QuickBooks Payroll, one of the products in Intuit’s suite of solutions, gives you full-service payroll, automatic tax filings, next-day direct deposits, and multiple human resources (HR) functions. It’s ideal for businesses that already use QuickBooks Accounting or want to move to a reliable accounting solution that integrates with payroll. With monthly fees that start at $45 plus $5 per employee, it’s a reasonably priced option that works well for small businesses. In our evaluation of the best payroll software for small businesses, QuickBooks Payroll earned an overall score of 4.54 out of 5.

Pros

- Unlimited pay runs

- Native integration with QuickBooks for accounting

- Same- and next-day direct deposits

- Robust tax penalty protection; QuickBooks to cover tax penalties (up to $25,000 per year) regardless of who makes the mistake (with highest plan)

- Low-cost contractor payments

- Offers time tracking and HR advisory services

Cons

- Its basic Core plan doesn’t include local tax filings and time tracking; you have to upgrade to its Premium or Elite tier

- Basic HR features

- Tax penalty protection and HR advisory services available only in the Elite plan

- Limited health benefits coverage (doesn’t include HI, VT, and DC)

- Lacks mobile apps for employee self-service (only has a workforce portal you can access online)

What We Recommend QuickBooks Payroll For

We’ve examined and compared QuickBooks Payroll against several payroll software for multiple uses—from general business to specific industries like trucking—and it almost always ranks in our lists of best employee pay processing tools, such as:

- Best Payroll Software for Accountants

- Best Restaurant Payroll Software

- Best HR Payroll Software

- Best Payroll Software for Trucking Companies

- Best Church Payroll Services

- Best Payroll Software for Paying Contractors

- Best Construction Payroll Software

- Best Payroll Software for Mac Users

- Best Payroll Software for Nonprofits

QuickBooks Payroll Deciding Factors

Supported Business Types | Small businesses, contractor-only companies, and QuickBooks Accounting users |

Free Trial | 30-day free trial or 50% off the base fee for the first three months |

Pricing |

|

Discounts | None (aside from the discount option for new clients) |

Standout Features |

|

Ease of Use | While its platform is relatively easy to use, having basic knowledge of how to do payroll will make navigating through its pay processing tools easy for users. |

Customer Support |

|

Are you looking for something different? Read our guide to the best payroll services for small businesses to find a service or software that’s right for you.

How QuickBooks Payroll Compares With Top Alternatives

Best For | Free Trial | Starter Monthly Fees | Our Reviews | |

|---|---|---|---|---|

Small companies that use QuickBooks accounting | 30 days | $45 base fee plus $6 per employee | ||

Businesses that need full-service payroll and solid HR support | 1 month free payroll* | $40 base fee plus $6 per employee | ||

Small retail and restaurants businesses | ✕ | $35 base fee plus $6 per employee | ||

Companies looking for an all-in-one HR, payroll, and information technology (IT) solution | ✕ | $35 base fee plus $8 per employee** | ||

*Get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

**Pricing is based on a quote we received.

QuickBooks Payroll offers transparent pricing, so you know just how much you need to pay when running payroll through its platform. While its monthly fees are reasonably priced, its unlimited pay runs also help to keep the costs down, unlike other payroll providers that charge fees on a per-employee and per-pay run basis. These factors contributed to QuickBooks Payroll getting perfect marks in this criterion.

Intuit QuickBooks Payroll pricing for its three plans (Core, Premium, and Elite) ranges from $45 to $125 per month plus per-employee monthly fees of $6 to $10. Each plan includes full-service payroll, tax payments and filings, next-day direct deposits, and automatic pay runs. However, depending on your plan, you have to pay extra for some services, such as multiple state filings and workers’ compensation administration.

Core | Premium | Elite | |

|---|---|---|---|

Monthly Pricing | $45 plus $6 per employee | $80 plus $8 per employee | $125 plus $10 per employee |

Full-service Payroll | ✓ | ✓ | ✓ |

Direct Deposit Timelines | Next day | Same day | Same day |

Tax Payments and Filings | Federal and state | Federal, state, and local | Federal, state, and local |

Multiple State Tax Filing | One state only; each additional state is $12 per month | One state only; each additional state is $12 per month | ✓ |

401(k) Plans and Health Benefits* | ✓ | ✓ | ✓ |

Workers’ Compensation Administration** | $5 per month | ✓ | ✓ |

Time Tracking | N/A | ✓ | ✓ |

HR Support Center | N/A | ✓ | ✓ |

Project Tracking | N/A | N/A | ✓ |

Personal HR Adviser | N/A | N/A | ✓ |

Tax Penalty Protection (Up to $25,000 per year) | N/A | N/A | ✓ |

Expert Setup | N/A | Setup review only | ✓ |

*Additional fees may apply, depending on the type of plan selected.

**Workers’ compensation insurance isn’t available in Ohio, North Dakota, Washington, and Wyoming.

Are you unsure which QuickBooks Payroll plan to get? Read our QuickBooks Payroll: Core vs Premium vs Elite guide to help you find the right payroll package for your business.

Contractor Payments

For small businesses that only hire contractors, QuickBooks has a contractor payments package that’s very affordable. For $15 per month, you can process payments for up to 20 workers (plus $2 for each additional contractor), e-file 1099 forms, and pay contractors via next-day direct deposits. This plan also comes with self-service tools, so your contract workers can set up their QuickBooks Payroll accounts, complete W-9s, and provide bank information details for pay processing.

Additionally, businesses that are first-time users of QuickBooks’ contractor payments package can get either a 30-day free trial or 50% off its base fee. However, if you must pay both employees and contractors, you must sign up for one of QuickBooks Payroll’s plans.

While its intuitive interface is designed to streamline pay processes, it didn’t get a perfect rating here because it doesn’t have a pay-on-demand feature and only offers local state tax filings in its higher tiers. However, QuickBooks Payroll’s online tools are still a great choice for small businesses looking for fast direct deposits and an affordable contractor payment plan.

The QuickBooks Payroll dashboard contains helpful shortcuts, a to-do list, and an “auto-payroll” box that allows you to turn its automatic pay runs feature on and off easily. (Source: QuickBooks Payroll)

If you’re a new user and need help navigating its pay features, check out our guide to setting up and running QuickBooks Payroll. It also includes a video tutorial if you prefer a visual walk-through.

With QuickBooks Payroll, you can run unlimited monthly payroll and pay employees and contractors through paper checks or direct deposits. Since payroll processing is unlimited, you can set different schedules for different employees. You can also pay your staff quickly—QuickBooks offers next- or same-day direct deposit vs the two- to four-day option with other providers. While some services charge extra for processing deductions and garnishments, QuickBooks includes this in all plans.

For business owners who prefer to pay employees via paychecks, QuickBooks Payroll has check printing capabilities. To print paper checks yourself, you need to purchase the proper check stock and adjust your printer settings. For more information about this feature, check out our guide to printing QuickBooks payroll checks.

If you’ve run payroll several times and don’t require any revisions or salary changes, QuickBooks has an auto-payroll feature that will run payroll automatically every pay period. However, this functionality is available only for those who employ salaried employees and have payments set on direct deposits with e-services enabled. Your payroll account should also be in good standing and not have been placed on hold in the six months prior to running auto-payroll.

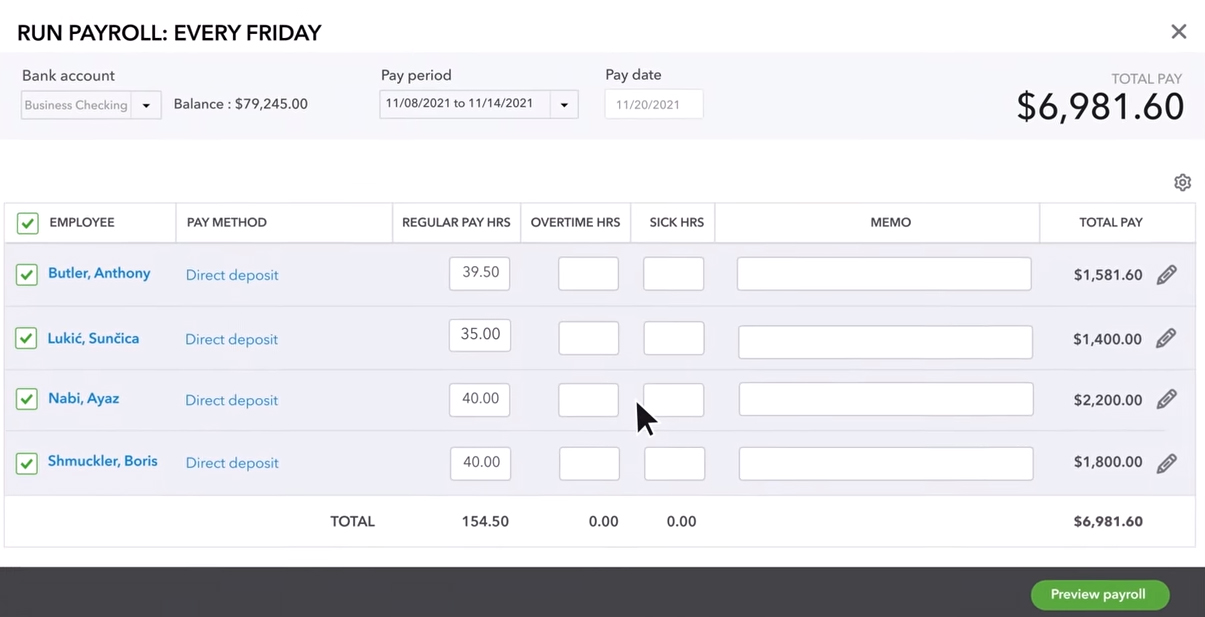

With QuickBooks Payroll, you can process, review, and approve employee payroll with a few clicks. (Source: QuickBooks Payroll)

QuickBooks Payroll handles tax payments and filings for federal and state taxes, including year-end tax forms. If you require automated local tax filings, consider either its Premium or Elite plan. For Elite subscribers, there’s additional insurance against penalties of any kind up to $25,000, even if you are at fault. A QuickBooks tax resolution team will also represent you in resolving filing or payment issues with the IRS.

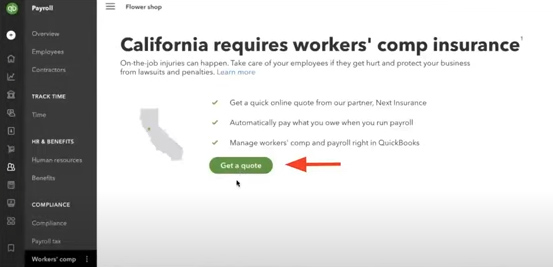

QuickBooks Payroll files state and federal unemployment insurance and works with AP Intego for workers’ comp to get you the best plan price. Managing workers’ compensation is also made easy since AP Intego integrates your plan directly into QuickBooks Payroll. Note, however, that workers’ comp administration is only included in the Premium and Elite tiers. If you’re on Core, you have to pay $5 monthly for this service. Also, it isn’t available in Ohio, North Dakota, Washington, and Wyoming.

You can manage workers’ comp plans easily and get an online quote from the provider’s insurance partners directly through QuickBooks Payroll’s benefits module. (Source: QuickBooks Payroll)

This system’s HR functionalities may not be extensive but are sufficient enough to help small businesses manage basic employee data, benefits, and time tracking. While it earned a 4.38 out of 5 in this category, QuickBooks Payroll would have received a much higher rating if it provided access to health insurance plans that cover all 50 states (unavailable in Hawaii, Vermont, and Washington, D.C.).

If you select either its Premium or Elite package, you can track your employees’ work hours and paid time off (PTO) through QuickBooks Time (formerly TSheets). With its mobile app, your staff can clock in/out, switch jobs or tasks, and check their attendance while on the go. It has GPS functionalities, allowing you to check your field employees’ location when they clock in.

If you’re not on a Premium or Elite plan, you can input your staff’s regular and overtime hours into QuickBooks Payroll directly. (Source: QuickBooks Payroll)

For employee health benefits, QuickBooks Payroll offers health insurance options through SimplyInsured, which helps small businesses find the best insurance packages for their budget. It’s a three-step application, and you get instant quotes. If you select benefits through QuickBooks Payroll, you can easily administer them through its software. Note, however, that its health plans aren’t available in Hawaii, Vermont, and the District of Columbia, as of this writing.

In addition, all of its plans include access to a 401(k) program. It is administered by Guideline, an independent third party that handles compliance and record-keeping—although there may be some 401(k) plan fees (Guideline offers three plans with fees that start at $49 plus $8 per active participant monthly).

QuickBooks Payroll has partnered with Mineral to provide HR support and administration to its clients. Available only for Premium and Elite subscribers, the HR support center grants you access to customizable job descriptions, onboarding checklists, and performance tools. If you sign up for an Elite plan, you can contact Mineral HR and compliance experts (either online or via phone) if you have critical HR issues. They can also assist you in creating HR policies and custom handbooks.

The QuickBooks Payroll portal lets employees access pay stubs and W-2s as well as view PTO balances and withholdings. They can also change and update their details like contact information, bank accounts, and more. In addition to logging time sheets, it lets employees apply for expense reimbursements and request PTO. There’s also a section for HR documents like employee manuals. Note that the features employees can use may vary according to your QuickBooks Payroll plan.

QuickBooks Payroll meets all the requirements we’re looking for when it comes to reporting capabilities. It has built-in reports that cover anything from payroll costs and tax liabilities to employee details and retirement plan contribution information. Reports are downloadable in comma-separated values (CSV) and XLS file formats. You can also customize reports (and save these) by selecting items you want to appear in the report and adding filters, such as date ranges and employee types.

If you click on the star beside the report, QuickBooks Payroll will add it to your Favorites, making it easy for you to access. (Source: QuickBooks Payroll)

If you need help generating reports, read our guide to running QuickBooks Payroll reports.

This provider scored well for ease of use, given its intuitive interface and user-friendly tools. However, its limited customization options cost it some points. While QuickBooks Payroll connects seamlessly with other Intuit products, you need to get its accounting solution if you want to integrate with third-party software.

- Automatic integration with QuickBooks Accounting software

- Self-service onboarding

- Intuitive interface

- Online setup wizard

- 24/7 chat support

- Setup assistance available in Elite plan

- How-to guides and videos

- US-based live phone support

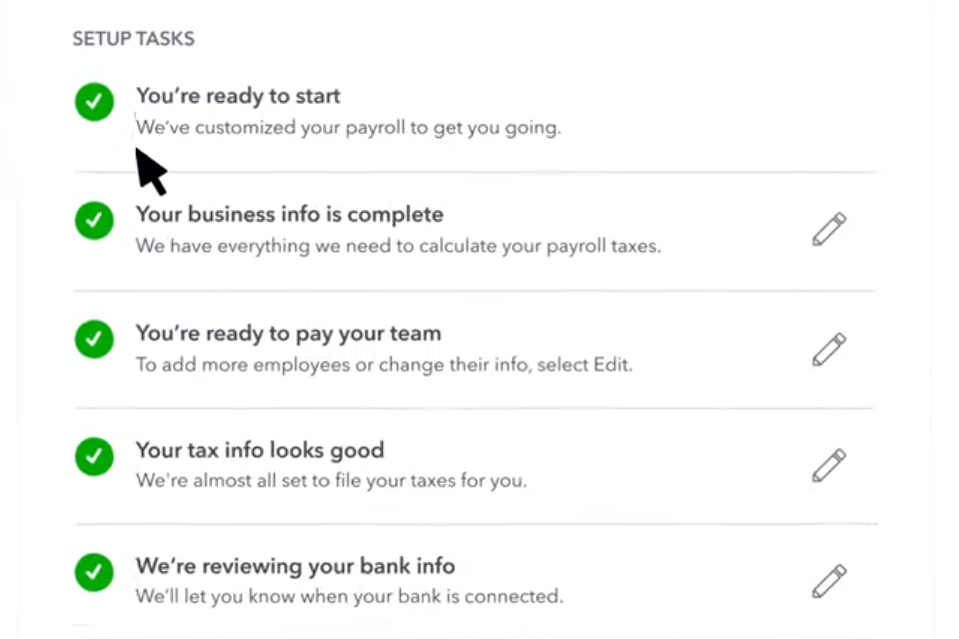

QuickBooks Payroll is an easy program to use, especially if you are already familiar with QuickBooks in general. You do have to set up payroll on your own unless you get the Elite plan, but you can contact support with questions. The Premium package does give you access to a setup review to ensure everything is correct before you process your first payroll. Once you run payroll for an employee, you can no longer add historical data, so be sure to add all the information first.

For new users, your QuickBooks Payroll dashboard will show tasks that you need to complete when setting up your business and employee details in the system. (Source: QuickBooks Payroll)

When running payroll in QuickBooks Payroll, the entire process requires only several button clicks. Its system pulls up the specific employee and pay information, including time data (if you have QuickBooks Time) automatically, and you can make changes before completing the payroll run. The interface is not complex, and there is a help button with how-to articles, plus a way to contact its 24/7 chat support. You can also call a customer service rep via phone from Mondays to Fridays, 6 a.m. to 6 p.m. Pacific time, and Saturdays, 6 a.m. to 3 p.m., PT.

In our expert assessment of QuickBooks Payroll, we found its online solutions great for small businesses looking for solid payroll and tax support. However, its HR functionalities aren’t as robust as other pay processing software, such as Rippling and Gusto. If you require advanced HR tools to hire employees and manage learning programs, consider either ADP or Paychex.

The Intuit QuickBooks Payroll reviews on third-party sites, such as G2 and Capterra, showed solid ratings. In our evaluation of this provider’s popularity among users, QuickBooks Payroll received a 3.75 out of 5 score. While it received an average rating of 4 and up on online review sites, it lost points because its average number of user reviews didn’t reach 1,000.

Many of those who left positive QuickBooks Payroll reviews appreciate its ease of use, fast direct deposits, and efficient online tools that make paying employees and managing taxes easy. Some reviewers like that it integrates with QuickBooks as it helps them update general ledgers (GLs) efficiently after pay runs.

However, others said it is expensive compared to similar small business payroll providers. Customer support is also hit or miss. Many reviewers complained about the long wait times when contacting its support team, while a few said that the customer reps they spoke with are not helpful.

| Users Like | Users Don’t Like |

|---|---|

| Very easy to use and set up | Can be pricey for small businesses |

| Well-organized; easy to track records | Occasional software glitches |

| Makes taxes a breeze | Inconsistent customer support quality; wait time can be long |

| Seamless integration with other Intuit QuickBooks products | |

At the time of publication, Intuit QuickBooks Payroll reviews earned the following scores on popular user review sites:

- Capterra: 4.5 out of 5 based on nearly 800 reviews

- G2: 3.7 out of 5 based on 40-plus reviews

Bottom Line

If you like QuickBooks, then its payroll software is a natural choice. With seamless integration, it makes calculating employee pay simple and easy. Plus, it handles tax payments and filings for you. In addition, QuickBooks’ parent company, Intuit, has partnered with several reputable companies to enable you to offer and manage benefits and basic HR tasks for your employees, so you can do it all on one system.

What’s great about this software is you don’t have to have QuickBooks Accounting to use QuickBooks Payroll. You can get its payroll module as a standalone solution and then add Intuit’s other products to your platform as you grow your business.

Sign up for QuickBooks Payroll’s three-month free trial today and learn more about its features.