QuickBooks Premier Professional Services Edition, a version of QuickBooks Desktop Premier, is tailored to businesses that bill customers by the hour. Hourly rates can be set by the type of service, employee, or customer, and unbilled time and expenses can be added to invoices easily.

The biggest drawback to using QuickBooks Premier Professional Services is that it can’t be accessed from the cloud. It’s also a bit costly for one user, with a starting price of $799 per year—same as the general business edition. Learn if it’s worth the price through our detailed QuickBooks Premier Professional Services review.

QuickBooks Premier will no longer be available for new users after September 30, 2024 and on October 1, 2024 the annual price for existing subscribers will increase to $1,399. It has already been removed from the QuickBooks website, so you’ll need to call QuickBooks customer service to subscribe. QuickBooks Enterprise is not being discontinued and comes in the same industry versions as Premier with the same industry-specific features discussed below.

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface; we immerse ourselves in every platform we review by exploring the features down to the finest nuances.

We have an extensive history of reviewing small business accounting software, and we stay up-to-date with the latest features and enhancements. Our first-hand experience, guided by our internal case study, helps us understand how the different products compare with each other and how they work in real-world scenarios.

Pros

- Lets you create billable and nonbillable service codes

- Allows you to batch-create invoices for unbilled time and expenses

- Supports billing rates by service code, employee, customer, and job

- Enables you to review billed, unbilled, and nonbillable time by employee, customer, or project

- Offers fast navigation and input compared to cloud-based programs

Cons

- Doesn’t allow you to track billing adjustments made for fixed-fee engagements

- Doesn’t let you perform three-way reconciliations of trust accounts for law firms

- Is locally installed; can be accessed only from the computer where it is installed

- Has a new, upgraded mileage tracking app but it’s available only for iOS devices

Is QuickBooks Premier Professional Services Right For You?

Is QuickBooks Premier Professional Services for You?

Premier Professional Services Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Has a strong feature set | Is a bit costly for small businesses |

| Can connect bank accounts to the platform | Has inefficient customer service |

| Provides robust reporting features | |

We haven’t found any specific Professional Services Edition reviews, but based on feedback on the general business edition, many users like Premier’s extensive feature set. Having used the platform myself, I can attest that Premier offers many useful functions that can automate various tasks, like invoicing, expense tracking, and reporting.

One user appreciates that they can connect their bank accounts to better manage their financials and that they could generate customized reports based on their needs. We agree that QuickBooks Premier’s biggest strengths are banking and reporting, as highlighted in our QuickBooks Desktop Premier review.

On the downside, some reviewers commented that Premier is a bit costly, especially for small businesses. One dislikes that they had to purchase the program at a higher cost every year. Moreover, we found some complaints about its inefficient customer support, but we can’t vouch for these claims, as the quality of customer service you’ll get could vary from one agent to another.

As of this writing, here’s how QuickBooks Premier is rated by top review sites:

- Capterra[1]: 4.5 out of 5 based on around 100 reviews

- TrustRadius[2]: 8.2 out of 10 based on more than 400 reviews

QuickBooks Premier earned a fair rating in our evaluation for pricing. While it’s a bit expensive for a single user at $799 per year, the cost for each additional user is reduced, so it becomes affordable for three to five users.

Prices for QuickBooks Premier Professional Services are the same as the general business edition, which is summarized in the table below:

Number of Users | Pricing (Cost per Year) | Access to Professional Services Edition Features | 60-day Money-back Guarantee |

|---|---|---|---|

1 | $799 | ✓ | ✓ |

2 | $1,099 | ✓ | ✓ |

3 | $1,399 | ✓ | ✓ |

4 | $1,699 | ✓ | ✓ |

5 | $1,999 | ✓ | ✓ |

QuickBooks Premier Professional Services New Features for 2023

- Cash Flow Hub: The new Cash Flow Hub can help professional service businesses project their future cash flow based on your bank and activity, helping you make budget-related decisions wisely.

- Automatic mileage tracking: The new mileage tracking app (only for iOS devices) lets you calculate your business mileage automatically. Enter your place of origin and destination, and the app will calculate the mileage automatically. This means you don’t have to track your odometer readings manually.

QuickBooks Premier Professional Services Accounting Features

QuickBooks Premier Professional Services offers the same accounting features found in the general business edition. These include accounts payable (A/P) and accounts receivable (A/R) management, banking, and project accounting. These features are evaluated using our internal case study and are explained in detail in our review of QuickBooks Premier.

QuickBooks Premier Professional Services Edition Features

In addition to general accounting features, professional service firms will find even more useful functions in the Professional Services edition.

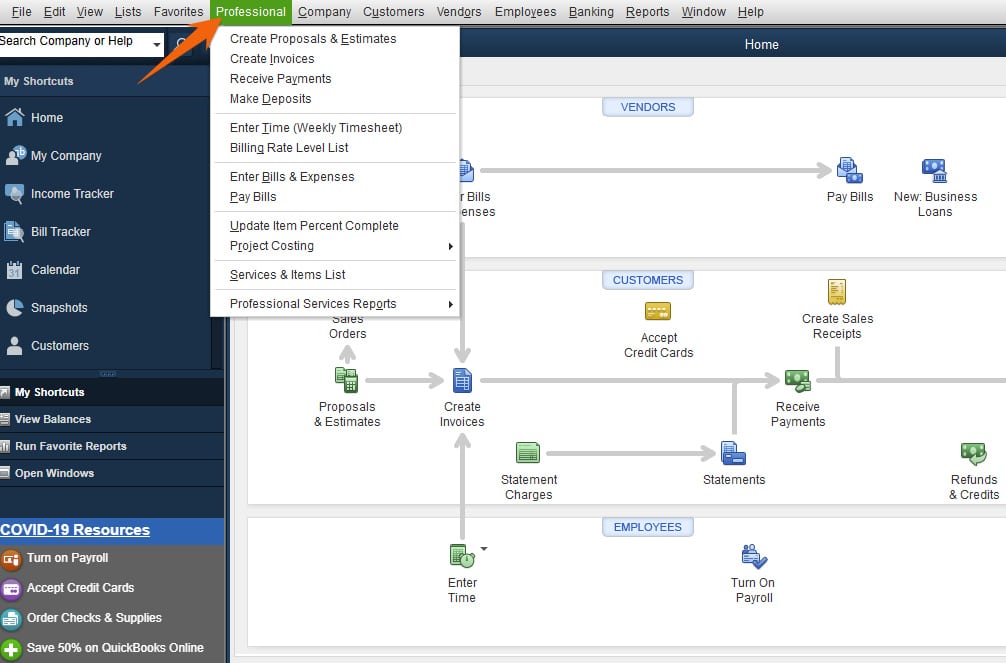

In addition to estimates, you can create proposals. You can access the proposal form from the Professional menu on your dashboard. To complete the form, you need to enter details about the product or service you wish to provide, such as class, rate, amount, markup, and total.

Create a proposal in QuickBooks Premier Professional Services

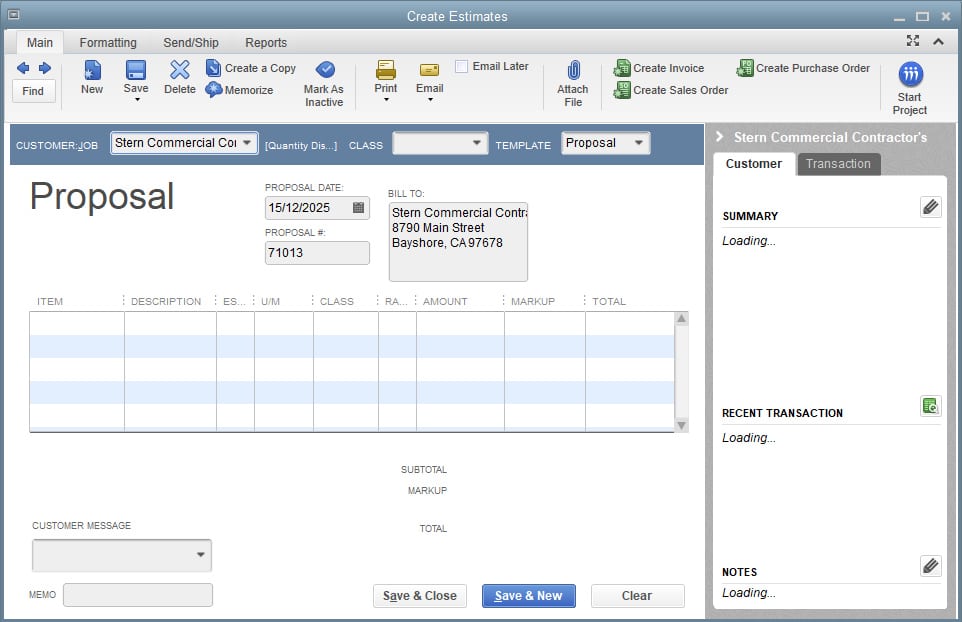

You can set any number of billing rate levels and apply them to whichever employees you choose. For example, in a legal firm, you might want to set different billing rates for partners, paralegals, law associates, and outside consultants.

You can also set fixed or custom hourly rates by service item and assign them to employees. Then, every time you create an invoice, QuickBooks Desktop will provide the rate of each item automatically based on the assigned employee.

You can choose from the two billing rate types in QuickBooks Premier Professional Services:

- Fixed Hourly Rate: This applies a fixed hourly rate to an employee, which can be set in the Hourly Rate field.

- Custom Hourly Rate Per Service Item: Use this billing type when employees are billed at different rates based on the service being performed.

Set up bill rate level in QuickBooks Premier Professional Services

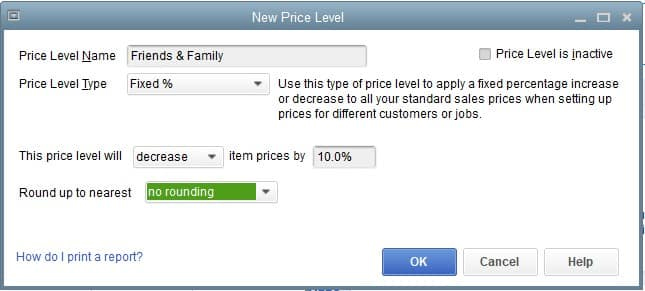

You can set a per-hour price level and assign it to particular types of work. For example, you can create a service item for lawn care and set a price level of $50 per hour, regardless of which employee performs the service.

Also, you can set special price levels to be applied to particular customers. For instance, you can set a friends and family special price level equal to 90% of the standard rate for all services. After assigning the friends and family rate to the desired customers, it would be used automatically when an invoice is calculated.

Set new price level in QuickBooks Premier Professional Services

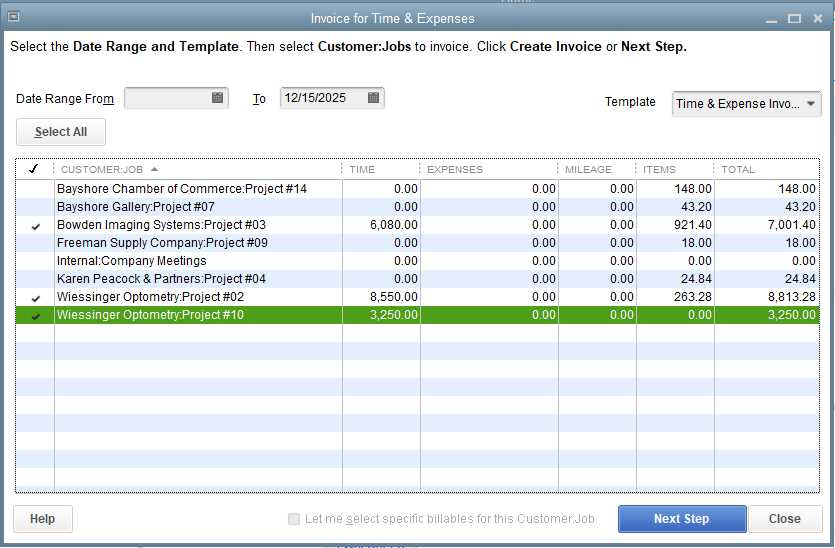

You can batch-create invoices for unbilled time and expenses. QuickBooks will provide a screen showing all unbilled time, expenses, and mileage by job. You can select the clients you want to bill, and invoices will be generated automatically. You can also choose to select a single job and view the details of unbilled time and expenses to bill only a portion.

Invoice for time and expenses in QuickBooks Premier Professional Services

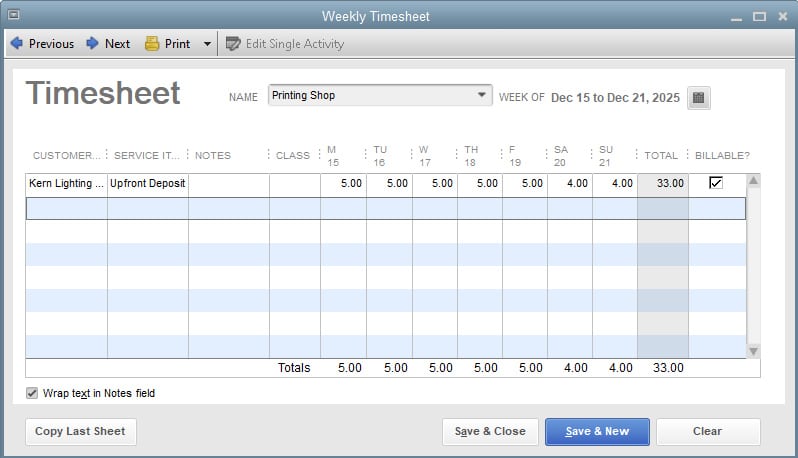

You can enter employee time in a weekly timesheet and assign it to a particular service code and customer job. Nonbillable time can be assigned to a nonbillable service item. The timesheet entry isn’t only used to accumulate hours to bill but also to calculate an hourly employee’s paycheck if you’ve subscribed to QuickBooks Payroll. Hours entered for salaried employees won’t affect their paychecks.

Weekly timesheet in QuickBooks Premier Professional Services

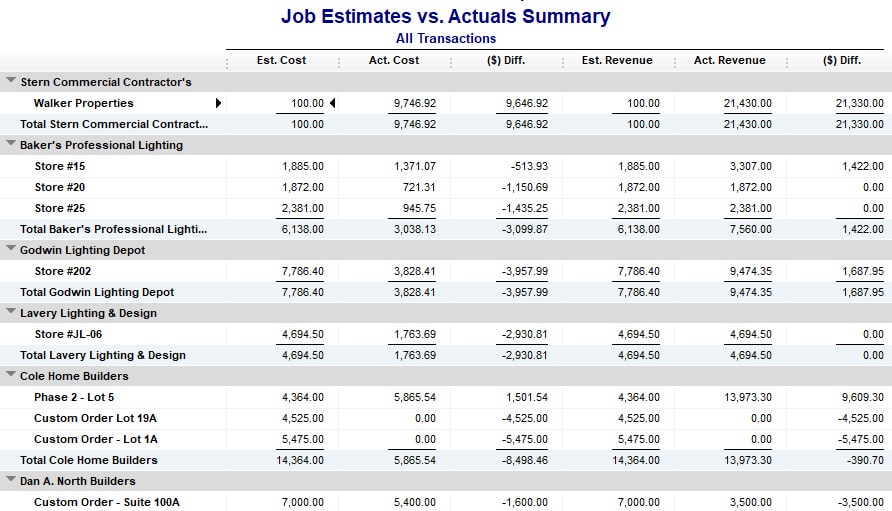

Project costing in QuickBooks Premier Professional Services Edition allows you to track the expenses for a project and compare them to your revenue, giving you an idea of how much you make and spend for each project. An important feature unavailable in QuickBooks Online, the cloud-based version, is the ability to compare job estimates and actual expenses.

Sample report on job estimates vs actual expenses

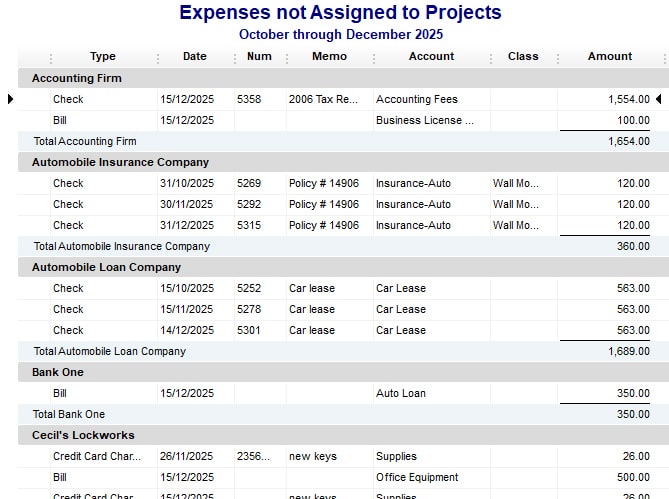

While Professional Services Edition includes all the traditional financial reports of QuickBooks Premier, it also has a list of reports that help track your billable expenses to ensure they eventually get assigned and billed to a customer or project.

- Expenses not Assigned to Projects: You can refer to this list to find expenses that haven’t been assigned to customer jobs.

Sample report on Expenses not Assigned to Projects

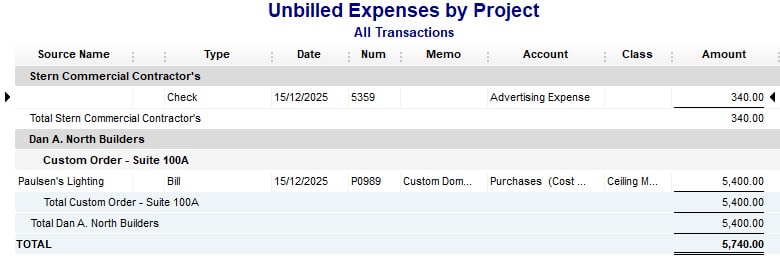

- Unbilled Expenses by Project: This will provide a list of expenses that have been assigned to a customer’s job but not yet billed to the customer on an invoice.

Sample report on Unbilled Expenses by Project

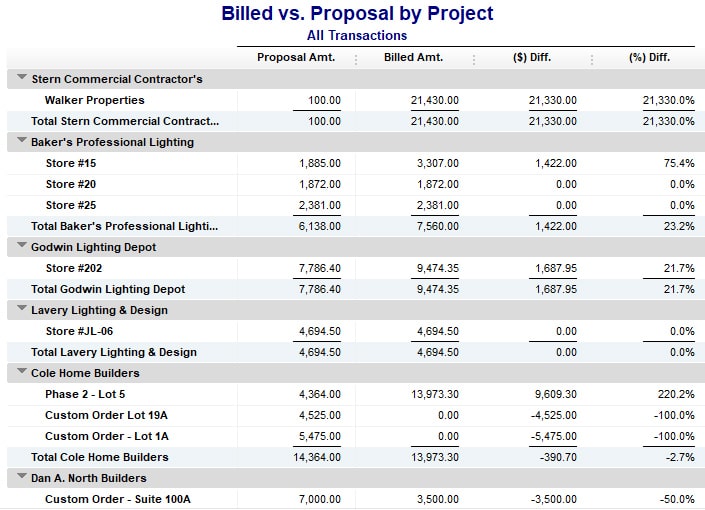

- Billed vs. Proposal by Project: This compares the proposed fee for a customer job to the amount that has already been billed. You can refer to this report to determine if additional unbilled time and expenses should be billed.

Sample Billed vs. Proposal by Project report

- Billed and unbilled hours by employee and project: Here, you’ll find a list of hours that have been charged by employees to a customer’s job but haven’t been billed to the customer.

- Actual project costs detail: You can analyze this report to determine the actual cost incurred on a customer job. This is different from the amounts billed for a job. For example, while you might bill a customer $100 per hour for a particular employee, the actual project cost report will only show the amount you paid the employee, such as $25 per hour.

QuickBooks Desktop Premier Professional Services uses a workflow-based navigation system, which may require a learning curve for those who are new to the software. We often recommend it for experienced accountants and bookkeepers because these professionals are more likely to appreciate and leverage the workflow system effectively. Additionally, since it’s desktop-based, it might not be that intuitive for those who are accustomed to cloud-based software.

We consider QuickBooks Premier Professional Services’ customer support generally efficient. It offers users different ways to seek assistance, including phone support (callback), live chat, a chatbot, and plenty of online resources, like setup guides and tutorial videos. However, it would have done better in our evaluation if there was an option to directly call an agent without sending a request first. Also, the addition of email support could be useful for many users.

How We Evaluated QuickBooks Premier Professional Services

We evaluated QuickBooks Premier Professional Services using the same rubric we used for scoring the general business edition, as explained below.

5% of Overall Score

Software is rated based on its price for various levels of users including one, three, and five users. It is also awarded points if it offers a free trial or discount for new users and if monthly versus annual plans are available.

53% of Overall Score

- General: General features include being able to add basic company information, record a fiscal year-end, close the books for prior periods, and restrict the rights of additional users.

- Banking: Important features within banking include the ability to connect a bank account so that the transactions transfer automatically and reconcile accounts.

- A/P: The main criteria in A/P is that you can manage vendor names, track unpaid bills, and then record the payment when made.

- A/R: Software should be able to email and print invoices that are customizable with the option to add a company logo.

- Inventory: Good bookkeeping software must keep track of both the cost of inventory on hand as well as the cost of goods sold.

- Project accounting: Ideally, the software should allow the company to produce estimated costs for a project and then assign actual costs to the project for comparison.

- Tax: Users should be able to designate which items on an invoice are subject to sales tax, track the sales tax liability, and then record a sales tax payment.

- Reporting: Most importantly, software should produce a balance sheet and income statement that compare current period numbers to prior period numbers. Additionally, points are awarded for a list of 13 reports we think are important.

- Integrations: We look for easy-to-use two-way integrations for processing payroll, tracking time, receiving payments electronically, and paying your bills electronically from within the bookkeeping software.

10% of Overall Score

Customer service is evaluated based on the number of communication channels available, such as phone, live chat, and email. Companies also receive points based on other resources available, such as self-help articles and user community. Finally, companies are awarded points based on the ease with which users will be able to find assistance from independent bookkeepers with expertise in the software.

5% of Overall Score

A good mobile app should be able to perform all the same functions as the computer interface.

20% of Overall Score

- Ease of setup: This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts, vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

- Ease of use: This includes the layout of the dashboard and if new transactions can be initiated from the dashboard, rather than having to navigate to a particular module. Other factors considered are user reviews specific to ease of use and a subjective evaluation by our expert of both the UI and general ease of use.

7% of Overall Score

We include the average user review score for each software collected from large third-party websites dedicated to the collection of user reviews, such as Software Advice, SourceForge, and G2.com.

Frequently Asked Questions (FAQs)

Professional Services has the same interface as the base Premier program, so if you have used other QuickBooks Desktop products, then you should find your way around easily. To get the most out of the software, we recommend that you have a dedicated on-site bookkeeper.

Premier Professional Services is great for businesses that bill customers by the hour. Examples are engineering firms, accounting firms, and digital marketing companies.

Bottom Line

QuickBooks Premier Professional Services Edition helps businesses that bill clients by the hour, such as engineers, consultants, and lawyers, by managing billing rates so that they can invoice clients effectively. However, it doesn’t track billing adjustments by employee. Larger firms may want to use it for their core accounting needs while using specialized software to track employees’ billable-hour realization.