Payroll internal controls are the processes and procedures your small business follows to protect confidential payroll data, prevent payroll fraud, and ensure no pay-related mistakes are made. Limiting access to payroll records, creating a checks and balances process, and using payroll software are all great ways to control access to your company’s payroll.

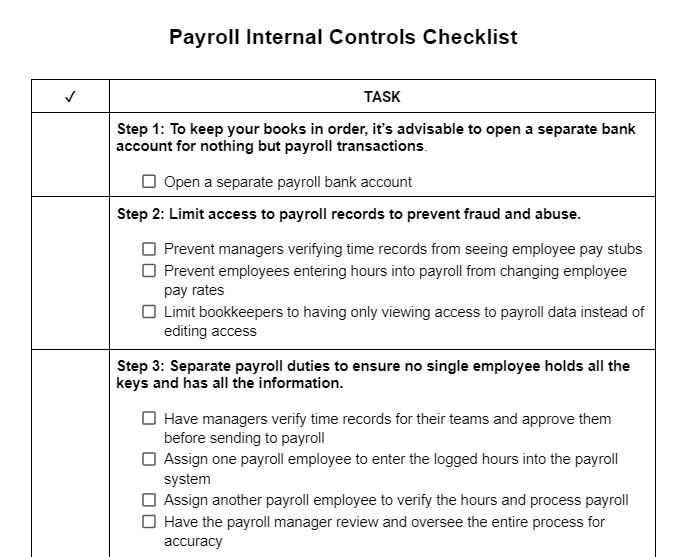

Continue reading for our eight best practices for establishing payroll internal controls and download our free checklist as a quick reference for your business.

1. Open a Separate Payroll Bank Account

You probably already have a business bank account, but a great way to ensure internal control over payroll is to open a bank account specifically used for payroll.

Luckily, you have free business checking account options, so you’re not forced to increase your budget. When you have a separate payroll bank account, that’s all you use it for, making it easy to tell if there’s fraud or some other issue.

Link your payroll bank account to your regular business checking account. This will make it easy to transfer money from your general business account to your payroll account to cover each payroll run.

2. Limit Access to Payroll Records

One of the best ways to manage your payroll is to limit the number and type of employees who have access to the data. Generally, only employees working in your HR and payroll departments should have access. Even then, depending on the size of your company, you may limit access further to specific employees only.

For instance, you may have an employee doing timesheet reviews and entering it into payroll, but they won’t need to see any deductions or withholdings for each employee. Meanwhile, your payroll manager may have full access to payroll data to help them review and audit each payroll run—more on that later.

In much smaller businesses, you’re likely playing an integral role in your payroll process. Even if you have a payroll specialist running payroll, you’ll need to verify the data to ensure accuracy. Your payroll specialist won’t need a full view of all the payroll information—only you will.

Quick List To Limit Access to Payroll Records:

- Prevent managers that verify time records from seeing employee pay stubs

- Prevent employees that enter hours into payroll from changing employee pay rates

- Limit bookkeepers to “view access” to payroll data instead of “edit access”

3. Separate Payroll Duties

When your business has fewer than 20 employees, you probably do payroll yourself or have a single payroll employee handling your payroll. But when your business grows and you add payroll employees, it’s a good idea to separate payroll duties among workers.

Each manager may approve time sheets, which are then reviewed by your payroll specialist. Once they’re comfortable with the accuracy of the time sheets, they’ll enter the payroll data into your system. Your payroll manager will then review the data entered and approve the final payroll.

You may even want to do a final check, reviewing the payroll entries and total amount needed to cover payroll. Even if your business is smaller, it’s a good idea for you to review payroll before the payments are sent to employees.

Quick List to Separating Payroll Duties:

- Have managers verify time records for their teams and approve them before sending to payroll

- Assign one payroll employee to enter the logged hours into the payroll system

- Assign another payroll employee to verify the hours and processes payroll

- Have the payroll manager review and oversee the entire process for accuracy

4. Conduct Regular Payroll Audits

Regular payroll audits, both internal and external, are crucial to ensuring your payroll controls are effective. Internally, you or a trusted payroll manager should regularly audit your payroll records. You need to make sure the data is accurate. Regularly reviewing these records can also help you spot trends and discrepancies—more on that later.

We suggest conducting internal audits at least quarterly, especially if you’re not involved in payroll. Not only could the employee running payroll make honest mistakes, but they could also make intentional “mistakes” that benefit them. Going too long without an audit will let these problems go unnoticed, increasing the detrimental economic effect on your business.

An external audit is when you have someone other than an employee review your payroll records for compliance and accuracy. An accounting firm is a natural choice to look for this service. If you already partner with one, that will make it easy for them to access your records and conduct a thorough audit. A full-service payroll provider may be able to offer you audit services too, usually for an added fee. The upside is that they already have access to all of your payroll data so the process may be more streamlined.

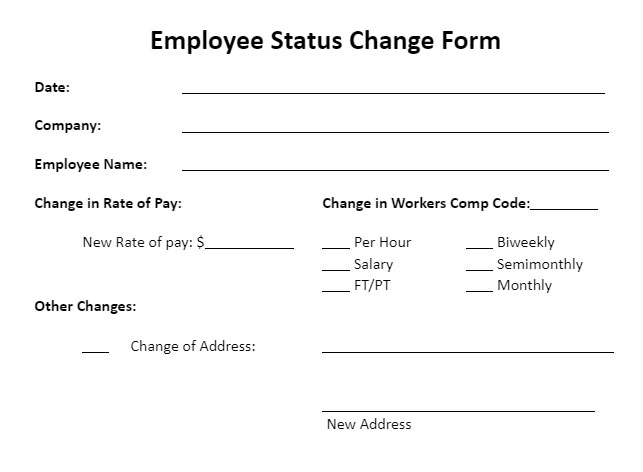

5. Establish a Change Authorization Process

Changes occur in payroll when an employee gets married, has a child, gets a raise, changes healthcare plans, or any other related matters. When these changes occur, your payroll team needs to update payroll records. But you must ensure there’s a process for tracking these changes.

Status update processes typically start with a form submitted by an employee that is requesting a change. We have a downloadable employee status change form that you can use and edit for your company.

Let’s look at what would happen if an employee got married. They might need to change their name, address, withholding amount, bank account information, and healthcare information. Never make any of these changes without paperwork tracking the request from the employee and the changes made by your payroll team.

Tracking these changes is the first step; the second is getting authorization. Whether from you or your payroll or HR manager, your team should not make any changes without first getting authorization—your payroll team should never simply make a change because an employee requests one. Without this documented process, there’s no proof the employee ever requested a change and there’s no proof you ever reviewed and approved the change.

6. Use Software for Time Sheet & Payroll Verification

Preventing fraud in your payroll process is important. The simplest way to do it at the employee level is to use automated timekeeping software.

These systems disallow workers to change their time records. This means that your time sheets will remain accurate, requiring less administrative work to change them when mistakes are found—which is something that happens frequently when using paper timecards.

If you need to create your own time sheets, here are some time sheet templates you can use.

Another benefit of using time sheet software is that you can review and approve time sheets quickly and electronically. Many of these systems automatically calculate base wages and overtime, making it a simple and time-saving way for your payroll team to do payroll.

Meanwhile, if you’re using paper timecards, you’ll need to have the employee sign them, their manager sign them, and your payroll specialist will need to sign off on their accuracy. The payroll specialist will also need to calculate the overtime pay, tax deductions, and withholdings, possibly by hand, which could lead to costly errors. That’s a large administrative burden. With the right software, you and your team simply need to review the payroll reports for accuracy.

7. Perform a Final Payroll Review

Before payroll is submitted, a final review must be made. Make sure employee hours and pay are correct, deductions and tax withholdings are accurate, and nothing seems out of the ordinary. This task is best done by your payroll manager or by you.

When that is complete, run a payroll report showing the total amount of cash required to cover this pay period. Access to this report can be limited to yourself, not just to ensure confidentiality, but also to separate duties, as part of the practice noted above.

8. Regularly Review Your Payroll Trends

When you’re regularly involved in payroll, you can spot trends. Even if you’ve removed yourself from the payroll equation when your business has grown, you should regularly review reports to spot trends.

Know how much cash you regularly need to have on hand to cover each payroll. If you haven’t hired any new employees recently and payroll has gone up dramatically, not only will you spot it, but you’ll also be able to investigate the cause. While there may be an honest error or a legitimate explanation, you won’t know there’s an issue unless you understand your payroll trends.

Importance of Having Payroll Internal Controls

Handling your company’s payroll is more than just paying employees and computing for taxes—you must also adhere to payroll compliance rules. Payroll internal controls also help you mitigate risks to your business and streamline scaling your business.

To Ensure Payroll Accuracy

Creating payroll internal controls helps you process accurate payroll each time, avoiding angry and frustrated employees. If paychecks are frequently wrong, employees will quickly lose faith in your company, killing morale and retention.

This also protects your time and your payroll employees’ time having to manually correct errors and reissue paychecks. Incorrect payroll can also lead to modified tax filings and associated fees.

Accurate payroll signifies that you take your business finances seriously. For most companies, payroll is their largest expense, and showing that you can effectively handle this massive expense with accuracy goes a long way to show your employees, customers, and potential investors that you’re serious about operating your business effectively and efficiently.

To Mitigate Payroll Risks

When you’re a small business, you face many payroll risks. You may make a mistake calculating overtime, or you might even forget to pay taxes. Even innocent mistakes, however, come with substantial penalties.

If you don’t pay an employee correctly, for example, the government may fine you, make you pay the employee the wages they’re owed, and make you pay both your tax burden and the employee’s. This quickly becomes expensive.

Beyond that, you could also face employee lawsuits. When employees aren’t paid correctly, they have legal options to sue you for the payments they’re owed. Using internal payroll controls helps you avoid these expenses and the related headaches.

Here are some examples of payroll risks that can be mitigated by payroll internal controls:

- Incorrect pay rates or withholdings: Employees being paid at the wrong hourly rate or having improper tax deductions taken out of a paycheck can lead to payroll errors. Requiring manager authorization for all pay rate changes prevents unauthorized adjustments. Mandatory tax withholding forms ensure accurate deductions.

- Fake or ghost employees: Adding fake employee names to the payroll allows embezzlement through salary payments to non-existent employees. Requiring manager approval for adding new employees prevents fake names from being added without oversight. Audits further help uncover ghost employees.

- Excessive overtime: Employees working or adding unauthorized overtime hours to payroll can inflate labor costs rapidly. Mandating pre-approval of all overtime by managers ensures overtime is justified, caught early, and budgeted for by your finance team.

- Unauthorized payroll changes: Employees altering their own or co-workers’ pay rates, bonuses, or deductions enables fraud. Restricting access to payroll systems only to authorized employees limits opportunities for misconduct.

To Scale Your Business Easily

When you build your internal control over payroll early on, you can scale the processes and procedures as you grow—helping avoid complications while also keeping a reign on your payroll.

To put this into perspective, say you own a small retail store with a dozen employees. Right now, you do payroll yourself; it’s time-consuming, but you can’t yet justify hiring a payroll specialist.

You decide to build internal payroll controls now so you have processes in place. Your employees use paper time cards that they sign and turn in to you each week. You then review each for accuracy, sign them, and enter them into your payroll system for payment. From there, you review the total wages, taxes, deductions, and withholdings, along with the total payroll number.

When you open your second location and hire a dozen more employees, you can also hire a payroll specialist to handle payroll for both locations. Because you’ve documented and built the payroll internal controls already, your payroll specialist simply has to follow the process, leaving the final payroll review for you.

Examples of Fully Established Payroll Internal Controls

Let’s look at a couple of fictional scenarios showing what it might look like using established payroll internal controls. Note that not every step above is always necessary, given the specific situation.

Frequently Asked Questions (FAQs)

What resources do I need for implementing payroll internal controls?

You’ll need reliable timekeeping and payroll software with strong access controls. Staff or outsource payroll managers familiar with control procedures. An independent CPA should audit your payroll process at least annually.

How much time should I spend on designing controls?

To build your initial controls, it may take you several days. Invest time upfront to build a customized control framework matching your payroll complexity and risks. But don’t take a quick shortcut as that can lead to easy exploitation of poorly set up controls. Your day-to-day compliance should not be overly burdensome and, once set up, should only require a few hours per year of updates.

What are some low-cost controls I can implement?

Low-cost options include having you, the business owner, review payroll before checks are distributed, performing spot-check audits of time sheets, requiring secondary sign-off for manual paycheck changes, and having employees confirm receipt of pay stubs. While these are manually intensive tasks, they satisfy a budget-conscious approach.

What common mistakes lead to payroll control issues?

Inadequate segregation of duties, poor access controls and training, lack of secondary approval protocols, infrequent auditing, and insufficient documentation of policies and procedures can all lead to mistakes. Staying vigilant is key to avoiding these errors.

Bottom Line

Creating and implementing payroll internal controls will help reduce payroll errors and ensure your company stays compliant with laws and regulations. If you don’t have any internal controls, you’re asking for mistakes and possibly even fraud. With internal payroll controls, you ensure your employees remain happy and your company continues to thrive and grow.

For more help to ensure your payroll runs smoothly, check out our top tips for managing payroll.