Hiring workers in India gives you a much wider pool of high-quality talent that can help fill your business’ information technology and other staffing needs. The first thing to consider when hiring from India would be whether to hire a local employee or an independent contractor.

For small businesses looking to hire only a few workers, independent contractors can be more beneficial. Meanwhile, if you plan to hire many workers, setting up a business and hiring employees might be your best bet. We’ve outlined the steps for hiring both types of workers in India below.

Looking for an all-in-one HR & Payroll platform for your global team? Easily hire and pay employees and contractors in 140+ countries using Rippling. |

|

Once you know how to hire both contractors and employee in India, you’ll need to determine how you’re going to pay them. For everything you’ll need to consider, check out our full guide on How to Do Payroll in India.

Hiring Independent Contractors in India

If you just need a few employees, hiring an independent Indian contractor can help you reduce your overhead costs and dispense the need to create a legal entity. Even better, many remote employees from India are used to working on an independent contractor basis. However, take note that you will have less control over the work done and may face stiff fines and penalties for misclassification.

Hiring independent contractors from India generally follows the same process as listed in our guide to hiring international contractors (creating a job ad, reviewing candidates, etc.). Here, we’ve indicated some of the considerations specific to hiring contractors in India.

Step 1: Review India’s Labor Laws

India’s independent contractor law, Contract Labour Act 1970, defines independent contractors as a worker engaged in producing a given result. Essentially, this is similar to how the US defines an independent contractor as someone working for a company on a by-project basis.

India allows independent contractors to work for multiple companies if they so choose. The workers may also include temporary, fixed-term, and gig workers.

Compliance Note: If you plan to hire more than 20 independent contractors, you must become a principal employer in India. This is a registration certificate that will require you to jump through several bureaucratic hoops.

What to Know About Gig Workers in India

Because gig work has become so popular recently, let’s dive in a little further. “Gig workers” are actually a new worker designation under The Code on Social Security, 2020. These workers are generally more short-term than normal independent contractors, though you could still use gig workers for projects you need completed.

What’s important to note about this law, however, is that a gig worker must contribute to the Social Security program in India. They will contribute 1%–2% of their annual gig worker income. Your company will need to be aware of this provision, but you won’t likely be required to withhold this income on the independent contractor’s behalf.

Misclassifying Independent Contractors in India

India, like the US, has regulations around misclassifying independent contractors. If you partner with an independent contractor in India, make sure you keep the worker’s status as a contractor by:

- Signing an independent contractor agreement

- Not making the contractor work solely for your company or sign a noncompete agreement

- Letting the contractor work their own hours

- Ensuring that the contractor has their own equipment to do their work

- Not providing the contractor with any employment benefits

The fines and penalties your company may be subjected to if you’re deemed to have misclassified an Indian worker include:

- Back pay and back taxes

- Government fines

- Jail time

Employee (W2 Workers) and Independent Contractor (1099 Worker) are starkly different worker classifications that you’ll have to understand to avoid penalties. Learn more about it in our 1099 vs W2 article—though targeted for the US workforce, it is quite similar to India’s definition of these types of workers.

Step 2: Determine Withholding Taxes & Collect W-8BEN Forms

If the independent contractor you work with lives and does all their work for you inside India, then you don’t have to withhold taxes.

However, if the independent Indian contractor ever comes to the US and does work for you while in the US, then the time you compensate them for work done will be taxed by the US. That’s why it’s vital that you have the independent contractor complete Form W-8BEN or W-8BEN-E. These forms must be completed by the foreign independent contractor and retained by your business—you don’t file them with any government agency. The purpose of these forms is to ensure you don’t have to withhold taxes—or, if you do, you withhold at the appropriate rate.

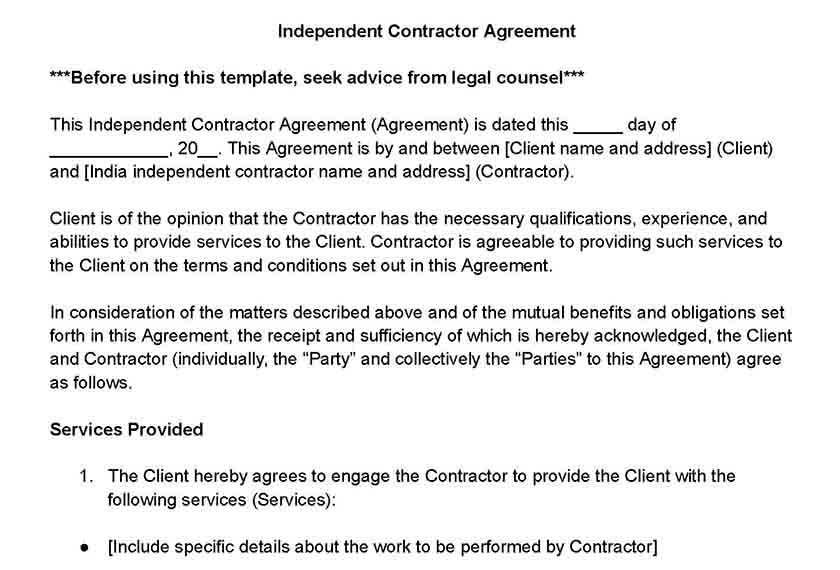

Step 3: Use an Independent Contractor Agreement

When hiring international contractors, instead of providing a job offer, you’ll be having an independent contractor agreement signed. Indian law does not require you to use one, but we highly recommend doing so. This agreement will lay out the terms and conditions of your relationship, stating clearly what you need the independent contractor to do and that there is no employer-employee relationship.

Your agreement should include:

- Specific description of the project, including a term or duration if known

- Payment rate, terms, and an administrative fee of not less than 10% of the total contract amount

For an easier time, use our independent contractor agreement template when hiring from India.

Compliance Note: Be aware that Section 27 of the Indian Contract Act makes noncompete clauses invalid. It’s common practice in the US to use these clauses in employment agreements and independent contractor agreements, although some states are beginning to enact laws restricting companies from using them. But these clauses are unenforceable in India.

Step 4: Determine How to Pay the Indian Independent Contractor

You’ll need to set up a regular payment system to pay the Indian independent contractor. You can pay by wire transfer, but that may come with cost-prohibitive charges, especially if you’re paying more than once per month. Learn the basics of paying independent contractors in India in our guide on how to pay international contractors.

Independent contractors in India are used to being paid just once per month, so you may use that timetable for your payments. Because of its simplicity, many companies prefer to use the Society for Worldwide Interbank Financial Telecommunications (SWIFT) for payments to India. You’ll be charged a fee, but SWIFT makes it easy to make your payment in US dollars and have the foreign worker receive the payment in their currency.

You could also consider using a payroll provider like Papaya Global. Even if you don’t plan to hire employees in India, Papaya Global can easily set up and pay your Indian independent contractor on the regular schedule you decide. Learn more about Papaya Global in our in-depth Papaya Global review.

Hiring Employees in India

Setting up a legal entity in India is a good idea if you plan on expanding your business there or are hiring over 20 employees. Hiring an employee from India will follow the same steps as outlined in our guide to hiring international employees, including determining the type of worker you hire (full time, part time, seasonal, or temporary) and writing your job description.

Here are the main differences you’ll need to watch out for when hiring in India.

Step 1: Set Up a Legal Entity in India

It is illegal for you to begin hiring employees in India without establishing a legal entity. However, opening an office location or creating a legal entity can be a time-consuming and costly process.

To establish a legal entity in India, you need the following:

- Director Identification Number

- Digital Signature Certificate

- Business name approved and registered with the Registrar of Companies

- Memorandum and Articles of Association

- Permanent Account Number

- Employees’ Provident Fund Organization filing

- Value-added tax (VAT) registration

- Medical insurance application

- Incorporation application

- Certificate to commence operations

You may, however, hire through an employer of record licensed to work in India. It can save you enormous amounts of time, money, and headache.

Step 2: Determine Salary & Benefits and Understand Compliance

Because the cost of living in India is about 81% less than in the US, an average salary is about $400 per month. In fact, even in specialized positions, you could see a reduction in overhead costs.

While that may be the case, expect salary negotiations to occur. Companies often include additional benefits, which are highly valued by Indian workers. According to the Payment of Bonus Act of 1965, companies must pay bonuses to employees if the company employs at least 20 staff and an employee earns less than 10,000 Indian rupees (about $130) per month. The required bonus ranges based on the salary but must be at least 8.33% of wages. If you’re having trouble figuring out bonuses, check out our article on how to calculate bonuses for employees.

Payroll & Employment Law Compliance in India

There is no payroll schedule requirement, but most Indian workers are used to being paid at least monthly. There are important labor laws and taxes you need to know, which are:

- Minimum Wage: India’s minimum wage is adjusted frequently by taking into account over 2,000 job types. It’s currently set at 176 rupees per day (about $2.15). Many municipalities have higher minimum wages broken down by different zones and industries.

- Overtime: Employees receive twice their base pay for any work over 48 hours in one week.

- 13th Month Pay: With few exceptions, this is a mandatory bonus paid as a percentage of the employee’s annual salary at the end of the year.

- Employer Payroll Contributions: These are mandatory deductions from an employee’s paycheck, as indicated in the table below.

Benefit | Employee Share | Employer Share |

|---|---|---|

Employee’s Provident Fund | 12% | 12% |

Employee’s State Insurance | 1.75% | 4.75% |

Health and Education Cess | 4% | 0% |

- Paid Time Off: Indian workers must receive at least 15 paid days off following 240 days of employment. While this is the minimum, most employers offer more time off to attract top talent, including unlimited PTO. Download our free PTO template policy or check out our guide on providing unlimited PTOs.

- Sick Leave: Any employee who has been employed for three months or more continuously is entitled to 12 paid sick days per year. Sick days are paid at 70% of the employee’s regular rate of pay.

- Parental Leave:

- Maternity: 26 weeks of 100% paid maternity leave for their first two children and 12 weeks for any additional children

- Paternity: When an employee has worked for their company for at least 80 days before the delivery date or adoption date, a worker is entitled to at least 15 days off that must be taken within six months of the birth or adoption date of the child

- Holiday Leave: There are many national holidays and local holidays in India where employees commonly take time off or where companies close, usually between eight and 12 days. Employers are only required to give paid time off for employees during the following national holidays:

- Republic Day

- Independence Day

- Gandhi Jayanti

Hiring international employees requires compliance with laws in two countries, which can be overwhelming for small businesses. That’s why we recommend using a compliance partner like Papaya Global. Its services can help you pay your Indian workers correctly and ensure compliance with both US and Indian laws. In fact, it is even one of the top recommendations in our best employer of record services guide.

Step 3: Post the Job Ad

Your job ad needs to describe the duties and responsibilities of the position and the work hours. Whether you decide to have your Indian staff work their local hours or your hours, spell out what you expect—this will help you narrow your candidate pool down quickly.

Post your job ad on job boards Indian workers will see. Some of the most common job sites include:

Learn how to attract the best candidates in our guide to creating effective job advertisements.

Step 4: Review Candidates & Conduct Interviews

To help you conduct applicant screening effectively, make a must-haves list for the role. The best talent should be able to match with your handful of must-haves.

Conducting interviews across time zones will present some challenges, though this is an opportunity for you to see how the applicant communicates given the obstacle, especially if you need them to work your hours. Set up a video interview with the half dozen most qualified—this, instead of a voice call, will ensure you can trust their internet connection.

Remember to prepare structured interview questions for each applicant. This lets you rate candidates based on their answers to the same questions, allowing you to narrow the pool down to just one.

Step 5: Conduct Reference Checks

After you have targeted the candidate you want to hire, ask for references—and speak with at least two supervisory references. This will give you insight into the applicant’s work ethic, the skills they possess, and what it’s like to manage the individual. Ask references direct and follow-up questions to gauge whether the candidate will be successful in the role.

While we recommend all employee reference checks be completed via a phone call, it might be too cumbersome to do so internationally. As such, communicating with a reference through email is often acceptable. You may use our curated list of employee reference check questions for some ideas on how to approach this process.

Step 6: Make an Offer

When making a job offer, connect with the person to discuss it and any other details. Once you’ve agreed on all the terms, present them with a formal employment contract. Although this is not a requirement in India, this is an extremely common practice and will protect you as the employer later on.

Ensure it includes:

- Salary and pay frequency

- Job title

- Start date

- Specific working hours

- Benefits

Insert the job description for the candidate to sign off on, as well, so that you can hold them accountable if they do not meet your expectations. Give them at least a week to review the proposed employment contract and return it to you.

Download our free job offer template to ensure that you’re providing the necessary information in your letter.

What to Consider Before Hiring in India

One of the biggest reasons small businesses hire workers from India is the reduced overhead. However, while you may save more money than you would by hiring someone in the US, there are certainly other factors to consider when hiring in India.

For one, they are not afraid to job hop—about half of all workers have left a job shortly after starting. They do this to improve their skills and salary, which means you don’t have to look for only unemployed workers.

Here are some other things to consider before hiring in the country.

Common Types of Work Outsourced to India

With about 400 million workers in India, you can find someone to do just about any job. However, there are some jobs more commonly outsourced to India. These jobs and industries include:

- IT

- Web design

- Web development

- Software design

- Cybersecurity

- Data analytics

- DevOps

- Cloud infrastructure

- QA Testers

- Call center/customer service

The overwhelming majority of workers in India are in IT and computer sciences. There are specialized universities that teach people the skills needed for all kinds of IT work, making India a dominant source of skilled IT workers. Many companies in the US are tapping into the Indian workforce to save costs over domestic workers with similar skills commanding much higher salaries.

US companies with clients around the world can also use Indian customer support and call center representatives. If your small business has this need, you can get people who can work business hours to support your Indian and Asian clients and speak the same language.

Cultural Differences

The cultural differences between the US and India are not as significant as you might assume. For example, Hindi is the official language of India, but English is an official sub-language. Many people living in India speak conversational English.

Where cultures differ more is around business hours. In India, the workday starts later, usually around 10 a.m. and stops about 6 p.m. However, workers in India are used to working US hours or staggered shifts, so don’t let this deter you from hiring employees in India. While that may be the case, you may still need to be more flexible with shift start and end times.

Job titles are very important to Indian workers, as is recognition for loyalty. It’s not uncommon for a company to reward employee loyalty with substantial raises of 10% or more each year, in addition to a promotion.

Time Difference

Even though India spans three geographic time zones, it adheres to a single time zone. Called India Standard Time, it’s five and a half hours ahead of Greenwich Mean Time (GMT) and nine and a half hours ahead of US Eastern time. Because India decided to have just one time zone instead of two or three, they compromised and split the difference, creating a single fractional time zone (which is where the 30 minutes comes from).

This extreme time difference can make it difficult to collaborate with your Indian employees. Your US-based staff may have to work earlier some days, while your Indian team may have to work later. Some companies require Indian workers to work US hours all the time. While that means they’re working overnight and you’ll probably need to pay them a little more, it can benefit your company by having every employee on the same schedule.

Bottom Line

Hiring employees in India—or partnering with an international independent contractor—may present international challenges, but you can streamline the process by following our guide. You may also want to get advice from an international employment lawyer to ensure your company stays in compliance.