House flipping has become a lucrative endeavor for many investors because it offers substantial returns on investment. However, investors will encounter a host of challenges throughout the house-flipping process. These include managing renovation expenses, adapting to market fluctuations, and ensuring projects stay on schedule.

This article provides 13 invaluable tips for investors to navigate these challenges and learn how to make money flipping houses.

1. Craft a Solid Business Plan

When beginning the house-flipping journey, having a well-structured business plan as your foundation will help you achieve success. Your real estate investing business plan should have components that outline your mission, vision, business objectives, project funding, and financial goals. It will not only keep you on track when flipping houses but serve as a tool when seeking financing or partnerships.

In addition to the items listed in a typical investment business plan, you’ll also want to include information specific to a house-flipping business plan:

- Professional support system: Outline how you’ll build and leverage a network of real estate professionals, contractors, inspectors, and other experts to support your projects.

- Financial planning: Develop a detailed financial plan that includes budgets for acquisitions, renovations, holding costs, and contingency funds. Ensure you have a clear understanding of your financing options.

- Property analysis: Describe your criteria for selecting properties, including factors like location, condition, and potential for value appreciation. Include an assessment of each property’s after-repair value (ARV).

- Exit strategy: Define your exit strategy for each property. Will you sell it immediately after renovation, hold it as a rental, or use other creative methods for profit generation?

For more guidance on crafting a business plan for your fix-and-flip venture, explore our article How to Start a House Flipping Business in 7 Steps (+ Free Download), and download the free business planning template.

2. Navigate Risks & Prepare for the Unexpected

House flipping isn’t a guaranteed path to success—it comes with its fair share of risks, which is why tips for flipping houses are invaluable. Factors like market fluctuations, unexpected renovation expenses, or a property not selling as quickly as anticipated are all scenarios investors might encounter. To avoid these potential pitfalls, investors should research and educate themselves on the possible risks and develop strategies (using our tips for flipping houses is a good start) to mitigate them.

One effective approach is to conduct thorough due diligence on potential properties to identify any red flags that could lead to costly setbacks. If a renovation project uncovers unexpected issues, assess the situation and adjust budgets and timelines as needed. Having the guidance of experienced flippers or seeking guidance from mentors can also be invaluable during these moments.

Performing a rental market analysis (RMA) allows investors to evaluate the rental income potential of a property. In the event you are unable to quickly sell the property, perhaps you can generate rental income in the meantime to not lose valuable time on the market.

3. Select the Ideal Investment Location

Choosing the right neighborhood and local market is a foundational step in house flipping and a key component of understanding how to make money flipping houses. New investors should conduct thorough market research to identify areas with strong potential for property appreciation and high sales demand.

Look for neighborhoods with good schools, access to amenities, and a history of consistent property value growth. Understanding the local market dynamics will help you make informed decisions about where to invest your time and resources.

Some key factors when evaluating neighborhoods to find the best option for your house-flipping venture include:

- Location and accessibility: Look for neighborhoods with convenient access to major highways, public transportation, and amenities, like schools, shopping centers, and medical facilities. Proximity to job centers and entertainment options can also enhance a neighborhood’s appeal.

- Market trends: Analyze the historical and current real estate market trends in the area. Choose an area where property values are increasing and there is a high demand for homes. A neighborhood with a strong track record of appreciation is often a wise choice.

- Safety and security: Safety is a paramount concern for both homeowners and potential buyers. Research local crime rates and the presence of law enforcement to ensure the neighborhood provides a secure environment.

- School district quality: For families or future buyers with children, the quality of the local school district can be a significant selling point. Research school ratings and performance to gauge the attractiveness of the neighborhood to families.

- Amenities and lifestyle: Consider the availability of parks, recreational facilities, and cultural attractions in the neighborhood. A neighborhood with amenities that cater to various lifestyles can be more appealing to a broader range of buyers.

- Future development: Investigate any planned or ongoing development projects. New infrastructure, business growth, or community improvements can contribute to the neighborhood’s long-term desirability and potential for appreciation.

- Property taxes and regulations: Examine the property tax rates and local regulations, as they can significantly impact your investment’s profitability. Lower property taxes and reasonable zoning laws can be advantageous for house flippers.

- Overall condition: Take a close look at the condition of the existing homes in the neighborhood. Are there many distressed properties that could indicate a potential for value appreciation after renovation?

It’s essential to stay updated on the economic and demographic trends in your chosen area. Changes in job markets, population growth, and infrastructure development can significantly impact the desirability of a location. By keeping your finger on the pulse of the local real estate market, you’ll be better equipped to make strategic investment choices.

4. Find the Perfect Property to Flip

Uncover the best way to make money flipping houses with a focus on optimizing your investment returns through wise property selections. Novice house flippers should focus on homes that are undervalued, often due to cosmetic issues or neglect. Look for properties with strong bones and good structural integrity, as these can provide a solid foundation for your renovations. Additionally, consider the property’s size, layout, and potential for improvement.

Investors can find properties for flipping homes through various channels:

- Multiple Listing Service (MLS): The MLS is a database used by real estate agents to list properties for sale. You can work with a real estate agent or access MLS listings online to find potential flip opportunities.

- Real estate auctions: Many auctions will sell foreclosures and distressed properties. Auctions can be a source of properties at competitive prices—but they often require cash purchases and thorough due diligence.

- Bank-owned (REO) properties: Banks often have a portfolio of properties they’ve repossessed through foreclosure. These REO properties are typically sold below market value, making them attractive for house flippers.

- Online real estate marketplaces: Websites and platforms like Zillow, Redfin, and Realtor.com provide a wealth of property listings. You can filter search results to find distressed or below-market-value properties suitable for flipping.

- Direct mail marketing: Some investors use direct mail campaigns to reach out to homeowners who may be interested in selling their properties. This method can yield off-market deals.

- Networking and word of mouth: Networking with real estate professionals, fellow investors, and local contacts can lead to word-of-mouth opportunities. Sometimes, the best deals are those that aren’t widely advertised.

- Real estate investment clubs: Joining local real estate investment clubs or associations can provide access to a network of like-minded individuals who may have leads on potential flip properties.

- Social media and online forums: Participating in real estate-related social media groups and forums can lead to potential deals. Investors often share leads and opportunities in these online communities.

- Driving for dollars: Driving through neighborhoods and looking for distressed or vacant properties can uncover potential flip opportunities. You can then contact the property owners to inquire about selling.

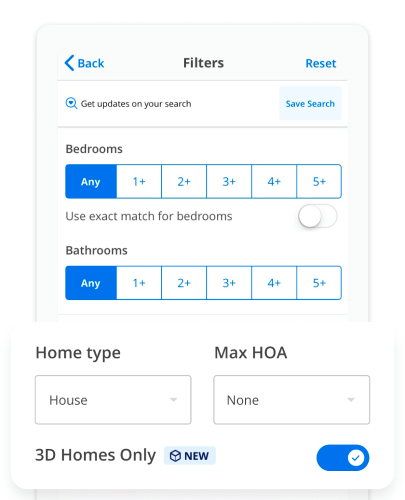

Zillow property search (Source: Zillow)

Zillow is an all-in-one solution for finding, evaluating, and inquiring about real estate investment opportunities. Its user-friendly interface allows investors to filter properties based on criteria such as for sale by owner, location, price range, and property type, making it easy to narrow a property search. The platform also provides comprehensive property details that include high-quality images, property history, and estimated values. This enables investors to conduct thorough research before making an informed investment decision.

5. Assess the Investment Potential of the Property

Assessing the prospective property is essential to understanding how to make money flipping houses and determining if it’s a viable investment. Investors must carefully consider the purchase price relative to the property’s current condition and its potential value after renovation. It’s important to find a sweet spot where you can buy the property at a price that gives you enough money to fix it up but also leaves room for you to make a decent profit when you sell it later.

Here are some important formulas to consider:

- Return on investment (ROI): ROI measures the percentage of money you’re earning from your investment, helping you determine if the project is financially rewarding. Twenty-eight percent is an ideal ROI in house flipping.

- After-repair value (ARV): ARV estimates the property’s potential resale value after completing renovations. Investors should aim to purchase houses for less than 70% of the house’s ARV.

- Cost per square foot: This formula helps evaluate if the purchase price is reasonable based on the property’s size. Anticipate renovation costs ranging from $10 to $60 per square foot. This will get added to your purchase price per square foot, so investors can determine if the final price fits within their financial goals.

Investors must also consider the property’s potential for value appreciation. A successful house flipper takes into consideration any strategic improvements that can significantly increase the property’s market appeal and value beyond its current state. For example, adding outdoor patio space in homes located in hotter climates can make the property more attractive and potentially lead to a higher resale price.

6. Perform a Home Inspection

Beyond the financial aspects, performing a home inspection lets investors understand the property’s true condition. Enlisting the services of a qualified home inspector is akin to having a detective uncover hidden issues that may not be immediately apparent. These issues can range from structural problems, such as foundation cracks or roof issues, to underlying plumbing, electrical, or HVAC system problems.

By identifying potential issues early on, you can accurately estimate the cost of necessary repairs and renovations. It’s essential to budget for these repairs and factor them into your overall project costs. This ensures that you have a clear understanding of the total investment required and helps prevent unexpected expenses that can cut into your profit margin.

There are certain property conditions to steer clear of due to the potential for excessively high expenses, such as:

- Foundation issues: Properties with significant foundation problems can be costly to repair and may indicate broader structural issues. Avoid homes with extensive foundation damage, as remedying this concern can substantially eat into your budget and profit margins.

- Mold and water damage: Homes plagued by mold infestations and water damage pose health risks and can be challenging to remediate. These issues often signal underlying problems like leaks or poor drainage. It’s advisable to steer clear of properties with severe mold or water damage unless you have the expertise and resources to address them effectively.

- Structural integrity: Houses with major structural issues, such as sagging roofs, compromised load-bearing walls, or severe termite damage, can be risky investments. Repairing these problems requires specialized skills and can lead to substantial costs.

- Environmental hazards: Properties in areas prone to environmental hazards like flooding, earthquakes, or wildfires can present unique challenges. While not necessarily a deal-breaker, it’s essential to factor in the additional costs associated with mitigating these risks for potential buyers, like flood insurance requirements.

A thorough home inspection provides the opportunity to prioritize renovations strategically. You can focus on addressing critical issues that impact the property’s safety and integrity while planning cost-effective improvements that enhance its overall market appeal. By incorporating the findings from a professional home inspection into your house-flipping strategy, you’re better equipped to execute a successful and profitable project.

7. Make Strategic Home Improvements for Maximum Value

Discovering how to make a profit flipping houses requires a keen understanding of market trends and cost-effective improvement strategies. When purchasing materials and fixtures for your renovation, be strategic in your choices. Seek out quality products that fit within your budget. It’s also advisable to purchase in bulk when possible to take advantage of cost savings. Every dollar saved during the renovation process contributes to your overall profit margin. Be diligent in comparing prices and quality to ensure you get the best value for your real estate investment.

At the same time, exercise restraint to avoid over-improvement. While it’s tempting to go all out with high-end finishes, it may not always translate to a higher selling price. Your improvements should align with the expectations of the local market and the property’s overall value. Striking a balance between cost-effective upgrades and a visually appealing transformation is the key to maximizing your profit.

8. Select the Right House-flipping Financing Option

Traditional mortgages, hard money loans, private investors, and partnerships are all potential sources for financing house-flipping projects. Investors must choose the option that aligns with their financial situation and investment strategy. However, for those wondering how to get money to flip a house, it’s important to note that many traditional lenders may not approve loans on properties with low appraisal value or borrowers lacking secure and steady income.

Here are some advantages and disadvantages of having lenders for house-flipping projects:

| ADVANTAGES | DISADVANTAGES |

|---|---|

| Lenders provide access to the capital you need to purchase and renovate properties, allowing you to undertake more projects simultaneously. | Lenders often have strict approval criteria that can make the process challenging, like credit score requirements, income verification, and experience in house flipping. Meeting these requirements can be challenging. |

| Lenders can expedite the financing process to allow you to act quickly when you identify a promising property. | When working with lenders, you may have less control over the project since they may impose conditions or requirements that you must adhere to. |

| Some lenders specialize in real estate and house flipping, which can offer valuable insights and guidance throughout your projects. | Borrowing means taking on debt that must be repaid regardless of project success. |

Investors must pay close attention to interest rates, terms, and repayment schedules. A lower interest rate may reduce your holding costs, while flexible repayment terms can provide more breathing room for your project. However, it’s crucial to strike a balance between favorable terms and the lender’s overall reliability and reputation. Thoroughly reviewing loan agreements, understanding the fine print, and seeking recommendations or referrals from fellow investors can help you make informed decisions when choosing the right lender for your house-flipping venture.

Read about the best loans for flippers in our article 5 Best Fix & Flip Loan Options.

9. Build a Strong House-flipping Team

House flipping is rarely a one-person operation. As a new flipper, it’s essential to assemble a team of skilled professionals to support your projects. This team may include contractors, real estate agents, architects, and inspectors. Each member plays a crucial role in ensuring the success of your flips. When selecting team members, prioritize experience, reliability, and professionalism. Research and interview potential candidates to ensure they have a track record of delivering quality work and meeting deadlines.

Here is a list of key individuals involved in house flipping and their respective roles:

- Real estate agent: Hire a great agent who assists in property acquisition and resale, provides market insights, and helps with property listings.

- Architect: Designs and plans renovation projects to ensure that structural changes align with safety codes and enhance the property’s value.

- Contractor: Manages the renovation process, hires subcontractors, and ensures the property improvements align with the investor’s vision.

- Home inspector: Conducts a thorough inspection of the property to identify existing issues and assess its condition.

- Appraiser: Determines the property’s value before and after renovations to help investors gauge potential profit.

- Mortgage lender: Provides financing for property acquisition and renovation costs, if necessary.

- Title company: Ensures a clear title and handles the legal aspects of the property transfer.

- Insurance agent: Arranges property insurance to protect against unforeseen events during the flipping process.

- Property manager: If the property is held as a rental, this individual manages tenant relations and property maintenance.

- Lawyer/attorney: Offers legal counsel, reviews contracts, and assists with any legal issues that may arise.

- Accountant/financial adviser: Manages financial aspects like budgeting, tax planning, and financial reporting.

Investors can find these team members for their projects through referrals from industry peers, local real estate associations, and online platforms, especially when exploring the world of how to make money flipping houses. Websites like Angi or Thumbtack can be a good starting point to find local professionals who can help you make a decent profit when you sell it later.

10. Stay Organized With Effective Systems

House flipping is not just about renovating properties—it’s a multifaceted business that needs to run efficiently. Implementing robust customer relationship management (CRM) software, project management tools, and financial tracking systems can streamline processes, enhance communication, and keep you on top of project timelines and budgets. These systems offer a centralized repository for property details, financial records, and contacts, allowing you to monitor progress and track expenses in real time.

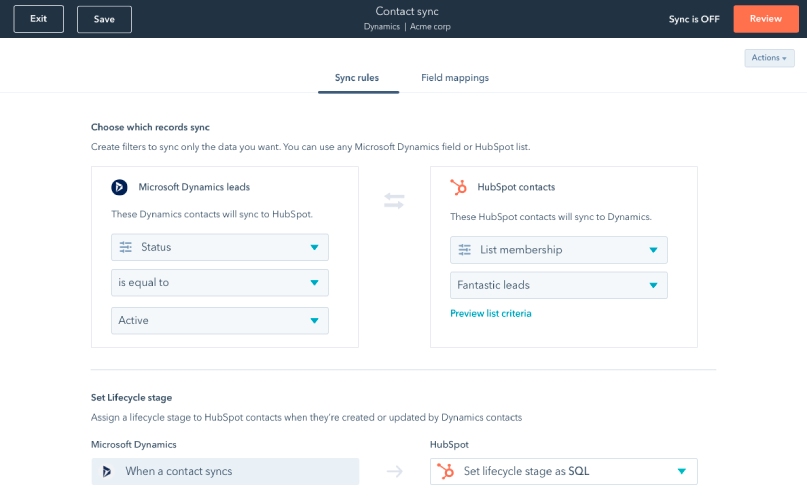

HubSpot data sync (Source: HubSpot)

Platforms like HubSpot can help streamline your house-flipping efforts by managing property leads and launching effective marketing campaigns. Its Operations Hub solution is designed to empower business owners with powerful software tools that automate essential business processes and facilitate seamless team communication on projects. With HubSpot, investors can efficiently manage property acquisitions, track project timelines, and connect their data into one dashboard from other business applications.

11. Set the Right Selling Price

Incorporating valuable tips for flipping houses can significantly impact your success in the competitive house-flipping industry. However, accurate and competitive pricing is essential to your overall profitability. Investors can seek the expertise of real estate agents who are well-versed in the local market dynamics.

These professionals can provide insights into recent comparable sales and analyze current market trends. Additionally, appraisers can conduct thorough assessments to determine the property’s value, considering its condition and improvements.

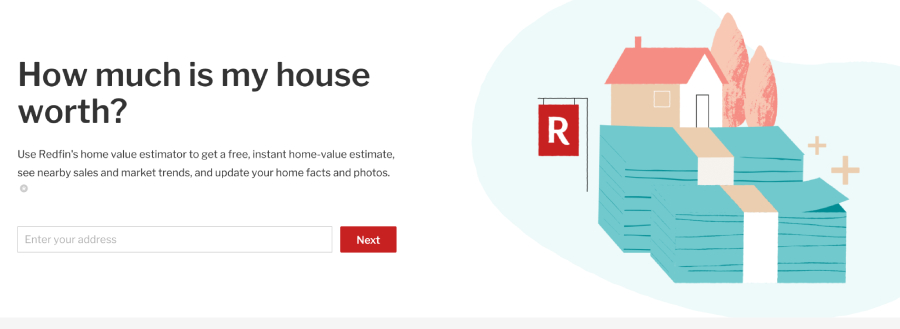

Redfin’s home estimator (Source: Redfin)

Investors can tap into the power of online real estate platforms and valuation tools to gain valuable insights into their property valuation. For instance, Redfin offers a complimentary home value estimator that provides instant property value estimates, access to nearby sales data and market trends, and the capability to update property information and visuals. The platform can even help list your property to interested buyers.

12. Use Effective Marketing Strategies

Marketing your flipped property will help match you with a serious buyer quickly. Utilizing online real estate marketing channels is crucial to extending your marketing reach. You should consider incorporating compelling storytelling into your marketing materials to create an emotional connection with potential buyers. This helps them envision the possible lifestyle that your flipped property can offer.

Additional ways to maximize your property’s visibility and appeal:

- Postcards: Direct mail postcards can be an effective way to target potential buyers in your local area. It provides a platform to showcase high-quality images of the property and highlight its key features.

- Email marketing: Engaging email campaigns featuring professional photos and a compelling property description can capture the attention of prospective buyers. Investors can segment the email list to reach out to potential buyers who have expressed interest in similar properties.

- Social media: Social media platforms such as Facebook, Instagram, and LinkedIn can promote your property. Share eye-catching videos and engaging posts to capture the attention of buyers in your social network.

- Virtual tours: Consider creating virtual tours or 3D walk-throughs of the property to allow potential buyers to explore every corner of the home from the comfort of their homes.

- Professional staging: Professional staging can greatly enhance a property’s visual appeal. High-quality furniture and decor arrangements can help buyers envision themselves living in the space.

- Professional photos: High-quality photography is essential to capture the property’s best angles, lighting, and features, making your online listings and marketing materials more visually appealing and enticing to potential buyers.

Exterior landscape rendering example (Source: Fit Small Business)

If professionally staging your house is out of the budget, investors can leverage digital staging companies to make the marketing process more visually appealing. These companies specialize in digitally enhancing property photos to showcase a property’s full potential. Through virtual furniture placement and decor enhancements, they transform empty or outdated spaces into inviting and stylish environments, making it easier to attract prospective buyers.

13. Build a Reserve Fund for Contingencies

Creating a reserve fund is a necessary step in the house-flipping process. It provides financial security when unforeseen expenses arise during renovations, such as structural repairs or project delays. It’s recommended that you allocate a percentage of your total budget to this fund—typically between 10% and 20%. This financial cushion not only offers peace of mind but also enhances your ability to navigate unexpected challenges without compromising the entire project or your profitability.

Frequently Asked Questions (FAQs)

New house flippers often make common mistakes like underestimating renovation costs, over-improving properties, and neglecting thorough due diligence. To avoid these pitfalls, conduct a comprehensive property inspection, create a detailed budget with a contingency fund, and prioritize cost-effective improvements that add value. Additionally, resist the urge to personalize properties with unique or expensive features that may not align with the market’s expectations.

Finding reliable contractors and professionals is crucial for the success of your house-flipping endeavors. Networking within the real estate industry, attending local real estate meetings, and seeking recommendations from experienced flippers can be effective ways to find trustworthy contractors. When evaluating potential professionals, check their credentials, past work, and client references. Establishing a team of experts can help you learn how to make money remodeling homes.

The amount you need to start flipping houses can vary widely depending on your location, the property market, and the scale of your projects. However, as a general guideline, it’s advisable to have approximately $20,000 to $30,000 as a starting budget. This amount should cover the down payment, renovation costs, and initial holding expenses. Keep in mind that the more you can allocate to your budget, the more flexibility and potential for profit you’ll have.

Bottom Line

Making a profit when flipping houses is a complex endeavor for investors. The process demands a high level of organization and a deep understanding of the intricacies of the real estate market. It involves meticulous planning, astute financial management, and the ability to navigate unexpected challenges that may arise during the renovation and selling phases. By applying these tips for flipping houses, investors can navigate the complexities of the real estate market and turn properties into profitable assets.