A pay period is the recurring period of time during which employees work and are paid. These are fixed and most often occur on a biweekly or semimonthly basis—but note that some state’s laws may require a certain frequency. Also, some industries follow a specific pay period calendar for certain workers, such as weekly payroll for hourly employees in manufacturing companies.

Given that payroll impacts your business’s cash flow and financial reporting requirements, you must select the pay period that best fits your company’s needs and worker types. Continue reading for a better understanding of what a pay period is and what it means for your small business, and download our free pay period calendars that correspond with your business’s pay cycles.

How Pay Periods Work

Employers set a regular pay period to ensure their employees receive consistent paychecks. While most companies base their pay schedule on the needs of the business, there are federal and state labor laws in place that govern the minimum consistency with which these schedules must comply.

Employers consider the minimum frequency at which they can legally process payroll—usually monthly—to set a regular pay schedule. Remember, every pay schedule includes start and end dates for time worked and a payday on which employees receive their paychecks. The payday varies depending on the employer; some designate the payday to be the last date of every pay period, while others may opt to pay a week after the pay period ends.

Types of Pay Periods

Here are a few pay period examples and some of the most common pay schedules from which you can choose. Keep in mind that certain industries have norms, and you may need to follow your industry’s tradition to remain a competitive employer.

We recommend using a pay period calendar and/or chart to help you.

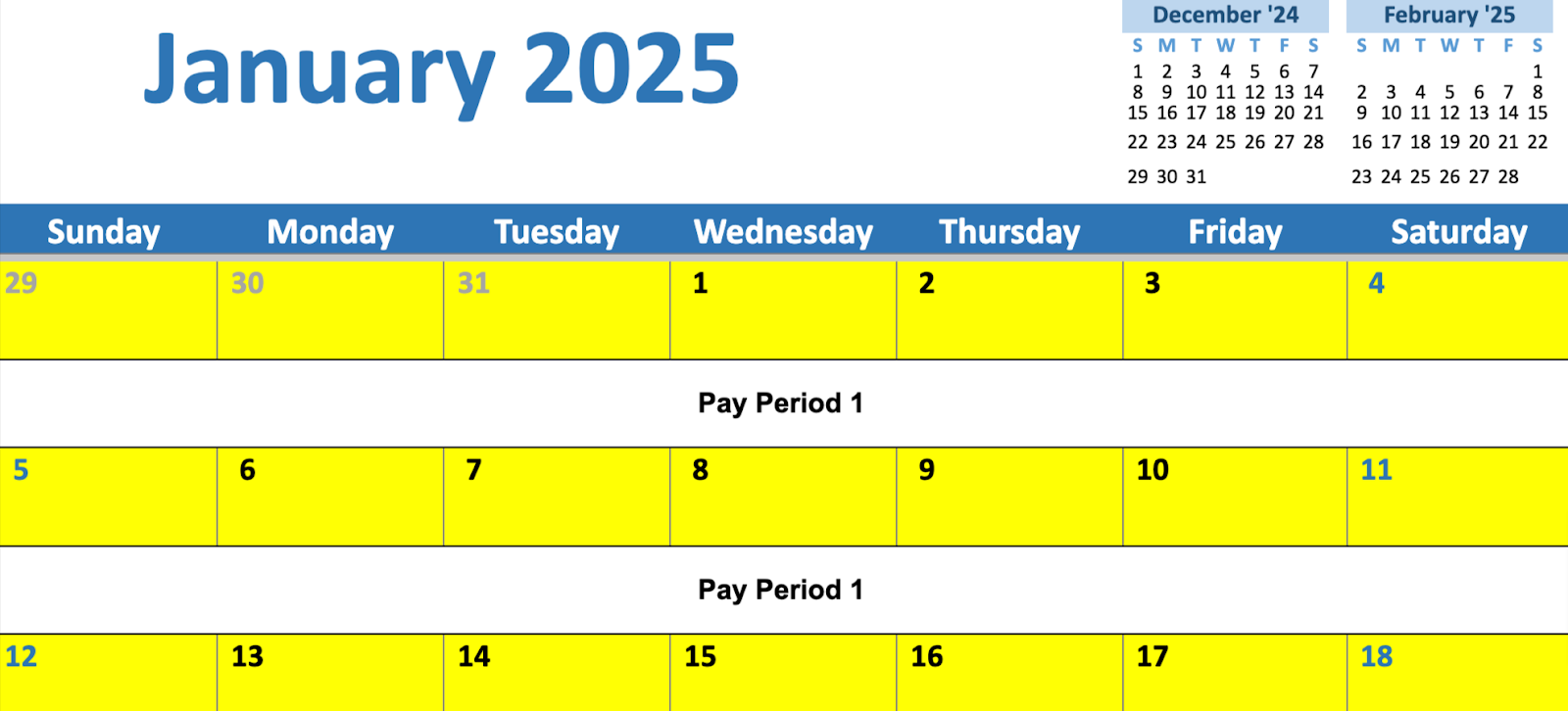

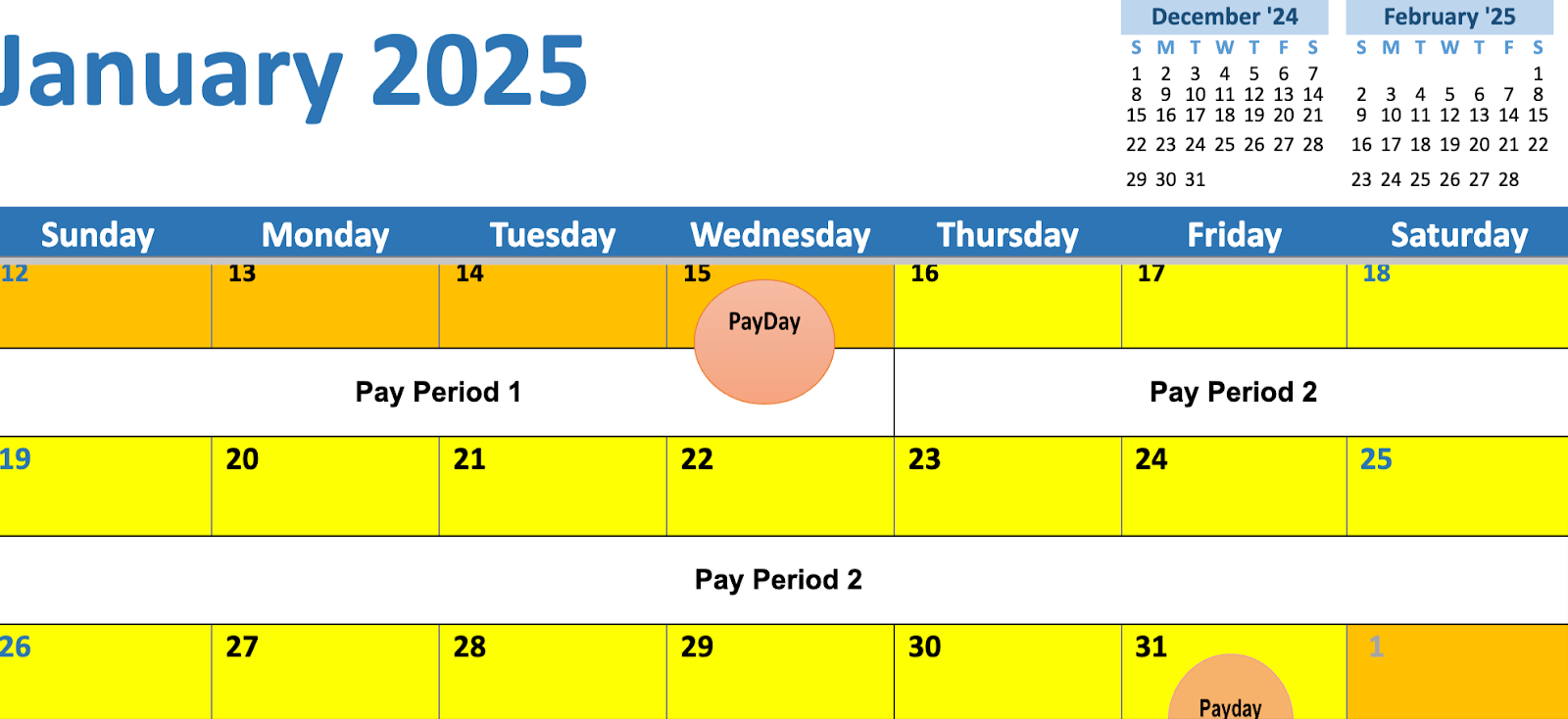

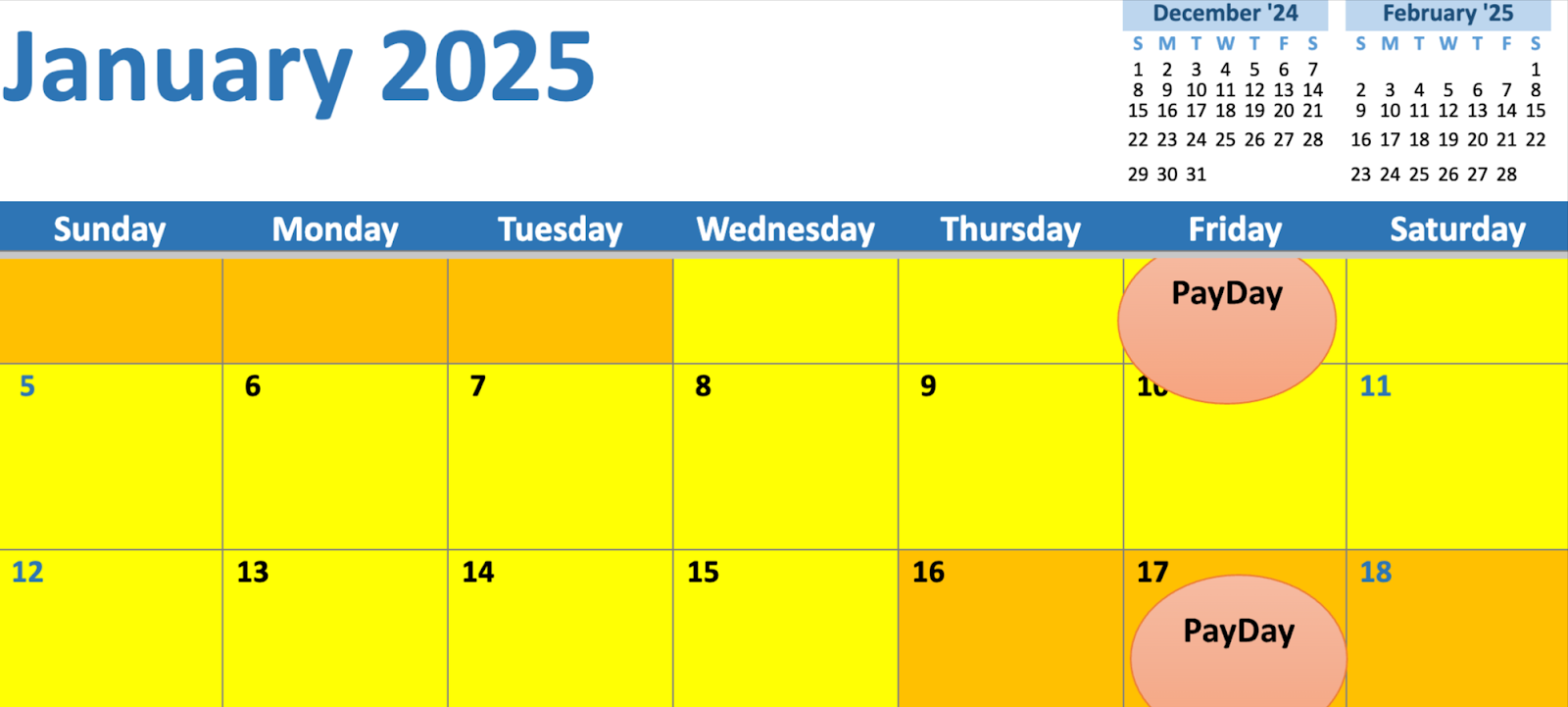

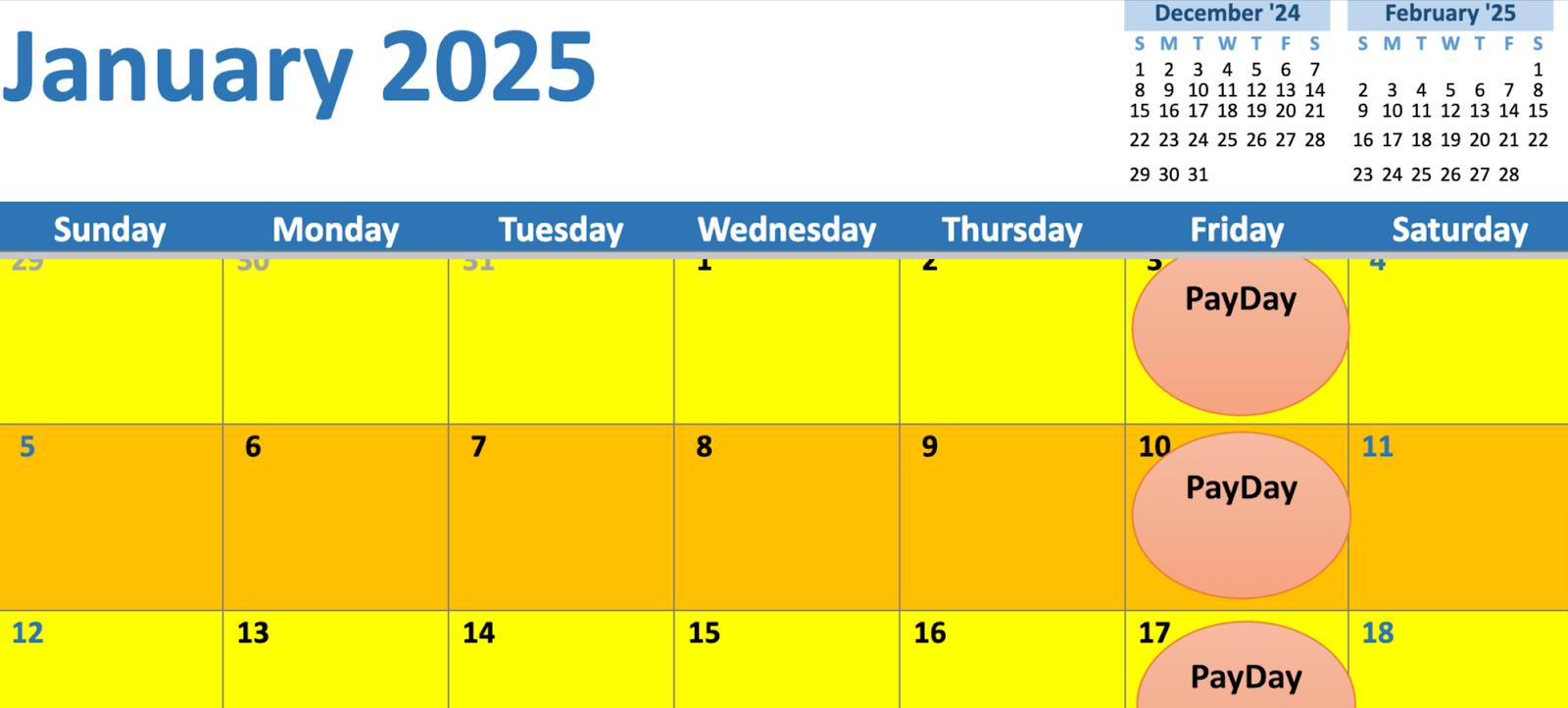

- A pay period calendar makes it easy to see each pay date because they’re highlighted. Post the calendar on your desk or wall for easy reference and write additional information or reminders to help you keep track of other important dates. Just follow along each day, and you’ll always know when payday is approaching. This really comes in handy if you process payroll manually.

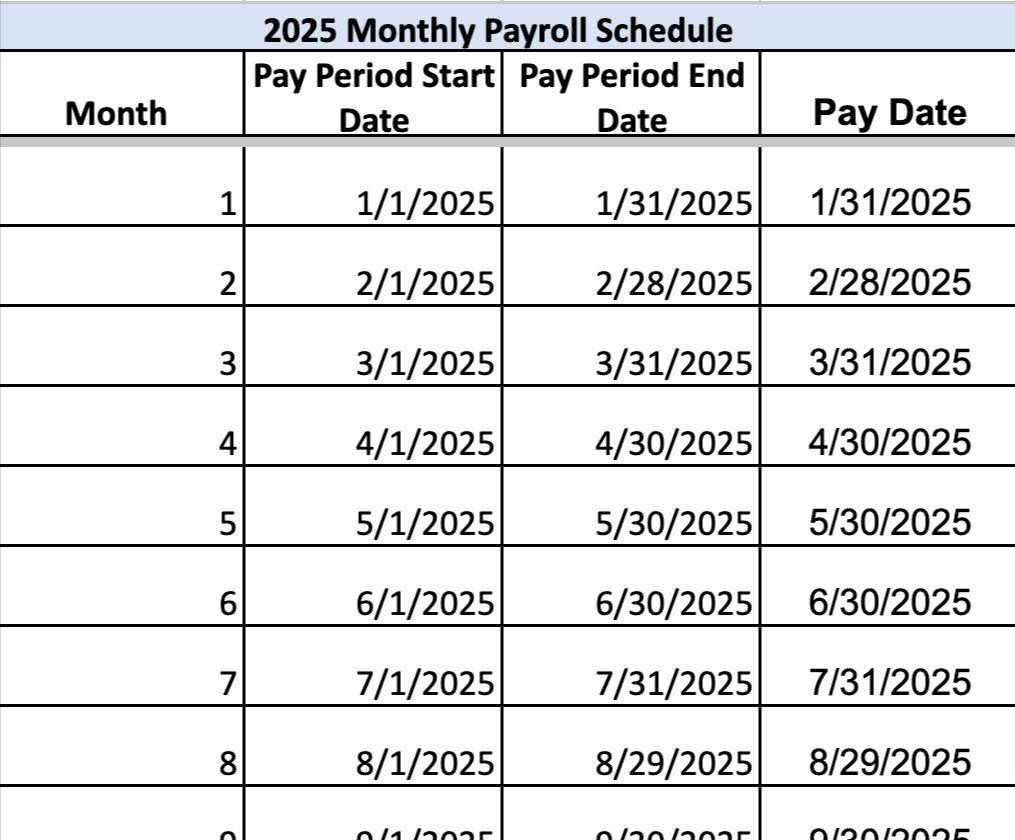

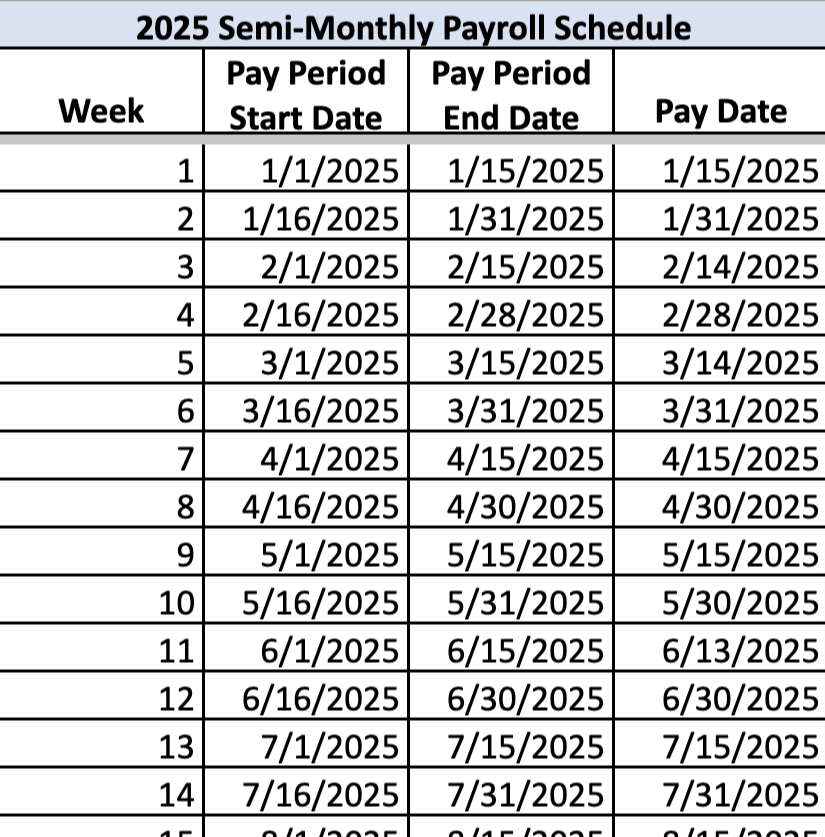

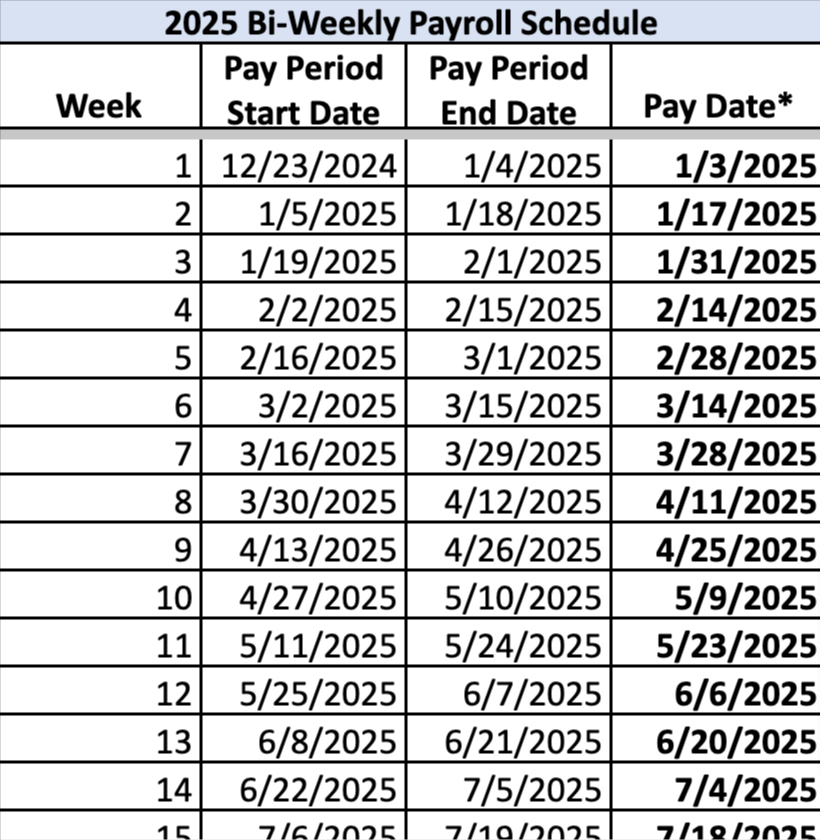

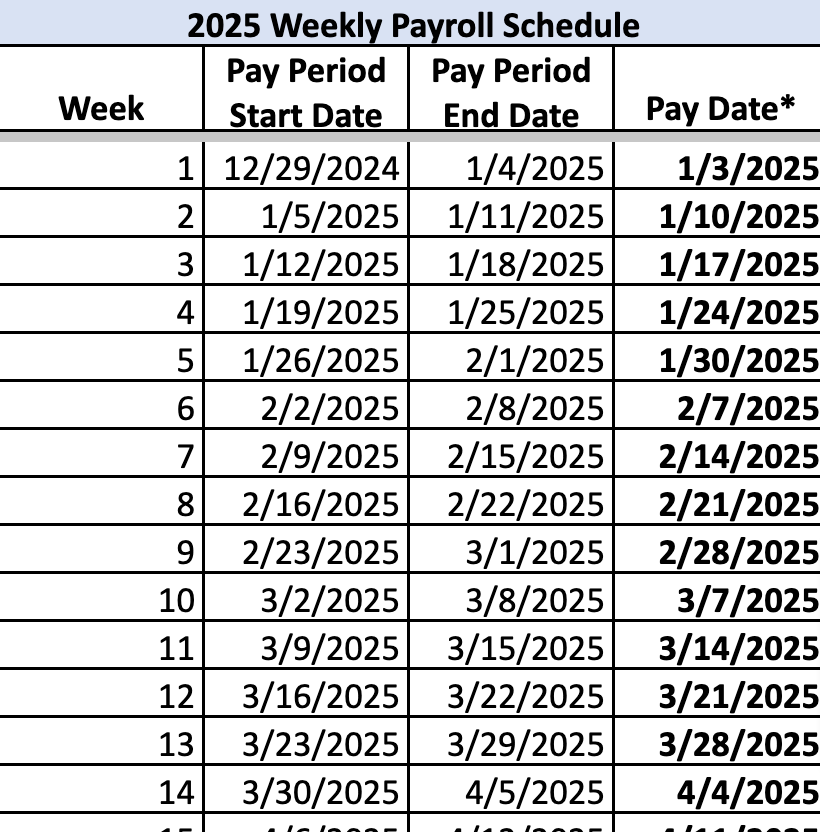

- Use a pay period chart when calculating your employees’ work hours. The chart lists the beginning and end dates you need to consider for each payroll, so you can easily ensure you’re only paying for time worked in the appropriate period. It’s a good idea to require your hourly employees to submit timesheets based on your set pay schedule.

Monthly

With a monthly pay schedule, payroll is processed once a month. It’s not as common as the others and results in only 12 pay dates in the year. Some companies pay employees on the last Friday of each month, while others opt to pay on the last day of the month. If that happens to be on the weekend, they may pay on the last weekday before it. While it simplifies payroll administration, monthly periods require employees to exercise careful budgeting to manage their expenses between payments.

Semimonthly

Semimonthly, which is sometimes confused with biweekly, means twice a month. Many companies opt to pay on the 15th and last day of every month. If either of those days falls on a weekend, payroll is processed on the closest weekday before it. The pay period can include 14 to 16 days, depending on the number of days in the month. While it simplifies accounting, it can complicate calculations when periods split work weeks.

Here are several practical solutions for handling split workweeks in semimonthly pay periods:

- Time estimation system: The system relies on managers to estimate hours for split week’s days using schedules and historical patterns as their guide. Any differences between estimated and actual hours are reconciled and adjusted in the following pay period, ensuring employees receive accurate compensation.

- Rolling cutoff method: This method establishes a timecard submission cutoff two to three days before the period ends, allowing complete processing of available data. The remaining days automatically roll into the next period, creating a consistent lag in the payroll cycle while maintaining payment accuracy.

- Hybrid payment schedule: Fixed salary components are processed on a semimonthly basis, providing predictable earnings disbursement to employees. Variable components, such as overtime, are handled on a delayed schedule, allowing time for proper calculation and verification of additional earnings.

- Payroll software solutions: Advanced payroll systems equipped with built-in split-week management capabilities handle the complexities of semimonthly pay periods. These systems automatically manage calculations, adjustments, and carry-forward, reducing manual intervention and potential errors in payroll calculations.

Biweekly

Biweekly means payroll is run once every two weeks or every other week, wherein employees are paid for two workweeks. For most months, this equates to two paydays, but three months in the year (that vary from year to year) have three biweekly paydays. The workweek for this pay period typically starts on a Sunday and ends on a Saturday.

One thing to note is that biweekly is the most common pay schedule overall, with more than a third of US private businesses historically paying their employees every two weeks. Many businesses in education, healthcare, leisure and hospitality, and information technology industries follow it.

Note: The start of the January pay period can vary depending on when an employer first ran biweekly payroll. If this template’s pay periods align with your pay schedule, you can use the form. If it doesn’t, you have to manually adjust the pay periods and pay dates to fit your requirements.

Weekly

Employees are paid once a week; their paychecks include hours worked (or salary) for a workweek—for instance, Sunday through Saturday. Many companies choose Friday as their payday since it’s the last weekday, but it can be any day of the week. Many businesses in the construction, manufacturing, restaurant, and mining industries pay on this cycle.

Fixed-length

In a fixed-length pay period, employees are paid based on the number of days per pay period instead of a calendar date. The number of days could vary in this pay period; thus, the number of checks an employee receives every year may also vary. This type of pay period is common in industries where hourly or salaried employees follow unique schedules.

An example is the educational sector, where staff members and school teachers don’t typically work in the summer. Instead of receiving biweekly payroll throughout the calendar year, they only get their salaries during the 10 months they work or have their annual salary distributed over 21 paychecks. Note that some states have rules around this type of pay period, so check state regulations to ensure compliance.

Custom

A custom pay period allows employers to set a unique pay schedule that best suits their business needs. This could involve paying employees on specific dates each month, such as the 1st and 15th, or on a less conventional schedule tailored to the company’s workflow.

Aside from the different pay periods, some companies also offer on-demand pay or instant pay. This payout schedule allows employees to access their earned wages whenever they need it, instead of waiting for the standard pay period or payout schedule. However, only a certain percentage of the pay can be requested because the employee’s earned wages will still be subject to the usual taxes and deductions.

Tips for Choosing the Right Pay Period

A year can be divided into 52 weeks, 365 days, or 12 months, which means there are numerous schedules you can use for your payroll. Some businesses are more concerned with weekly payouts and opt to pay once a week or every other week. Others divide each month in half and choose to pay in the middle and at the end. Additionally, although not as frequent, a monthly pay schedule works better for some companies.

Here are some factors you should consider when determining your pay schedule.

- Consider your workforce composition: Analyze employee demographics and the types of workers you have. Hourly or restaurant employees (who earned tipped minimum wage) often prefer weekly or biweekly pay periods for more frequent access to their earnings, while salaried employees might be comfortable with semimonthly payouts. Forcing employees who receive low wages to wait two to three weeks for payday could damage morale.

- Account for state requirements: Some states mandate minimum pay frequencies or maximum intervals between work performed and payment received. Ensure compliance with federal, state, and local labor laws regarding pay frequency, minimum wage, overtime, and payroll tax regulations.

- Evaluate your cash flow: Paying weekly means you must have enough cash available to pay more often. Some businesses have cash flow cycles that require more time before bank accounts are replenished—like stores that sell merchandise on credit.

- Check your profitability: Processing payroll more often usually costs more money ($50 to $100 per pay run for 10 employees), and some businesses, especially startups, have to manage their expenses more carefully. Using providers like Gusto allows employers to run unlimited monthly payrolls at no extra cost.

State Payroll Guides

Before choosing your pay schedule, it’s important to know how often your state requires employers to process payroll, which we detail in our state payroll guides. You also need to check each state’s requirements for pay periods. Click on the map below to see the guide for your respective state:

State Payroll Directory

Paying in Arrears vs Current

When you pay on a current schedule, you pay employees as soon as or before their pay cycle ends. Paying in arrears means there’s a delay between the time employees work and when they receive pay for that work. This delay could be a week or more, depending on state laws.

Here’s an example of paying employees in arrears.

Jeff sets his pay period as Sunday through Saturday but opts to pay on Friday the following week (six days after the last workday). While this is sometimes a nuisance to new employees who may have to work a week “in the hole,” meaning they’re not paid at the end of their first week, it can be beneficial for some employers.

If you pay your employees for time that has not yet passed, there could be unexpected changes in their schedule for which you’ll need to make adjustments on the next pay period. This can become cumbersome, as you’ll have to keep track of pay cycles for which you’ve already processed payroll; it can also involve complying with federal overtime laws—paying time and a half (1.5 times regular hourly pay) for hours worked over 40 in a workweek.

Determining Whether to Pay in Arrears or Current

There is no hard rule guiding whether you should pay in arrears or current. You should consider the needs of your business and your employees. Paying in arrears gives you time to gather all timesheets, tip reports, and other information to ensure you process payroll correctly; there’s no need to forecast employee schedules.

Paying current is less confusing for some employees and works well in certain instances. Let’s assume a company has a Sunday through Saturday pay cycle, with Friday being the payday. If the employees only work weekdays, Monday through Friday, there would be less guesswork. Although Saturday is a part of the pay cycle, the employees don’t work on Saturdays. It also works for salaried employees who are paid the same amount every pay period, regardless of hours worked.

Frequently Asked Questions (FAQs)

A pay period refers to the timeframe over which an employee’s work hours are recorded, typically weekly, biweekly, or monthly. A pay date, on the other hand, is the specific day when employees receive their wages for that period. In essence, the pay date is when employees get paid for the work they’ve done during the pay period.

These are months where biweekly paid employees receive three paychecks instead of two. If you get paid every two weeks, you’ll have 26 pay periods in one year because there are 52 weeks in a year (52 ÷ 2 = 26).

A business can change its pay period, but it must comply with federal, state, and labor laws and regulations governing pay frequency. Employers typically need to provide advance notice to employees before changing the pay period, and the change should not result in any financial loss to the employees. It’s essential for businesses to communicate any changes clearly and ensure they comply with legal requirements.