QuickBooks Mac Plus 2023, also called QuickBooks Desktop for Mac, is a subscription-based accounting software program designed exclusively for Mac users. It offers features similar to its Windows counterpart but with added Mac-specific functionality, such as the ability to connect iCloud Contacts for easy access to customer or vendor contact information.

The program has an average user rating of 4 out of 5, and many reviewers praise it for its ease of use. However, we find it difficult to purchase, and its mobile app is limited only to capturing receipts. To help you decide if it’s worth purchasing ($549.99 per year for one user), this QuickBooks for Mac review discusses its features, pricing, pros and cons, and more.

The Fit Small Business mission is to help businesses make informed decisions about accounting software solutions. To achieve this, we provide unbiased insights and recommendations to our readers by carefully evaluating the software we review using an internal case study. This method enables us to assess each solution based on how it performs against key criteria that matter to businesses.

Pros

- Has an easy-to-use and well-designed user interface

- Supports an unlimited number of companies with a single license

- Includes unlimited customer support and product updates

- Has Mac-only features to improve productivity

Cons

- Is difficult to purchase as it’s unavailable on Intuit’s website

- Has no accountant's copy—file sharing with your accountant is complicated

- Limited mobile app; intended for receipt and bill capture only

- Limits users to three

- Has fewer versions than the Windows program

Is QuickBooks for Mac Right For You?

Is QuickBooks for Mac Suitable for Your Business?

QuickBooks for Mac Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Easy to use | A bit expensive |

| Compatible with Mac | Insufficient self-help resources |

| Strong invoicing | |

| Robust reporting function | |

Based on the most recent reviews, it’s clear that many appreciate QuickBooks for Mac for its ease of use and seamless compatibility with Mac devices. One user who left a positive QuickBooks for Mac review explained that it has a neat user interface and that it’s efficient for invoicing. Others mentioned that it allows them to create customizable reports.

Meanwhile, one reviewer commented on its pricing structure, while another hoped that there were more comprehensive help and tutorial sections.

Generally, QuickBooks for Mac reviews are positive on several third-party sites:

- Software Advice[1]: 4.0 out of 5 based on around 80 reviews

- TrustRadius[2]: 7.8 out of 10 based on more than 110 reviews

Fit Small Business Case Study

Our internal case study shows how QuickBooks Desktop for Mac stacks up against some of its competitors. The chart below sums up the result of our case study.

Touch the graph above to interact Click on the graphs above to interact

-

QuickBooks for Mac From $549.99 per year for one user Secondary Series (More faded, in the background, than the primary series)

-

Xero From $13 per month

-

QuickBooks Online From $30 per month

-

Zoho Books Has a free plan; paid plans start at $20 monthly

Where QuickBooks for Mac Won

As seen in the chart above, QuickBooks for Mac is as powerful as QuickBooks Online in terms of banking, project accounting, and inventory. This isn’t surprising, as they are designed by the same company and thus share many common features. For instance, QuickBooks for Mac and QuickBooks Online can provide a detailed breakdown of actual inventory used in a project in the actual vs. budget report.

QuickBooks for Mac beats Xero and Zoho Books in important areas like inventory management because we found some weaknesses in the two software. For instance, Zoho Books only allows you to view inventory in your profit and loss (P&L) statement. With Xero, inventory isn’t automatically reduced on a partially received purchase order—meaning manual adjustment is required.

Where QuickBooks for Mac Lost

QuickBooks for Mac’s biggest weakness is its limited mobile app. Also, while it has a simple user interface, it’s not as easy to use as its cloud-based counterpart, QuickBooks Online. Additionally, QuickBooks for Mac lost in pricing as it can be expensive for two or three users. QuickBooks Online and Xero are a bit more affordable, whereas the winner, Zoho Books, has a free plan for businesses that make $50,000 or less per year in revenue.

We gave QuickBooks Desktop a poor price rating primarily due to its pricing structure, which is less favorable for small businesses compared to other options that provide more scalable pricing models.

Below is a quick rundown of QuickBooks for Mac pricing structure.

Number of Users | Price (Cost per Year) | Access to All Features | Unlimited Customer Support | 60-day Money-back Guarantee |

|---|---|---|---|---|

1 | $549 | ✓ | ✓ | ✓ |

2 | $749 | ✓ | ✓ | ✓ |

3 | $949 | ✓ | ✓ | ✓ |

You can’t purchase QuickBooks for Mac directly from the Intuit website, and you have to contact QuickBooks at (844) 848-0426.

QuickBooks for Mac New Features for 2023

- Pay bills online: QuickBooks Mac Plus 2023’s Pay Bills Online feature lets you schedule and pay bills online without leaving QuickBooks.

- Upload bills: You can now upload a photo of your bill using the iPhone scanner or QuickBooks Photo Sync feature. When a new bill is uploaded, QuickBooks will match the data to an existing transaction or create a new one automatically.

- Customer group reporting: You can now run reports on a specific customer group and create a group with certain criteria, such as high-balance customers.

- Additional reports: QuickBooks Mac Plus 2023 added four new reports: adjusting journal entries, profit and loss (P&L) unclassified, P&L budget performance, and unpaid bills by job.

- Expanded Photo Sync: You can now add bills and attachments to your company file using the Photo Sync feature. Place them in a shared Photos album on your computer and then import them easily to QuickBooks for Mac.

- Improved item management: You can now duplicate existing items with the ability to change information to the new item as needed.

- Improved condense facility: QuickBooks for Mac 2023 has added more options to condense your company file, allowing you to customize the data that you want to condense. For instance, you can choose to remove audit trail info to date or remove transactions based on date choices.

You can learn more about the new QuickBooks for Mac 2023 features through the series of QuickBooks videos.

QuickBooks for Mac Features

QuickBooks for Mac did well in this criterion but could have garnered a higher score if it could track income and expenses by location—the same weakness of the other QuickBooks Desktop products. If you need to track accounting data for location-based activities, a way around this would be to set up each location as a class.

Despite its weakness, QuickBooks for Mac still has great standard accounting features and includes added Mac-specific features, including the ability to add general contact information, credit limits, to-do lists, default sales tax, customer credits, maps, and directions. There’s also an option to create contact groups and invoice the entire group at once.

Importing an existing chart of accounts and beginning balances is also possible, but the program lacks an Accountant’s Copy―offered in the Windows version―making it complicated to share accounting files with your accountant. However, the new version lets you exchange data with the Pro, Premier, and Premier Accountant editions.

Mac-specific Features

- iCloud Document Sharing: This allows you to work on your QuickBooks company file from multiple computers. It also enables you to share a link to your file with your client through iCloud Drive so that they can make changes as needed. However, note that this feature isn’t intended to allow work on multiple computers simultaneously.

When working from multiple devices, be aware of how long it takes your computer to sync to iCloud to avoid unintentional changes to your company file. If changes are made simultaneously from two devices, QuickBooks will indicate that it detects a conflict, and you’ll be able to choose which version to keep.

- iPhone scanner: You can use your iPhone or iPad to take photos or scan documents and attach them to any transaction in QuickBooks. To use this feature, use at least macOS Mojave and iOS 12 on your phone.

- Contact Sync: When you set up Contact Sync, all contacts from your app automatically synchronize with QuickBooks. This means whenever you make changes in Contacts or QuickBooks, all changes are automatically synced between the programs.

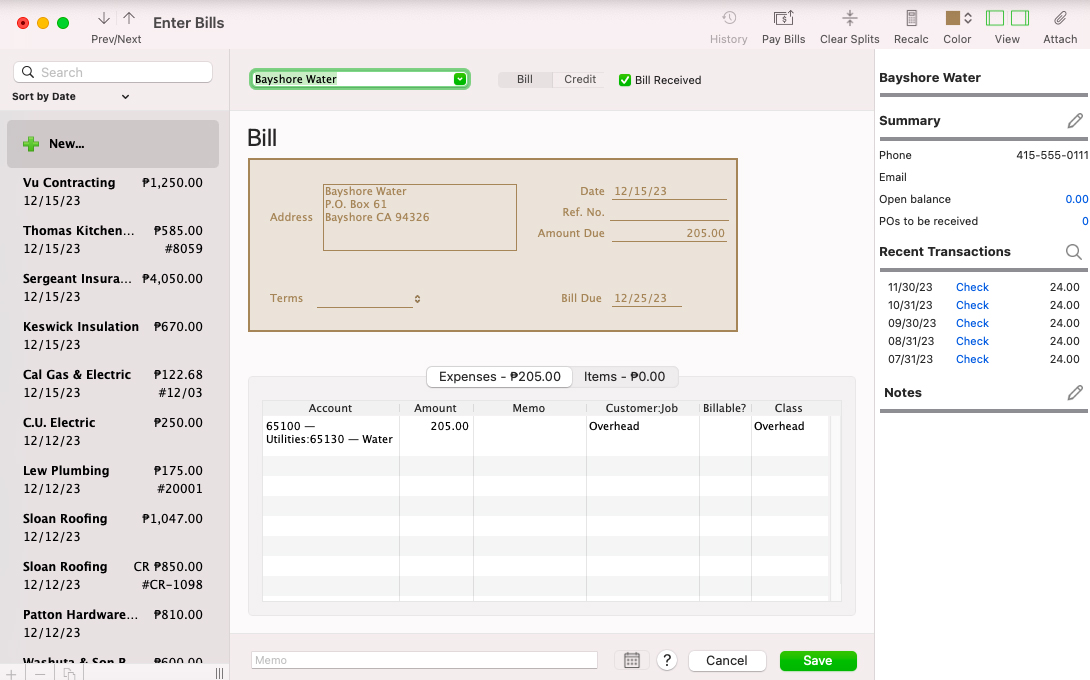

QuickBooks Mac Plus 2023 has solid A/P features, but it’s not that easy to use—which explains the slight blow to its score. The A/P module allows you to enter and pay a bill, track unpaid bills, record recurring expenses, create and print vendor checks, and short-pay an invoice. The Pay Bill screen isn’t as streamlined as in the Windows version, but the fields are almost similar.

Entering a bill in QuickBooks Desktop for Mac

Vendor management is also excellent in the Mac version. It allows you to perform advanced transactions, such as recording credit memos and paying independent contractors through service items.

QuickBooks Desktop for Mac would have the same features and benefits as QuickBooks Online and QuickBooks Desktop if only it included a mobile application. As such, it doesn’t have a feature that allows you to upload an expense receipt through a mobile app, which could have been time-saving for users.

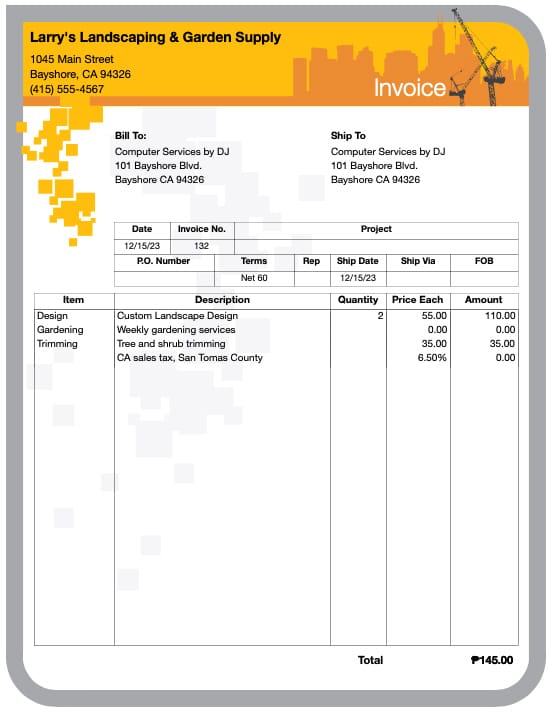

QuickBooks Desktop for Mac lets you create and send invoices to your clients. While not as flexible as QuickBooks Online’s invoicing, the Mac version allows you to change the format setup, adjust alignment, add a logo, and update the text color of your invoice. You can choose from QuickBooks’ default templates or create your own template.

Sample invoice in QuickBooks for Mac Plus 2023

Additionally, it offers excellent customer tracking in its A/R module, where you can view outstanding invoices, view balance by customer, view transactions by customers, and set up recurring invoices.

You can even create invoices from estimates. When a customer approves your estimate and agrees to pay a fixed rate rather than for time and costs, you can convert that estimate into an invoice.

All the information in your original estimate will carry over to the new invoice and, if needed, you can remove or add additional line items or change the quantities or prices. If applicable, other items, such as sales tax, discounts, and other subtotals, will also appear on your invoice.

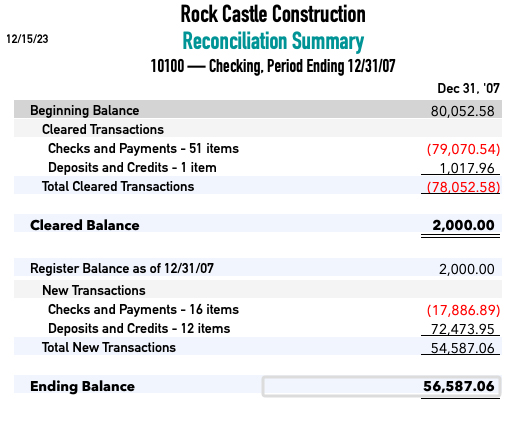

Banking in QuickBooks Mac Plus 2023 is as great as in QuickBooks Online. You can connect your bank accounts, import bank transactions to QuickBooks, and perform bank reconciliations—even if you don’t connect your bank account to the software.

You can also enter the ending balance in your bank statement and match bank statement items manually with the books. After reconciling your bank and credit card accounts, the software generates a reconciliation report to show any timing differences between transactions in your books and those that have cleared your bank.

Sample reconciliation summary report in QuickBooks for Mac

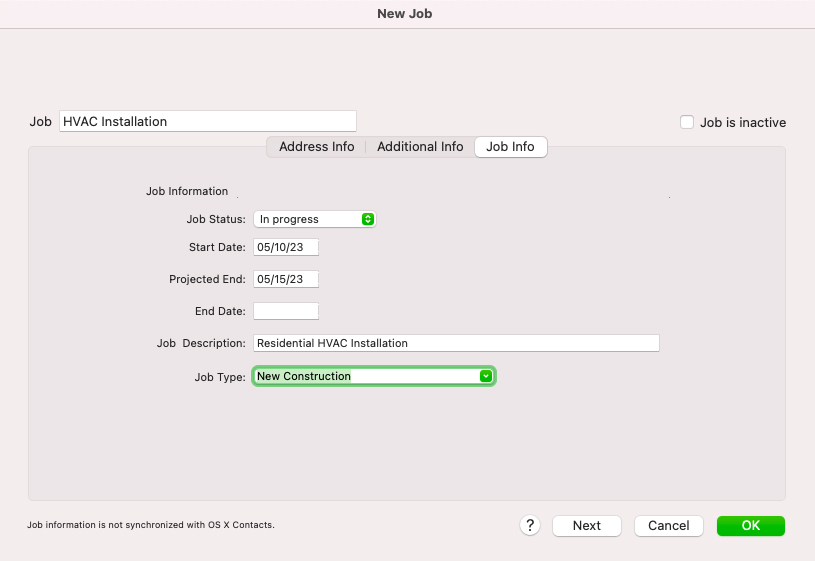

QuickBooks Mac Plus 2023 allows you to create projects connected to customers. With this feature, you can set a job status, start date, projected end date, and description. You can also run job costing reports. Most importantly, the program allows you to compare actual and budgeted project costs. You can track time, create timesheets, attach billable time to invoices, and use progressive invoicing as each step of a project is completed.

To add a new job, select Customers, click on the customer you wish to create the job for, and then complete the New Job form. The new job form consists of three tabs: Address Info, Additional Info, and Job Info. Complete all the required details, and then click the OK button to record the new job.

Adding a new job to a customer in QuickBooks for Mac

You can find the new job as a dropdown item under the customer name in your customer list. Once the job is completed, click on the job entry and then update the status field under the Job Info tab in the New job screen.

This application offers the same features that other QuickBooks products have. You can add sales tax items, track sales tax liability, and adjust sales tax from sales returns. If you’re working with independent contractors, you can add them to QuickBooks and track their 1099 payments. Unfortunately, unlike QuickBooks Online, the Mac-only version doesn’t allow you to e-file your taxes.

QuickBooks for Mac 2023 uses the average cost (AVCO) method to track the cost of inventory items, as opposed to QuickBooks Online’s first-in, first-out (FIFO) method.

Inventory tracking in the Mac version is easy, as it computes the cost of goods sold (COGS) automatically in every invoice and determines the cost of ending inventory. This means that there’s no need to track the original costs of your removed items since they’re calculated automatically.

What’s more, the inventory screen shows the quantity and total value of your item and reorder points, so you can be prompted to order more inventory.

Tracking inventory items in QuickBooks for Mac

There are more than 100 reports available in QuickBooks Desktop for Mac, which include P&L statements, balance sheets, sales reports, charts, and graphs. Reports can be modified through filters and presented per class. The only limitation to its reporting feature is the inability to create reports by location, which is a big deal for businesses that operate in multiple locations or offices.

Sample reports available in QuickBooks Mac

QuickBooks Desktop for Mac lets you charge your clients for business-related trips or deduct mileage from your taxes. However, mileage tracking on the platform is not as comprehensive as with QuickBooks Online, as you have to enter your starting and ending destinations manually. With QuickBooks Online, you can use the mobile app to track your trips automatically via your phone’s GPS.

QuickBooks for Mac has a mobile app, but it’s very limited since you can only use it for capturing expense receipts. If you need to access your files away from your office, you have to look elsewhere. Our top recommendation for mobile accounting is Zoho Books, which offers all of the features we wanted to see in a mobile app, such as the ability to create and send invoices, accept payments, and record billable time. You may also check out other alternatives in our list of the best mobile accounting apps.

QuickBooks Desktop for Mac has a clean interface, but it isn’t as easy to use as cloud-based programs like QuickBooks Online. Luckily, with the new subscription-based plan for all installable QuickBooks products, users will now enjoy unlimited access to live customer support without an additional fee. With the earlier versions, you would have needed to purchase a QuickBooks Care plan to enjoy unlimited support.

You can also ask QuickBooks to call you in case you have questions. Apart from that, chatbots and self-help information are available online. Unfortunately, most articles about QuickBooks Desktop for Mac are outdated and scarce.

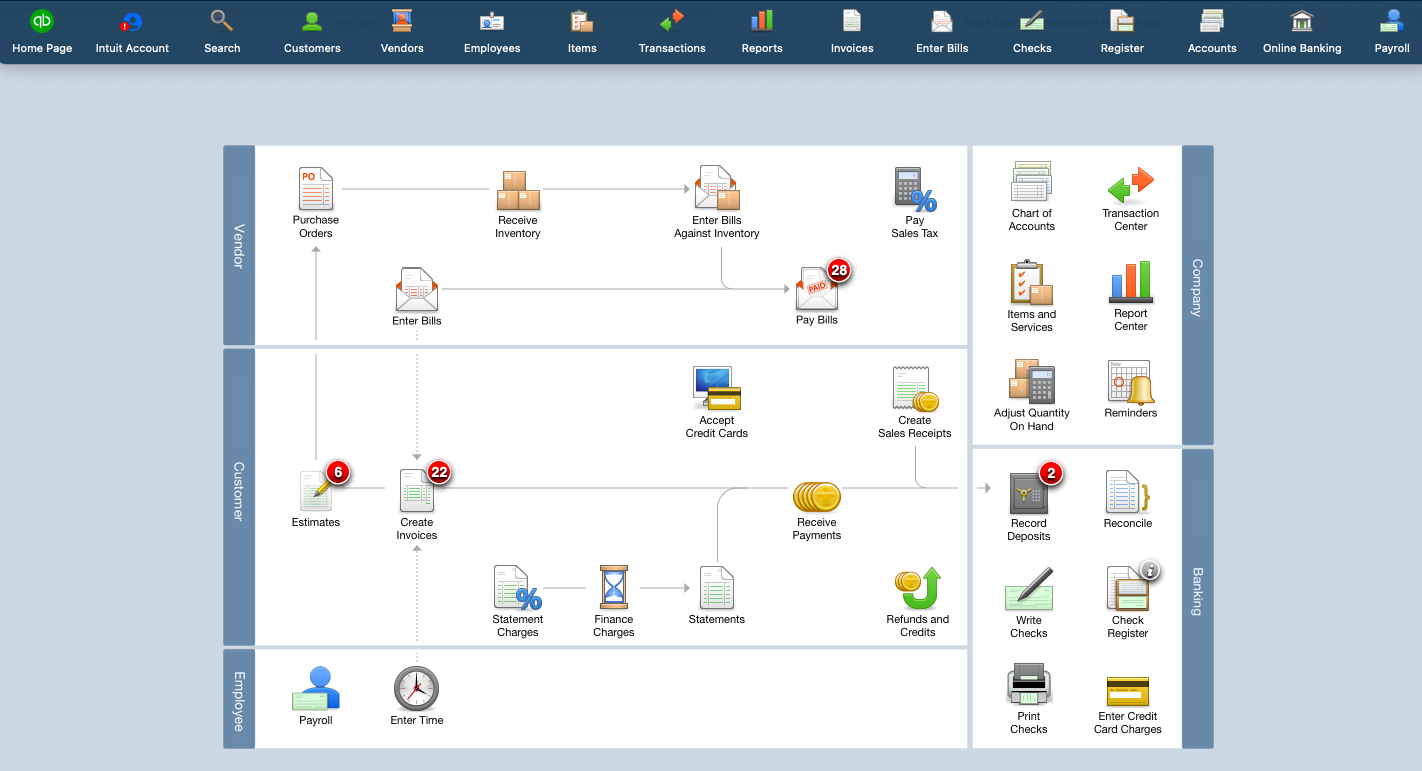

Just like the other QuickBooks Desktop products, QuickBooks for Mac has a workflow-based homepage. From the main page, you can find important features that are categorized by vendor, customer, company, and banking. This helps you navigate through the program easily.

QuickBooks Desktop for Mac Homepage

On the downside, QuickBooks for Mac lacks the Accountant’s Copy feature found in QuickBooks for Windows. With QuickBooks for Mac, you can send your accountant a copy of your company file, but you then can’t use the program until they send an updated company file back to you. Otherwise, you’ll end up with two different company files that will need to be reconciled manually. With QuickBooks Online, none of this is necessary as your accountant can access your cloud-based account whenever needed.

How We Evaluated QuickBooks for Mac

We evaluated QuickBooks for Mac using the following scoring rubric.

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and number of users.

7% of Overall Score

This section focuses more on first-time setup and software settings. The software must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

7% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

7% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

7% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage cost of goods sold (COGS), and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

30% of Overall Score

Ease of use gets the highest weight in this case study because we want to give more credit to easy accounting software. For this section, we considered customer service, support network, and a subjective expert opinion score. Users must have easy access to customer service channels in case of problems, questions, or assistance.

Support network refers to a community of software users that can extend professional help to businesses. Having an independent software expert perform the bookkeeping is good for overall ease of use. Lastly, our expert opinion score is our subjective rating based on our experience in trying the software.

5% of Overall Score

The software must also have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops.

4% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

It’s the right fit if you’re a self-employed freelancer or a very small business owner who does your own bookkeeping on a Mac computer.

While the interface is clean, it may still take time to familiarize yourself with the features, especially if you’re used to cloud-based accounting programs.

Yes, you can convert QuickBooks for Mac to QuickBooks for Windows. To do this, click on File on your QuickBooks for Mac dashboard and then select Export. Next, select To QuickBooks for Windows and follow the on-screen instructions to convert QuickBooks for Mac to Windows.

No, it’s not. However, it’s hard to find as QuickBooks is focusing its energy on QuickBooks Online, which we believe is better software.

QuickBooks for Mac 2023 has several new features, such as the ability to pay bills online, upload bills, and run new reports, such as P&L unclassified and P&L budget performance.

Bottom Line

QuickBooks Desktop for Mac offers many of the powerful features found in QuickBooks Online and QuickBooks Desktop for Windows, such as job costing, class tracking, invoicing, and income and expense tracking. While it has some limitations, such as the lack of a mobile app and location tracking, the added Mac-specific features make up for its weaknesses. If you use a Mac and manage your books in-house, then we don’t see any reason not to use QuickBooks for Mac.

[1]Software Advice

[2]TrustRadius