QuickBooks Contractor, a special edition of QuickBooks Desktop Premier software, is tailored to businesses in the construction industry. It includes special features and reports to help you budget and account for the costs of large jobs. QuickBooks Contractor, like the general business edition of QuickBooks Premier, has prices that start at $799 per year for one user. Through our QuickBooks Contractor review and evaluation of the platform, learn if it’s suitable for your construction business based on its features, pricing, and more.

QuickBooks Premier will no longer be available for new users after September 30, 2024, and on October 1, 2024 the annual price for existing subscribers will increase to $1,399. It has already been removed from the QuickBooks website, so you’ll need to call QuickBooks customer service to subscribe. QuickBooks Enterprise is not being discontinued and comes in the same industry versions as Premier with the same industry-specific features discussed below.

Are you looking for something different? For other comprehensive accounting solutions, check out our guide to the best small business accounting software.

QuickBooks Contractor vs Competitors

Software | Pricing | Cloud Access | Users Included | Job Costing | Equipment Management | Mobile App | Employee Location Tracking | Construction Billing |

|---|---|---|---|---|---|---|---|---|

$799 to $1,999 per year | ✕ | 1 to 5 (fee per additional user) | ✓ | ✕ | ★ | ✕ | ✕ | |

$35 to $235 per month | ✓ | 1 to 25 | ✓ | ✕ | ★★★★★ | ✕ | ✕ | |

$399 to $1,299 per month | ✓ | Unlimited | ✓ | ✕ | ★ | ✓ | ✓ | |

Custom pricing | ✓ | Unlimited | ✓ | ✓ | ★ | ✕ | ✓ | |

Rating Explanation: ★★★★★: Excellent ★★★★: Very good ★★★: Good ★★: Fair ★: Poor | ||||||||

QuickBooks Contractor vs Competitors: Case Study

To provide you with good QuickBooks Contractor alternatives, we developed an internal case study comparing QuickBooks Contractor against QuickBooks Online and Xero. The results are summarized in the chart below.

QuickBooks Contractor vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

QuickBooks Contractor From $799 per year Secondary Series (More faded, in the background, than the primary series)

-

QuickBooks Online From $30 per month

-

Buildertrend From $399 per month

Based on the chart above, QuickBooks Contractor is as comprehensive as QuickBooks Online in terms of general accounting. However, just like its online counterpart, QuickBooks Desktop Contractor has no construction management features, like project scheduling, equipment management, and document management. If you want enterprise resource planning (ERP) features like time and material billing and equipment management, Buildertrend is a great alternative.

Additionally, QuickBooks Contractor is the most expensive, considering that prices rise with each additional user. Another drawback is mobile accounting—while QuickBooks Contractor has a mobile app, you can only use it to capture expense receipts and track business mileage. QuickBooks Online has a more developed app that can be used for invoicing and processing online payments.

While QuickBooks Contractor is moderately priced for solopreneurs, it can be expensive if you need to add up to five users, which explains the significant blow to its score. Below, we sum up the QuickBooks Contractor pricing structure, including the number of users included and key inclusions.

Number of Users | Pricing (Cost/Year) | Access to All Features | 60-day Money-back Guarantee |

|---|---|---|---|

1 | $799 | ✓ | ✓ |

2 | $1,099 | ✓ | ✓ |

3 | $1,399 | ✓ | ✓ |

4 | $1,699 | ✓ | ✓ |

5 | $1,999 | ✓ | ✓ |

QuickBooks Contractor Edition New Features for 2023

- Cash Flow Hub: This provides a one-stop shop for tracking cash position, bank and credit card accounts and loans, and all money-in and money-out transactions.

- Automatic mileage tracking: QuickBooks Contractor helps track drives between all job sites with its new automatic mileage tracker. Simply enter your place of origin and destination, and the app will calculate the mileage automatically instead of manually recording the odometer readings. This feature is available only for iOS users.

- Bill and PO workflow approvals: This lets you set up a workflow where responsible team members verify information and get necessary approvals before submitting payments.

- Improved bank feeds: QuickBooks Contractor now uses modern bank feeds so that you can instantly import your banking transactions.

QuickBooks Contractor Edition offers all the standard features of the general business edition, as discussed in our QuickBooks Desktop Premier review. We couldn’t give it a perfect score because it has some limitations, such as expensive payroll and the lack of a customer portal.

Here are some of the salient QuickBooks Contractor features.

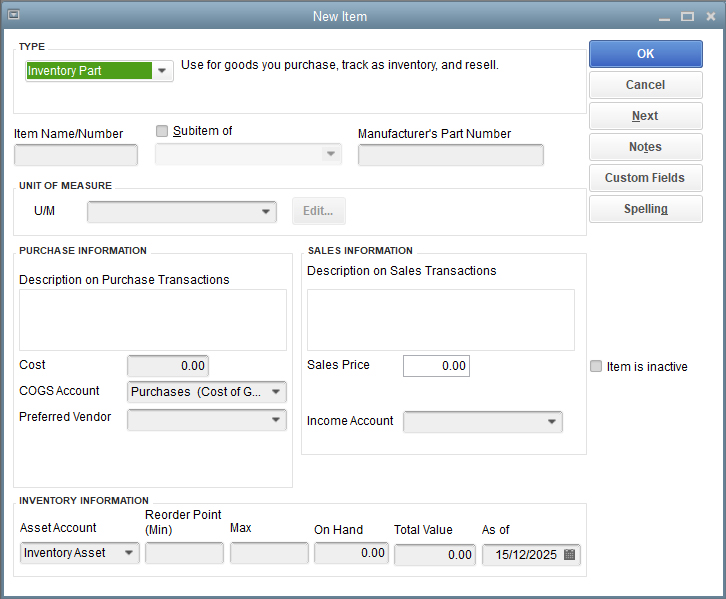

QuickBooks Premier Contractor lets you pay vendor bills from within the program. To stay on top of your accounts payable (A/P), QuickBooks has a built-in bill tracker that displays a real-time view of your bills, including essential details like vendor, bill type, and due dates.

Bill tracker in QuickBooks Contractor

QuickBooks’ income tracker provides an easy way to get a quick look at your finances by showing multiple sales transactions, such as estimates, open invoices, and overdue invoices.

Income tracker in QuickBooks Contractor

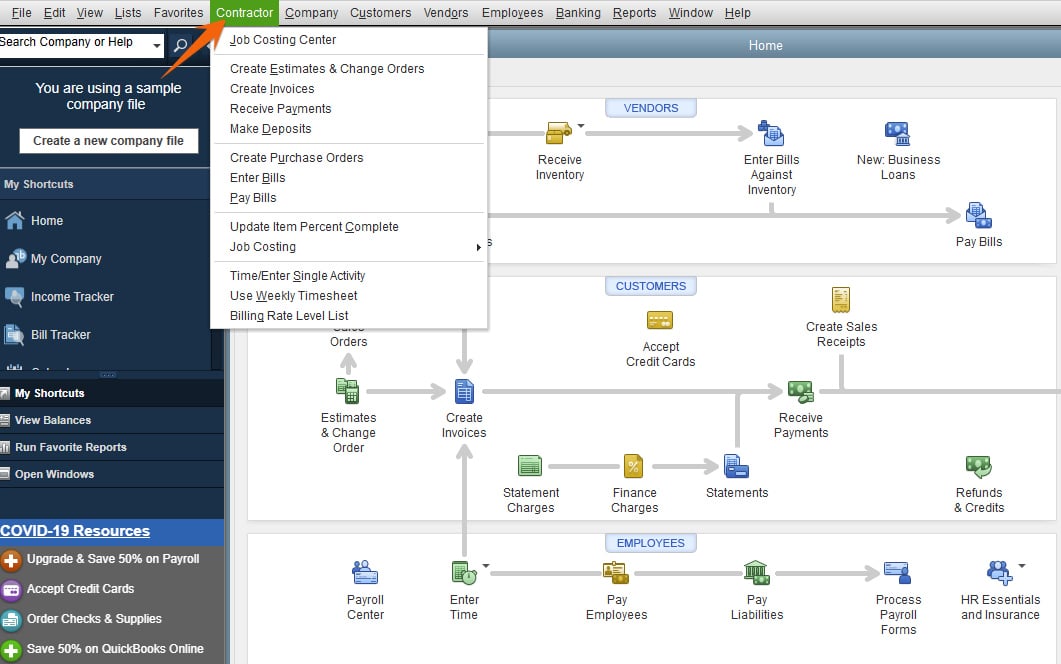

You can create customizable invoices that you can email to your customer and print if needed. One of QuickBooks Desktop’s timesaving features is batch invoicing. If you have customers who purchase the same service or product from you, select the customers you wish to invoice from the Batch invoice screen, and QuickBooks will send the invoices to all selected customers.

Batch invoicing screen in QuickBooks Contractor

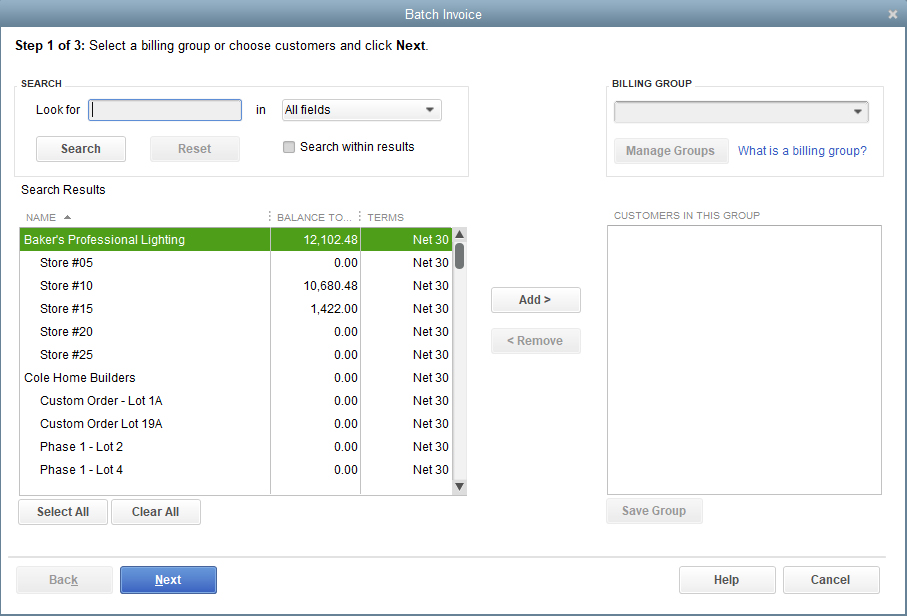

QuickBooks Contractor lets you reconcile bank or credit accounts with or without bank feeds. The reconciliation screen lets you compare your bank statements with your QuickBooks records. QuickBooks has some unique features that make it easy to reconcile. For instance, a matched transaction from your bank feed has a lightning bolt next to it, and when you reconcile it, it turns into a checkmark.

Credit card reconciliation screen in QuickBooks Contractor

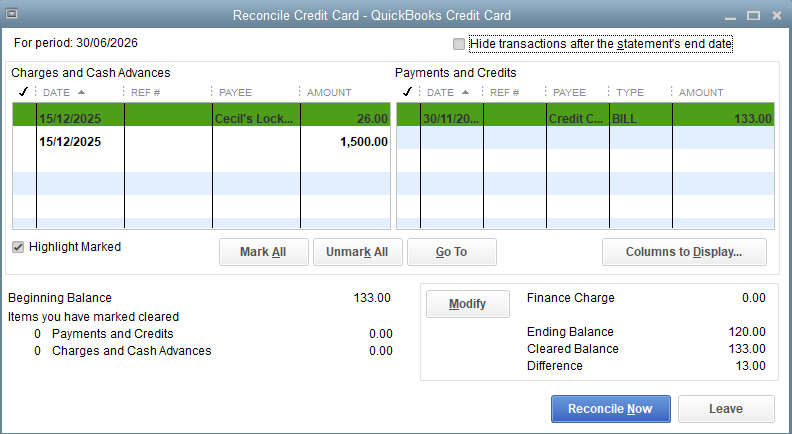

You can use QuickBooks Desktop to track your items that are in stock. The inventory management module lets you track the cost of goods sold (COGS), adjust inventory, set reorder alerts when items fall below a certain point, and more.

Inventory management module in QuickBooks Contractor

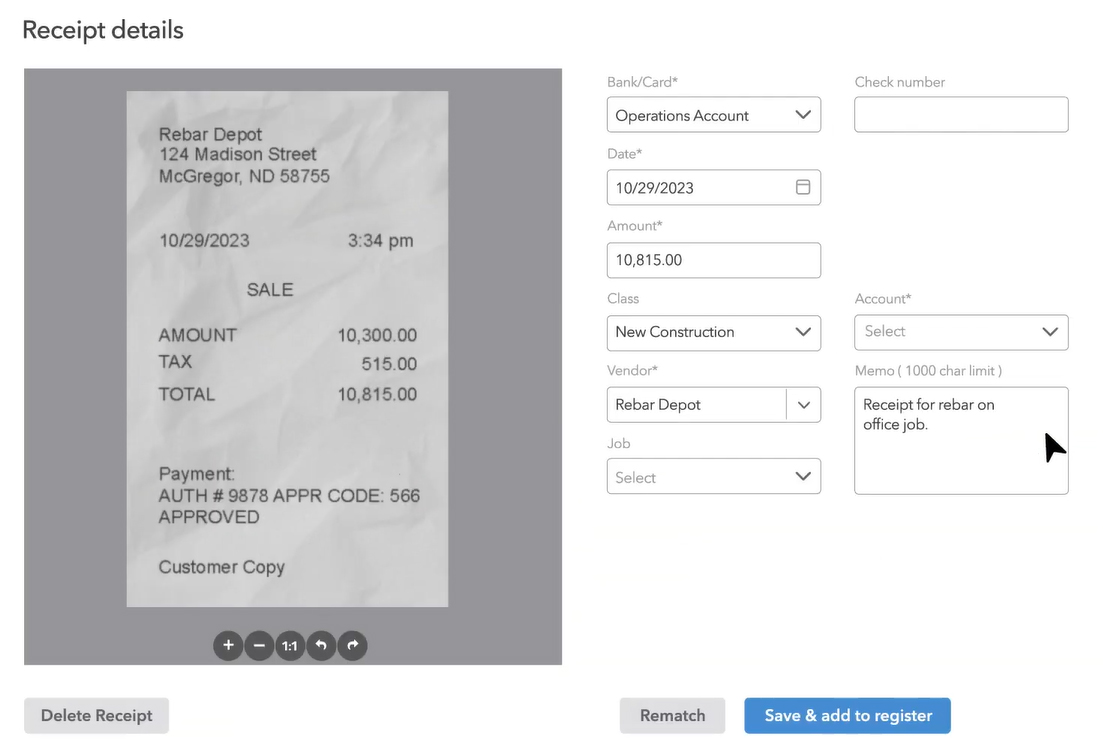

To track expenses accurately, QuickBooks Contractor lets you upload receipts that can be attached to expense entries as documentation support. You can also select a classification, vendor, job, or account. Snap a photo of your expense receipt using the mobile app, upload it to QuickBooks Desktop, and the program will generate a digital transaction out of it automatically.

Uploading receipts in QuickBooks Contractor

QuickBooks Contractor didn’t do well in this category because it has no specialized construction management features, like task scheduling, communication tools, and document management. However, QuickBooks Contractor has extra features that construction businesses will find useful.

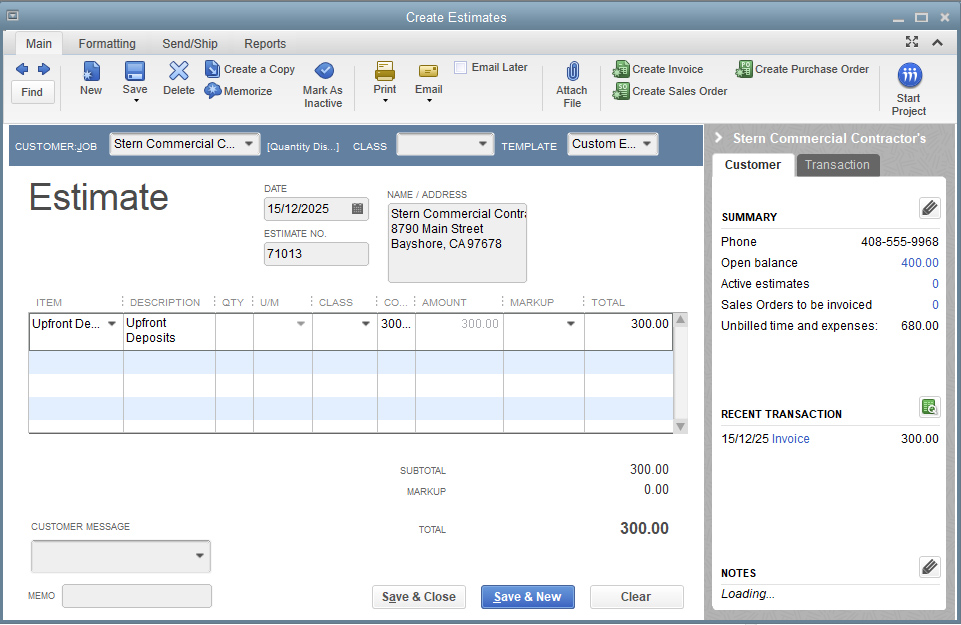

You can create and send job estimates to potential customers. To complete the estimate form, provide several pieces of information, such as the customer or customer job and the services you propose to do or products to include as a sale. It’s important to add as much detail as possible in the estimate as this provides the base for future change orders, invoices, and budget analysis.

Estimate form in QuickBooks Contractor Edition

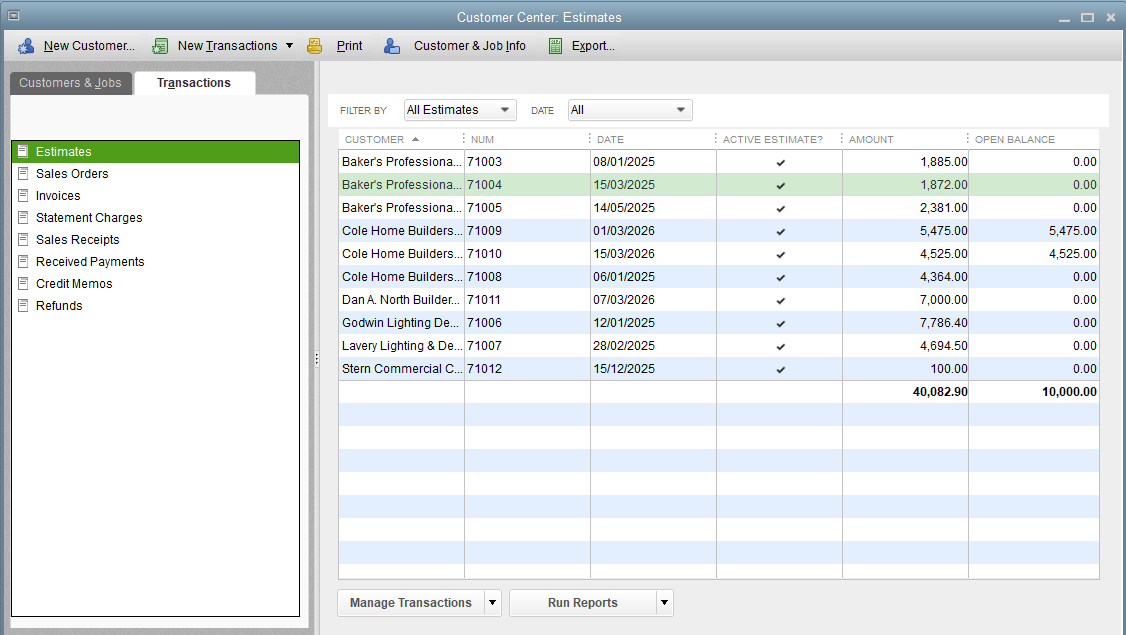

Large jobs rarely go as planned. When a change is necessary, you can make modifications to your original estimate, and QuickBooks will produce a change order automatically to send to your customer. To edit an existing estimate, go to the Customer Center and find the estimate you wish to edit from the Transactions tab.

Edit an existing estimate from the Customer Center

You can create POs from scratch or directly from the estimate form. This helps prevent your project managers from forgetting to order needed materials, resulting in pricey add-ons and lost time. Your project managers can also use the POs to identify needed materials that aren’t included in the estimate.

You can create an in-progress invoice by specifying a set percentage to bill for each item on the estimate, or you can select only specific items on the estimate to invoice. For example, you might decide to invoice only the materials listed on the invoice. When it’s time to invoice the remaining estimate, view the estimate again, click Create Invoice, and QuickBooks will ask if you want to invoice the remaining amount

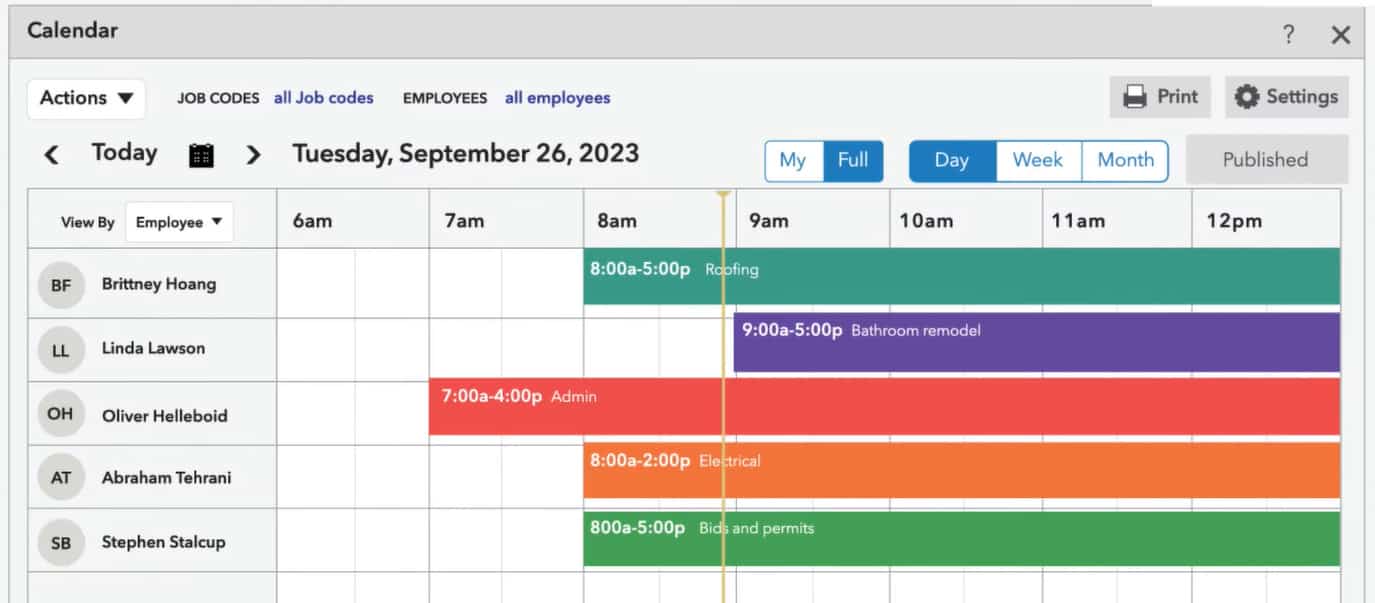

QuickBooks Contractor lets you track time worked by your crew. You can assign the cost of an employee’s wages to a particular job and to a service item that corresponds to the service items listed on your estimate. When wages are assigned to a particular job and service item, QuickBooks will assign any payroll taxes automatically to that job as well.

QuickBooks Contractor Timesheet entry by job and service item

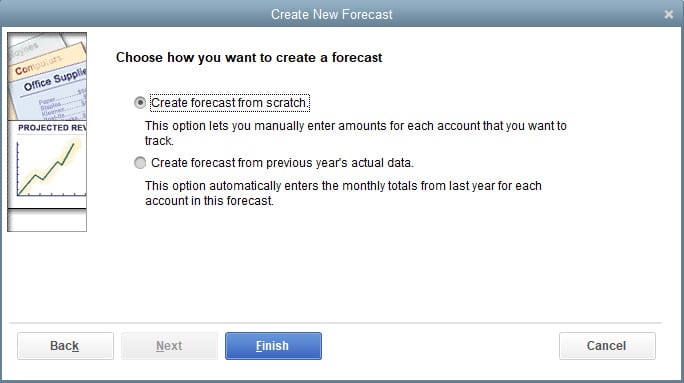

QuickBooks Contractor Edition lets you set up a budget or forecast, which is useful for financial management teams. You can create a forecast from scratch or use your previous year’s actual data. Either way, it can help you get a good look at your company’s financial future, which can be useful if you’re ensuring that all employees and bills will get paid in the next month.

Create a new forecast in QuickBooks Contractor

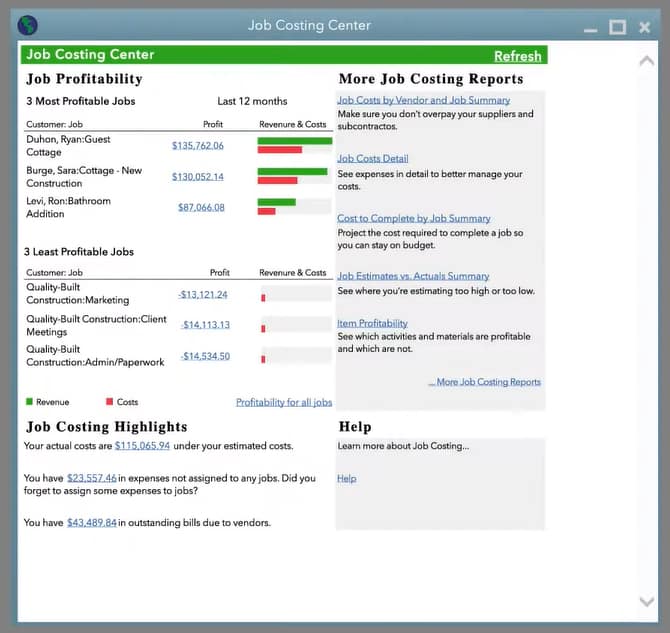

The job costing center provides the top and bottom three jobs ranked on profitability over the last three months. It also includes a few highlights of your recent performance and links to useful job costing reports.

QuickBooks Contractor Edition Job Costing Center

In addition to the standard reports you can create in QuickBooks Premier, Contractor Edition provides contractor-specific reports, such as:

- Job profitability: This shows actual revenue and costs. Revenue and costs can be summarized for all selected jobs or can be displayed by service items for a particular job.

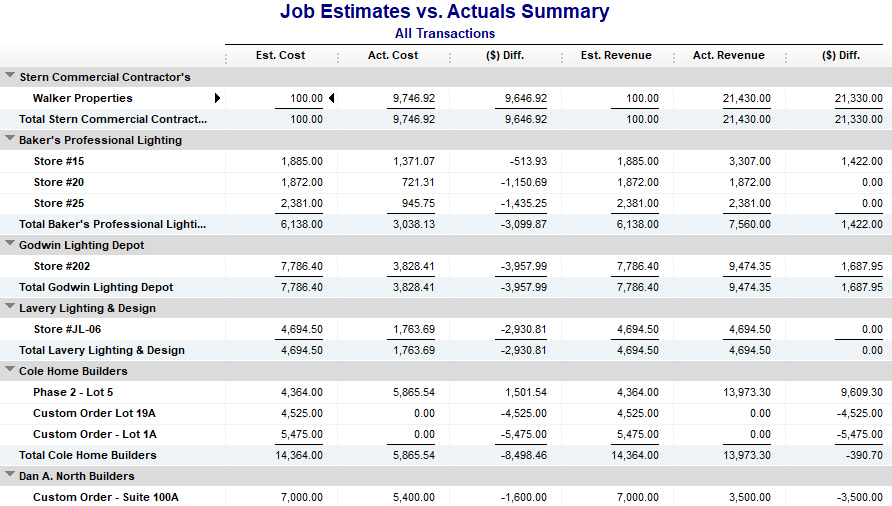

- Job estimates vs actuals: This provides a comparison of actual to estimated revenue and expenses. The report can be summarized by job or broken out by service items for a particular job.

Sample Job Estimates vs Actual Cost report in QuickBooks Contractor

- Job progress invoices vs estimates: This compares the cumulative amount of progress invoices to the estimate by job, so you can identify any jobs that haven’t been invoiced fully.

- Item profitability: This shows actual revenue and cost separated by service item across all jobs. This helps you identify which service items are the most and least profitable.

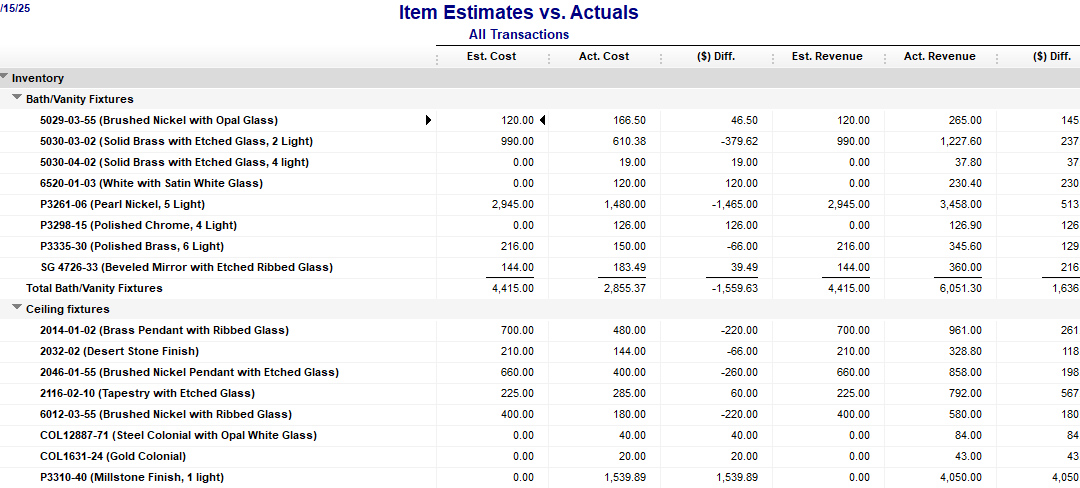

- Item estimates vs actual: This provides a comparison of actual vs estimated revenue and expenses by service item across all jobs. This enables you to see which service items are being poorly estimated.

Sample Item Estimates vs Actuals report in QuickBooks Contractor

- Unpaid bills by job: This is a list of outstanding bills separated by job. This is important to track to wrap up jobs properly and avoid any errors that could cause a customer to be threatened with a lien from your vendor.

- Expenses not assigned to jobs: This offers a list of expenses not assigned to jobs that should be reviewed to ensure they don’t include direct materials or other charges that can be billed to a job.

As mentioned earlier, QuickBooks Contractor has a mobile app, but you can only use it for capturing expense receipts and tracking business mileage. If mobile accounting is important to your business, you should check out our roundup of the best mobile accounting apps.

We don’t recommend QuickBooks Contractor for bookkeepers needing frequent help from an external accountant. The user interface isn’t as intuitive as a cloud-based program, and file sharing isn’t that easy. With QuickBooks Desktop, you need to create an Accountant’s Copy of your file before you can send it to your bookkeeper.

With most cloud programs like QuickBooks Online, you only need to send an invitation email to your accountant for them to access your files. However, if you have an experienced bookkeeper who isn’t dependent on help from anyone else, QuickBooks Contractor is a very powerful tool.

You gain access to unlimited customer support through phone (callback only), live chat, and chatbot. For self-guided support, you can check out Intuit’s articles and videos about QuickBooks. However, QuickBooks seems to have removed resources that are particular to QuickBooks Premier as it’s now more focused on QuickBooks Online and QuickBooks Enterprise.

While we haven’t come across any QuickBooks Premier Contractor reviews, we’ve found feedback on the general business edition, which you can use as references.

Many users who left positive reviews of QuickBooks Desktop Premier commented that the program is easy to use for accounting professionals. Others like that the reports can be customized to various purposes, such as specific account reporting and tax audits.

Meanwhile, those who shared negative reviews complained that it’s difficult to contact live customer service. Another user explained that the cost can be a problem for many small businesses, especially those that are still starting out.

As of this writing, QuickBooks Premier earned the following ratings on top review sites:

- Capterra[1]: 4.4 out of 5 based on about 100 reviews

- TrustRadius[2]: 8.2 out of 10 based on over 400 reviews

Frequently Asked Questions (FAQs)

Small and medium-sized construction businesses, such as electrical, trade, design, and freelance contractors needing to track all costs associated with their projects should use QuickBooks Desktop Premier Contractor. Larger companies may consider upgrading to QuickBooks Enterprise.

QuickBooks Premier has a steep learning curve for beginners, so you might need some time to get yourself acquainted with the software. To get the most out of it, it’s best that you have an experienced bookkeeper managing your books.

While QuickBooks Contractor is great for construction accounting, it has no built-in construction management features. If you want a full-featured construction management solution, check out our guide to the best construction accounting software.

Bottom Line

While QuickBooks Desktop Premier Contractor lacks ERP and construction management features compared to its competitors, it still offers excellent accounting features. We recommend it if you want to focus on construction accounting and tracking the profitability of jobs. If you want construction management and ERP alongside accounting features, then we recommend Buildertrend with QuickBooks Online Plus as a full accounting and construction management solution combined.