Melio and Plastiq are two names often heard in the world of digital payments, each offering its own features and advantages. While Melio is best for businesses needing to manage their A/P and streamline the process of paying vendors and suppliers, Plastiq is especially valuable for businesses looking to earn credit card rewards or manage cash flow by deferring payments.

When choosing between Melio vs Plastiq, it is important to consider your specific payment needs and the fees associated with each platform.

- Melio: Optimal for businesses looking for free bill-pay and invoicing software

- Plastiq: Ideal for businesses seeking flexibility with payment options, including short-term financing

Melio vs Plastiq At-a-Glance Comparison

| ||

|---|---|---|

Monthly Pricing |

|

|

Transaction Fees |

| |

Free Trial | 30 days for paid plans | N/A |

Approval Workflows | ✓ | ✓ |

Manage Bills | ✓ | ✓ |

Customizable Account Permissions | ✕ | ✓ |

Compatible with American Express | ✓ | ✕ |

✓ | ✕ | |

Batch Payments | ✓ | ✓ |

Mobile App | iOS and Android | iOS and Android |

Payment in Multiple Currencies | ✕ | ✓ |

Vendor Portal | ✕ | ✕ |

Short-term Financing | ✓ | ✓ |

User Review Rating on Third-party Sites | ||

Use Cases and Pros & Cons

User Reviews: Melio Wins

Melio and Plastiq received good user reviews, but Melio fared a bit better, so I awarded it the leader of this category. I agree with users who felt that Melio was easy to use, and I appreciate that it integrates with both QuickBooks Online and Xero. Plastiq is also a good option, especially if you don’t mind paying a bit more for access to unlimited users.

One satisfied user shared that Melio is easy to set up and use, with an intuitive UI. Others commented on the knowledgeable customer support reps, although some reported that it can be challenging to reach someone if technical support is required. I commend Melio’s ability to integrate with both QuickBooks and Xero if you require accounting software integration.

On the downside, some reviewers complained about issues regarding slow or unsuccessful payments to vendors. Others dislike that phone support is unavailable; only live chat and email are offered.

Here’s how Melio is rated on top review websites:

Reviewers expressed that they like that Plastiq’s paid plans offer access to unlimited users and that the provider offers a 60-day free trial. They also appreciated the free plan for up to three users. However, users disliked that it doesn’t offer online chat support with agents and that its fees are more expensive than those of its competitors.

Plastiq has earned the following average scores on popular review sites:

Pricing: Plastiq Wins

| ||

|---|---|---|

Monthly Pricing |

| To send money:

To receive money:

|

Number of Users | 1 ($10 monthly for each additional user for the Core and Boost plans) | Unlimited |

ePayment/ACH Fees | $0.50 per ACH transfer in excess of the allotted amount for each plan | $0.99 |

Check Mailing Fee | $1.50 (first two per month are free) | $1.49 |

Payment by Debit or Credit Card | 2.9% | 2.9% |

Invoice Mailing Fee | N/A | N/A |

Short-term Financing Rates | N/A | 2.7% to 10.65% transaction fee |

Free Trial | 30 days for paid plans | N/A |

When it comes to pricing, I selected Plastiq as the winner because it doesn’t charge any monthly fees and allows unlimited users. Both charge a 2.9% fee for payment by debit or credit card.

While it may seem that Plastiq’s short-term financing is a good option, keep in mind that its rates are very expensive—a 2.7% to 10.65% transaction fee for a period of only 30 to 90 days. It is not totally clear how these rates are determined, but it is likely a combination of the length of the term and the quality of your credit score.

Features: Plastiq Wins

| ||

|---|---|---|

A/P & A/R Features | ✓ | ✓ |

Compatible Accounting Software | QuickBooks Online, QuickBooks Desktop, Xero, and Amazon Business | QuickBooks Online, Xero, NetSuite, and Sage Intacct |

Mobile App | iOS and Android | iOS and Android |

Batch Payments | ✓ | ✓ |

International Payments | ✓ | ✓ |

Approval Workflows | ✓ | ✓ |

Vendor Management | ✓ | ✓ |

Pay Vendor With Credit Card | ✓ | ✓ |

Customizable Account Permissions | ✕ | ✓ |

Payment in Multiple Currencies | ✕ | ✓ |

Dashboard & Insights | ✕ | ✓ |

Autocapture Receipts & Bills | ✓ | ✕ |

Compatible With American Express | ✓ | ✕ |

OCR for Bill Importing | ✓ | ✕ |

Audit Trails | ✕ | ✕ |

Both Melio and Plastiq offer several useful features. These include the ability to make batch and international payments, set up approval workflows, manage vendors, pay vendors with a credit card, and access short-term financing to pay bills.

However, Plastiq is the clear winner of this category because it lets you make payments in multiple currencies, customize account permissions, and access business insights on its dashboard. Melio offers features that Plastiq lacks, though, such as the ability to autocapture receipts and bills and compatibility with American Express.

Accounts Payable: Melio Wins

| ||

|---|---|---|

Bill Approvals | ✓ | ✓ |

Recurring Bills | ✓ | ✓ |

1099 Payment Tracking | ✓ | ✕ |

Automatic Bill Capture | ✓ | ✕ |

Intelligent Virtual Assistant | ✕ | ✕ |

Both offer strong A/P features, including bill approvals and recurring bills, but Melio also lets you track 1099 payments, produce an exportable report from your dashboard, and capture bills automatically. Neither Melio nor Plastiq offers an intelligent virtual assistant.

Accounts Receivable: Melio Wins

| ||

|---|---|---|

Send Payment Requests | ✓ | ✓ |

Virtual Terminal to Accept Payments | ✕ | ✓ |

Create & Send Invoices | ✓ | ✕ |

Add Logo to Invoice | ✓ | ✕ |

Recurring Invoices | ✓ | ✕ |

Sales Tax Tracking | ✕ | ✕ |

Invoice Customization | ✕ | ✕ |

Plastiq’s A/R features are very limited—you can send payment requests and accept payments with a virtual terminal, but you can’t create invoices. Melio doesn’t let you customize your invoices except in the form of uploading a logo. You can also set up recurring invoices with Melio, which is why I selected it as the leader in this category. However, neither tracks sales tax and lets you customize invoices.

Ease of Use: Tie

| ||

|---|---|---|

Overall Ease of Use | Easy | Easy |

Accessibility | Cloud | Cloud |

Online Help Section | ✓ | ✓ |

User-friendly Dashboard | ✓ | ✓ |

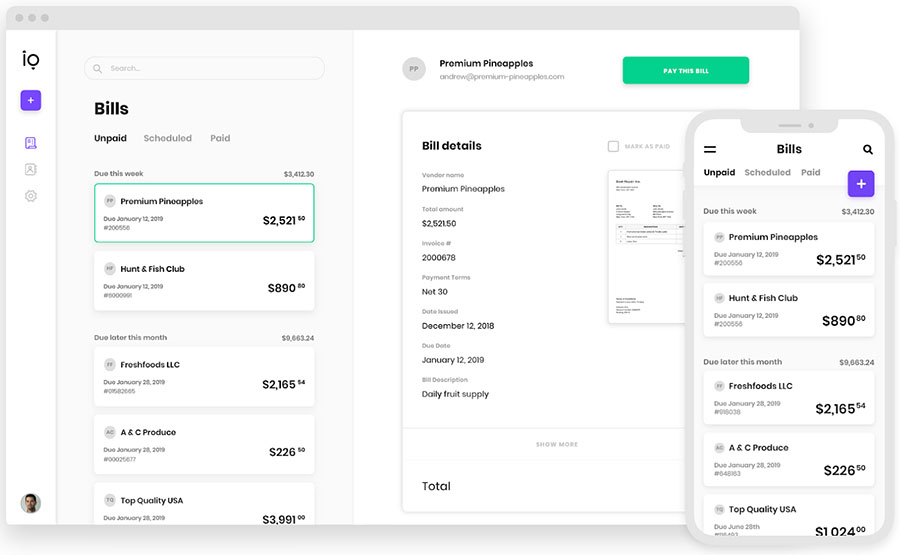

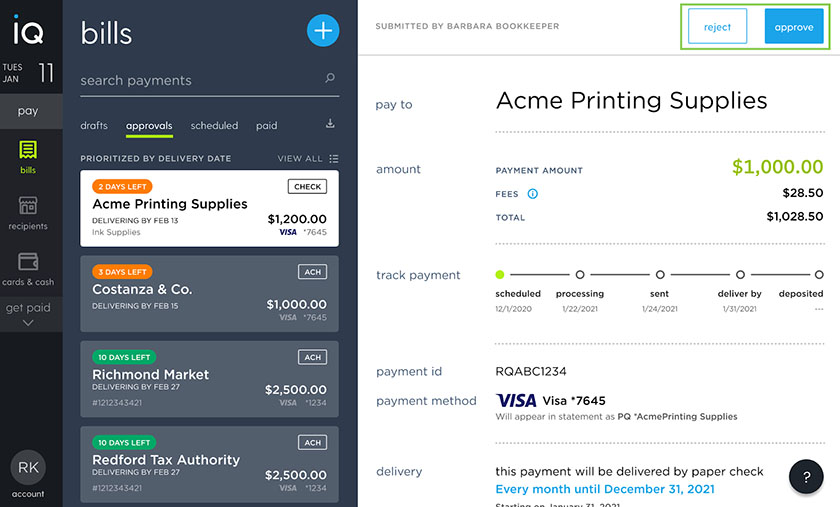

I declared a tie in this category because both are easy to use with an intuitive dashboard. You can access an online help section with each provider, which gives you answers to frequently asked questions (FAQs) and help with setup. Melio’s dashboard is clean and user-friendly, with a similar interface to the mobile version.

Melio’s dashboard on web and mobile app

Plastiq’s UI is also straightforward, with buttons that let you easily navigate from one section to another. It allows you to easily identify the status of bill payments, any associated fees, and delivery methods.

Plastiq’s dashboard that shows bill payments

Mobile App: Plastiq Wins

| ||

|---|---|---|

Accessibility | iOS and Android | iOS and Android |

Pay Bills | ✓ | ✓ |

Add & Manage Vendors | ✓ | ✓ |

Monitor Cash Flow | ✕ | ✓ |

Both Melio and Plastiq offer mobile apps for iOS and Android users. You can use both providers’ apps to pay bills and add or manage vendors—but only Plastiq lets you monitor cash flow, which is why it wins in this criterion. Both mobile apps lack the ability to scan bills and receipts, invoice customers, and send estimates or sales receipts.

Customer Support: Tie

| ||

|---|---|---|

Customer Support Hours | Monday-Friday, 9 a.m. to 8 p.m. Eastern time | Undisclosed |

Email Support | ✓ | ✓ |

Live Chat Support | ✓ | ✓ |

Searchable Knowledge Base | ✓ | ✓ |

Online Help Resources | ✓ | ✓ |

Phone Support | ✕ | ✕ |

Community Support | ✕ | ✕ |

The customer support offerings for Melio and Plastiq are essentially the same, with the exception that Melio provides its hours for customer support and Plastiq does not. Regardless of that, I called this category a tie. You have access to email and live chat support from both providers, but neither offers phone support.

Also, Plastiq requests that you send an email to customer support, and it will get back to you within one business day. A searchable knowledge base and online help resources are also available with both Plastiq and Melio.

How I Evaluated Plastiq vs Melio

Here’s a breakdown of the key factors I used when comparing Plastiq vs Melio:

- Pricing: I reviewed how much the platforms cost and whether a free trial is available.

- Features: I checked the features provided, including A/P, A/R, vendor management, payment in multiple currencies, autocapture of receipts and bills, and approval workflows.

- Ease of use: I assessed how easy it is to use both tools, particularly the user dashboard.

- Mobile app: I compared the mobile apps’ features and checked whether the apps are available on both iOS and Android.

- Customer support: I looked into the available customer support options, such as phone, email, live chat, chatbot, and self-help resources. I also considered whether 24/7 support is available.

- User reviews: I read through customer feedback on popular third-party review websites to see what actual users have said about the tools.

Frequently Asked Questions (FAQs)

Yes, Plastiq offers iOS and Android mobile apps. You can make, approve, or reject payments as well as add and manage vendors. The main dashboard lets you monitor cash flow and view upcoming scheduled payments, including the details for each.

Melio doesn’t charge a monthly fee or charge for its ACH transactions. For payment by debit card, it charges a fee of 2.9%, and it charges a $20 flat fee for international wire transfers in US dollars. It doesn’t offer international wire transfers in local currency. Melio also charges a $1.50 mailing fee per check payment, but the first two per month are free.

Yes, Plastiq lets you pre-qualify for short-term financing, which is powered by Slope. Payment terms are available in 30-, 60-, and 90-day installments, the transaction fees range from 2.7% to 10.65%, and you can choose whether to pay back the loan in full or in regular installments.

It normally takes around one to three business days to process payments with Melio.

Bottom Line

Both providers offer valuable solutions for managing payments and bills, catering to different needs. Melio is an excellent choice for small businesses looking to streamline their domestic payment processes, with features designed to simplify vendor management. Meanwhile, Plastiq specializes in enabling credit card payments for a wide range of bills, offering flexibility to businesses. The choice between Plastiq vs Melio ultimately depends on your specific payment requirements and preferences.

User review references:

[1]Capterra | Melio

[2]Trustpilot | Melio

[3]Capterra | Plastiq

[4]Trustpilot | Plastiq