MileageWise is a mileage tracker app that features IRS compliance in mileage tracking. It highlights features that can help users avoid fines and problems with the IRS with respect to claiming mileage deductions. It has a built-in IRS auditor that checks all mileage logs for inconsistencies. You can try MileageWise for 14 days for free. Plans start at $9.99 per vehicle, per month. Complete pricing is available after signing up.

Pros

- Past mileage recovery feature

- Supports mileage tracking for electric cars

- Volume discounts for annual plans

- Tax-focused mileage tracking features

- Built-in expense tracker (web browser only)

- Has lifetime packages

Cons

- Pricing is only available after signing up for the free trial

- No monthly billing cycles for annual plans and lifetime packages

- Cannot track expenses that are not vehicle-related

- Tracking IRS-compliant mileage logs: MileageWise focuses on tracking mileage for tax reporting purposes. It’s a mileage tracker that emphasizes IRS compliance in tracking miles per vehicle. It also has a built-in “IRS auditor” that checks errors and conflicts in your mileage data to avoid IRS fines.

- FreshBooks users: MileageWise offers seamless integration with FreshBooks. You can export mileage data easily to FreshBooks for accounting and recording.

- Companies with electric cars: Electric cars have a built-in mileage tracking system. You can import mileage data directly from your car to MileageWise.

- Companies using Google Maps Timeline: Google Maps Timeline is a service within Google Maps that can help you measure distances. You can import Google Maps Timeline data into MileageWise, and the app will convert them automatically to IRS-proof mileage logs.

- Companies that need to plan routes: While MileageWise is good for keeping mileage expenses IRS-compliant, the software doesn’t help companies plan routes. Route planning is a good feature for logistics companies since this feature aids in estimating delivery routes and time. We recommend choosing TripLog, our overall best mileage tracker app. Its route planning feature helps you find the optimal route and steers you away from traffic. Read our TripLog review to learn more about it.

- Individuals with simple mileage tracking needs: If you track mileage for client visits occasionally, MileageWise’s features would be too much for your needs. MileIQ is our recommendation for a simple mileage tracking solution for occasional drivers. Our MileIQ review discusses in greater detail why it’s our pick for simple mileage tracking.

- Rideshare drivers and self-employed individuals looking for a more affordable mileage tracking solution: MileageWise is not the most affordable mileage tracking solution. If you’re seeking an affordable alternative, you should choose an option that has all the features you need in a business. Our recommendation would be Hurdlr, which has accounting, invoicing, annual tax filing, and mileage tracking features. To learn more about Hurdlr’s tax features, read our Hurdlr review.

- Businesses looking for accounting software with mileage tracking: MileageWise is great at monitoring mileage expenses for IRS compliance, but it doesn’t have accounting features. Instead, QuickBooks Online is a good alternative for businesses looking for affordable accounting software with mileage tracking. As one of our best mobile accounting apps, you can track mileage through GPS by using the QuickBooks Online app. Since QuickBooks Online is accounting software, you can easily enter mileage expenses. Our QuickBooks Online review can help you decide if the solution fits the bill.

MileageWise Deciding Factors

Supported business types | Businesses whose main purpose for tracking mileage is to avoid fines and inquiries from the IRS |

Pricing |

|

Free Trial | 14 days |

Standout Features |

|

Customer Support | Phone, email, and knowledge base |

MileageWise New Feature 2023: Expense Tracking

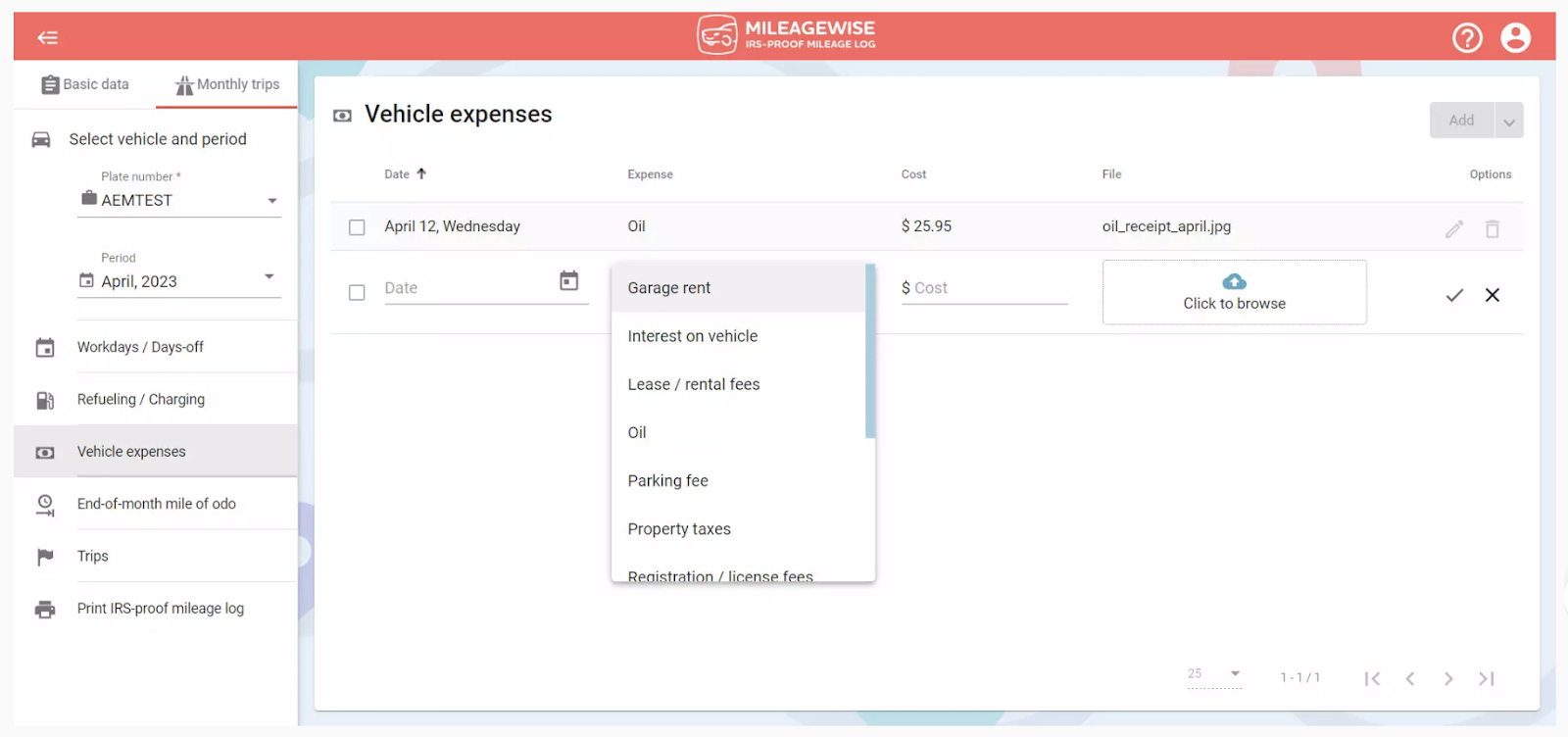

Apart from mileage tracking, the app offers built-in expense tracking for vehicle-related business expenses and car repairs. However, this feature is available only to users who chose the actual expense method for mileage deductions.

Recording an Expense (Source: MileageWise)

With this new feature, you can record all car-related expenses and classify them into 12 categories, as follows:

- Garage rent

- Interest on vehicle

- Lease and rental fees

- Oil

- Parking fees

- Property taxes

- Registration and license fees

- Repairs and maintenance

- Tires

- Tolls

- Vehicle insurance

- Other expenses

The app also lets you upload receipts and attach them to expense entries. But since MileageWise is heavily focused on mileage tracking, the expense tracker is mainly for mileage and car-related expenses.

MileageWise Alternatives

Best for: Businesses looking for a mileage tracking app with invoicing and multiple integrations | Best for: Small companies looking for a simple mileage tracker | Best for: Self-employed individuals and rideshare drivers |

Cost: $10 per user per month or custom priced for Business plans | Cost: $5 to $15 per user, per month, for Teams | Cost: $0 to $200 per year |

No review available |

MileageWise vs Competitors

We compared MileageWise with two of its top competitors, TripLog and Hurdlr. Our evaluation focused on six areas: pricing, mileage tracking features, ease of use, user reviews, and expert analysis. Our methodology section below explains our rubric in greater detail.

MileageWise vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

MileageWise Starts at $9.99 per vehicle, monthly

-

TripLog Starts at $10 per vehicle, monthly

-

Hurdlr Starts at $0

MileageWise’s pricing is less flexible compared to TripLog and Hurdlr. Its most basic plan is the only plan with a month-to-month contract, whereas higher plans are bundled in either one-, two-, or three-year plans. Getting plans with MileageWise can be a burden financially because of the initial large cashout. We recommend TripLog or Hurdlr if you’d like monthly options.

In terms of mileage tracking and related app features, MileageWise lags behind because it lacks features like invoicing, reimbursements, and accounting. Though we don’t see this as a major miss, we believe that this app fits perfectly with businesses or individuals looking for IRS-proof mileage logs.

Overall, MileageWise performs well in our evaluation. Amid its missing features, we still praise it for designing features that can help during the tax season.

MileageWise Pricing

Choose among MileageWise’s monthly plan, five annual plans, and two lifetime plans.

Small Monthly | |

|---|---|

Billing Cycle | Monthly |

Pricing | $9.99 |

Monthly Price per Vehicle | $9.99 |

Trip Classification | ✓ |

Built-in IRS Auditor Feature | ✓ |

IRS-proof Mileage Log Creator | ✓ |

Past Mileage Log Reconstruction | ✕ |

Google Timeline Import | ✕ |

Volume Discounts | ✕ |

Small | Bronze | Silver | Gold | Concierge | |

|---|---|---|---|---|---|

Billing Cycle | 1 year | 1 chosen year | 2 chosen years | 3 chosen years | 1 chosen year |

Pricing | $69.99 per year | $199.99 per year | $319.99 per 2 years | $399.99 per 3 years | $623.98 per year |

Monthly Price per Vehicle | $5.83 | $16.66 | $13.33 | $11.11 | $51.99 |

Trip Classification | ✓ | ✓ | ✓ | ✓ | ✓ |

Built-in IRS Auditor Feature | ✓ | ✓ | ✓ | ✓ | ✓ |

IRS-proof Mileage Log Creator | ✓ | ✓ | ✓ | ✓ | ✓ |

Past Mileage Log Reconstruction | ✕ | ✓ | ✓ | ✓ | ✓ |

Google Timeline Import | ✕ | ✓ | ✓ | ✓ | ✓ |

Volume Discounts | ✕ | ✕ | ✓ | ✓ | ✓ |

Small Lifetime | Gold Lifetime | |

|---|---|---|

Billing Cycle | One-time payment | One-time payment |

Pricing | $99.99 | $499.99 |

Monthly Price per Vehicle | N/A | N/A |

Trip Classification | ✓ | ✓ |

Built-in IRS Auditor Feature | ✓ | ✓ |

IRS-proof Mileage Log Creator | ✓ | ✓ |

Past Mileage Log Reconstruction | ✕ | ✓ |

Google Timeline Import | ✕ | ✓ |

Volume Discounts | ✕ | ✕ |

MileageWise Features

MileageWise is accessible via web browser and app. You can use the mobile app to track mileage via GPS and the web dashboard to organize your trips.

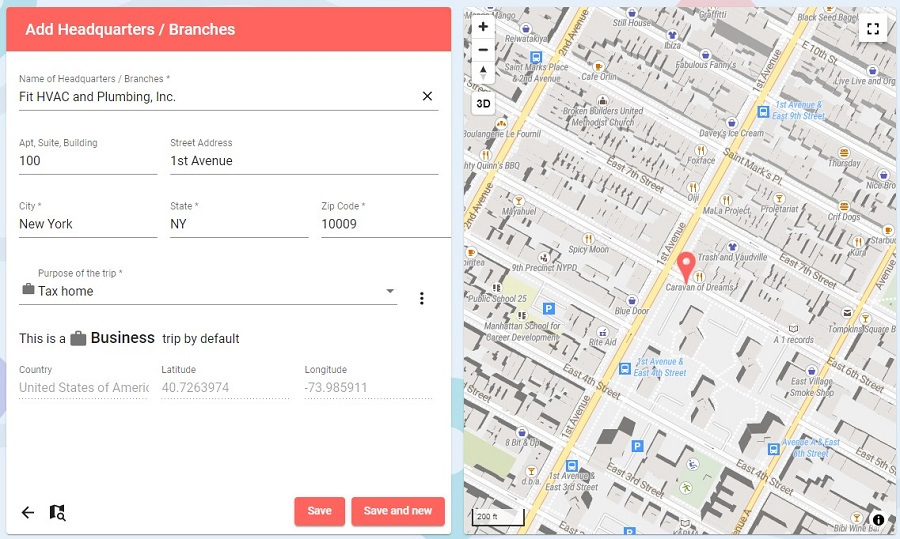

In MileageWise, you can create multiple branches and set your headquarters. The address you choose upon setup becomes the headquarters by default. The main purpose of setting up your branches is to track mileage for trips to and from branches efficiently. Later on, you can edit the category of this address.

Adding Headquarters or Branches

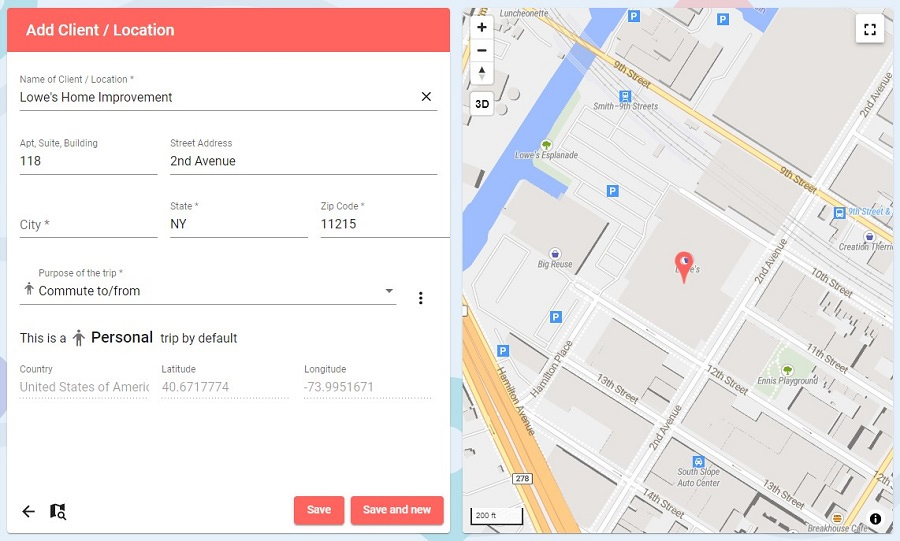

Under Clients and Locations, you can record all the locations and clients you visit. Locations can be hardware stores, a client’s address, meeting venues, warehouses, storage units, and many more. Adding locations helps MileageWise track vehicles’ visits to given locations.

Adding Clients or Locations

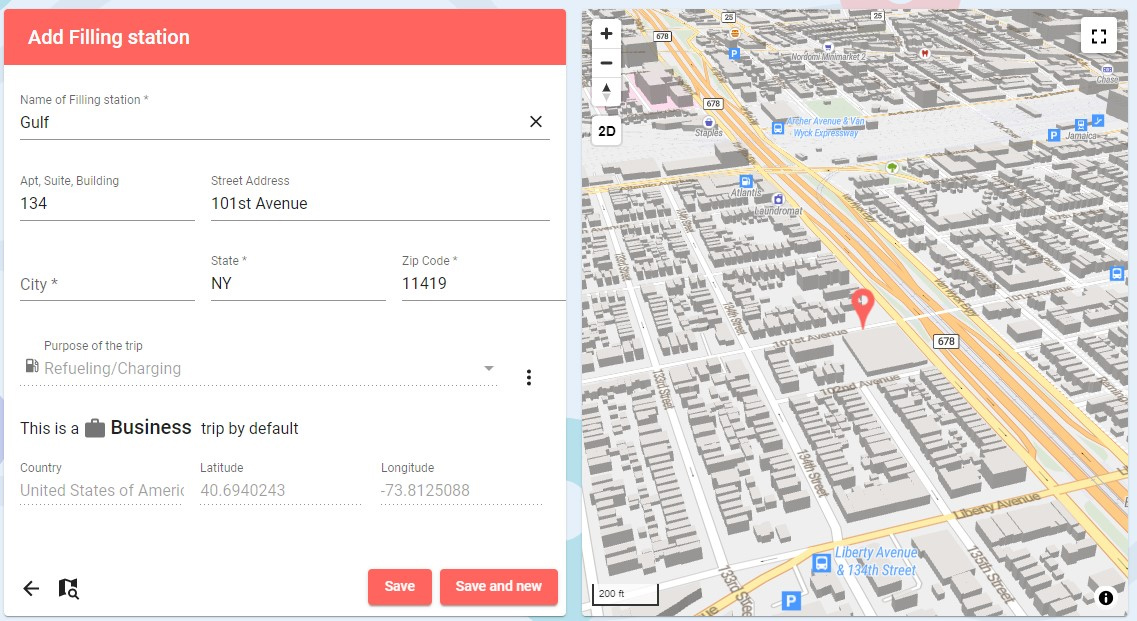

You also need to record the refueling or charging stations that your vehicles visit—having a record of these stations helps MileageWise match fuel charges on every trip. Whenever you visit a fuel station along the way while tracking mileage, MileageWise will recognize your current location automatically as long as the fuel station is recorded in the app.

Adding Filling or Charging Stations

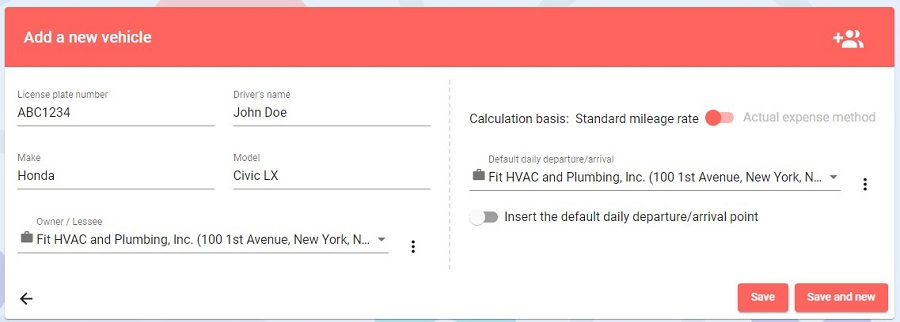

Before using MileageWise, you need to record all company vehicles. MileageWise will use vehicle data for matching locations or clients visited. Moreover, companies with electric vehicles (EVs) can use MileageWise to compute mileage deductions for electric vehicles. Aside from that, you can also perform the following:

- Vehicle-client pairing: This allows users to categorize clients by vehicles. You can assign which vehicle can visit the headquarters, branch, client, or filling station.

- Client-vehicle pairing: This lets users categorize vehicles by clients. You can use this feature to manage headquarters, clients, or filling stations with specific vehicles.

Adding a Vehicle

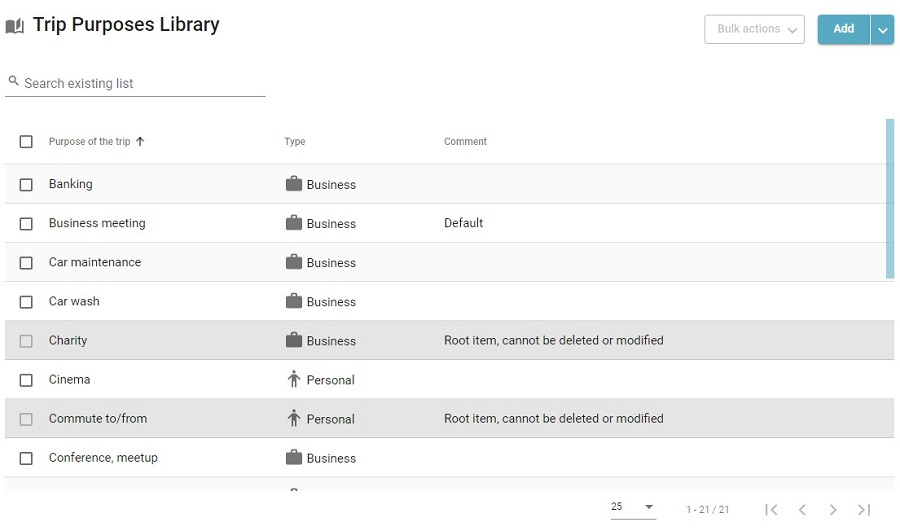

MileageWise comes with a default list of trip purposes that help categorize trips. Some trip purposes can be deleted or modified like those in gray boxes in the image below. However, if your company has specific purposes, you can add them to the Trip Purposes window.

Trip Purposes

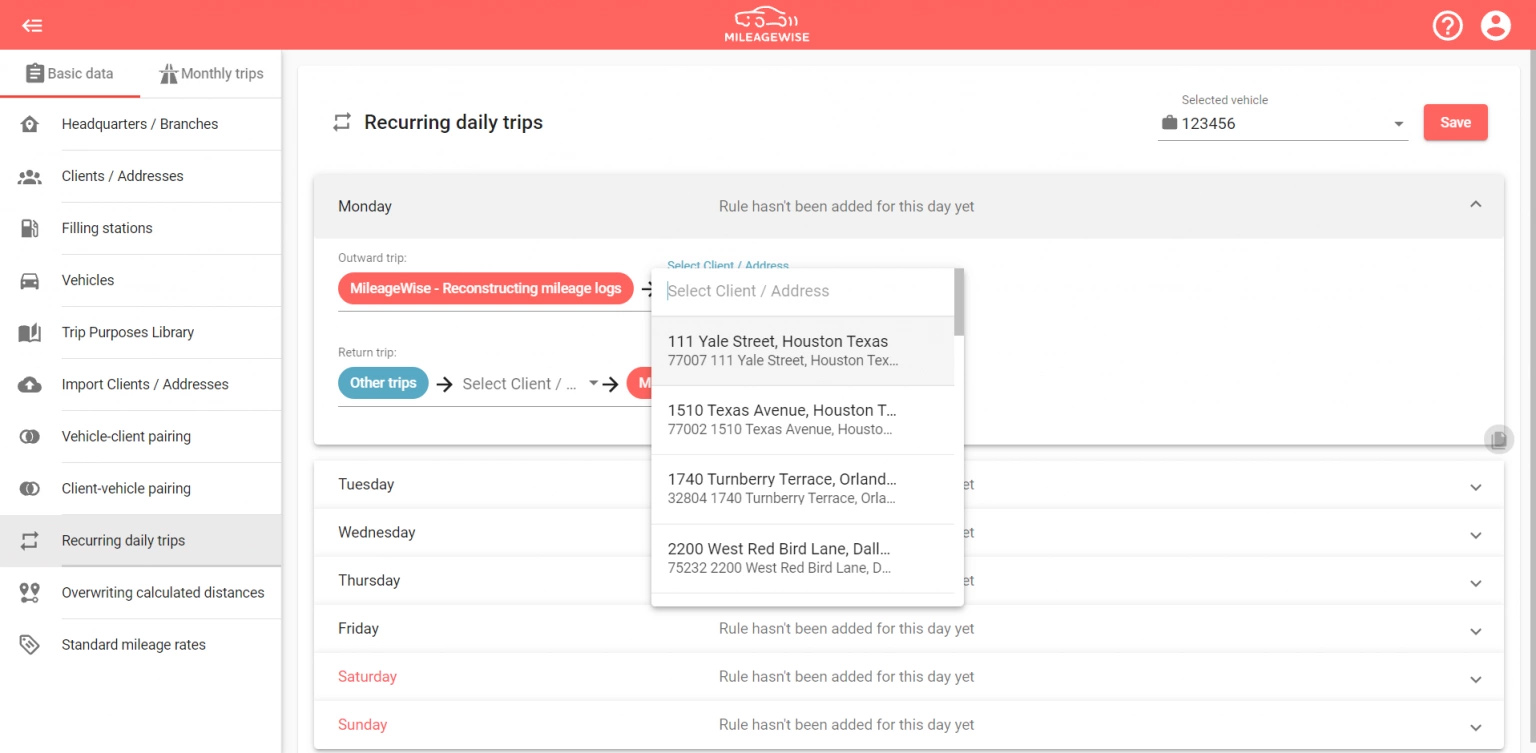

Setting up recurring trips can help MileageWise identify trips automatically. Outward Trips are trips from your office to any other location like a client address or your home address while return trips are trips from any other address to the office address. By default, Saturday and Sunday aren’t considered workdays. You can adjust them in the settings if you work on weekends.

All recurring trips are set for each vehicle. You need to set up recurring trips individually for all company vehicles in this window.

Recurring Trips (Source: MileageWise)

MileageWise integrates with Waze for navigation. When recording trips on MileageWise, you’ll see the Waze icon on the top right portion of the screen. Pressing the icon will record the trip in MileageWise automatically, and you’ll be redirected to the Waze app to see your directions.

Waze and MileageWise Integration (Source: MileageWise)

MileageWise integrates with FreshBooks to export mileage data from MileageWise seamlessly. To integrate MileageWise, you first need to have a FreshBooks subscription, and it’s sold separately on FreshBooks’ website. Once you have a subscription, go to settings and look for Apps and Integration. Search for MileageWise and allow the connection.

On your MileageWise Dashboard, go to Print IRS-proof mileage log and click the FreshBooks icon. If you’re doing this for the first time, MileageWise will prompt you to create a connection between the two apps. After that, you’ll see mileage data recorded on FreshBooks.

You may be interested in reading our review of FreshBooks if you aren’t a subscriber and want to learn more about the platform.

MileageWise Ease of Use

MileageWise’s ease of use is outstanding. It has unlimited customer service to address customer needs. Users can contact customer support through phone or live chat. We also like the user interface of the web app. It is clean and easy to navigate, especially for first-time users. The support page of MileageWise is also comprehensive, which makes it a good resource for immediate help.

MileageWise User Reviews

There are only a few MileageWise reviews online. Users noted how the solution helped them accurately track business mileage and mentioned that it’s a good mileage tracker for reporting mileage deductions during tax season. We have seen only a few negative comments about the software. In our expert opinion, we can’t fully rely on the information due to the limited number of reviews.

- Trustpilot1: 4.7 out of 5 stars based on around 40 reviews

- G22: 4.8 out of 5 stars based on about 5 reviews

How We Evaluated Mileage Tracking Software

We evaluated MileageWise based on five major categories that should be present in mileage tracker apps.

20% of Overall Score

Affordability is a primary concern for small businesses. Hence, we’re giving pricing a significant percentage to give more points to mileage tracker apps with a more affordable price point.

30% of Overall Score

In this area, we’d like to see basic mileage tracking features including income and expense tracking and trip categorization. Aside from these major features, it would be a plus to see features like receipt capturing, route planning, scheduling, and other minor features.

20% of Overall Score

The ease of use score measures how easy and convenient it is for users to use the web or mobile app. Part of this is customer service, in case customers want technical assistance.

10% of Overall Score

We considered the ratings of actual users from review websites. This score helped us gauge feedback from current users of the software.

10% of Overall Score

Our expert score is a summative measure of all app features as a whole. We look at the harmony of its features, accessibility, ease of use, reporting, and popularity.

Frequently Asked Questions (FAQs)

No, but you can try it for 14 days with no credit card needed to sign up.

MileageWise offers unlimited customer support to customers. Customer service is open on weekdays from 7 a.m. to 7 p.m. Eastern time.

Bottom Line

MileageWise offers a mileage tracking solution for businesses and individuals who want to avoid fines and problems with the IRS. Through its built-in IRS auditor, the software can spot inconsistencies in mileage logs that would cause IRS fines if left unspotted. We recommend MileageWise if your company has a large fleet of vehicles needing mileage tracking and if you use FreshBooks.

User review references:

1Trustpilot

2G2