QuickBooks Ledger is a new QuickBooks Online plan built exclusively for QuickBooks ProAdvisors or accounting professionals subscribed to QuickBooks Online Accountant. It’s focused on after-the-fact accounting for year-end or tax-only clients, making it ideal for compiling income and expenses without the need for comprehensive accounting functionalities like invoicing and bill payment. It costs $10 monthly per company file and can be purchased only through QuickBooks Online Accountant.

Note that QuickBooks Ledger doesn’t offer the business management tools of the client-facing versions of QuickBooks Online. It isn’t designed to manage a business—it is an accounting ledger and can be used to compile income and expenses for tax-only, basic write-up, and after-the-fact clients. Through our detailed QuickBooks Ledger review, learn if this new product is right for your bookkeeping or accounting practice.

The Fit Small Business editorial policy is rooted in our company’s core mission: to deliver the best answers to people’s questions. This mission serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audiences have. This ensures that the content is rooted in knowledge and accuracy.

We also employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased.

Pros

- Ideal for managing after-the-fact accounting tasks

- Interface is similar to the other versions of QuickBooks Online

- Connect bank feeds and reconcile bank accounts

- Sync trial balances with ProConnect Tax for easy tax preparation

Cons

- No invoicing or accounts payable functions for clients

- Available only to accountants using QuickBooks Online Accountant

- Can’t downgrade from another QuickBooks Online product to QuickBooks Ledger

- Unideal for accrual-based businesses

- Not much information available online

Pricing | $10 monthly per company file |

Discount | ✕ |

Free Trial | ✕ |

Payroll | Through QuickBooks Payroll integration; from $45 plus $5 per employee, per month (read our QuickBooks Payroll review) |

Standout Features |

|

Ease of Use | Easy to use; interface is similar to the other versions of QuickBooks Online |

Customer Support | Live chat, phone support (callback only), community forum, and a few blogs |

- Accountants handling tax-only clients: If you have clients who only require assistance with annual tax filings and don’t need ongoing bookkeeping or financial management, then QuickBooks Ledger is a great choice. It can be used to categorize transactions, reconcile accounts, and generate basic reports necessary for tax preparation and filing.

- Firms providing after-the-fact accounting services: QuickBooks Ledger might be suitable for accountants who are focused only on compiling your client’s income and expenses and don’t need to send invoices or pay bills on their behalf.

- Accountants managing basic write-up clients: If you offer basic write-up services for sole proprietors and freelancers needing help with organizing their records and preparing basic financial statements, then QuickBooks Ledger might be sufficient.

- Accountants converting QuickBooks Desktop clients: If you have after-the-fact or tax-only clients using QuickBooks Desktop, then you can easily bring them into QuickBooks Ledger using the built-in data migration tool.

QuickBooks Ledger Alternatives

QuickBooks Ledger Reviews From Users

No user has left a QuickBooks Ledger review on third-party review sites as of this writing—likely because the platform is still green. We may have user insights to share later in the year.

QuickBooks Ledger Pricing

QuickBooks Ledger costs $10 monthly per company file and is available only through your QuickBooks Online Accountant. It’s billed through firm billing, meaning accountants have to purchase the software for their clients. A single subscription includes two accountant users and one client user.

QuickBooks Ledger Features

QuickBooks Ledger provides the necessary tools to manage after-the-fact accounting tasks without the need for typical business management features, like invoicing and bill payment. Here are some of its most notable features:

Like other QuickBooks Online versions, QuickBooks Ledger allows you to connect your bank accounts to automate transaction import. Alternatively, you can opt to manually upload your transaction file in a .qbo or .csv file.

You can also create bank rules to automate the process of categorizing transactions, reconcile bank and credit card accounts, and print checks if needed. The only difference is that you can’t upload a paper receipt into Ledger and attach it to a transaction like in other QuickBooks Online plans.

QuickBooks Ledger includes the full Books review and Client overview sections found in QuickBooks Online Accountant. These tools make it easy for accountants to effectively review transactions, reconcile accounts, and identify discrepancies, helping them ensure the accuracy of their clients’ data.

While QuickBooks Ledger has no bill management features, you can manually enter expenses or import expense transactions from bank feeds. You can also categorize expenses by assigning them to specific accounts or categories. This makes QuickBooks Ledger suitable for accounting professionals needing to compile and manage clients’ expenses efficiently.

If you have transactions that occur regularly—particularly expenses, checks, or journal entries—then you can set them up as recurring transactions in QuickBooks Ledger. For instance, if your client has fixed monthly expenses, like rent payments and insurance premiums, then you can specify the frequency and amount of the transaction in QuickBooks Ledger, and the software will automatically record them every month.

Just like Simple Start and higher QuickBooks Online versions, QuickBooks Ledger provides a default chart of accounts that covers essential categories, like income, expenses, assets, and liabilities. You can also create a new chart of accounts or import an existing chart of accounts using QuickBooks Online Accountant’s chart of account import tool.

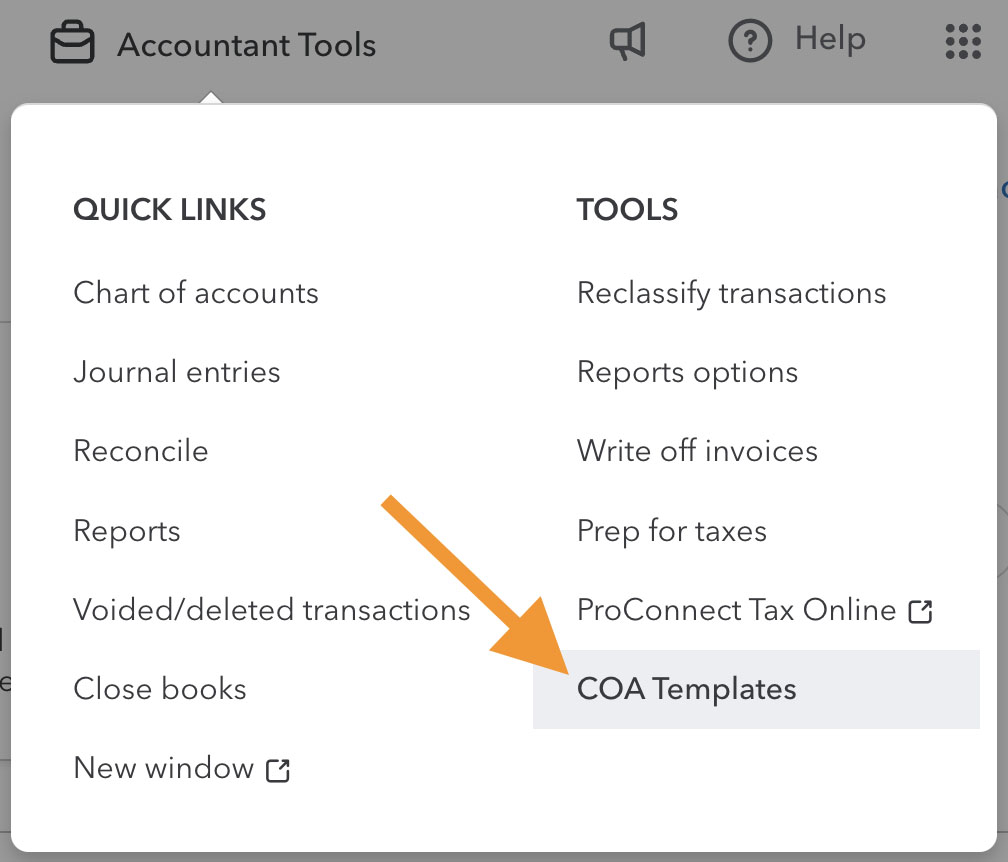

From your QuickBooks Online Accountant portal, click on Accountant Tools and then select COA Templates. You can create multiple charts of account templates and then add them to your QuickBooks Ledger account.

Creating a COA template in QuickBooks Online Accountant to be added to Ledger

If needed, you can create journal entries in QuickBooks Ledger to manually record financial transactions like accruals and deferrals, depreciation, and error correction.

QuickBooks Ledger lets you add vendors as contractors and manage and track payments made to those contractors. The software categorizes these payments accordingly and aggregates the totals for each vendor, making it easy to track 1099 reporting thresholds. Additionally, QuickBooks Ledger generates 1099 forms and lets you e-file them with the IRS.

QuickBooks Ledger provides basic reports, including profit and loss (P&L), cash flow statements, balance sheet, and trial balance. However, since it has no invoicing and bill management features, you won’t find any accounts payable (A/P) or accounts receivable (A/R) reports, like A/R and A/P aging reports.

As mentioned earlier, you have the option to give your clients access to Ledger by adding them as a primary admin. This allows them to review transactions, collect documents, connect bank feeds, and generate reports within QuickBooks Ledger.

Note that some banking and credit card providers offer direct bank feeds without requiring your clients to be on QuickBooks Ledger. However, you may still want to give your clients access, as they may need to review transactions and collaborate with you on various tasks.

Just like the other versions of QuickBooks Online, you can bring a QuickBooks Desktop client to QuickBooks Ledger within the same company file using QuickBooks’ data conversion tool. You can even use the batch data import tool, which allows you to migrate up to 50 clients or company files at a time to your QuickBooks Ledger account.

QuickBooks Ledger connects to ProConnect Tax, a tax preparation software, to help you simplify tax filing. Trial balances created in QuickBooks Ledger can easily be transferred to ProConnect Tax, making it easy for accountants to prepare tax returns for their clients.

QuickBooks Ledger vs QuickBooks Simple Start or Higher

To help you understand how this new plan differs from the higher versions of QuickBooks Online, here’s a comparison of QuickBooks Ledger vs QuickBooks Online Simple Start.

QuickBooks Ledger | QuickBooks Online Simple Start or Higher | |

|---|---|---|

Connect to Bank Accounts | ✓ | ✓ |

Reconcile Bank Transactions | ✓ | ✓ |

Print Checks | ✓ | ✓ |

Manage 1099 Contractor | ✓ | ✓ |

Enter Expenses | ✓ | ✓ |

Create & Send Invoices | ✕ | ✓ |

Enter & Pay Bills | ✕ | ✓ |

Upload Receipts | ✕ | ✓ |

Create Purchase Orders (POs) | ✕ | ✓ |

Create Products & Services | ✕ | ✓ |

Create Estimates & Projects | ✕ | ✓ |

Manage & Track Inventory | ✕ | ✓ |

Track Receivables | ✕ | ✓ |

Add Vendor | ✕ | ✓ |

Track Sales Taxes | ✕ | ✓ |

Track Mileage | ✕ | ✓ |

Reporting | Basic | Advanced |

QuickBooks Ledger Ease of Use

QuickBooks Ledger is relatively easy to use, especially since it has the same user interface as the other QuickBooks Online versions. You’ll get the same left navigation menu and the +New button for easily entering transactions.

You can easily access and switch between QuickBooks Ledger clients. Additionally, setting up a QuickBooks Ledger company file is essentially the same as entering business information in the other QuickBooks Online products.

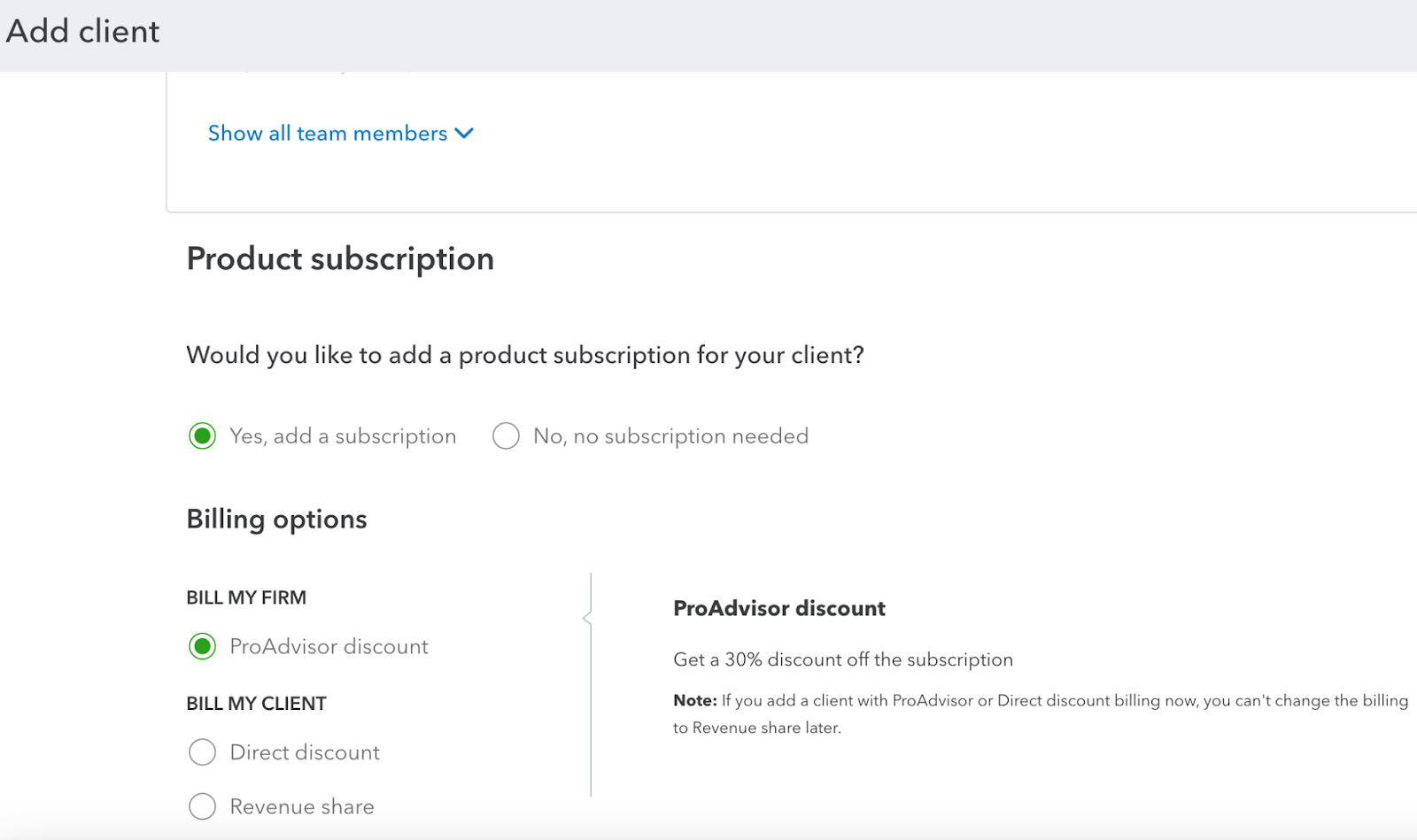

To set up a QuickBooks Ledger file for a client, you must add a new client from the Client tab in your QuickBooks Online Accountant portal. During the client setup process, select Yes, add a subscription under the “Would you like to add a product subscription for your client?” section and then select “ProAdvisor discount.”

Adding a client in QuickBooks Ledger

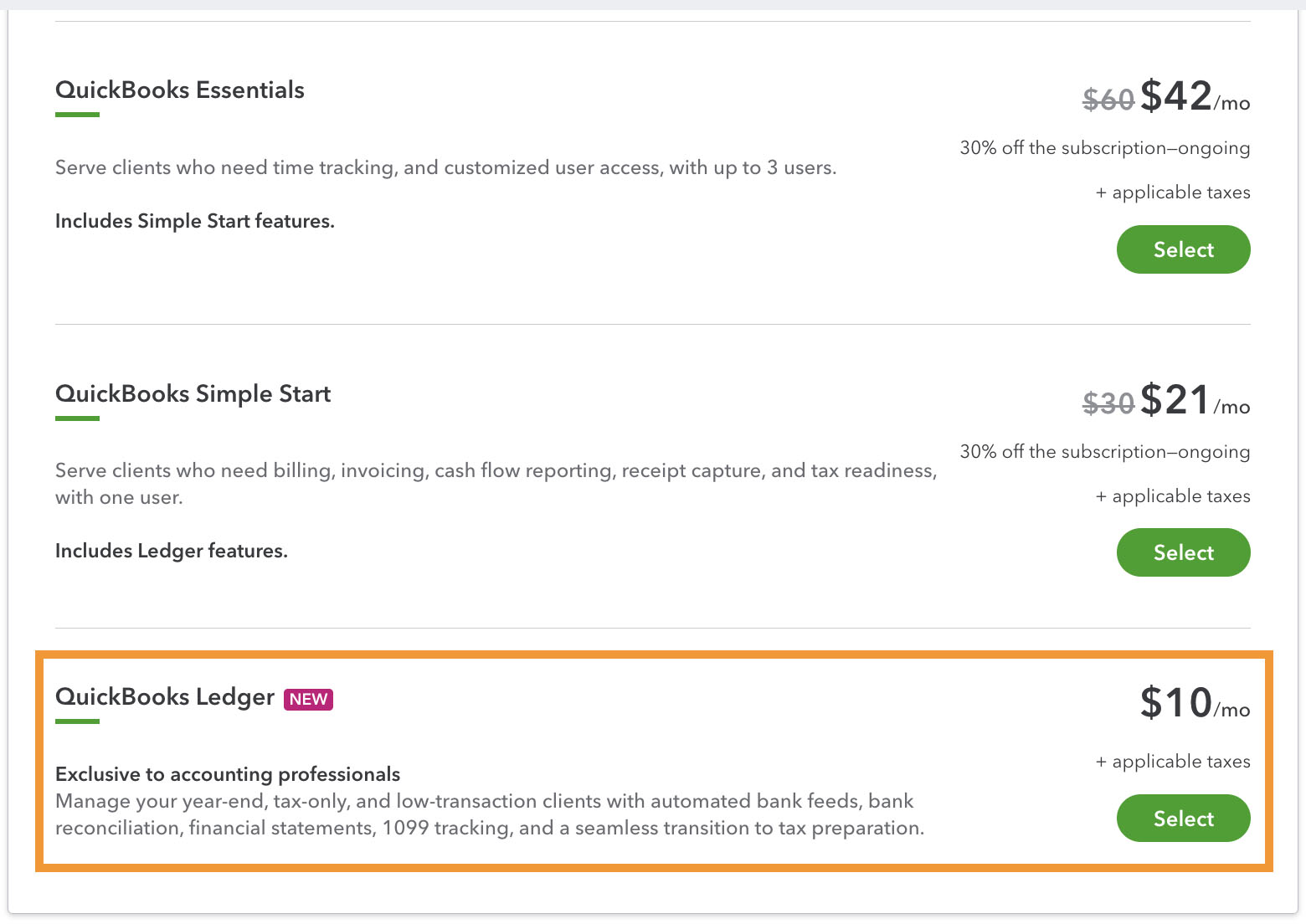

Then, QuickBooks will display a list of available products. From here, select QuickBooks Ledger.

Select QuickBooks Ledger from the QuickBooks Online product list

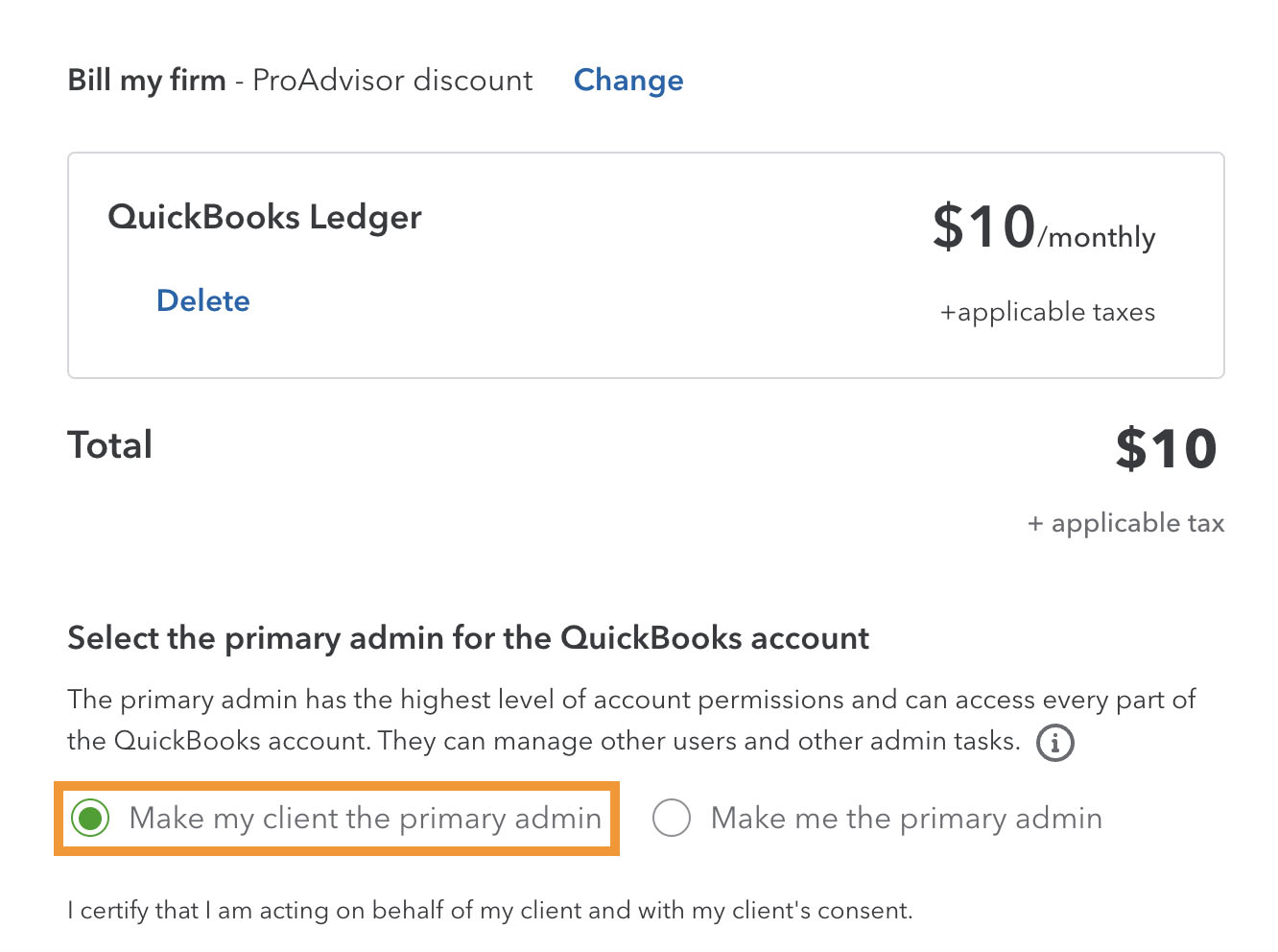

If you wish to grant your clients access to QuickBooks Ledger, you can add them as primary admin.

Make your client the primary admin in QuickBooks Ledger

By doing so, your clients will be able to connect bank feeds, review transactions, and run reports. When you add your client as an admin, you will still be part of the Ledger subscription as one of the QuickBooks Online Accountant admin users.

To complete the purchase, follow the on-screen prompts. Once your first client ledger is set up, you can access it from the client list in QuickBooks Online Accountant by selecting the company name or the QuickBooks logo—and you’ll be logged into the company file. You’ll then be able to set up the company information as you would in any other QuickBooks Online version.

QuickBooks Ledger Customer Support

QuickBooks Ledger users receive the same level of customer support as QuickBooks Online Accountant subscribers—you can talk to an agent via live chat or request a callback. Unfortunately, there aren’t many online resources as of this writing, but there are a couple of blogs and YouTube videos available.

How We Evaluated QuickBooks Ledger

We looked into QuickBooks Ledger’s pricing, ease of use, and feature set to see if the platform provides added value for businesses and accountants that don’t need comprehensive accounting software. We considered how this new product streamlines financial workflows, such as preparing trial balances, compiling income and expenses, and preparing reports needed for tax purposes.

Frequently Asked Questions (FAQs)

Yes, but it is a very basic one. It will track your transactions and produce financial statements, but it doesn’t offer any features to help manage your business like invoicing, bill pay, or inventory management.

Yes, they can. To make this possible, add them as a primary admin on the subscription page.

Yes, you can. However, note that you can’t downgrade from any higher plans to QuickBooks Ledger.

No, it’s not. It can be used to prepare your client’s financial information for any period—such as month, quarter, or year—as part of the closing process.

Bottom Line

QuickBooks Ledger is a cost-effective solution for QuickBooks ProAdvisors or accounting professionals using QuickBooks Online Accountant. If you’ve been using spreadsheets or expensive software to prepare data ledgers for basic write-up, tax-only, and after-the-fact clients, then it’s worth considering QuickBooks Ledger.