FreshBooks is a cloud-based accounting program that allows you to create and send unlimited invoices, manage clients and projects, and accept payments online. It offers a robust set of features, including double-entry accounting, recurring invoices, project management, and mobile accounting.

It has four plans with monthly fees that start at $19 per month for one user, and you can pay for more seats as needed ($11 per user, per month). Continue reading our in-depth FreshBooks review and evaluation for details on its features, pricing, and user reviews.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

Pros

- Includes unlimited invoices in all plans

- Lets you track time and bill clients for hours

- Has great customer service

- Offers a mobile app for accounting and invoicing

Cons

- Can’t track inventory and COGS

- Can’t monitor income or expenses by class

- Can’t track and reconcile bank accounts without a live bank connection

- Charges a fee for additional users

Supported Business Types | Freelancers and solopreneurs with service-based businesses and no inventory |

Pricing |

Each additional seat is $11 per month. |

Free Trial | 30 days for Lite, Plus, and Premium plans |

Payroll | FreshBooks Payroll (Powered by Gusto) starts at $40 plus $6 per person per month. |

Standout Features |

|

Customer Support | Self-help library, phone number, chatbot, and community page |

- Invoicing customers: We included FreshBooks in our list of the leading invoicing software because of its powerful invoicing capabilities. You can create professional invoices in seconds, choose your preferred currency, and send invoices from anywhere with its mobile app.

- Tracking billable hours: FreshBooks has a built-in time tracker that can help track billable hours. Since the time tracker is within the software, it’s easy to add billable hours to client invoices when it’s time to bill them, making FreshBooks our top choice for the top accounting software for consultants.

- Recurring billing for project-based businesses: FreshBooks earned a spot on both our best recurring billing software and leading project accounting software lists because you can create recurring invoices assigned to specific projects and track actual vs project revenue and expenses for those projects.

- Freelancers and solopreneurs using Mac: Since FreshBooks focuses on keeping things simple, self-employed individuals who want to do-it-yourself (DIY) bookkeeping will find it easy to use—even without bookkeeping experience. Hence, FreshBooks is one of our best accounting software for freelancers.

- Service-based businesses looking for a QuickBooks alternative: FreshBooks is part of our top-recommended QuickBooks alternatives because it offers competitive features even at its low price point, including expense categorization, receipt capture, billable time tracking, and simultaneous users.

- Businesses often working remotely: We selected FreshBooks as one of the leading cloud accounting software, especially for sole proprietors and freelancers tracking time. Not only does FreshBooks offer robust time tracking and invoicing features, but it also has a powerful mobile app that allows you to track mileage and communicate with clients directly through the app.

- Airbnb: FreshBooks also made it to our roundup of the best accounting software for Airbnb and vacation rentals. It’s best for users with just a couple of rental properties since it is easy to use but doesn’t have rental-specific features.

FreshBooks Alternatives

| Users Like | Users Dislike |

|---|---|

| Outstanding customer support | Limited billable clients |

| Easy-to-use interface | Too costly for multiple users |

| Excellent invoicing features | Limited integrations |

Below is the summarized feedback from users and our expert opinion on them:

- Excellent invoicing features: Users like FreshBooks for its invoicing features. They mentioned that the time tracking tool works perfectly when invoicing clients. We support this claim because, in our walkthrough of FreshBooks, its invoicing features definitely stand out—the invoicing interface is easy to understand and use, and you can choose different templates and designs.

- User-friendly interface: Some users like the easy interface of FreshBooks. However, larger businesses find it too basic and simple for their needs. In our expert opinion, FreshBooks’ design is not intimidating and overwhelming. Users with little or no accounting experience can learn FreshBooks at ease.

- Expensive: Some users find FreshBooks pricey for multiple users because each additional seat is $11 per month. We agree that FreshBooks is not ideal for large teams because it can get expensive.

Here are FreshBooks’ scores on user review websites:

- GetApp[1]: 4.5 out of 5 based on around 4,300 reviews

- G2[2]: 4.5 out of 5 based on about 710 reviews

- Google Play[3]: 4.5 out of 5 based on around 5,600 reviews

- App Store[4]: 4.7 out of 5 based on about 10,900 reviews

Fit Small Business Case Study

Our case study shows a side-by-side comparison of FreshBooks, QuickBooks Online, and Xero to help you decide which is right for your business.

Freshbooks review interactive chart

Touch the graph above to interact Click on the graphs above to interact

-

FreshBooks

-

QuickBooks Online

-

Xero

FreshBooks didn’t disappoint in accounting features, except inventory. Overall, it focuses more on simplicity and usability. Its core feature is to make it easy for users to handle accounting features—and that’s why it’s best suited for freelancers, solopreneurs, and very small businesses.

Compared to QuickBooks Online and Zoho Books, FreshBooks is behind in inventory because it has no features to compute COGS and track inventory costs. When it comes to project accounting, it takes the lead over QuickBooks but is only second to Zoho Books. FreshBooks has the highest ease of use score, which makes sense because it is branded as an easy-to-use and user-friendly accounting software.

Overall, with FreshBooks’ strengths in ease of use, A/R, and project accounting, we highly recommend it for freelancers and service providers. But if you sell inventory, we’d rather you check out QuickBooks or Zoho Books.

FreshBooks pricing took a hit in our evaluation because the platform’s Premium tier costs $104 per month for five users, which is $14 more than QuickBooks Online Plus ($90 per month), which also includes five seats and much better features—such as inventory. Although FreshBooks is affordable for one user, we considered the fact that some small businesses might need to add more seats.

FreshBooks offers four plans with monthly fees that start at $19 per month. The plans vary in terms of the maximum number of billable clients and the advanced features available, such as automated recurring invoices, double-entry accounting reports, and access to support. You can save an additional 10% by paying annually.

Lite | Plus | Premium | Select | |

|---|---|---|---|---|

Monthly Price | $19 | $33 | $60 | Custom |

Seats Included | 1 | 1 | 1 | |

Additional Seats | $11 per user, per month | |||

Billable Clients | 5 | 50 | Unlimited | Unlimited |

Unlimited Customized Invoices | ✓ | ✓ | ✓ | ✓ |

Double-entry Accounting Reports | ✕ | ✓ | ✓ | ✓ |

A/P | ✕ | ✕ | ✓ | ✓ |

Access to Exclusive Support Teams | ✕ | ✕ | ✕ | ✓ |

FreshBooks New Features 2024

- Timestamps are now included in the invoice, proposal, and estimate history.

- Advanced search is now available to find specific invoices using different filters or tags

- The dashboard is now customizable, which enables you to rearrange the dashboard and hide the information that you don’t need

- A dedicated journal entries section is now available.

FreshBooks Features

Below, we provide a quick assessment of FreshBooks within each category in our comprehensive case study to help you decide if it’s the right software for you. We also include videos of our detailed assessment of each feature.

Setting up FreshBooks is relatively easy but takes a while. You can input the company name, address, and telephone number. If you’re following a different accounting period, you can add a fiscal year as well. Its general features took a hit in our rubric because it lacks essential functionalities, like setting the entity type and modifying the chart of accounts.

However, we still commend FreshBooks for its simplicity. As accounting and bookkeeping experts here at Fit Small Business, we saw firsthand that the platform is user-friendly for those wanting to get their businesses in order as accounting is made easy, though the platform sacrifices some features.

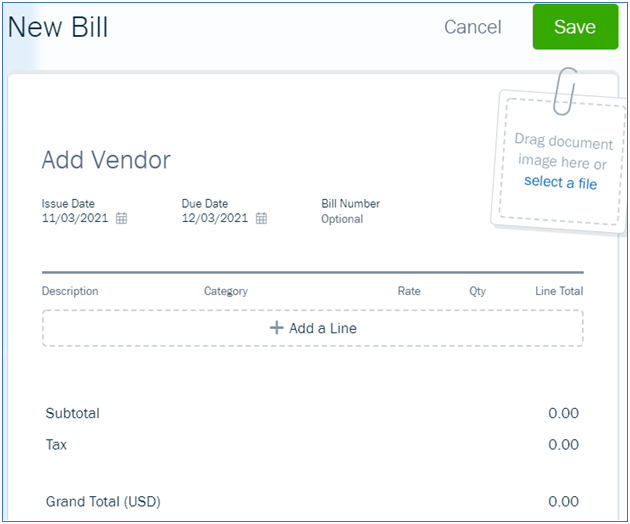

Available for Premium and Select users, the A/P tool includes bill and vendor management features. These can be found under the Expenses tab. FreshBooks didn’t get a high score in A/P because it doesn’t allow the recording of purchase orders and vendor credits. Moreover, it makes it hard to record expenses without bank connections.

Transactions entered manually must be recorded to the Petty Cash account—and those transactions can be assigned to a bank account when the transaction is imported via the bank connection and during bank reconciliation. Therefore, there’s no way to assign expenses to the appropriate payment accounts without allowing FreshBooks access to your bank account.

However, you can create a new vendor on the fly and enter a bill from scratch or by uploading a receipt. To enter a new bill, click on the Expenses menu, select the Bills drop-down menu, and then tap the New Bill button. Provide the required details in the New Bill screen and then click Save.

Add a New Bill Screen in FreshBooks

FreshBooks also allows you to record a payment and assign it as billable to a project or contractor. You can also set up nonstock and service items within a service order and add a default price for each item, but you can’t use the item to pay independent contractors. A/P is connected to your cash flow statement and profit and loss (P&L) reports, so you can view outstanding bills instantly.

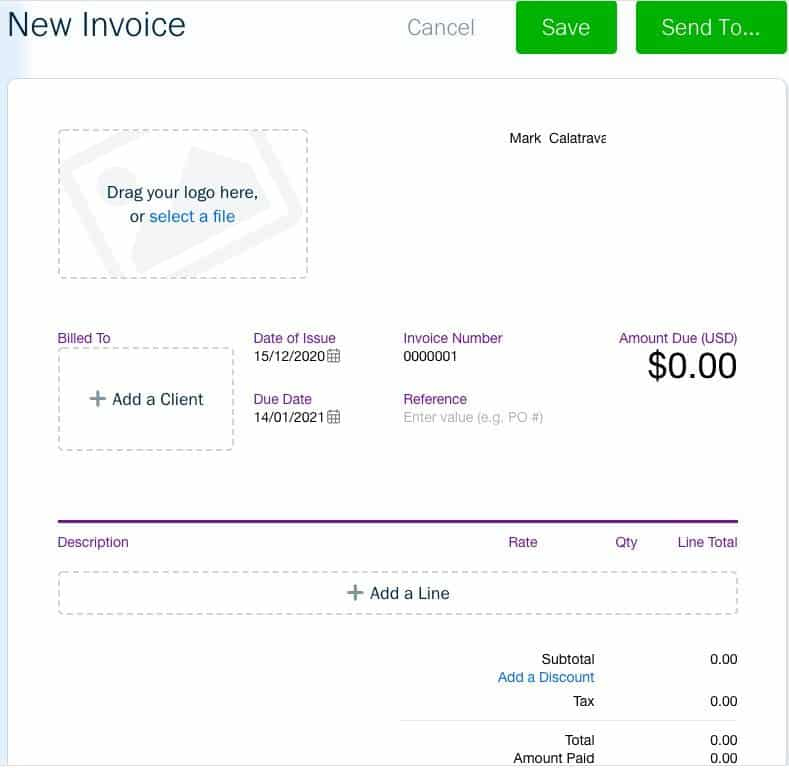

There are many important invoicing features in FreshBooks, but its outstanding invoice customization features are why it has a high score in this area. Its invoices look professional, and you can customize the style, add a logo, include a personal message, and add items, such as inventory, labor and expenses, and sales tax. You can also email and print your invoice.

Another nice feature is the ability to create recurring invoices, which comes in handy if you’re billing a customer for the same amount regularly. You can also view a filtered list of your outstanding invoices so that you can send your customers a friendly reminder.

To add a new invoice, click on the Invoices section, hit the New Invoice button, add your details and customize your invoice, and then click Save.

Create a New Invoice Screen in FreshBooks

Despite its great features, its A/R has shortcomings. You can’t issue a receipt for a sale paid immediately, issue a refund check to settle a negative A/R, or include a sales tax adjustment on a credit memo—which is why it didn’t ace the criterion in our rubric.

FreshBooks doesn’t perform well in terms of banking and cash management. You can’t reconcile bank statements unless you connect to your bank account, so if you’re uncomfortable connecting to your bank account, then this isn’t for you. At the very least, good accounting software should allow you to record a check in the register—but that’s not possible with FreshBooks. QuickBooks is the better pick if you want to connect bank accounts.

In FreshBooks, all transactions are deposited or withdrawn from cash on hand automatically. From there, transactions can be assigned to bank accounts—but only by utilizing the connection to your bank account. This makes FreshBooks nearly unusable if you don’t establish a bank connection. Even if you connect your bank, there’s no way to assign outstanding checks to a particular account so that you can see an available balance.

If you need project accounting, FreshBooks is an ideal choice—unless you need inventory accounting. FreshBooks can’t record inventory used in projects but includes project management features that work directly with its invoicing tool. This feature helps you manage timelines and simplify project workflows. You can create an estimate and add items such as labor, inventory, and sales taxes.

Once approved, you can convert an estimate to a project and allocate actual labor cost details. You can also compare estimated costs against actual costs, which is important for budget planning. If you need specialized accounting software for project management, check out our list of the best project accounting software.

FreshBooks lets you add sales tax items to bills, expenses, invoices, credit notes, and other income and vendor transactions. However, while you can track sales taxes, you have to set up the sales tax for each jurisdiction manually where you’ll be collecting tax, which is partly why FreshBooks didn’t earn a higher mark in our rubric.

The platform lets you generate a tax summary report to see the amount of sales tax collected and view your sales tax liabilities. If you could use FreshBooks to pay and file your tax returns, we could’ve awarded it more points.

We evaluated the sales and income tax features across the other categories, so there’s no separate video.

While you can set up inventory descriptions to be added to bills easily, there’s no way to track the number of items on hand, the value of stock available, and the cost of your inventory sold. Tracking your inventory costs by hand with a spreadsheet is very time-consuming and unnecessary with the right software.

So, if your business deals with inventories, then you need to look for alternatives like Xero, QuickBooks Online, or Zoho Books to avoid a spreadsheet nightmare. These three alternatives can handle inventory costs.

FreshBooks’s inventory management is assessed across the other categories, so we have no separate video.

If you only need basic financial reporting, you should do fine with FreshBooks. It generates a wide range of reports, but they aren’t as detailed as QuickBooks Online’s.

For instance, the balance sheets only show main categories, which means you can’t drill down in reports for more specific levels of detail, such as classes and location. Other reports available include A/R aging, A/P aging, income or loss by month or by customer, trial balance, and general ledgers (GLs).

FreshBooks has a capable mobile app that you can use for sending invoices. It can execute almost all the functions of the desktop interface—you can enter bills, accept payments, attach receipts, and record time worked. If you often do your business on the go, FreshBooks’ mobile app won’t disappoint you.

What’s missing in the app is assigning expenses to projects. We praise FreshBooks for its project accounting features—and we’d like to see this in the mobile app. Also, there’s no way to enter bill payments and categorize bank feed transactions from within the app.

FreshBooks integrates with over 70 software programs. These include Zoom, Shopify, Squarespace, Gusto, Google Workspace, Fundbox, Stripe, Bench, HubSpot, Dropbox, PayPal, QuickBooks Online, Slack, and Mailchimp. In our evaluation, some of the integrations we’re looking for, like time tracking and billing, are already part of FreshBooks’ features, so we awarded FreshBooks points for that.

FreshBooks took a hit in our evaluation of ease of setup because it doesn’t have a company setup wizard and assisted onboarding support, which new users can benefit from to make the transition easier and faster. We hope that FreshBooks will consider either of these options (better if both) in future updates.

FreshBooks is generally easy to use when navigating around the software. The design is clean and intuitive, making it easy to learn and understand. However, FreshBooks misses certain features like onboarding support and a customizable dashboard—which can improve the overall experience of the software, especially onboarding support.

Users with little to no experience in accounting might need onboarding support from FreshBooks to make their transition smoother. In lieu of onboarding support, a self-guided onboarding may also improve overall ease of use.

FreshBooks has earned a reputation for its award-winning customer service. It offers nearly all types of customer support, including phone and email support. You can speak with a customer service representative over the phone by calling 866-303-6061 Monday through Friday from 8 am to 8 pm EST, which is rare among accounting software providers.

You can also browse its vast self-help resources, which include how-to articles and answers to frequently asked questions. Amid FreshBooks’s limitations in scalability, we still praise the software for providing an easy accounting solution to users without accounting knowledge.

How We Evaluated FreshBooks

We evaluated QuickBooks Online and other leading accounting software using an internal scoring rubric with 15 major categories.

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and the number of users.

5% of Overall Score

This section focuses more on first-time setup and software settings. The platform must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

5% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

5% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

5% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

10% of Overall Score

Customer service is evaluated based on the number of communication channels available, such as phone, live chat, and email. Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform.

10% of Overall Score

This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

10% of Overall Score

Ease of use includes the layout of the dashboard and whether new transactions can be initiated from the dashboard rather than having to navigate to a particular module. Other factors considered are user reviews specific to ease of use and a subjective evaluation by our experts of both the UI and general ease of use.

5% of Overall Score

This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available.

5% of Overall Score

The software must have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. Some of the features we looked into include the ability to create and send invoices, accept online payments, enter and track bills, and view reports on the go.

7% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

Yes, but not in all aspects. FreshBooks is good for freelancers and project-based businesses. It’s also easy to use, making it accessible to DIY business owners. QuickBooks is better if you have inventory or want to track net income by classes.

Yes, you can send checkout links to clients to get paid faster. FreshBooks can also integrate with payment channels, such as PayPal, and banks.

Yes, FreshBooks includes time tracking functionality. You can track the time spent on projects or client work, assign rates to different tasks or team members, and easily convert tracked time into invoices or billable hours.

Yes, FreshBooks is designed specifically for freelancers, small businesses, and self-employed professionals. Its user-friendly interface, simplified accounting features, and scalable plans make it a popular choice for individuals and small teams.

Yes, you can upload receipts, categorize expenses, and even link your bank accounts or credit cards to automatically import transactions. This helps you keep track of your business expenses and simplifies the process of tax preparation.

Bottom Line

FreshBooks may lack some important features like managing your inventory and tracking income by class, which are present in slightly more expensive software, such as Xero and QuickBooks Online. However, FreshBooks’s powerful invoicing and project management features and excellent customer service make it a terrific choice for your small business.

User review references:

[1]GetApp

[2]G2

[3]Google Play

[4]App Store