”), which can solve or cause new problems. Land-buying must include researching existing and pending zoning changes to ensure they fit your plans.

Zoning is not the only restriction that can limit what you can do with the land. Make sure to research potential restrictions and requirements, which frequently include:

- Building moratoriums: This legal restriction stops the construction of all building projects on a piece of land. Many construction projects nationwide have building moratoriums in place due to potential code violations or environmental concerns.

- Easements and right-of-ways: An easement means that another party is legally permitted to use a piece of land, even when owned by someone else. Examples include wildlife and historic preservation easements that may prevent all future development. Right-of-ways provide pass-throughs for other properties; for example, a municipal water department may have a right-of-way through your land to access a water tower.

- Inadequate size or shape: Make sure the lot is large enough to build on by consulting a building professional. Also, keep road access, parking, and traffic in consideration.

- Setbacks: Many local areas have specifications about how far back a building must sit on a lot. Make sure to understand setbacks before starting a project.

- Covenants, conditions, and restrictions (CCRs): CCRs are set by local homeowner’s associations (HOAs) or local government and typically apply to land zoned for single-family homes. Make sure you know all the rules of your HOA before you move forward with any plans.

To investors unfamiliar with buying land, it may seem like most parcels only differ in size and terrain. However, you can easily buy a piece of worthless land if you are not careful and mindful of its physical characteristics.

Here are a few physical characteristics to focus on:

- Accessibility: Your land purchase must have road access to be profitable. A landlocked parcel is surrounded by other properties with no road or driveway access, making it nearly impossible to profit from or sell.

- Flood zones: Many pieces of land remain undeveloped because they are in a flood zone. You may never be able to build on these land parcels or may be unable to insure any structures.

- Environmental issues: There is a wide range of possible environmental concerns, like environmentally sensitive areas, including wetlands, habitats, wildlife zones, tribal lands, and national parks. Contact the U.S. Environmental Protection Agency (EPA) or the local conservation commission.

- Topography: Flat land can be easier to build on, but also consider the substrate. It could be ledge, wet, or sandy. Hilly and rocky areas also produce challenges. It is possible to build on most places, but clearing and building up land for development can be costly.

- Soil type: You may be required to do a soil test to get a permit before building. Therefore, it’s necessary to have that information before buying the land.

Plat maps show all the land parcels with lot lines, measurements, zoning designations, topographic and geographic features, and what they are adjacent to. These maps and surveys may be available online or at your county surveyor’s office.

Utilities like gas and electric may be available, but you may need to bring them to the lot line, which can be costly. For those still learning how to buy land, research the utilities you need, their accessibility, and the costs of having them on the property.

Look for the following:

- Water: If municipal water has not been run, investigate whether drilling a well is possible. If not, a lot without water is generally unbuildable.

- Sewer: If municipal sewer is unavailable, you must run a percolation test (perc test) to see if the parcel can have a septic tank. If it won’t perc, you will probably be unable to get a building permit.

- Electricity: Electricity is one of the easiest utilities to run to a lot if it’s nearby. Check with your local electric utility to estimate the cost of running a line if there isn’t an existing one.

- Gas (optional): Fortunately, if a lot has electricity, it doesn’t necessarily need gas. However, if gas is the custom in the area, you will want to check with the gas provider to investigate the cost of running a line to the lot. You may be able to substitute with propane.

- Phone, communication, and internet: The lack of telephone, cable TV, or internet won’t prevent you from developing, but lacking them will be unacceptable for anyone planning on living or working on the land you develop.

3. Where to Find Land to Purchase

To make substantial investments in any real estate, you need a solid strategy for finding investment properties for sale. Finding land for sale can be done in various ways, and it’s best to implement multiple strategies. These include working with real estate agents and land brokers, evaluating government-owned land, and searching the land for sale sites.

Land for Sale Sites

Searching for land parcels online is the most efficient method to find properties for sale. Many land-for-sale sites, including Zillow, the largest real estate marketplace for all properties, make searching easy. Other land marketplaces, like Crexi and LoopNet, provide investors with more extensive and relevant property details. Another great benefit of using land-for-sale sites is that all of them are free to browse.

Site | ||||

|---|---|---|---|---|

Key Features |

|

|

|

|

Learn More |

Land Brokers

Since many real estate salespeople don’t have experience with land sales, you may want to contact a specialist—a land broker directly. Land brokers are usually in rural and agricultural areas and are well-versed in finding parcels, evaluating your needs, and researching the lot’s characteristics.

Land brokers can help you find lots based on your goals.

The commissions for land brokers are higher than typical residential real estate agencies, often ranging from 7% to 10%. Since land is more challenging to sell than other property types, these agencies price their work into the commission.

For Sale by Owner Sites (FSBO)

Many land parcels on the market are being listed directly by their owners. If you’ve ever driven in less developed parts of town or more rural areas, you’ve probably seen any number of signs advertising a parcel of ground for sale. This makes online FSBO sites great sources of lots, developable parcels, and rural land.

One highly effective and valuable tool to find FSBO properties is REDX. Although it’s a real estate lead generation tool designed to connect agents with FSBOs, it’s used by investors to connect with land sellers more quickly and efficiently. REDX automatically searches various data sources to provide new FSBO listings earlier than you’d be able to find them on listing sites. Monthly pricing starts at $39.99, and they exclusively offer free setup to Fit Small Business readers—a discount of $150.

However, FSBO sites are generally easy to use and free to search, so they are great options if you aren’t ready to invest in a tool.

Sites | ||||

|---|---|---|---|---|

Key Features |

|

|

|

|

Learn More |

Real Estate Agents

Real estate brokerages and their agents have access to the most significant number of properties for sale, including raw land. Only 10% of real estate sales are for sale by owner (FSBO). Realtors Land Institute (RLI) research shows land sales over the last year surpassing commercial real estate transactions. This data proves that more land is listed through real estate agencies than anywhere else.

Change in land sales year-over-year (Source: Realtors Land Institute)

However, only some real estate professionals have experience with land sales. Make sure you choose an agent or broker with this specialty, and they will quickly become a valuable resource during your transaction.

The downside to searching for a property with an agent is that the seller has agreed to pay a commission for the sale, which will be reflected in the price. Including this commission in the transaction can make the land’s asking price about 3% to 5% higher. However, land prices are generally negotiable, so you can overcome the higher asking price with good negotiation.

Government-owned Land

Many government agencies have land available for sale, often coming from one of two sources. The first is surplus land that local, state, or federal agencies own but no longer need. The second comes when property owners fail to pay annual taxes, and the land is sold at tax lien and tax deed sales and auctions. Learn more about land auctions in your state’s surplus property division or search for surplus sales on the usa.gov website.

Auction Sites

Another critical strategy for buying land for investment reasons is finding auctions. Land sales are one of the most common property types sold by auction. Auctions remove the possibility of negotiations and shorten the closing period. Many auctions are local or in person, so you can find those by searching for terms like “Chicago auctions” and “Chicago land auctions.”

Online auction sites are also great ways to find land to buy. They often have an existing process that makes it easy to register, get all the property information, and bid online. Plus, most are free to browse and place bids since the seller is responsible for fees. Start by looking at four of the top real estate auction sites below.

Sites |  |  |  | |

|---|---|---|---|---|

Key Features |

|

|

|

|

Learn More |

4. Decide on the Type of Land to Purchase

Many new investors are only familiar with a few common types of land transactions, like rural property, farm acreage, and undeveloped residential lots. However, there is a wider variety of land types available for real estate investors to purchase and turn a profit in unique or creative ways.

Potential uses of vacant land can vary drastically based on your location, topography, climate, and the job market. Therefore, researching all the types of land available in your area helps you uncover some unexpected ways to invest or re-sell your land purchases.

Consider some lesser-known land types and uses:

- Residential

- Commercial

- Industrial

- Agricultural

- Recreational

- Timberland

- Transportation

- Parking lots

Click on the arrows below to see the type and definition of each land type:

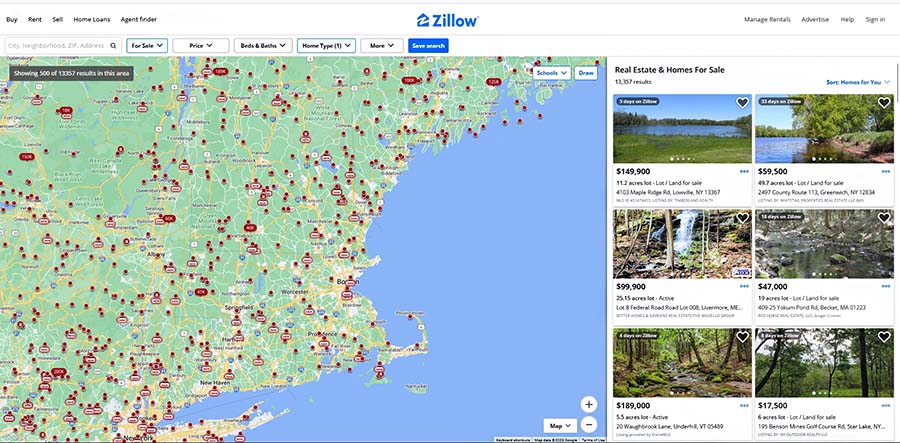

Zillow land search (Source: Zillow)

An easy way to find land to buy is to use real estate websites like Zillow. You can specify “land” in its filters and choose the location you want to search, price range, lot size, for sale by owner or listed with an agent, and current status. When you view land listings, you can see the number of days on the market, purchase history, taxes, and the land type.

5. Develop a Plan & Get Pre-approval

Before you proceed with the land-buying process, consider how you plan to purchase and profit from your investment. If you already have a relationship with a bank or lender, it’s a good idea to start there for your financing pre-approval since they already know you.

Whether your strategy is short- or long-term, create a real estate investment business plan as a guide to keep you on track, help secure financing, and budget for improvements and expenses. Remember that some strategies below generate a faster return, while others can take years. Ensure you evaluate each option alongside the land type, restrictions, and finances.

Get a Pre-approval & Arrange Financing for the Land Purchase

Many people want to know how to buy land without money. While there is no best way to buy land, financing an investment property is essentially the same for land, residential properties, and commercial buildings. Funding an investment purchase has two paths: using cash or obtaining financing. Financing can mean getting a mortgage, a hard money loan for development, or owner financing.

Get a pre-approval before making an offer.

The most common land financing includes:

- Paying cash: Because prices for raw land are generally lower than existing buildings, it’s common for buyers to pay cash. Banks also view raw land as riskier, making financing more difficult.

- Conventional loans: Most conventional lenders offer long-term mortgages for land purchases. Generally, the loan-to-value (LTV) is relatively low, so be prepared for loan options to cover as little as 50% of the purchase price.

- Land and lot loans: Many lenders specialize in land or lot loans. Often, these are savings and loan institutions in more rural areas. Land loans tend to have shorter terms of 10 years or less, typically higher than the market rate, and require 20% to 50% down.

- Owner financing: Owner financing is more prevalent with raw land than developed parcels. Vacant land is typically more challenging to sell than developed properties and is more commonly owned outright, making owner financing easier.

- Hard money: Hard money loans are short-term financing methods, usually set for under 18 months. They can be funded in a matter of days, which allows you to compete with cash buyers in competitive markets. However, you must have a solid plan to generate a return on investment (ROI) to cover the payment quickly, along with the higher interest rates.

Read our article Investment Property Financing & Requirements for more details about your financing options and the documentation you need to obtain a loan.

Create a Profit Plan

Decide in advance how you want to profit from your land investment and how soon you need the money out of it. Flipping the land is the fastest way to profit, whereas holding it until it appreciates is the longest. Write an investment property business plan before buying to help keep you focused and for guidance through your long-term goals.

The most common methods of profiting from a land purchase include:

- Holding it long term: The most basic land investment strategy is to buy and hold, reselling when the property appreciates. If new development is moving in the location of your land, it will apply upward price pressure. The closer development gets, the more valuable your land becomes, even if you don’t touch it.

- Improve the lot: You can naturally increase the value of the lot by building on it or making more minor changes like running utilities, sewer, clearing land, or adding a driveway.

- Get the property rezoned to a higher use: Land can be made more valuable by changing its zoning and what it can be used for. For example, land zoned for agricultural use that gets rezoned for residential development may significantly increase the value without any physical changes.

- Lease the land: This is an often-overlooked option for land purchases. Mobile home parks are structured around leased lots. Rural land can be leased to farmers to cultivate or graze livestock.

- Flip the land purchase: While land flipping is not nearly as common as flipping houses, it is possible to acquire a lot at a below-market price, then resell it quickly at a higher price. One route to do this is by offering owner financing to the new buyer. This can make the land purchase more attractive, and you can earn a profit on the resale and collect periodic interest.

6. Go Through the Purchase Process

With financing in place, a property selected, and a strategy, buying land for investment will be relatively similar to other real estate transactions. You’ll start by making an offer on the property, which includes providing financing details, the offer price, and any contingencies. For land purchases, you may want to include contingencies like environmental test results, permits, and land surveys.

The land owner may accept, reject, or provide a counteroffer, to which you can choose to negotiate the price. Once an agreement has been made, the closing timeline depends on the type of financing you are using to make the purchase. Conventional loans can take 30 to 60 days to approve, while hard money lenders can provide funds in a matter of days.

If you’re working with a real estate agent or land broker, you won’t have to worry about creating a legal purchase agreement or consulting an attorney. An experienced agent who already knows how to buy land will walk you through the process, provide recommendations, and schedule the necessary inspections and tests before closing.

To learn more about a traditional residential purchase, read our article How to Buy a Multifamily Investment Property in 9 Steps.

7. Move Forward With Your Profit Plan

With a land parcel finally under your ownership, you can start taking concrete steps to implement your plan to generate an ROI. After doing all the property research, you should have a clear understanding of any property restrictions and be very familiar with all the potential income opportunities. Although you should have an established real estate investing business plan before you close on the property, now is the time to start executing the plan.

Consider how you’ll profit before buying land.

The first steps you take will vastly differ depending on your profit plan. For instance, if you plan to flip the property, you might not change the land. Instead, you can start marketing to potential buyers once the land is in your name. On the other hand, if you plan to build a residential or commercial building, the first steps will involve getting permits, creating a blueprint, and hiring a contractor or homebuilder.

Although these steps may not be as exciting as seeing walls go up or getting a check deposited into your account, they are essential for the overall success of your investment. Ensure you take the time to do each step properly and interview potential architects and contractors before making any agreements. Rushing the process makes you more likely to hire a bad contractor, which can waste months and thousands of dollars down the line.

Frequently Asked Questions (FAQs)

Lenders see a tract of land purchased for investment as riskier than buying a new lot with plans to build someone’s home, so it requires a credit score of 720 or greater. The risk is attributed to the difficulty of reselling land and the higher risk of the borrower defaulting on the loan.

Yes. Land can be a smart purchase if it is planned properly. Location, zoning, buildability, and accessibility of utilities are all important factors in buying land. Also, find out if the property is at risk of becoming landlocked. If the owner cannot access the land, it can become valueless.

It’s extremely difficult to buy land with no money down. Banks see land purchases as high risk since there’s no house to act as collateral, and land takes a longer period of time for them to sell in a foreclosure auction. You might be able to move forward if you’re fortunate enough to find a seller who will finance a no-money-down purchase, but it’s rare because they also don’t want to assume the risk of default.

Bottom Line

Buying land for investment can be an incredibly lucrative and easy long-term investment for new or experienced investors. However, the success of your investment depends on your ability to do careful research and create an effective strategy to generate a return on your land investment.